Small Molecule Drug Discovery Market To Attain Revenue USD 163.76 Bn By 2032

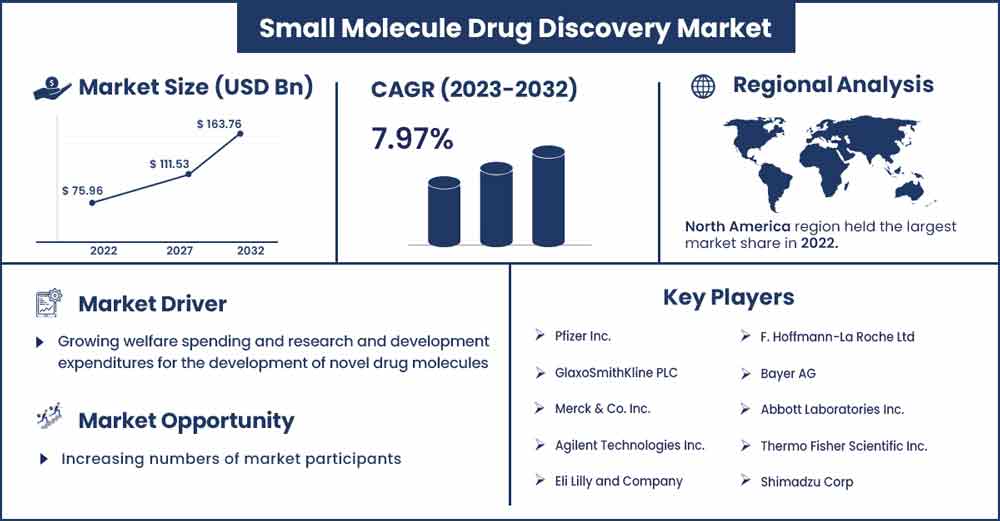

The global small molecule drug discovery market size was evaluated at USD 75.96 billion in 2022 and is expected to attain around USD 163.76 billion by 2032, growing at a CAGR of 7.97% from 2023 to 2032.

Drug discovery, which takes place in the domains of pharmacology, biotechnology, and medicine, is the process of examining new potential medications. In the past, pharmaceuticals were either accidentally found, as was the case with penicillin, or they were discovered by figuring out what made them work. The process known as classical pharmacology was used to identify drugs that had the desired therapeutic effects by screening chemical libraries of made small molecules, natural products, or extracts in entire cells or organisms. The rise in R&D investment, prompted by the demand for various preclinical and clinical services during the drug discovery and development process, is one of the main drivers affecting the global drug discovery market.

Market Growth:

The increasing prevalence of numerous chronic conditions, growing healthcare costs, and the upcoming patent expirations of several well-known medications around the world all significantly contribute to the growth of the worldwide drug discovery industry. The prevalence of diseases like cancer, diabetes, respiratory illnesses, cardiovascular diseases, and neurological disorders is increasing worldwide, which is dramatically increasing the demand for novel and cutting-edge medications. The pharmaceutical business, which is expanding tremendously as a result of the quick development of biopharmaceuticals, is anticipated to dominate the drug discovery market in the years to come. Due to increased government and corporate funding for the creation of novel medications to treat chronic diseases, the biopharmaceutical industry is expanding quickly.

Regional Analysis:

The worldwide drug discovery market was dominated by North America in 2022, according to geography. In terms of global spending on research and development, the US holds the top spot. Furthermore, the majority of the recently developed new pharmaceuticals are protected by US patents. Additionally, the rising frequency of chronic diseases has increased the demand for cutting-edge and novel medications, which has supported the expansion of the drug discovery market in North America. The most opportunistic market is anticipated to be in Asia Pacific in the next few years. This can be linked to the region's abundance of CROs. Additionally, nations like South Korea, India, and China are making significant investments in the expansion of the pharmaceutical business, which is boosting the demand for biopharmaceutical products.

Small Molecule Drug Discovery Market Report Scope:

| Report Coverage | Details |

| Market Revenue in 2023 | USD 82.03 Billion |

| Projected Forecast Revenue in 2032 | USD 163.76 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 7.97% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics:

Market Drivers:

The sum that pharmaceutical companies invest in R&D has increased over time. As a direct result, more money will be allocated to drug discovery. Studies are being conducted more frequently in circumstances requiring novel treatments. According to a study article published in Pharmaceuticals in February 2020, the FDA reportedly approved the Active Pharmaceutical Ingredients (APIs) for three peptides. The application of artificial intelligence in the pharmaceutical industry for medication development is expanding swiftly, according to a report published in BioPharma Trend 2020. This factor is anticipated to boost the significant investment in R&D activities for identifying innovative therapeutic targets, which will contribute to market expansion.

Market Restraints:

The cost of developing a drug is influenced by a wide range of variables, placing a significant financial burden on the companies involved in drug discovery and development. One of the main factors contributing to high costs is the expenditure of unsuccessful drug candidates during trial phases. Since the return on investment (ROI) is declining significantly, the pharmaceutical sector is under pressure to raise its success rate with limited resources to reduce the cost of failure. Long-term losses are experienced by large corporations. Nevertheless, small and medium-sized firms are significantly impacted by losses. As a result, the high capital expense needed for drug development and the low-profit margins presents a substantial barrier to the drug discovery sector.

Market Opportunities:

Type 1 diabetes affects more than 1.2 million kids and teenagers. According to the World Health Organization, cardiovascular illnesses are the main cause of death worldwide, causing close to 18 million deaths annually. As a result, the worldwide population has a high desire for novel medications that can treat chronic illnesses, which in turn is driving the expansion of the drug discovery industry. Global drug discovery market expansion is anticipated to be fueled by pharmaceutical companies' increasing spending on the R&D of several new medications and clinical trial research.

Report Segmentation:

Drug Type Insights:

The small molecule market segment led the market in 2022 when it came to drug type. This is a result of the population's rising need for small-molecule medications. Because of their small size and weight, small-molecule medications are able to treat diseases and easily affect cells. Therefore, the manufacturers' investments in the development of small-molecule drugs have increased as a result of the increased awareness of the usefulness of small-molecule drugs. On the other hand, it is anticipated that during the projected period, the large molecule or biologics segment will experience the quickest growth. The manufacture of biologics is being fueled by the growing adoption of innovative manufacturing methods.

End-User Insights:

In 2022, the drug discovery market was controlled by pharmaceutical corporations. This is due to the increased investments made in the creation of new drugs by the leading pharmaceutical and biotechnology corporations. Significant demand for numerous novel medications is being driven by the increased prevalence of chronic diseases and the aging population. The market for drug discovery has been stimulated by the rising drug demand around the world. The market has grown tremendously as a result of the biopharmaceutical industry's explosive growth.

Recent Development:

- In November 2020, a multi-target drug discovery partnership between Genentech and Genesis Therapeutics was established, and AI technology was used to identify potential therapeutic candidates.

- In 2019, In order to introduce Ogivri, a cancer medication that is a biosimilar to Herceptin, in the US, Biocon teamed up with Mylan.

- In January 2020, Exscientia, a startup that uses artificial intelligence to find new drugs, and Bayer worked together to develop medications for ailments connected to the heart and cancer.

Major Key Players:

- Pfizer Inc.

- GlaxoSmithKline PLC

- Merck & Co. Inc.

- Agilent Technologies Inc.

- Eli Lilly and Company

- F. Hoffmann-La Roche Ltd

- Bayer AG

- Abbott Laboratories Inc.

- Thermo Fisher Scientific Inc.

- Shimadzu Corp

- Market Segmentation:

By Drug Type

- Small Molecule Drugs

- Biologic Drugs

By Technology

- High Throughput Screening

- Pharmacogenomics

- Combinatorial Chemistry

- Nanotechnology

- Others

By End-User

- Pharmaceutical Companies

- Contract Research Organizations

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/2512

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333