What is the Quantum-Safe Cloud Storage Market Size?

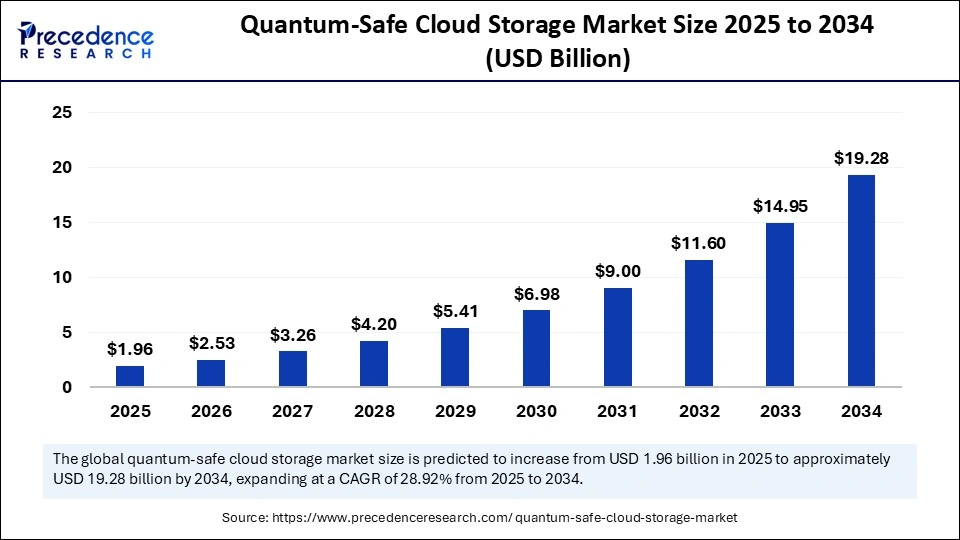

The global quantum-safe cloud storage market size was calculated at USD 1.52 billion in 2024 and is predicted to increase from USD 1.96 billion in 2025 to approximately USD 19.28 billion by 2034, expanding at a CAGR of 28.92% from 2025 to 2034. The growth of the market is driven by increasing incidence of cyber threats, the growing adoption of quantum-safe data storage solutions due to the possibility of quantum-led data breaches, and the evolution of quantum technology to secure cloud infrastructures.

Market Highlights

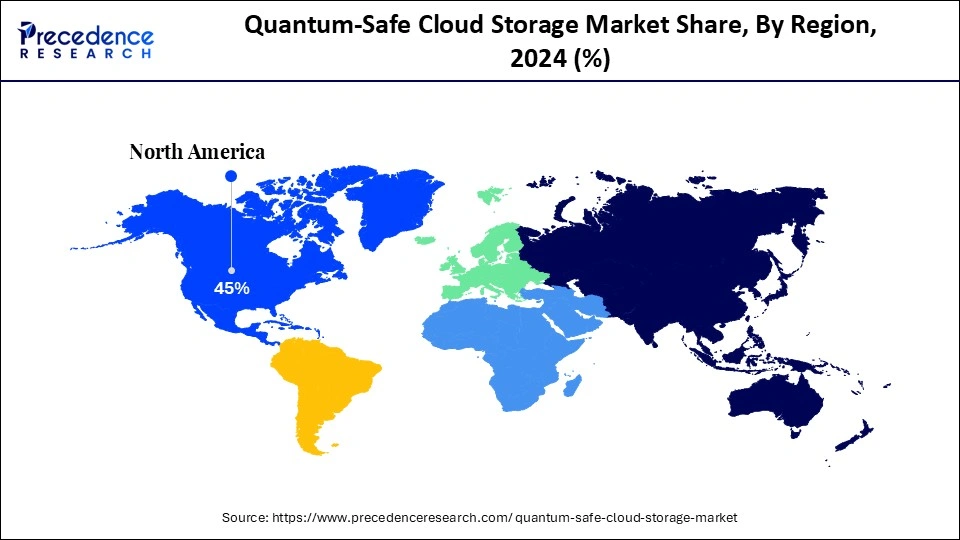

- By region, North America held nearly 45% share of the quantum-safe cloud storage market in 2024.

- Asia Pacific is expected to expand at the fastest CAGR during the forecast period of 2025-2034.

- By encryption type, the post-quantum cryptography (PQC) segment held approximately 50% share of the market in 2024.

- By encryption type, the quantum key distribution (QKD) segment is expected to grow at the fastest CAGR during the projection period.

- By deployment model, the public cloud segment led the market with a 45% share in 2024.

- By deployment model, the hybrid cloud segment is expected to witness the fastest growth during the foreseeable period.

- By service type, the data storage services segment dominated the market with nearly 40% share in 2024.

- By service type, the disaster recovery as a service (DRaaS) segment is expected to expand at the fastest CAGR during the foreseeable period.

- By end user, the BFSI segment held the largest market share of 40% in 2024.

- By end user, the healthcare & life sciences segment is expected to witness the fastest growth during the foreseeable period.

Market Size and Forecast

- Market Size in 2024: USD 1.52 Billion

- Market Size in 2025: USD 1.96 Billion

- Forecasted Market Size by 2034: USD 19.28 Billion

- CAGR (2025-2034): 28.92%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

Why Are Quantum-Safe Cloud Storage Solutions Gaining Momentum Across Industries?

The adoption of quantum-safe cloud storage solutions is driven by rising cyber threats, regulatory mandates, the expansion of cloud infrastructure, and enterprise investment in next-generation cybersecurity. The quantum-safe cloud storage market refers to cloud storage solutions that integrate quantum-resistant encryption to safeguard data against potential threats from quantum computing. Unlike classical encryption, quantum-safe solutions employ post-quantum cryptography (PQC), quantum key distribution (QKD), and hybrid approaches to maintain data confidentiality, integrity, and availability.

These solutions are critical for highly sensitive sectors, including banking, healthcare, government, and defense. North America leads adoption due to early technology deployment and regulatory support. At the same time, Asia Pacific is the fastest-growing region, driven by increasing cloud adoption and investments in secure digital infrastructure.

How is AI Transforming the Quantum-Safe Cloud Storage Market?

The integration of AI with quantum-safe cloud storage represents a revolutionary alliance of two cutting-edge technologies, where AI enhances the security and efficiency of cloud environments by utilizing quantum-resistant cryptographic algorithms. The pattern recognition of AI can identify quantum threats in advance by analyzing real-time data.

Along with continuous monitoring and scam alerts by AI, quantum-safe encryption can protect data from possible future attacks, creating a resilient environment for cloud data storage. AI-powered predictive analytics can identify foreseeable demand and optimize resources within cloud environments, enhancing the efficiency of quantum-safe data storage solutions.

- For instance, according to a white paper released by TCS, they will start to utilize quantum computers by 2028 and expect data threats due to weak cryptographic protocols. Hence, they are developing cybersecurity programs led by artificial intelligence to secure their future quantum ecosystem. (Source: https://www.tcs.com)

What are the Key Trends in the Quantum-Safe Cloud Storage Market?

- Adoption of Post-Quantum Cryptography: A significant trend that the market is witnessing is the increasing adoption of PQC, as quantum computers hold the potential to break current encryption algorithms, making data storage systems fragile and susceptible to future decryption. However, post-quantum cryptography involves additional cryptographic algorithms designed to counter quantum attacks, preparing for a proactive response, such as Harvest-Now, Decrypt-Later. Moreover, organizations are increasingly integrating PQC algorithms to future-proof their data against quantum attacks, even before quantum computers reach full capability.

- Hybrid Encryption: The hybrid approach to encryption, which combines both traditional and quantum-safe methods of security for reliable data storage, is another notable trend in the quantum-safe cloud storage market. It includes the implementation of hybrid schemes while transitioning to a complete quantum-safe future. Companies are combining classical and quantum-safe encryption methods to ensure both current and future data protection, especially during the transition phase.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 1.52 Billion |

| Market Size in 2025 | USD 1.96 Billion |

| Market Size by 2034 | USD 19.28 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 28.92% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Encryption Type, Deployment Model, Service Type, Compliance & Security Focus, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Concerns Over Quantum Hacking

A significant factor driving the growth of the quantum-safe cloud storage market is increasing concerns over quantum hacking. There are many computers with the potential to break current asymmetric encryption algorithms, such as RSA and ECC, which are primarily used to protect data on the cloud. Many organizations are seeking robust and highly reliable solutions to protect their data from breaches, driving the need for quantum-safe cloud storage.

Restraint

Complex Way of Migration

Despite its numerous benefits, the quantum-safe cloud storage market is facing several challenges, one of which is the complex task of transitioning from cloud infrastructure to quantum-safe methods. It requires a significant investment and a fundamental overhaul of existing systems and processes. However, a universally accepted method for quantum-safe cryptography is still in development and is expected to be introduced sooner, which can resolve the barrier.

Opportunity

Expansion of QKD Services

A significant opportunity that holds potential for the expansion of the quantum-safe cloud storage market is the growth of quantum key distribution (QKD) services, which utilize principles of quantum mechanics to distribute cryptographic keys securely, making it difficult to break or decipher code using both classical and quantum computers. This method of quantum key distribution is highly secure and can be utilized for various security-critical applications, including financial transactions, government communication, and critical infrastructure. As a result, QKD is gaining traction in highly sensitive sectors, such as finance and defense, offering secure key exchange that is resistant to quantum decryption.

- For instance, in June 2025, Orange Business and Toshiba Europe have launched Orange Quantum Defender, the first quantum-safe networking service in Paris. Combining Quantum Key Distribution (QKD) and Post-Quantum Cryptography (PQC), the service is now commercially available across the greater Paris area.

(Source: https://newsroom.orange.com)

Segment Insights

Encryption Type Insights

How Does the Post-Quantum Cryptography Segment Lead the Market in 2024?

The post-quantum cryptography (PQC) segment led the quantum-safe cloud storage market by holding the largest share of 50% in 2024. This is due to its practicality, scalability, and readiness for real-world deployment. The existing encryption methods are highly susceptible to future breaches by quantum decryption and PQC offers robust security solution against it by using new mathematical problems that are difficult to break by classical or quantum computers.

The quantum key distribution (QKD) segment is expected to expand at the fastest CAGR during the forecast period. QKD encryption is highly secure because it exchanges encryption keys to ensure data security, making it virtually impossible to break the password anonymously or tamper with data without identification. The increasing cyber threats is the leading reason behind the segment's growth.

Deployment Model Insights

What Made Public Cloud the Dominant Segment in the Quantum-Safe Cloud Storage Market?

The public cloud segment dominated the market with the largest share of nearly 45% in 2024. This is because public cloud can easily scale quantum-safe storage as per requirements to fulfill changing business needs according to time. Major cloud providers utilize quantum computing platforms and managed security services by quantum technology, leading to easy access for various enterprises to leverage these advanced solutions.

The hybrid cloud segment is expected to expand at the highest CAGR during the projection period, as this deployment offers a highly secure way for various enterprises to leverage quantum-resistant encryption without a need to fully migrate into complex infrastructure. Moreover, unified security frameworks, automated key orchestration, and consistent policy enforcement across private + public environments made hybrid cloud increasingly viable as the preferred deployment mode for quantum safe storage.

Service Type Insights

Why Did the Data Storage Services Segment Dominate the Market in 2024?

The data storage services segment dominated the quantum-safe cloud storage market, holding the largest share of 40% in 2024, as these services address the most immediate, high demand needs of organizations trying to protect data in transit, at rest, and over long time spans. The quantum-safe cloud storage provides high scalability and flexibility that allows organizations to utilize quantum-proof cryptography securely and accessible without needing to adopt complex infrastructure.Also, cloud-based quantum-as-a-service provides great cost efficiency which is crucial for data storage services.

The disaster recovery as a service (DRaaS) segment is expected to grow at the fastest rate in the upcoming period. DRaaS provides cost-effective and highly scalable solutions that enables businesses to outsource the working of disaster recovery infrastructure which is a complex task that can be handled by experts only. Compliance with data privacy regulations and growing concerns about data security are major factors driving the growth of the segment.

End User Insights

Why Did the BFSI Segment Hold the Largest Market Share in 2024?

The BFSI segment held a 40% share of the quantum-safe cloud storage market in 2024. BFSI handles highly sensitive and complex datasets along with a huge number of transactions, even cross-border payments that need to be done reliably as they are highly vulnerable to data breaches and future quantum attacks. Quantum-safe cloud storage offers higher security for BFSI than traditional encryption, which is a leading reason for its segment's dominance over the market.

The healthcare & life sciences segment is expected to witness the fastest growth during the foreseeable period. The sector is seeking solutions to safeguard the highly sensitive and personal data of various patients, ensuring trust among patients and compliance with privacy regulations to avoid a catastrophic event in the near future due to the possibility of quantum-led hacking. Strict regulatory requirements, such as HIPAA and GDPR, have forced organizations to adopt quantum-resistant encryption to ensure long-term data privacy and compliance, thereby boosting the demand for quantum-safe cloud storage solutions.

Regional Insights

U.S. Quantum-Safe Cloud Storage Market Size and Growth 2025 to 2034

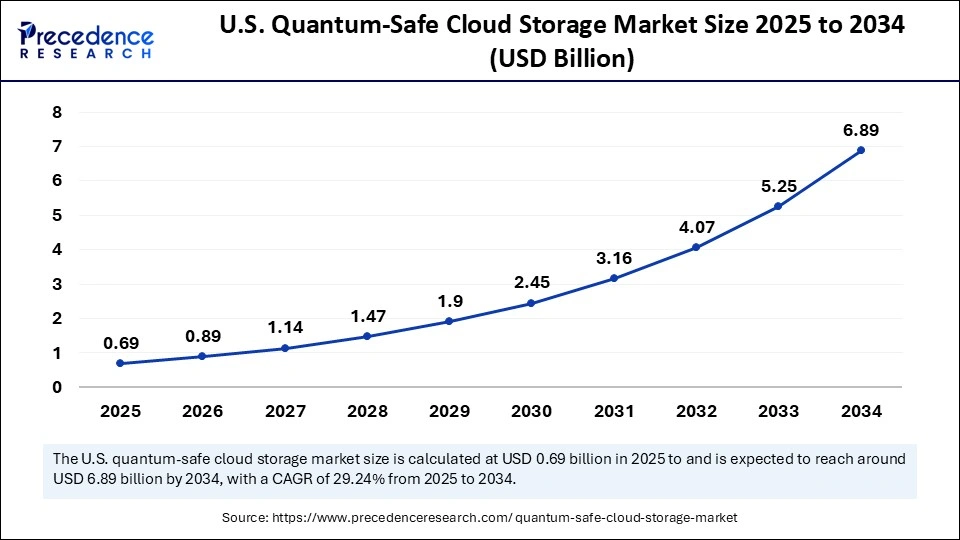

The U.S. quantum-safe cloud storage market size was exhibited at USD 0.53 billion in 2024 and is projected to be worth around USD 6.89 billion by 2034, growing at a CAGR of 29.24% from 2025 to 2034.

What Made North America the Dominant Force in the Quantum-Safe Cloud Storage Market?

North America dominated the market by capturing thelargest share of nearly 45% in 2024. The reason behind the region's dominance includes substantial government and private investments, a robust ecosystem thatsupports technological innovation, and cloud-based infrastructure, along with leading labs and universities that focus on research and development of quantummechanics and its commercialization to gain cutting-edge knowledge of quantum cryptography that can be applicable for various sectors. Government programs, such as the National Quantum Initiative Act, offer significant funding for quantum research and development, which has led to the development of quantum-safe solutions.

Leading tech companies like IBM, AWS, and Microsoft, along with various startups working on quantum technology and developing solutions to crucial battles like quantum encryption. Additionally, the region's stringent data privacy regulations and growing awareness of quantum computing threats drove early adoption of quantum-safe solutions, particularly in sectors like finance, healthcare, and government.

What Makes Asia Pacific the Fastest-Growing Market for Quantum-Safe Cloud Storage?

Asia Pacific is expected to witness the fastest growth during the foreseeable period. This is mainly due to the rising development of quantum hardware, like highly reliable and scalable quantum key distribution systems, as well as quantum software. The region's expanding IT infrastructure and strong government initiatives promoting data security and innovation fueled demand for quantum-safe solutions. To secure their digital infrastructure, various Asian countries, including India, China, and Japan, are heavily investing in building quantum technology through public and private partnerships and large-scale quantum projects. Rapid digital adoption, industry-specific demand, and growing concerns about data security are key factors driving the market's growth.

- For instance, In September 2025, HDFC bank of India have invested in QNu labs which offers quantum-safe security platforms for both hardware and software solutions.(Source: https://www.cnbctv18.com)

Top 3 countries with Substantial investment in Quantum technology

- U.S.: The U.S. government allocated around USD 1.8 billion of funding for quantum research under its initiative known as the “National Quantum Initiative Act.”

- Japan: Japan has invested USD 800 million in quantum technologies under its Moonshot Research and Development program.

- China: The Chinese government is expected to spend nearly USD 15 billion for various projects of quantum research and development, and AI integration along with it.

Value Chain Analysis

- Research & Development

This stage involves foundational research and development of quantum technology by large tech firms in collaboration with academics and institutes.

Key players: Quantinuum, SandboxAQ, QNu labs, and ID Quantique

- Component Manufacturing and Infrastructure Development

This stage involves the production of the various hardware components required to implement quantum-safe technology.

Key players: Entrust, Thales, ResQuant, and Intel

- PQC Integration

This is the final stage, which involves implementing PQC into cloud-based infrastructure by software companies.

Key players: Google Cloud, IBM, Microsoft Azure, and Cloudflare.

Quantum-Safe Cloud Storage Market Companies

- Amazon Web Services (AWS)

- Microsoft Corporation (Azure)

- Google Cloud Platform

- IBM Cloud

- Oracle Cloud

- Alibaba Cloud

- Thales Group

- ISARA Corporation

- Quintessence Labs

- ID Quanique

- Quantum Xchange

- Cloudflare

- Cyxtera Technologies

- Pure Storage

- HPE (Hewlett Packard Enterprise)

- Dell Technologies

- Fujitsu

- Huawei Cloud

- Nutanix

- VMware

Recent Developments

- In August 2025, Microsoft announced plans to implement quantum-safe solutions starting in 2029 and aims for full transition by 2033. This timeline is two years ahead of the 2035 government deadline for post-quantum cryptography adoption in the US, UK, and other countries.

(Source: https://www.infosecurity-magazine.com) - In February 2025, Google introduced quantum safe digital signatures in its Cloud Key Management services. It enables developers to utilize the NIST standardized ML-DSA and SLH-DSA algorithms to sign at digital platform.(Source: https://cloud.google.com)

Segments Covered in the Report

By Encryption Type

- Post-Quantum Cryptography (PQC)

- Lattice-Based Encryption

- Hash-Based Encryption

- Multivariate Polynomial Encryption

- Code-Based Encryption

- Quantum Key Distribution (QKD)

- Hybrid Classical-Quantum Encryption

By Deployment Model

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Service Type

- Data Storage Services

- Data Backup & Recovery

- Disaster Recovery as a Service (DRaaS)

- Security & Compliance Services

By Compliance & Security Focus

- GDPR Compliant Solutions

- HIPAA Compliant Solutions

- Defense & Government Grade Security

By End User

- BFSI (Banking, Financial Services, Insurance)

- Healthcare & Life Sciences

- Government & Defense

- IT & Telecom

- Manufacturing & Industrial

- Energy & Utilities

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting