What is the Quantum Sensing Medical Imaging Market Size?

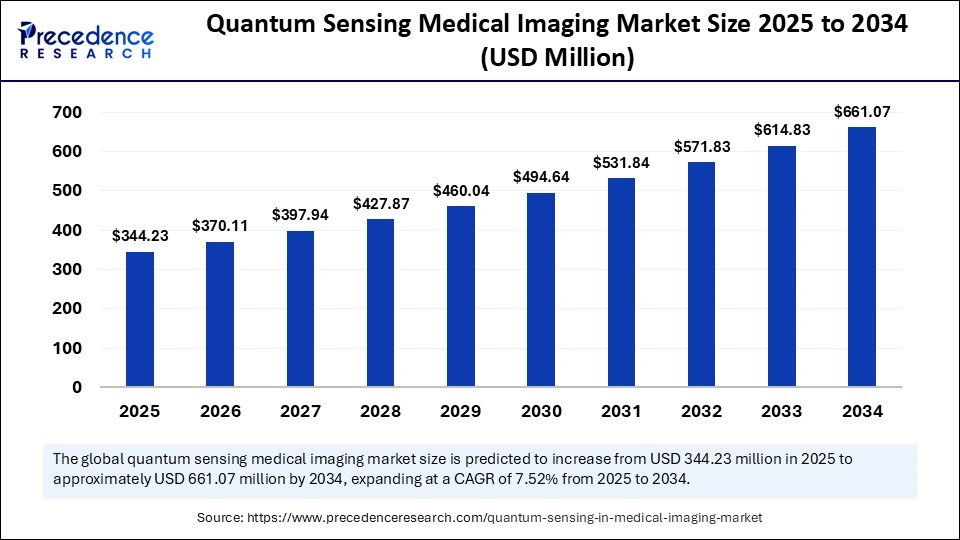

The global quantum sensing medical imaging market size accounted for USD 344.23 million in 2025 and is predicted to increase from USD 370.11 million in 2026 to approximately USD 661.07 million by 2034, expanding at a CAGR of 7.52% from 2025 to 2034. This market is growing due to the unprecedented precision and sensitivity of quantum sensors.

Market Highlights

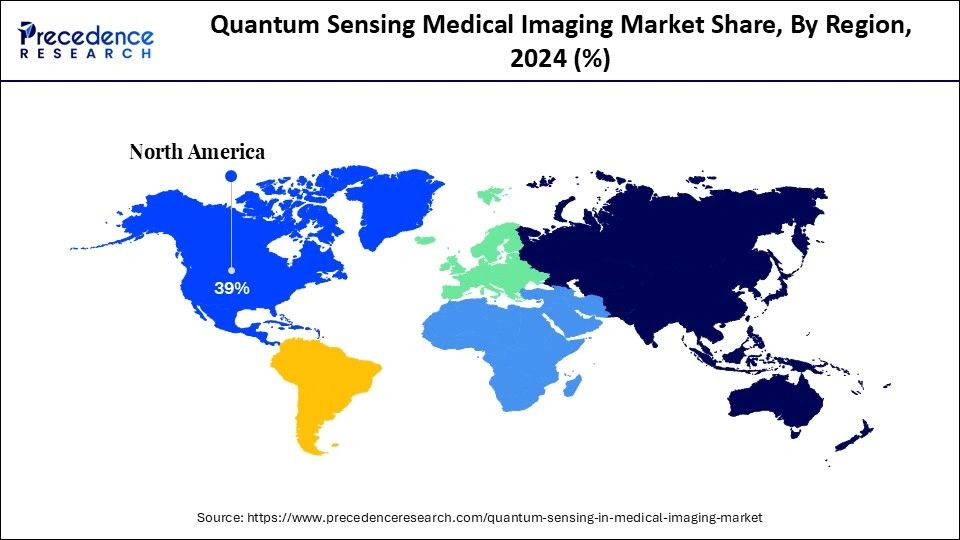

- By region, North America dominated the market, holding the largest market share of 39% in 2024.

- By region, Asia Pacific is expected to grow at a 9.2% CAGR in market share.

- By technology/sensing platform, the superconducting sensors segment held the largest share of the quantum sensing medical imaging market at 40.5% in 2024.

- By technology/sensing platform, the software as a service segment is growing at a notable CAGR of 8.6% during the forecast period.

- By product/offering, the standalone imaging systems segment held the largest market share of 34.5% in 2024.

- By product/offering, the services/installation/maintenance segment is expected to grow at the fastest CAGR of 9% during the forecast period.

- By imaging modality/application, the quantum-enhanced MRI segment held the largest market share of 36.5% in 2024.

- By imaging modality/application, the quantum optical imaging & microscopy segment is growing at a notable CAGR of 8.8% from 2025 to 2034.

- By end-user, the hospitals & medical centers segment held the largest share at 38.8% in 2024.

- By end-user, the diagnostics and imaging centers segment is expected to grow at the fastest CAGR of 8.4% during the forecast period.

- By component/subsystem, the sensor/detector segment held the largest market share of 32.8% in 2024.

Market Size and Forecast

- Market Size in 2025: USD 344.23 Million

- Market Size in 2026: USD 370.11 Million

- Forecasted Market Size by 2034: USD 661.07 Million

- CAGR (2025-2034): 7.52%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

Key Technologies Shifts in the Quantum Sensing Medical

- Higher Sensitivity and Image Resolution: The detection of incredibly weak magnetic fields is possible with quantum sensors such as optically pumped magnetometers and nitrogen-vacancy (NV) centers in diamonds. This feature enables more precise imaging of tissues with higher resolution, aiding in the early detection of conditions like cancer and neurological disorders.

- Portable and Non-Invasive Devices: Compact portable devices are the result of quantum sensor miniaturization. These tools lessen the need for conventional imaging methods by enabling safer non-invasive diagnostics such as tracking fetal heart activity or identifying cellular-level signals.

Market Overview

What is the Quantum Sensing Medical Imaging Market?

The quantum sensing medical imaging market is experiencing transformative growth, driven by the development of quantum technology and its application to medical diagnostics. Medical procedures are becoming safer and more precise thanks to innovations like quantum light-based imaging methods and quantum sensors for cardiac imaging.

- In August 2025, GDQ Labs Pct Ltd was capable of detecting ultra-weak magnetic fields generated by the human heart, offering a radiation-free and dye-free alternative to traditional ECG and MRI. This technology enabled 3D heart mapping, potentially replacing multiple diagnostic procedures. (Source: https://timesofindia.indiatimes.com)

Quantum Sensing Medical Imaging Market Outlook

- Industry Growth Overview: Higher sensitivity and resolution provided by developments in quantum magnetometers and quantum's are revolutionizing medical imaging. The industry is expanding rapidly due to increased R&D investments and collaborations between healthcare and quantum tech companies.

- Sustainability Trends: Comparing quantum imaging to conventional techniques, the former has lower radiation exposure and energy use, promoting environmentally friendly medical procedures. Numerous producers are creating environmentally friendly quantum sensors with recyclable parts and low-toxicity materials.

- Startup Ecosystem: Quantum imaging innovations are being pioneered by startups such as QDI systems and OT Sense to improve diagnostic accuracy. Their expanding funding rounds demonstrate investor confidence in the revolutionary potential of quantum healthcare.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 344.23 Million |

| Market Size in 2026 | USD 370.11 Million |

| Market Size by 2034 | USD 661.07 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.52% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology / Sensing Platform, Product / Offering, Imaging Modality / Application, End-User, Component / Subsystem, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Restraint

High Initial Investment

Many small and medium-sized hospitals cannot afford the high setup and maintenance costs associated with quantum imaging systems due to their sophisticated materials and technologies. This delays wider market penetration and restricts accessibility. Large-scale deployment is currently only affordable for prestigious hospitals and research institutes.

- In January 2024, QDI Systems announced it had secured 5 million in funding to scale its quantum dot technology for use in medical X-ray and mammography imaging.

(Source: https://thequantuminsider.com)

Opportunity

Personalized Healthcare

High-resolution patient-specific imaging made possible by quantum imaging supports individualized treatment regimens. For precision medicine, hospitals and diagnostic facilities can utilize this technology. It enabled the planning of targeted therapy by capturing minute physiological changes and reducing unnecessary interventions.

- In February 2025, OT Sense raised 6 million to advance single-cell quantum sensing for tailored disease diagnostics.(Source: https://thequantuminsider.com)

Segmental Insights

Technology/Sensing Platform Insights

Why Did the Superconducting Sensors Segment Dominate the Quantum Sensing Medical Imaging Market in 2024?

Superconducting sensors dominate the market with a 40.5 %share in 2024 because they are the most accurate at detecting weak magnetic fields. They allow for greater spatial resolution and diagnostic accuracy and are widely utilized in quantum MRI and MEG systems. Their market position is further reinforced by their dependability and expanding use of medical and research facilities.

The software as a service segment is expected to be the fastest-growing segment in the market during the forecast period, fueled by the need for AI-powered image analysis and cloud-based data management. Cost-effective for healthcare providers, SaaS platforms improve diagnostic collaboration, storage, and remote access. The trend toward digital medical imaging further supports this market.

Product/Offering Insights

Why Did Standalone Imaging Systems Dominate the Quantum Sensing Medical Imaging Market in 2024?

The standalone imaging systems segment dominates the market with a 34.5 % share in 2024 because of their great accuracy, dependability, and simplicity of integration in medicalfacilities. These systems are favored for neurology and oncology applications because they provide improved image clarity, allowing them to operate independently without relying on third-party software. To boost clinical adoption, manufacturers are also concentrating on standalone models that are small and reasonably priced.

Services/installation/maintenance are expected to be the fastest-growing segment in the market as more healthcare facilities adopt quantum imaging systems. Demand for specialized setup, calibration, and continuous support is boosting this category of expansion across global diagnostic centers. Service contracts are becoming essential for ensuring optimal imaging accuracy and uptime.

Imaging Modality/Application Insights

What Made the Quantum-Enhanced MRI Segment Dominate the Quantum Sensing Medical Imaging Market?

Quantum-enhanced MRI segment dominated the market with a 36.5% share in 2024 because of its exceptional imaging precision and capacity to identify illnesses in their early stages. Using quantum sensors, this modality produces noise-free, high-resolution images that improve diagnostic accuracy. Its non-invasiveness and compatibility with cutting-edge superconducting systems have led to its widespread use in facilities and scientific research centers.

The quantum optical imaging & microscopy segment is expected to be the fastest growing in the market during the forecast period, fueled by its ability to visualize biological structures at the nanoscale. This technology utilizes quantum entanglement and photon correlation for ultra-precise imaging, making it ideal for early disease detection and molecular diagnostics. Researchers are increasingly adopting it for cancer cell imaging and neural mapping.

End-User Insights

Why Did Hospitals & Medical Centers Dominate the Quantum Sensing Medical Imaging Market in 2024?

The hospitals & medical centers segment dominated the market with a 38.8% share in 2024 due to their strong emphasis on incorporating cutting-edge technologies to enhance patient care. The main users of quantum-enhanced MRI and MEG systems, which provide higher detection accuracy for neurological and cardiovascular conditions, are these institutions. Large-scale implementation of quantum imaging systems is made possible by the availability of highly qualified radiologists and sophisticated infrastructure.

The diagnostic & imaging centers segment is expected to be the fastest growing in the market during the forecast period. The demand for high-precision, non-invasive imaging technologies is rapidly increasing across these centers to offer specialized and affordable diagnostic services. The scalability and compact nature of quantum imaging systems make them ideal for standalone diagnostic facilities.

Component/Subsystem Insights

Why Did the Sensor/Detector Segment Dominate the Quantum Sensing Medical Imaging Market in 2024?

The sensor/detector segment is expected to dominate in 2024 and continue its growth trajectory throughout the forecast period because of its essential function in the acquisition of quantum data. These constituents serve as the fundamental building blocks of quantum imaging systems, guaranteeing exceptional sensitivity and precision. Ongoing advancements are improving imaging resolution in quantum photonics and superconducting detector technologies.

How Quantum Sensing Will Reshape the Future of Healthcare?

| Segments | Insights and Breakthroughs | Strategic growth | Company Benefits in the Future |

| By Technology | Integrating AI with quantum detector data via SaaS analytics is driving rapid growth beyond superconducting hardware by delivering advanced insights. | Prioritize AI and machine learning integration to unlock predictive analytics. Move towards service-based models for periodic revenue from complex systems | Enables new AI-driven diagnostic platforms and personalized medicine offerings, bringing new business models. Faster data analysis means quicker development of new usages. |

| By Offerings | The market is transitioning from selling expensive standalone systems to centering on services, inaugurations, and maintenance, which are the fastest-growing segments. | The demand for ongoing endorsement, achieved by bundling services with hardware, drives funding. This builds long-term customer relationships and proves stable revenue pours. | Brings high-margin, stable service and support companies alongside hardware sales, growing profitability, and customer loyalty. |

| By Applications | Optical imaging and microscopy are swiftly advancing and promise cellular-level resolution. Quantum-enhanced MRI ruins a leading application. | Invest in next-generation optical imaging and quantum-enhanced MRI to improve diagnostics for oncology and neurology | High-resolution imaging will be used to improve early detection for cancer, neurological disorders, and cardiovascular issues |

| By Components | The sensor/detector segment remains central to the market. Advancements focus on miniaturization and higher sensitivity, which are critical for future applications. | Invest in sensor R&D to improve performance and drive down costs. Focus on miniaturization to let wearable and more portable diagnostic devices. | The rise of miniaturized and wearable medical devices expands market access by enabling real-time patient monitoring and diagnostics. |

Regional Insights

U.S. Quantum Sensing Medical Imaging Market Size and Growth 2025 to 2034

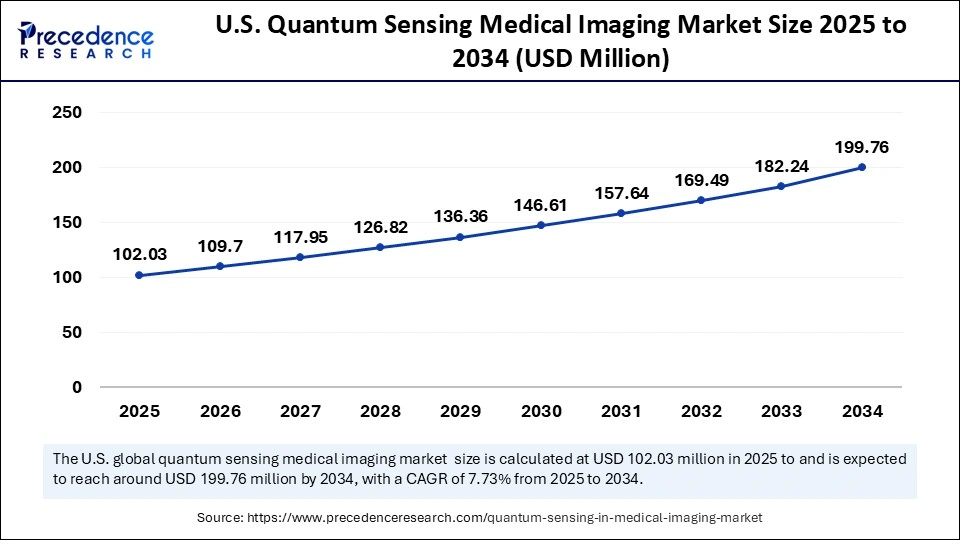

The U.S. quantum sensing medical imaging market size was exhibited at USD 102.03 million in 2025 and is projected to be worth around USD 199.76 million by 2034, growing at a CAGR of 7.73% from 2025 to 2034

What Made North America Dominate the Quantum Sensing Medical Imaging Market in 2024?

North America dominated the market with approximately 39% share in 2024 because of the early adoption of quantum technologies, robust funding for healthcare innovation, and strong research infrastructure. To improve diagnostic accuracy, top medical facilities and academic institutions are proactively incorporating quantum imaging systems. The presence of key technology providers and ongoing product development further reinforces the region's market position.

India Quantum Sensing Medical Imaging Market Trends

India is witnessing a growing demand for the quantum sensing medical imaging market due to the early adoption of sophisticated imaging systems and substantial government funding. Research partnerships between academic institutions and medical facilities have sped up the development of quantum MEG and MRI technologies. Ongoing investments and affirmative legislation are strengthening Canada's dominance in quantum-based medical imaging.

Asia Pacific is expected to be the fastest-growing market during the forecast period, driven by rising investment in quantum healthcare research and growing adoption of advanced imaging systems. Hospitals and research organizations are increasingly focusing on quantum-based diagnostics to improve patient outcomes. Expanding healthcare infrastructure and supportive innovation programs are propelling rapid technology adoption across the region.

Canada Quantum Sensing Medical Imaging Market Trends

Canada's quantum sensing medical imaging market is growing, driven by growing investments in healthcare and a greater emphasis on developing domestic quantum technology. To increase the accuracy of diagnoses, hospitals and research facilities are investigating quantum imaging solutions. Rapid adoption is being accelerated nationwide by government-backed programs and growing healthcare infrastructure.

Country-Level Investments/Funding Trends for Quantum Sensing Medical Imaging Market

| Country | Investment Context | Key Funding/Investment Trends |

| United States | Leads in market share due to advanced healthcare and tech giants. Has a well-established and large tech industry supporting quantum innovation. | The quantum innovation hub is driven by a mix of strong private funding from tech giants like IBM, Google (Alphabet), and Amazon, along with venture capital and federal support |

| Germany | Robust research base and government-driven industrial application. Focuses on moving quantum technologies from the research stage into market-ready medical devices. | Relies on major government funding and EU support for collaborations with academic and research institutes. Projects involve organizations like Fraunhofer and include efforts with global partners on quantum sensors for neurosurgery. |

| India | Driven by a growing high-tech market and national focus on innovation, the country aims to become a leader in quantum technologies through a nationwide mission. | Government-backed National Quantum Mission funds startups like Quantum Biosciences and QNu Labs. Focuses on developing a quantum ecosystem for healthcare applications and clinical validation through partnerships. |

| UAE | Strategic national initiatives and sovereign wealth fund investments are fueling the growth of an innovation hub. | Strong state investment comes from institutions like Abu Dhabi's Technology Innovation Institute (TII). These entities focus on building in-house expertise through strategic partnerships with global quantum firms. |

Analyst Insights: Quantum Sensing in Medical Imaging

The quantum sensing medical imaging market occupies a quintessentially embryonic yet strategically consequential node at the intersection of advanced instrumentation, precision diagnostics, and next-generation imaging economics. From a capital-markets and strategy vantage, the sector should be framed as a technology-led growth theme with asymmetric upside driven by step-function improvements in sensitivity, spatial resolution, and noninvasiveness but simultaneously constrained by translational risk, scale-up complexity, and clinical/regulatory gating.

Market positioning and growth impulse

Market forecasts converge on a narrative of sustained, mid-to-high single-digit to double-digit CAGR expansion over the coming decade as quantum sensor modalities migrate from R&D labs into clinical prototyping and pilot deployments. These projections underpin a near-term addressable market measured in the low hundreds of millions (device-level) with a pathway to multi-hundred-million / low-billion TAM as the technology broadens across neuroimaging, molecular MRI augments, and bedside magnetocardiography. The quantitative literature supports a multi-vector growth case premised on both modality substitution (higher-sensitivity magnetometers replacing legacy sensors) and new-use creation (nanoscale NMR, single-cell spectroscopy).

Analytical implication: treat headline market figures as indicative rather than definitive; the real value creation will be realized through platformization of quantum sensors into validated clinical workflows, not raw device shipments.

Technology vectors and competitive moats

Two technical architectures dominate the near-term competitive set: optically pumped atomic magnetometers (OPMs) and nitrogen-vacancy (NV) centers in diamond (diamond NV magnetometry / quantum diamond sensors). NV-center platforms promise room-temperature operation with nanoscale spatial fidelity; OPMs offer high absolute sensitivity for biomagnetic mapping. The choice of architecture has material business consequences; NV technologies favor miniaturization and chip-scale OEM models, whereas OPMs presently align to modular clinical instruments and hospital capital procurement cycles.

Strategic take: durable moats will accrue to players able to combine hardware IP (sensor physics), systems engineering (cryogenics-free, clinical form-factor), and upstream algorithmic stacks (denoising, source localization, and clinical decision support). Proprietary sample-preparation and surface-chemistry know-how for NV devices may create additional defensibility at the interface of material science and device integration.

Commercial models and go-to-market dynamics

The quantum sensing medical imaging market entrants will bifurcate into three commercial archetypes: (i) medical-device incumbents/integrators pursuing capital sales and service contracts; (ii) chip-and-component OEMs selling sensors to instrument makers under supply agreements; and (iii) platform-software providers monetizing analytics and clinical workflows (SaaS/analytics subscriptions, per-scan fees, or bundled outcomes contracts). Early adopters are likely to be specialty neuro-centers and research hospitals where the clinical utility threshold and willingness to fund pilots are highest. Reimbursement trajectories will lag technology adoption and constitute a key commercialization constraint.

Investor implication: the highest-conviction opportunity is in vertically integrated offerings that can demonstrate not just incremental signal fidelity but measurable clinical endpoints (diagnostic yield, therapy guidance, or cost-of-care improvement), enabling premium pricing or payor acceptance.

Clinical validation, regulatory, and reimbursement hurdles

Clinical translation will be governed by a tripartite gating mechanism: robust comparative effectiveness evidence (RCTs / large observational cohorts), regulatory classification (SaMD adjunct vs standalone diagnostic device), and payer economics. Given that many use-cases (e.g., microstructure MRI, magnetoencephalography with sensor proximity) address diagnostic ambiguity rather than replace existing imaging wholesale, reimbursement will require demonstrable downstream cost offsets (reduced follow-ups, targeted interventions). The regulatory pathway is therefore elongated and capital-intensive; investors should model multi-phase trials and conservative commercialization timelines.

Manufacturing, supply chain, and scale risk

Commercial viability depends critically on scaling quantum-grade materials (synthetic diamond substrates with controlled NV density, chip-scale photonics, low-noise lasers, and control electronics). These upstream bottlenecks create an opportunity for early-mover supply chain capture (specialized fabs, epitaxial growth partnerships) and also heighten the likelihood of strategic supplier consolidation or exclusive supply arrangements. Manufacturing risk will be an underappreciated diluent of near-term margins and a latent driver of M&A interest from larger medtech incumbents seeking to internalize supply.

Data, analytics, and clinical AI as value multipliers

Raw quantum sensor outputs require sophisticated signal processing (noise suppression, artifact rejection, inverse problem solving). Therefore, the platform capable of coupling sensor fidelity with validated AI/ML pipelines and clinical decision support will extract a disproportionate share of downstream value. Data governance, real-world evidence capture, and longitudinal registries will be commercial assets that accelerate payer acceptance and recurring revenue models. Intellectual property in proprietary denoising transforms and clinically labeled data sets will be monetizable through licensing, federated learning partnerships, or vertical integration.

Capital markets, strategic M&A, and financing outlook

Early financings and grant flows are robust in jurisdictions that prioritize quantum technology ecosystems; however, corporate investors and strategic acquirers will condition late-stage capital on clinical inflection points. Expect two parallel liquidity pathways: (i) strategic M&A of proven platform players by large medtech / imaging incumbents seeking differentiation, and (ii) scaled IPOs for entities that can demonstrate recurring software revenue, regulatory approvals, and defensible supply chains. Private capital should be structured with milestone-linked tranches and patient liquidity horizon assumptions.

Risk factors and scenario analysis

Key downside risks include: slower-than-expected clinical benefit translation, unanticipated biophysical limitations at clinical scales (signal-to-noise constraints in vivo), supply chain failures for quantum materials, and protracted reimbursement timelines. Upside scenarios hinge on a limited set of binary events: first-mover demonstration of superior diagnostic utility in a high-value clinical indication (e.g., epilepsy localization, early neurodegeneration biomarkers), and regulatory acceptance that enables premium reimbursement. Model portfolios should therefore be skewed toward optionality: small, targeted equity positions in differentiated platform providers combined with exposure to component suppliers with early revenue traction.

Top Quantum Sensing Medical Imaging Market Companies

- Qnami: Qnami is a leading innovator in quantum sensing, leveraging diamond-based nitrogen-vacancy (NV) centers for ultra-sensitive magnetic imaging at the nanoscale.

Its ProteusQ quantum microscope enables unprecedented visualization of magnetic structures in biological and medical materials, advancing quantum-enabled diagnostic research. - Quantum Diamond Technologies Inc. (QDTI): QDTI develops high-sensitivity diamond NV center sensors designed for non-invasive medical imaging and cellular-level magnetic field detection. The company's quantum sensing platform offers potential for next-generation MRI enhancement, enabling better contrast and detection without strong magnetic fields.

- Siemens Healthineers: Siemens Healthineers is integrating quantum-enhanced magnetic resonance imaging (MRI) technologies into its diagnostic portfolio to achieve higher image clarity and faster scans. Through research collaborations, Siemens aims to reduce noise, enhance spatial resolution, and develop hybrid quantum-classical imaging systems for clinical use.

- GE Healthcare: GE Healthcare explores quantum sensing and superconducting technologies to push the limits of MRI sensitivity and imaging speed. The company's R&D focuses on precision diagnostics, low-field MRI, and portable imaging solutions powered by quantum-enhanced sensors for early disease detection.

- NVision Imaging Technologies: NVision is pioneering quantum hyperpolarization technology to increase MRI signal strength by up to 10,000 times, enabling real-time metabolic and molecular imaging. Its quantum-based approach helps visualize biochemical changes in living tissues, improving early diagnosis of cancer, neurological disorders, and metabolic diseases.

Other Companies in the Quantum Sensing Medical Imaging Market

- Element Six (De Beers): A leader in synthetic diamond production, Element Six provides high-purity diamond materials essential for quantum sensing and MRI enhancement applications.

- QuSpin Inc.: Designs and manufactures compact optically pumped magnetometers (OPMs) for quantum-based brain imaging (MEG) and neuromagnetic sensing.

- Oxford Instruments plc: Offers advanced scientific instrumentation integrating quantum technologies for ultra-sensitive magnetic resonance imaging and materials analysis.

- Thermo Fisher Scientific: Focuses on quantum-enabled analytical and imaging technologies for biomedical research, including high-precision magnetic and molecular diagnostics.

- Bruker Corporation: Specializes in high-resolution MRI and NMR systems, investing in quantum sensing research to enhance imaging sensitivity and spatial resolution.

- Philips Healthcare: Innovates in advanced diagnostic imaging using quantum principles to improve MRI performance, reduce noise, and enhance patient safety.

- IBM Corporation: Integrates quantum computing and sensing technologies for advanced medical imaging data analysis and molecular-level visualization.

- Honeywell International: Develops high-precision quantum sensors for magnetic and gravitational measurements, with potential applications in medical diagnostics and imaging.

- Canon Medical Systems Corporation: Explores quantum sensor integration into MRI and CT technologies to deliver faster, higher-resolution medical imaging systems.

- ZTE Corporation: Expands into quantum-enhanced imaging and sensor integration for medical diagnostics through partnerships and R&D in quantum communication and sensing.

Recent Developments

- In June 2025, a Boston-based medical device company announced exploring quantum sensing technologies to revolutionize medical imaging with unprecedented precision and insights into human biology at the molecular level.(Source: https://www.medeviceboston.com)

- In July 2024, the University of Birmingham established a new hub concentrating on quantum sensing, imaging, and timing. It is a part of a 160 million investment to advance quantum technologies with applications in medical imaging, aiming to enhance diagnostic precision and treatment outcomes.(Source: https://www.birmingham.ac.uk)

Segments Covered in the Report

By Technology / Sensing Platform

- Nitrogen-Vacancy (NV) Centers in Diamond

- Optically Pumped Atomic Magnetometers (OPMs)

- Superconducting Sensors (SQUIDs & Superconducting Quantum Magnetometers)

- Atom-Interferometry / Cold-Atom Sensors

- Quantum-Enhanced Photonic Imaging (Entangled / Quantum Light)

- Rydberg / Single-Electron Detectors

- Other Quantum Detectors

By Product / Offering

- Standalone Imaging Systems

- Sensor Modules / OEM Components

- Hybrid Systems / Add-Ons

- Software & Analytics

- Services / Installation / Maintenance

By Imaging Modality / Application

- Magnetoencephalography (MEG)

- Magnetocardiography (MCG)

- Quantum-Enhanced MRI

- Quantum Optical Imaging & Microscopy

- Photoacoustic Imaging

- Quantum-Aided Endoscopic Imaging

By End-User

- Hospitals & Medical Centers

- Diagnostic & Imaging Centers

- Clinical & Academic Research Institutes

- Pharmaceutical & Biotechnology Companies

- OEMs & Integrators

By Component / Subsystem

- Sensor / Detector

- Cryogenics / Thermal Control

- Optics / Laser Sources

- Readout Electronics & Data Acquisition

- Software

- Consumables

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting