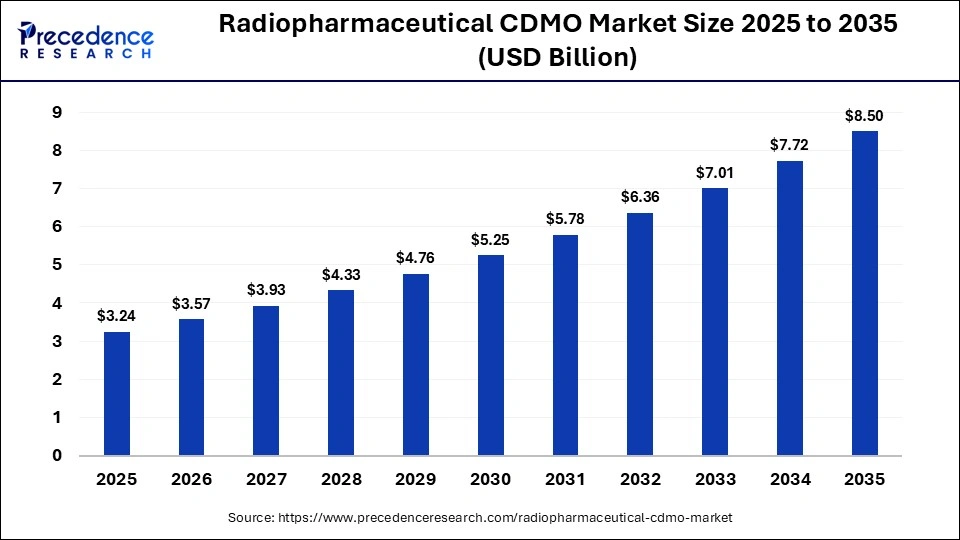

What is the Radiopharmaceutical CDMO Market Size?

The global radiopharmaceutical CDMO market size accounted for USD 3.24 billion in 2025 and is predicted to increase from USD 3.57 billion in 2026 to approximately USD 8.50 billion by 2035, expanding at a CAGR of 10.12% from 2026 to 2035. The radiopharmaceutical CDMO market is growing steadily, driven by rising nuclear medicine demand, oncology-focused innovation, regulatory outsourcing, and expansion of personalized radiotherapies.

Market Highlights

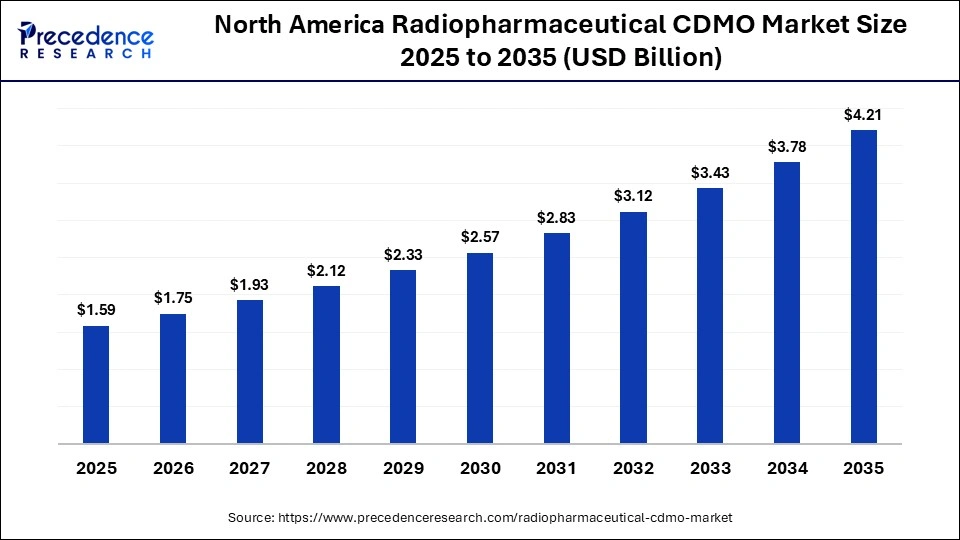

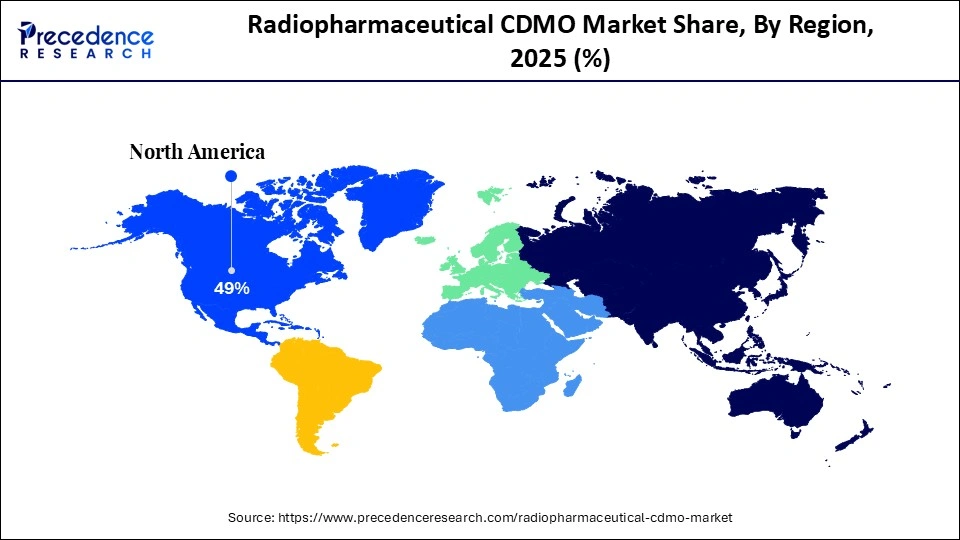

- North America led the radiopharmaceutical CDMO market with a 49% share in 2025.

- The Asia Pacific is estimated to expand at the fastest CAGR between 2026 and 2035.

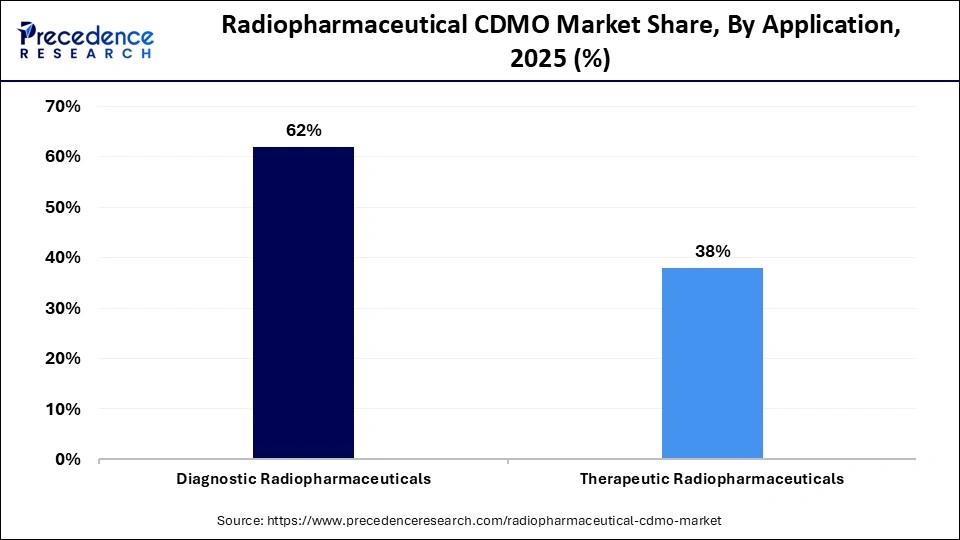

- By application, the diagnostic radiopharmaceuticals segment captured approximately 62% market share in 2025.

- By application, the therapeutic radiopharmaceuticals segment is growing at the highest CAGR between 2026 and 2035.

- By radioisotope type, the Fluorine-18 segment held around 34% market share in 2025.

- By radioisotope type, the Actinium-225 segment is projected to grow at a solid CAGR between 2026 and 2035.

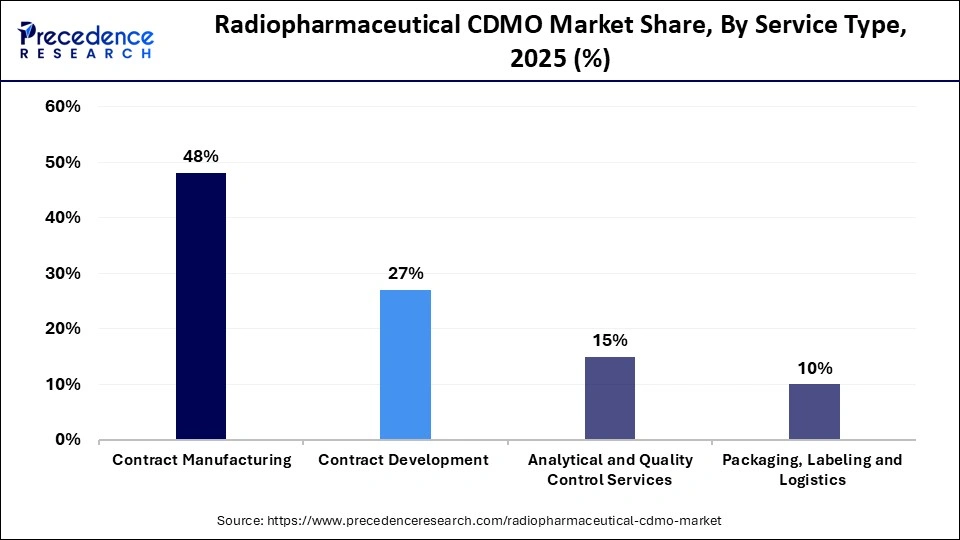

- By service type, the contract manufacturing segment led the market and held approximately 48% market share in 2025.

- By service type, the packaging, labeling & logistics segment is expected to expand at the highest CAGR from 2026 to 2035.

- By therapeutic area, the oncology segment led the market and held 71% market share in 2025.

- By therapeutic area, the neurology segment is expected to expand at the fastest-growing CAGR from 2026 to 2035.

What Are the Factors Behind Growing Demand for Radiopharmaceutical CDMO?

Radiopharmaceutical CDMO is the term for third-party companies/facilities that develop, manufacture, and package your radioactive drugs that are used for both diagnostic imaging and targeted cancer therapy. These companies assist pharmaceutical companies with everything from isotope handling, through all pharmaceutical regulatory compliance requirements, to sterile production and packaging in highly controlled environments.

The growth of the radiopharmaceutical CDMO market is primarily driven by an increasing utilization of nuclear medicine across oncology, cardiology, and neurology and a growing pipeline of targeted radiotherapies for these indications. There is a growing trend in drug development toward the outsourcing of development and manufacturing services; drug developers are increasingly using third-party radiopharmaceutical cdmos as a means of reducing the capital requirements associated with developing & manufacturing a radioactive drug and managing the complex logistics associated with short half-lives. Advances in both the development of PET & SPECT radiopharmaceutical tracers, along with increasing levels of compliance to regulatory standards, further augment the demand for experienced CDMOs that can provide an integrated development through commercialization solution.

Harnessing the Power of AI to Enhance Quality and Speed

Artificial intelligence continues to play an increasingly important role in the radiopharmaceutical contract development and manufacturing organization (CDMO) market by allowing for more accurate manufacturing processes, faster turnaround times, and enhanced operational efficiencies. Many of today's leading CDMOs are utilizing AI systems, such as digital twins and predictive analytics, to help streamline their complex manufacturing processes, improve the overall quality assurance of their products, and decrease the risk of human error when working with highly sensitive radioactive materials.

- In May 2025, Viva Biotech launches the AI-driven drug discovery platform, transforming new drug R&D logic and enabling one-stop innovative drug discovery. The AIDD platform acts as a transformative enchantment for drug R&D, offering an intelligent, efficient, and integrated approach to accelerate the discovery of novel therapeutics.

Furthermore, AI tools provide CDMOs with the ability to reduce product development and testing cycles by creating virtual production environments and forecasting any logistical roadblocks before they occur, which is essential for CDMOs to meet stringent regulatory demands and maintain accelerated time-to-clinic. As more companies implement sophisticated AI-based manufacturing and analytics platforms, this innovative technology will become an increasingly valuable and strategic means to ensure consistent and high-quality radiopharmaceutical therapies are available.

Radiopharmaceutical CDMO Market Outlook

- Market Overview: Government-supported nuclear medicine programs are boosting PET and SPECT imaging's worldwide use, increasing outsourcing of radiopharmaceutical manufacturing to specialized CDMOs with licensed hot cell capabilities.

- Regulations & Safety: The stringent nature of good manufacturing practices (GMP), Radiation Safety, and Pharmacovigilance enforced by regulatory agencies such as the US Food and Drug Administration (FDA) and European Medicines Agency (EMA) causes pharmaceutical companies to partner exclusively with CDMOs that are in compliance, as evidenced by their proven records of regulatory inspections.

- Increasing Clinical Development Pipeline: The public was able to track and monitor the steady increase of radioligand therapies in the Oncology area, resulting in a greater need for CDMOs that can handle small-batch production, high-precision isotope handling, and rapid turnaround times in product manufacture.

- Supply Constraints: Government documents provide evidence that there are limited numbers of medical isotopes produced globally, including Lutetium-177, which has led to increased collaboration between CDMOs and those with established supply chains linked to reactors or cyclotrons.

- Infrastructure & Localization Trends: National healthcare programs supporting the establishment of domestic radiopharmaceutical production initiatives have created opportunities for the establishment of local CDMO radiopharmaceutical production facilities, providing the added benefit of reducing the risks associated with the transportation of radioactive products over international borders and losses due to the radioactive decay of product.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.24 Billion |

| Market Size in 2026 | USD 3.57 Billion |

| Market Size by 2035 | USD 8.50 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 10.12% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Application, Radioisotope Type, Service Type, Therapeutic Area, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Application Insights

What Makes Diagnostic Radiopharmaceuticals the Primary Drivers for Demand in CDMO Services?

Diagnostic radiopharmaceuticals dominated with a 62% share in 2025, due to high PET/SPECT procedure volumes, while therapeutic radiopharmaceuticals are growing rapidly, driven by radioligand therapies. CDMOs provide the ability to produce a high volume of short half-life radiotracers (i.e., FDG) in a validated way at a high frequency with a high level of regulatory oversight and dependable supply chains. As hospitals continue to turn to outsourced providers for both the manufacturing of these products and performing quality control testing, this provides a continued demand for diagnostic-focused CDMO services.

The therapeutic radiopharmaceuticals segment is expected to be the fastest-growing with the highest CAGR during the forecasted period. The growth of therapeutic radiopharmaceuticals is fueled by the recent increase in clinical and commercial interest in the development of Radioligand Therapeutics. As recently processed beta- and alpha-emitting therapeutic radiopharmaceuticals are now receiving FDA approvals, pharmaceutical companies are increasingly looking to CDMO experts to assist with expert-level formulation for these complex radiopharmaceuticals and for help in scaling them up. The lack of internal capabilities and increased product handling demands during post-approval development are accelerating the outsourcing of late-stage development work and subsequent commercial production.

Radioisotope Type Insights

What Is the Reason for the Dominance of Fluorine-18 As the Most Popular Radioisotope?

Fluorine-18 radioisotopes dominated the market in 2025 with a 34% share as CDMO companies and hospitals well-established the use of Fluorine-18 in FDG-PET imaging. In addition, Fluorine-18 has ideal physical characteristics (such as half-life and resolution), making it a preferred choice. CDMO companies have a regular daily production cycle for FDG-PET imaging, leading to a consistent demand for Fluorine-18 through outsourcing. As a result, CDMO companies can take advantage of scalable production capabilities and validated synthesis methodologies, allowing them to support high usage of Fluorine-18 across the various diagnostic networks utilized in the delivery of FDG-PET imaging.

Actinium-225 represents the fastest-growing segment of radioisotopes due to its use in alpha-emitting radiotherapeutics for the treatment of cancer. Increased interest in targeted alpha therapy has caused an increase in the number of radiopharmaceutical producers seeking to develop specialized capabilities to handle, purify, and label Actinium-225. Because of limited global supply and complexity in processing Actinium-225, CDMO companies with advanced expertise in radiochemistry and experience with regulatory affairs are becoming more dependent on producing Actinium-225.

Service Type Insights

Why Is Contract Manufacturing Leading the Market for Radiopharmaceutical CDMOs?

Contract manufacturing led the market with a 48% share during 2025 as companies realized that they must outsource both the regular production and large-scale manufacturing of their products, as this is cost prohibitive for most developers due to high capital investment, extensive regulations, and the requirement for radiation-shielded facilities. Without this, they have no choice but to outsource to contract manufacturers who have developed proven systems, trained personnel, and achieved batch-to-batch consistency. Therefore, outsourcing to CDMOs provides diagnostic imaging facilities, as well as supply chains for delivering therapeutics, with a dependable source of supplies.

The packaging, labeling, and logistics segment is set to be the fastest-growing with the highest CAGR during the forecasted period. It is essential for CDMOs to offer a complete service package comprising full-service last-mile distribution, compliance with cold chain requirements, and the ability to deliver in the shortest possible time. The growing number of decentralized imaging centers and the need to move product between countries (cross-border shipments) are also driving a need for reliable and competent logistics providers along the radiopharmaceutical value chain, which is opening opportunities for CDMOs that are able to meet these needs.

Therapeutic Area Insights

What Are the Reasons Oncology Continues to Dominate the Market for Radiopharmaceutical CDMO Support?

The oncology segment dominated the market with a 71% share during 2025, due to it being the most heavily utilized therapeutic area due to the growing use of theranostic therapies in developing therapies for patients with cancer. These unmet needs in cancer optimization and advancement of the clinical pipeline are driving repetitive use of radiation through CDMO supported oncology initiatives. Additionally, the complexities associated with radio-labeling and individualized dosing continue to drive the industry towards favorable partnerships based on oncology capabilities.

Neurology has been the fastest-growing therapeutic area in the radiopharmaceutical CDMO market, primarily driven by increased interest in the use of imaging agents for diagnosing Neurodegenerative Diseases; this interest has led to a significant increase in the interest of Biomarker discovery in both Alzheimer's and Parkinson's, leading to many new tracers being developed for clinical validation. A key role of CDMOs is providing the necessary support in small batch manufacturing, developing the required regulatory support documentation, and facilitating the transition from preclinical research to clinical use in as efficient a manner as possible.

Regional Insights

How Big is the North America Radiopharmaceutical CDMO Market Size?

The North America radiopharmaceutical CDMO market size is estimated at USD 1.59 billion in 2025 and is projected to reach approximately USD 4.21 billion by 2035, with a 10.23% CAGR from 2026 to 2035.

Why Did North America Dominate the Radiopharmaceutical CDMO Market in 2025?

North America is the global leader in radiopharmaceutical contract development and manufacturing (CDMO) with a 49% share due to the presence of a sophisticated nuclear medicine ecosystem, the extensive collaboration between the pharmaceutical developers and the suppliers of isotopes, and the regulatory authority that has legislation in place for radiopharmaceutical production. RLS Radiopharmacies added CDMO capabilities to eight of the 31 sites in its network in the U.S., answering the growing demand for the development and manufacture of radiotherapies. Additionally, the presence of many manufacturers providing targeted products for oncology, cardiology, and neurology has led to a high level of acceptance of these types of products because of the growing number of clinical trials being conducted and the rapid development of clinical applications of newly created radiotracers, which will create a long-lasting requirement for contract manufacturing and development services.

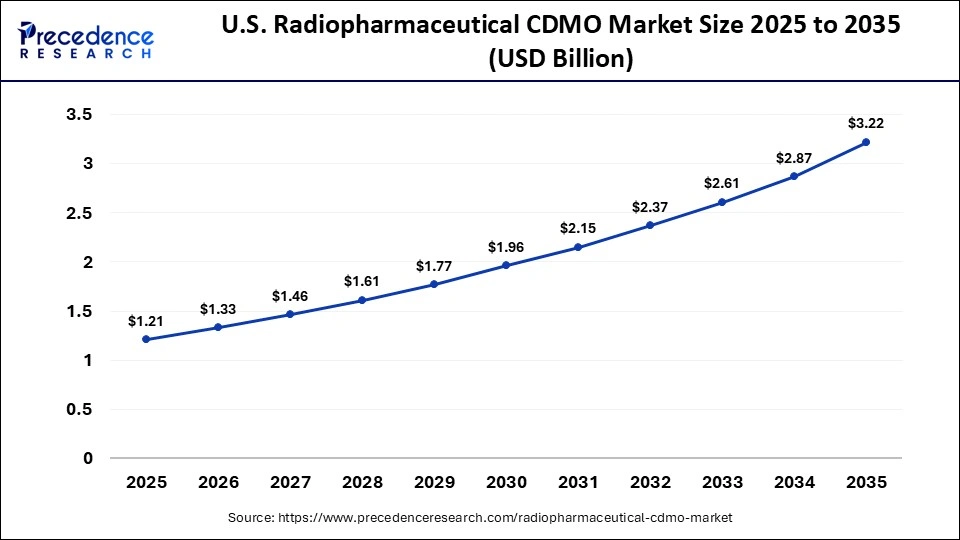

What is the Size of the U.S. Radiopharmaceutical CDMO Market?

The U.S. radiopharmaceutical CDMO market size is calculated at USD 1.21 billion in 2025 and is expected to reach nearly USD 3.22 billion in 2035, accelerating at a strong CAGR of 10.28% between 2026 and 2035.

U.S. Radiopharmaceutical CDMO Market Trends

The U.S. is the key to the overall regional success in the radiopharmaceutical CDMO market. The country has developed an extensive network of nuclear pharmacies and other laboratories as well as research/teaching hospitals conducting research into new radiopharmaceuticals. U.S. manufacturers are now able to outsource their production of radiopharmaceuticals with greater confidence due to the availability of improved guidance from the FDA related to radiopharmaceutical drugs. The growing acceptance of theranostics and development of new radiopharmaceuticals being produced from isotopes being created in the U.S. will continue to make the U.S. the largest marketplace for radiopharmaceutical CDMO activities.

In October 2024, PharmaLogic Holdings Corp., a premier contract development and manufacturing organization (CDMO) and radiopharmacy solutions provider, announced the opening of its radiopharmaceutical production and research facility in Los Angeles

Why Is Asia Pacific Set to Have the Fastest Growth of Radiopharmaceutical CDMO Market?

The Asia Pacific region is set to be the fastest-growing region in the world. Many factors contribute to its massive growth, including the rapid growth of nuclear medicine, increased demand for cancer diagnostic services, and the coupled support of the governments of the various countries for developing the necessary infrastructure to produce isotopes domestically. Countries in the Asia Pacific are investing significantly in cyclotron installations and the research of radiopharmaceuticals in order to reduce their reliance on imported isotopes. As the level of clinical trial activity and the availability of cost-efficient manufacturing facilities and trained radiochemists to work in those facilities continue to increase, pharmaceutical companies are finding it increasingly beneficial to partner with regional contract development manufacturing organizations (CDMOs). In support of these activities, regulatory bodies are developing new frameworks to enhance radiopharmaceutical development and cross-border collaboration.

China Radiopharmaceutical CDMO Market Trends

China is leading the radiopharmaceutical CDMO market in the Asia Pacific region, with a strong focus on producing radiopharmaceuticals for a long time, and has built a very strong hospital-based radiopharmaceutical business. The Chinese government has been supportive of the domestic production of radioisotopes and advanced nuclear imaging research for many years. The country's high use of PET and SPECT and the strong regulations surrounding them make the country a regional hub for radiopharmaceutical CDMO companies.

What Are the Factors Contributing to Growth of Radiopharmaceutical CDMO Market in Europe?

Europe has experienced good growth due to a strong working relationship between hospitals, research facilities, and specialized manufacturing companies. Within Europe, the clinical research framework for radiopharmaceuticals, especially within oncology and neurology, is one of the most advanced. The increased emphasis on personalized medicine and theranostics has increased the need for low-volume, high-complexity manufacturing-an excellent fit with the CDMO model. Europe continues to be an attractive region for partnerships in the development and manufacturing of radiopharmaceuticals due to the large numbers of cross-border research programs and consortiums that coordinate the supply of isotopes to researchers.

Germany Radiopharmaceutical CDMO Market Trends

Germany plays a vital role in the development and manufacture of radiopharmaceuticals because of its advanced capabilities in radiochemistry and the high concentration of both research reactors and cyclotrons. The importance of precision diagnostics, strong collaboration between academia and industry, and the well-established GMP infrastructure all support complex radiopharmaceutical production in Germany. In addition, Germany provides an important benchmark for radiopharmaceutical activity throughout Europe in terms of logistics and regulatory issues.

How Is the Middle East & Africa Notably Growing in the Radiopharmaceutical Market?

The region of the Middle East & Africa is emerging in the radiopharmaceutical CDMO market with developments. Gradual investments in nuclear medicine facilities are being made, and there is heightened awareness of new advanced diagnostics and therapeutic Radiopharmaceuticals, and as a result, countries in this region are focusing on modernizing their respective healthcare systems. Through the establishment of cyclotron facilities and radiopharmacy units, several countries will enhance the availability of radiopharmaceuticals to patients. Even though the ability to produce radiopharmaceuticals locally is still being developed, many have put in place the framework for continued growth in the Region by partnering with International Contract Development and Manufacturing Organizations (CDMO) and supporting Technology Transfer.

Saudi Arabia Radiopharmaceutical CDMO Market Trends

Saudi Arabia is driving healthcare direct modernization and nuclear medicine services, thus expediting the progressive growth seen across the region, through Strategic Initiatives and investments into the field of nuclear medicine. Additionally, the expansion of the Kingdom's Radiopharmaceutical Production capabilities continues, as there are existing capabilities within several of the kingdom's general hospitals and research centers located in the major medical cities within Saudi Arabia. Government-backed programs aiming to localize advanced therapies and diagnostic services have positioned Saudi Arabia as a potential future center of excellence for radiopharmaceutical CDMO in the Region.

Who are the Major Players in the Global Radiopharmaceutical CDMO Market?

The major players in the radiopharmaceutical CDMO market include Curium Pharma, Eckert & Ziegler, ITM Isotope Technologies Munich, NorthStar Medical Radioisotopes, Cardinal Health, SOFIE Biosciences, PharmaLogic Holdings, SpectronRx, Monrol, SHINE Technologies, IONETIX Corporation, Nucleus RadioPharma, Evergreen Theragnostics, Minerva Imaging, Seibersdorf Labor GmbH, and Nihon Medi-Physics.

Recent Developments

- In June 2025, A new theranostic infusion system by Nucleus RadioPharma is being developed to improve radiopharmaceutical delivery with a shielded, disposable IV cartridge compatible with standard hospital pumps, enhancing safety and precision.(Source: https://www.fiercepharma.com)

- In January 2025, Lantheus agreed to acquire radiopharma CDMO Evergreen Theragnostics for $250 M upfront, with up to $752.5 M in milestones, expanding manufacturing infrastructure and diagnostic and theranostic pipelines.(Source: https://lantheusholdings.gcs-web.com)

Segments Covered in the Report

By Application

- Diagnostic Radiopharmaceuticals

- Therapeutic Radiopharmaceuticals

By Radioisotope Type

- Fluorine-18

- Technetium-99m

- Gallium-68

- Lutetium-177

- Actinium-225

- Others

By Service Type

- Contract Manufacturing

- Contract Development

- Analytical & Quality Control Services

- Packaging, Labeling & Logistics

By Therapeutic Area

- Oncology

- Neurology (Fastest Growing)

- Cardiology

- Others (Nephrology, Inflammation, Rare Diseases)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting