U.S. Radiopharmaceutical Therapies Market Size and Forecast 2025 to 2034

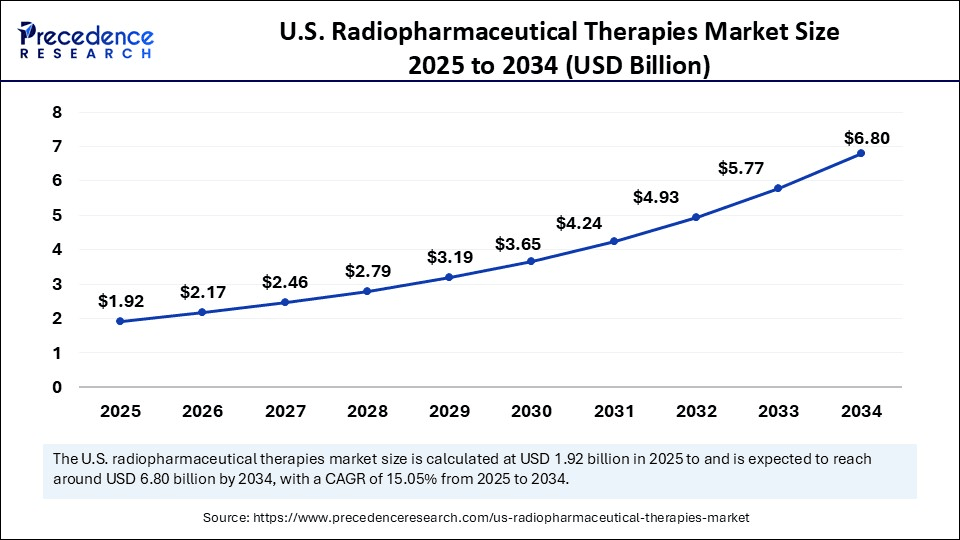

The U.S. radiopharmaceutical therapies market size accounted for USD 1.71 billion in 2024 and is predicted to increase from USD 1.92 billion in 2025 to approximately USD 6.80 billion by 2034, expanding at a CAGR of 15.05% from 2025 to 2034. The market is growing due to the increasing cancer prevalence and rising adoption of targeted nuclear medicine for precise and minimally invasive treatments.

U.S. Radiopharmaceutical Therapies MarketKey Takeaways

- By therapy type, the targeted beta therapy segment held the largest share of 66.29% in 2024.

- By therapy type, the targeted alpha therapy segment is expected to grow at the fastest CAGR of 25.27% during the forecast period.

- By radioisotopes used, the beta emitters segment held the largest share of 66.29% in 2024.

- By radioisotopes used, the alpha emitters segment is expected to grow at the fastest CAGR of 25.26% in the upcoming period.

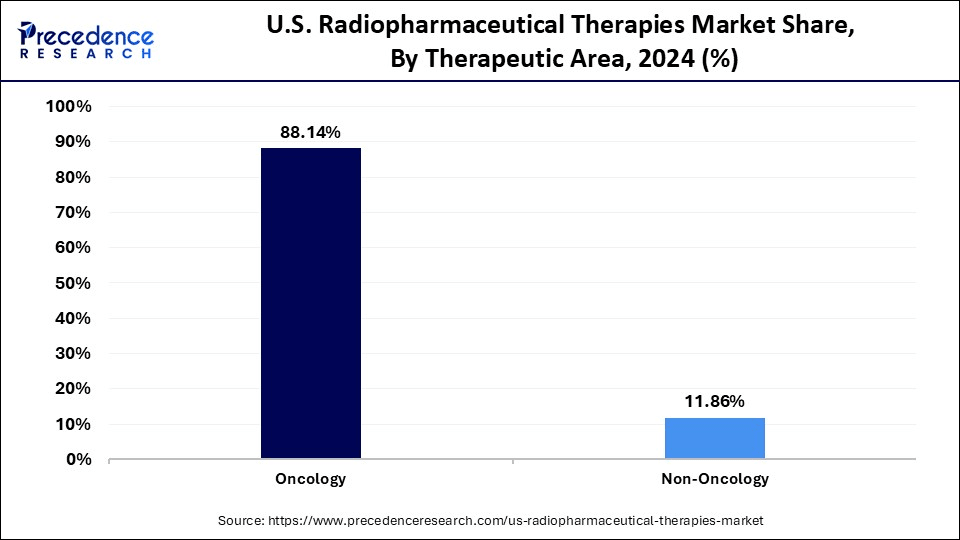

- By therapeutic area, the oncology segment held the biggest market share of 88.14% in 2024.

- By therapeutic area, the non-oncology segment is emerging as the fastest growing during the forecast period.

- By route of administration, the intravenous injection segment generated the major market share of 80.14% in 2024.

- By route of administration, the intratumoral (investigational) segment is expected to grow at the fastest CAGR of 25.06% during the forecast period.

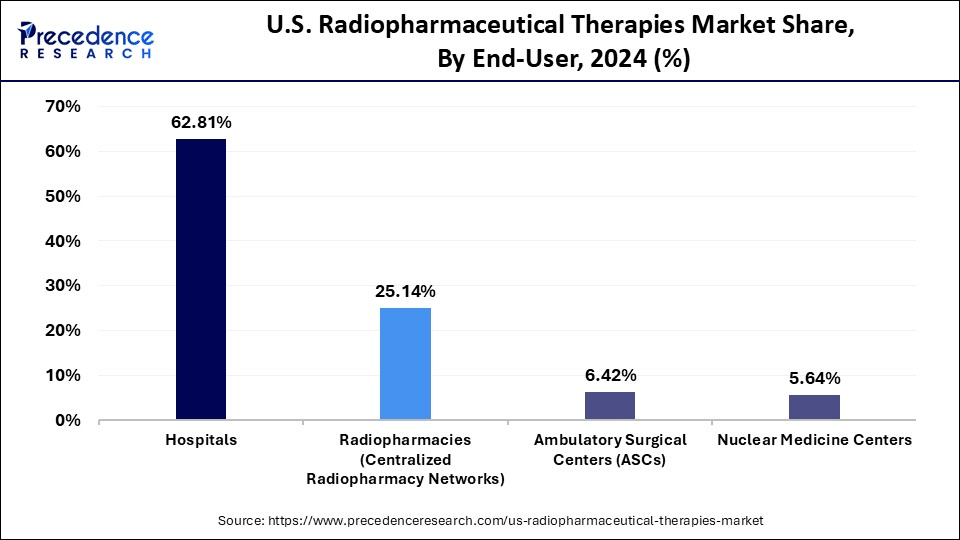

- By end-user, the hospitals segment held the highest market share of 62.81% in 2024.

- By end-user, the radiopharmacies (centralized radiopharmacy networks) segment is observed to grow at the fastest CAGR of 17.50% during the forecast period.

Impact of AI on the U.S. Radiopharmaceutical Therapies Market

Artificial Intelligenceis reshaping the U.S. radiopharmaceutical therapies market by improving diagnostic accuracy, accelerating drug development, and personalizing treatment strategies. In nuclear medicine, AI-driven imaging analysis helps detect cancer lesions more precisely, allowing radiopharmaceutical agents to be targeted with greater confidence. This leads to better patient selection for therapies like Pluvicto or Lutathera, enhancing clinical outcomes.

It enables faster detection of cancer lesions through AI-powered PET/CT scans and supports precise dosimetry for safer, targeted treatments. AI also accelerates drug discovery by predicting ligand-receptor interactions and optimizing logistics for time-sensitive isotope delivery. As AI integrates deeper into nuclear medicine workflows, it is driving more efficient, personalized, and scalable radiopharmaceutical solutions in the U.S. healthcare system.

Market Overview

The demand for radiopharmaceutical therapies is increasing in the U.S. due to the growing prevalence of cancer. Nuclear medicine offers extremely effective and minimally invasive treatment options for cancers like prostate, thyroid, and neuroendocrine tumors, which are becoming increasingly common. The ability of radiopharmaceuticals to deliver therapeutic radiation directly to diseased tissues while minimizing harm to healthy cells has led to a growing preference among patients and healthcare providers. The market is expanding due to the increase in FDA approvals for innovative radiotherapeutics, rising investments in nuclear medicine research, and better diagnostic imaging infrastructure. Furthermore, the country's long-term adoption of radiopharmaceutical therapies is being aided by the aging population and growing awareness of personalized medicine.

U.S. Radiopharmaceutical Therapies MarketGrowth Factors

- Advancing Technology: Innovations in nuclear medicine and imaging are enhancing treatment accuracy and driving clinical adoption.

- Regulatory Support: Fast-track FDA approvals and favorable policies are accelerating the launch of new radiopharmaceuticals.

- Therapies: Growing preference for personalized, minimally invasive treatments is favoring radiopharmaceutical use.

- Robust Healthcare Infrastructure: Availability of advanced treatment centers and specialists supports broader market access in the U.S.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 6.80 Billion |

| Market Size in 2025 | USD 1.92 Billion |

| Market Size in 2024 | USD 1.71 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 15.05% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Therapy Type, Radioisotope Used, Therapeutic Area, Route of Administration, End-User |

Market Dynamics

Drivers

High Cancer Burden

The rising cancer burden is a major factor driving the growth of the U.S. radiopharmaceutical therapies market. Prostate, thyroid, and neuroendocrine tumors are among the cancers that are being diagnosed more frequently, which is increasing the demand for targeted, precise treatments like radiopharmaceuticals. Radiopharmaceuticals provide targeted therapy with less systemic toxicity than traditional treatments, which frequently have serious side effects. Demand is further fueled by the growing elderly population, which is more vulnerable to cancer. More patients are receiving earlier diagnoses as cancer screening and awareness increase, expanding the pool of patients who can receive radiopharmaceutical therapy.

Strategic Partnerships and Collaborations

Strategic alliances between pharmaceutical companies, academic research institutions, and radiopharma startups are boosting innovation and speeding up time to market. These partnerships help in overcoming infrastructure, supply chains, and regulatory hurdles. Joint ventures and acquisitions such as those by Novartis and Bayer are reshaping the competitive landscape and driving clinical expansion of radiopharmaceutical platforms.

Restraint

Short Life of Radioisotopes

Due to their incredibly short half-lives, many radiopharmaceuticals must be prepared, transported, and administered quickly. This creates major logistical challenges, especially for rural or non-specialized healthcare centers. If the radioisotope decays before use, treatment delays may result in decreased efficacy. Keeping up a dependable distribution network with well-planned scheduling becomes expensive and operationally demanding. This time-sensitive nature limits broad deployment throughout the U.S. medical system.

Stringent Regulatory and Safety Requirements

Radiopharmaceuticals fall under dual regulation (drug + nuclear material), requiring strict compliance with both the FDA and Nuclear Regulatory Commission (NRC) standards. This slows product approvals and facility licensing. From isotopic purity to radiation handling protocols, compliance involves complex documentation, audits, and staff training. These regulatory burdens often delay market entry for new players and restrict the number of certified treatment centers.

Opportunities

Expansion of Theragnostic

The growing use of theragnostic, where a single radiopharmaceutical agent is used for both diagnosis and therapy, creates significant opportunities in the U.S. radiopharmaceutical therapies market. By enabling real-time treatment personalization and disease monitoring, theragnostic enhances treatment precision. With rising clinical success in treating prostate and neuroendocrine tumors, theragnostic applications are gaining wider approval. Healthcare providers are increasingly adopting theragnostic protocols, and new pipeline agents are expanding their use beyond oncology. This dual-purpose approach is becoming a cornerstone of precision nuclear medicine.

Development of Next-Gen Isotopes

Due to their potential for targeted alpha therapy, emerging isotopes such as Actinium-225, Copper-64, and Lead-212 are being studied to treat cancers that were previously unresponsive to traditional treatment. Because these isotopes emit high-energy short-range radiation, they can destroy tumor cells more effectively and with fewer side effects. The therapeutic landscape will expand as next-generation isotopes open niche applications across resistant tumors and rare cancers as production capacity increases and clinical trials progress.

Therapy TypeInsights

Why Did the Targeted Beta Therapy Segment Dominate the Market in 2024?

The targeted beta therapy segment dominated the U.S. radiopharmaceutical therapies market in 2024. The dominance of the segment stems from its established clinical use and broad adoption in treating cancers such as prostate and neuroendocrine tumors. Beta emitters like Lutetium-177 deliver radiation over a relatively longer tissue range, making them suitable for solid tumors of moderate size. Their proven safety profile, availability, and regulatory support have made beta therapy the standard of care in multiple oncology applications.

The targeted alpha therapy segment is expected to grow at the fastest rate over the projection period because it minimizes harm to healthy tissues by releasing high-energy radiation over a shorter path length, providing greater cytotoxicity and precision. Micro metastatic and resistant cancers respond particularly well to this treatment. In the U.S., its adoption is accelerating due to the increase in clinical trials involving isotopes like Actinium-225 and growing interest in rare cancer treatments.

Radioisotopes Used Insights

What Made Beta Emitters the Dominant Segment in the Market in 2024?

The beta emitters segment dominated the U.S. radiopharmaceutical therapies market in 2024 due to their established therapeutic use, availability, and compatibility with existing theragnostic agents. Beta emitters like Lutetium-177 and Iodine-131 have long been used in treating neuroendocrine tumors and thyroid cancer. Their relatively long half-life and proven clinical performance make them widely accessible for routine hospital use.

The alpha emitters segment is likely to expand at the fastest CAGR in the coming years because of their exceptional capacity to kill cancer cells at the cellular level while preserving the healthy tissue around them. Alpha emitters like Radium-223 and Actinium-225 are becoming more popular in applications related to prostate cancer and metastases. The next generation of targeted therapies is anticipated to heavily rely on alpha emitters as production and regulatory pathways advance.

Therapeutic AreaInsights

Why Did the Oncology Segment Dominate the Market in 2024?

The oncology segment dominated the U.S. radiopharmaceutical therapies market in 2024 since radioligand therapy is mainly used to treat cancers such as thyroid, prostate, and neuroendocrine tumors. The dominance of the segment is also reinforced by the growing incidence of cancer, especially in older populations, as well as the accuracy and efficacy of nuclear-targeted therapies. Ongoing research & development in radiotherapeutic oncology agents further ensure the long-term growth of the segment.

The non-oncology segment is expected to expand at the highest CAGR during the forecast period. This is mainly due to the rising usage of radiopharmaceuticals in fields like bone pain palliation and cardiology. Researchers are exploring the use of radiopharmaceuticals to treat chronic inflammation and rheumatoid arthritis. Beyond diagnostic applications, the non-oncology segment is anticipated to grow into targeted therapeutic roles as clinical data becomes available and technology becomes more adaptable.

Route of Administration Insights

How Does the Intravenous Injection Segment Dominate the U.S. Radiopharmaceutical Therapies Market in 2024?

Intravenous injection is the dominant route of administration due to its effectiveness in delivering radiopharmaceuticals directly into systemic circulation. Most approved therapies, including Pluvicto and Lutathera, are administered via IV infusion, enabling rapid targeting of disease sites throughout the body. Hospitals and nuclear medicine centers are already equipped to support IV-based therapies, reinforcing their dominance. The rising demand for targeted drug delivery further bolsters segmental dominance.

The intertumoral (investigational) segment is likely to grow rapidly over the projection period, as it enables the direct administration of therapeutic isotopes into tumor tissues, boosting local effectiveness and lowering exposure to the system. Clinical trials are investigating this technique for solid tumors that are challenging to reach through systemic circulation. Intertumoral radiopharmaceuticals may open treatment options for localized and resistant cancers as precision delivery technologies advance.

End-User Insights

What Made Hospitals the Dominant Segment in the Market in 2024?

Hospitals are the dominant end-users of radiopharmaceutical therapies in the U.S. due to their access to nuclear medicine departments, skilled personnel, and advanced imaging infrastructure. Large academic and cancer-specialty hospitals serve as primary sites for diagnosis, administration, and clinical trials of radiopharmaceuticals. Their ability to manage storage, radiation safety, and compliance makes them the key hub for radioligand therapy.

The radiopharmacies segment is expected to grow at a rapid pace in the upcoming period because they act as centralized facilities for radiopharmaceutical distribution and compounding. The rise in decentralized care and outpatient treatment models has led to increased demand for timely, made-to-order doses prepared by radio pharmacies. In both urban and rural care settings, this model promotes safer handling, improved inventory control, and quicker delivery.

Country Level Analysis

There is a high demand for nuclear medicine in the U.S. A well-established healthcare system and the FDA's fast-track approval of radioligands drive market growth. Medicare coverage makes medications like Pluvicto, Lutha Thera, and Illuccix more affordable, and they are widely available through major cancer centers. In addition, the nation has a developing outpatient network that provides nuclear therapies, making access easier outside of major academic hospitals. The U.S. investments in domestic isotope production are coming from the Department of Energy and private companies. Additionally, M&A activity and R&D investments are speeding up innovation, making the U.S. a center for the commercialization and clinical testing of specific radiopharmaceuticals.

U.S. Radiopharmaceutical Therapies MarketCompanies

- Bayer

- Novartis

- China Isotope & Radiation

- Dongcheng

- Q BioMed

- Curium Pharmaceuticals

- Jubilant DraxImage

- Lantheus

- Spectrum Pharmaceuticals

- Progenics Pharmaceuticals

- International Isotopes

Recent Developments

- On 24 June 2025, Telix Pharmaceuticals U.S. announced FDA label expansion for Ga-68 gozetotide, permitting its use in PSMA PET imaging for patient selection before taxane chemotherapy in metastatic castration resistant prostate cancer.(Source: https://www.oncologynewscentral.com0

- In October 2024, PharmaLogic Holdings Corp. announced the official opening of its radiopharmaceutical production and research facility in Los Angeles, California. The facility has undergone extensive renovations and boasts state-of-the-art equipment, signifying PharmaLogic's significant investment in fostering the development of novel radiopharmaceuticals in the region.(Source: https://www.prnewswire.com)

Segments Covered in the Report

By Therapy Type

- Targeted Alpha Therapy (TAT)

- Actinium-225-based therapies

- Radium-223-based therapies

- Astatine-211-based therapies

- Targeted Beta Therapy

- Lutetium-177-based therapies (e.g., Lu-177 DOTATATE)

- Iodine-131-based therapies

- Yttrium-90-based therapies

- Brachytherapy-based Radiopharmaceuticals

- Auger Electron Emitting Radiopharmaceuticals (emerging)

- Others

By Radioisotope Used

- Beta Emitters

- Lutetium-177 (Lu-177)

- Iodine-131 (I-131)

- Yttrium-90 (Y-90)

- Alpha Emitters

- Actinium-225 (Ac-225)

- Radium-223 (Ra-223)

- Astatine-211 (At-211)

- Brachytherapy-based Radiopharmaceuticals

- Auger Electron Emitting Radiopharmaceuticals (emerging)

- Others

- Samarium-153

- Rhenium-186/188

- Holmium-166

By Therapeutic Area

- Oncology

- Prostate cancer

- Neuroendocrine tumors

- Liver cancer (e.g., HCC)

- Thyroid cancer

- Non-Hodgkin's lymphoma

- Non-Oncology

- Bone metastases pain palliation

- Hyperthyroidism

- Cardiology (e.g., atrial fibrillation ablation using radioisotopes)

By Route of Administration

- Intravenous Injection

- Oral (primarily Iodine-131)

- Intra-arterial (in case of liver cancer, radioembolization)

- Intratumoral (investigational)

By End-User

- Hospitals

- Academic Medical Centers

- Specialty Cancer Hospitals

- Radiopharmacies (Centralized Radiopharmacy Networks)

- Ambulatory Surgical Centers (ASCs)

- Nuclear Medicine Centers

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting