What is the Real-time PCR Market Size?

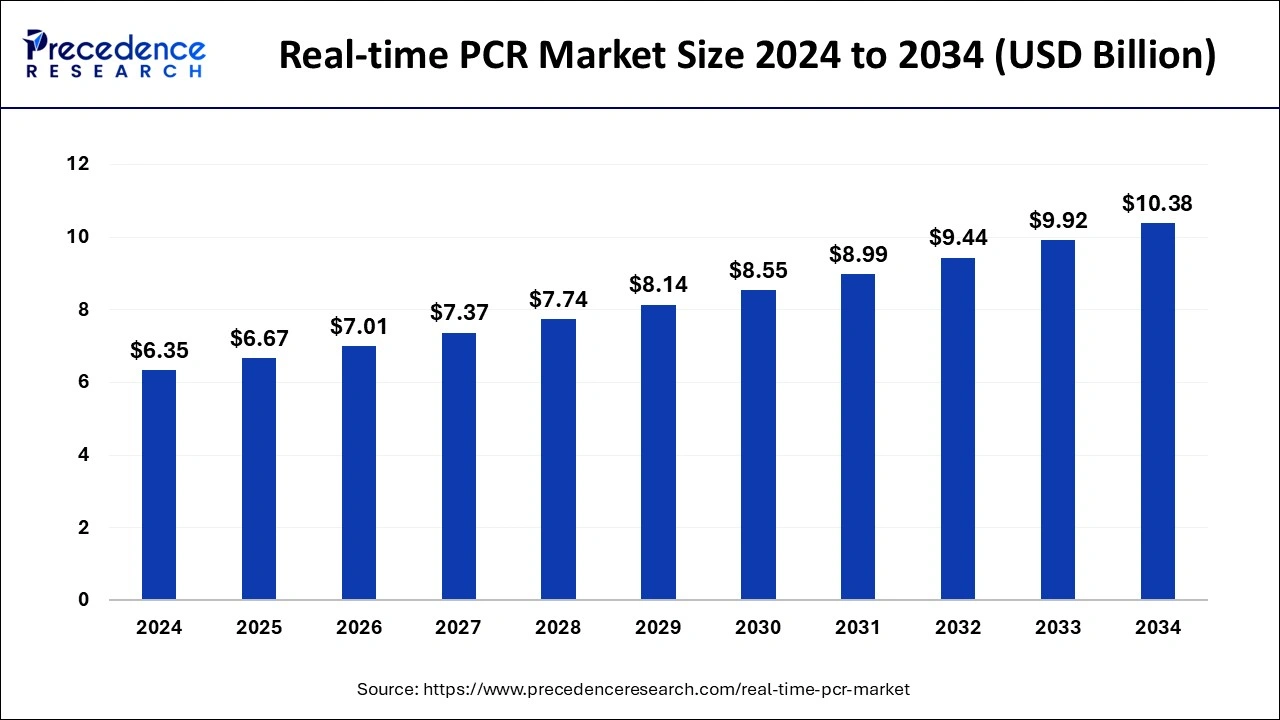

The global real-time PCR market size was calculated at USD 6.67 billion in 2025 and is expected to reach around USD 10.85 billion by 2035, expanding at a CAGR of 4.99% from 2026 to 2035. The rise in genetic disorders and rare diseases in human beings has increased the demand for real-time PCR (real-time Polymerase Chain Reaction), which is estimated to drive the growth of the real-time PCR market over the forecast period.

Real-time PCR Market Key Takeaways

- The global real-time PCR market was valued at USD 6.67 billion in 2025.

- It is projected to reach USD 10.85 billion by 2035.

- The real-time PCR market is expected to grow at a CAGR of 4.99% from 2026 to 2035.

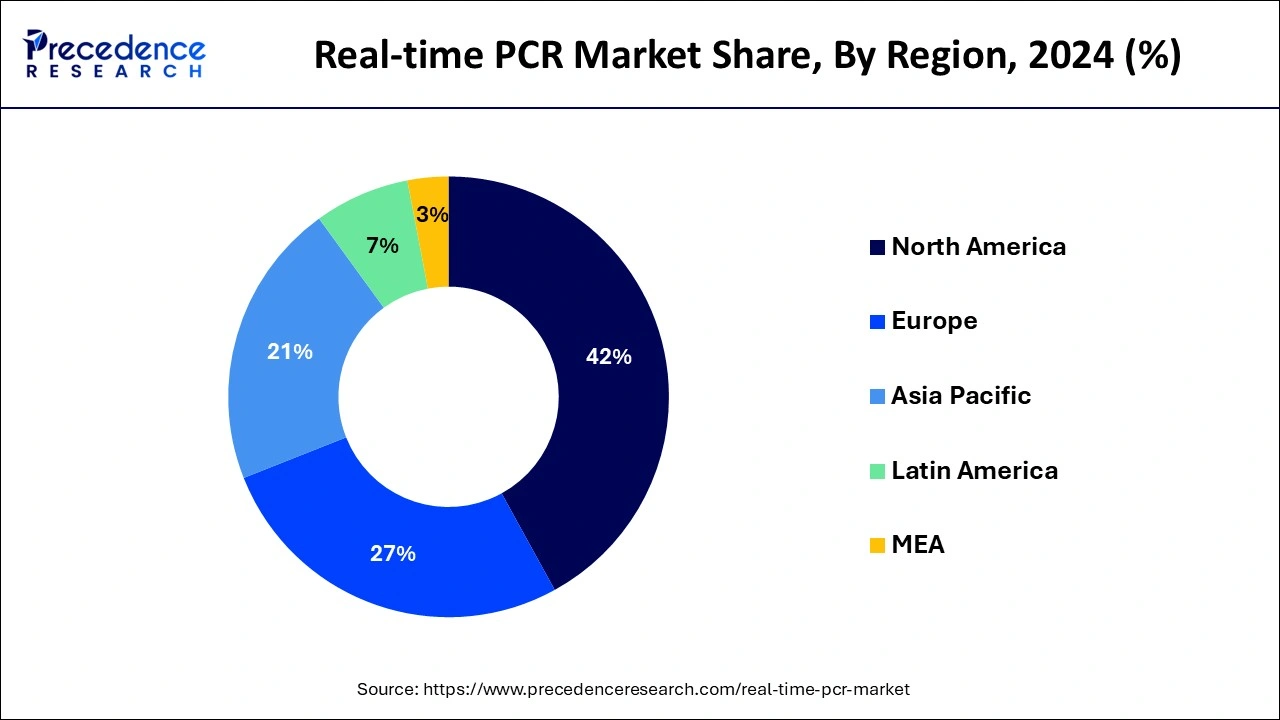

- North America dominated the real-time PCR market with the largest revenue share of 42% in 2025.

- Asia Pacific is expected to grow at a significant rate in the market during the forecast period.

- By product, the reagents & consumables segment dominated the market with the largest share in 2025.

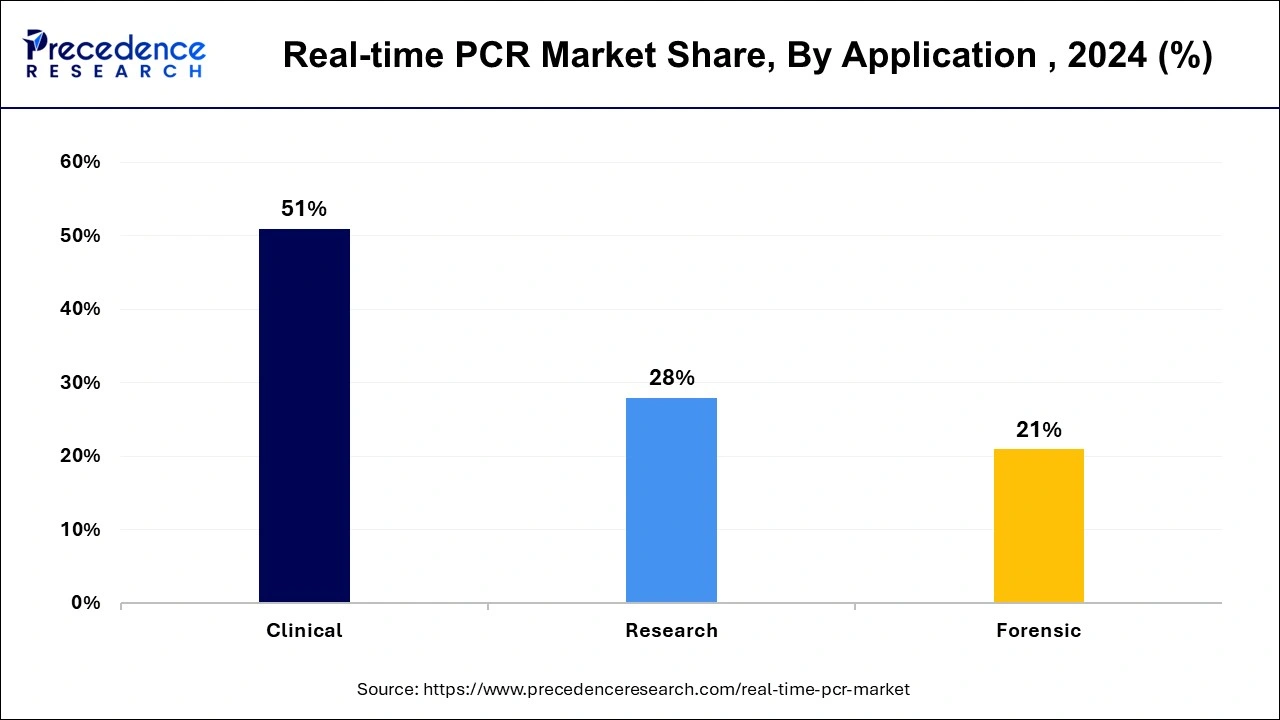

- By application, the clinical segment has contributed more than 51% of revenue share in 2025.

- By end user, the hospitals and diagnostic centers segment dominated the market in 2025.

Market Overview

Polymerase chain reaction (PCR) is a temperature-dependent nucleic acid amplification method that is used to enzymatically amplify DNA (Deoxyribonucleic acid) or RNA (Ribonucleic acid) in vitro. Polymerase chain reaction (PCR) products can be accurately detected and quantified with the use of real-time polymerase chain reaction (PCR), which is a valuable tool. Quantitative polymerase chain reaction (qPCR), a molecular biology laboratory technique based on the polymerase chain reaction (PCR), is another name for real-time polymerase chain reaction (PCR). In contrast to the traditional polymerase chain reaction (PCR) approach, which allows analysis only after the process is finished, the phrase "real-time" refers to the ability to track the amplification's progress while it is taking place.

Real-time polymerase chain reaction (PCR) works on the same amplification mechanism as polymerase chain reaction (PCR). Yet, the reaction is observed in "real-time" as opposed to seeing bands on a gel at the conclusion of the reaction. The reaction is added to a real-time polymerase chain reaction (PCR) apparatus, which uses a camera or detector to monitor the reaction as it happens. While there are numerous methods for tracking the development of a PCR reaction, they are always similar in one way. They all relate the production of fluorescence, which can be easily seen with a camera during each polymerase chain reaction (PCR) cycle, to the amplification of DNA (Deoxyribonucleic acid). Therefore, the fluorescence grows together with the amount of gene copies during the reaction, indicating the reaction's progress. The applications of real-time PCR are mutation detection, gene expression analysis, detection and quantification of pathogens, detection of allergens, species identification, detection of genetically modified organisms, determination of parasite fitness, and monitoring of microbial degradation.

Impact of AI on the Real-time PCR Market

AI technologies make real-time PCR tests faster and more precise. AI analyzes large amounts of data automatically, which helps healthcare professionals in both treatment and discovery tasks while also preventing mistakes and speeding up results. Researchers can better control testing operations to achieve higher precision by integrating AI algorithms into RT-PCR systems. AI speeds up treatment and diagnostics development by providing healthcare experts and researchers with real-time information to make faster decisions.

Real-time PCR Market Growth Factors

- Expansion of healthcare services can foster the growth of the real-time PCR market in the near future.

- The increasing launch of the new policy by the government to support gene therapy is expected to drive the growth of the market over the forecast period.

- The rising epidemiology of chronic diseases, infectious diseases, and genetic disorders has shown an increase in the demand for real-time PCR systems, which is expected to drive the growth of the market over the forecast period.

- The increasing geriatric population has raised the demand for rapid diagnostic tests, which is estimated to fuel the growth of the real-time PCR market over the forecast period.

- A rise in research and development activities for the discovery of new drugs is expected to foster the growth of the market in the near future.

- Increasing adoption of inorganic growth strategies like mergers for launching new real-time PCR technology is expected to drive the growth of the market during the forecast period.

- Increasing adoption of organic strategies like marketing and market expansion by the key companies is estimated to drive the growth of the real-time PCR market over the forecast period.

Market Outlook

- Market Growth Overview: The real-time PCR market is expected to grow significantly between 2025 and 2034, driven by the rising infectious diseases and chronic illnesses, growing adoption of personalized medicine, and expansion in genomic research and developments.

- Sustainability Trends: Sustainability trends involve eco-friendly consumables and packaging, green reagents and chemistry, and energy-efficient instrumentation.

- Major Investors: Major investors in the market include Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc., F. Hoffmann-La Roche Ltd., QIAGEN N.V., Agilent Technologies, Inc., and Danaher Corporation.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 10.85 Billion |

| Market Size in 2025 | USD 6.67 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 4.99% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Application, End User,and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing launch of the new real-time polymerase chain reaction system

The rise in the launch of the new real-time polymerase chain reaction system by the key market players operating in the market is expected to drive the growth of the real-time PCR market over the forecast period. The real-time polymerase chain reaction data makes it easy to conduct a fully quantitative analysis of gene expression. Therefore, in contrast to standard preparative PCR, Real-time PCR avoids "false negatives" by enabling the success of numerous polymerase chain reactions to be automatically determined after a short number of cycles without requiring individual inspection of each reaction.

- For instance, in November 2023, F. Hoffmann-La Roche Ltd, a multinational holding healthcare company, announced the introduction of the next-generation LightCycler PRO System, which assists in performing advanced molecular diagnostics. In-vitro diagnostics and translational research are becoming closer with this innovative real-time polymerase chain reaction technology, which also sets new standards for performance and usability. The LightCycler PRO System allows labs to easily and legally move from discovery research to patient clinical sample testing since it is labeled and built for both research and in-vitro diagnostic processes.

Restraint

Challenges and limitations associated with the real-time polymerase chain reaction

The limitations and challenges occurring with real-time polymerase chain reactions can restrict the growth of the real-time PCR market. For instance, in May 2023, according to the data published by the National Center for Biotechnology Information, it was estimated that there are various obstacles and restrictions associated with real-time polymerase chain reaction (PCR). The complexity and expense of microfabrication and detection techniques like electrochemical amplicon or fluorophore-assisted detection make point-of-care testing less feasible.

Furthermore, the PCR process's lengthy amplification time and complexity make it ineffective for diagnosing infectious infections that appear suddenly. The use of PCR in medical sciences and research is further hampered by limited access to sufficient instruments and resources, especially in underdeveloped African nations. Furthermore, bacteriological investigations must be incorporated into laboratory control schemes in order to identify species and assess the viability of microorganisms, as PCR may not be sufficient for these tasks alone. The mentioned hurdles and constraints highlight the necessity for progress in real-time polymerase chain reaction technology to overcome them and enhance its efficacy across a range of uses.

Opportunity

Approval by the regulatory authorities

Increasing approval of the newly innovated products by regulatory bodies is expected to create a lucrative opportunity for the growth of the real-time PCR market.

- For instance, in March 2024, Co-Diagnostics, Inc., a molecular diagnostics company, announced that CoSara Diagnostics Pvt Ltd., its joint venture for sales and manufacturing in India, received approval from the Central Drugs Standard Control Organization ("CDSCO") in India to manufacture and sell its SARAPLEX Influenza Multiplex polymerase chain reaction Test Kit to clinical laboratories as an in vitro diagnostic ("IVD") for the differentiation and detection of Influenza B and Influenza A. Based on the company's proprietary Co-PrimersTM technology, the CoSara real-time multiplex PCR test is intended to distinguish between H1N1 and H3N2 and to concurrently identify influenza A (H2N1, H1N1, H10N8, H3N2, H1N2, H5N1, H7N7, H9N2, H7N9, H5N6, H7N4, H7N2, and H2N2) and influenza B (Yamagata and Victoria strains).

Segment Insights

Product Insights

The reagents & consumables segment held the dominating share of the real-time PCR market in 2025 on account of increasing approval of the newly innovated products by the regulatory bodies.

- For instance, in January 2024, QIAGEN, a company that provides sample and assay technologies for applied testing, pharmaceutical research, molecular diagnostics, and academic research, revealed that the U.S. Food and Drug Administration (FDA) approved the NeuMoDx CT/NG Assay 2.0, which can be used for its integrated polymerase chain reaction-based clinical molecular testing systems NeuMoDx 96 and 288 in the U.S. NeuMoDx Molecular Systems' plan to expand its test menu in the U.S. is supported by this FDA clearance. It also expands upon the 16 European Union's (EU)-certified in-vitro diagnostics (CE-IVD) tests that are compatible with these systems; these are among the most comprehensive on the market in nations that recognize CE-IVD markings, and they include assays for viruses linked to respiratory infections, sexual and reproductive health, transplant recipients, and blood-borne infections.

Application Insights

The clinical segment held the largest share of the real-time PCR market in 2025. The increasing launch of the newclinical trial center for drug development and gene therapy development is estimated to drive the growth of the segment over the forecast period.

- For instance, in April 2024, the U.S. Food and Drug Administration's (FDA) Center for Drug Evaluation and Research (CDER), an authorized research center based in the U.S., revealed the introduction of a new center for external and internal experts to discuss new methods for designing and conducting clinical drug trials, dubbed the Center for Clinical Trial Innovation (C3TI).

Furthermore, the forensic segment is expected to show the fastest growth over the forecast period. Forensic genetic genealogy has become an invaluable resource for law enforcement investigations due to the proliferation of consumer DNA testing and open genetic databases. The characteristics of inherited genetics are essential to forensic genetic genealogy. The criminal justice community has benefited significantly from the use of DNA analysis done with the real-time polymerase chain reaction technique in forensic laboratories.

Increasing the launch of the reagent kit for DNA analysis by the polymerase chain reaction technique is expected to foster the growth of the segment over the forecast period. For instance, in March 2024, Promega Corporation, a biotechnology company mainly focused on manufacturing enzymes and molecular biology with a portfolio covering the fields of genetic identity, cellular analysis, genomics, protein analysis, and expression, among others, announced the introduction of the new DNA analysis kit with a different color reagent used to carry out polymerase chain reaction in Europe and used widely in the forensic labs.

The Promega Corporation introduced the PowerPlex 18E System, which combines eight-color short tandem repeat (STR) analysis chemistry to extract more useful information from difficult samples. All of the DNA markers that the European Network of Forensic Science Institutes (ENFSI), monopoly organization in the field of forensic science by the European Commission, monopoly organization in the field of forensic science by the European Commission recommends are included in the kit. Promega Corporation manufactured an eight-color chemistry kit for forensic DNA analysis.

End User Insights

The hospitals & diagnostic centers segment held the largest share of the real-time PCR market in 2025. The increasing prevalence of breast cancer due to changing lifestyles is raising the demand for point-of-care tests as well as oncology testing, which is expected to drive the segment growth over the forecast period. For instance, in March 2023, according to the data published by the World Health Organization, it was estimated that 670,000 deaths took place globally in the year 2022 due to breast cancer. Hence, the increasing prevalence of chronic diseases like breast cancer is raising the demand for oncology testing with real-time polymerase chain reaction techniques at hospitals &diagnostic centers.

Regional Insights

What is the U.S. Real-time PCR Market Size?

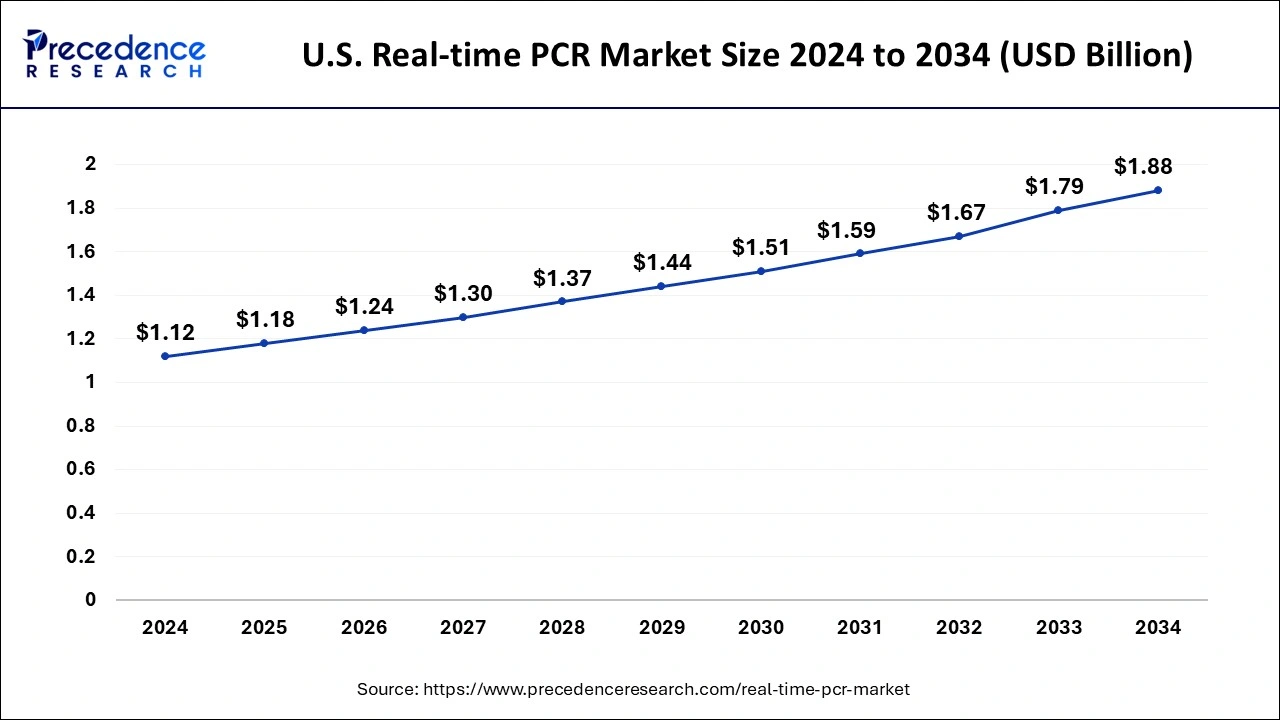

The U.S. real-time PCR market size was exhibited at USD 1.18 billion in 2025 and is projected to be worth around USD 1.99 billion by 2035, poised to grow at a CAGR of 5.37% from 2026 to 2035

North America witnessed the highest revenue share in 2025. The increasing launch of real-time polymerase chain reaction kits by the key players operating in the North American market is estimated to fuel the growth of the real-time PCR market in the North American region.

- For instance, in August 2023, Gold Standard Diagnostics, a company that is focused on manufacturing proprietary instruments for clinical diagnostics based in the U.S., revealed the introduction of the DNAllergen real-time PCR kits used for allergen testing with the molecular method.

Moreover, increasing funding activity and initiatives by the government of Canada is expected to drive the growth of the real-time PCR market in the Canadian region.

- For instance, in May 2024, according to the data published by the National Center for Biotechnology Information, non-profit organization of Library of Medicine, a branch of the National Institutes of Health, announced that nearly US$ 574 million funding has been provided to 19 projects at 14 research institutions across Canada by the Canada Biomedical Research Fund (CBRF), non-profit funding organization along with Biosciences Research Infrastructure Fund (BRIF), non-profit research organization of Canada. Since the introduction of Canada's Biomanufacturing and Life Sciences Strategy in 2021, the federal government has committed US$2.2 billion to the development of state-of-the-art biomanufacturing capabilities.

U.S. Real-time PCR Market Trends

The U.S.'s rising adoption of multiplexing capabilities, automated, high-throughput systems, and point-of-care devices, integration of the digital PRC, and rising need for testing kits in infectious diseases and oncology fuel the market growth. Advancements in multiplexing, automation, and digital integration are enhancing assay efficiency, reducing turnaround times, and improving laboratory workflows.

Asia Pacific is estimated to be the fastest-growing during the forecast period, significantly driven by the launch of new products by the key players operating in the real-time PCR market to meet high clinical needs.

- For instance, in March 2023, Xi'an TianLong Science and Technology Co., Ltd, a medical and diagnostic instrument manufacturing company based in China, announced the introduction of the Gentier mini+ Real-time PCR System and the GeneFlex Nucleic Acid Extractor. The Gentier mini+ Real-time PCR System is a small, lightweight, portable device developed for the prevention and detection of infectious diseases, animal diseases, food safety, and clinical scientific research applications. As this is a portable and lightweight device, it is significantly used in small laboratories, on-site testing requirements, or mobile laboratories.

China Real-time PCR Market Trends

China has shifted to Digital PCR (dPCR), which is rapidly becoming the gold standard for high-sensitivity applications in oncology and biomarker discovery. This growth is fueled by a dual-track demand: specialized clinical diagnostics for chronic infectious diseases and a surge in pharmaceutical R&D infrastructure.

How Did Europe Experience A Notable Growth in the Real-time PCR Market?

Europe's high R&D investment and favorable reimbursement policies will drive the adoption of high-throughput, automated systems from leaders like Roche and QIAGEN. The strategic pivot toward personalized medicine has solidified digital PCR (dPCR) as a critical tool for high-sensitivity oncology biomarkers and rare mutation detection.

Germany Real-time PCR Market Trends

Germany's shift towards high-throughput systems and multiplexing capabilities, which allow for the simultaneous detection of multiple genetic targets in a single reaction. Rising expansion in clinical application and increasing shift towards digital PRC are driving market growth.

Value Chain Analysis of the Real-time PCR Market

- Raw Materials and Components

This stage involves the manufacturing of high-purity components required for PCR, including oligonucleotides, fluorescent probes, DNA polymerase enzymes, nucleotides (dNTPs), and plastic consumables.

Key Players: Promega Corporation, Twist Bioscience Corporation, Zymo Research Corporation, BioLegend Inc., Takara Bio Inc. - Instrumentation and Reagent Manufacturing

This stage focuses on the design and assembly of Real-time PCR machines (thermal cyclers with optical modules) and the formulation of specialized assay kits for specific diagnostic or research applications.

Key Players: F. Hoffmann-La Roche Ltd, Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc., QIAGEN N.V., Danaher Corporation, Agilent Technologies, Inc. - Distribution, End-Users, and Application

This stage involves the distribution of instruments and reagents through direct sales or third-party distributors to final consumers, such as hospitals, diagnostic labs, and research institutions.

Key Players: Quest Diagnostics, LabCorp.

Real-time PCR Market Companies

- Abbott: Abbott provides automated molecular diagnostic solutions, such as the m2000 and Alinity m systems, which enable high-throughput real-time PCR testing for infectious diseases, oncology, and genetics.

- Agilent Technologies, Inc.: Agilent offers a comprehensive portfolio of real-time PCR instruments, including the AriaMx and AriaDx systems, which are known for their modular design and rapid data analysis.

- bioMérieux: bioMérieux is a leader in syndromic testing, utilizing their BIOFIRE FILMARRAY and SPOTFIRE systems to provide fast, multiplexed PCR results for infectious diseases. Their GENE-UP real-time PCR solution specifically aids the industrial sector by providing rapid pathogen detection for food and pharmaceutical quality control.

- Bio-Rad Laboratories Inc.: Bio-Rad is a key manufacturer of versatile, high-performance real-time PCR detection systems like the CFX Opus and CFX96, which feature advanced optical technology and thermal gradients for optimized assays.

- Eppendorf SE: Eppendorf contributes to the real-time PCR market by manufacturing high-quality, precise PCR consumables, such as microplates and tubes, which are essential for reliable, high-throughput qPCR workflows.

- GE Healthcare: GE Healthcare/Cytiva contributes primarily to the upstream workflow of PCR by providing advanced magnetic bead technologies and automated instrumentation for sample preparation and nucleic acid purification.

Other Major Key Players

- F. Hoffmann-La Roche Ltd.

- Fluidigm Corporation

- Thermo Fisher Scientific, Inc.

- TOYOBO Inc.

- Vela Diagnostics

- Takara Bio Inc.

- Lumex Instruments

- Primedesign Ltd.

- QIAGEN

- PerkinElmer Inc.

- Siemens

- Merck KGaA

Industry Leader Announcement

- In November 2024, Takara Bio USA, Inc., a wholly owned subsidiary of Takara Bio Inc., launched the SmartChip ND Real-Time PCR System, an automated, research-use-only (RUO), high-throughput qPCR solution for infectious disease research. Carol Lou, President & CEO of Takara Bio USA, said that this innovative platform, designed for ease of use and streamlined functionality, provides unmatched accuracy, reproducibility, and flexibility for broad pathogen research.

Recent Developments

- In November 2024, RNAConnect unveiled the UltraMarathonRT Two-Step RT-PCR Kit which offers an advanced solution for scientific research teams who need to convert RNA to cDNA and amplify samples.

- In April 2024, Bio-Rad Laboratories announced the launch of its first highly sensitive multiplexed digital PCR assay, the ddPLEX ESR1 Mutation Detection Kit. This product allows the company to better serve healthcare providers using its real-time PCR technology to identify cancer markers and monitor treatment progress.

Segment Covered in the Report

By Product

- Instruments

- Reagents & Consumables

- Software & Services

By Application

- Clinical

- Pathogen Testing

- Oncology Testing

- Blood Screening

- Liquid Biopsy

- dPCR-based Non-Invasive Prenatal Testing (NIPT)

- Others

- Research

- Stem Cell Research

- DNA Cloning & Sequencing

- Recombinant DNA Technology

- Rare Mutation Detection

- Gene Expression

- Single Cell Analysis

- Microbiome Analysis

- Copy Number Variation Analysis

- Library Quantification (NGS)

- Characterization of Low-fold Changes in mRNA and miRNA expression

- Species Identification

- GMO Detection

- Forensic

By End User

- Hospitals & Diagnostic Centers

- Pharmaceutical & Biotechnology Companies

- Research Laboratories & Academic Institutes

- Clinical Research Organization

- Forensic Laboratories

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting