What is the Refrigeration Monitoring Market Size?

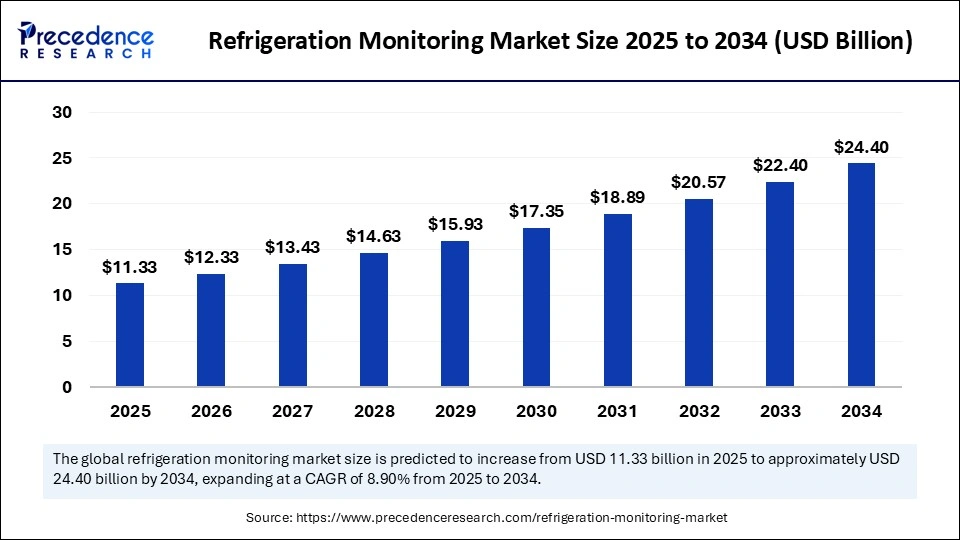

The global refrigeration monitoring market size is accounted at USD 11.33 billion in 2025 and predicted to increase from USD 12.33 billion in 2026 to approximately USD 24.40 billion by 2034, expanding at a CAGR of 8.90% from 2025 to 2034. The market is expanding significantly due to stringent regulations regarding food and pharmaceuticals safety and the growth of e-commerce and cold chain logistics. Technological advancements also drive market growth by boosting the efficiency and capabilities of monitoring systems.

Refrigeration Monitoring Market Key Takeaways

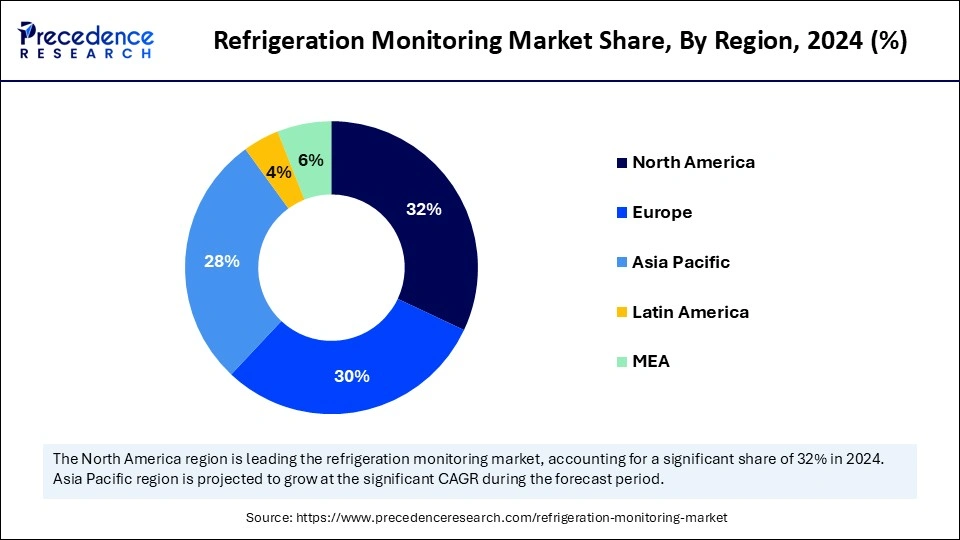

- North America dominated the refrigeration monitoring market with the largest share of 32% in 2024.

- Asia Pacific is expected to grow at a CAGR of 11% during the forecast period.

- By component, the hardware segment held the major market share of 61% in 2024.

- By component, the software segment is projected to grow at a CAGR of 12.5% in the coming years.

- By application, the food retail segment dominated the market with the largest share in 2024.

- By application, the pharmaceutical & life sciences segment is expected to witness the fastest growth during the upcoming period.

- By deployment mode, the on-premises segment held a significant share of the market in 2024.

- By deployment mode, the cloud-based segment is observed to be the fastest-growing segment during the forecast period.

- By type, the stationary refrigeration systems segment dominated the market with the highest share in 2024.

- By type, the transport refrigeration systems segment is seen to grow at the fastest rate in the upcoming years.

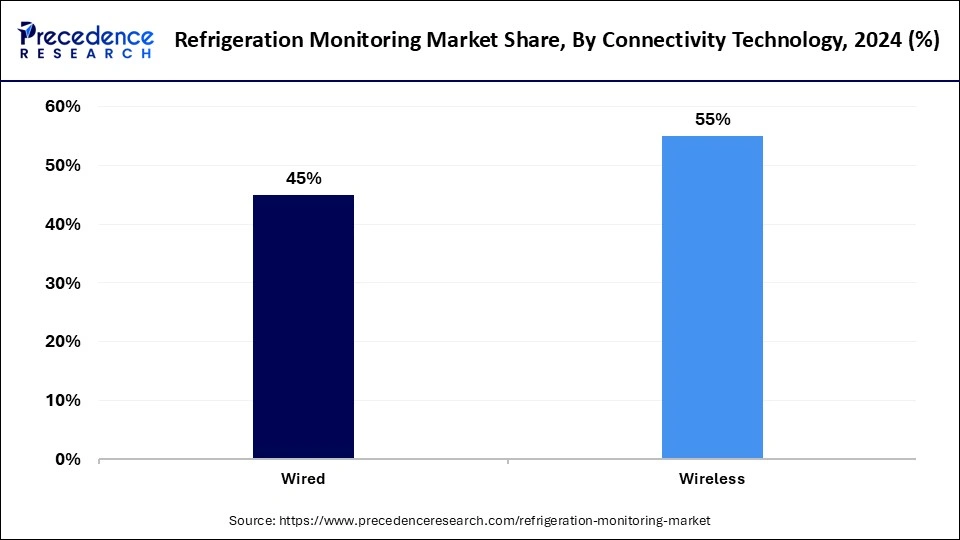

- By connectivity technology, the wired segment captured the largest market share in 2024.

- By connectivity technology, the wireless segment is expected to witness the fastest growth during the predicted timeframe.

Artificial Intelligence: The Next Growth Catalyst in Refrigeration Monitoring

Artificial intelligence (AI) is transforming the market for refrigeration monitoring by enabling real-time analytics, predictive maintenance, and energy optimization. AI-powered systems analyze data from sensors to detect anomalies, predict equipment failures, and dynamically adjust cooling parameters. This leads to energy savings and improved efficiency of refrigeration monitoring and minimized equipment downtime, especially in industries like food and beverage, pharmaceuticals, and logistics.

- In February 2025, Samsung launched its new Bespoke AI Refrigerator series in the 330L & 350L capacity range. This new range combines advanced AI-driven features such as AI Energy Mode, AI Home Care, and Smart Forward with elegant designs and versatile storage options. This focused on tackling the requirements of Indian consumers by offering a harmonious blend of functionality, style, and innovation.

Strategic Overview of the Global Refrigeration Monitoring Industry

The refrigeration monitoring market comprises systems that use advanced technologies to track and manage the temperature and other critical parameters of refrigeration systems. These systems are used for various applications, such as the storage of food, pharmaceuticals, and chemicals. They are widely used in hospitals for storing temperature-sensitive drugs. The market is characterized by growing competition among established players and emerging companies with a focus on innovation and sustainable solutions.

Refrigeration Monitoring Market Growth Factors

- Growing Demand for Food Safety: Increased consumer awareness and regulatory requirements for food safety and quality propel the demand for effective refrigeration monitoring.

- Concern About Food Waste: The refrigeration monitoring systems help to prevent food spoilage and waste by maintaining proper temperature control throughout the supply chain.

- Technological Advancements: The adoption of advanced technologies such as internet of things IoT, AI, and cloud-based technologies improves the capabilities of monitoring systems by providing real-time alerts, remote access, and data analysis.

- Compliance Demands: Regulations regarding food safety and pharmaceutical efficacy, together with energy efficiency, are driving the adoption of reliable and accurate monitoring solutions for the sake of safety and good quality standards.

- Expanding E-commerce and Cold Chain Logistics Operations: The rising popularity of online food delivery and the demand for efficient cold chain management are increasing the need for refrigeration monitoring in the transportation and storage sectors.

Market Outlook:

- Market Growth Overview: The Refrigeration Monitoring market is expected to grow significantly between 2025 and 2034, driven by technological integration, growing cold chain demand, and the market is moving towards cloud-based platforms for centralized control, remote access, and efficient data analytics, which reduces IT overhead and facilities scalability.

- Sustainability Trends: Sustainability trends involve improving energy efficiency, reducing carbon footprints, and adopting natural refrigerants. IoT, AI, and predictive analytics are used to optimize system performance and minimize energy waste, with advanced systems improving efficiency by 25–30%.

- Major Investors: Major investors in the market include Microsoft, Amazon Web Services (AWS), Venture Capital Firms, Accel, and Private Equity Firms.

- Startup Economy: The startup economy is focused on developing and deploying innovative IoT-enabled sensors, AI-powered platforms for predictive analytics, and sustainable transport solutions.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 24.40 Billion |

| Market Size in 2025 | USD 11.33 Billion |

| Market Size in 2026 | USD 12.33 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.90% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Growing Demand for Temperature-Sensitive Drugs

The growing demand for temperature-sensitive drugs is a major factor driving the growth of the refrigeration monitoring market. These drugs require reliable cold-chain solutions to maintain their efficacy for longer periods. There is a high demand for refrigeration monitoring solutions in the pharmaceutical and biotech industries. These industries increasingly focus on maintaining accurate temperature ranges for drugs, vaccines, and other medical products during transport and storage. In addition, the increasing production of processed food supports market growth.

Restraint

High Cost

A major restraint in the refrigeration monitoring market is the high installation cost of refrigeration monitoring systems, which require substantial investment in sensors, connectivity networks, and data analytics platforms. These systems require regular maintenance, which further adds to operational costs. The transition to lower-cost alternative refrigerants can help reduce overall operational costs related to refrigeration systems. While the benefits of real-time monitoring are perspicuous, the higher cost can create barriers for small and medium-sized businesses, limiting the growth of the market.

Opportunity

Integration of Advanced Technologies

Ongoing technological advancements create immense opportunities in the refrigeration monitoring market. The integration of advanced technologies, such as AI and machine learning, leads to proactive maintenance and energy optimization. These technologies enable real-time data analysis, anomaly detection, and proactive maintenance, minimizing downtime and energy consumption. By identifying patterns and anomalies in temperature, humidity, and other parameters, AI predicts when a system requires maintenance.

Component Insights

The hardware segment held a dominant share of the refrigeration monitoring market in 2024. This is mainly due to the increased need for sensors for ensuring energy efficiency, predictive maintenance, and real-time monitoring, particularly in critical applications like pharmaceuticals and biotech storage. The necessity for continuous monitoring in applications where temperature deviations can have severe consequences, such as vaccine storage, boosted the need for temperature and humidity sensors. Advancements in sensor technology further bolstered the segment's growth.

The software segment is projected to expand rapidly in the coming years because software solutions offer real-time data analysis, allowing businesses to detect bottlenecks, optimize energy usage, and prevent downtime. The increasing demand for data-driven insights, real-time monitoring, and predictive maintenance capabilities further supports segmental growth. Software platforms provide actionable insights, empowering businesses to make informed decisions, like temperature control, schedule maintenance, and resource allocation. The demand for AI-powered software solutions is rising due to their ability to analyze sensor data to predict equipment failures and optimize maintenance schedules, supporting the growth of the segment.

Application Insights

The food retail segment dominated the refrigeration monitoring market with the largest share in 2024 due to the increased need for temperature control to maintain food quality and safety and minimize spoilage. The increased consumption of packaged and processed foods has driven the necessity of refrigeration monitoring in retail settings. Food retailers often require real-time monitoring solutions to check food quality and safety and ensure compliance with food safety regulations.

The pharmaceutical & life sciences segment is expected to witness the fastest growth during the upcoming period. The segment's growth can be attributed to the increasing demand for temperature-controlled storage and transportation solutions due to stringent regulations regarding the safety and efficacy of pharmaceutical products. The rising production volumes of drugs, vaccines, and other temperature-sensitive biological products contribute to segmental growth. Cold-chain solutions are crucial for ensuring the quality and preventing spoilage or degradation of pharmaceutical products.

Deployment Mode Insights

The on-premises segment held a significant share of the refrigeration monitoring market in 2024. This is mainly due to the increased concerns regarding data security and regulatory adherence. On-premises solutions offer greater control over data and systems. On-premises solutions also empower businesses to customize monitoring systems to meet their specific needs. Furthermore, these systems provide supremacy over data storage and security measures by minimizing the risk of unauthorized access and protecting sensitive data from breaches.

The cloud-based segment is observed to be the fastest-growing segment during the forecast period, owing to its scalability, cost-effectiveness, and ability to provide real-time monitoring and analysis. Cloud-based solutions provide businesses with flexibility and remote access along with centralized data management, resulting in enhanced operational efficiency. Cloud platforms also provide centralized storage for refrigeration data to improve operations. Cloud-based solutions reduce investments in IT infrastructure, making them the preferred choice.

Type Insights

The stationary refrigeration systems segment dominated the refrigeration monitoring market with the highest share in 2024. This is mainly due to the increased demand for stationary refrigeration systems in commercial settings, such as supermarkets, cold storage warehouses, and food processing units. Technological advancements led to the development of smart refrigeration systems equipped with sensors and internet connectivity, offering features like temperature monitoring, inventory management, and energy consumption tracking. These systems handle a large volume of goods.

The transport refrigeration systems segment is seen to grow at the fastest rate in the upcoming years. This is mainly due to the increasing demand for real-time tracking and compliance with regulations in the cold-chain logistics and pharmaceutical industries. Various companies are adopting GPS-enabled and sensor-integrated solutions for complete visibility and temperature compliance while in transit. Transport refrigeration systems are preferred to transport food and pharmaceutical goods, ensuring the safety and integrity of these goods during transit. This growing need to ensure the integrity and safety of goods during transportation supports segmental growth.

Connectivity Technology Insights

The wired segment captured the largest share of the refrigeration monitoring market in 2024. This is mainly due to its superior reliability, speed, and security compared to wireless options. Wired systems provide continuously stable data flow, reducing the risk of data loss and avoiding data latency. Also, the operational cost of wired systems is quite low as they require low maintenance compared to wireless systems. Wired systems offer a stable and uninterrupted connection, making them suitable for critical applications like cold chain management, where data accuracy and real-time monitoring are fundamental.

The wireless segment is expected to witness the fastest growth during the predicted timeframe. The growth of the segment is attributed to the advantages of remote monitoring and real-time data collection facilitated by wireless technologies, like IoT and wireless sensors. Wireless systems can be easily installed, making them the preferred option. The rising demand for smart solutions for monitoring temperature-sensitive goods is likely to support segmental growth.

Regional Insights

U.S. Refrigeration Monitoring Market Size and Growth 2025 to 2034

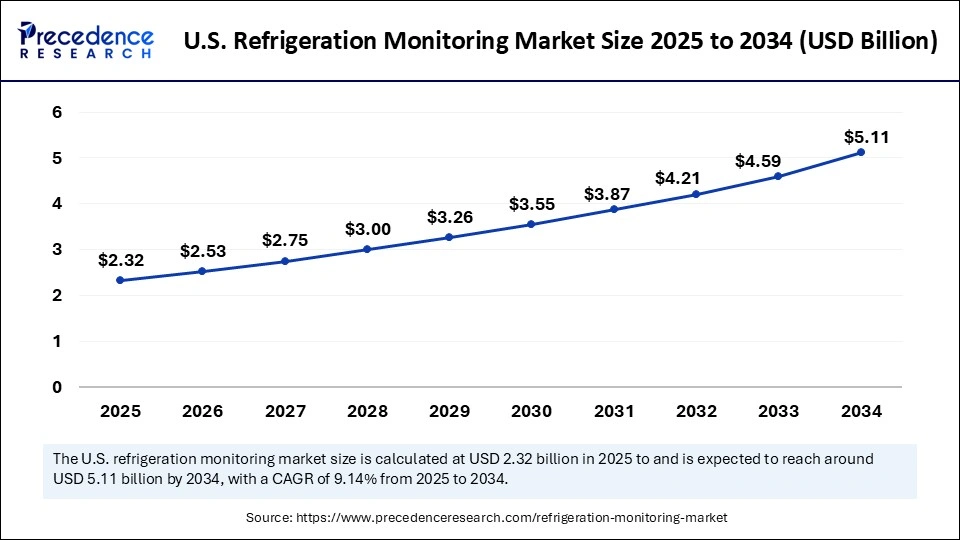

The U.S. refrigeration monitoring market size is exhibited at USD 2.32 billion in 2025 and is projected to be worth around USD 5.11 billion by 2034, growing at a CAGR of 9.14% from 2025 to 2034.

North America: U.S. Refrigeration Monitoring Market Trends

The U.S. refrigeration monitoring market is trending toward advanced IoT, AI, and cloud-based solutions for real-time tracking, predictive maintenance, and enhanced data analytics. Strict regulatory compliance, particularly in the food and pharmaceutical sectors, is a major driver for the adoption of these technologies. Furthermore, there is a strong focus on improving energy efficiency, sustainability, and end-to-end visibility within cold chain logistics.

North America dominated the refrigeration monitoring market by capturing the largest share in 2024. This is mainly due to the high adoption rates of refrigeration systems across food & beverages, healthcare, logistics, and pharmaceutical industries. Stringent food and pharmaceutical safety regulations imposed by the FDA and USDA bolstered the adoption of refrigeration systems. This significantly created the need for accurate monitoring of temperature and other parameters within refrigeration systems. The region is likely to sustain its position in the market in the upcoming period. The increasing production of temperature-sensitive drugs and vaccines spurs the demand for refrigeration monitoring systems. The U.S. is a major contributor to the refrigeration monitoring market in North America. There is a high demand for refrigeration systems and monitoring solutions. The U.S. is also actively acquiring sustainable refrigeration solutions, such as eco-friendly refrigerants and energy-efficient systems.

- In January 2024, Liebherr launched new wine-tempering fridges in North America that include humidity control. This feature offers adjusting humidity levels in 5% increments between 50% and 80% relative humidity. The StorageZone in the lower section of the Vinidor Selection series appliances is designed for long-term wine storage, essential for maintaining ideal cork conditions and avoiding oxidation.

Asia Pacific is expected to witness the fastest growth in the coming years. This is mainly due to an increase in urban populations and industrial activities in the region, which results in increased demand for refrigeration and cooling systems across various sectors, including food & beverages, pharmaceuticals, and healthcare. The prominent key players in the region, such as Daikin Industries, Panasonic, LG Electronics, Hitachi, and Haier Group, contribute to the expansion of the market in the region. Furthermore, the booming e-commerce industry and rising online grocery shopping are boosting the adoption of smart refrigerators and IoT-enabled monitoring systems.

Asia Pacific: China Refrigeration Monitoring Market Trends

China is expected to have a stronghold on the Asia Pacific refrigeration monitoring market. This is because of a huge population and a growing number of supermarkets, hypermarkets, and fast-food restaurants requiring efficient refrigeration systems. China is actively encouraging the use of low GWP (Global Warming Potential) refrigerants like R290 that are substitutes for hydrofluorocarbons (HFCs).

India Refrigeration Monitoring Market Trends

India also plays a crucial role in the market for refrigeration monitoring. This is because cold-chain logistics providers in India are integrating cloud platforms with mobile dashboards to manage diverse fleet operations by improving the reliability of the growing cold-chain logistics sector. Government Initiatives, such as the India Cooling Action Plan (ICAP), aim to minimize cooling demand, refrigerant demand, and cooling energy requirements by demonstrating the commitment of India to sustainable cooling practices.

Europe: Germany Refrigeration Monitoring Market Trends

Europe is considered to be a significantly growing area. There is a high demand for refrigeration systems for the storage, transportation, and distribution of perishable goods, including food, pharmaceuticals, and healthcare supplies, all of which require controlled temperature conditions. The presence of a well-established food & beverages industry supports regional market growth. The growing focus on energy efficiency is boosting the demand for energy-efficient refrigeration systems. In addition, strict regulations regarding food safety influence the market's growth.

Germany's refrigeration monitoring market is high demand for energy efficiency, stringent EU and national regulations, and the rapid adoption of IoT, cloud, and AI technologies. Companies are integrating these advanced systems for real-time monitoring and predictive maintenance to ensure compliance and reduce operational costs.

Value Chain Analysis of the Refrigeration Monitoring Market

- Hardware & Component Manufacturing

This initial stage focuses on designing and manufacturing the physical components essential for monitoring, such as IoT sensors, data loggers, gateways, and cameras. Key Players: Siemens AG, Emerson Electric Co. - Software Development & Data Analytics

This stage involves creating the software platforms, cloud infrastructure, and data analytics tools that process the data collected by the hardware.

Key Players: Amazon Web Services (AWS) and Microsoft - System Integration & Deployment

System integrators are responsible for combining the hardware and software components into a seamless, operational system tailored to the end-user's specific needs (e.g., a cold storage warehouse vs. a transport truck).

Key Players: Wipro - Service Provision & Support

After deployment, the focus shifts to ongoing services, including data monitoring, maintenance, customer support, and compliance reporting.

Top Companies in the Refrigeration Monitoring Market & Their Offerings:

- Emerson Electric Company, a major global player, significantly contributes to the refrigeration monitoring market with its wide range of solutions, including sensors and cloud-based platforms. Their collaborations with other tech companies enhance monitoring capabilities for the healthcare sector, ensuring the proper temperature for sensitive items like vaccines.

- Danfoss contributes by offering smart refrigeration monitoring platforms that integrate IoT for real-time temperature and energy management. Their advanced solutions optimize energy efficiency and help businesses make data-driven decisions to improve sustainability.

- Digi International, through its Smart Sense brand, provides cloud-based monitoring platforms for food retailers, enabling improved traceability and food safety. Their IoT-enabled sensors offer real-time tracking of temperature and energy, contributing to proactive maintenance strategies.

- Monnit is a key player providing low-cost, wireless, and cloud-connected remote sensors for refrigeration monitoring, serving various industries. Their sensors send instant alerts at the first sign of trouble, acting as a "personal watchman" for refrigerated products.

- ORBCOMM is a major contributor to the cold chain monitoring market by offering solutions that enable fuel and temperature management for refrigerated assets. Their technology allows for remote reefer temperature control and provides real-time alarms for regulatory compliance and efficient logistics.

- Zebra Technologies contributes to the market through its rugged and portable handheld computers and barcode scanners, which support warehouse management and cold chain logistics. These devices help track temperature-sensitive inventory, but the company also offers standalone temperature data loggers.

- Texas Instruments (TI) contributes by manufacturing a variety of temperature sensors and other electronic components used in refrigeration monitoring systems. These components are crucial for the development of accurate and reliable digital temperature controls and sensor modules used by system integrators.

- Vaisala specializes in environmental and industrial measurement, and while not explicitly detailed in the search results for refrigeration monitoring, they likely contribute with high-precision temperature and humidity sensors used in commercial and scientific refrigeration applications.

- Berlinger & Co. was acquired by Sensitech, a part of Carrier Global Corporation, expanding Sensitech's cold chain monitoring portfolio with proprietary conventional and real-time monitoring solutions. This integration provides enhanced capabilities for the pharmaceutical and life sciences industry, strengthening the overall market offering.

- Cargo Data Corporation contributes with its specialized cold chain monitoring solutions, focusing on products like temperature data loggers with NFC technology. These recorders simplify temperature tracking during transit and storage for perishable food, pharmaceutical, and floral industries.

- Samsara provides a platform for fleet management and IoT, likely offering integrations and solutions that enable temperature monitoring for refrigerated transportation. While not specifically detailed in the results, their focus on asset tracking aligns with the needs of the cold chain market.

- Sensaphone offers remote monitoring solutions, including for temperature-sensitive applications like refrigeration, using wireless sensors and instant alert systems.

Refrigeration Monitoring Market Companies

- Emerson Electric Company

- Danfoss

- Digi International (Smart Sense)

- Monnit

- ORBCOMM

- Zebra Technologies Corp.

- Texas Instruments

- Vaisala

- Berlinger & Co.

- Cargo Data Corporation

- Samsara

- Sensaphone

Recent Developments

- In December 2024, Dixon Electro Manufacturing, a part of Dixon Technologies, signed a memorandum of understanding with Cellecor Gadgets to produce refrigerators and related components. This collaboration helps strengthen the domestic production capacity of India, supporting the Make in India initiative.

- In October 2024, at Refcold 2024, Copeland launched its new ZB refrigeration scroll compressor technology, which offers an average efficiency improvement of up to 8% compared to existing models with enhanced reliability for medium and high-temperature applications. This next-generation compressor technology can help Indian customers upgrade their systems for superior seasonal energy efficiency.

- In April 2024, Honeywell introduced an IoT-enabled advanced temperature monitoring system designed for cold chain logistics. This system integrates AI-based analytics to detect temperature anomalies by ensuring compliance with pharmaceutical and food safety standards.

- In February 2024, Star Refrigeration launched the latest generation of its outstanding Azanechiller, setting the model for efficiency, safety, durability, and sustainability. The newly introduced Azanechiller 3.0 is an ultra-modern, industrial air-cooled ammonia chiller designed to deliver superior performance and reduce environmental impact.

Segments Covered in the Report

By Component

- Hardware

- Sensors

- Temperature

- Humidity

- Pressure

- Vibration

- Others

- Data Loggers

- Control Units/Monitors

- Others

- Sensors

- Software

- Services

By Application

- Food Retail

- Food & Beverage Processing

- Pharmaceuticals & Life Sciences

- Cold Chain Logistics

- Hospitality & Catering

- Others

By Deployment Mode

- On-premises

- Cloud-based

By Type

- Stationary Refrigeration Systems

- Walk-in Coolers & Freezers

- Display Cases

- Cold Rooms

- Industrial Chillers

- Transport Refrigeration Systems

By Connectivity Technology

- Wired

- Wireless

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting