What is the Respiratory Care Devices Market Size?

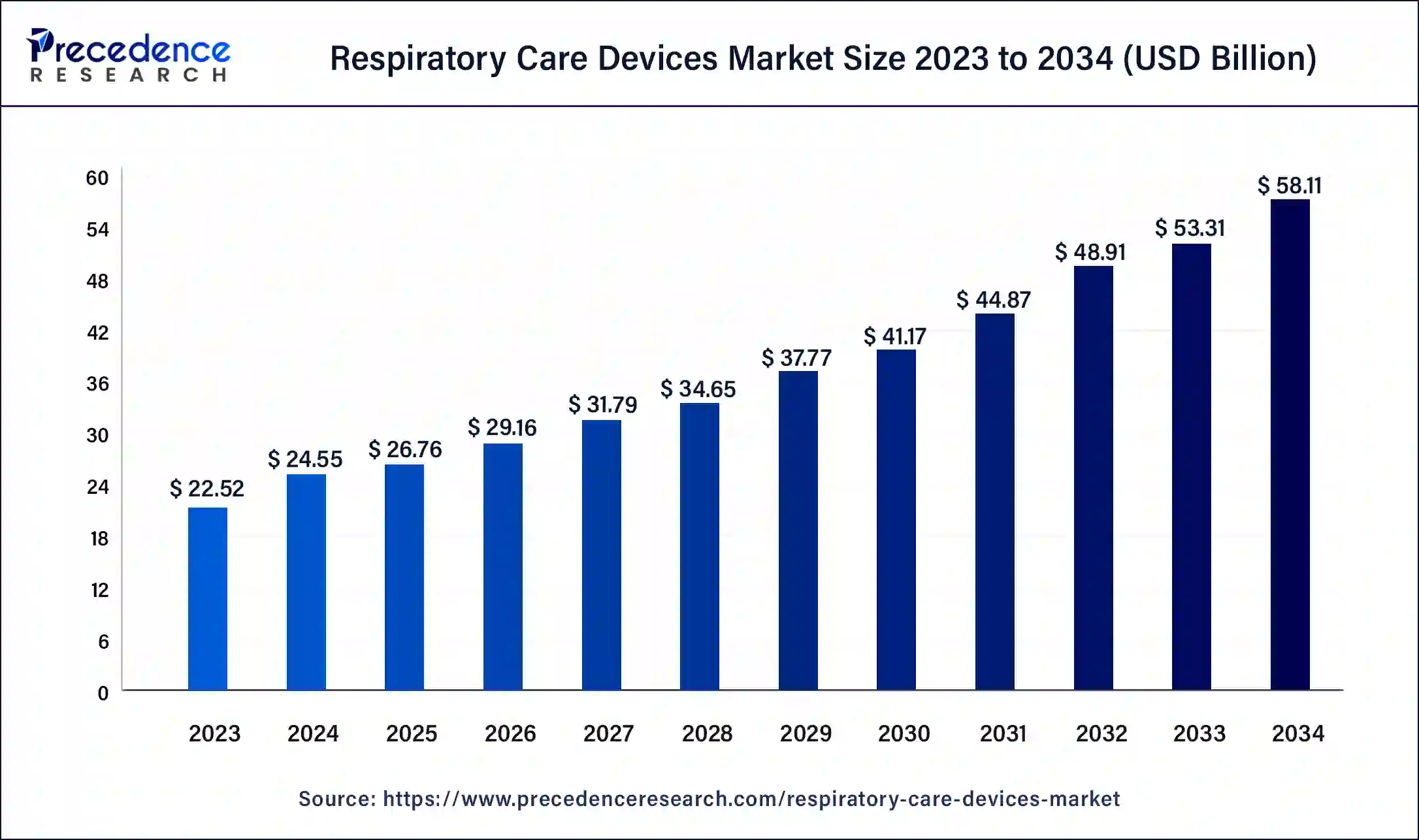

The global respiratory care devices market size was USD 26.76 billion in 2025, accounted for USD 29.16 billion in 2026, and is expected to reach around USD 62.64 billion by 2035, expanding at a CAGR of 8.88% from 2026 to 2035.

Respiratory Care Devices Market Key Takeaways

- In terms of revenue, the market is valued at $26.76billion in 2025.

- It is projected to reach $62.64billion by 2035.

- The market is expected to grow at a CAGR of 8.88% from 2026 to 2035.

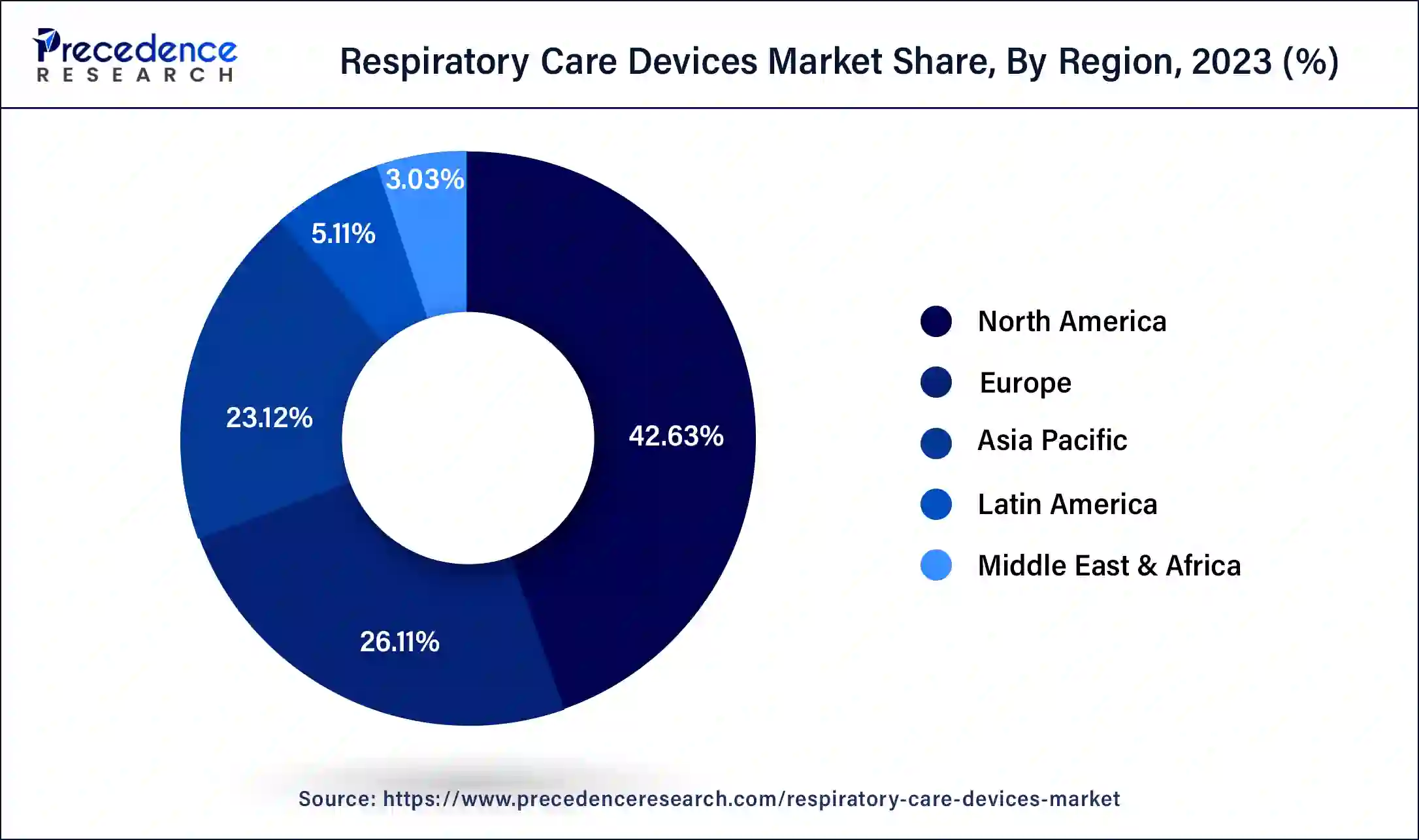

- North America led the global market with the highest market share of 42.63% in 2025.

- By types, the therapeutic devices segment has held a significant market share in 2025.

- By end-user, the hospitals segment captured the biggest revenue share in 2025.

Market Overview

Respiratory care devices are medical devices used for treating and managing respiratory conditions. These devices are designed to assist patients in breathing, improve respiratory function, and provide respiratory support. Respiratory care devices' primary objective is to increase the prevalence of respiratory diseases, a growing aging population, technological advancements in device design, and a rise in healthcare spending.

The market is driven by the increasing prevalence of respiratory diseases, the growing aging population, and the increasing demand for home care settings. The rising incidence of respiratory diseases such as asthma, chronic obstructive pulmonary disease (COPD), and sleep apnea drives the demand for respiratory care devices. As the global population ages and environmental factors contribute to respiratory issues, the need for effective respiratory care solutions is rising.

Furthermore, the growing aging population has a higher prevalence of respiratory conditions among elderly individuals. Elderly individuals are more susceptible to respiratory diseases such as chronic obstructive pulmonary disease (COPD), pneumonia, and sleep apnea. This drives the demand for respiratory care devices to maintain adequate breathing and ensure optimal respiratory function. Thus, the respiratory care device market is expected to grow significantly during the forecast period. As people diagnosed with respiratory diseases increase, the demand for respiratory care devices grows.

However, the high cost of respiratory care devices, growing demand for home care therapeutic devices, and lack of awareness and education impede the market growth. Respiratory care devices require a reliable and efficient infrastructure for low-income individuals or healthcare facilities. The inadequate infrastructure and training distribution is currently limited, which may restrict the growth of the respiratory care device market. Also, cost constraints may create challenges for manufacturers of respiratory care devices and end-users. These challenges may restrain demand for the respiratory care device market.

The lockdown measures implemented by various governments in anticipation of the COVID-19 pandemic have caused disruptions in supply chains and manufacturing, leading to a slowdown in economic activity and affecting demand for supply chain disruptions for respiratory care devices. However, the pandemic has also highlighted the importance of respiratory care devices and prompted collaborations across industries to meet the increased demand. The pandemic has also increased government stimulus spending on infrastructure projects and producing ventilators, which could provide opportunities for the respiratory care device market during the forecast period.

What Are the Key Trends Shaping the Respiratory Care Device Market?

- Increasing incidence of chronic respiratory diseases: The increasing global prevalence of asthma, COPD, and sleep apnea are fueling ongoing market demand for advanced respiratory care technologies that enable long-term disease management and better patient outcomes.

- Home healthcare trend towards home healthcare: The cost efficiency and ease-of-use of home healthcare options for respiratory care has increased demand for portable devices such as oxygen concentrators, nebulizers, etc... for elderly patients and chronic patients, increasing market demand for relatively portable devices.

- AI. and IoT integration: Smartspace respiratory devices are often integrated with AI and IoT, enabling real-time monitoring, predictive analytics, and remote monitoring and management to allow personalized care plans. Plus, it improves patient compliance and accuracy of diagnoses.

- Innovative changes to ventilators: Manufacturers are producing more compact, non-invasive, user-friendly ventilators with touchscreen capabilities and automated features across broad clinical and homecare settings.

Market Outlook

- Industry Growth Overview: Ongoing growth is occurring in the market for devices used to provide respiratory care as a result of increased respiratory ailments and an increase in the number of ageing individuals. An increase in the number of intensive care unit (ICU) admissions, and the continuous enhancements in technology being made to create non-invasive methods of ventilating patients.

- Sustainability Trends: Manufacturers are focusing on production that utilizes eco-friendly materials, creates energy-efficient products, and provides reusable respiratory care accessories to help reduce the amount of medical waste, while also adhering to global health sustainability criteria and striving towards producing carbon-neutral products.

- Global Expansion: There is significant investment within the emerging economies for developing new healthcare infrastructure, to improve access to respiratory services for those living in rural areas, and for increasing the import of sophisticated devices to serve patients previously lacking access to required clinical services.

- Startup Ecosystem: There is a market for innovative portable, artificial intelligence-enabled, and home-based devices and services to provide respiratory therapy, attracting significant amounts of venture capital funding while providing better access to affordable healthcare, remote monitoring capabilities, and individualized care.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 26.76 Billion |

| Market Size in 2026 | USD 29.16 Billion |

| Market Size by 2035 | USD 62.64 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 8.88% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Types, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing prevalence of respiratory diseases to brighten the market prospect

The global burden of respiratory diseases such as chronic obstructive pulmonary disease (COPD), asthma, and sleep apnea is rising. Factors such as air pollution, smoking, and aging populations contribute to the increased occurrence of these conditions. Age-related changes in lung function weakened immune systems, and comorbidities make the elderly more susceptible to respiratory diseases. Moreover, unhealthy lifestyle habits, such as smoking tobacco, contribute significantly to the prevalence of respiratory diseases. According to the American Lung Association, Smoking is a leading cause of COPD, lung cancer, and other respiratory disorders. Exposure to secondhand smoke also increases the risk of respiratory conditions in non-smokers. This makes respiratory care devices essential in producing and distributing respiratory care devices.

Furthermore, using respiratory care devices in elderly individuals often requires oxygen therapy, nebulizers, and other devices to manage their respiratory health. In addition, governments and industries worldwide are investing heavily in developing healthcare and infrastructure, which is anticipated to drive the growth of the respiratory care device market. For instance, in March 2022, the Australian Government announced its commitment to investing in a robust health system as part of its strategy for a stronger future. This investment entails a record amount of $132 billion for the fiscal year 2022-23, which may increase to $140 billion by 2025-26. The Government has pledged a total commitment of $537 billion over the next four years, emphasizing its dedication to enhancing the healthcare sector. Moreover, with the awareness about respiratory diseases, their prevention, and the importance of early diagnosis and treatment, the demand for respiratory care devices will likely increase to meet the needs of this growing market.

Growing aging population

As the global population ages, respiratory conditions and diseases are more prevalent and associated with age-related changes and comorbidities. Respiratory care devices are essential in ensuring quality and innovative respiratory care devices. The growing risk of respiratory situations with age is associated with physiological changes in the respiratory system, such as decreased lung function, reduced respiratory muscle strength, and increased susceptibility to respiratory infections. Oxygen therapy, nebulizers, positive airway pressure devices, and ventilators are generally used to provide respiratory support and develop the quality of life for elderly patients.

Furthermore, elderly individuals may experience a decline in lung function and are more susceptible to respiratory ailments such as chronic obstructive pulmonary disease (COPD), pneumonia, and sleep apnea. This has led to a rise in the need for respiratory devices that may assist in managing these conditions and improve the quality of life for older adults. Moreover, the aging population may require long-term care and assistance, leading to a growing demand for home healthcare solutions. Respiratory devices that are portable, easy to use, and suitable for home settings are generally sought after as they allow older adults to receive respiratory care and treatment in the comfort of their own homes.

Key Market Challenges:

Low awareness and a significant population with under-diagnosed and under-treated respiratory conditions

Respiratory care devices are complex devices, and low awareness about respiratory diseases and available treatment options may result in limited market penetration for respiratory care devices. Many individuals may not know the available devices or their benefits in managing their respiratory conditions. This lack of awareness may lead to the underutilization of respiratory care devices and hinder market growth. Furthermore, a population with under-diagnosed and under-treated respiratory conditions means many individuals are not receiving timely and appropriate care. This delay in diagnosis and treatment may result in the progression of respiratory diseases, worsening symptoms, and increased healthcare costs. This may result in a limited customer base and, ultimately, slow down the growth of the respiratory care device market.

However, increasing awareness, early detection, and appropriate utilization of respiratory care devices may improve patient outcomes, enhance the quality of life, and contribute to the market's overall growth. In addition, with the growth of the respiratory care device market, economies of scale may be achieved, reducing demand for devices. Furthermore, the increasing awareness and the continued investments made in the respiratory device industry by governments and industries worldwide may create an opportunity to drive innovation and cost reductions in the respiratory care device market.

Key Market Opportunities

- The rapid expansion of the global geriatric population

- Increasing prevalence of chronic diseases.

- Cost-effectiveness of home care devices and services

Segment Insights

Types Insights

On the basis of types, the respiratory care device market is divided into therapeutic devices, diagnostic, monitoring devices, diagnostic devices, and consumables and accessories. The increasing use of ventilators, nebulizers, positive airway pressure devices, oxygen concentrators, inhalers, and humidifiers mainly drives the demand for therapeutic and respiratory care devices. Furthermore, improving respiratory function, providing relief, and enhancing the quality of life for individuals with respiratory conditions further drive demand for the segment across the market. Therapeutic and respiratory care devices remove impurities and produce high-purity devices that may be used in various applications.

End User Insights

On the basis of the end-user, the respiratory care device market is divided into hospitals and home care. Hospitals accounted for the largest market share. This is because it provides critical care, manages acute respiratory conditions, and supports patients during surgeries or post-operative recovery. Respiratory care devices the need for effective diagnosis, treatment, and management of respiratory conditions, ensuring optimal patient outcomes.

Regional Insights

What is the U.S. Respiratory Care Devices Market Size?

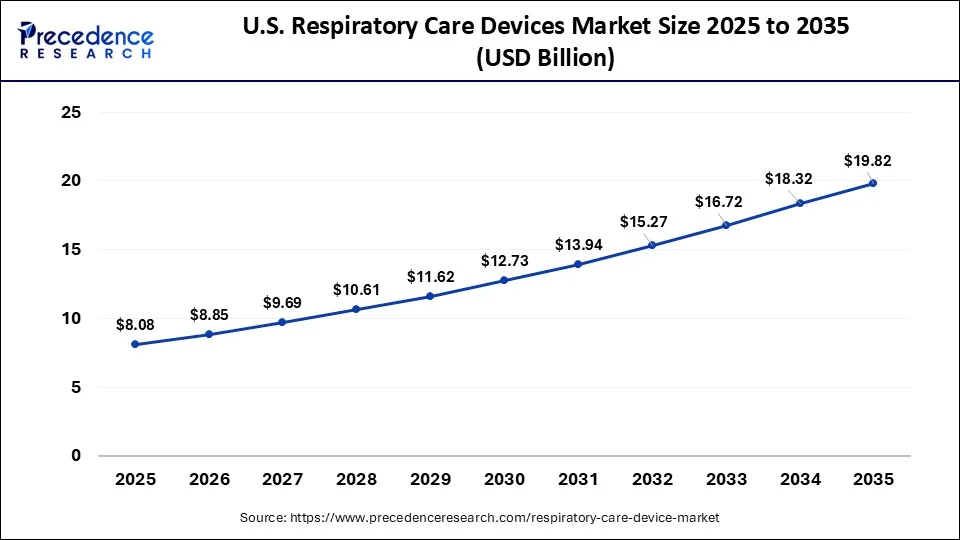

The U.S. respiratory care devices market size was estimated at USD 8.08 billion in 2025 and is predicted to be worth around USD 19.82 billion by 2035, at a CAGR of 9.39% from 2026 to 2035.

On the basis of geography, North America dominates the market, primarily driven by the increasing prevalence of respiratory diseases such as COPD, TB, asthma, and sleep apnea. The region is expected to witness significant growth in the respiratory care device market during the forecast period. This is due to the large patient population, high healthcare expenditure, advanced healthcare infrastructure, and a strong focus on technological advancements. The U.S. is the major country driving the demand for respiratory care devices in the North American region. The country has a burden of respiratory diseases, including COPD, asthma, and other chronic respiratory conditions. In addition, these countries are investing heavily in technology and advanced healthcare infrastructure, which is expected to drive the demand for respiratory care devices in the region.

Europe is a significant market for respiratory care devices, with Germany, France, and the United Kingdom being the major contributors to the market's growth. This is due to the rising adoption of healthcare systems, robust regulatory frameworks, and a growing prevalence of respiratory diseases. These countries have well-established industries that are major consumers of patient safety, quality standards, and the adoption of innovative medical technologies, contributing to the demand for the respiratory care devices market.

The region in the Asia Pacific is anticipated to have the greatest CAGR. The market is driven by various factors, such as expanding healthcare infrastructure and increasing awareness about respiratory care devices. China, Japan, and India are the major countries driving the demand for respiratory care devices in the Asia Pacific region. These countries have well-established industries, a large population base, increasing healthcare expenditure, and a rising prevalence of respiratory conditions. Moreover, these countries are investing heavily in developing technology and advanced healthcare infrastructure, which is expected to drive the demand for respiratory care devices in the region.

Latin America: Access to Upgraded Respiratory Solutions:

Latin America has seen a continuously growing demand for critical respiratory solutions as a result of improved access to healthcare, rising levels of urbanization and pollution, and increasingly aggressive investments by public and private hospitals in critical care facilities. The fastest-growing country in the Latin American region is Brazil, with the rapid expansion of its ICU, coupled with a growing demand for the adoption of oxygen therapy systems.

Middle East & Africa (MEA): The Growth of the Healthcare Sector:

In the MEA region, growth is being driven by healthcare modernization programs, increased healthcare tourism, and government expenditure on respiratory and critical care equipment within tertiary healthcare centers. The fastest-growing country in the MEA region is Saudi Arabia, as a result of significant healthcare reform initiatives defined by Vision 2030 and rapidly expanding hospital facilities.

Value Chain Analysis of the Respiratory Care Device Market

- Production of Raw Materials and Components: The beginning of the value chain is the production of highly precise components such as sensors, compressors, valves, and medical-grade plastics.

Key Players: 3M, Honeywell, Parker Hannifin. - Assembling Devices and Integrating Technology: At this stage, the components are assembled into advanced respiratory devices, including ventilators, CPAP machines, and oxygen concentrators.

Key Players: Philips Healthcare, ResMed, and Medtronic. - Distribution, After-Sales Distribution, and Clinical Support: The last part of the value chain involves distributions to the end customer via global distribution channels or partnerships with hospitals or home care providers, as well as support services for customers, including maintenance, training, and remote monitoring of devices after they have been purchased.

Key Players: Getinge, Fisher & Paykel Healthcare, and Drive DeVilbiss.

Respiratory Care Devices Market Companies

- Philips Healthcare

- ResMd Inc.

- Medtronic plc.

- Masimo corporation

- DeVilbiss Healthcare LLC

- Dragerwerk AG

- Fisher & Paykel Healthcare Ltd

- GE Healthcare

- SAES Pure Gas Inc.

- Getinge AB

Recent Developments

- In February 2024, Getinge, a global medical technology player has launched its Servo-c mechanical ventilator in India. Getinge's mechanical ventilator Servo-c promises to meet affordability requirements of Indian hospitals. Servo-c offers functionalities for personalized respiratory treatments and smart fleet management, eliminating the need for proprietary disposables. It features CO2 monitoring and Servo Compass for insights into lung mechanics and gas exchange.

(Source: https://www.healthcareradius.in) - In November 2024, SMU unveils new research for monitoring breathing modes via in-ear microphones. The novel BreathPro system by the SMU team can identify shortness of breath in real time and runners can be to relieve them or even be trained learn to avoid them. The same principle can be also extended to heart rate monitoring during running.

(Source: https://news.smu.edu.sg) - In October 2024, ATPC and FORMEDIC Technologies announce strategic collaboration to introduce lega, an electronic chest percussion device for respiratory care. his partnership marks a major advancement in respiratory health, as the two companies combine their strengths to address the growing demand for advanced respiratory solutions.

(Source: https://www.biospace.com) - In March 2023,Vitalograph, a company specializing in developing and manufacturing respiratory diagnostic devices, introduced the VitaloPFT Pulmonary Function Testing Series. This series is specifically designed for use in secondary care settings. The VitaloPFT Series offers state-of-the-art respiratory diagnostic solutions to hospitals and other secondary care units that require sophisticated pulmonary function testing.

- In February 2022,Aptar Pharma launched HeroTracker Sense, a novel digital respiratory health solution that transforms a standard metered dose inhaler (pMDI) into a smart connected healthcare device. HeroTracker Sense aims to enhance the well-being of patients globally afflicted with chronic respiratory diseases like asthma, COPD, Cystic Fibrosis, and other respiratory conditions resulting from COVID-19. It enables patients to monitor their MDI usage and promotes better adherence to their prescribed therapy.

- In April 2019, InnAccel, a medical technology innovation firm, introduced SAANS, a portable neonatal CPAP system. This system is specifically designed to offer respiratory support to critically ill neonates with Respiratory Distress Syndrome (RDS) in areas with limited resources and during transportation.

Segments Covered in the Report

By Types

- Therapeutic Devices

- Diagnostic

- Monitoring Devices

- Diagnostic Devices

- Consumables and Accessories

By End User

- Hospitals

- Homecare

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting