Ring Main Unit Market Size?

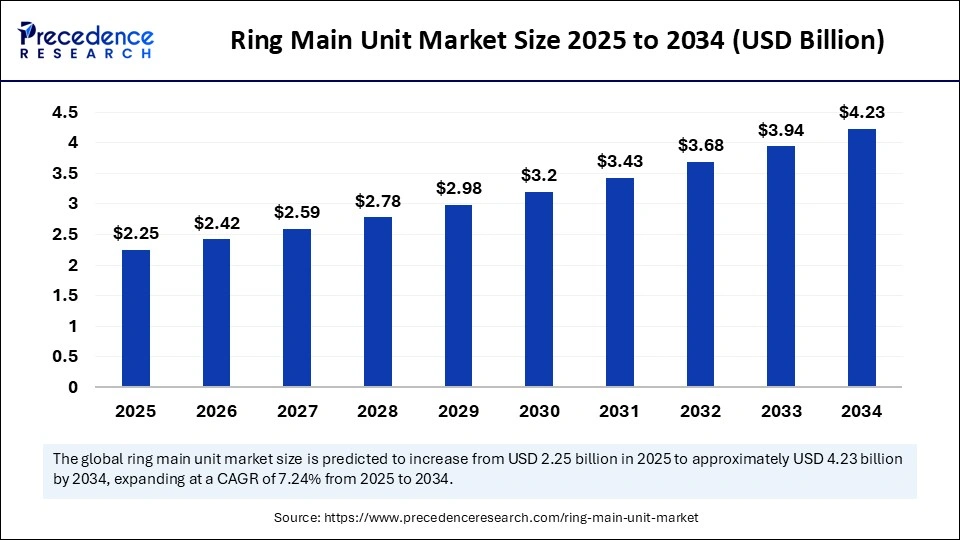

The global ring main unit market size accounted for USD 2.25 billion in 2025 and is predicted to increase from USD 2.42 billion in 2026 to approximately USD 4.23 billion by 2034, expanding at a CAGR of 7.24% from 2025 to 2034. The market is experiencing significant growth due to the increasing adoption of renewable energy sources, government policies fostering power system modernization, and the demand for dedicated power infrastructure in developing economies.

Market Highlights

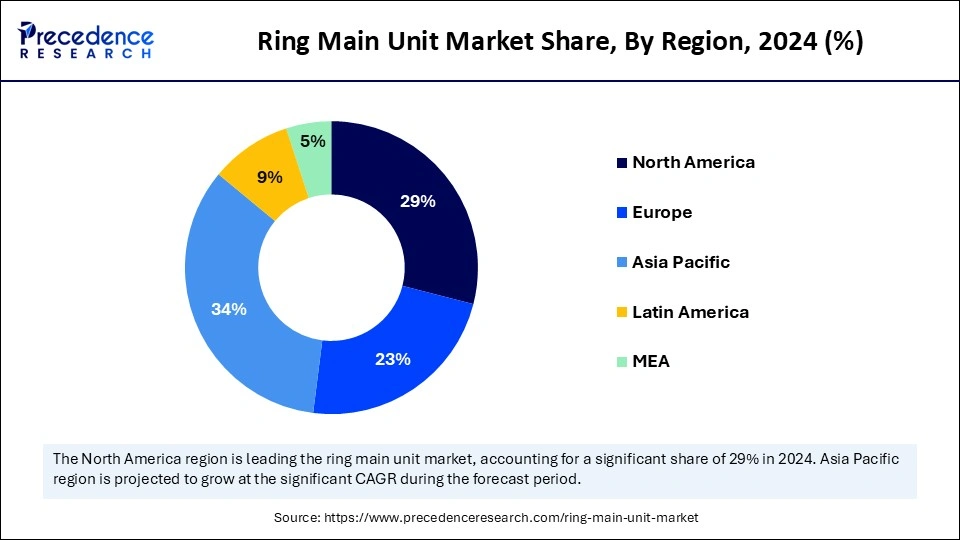

- Asia Pacific dominated the global market with the largest market share of 34% in 2024.

- North America is expected to be the fastest-growing region during the forecast period.

- By insulation type, the gas-insulated segment captured the biggest market share in 2024.

- By insulation type, the oil-insulated segment is expected to grow at the fastest CAGR during the forecast period.

- By installation, the outdoor segment contributed the highest market share in 2024.

- By installation, the indoor segment is expected to expand at the fastest CAGR in the coming years.

- By voltage rating, the up to 15kV segment generated the major market share in 2024.

- By voltage rating, the above 25 kV segment is expected to witness the fastest growth during the predicted timeframe.

- By application, the transmission and distribution segment held the biggest market share in 2024.

- By application, the commercial and residential infrastructure segment is expected to grow at a significant rate in the upcoming years.

Market Overview

The ring main unit market refers to the global industry for independent, factory-assembled switchgear units used in medium-voltage power distribution networks. These units, typically characterized by a ring-shaped configuration, are designed to ensure a reliable power supply, even in the event of component failure, and facilitate efficient and safe energy distribution. There are various ring main unit types, including gas-insulated units, oil-insulated units, and air-insulated units, which caters to diverse applications such as power grids, renewable energy integration, and underground installations.

Impact of Artificial Intelligence on the Ring Main Unit Market

Artificial Intelligence is revolutionizing the ring main unit market by enabling real-time monitoring, fault detection, and predictive maintenance in power distribution networks. This translates to upgraded grid efficiency, reduced downtime, and improved grid resilience. AI-powered ring main unit can continuously monitor network conditions, allowing for proactive identification and resolution of issues. Furthermore, AI algorithms can analyze data from sensors and other sources to quickly detect faults, minimizing disruption to the power supply.

Ring Main Unit MarketGrowth Factors

- Urbanization and Industrialization: Growing urban and industrial areas are leading to increased energy demand, driving the demand for robust and reliable power distribution systems like Ring Main Units.

- Smart Grid Development:The adoption of smart grids is boosting the demand for Ring Main Units equipped with advanced technologies for remote monitoring, data analysis, and automation.

- Enhanced Grid Efficiency and Reliability:Ring Main Units play a crucial role in enhancing grid efficiency and reliability, making them essential for meeting the increasing energy requirements of modern society.

- Sustainability Solutions:Ring Main Unit contributes to sustainable energy practices by optimizing energy distribution and reducing energy losses.

Market Outlook Global Ring Main Unit Market

- Market Overview: Ring Main Units are essential components of efficient secondary‑distribution systems, providing compact switchgear solutions that improve network reliability and fault isolation.

- Global Growth:Urbanization, especially in Asia, and increasing infrastructure investment are contributing to the widespread use of RMUs in substations located in urban areas.

- Research and Development: Increasing attention is being paid to SF₆‑free insulation (e.g., both dry‑air and solid dielectric) and IoT RMUs that facilitate remote monitoring and predictive maintenance.

- Regulatory and Environmental Pressures: Technologies like the EU F‑gas Regulation are creating pressure on utilities to phase out the use of SF₆ because of its very high global‑warming potential.

- Modernization of Grids: Aging distribution infrastructure is being renewed, with RMUs playing a vital role in improving the reliability and resilience of electricity grids in the future.

- Decentralization and Integration of DERs: As the deployment of distributed energy resources (DERs) continues, RMUs are being used increasingly in microgrids and looped systems to manage variable generation and improve stability.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 2.25 Billion |

| Market Size in 2026 | USD 2.42 Billion |

| Market Size by 2034 | USD 4.23 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.24% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Insulation Type, Installation, Voltage Rating, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Transition Towards Smart Grid Infrastructure

The primary driver in the ring main unit market is the transition toward smart grid infrastructure. This transition is further driven by increasing urbanization, industrialization, the integration of renewable energy sources, and the demand for enhanced reliability and efficiency of distribution networks. The ongoing modernization of power grids to improve efficiency and reliability boosts the demand for switchgear solutions like ring main units (RMUs).

Restraint

High Costs and Environmental Regulations

Initial upfront investment in RMUs is much higher than traditional switchgear solutions. They require regular maintenance and inspection to ensure proper functioning, which leads to increased maintenance costs. This high cost factor created challenges, especially for SMEs. Moreover, stringent environmental regulations, especially those related to the use of sulfur hexafluoride (SF6) gas, limit the adoption of gas-insulated RMUs. SF6 is a powerful greenhouse gas with a high global warming potential, leading to restrictions and bans on its use in many regions.

Opportunity

Advances in Technology and the Development of Smart Grids

Ongoing advancements in technology create immense opportunities in the ring main unit market. Innovations in RMU technology, such as solid-state switching and vacuum circuit breakers, enhance performance efficiency. Integrating technologies like AI in RMUs enable real-time fault detection, predictive maintenance, and enhance the overall efficiency of power distribution networks. In addition, the development of smart grids opens up avenues for advanced RMUs with automation capabilities.

Segment Insights

Insulation Type Insights

Why did the Gas-insulated Segment Dominate the Market in 2024?

The gas-insulated segment dominated the ring main unit market with the largest share in 2024 due to its several perceived benefits. Utilizing SF6 gas as the insulation medium, where SF6 gas provides excellent dielectric properties, ensure high insulation performance and minimal power losses during operation. Gas-insulated RMUs are known for their compact size, making them ideal for applications where space is limited. They are also designed to withstand harsh environmental conditions, including temperature variations and seismic events, making them suitable for various applications. SF6 provides excellent insulation properties and robustness, ensuring reliable power distribution and preventing accidents with a long-term cost-saving solution.

- In June 2024, TECO Electric & Machinery Co. Ltd. (1504) and Siemens Taiwan announced the signing of a Memorandum of Understanding to produce 24 kV Sulfur hexafluoride-free (blue GIS) clean-air gas-insulated switchgear in Taiwan.

The oil-insulated segment is expected to grow at the fastest rate in the market during the forecast period, owing to its reliability, durability, and cost-effectiveness. Utilizing oil as the primary insulating and cooling medium in RMUs provides excellent insulation characteristics, allowing for high-voltage operation and reliable performance. They are widely used in applications where high-voltage power distribution is required, such as industrial facilities, infrastructure projects, and transportation networks.

Installation Insights

What Made Outdoor the Dominant Segment in the Ring Main Unit Market?

The outdoor segment dominated the market with a major share in 2024. This is mainly due to the increased installation of RMUs in outdoor applications such as renewable energy installations, grid expansion in remote areas, and infrastructure modernization. As power grids are extended to more remote areas, the demand for weatherproof and reliable RMUs that can withstand harsh environmental conditions increases. The trend toward smart grids and digitalization in the utilities sector is also driving demand for RMUs equipped with advanced monitoring, control, and communication capabilities.

The indoor segment is expected to expand at the fastest rate in the coming years due to increasing urbanization, industrial expansion, and the need for space-efficient power distribution solutions. Advancements in gas-insulated ring main units, smart monitoring systems, and eco-friendly insulation technologies support segmental growth. The rising need for reliable power distribution networks in commercial buildings, metro stations, and data centers further drives the growth of the segment.

Voltage Rating Insights

How Does the up to 15 kV Segment Dominate the Market in 2024?

The up to 15kV segment dominated the market with the largest share in 2024. This is mainly due to its widespread use in distribution networks. This dominance is driven by the growing demand for reliable and efficient power distribution, particularly in urban areas and expanding infrastructure projects. Up to 15kV ring main units are essential for connecting loads in distribution networks, making them a fundamental component of power grids. Also, low-voltage Ring Main Units are designed to handle high fault currents, coupled with integrating renewable energy sources like solar and wind power into the grid, making them a vital part of the energy transition by ensuring reliability in distribution networks.

The above 25 kV segment is expected to witness the fastest growth during the predicted timeframe, owing to the increasing demand for high-voltage power transmission and distribution, especially in areas experiencing rapid metropolitanization. As renewable energy sources like solar and wind expand, ring main units with higher voltage ratings are needed to efficiently integrate these sources into the grid and transport power over longer distances. This growth is further driven by factors like urbanization, industrialization, and the demand for more efficient and reliable power infrastructure. Governments are investing heavily in modernizing power grids and expanding distribution networks, which creates significant demand for ring main units of various voltage ratings.

Application Insights

Why did the Transmission and Distribution Segment Dominate the Market in 2024?

The transmission and distribution segment dominated the ring main unit market by capturing the biggest revenue share in 2024. This is mainly due to the widespread use of RMUs in power distribution networks, particularly in areas experiencing urban and industrial growth. RMUs are essential for a reliable power supply, especially as smart grids and renewable energy integration ensure reliable and efficient power delivery to end users. These can also provide the necessary switching and protection functions to ensure reliable power flow with improved reliability and resilience of power grids by allowing sectional maintenance and providing alternate power paths in case of faults.

The commercial and residential infrastructure segment is expected to grow at a significant rate in the upcoming years. The growth of the segment is attributed to the increasing urbanization and rising demand for reliable and efficient power distribution. The segment growth is further reinforced by the growth of smart grids, the need for sustainable energy infrastructure, and the rising development of smart buildings, as well as new infrastructure like IT parks, industrial zones, and other infrastructure projects requiring efficient power distribution. RMUs are suitable for these applications due to their compact size, modular design, and ease of expansion.

Regional Insights

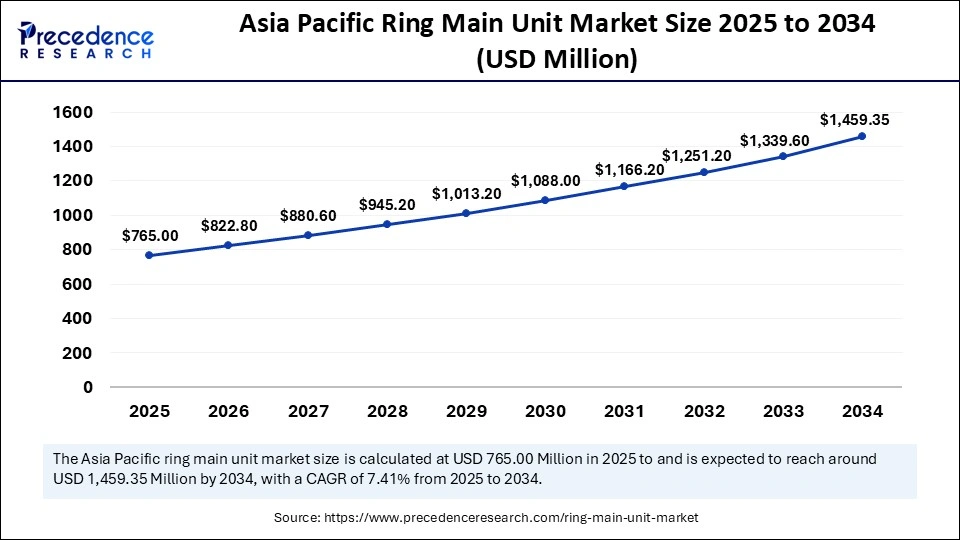

Asia Pacific Ring Main Unit Market Size and Growth 2025 to 2034

Asia Pacific ring main unit market size is exhibited at USD 765.00 million in 2025 and is projected to be worth around USD 1,459.35 million by 2034, growing at a CAGR of 7.41% from 2025 to 2034.

What Factors Contributed to Asia Pacific's Dominance in the Market?

Asia Pacific dominated the ring main unit market by holding the largest share in 2024. This is mainly due to the increased urbanization and industrialization, particularly in countries like India, China, and Japan. This led to the increased need for reliable and efficient power infrastructure, making the RMUs essential. Additionally, governments in the region are investing in power infrastructure modernization and are increasingly focused on energy security and sustainability, which are facilitated by the RMUs. For instance, India's Neighborhood First policy and the Act East Policy aim to strengthen regional power grid infrastructure through collaborations and partnerships.

India: A Key Force in the Ring Main Unit Market

India is emerging as a major player in the market due to the rising integration of renewable energy sources into the grid. This creates the need for switching devices like RMUs. This increasing urbanization and rising development of infrastructure such as smart cities and power distribution networks further contribute to market expansion. Moreover, the rising modernization of aging grids positively impacts the market.

North America: The Fastest-Growing Region

North America is expected to grow at the fastest rate during the forecast period because of various factors such as growing investments in renewable energy, increasing industrial infrastructure, and the modernization of power grids. Rising government investment in infrastructure projects, including transmission and distribution lines, are driving the need for RMUs to manage power flow efficiently. Government policies and incentives such as the Investment Tax Credit (ITC) for renewable energy projects in the U.S. stimulate investment in renewable energy, which in turn boosts the demand for the RMUs.

The U.S. Ring Main Unit Market Trends

The U.S. plays an important role in North American ring main unit market due to its strong economic growth, rapid urbanization, and increasing demand for reliable and efficient power distribution systems, along with rising infrastructure development, including renewable energy projects. The increasing focus of sustainability is boosting the demand for RMUs that support integration of renewable energy. The U.S. government and private sector are investing heavily in upgrading grids, which support market growth.

How is Europe Emerging as Notably Growing Region for Ring Main Unit Market?

Europe is an established RMU market, which is seeing growth due to utility grid modernization and strong regulation. Old medium-voltage infrastructures in some areas are being replaced, and efforts are being made to switch to eco-friendly, low-GWP switchgear as the EU phases out SF₆. Major manufacturers (e.g., ABB, Siemens, Schneider) are active in this market, and interest in smart, SF₆-free RMUs is growing, particularly in urban underground networks.

Germany

Germany is the clear leader for the RMU Market in Europe, driven by a strong grid-modernization initiative, a large share of renewable generation, and a focus on carbon-neutral infrastructure. These initiatives are forcing utilities to adapt and pursue SF₆-free and digital RMUs. In Germany, utilities leverage and prioritize smart monitoring and digital control of the power grid, contributing to the future regional resilience of the network. Major switchgear manufacturers are significant players in the German market and provide a source of innovation and adoptability.

How Is Middle East & Africa Showing Significant Growth In Category Management Software Industry?

MEA is an emerging RMU region, with increasing electrification, spending on infrastructure, and reinforcement of the power-grid. Rapid urbanization, large utility projects and a growing renewable-energy segment are driving demand. Utilities in the Gulf region and on the African continent are increasingly using RMUs, where appropriate, to enhance reliability in challenging climate conditions.

Saudi Arabia has been identified as the leading country for RMU demand in the Middle East & Africa region. As part of Vision 2030, Saudi Arabia is investing heavily in modernizing the grid infrastructure with RMUs to support its cities and renewable integration. Gas-insulated RMUs have become a preferred option in this region due to their compact size and reliability operating in difficult conditions and they are being used by Saudi utilities.

How is Europe Emerging as Notably Growing Region for Ring Main Unit Market?

Europe is an established RMU market, which is seeing growth due to utility grid modernization and strong regulation. Old medium-voltage infrastructures in some areas are being replaced, and efforts are being made to switch to eco-friendly, low-GWP switchgear as the EU phases out SF₆. Major manufacturers (e.g., ABB, Siemens, Schneider) are active in this market, and interest in smart, SF₆-free RMUs is growing, particularly in urban underground networks.

Germany

Germany is the clear leader for the RMU Market in Europe, driven by a strong grid-modernization initiative, a large share of renewable generation, and a focus on carbon-neutral infrastructure. These initiatives are forcing utilities to adapt and pursue SF₆-free and digital RMUs. In Germany, utilities leverage and prioritize smart monitoring and digital control of the power grid, contributing to the future regional resilience of the network. Major switchgear manufacturers are significant players in the German market and provide a source of innovation and adoptability.

How Is Middle East & Africa Showing Significant Growth In Category Management Software Industry?

MEA is an emerging RMU region, with increasing electrification, spending on infrastructure, and reinforcement of the power-grid. Rapid urbanization, large utility projects and a growing renewable-energy segment are driving demand. Utilities in the Gulf region and on the African continent are increasingly using RMUs, where appropriate, to enhance reliability in challenging climate conditions.

Saudi Arabia has been identified as the leading country for RMU demand in the Middle East & Africa region. As part of Vision 2030, Saudi Arabia is investing heavily in modernizing the grid infrastructure with RMUs to support its cities and renewable integration. Gas-insulated RMUs have become a preferred option in this region due to their compact size and reliability operating in difficult conditions and they are being used by Saudi utilities.

Ring Main Unit Market Companies

- ABB Ltd

- alfanar Group

- Eaton Corporation plc

- ENTEC Electric & Electronic Co. Ltd.

- EPE Switchgear (M) Sdn. Bhd.

- Larsen & Toubro Ltd.

- LS Electric Co. Ltd.

- Lucy Electric UK Ltd. (Lucy Group Ltd.)

- Schneider Electric SE

- Siemens AG

- TIEPCO

Recent Developments

- In February 2025, Schneider Electric, the leader in the digital transformation of energy management and automation, secured a landmark contract from Tata Power Company Limited, Mumbai, for the deployment of 11kV SF6-Free Ring Main Units using Schneider Electric's cutting-edge RM AirSeT SF6 Free technology.(Source: https://www.pv-magazine-india.com)

- In July 2024, the Saudi Electricity Company (SEC), in collaboration with Alfanar, announced the successful installation and operation of the first locally-manufactured, eco-friendly Smart Ring Main Unit in the Middle East. This innovative unit has passed all quality and safety tests conducted by a leading global laboratory specializing in electrical equipment testing.(Source: https://www.se.com.sa)

- In March 2024, Lucy Electric unveiled EcoTec, the first ring main unit (RMU) of its kind in the UK, designed for medium voltage networks without the use of Sulphur hexafluoride (SF6).(Source: https://electricalreview.co.uk)

Segments Covered in the Report

By Insulation Type

- Oil-insulated

- Solid dielectric

- Air-insulated

- Gas-insulated

By Installation

- Indoor

- Outdoor

By Voltage Rating

- Up to 15 kV

- 15�25 kV

- Above 25 kV

By Application

- Transmission and distribution

- Commercial and residential infrastructure

- Power

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting