What is the Electricity Demand and Supply Forecasting Solutions Market Size?

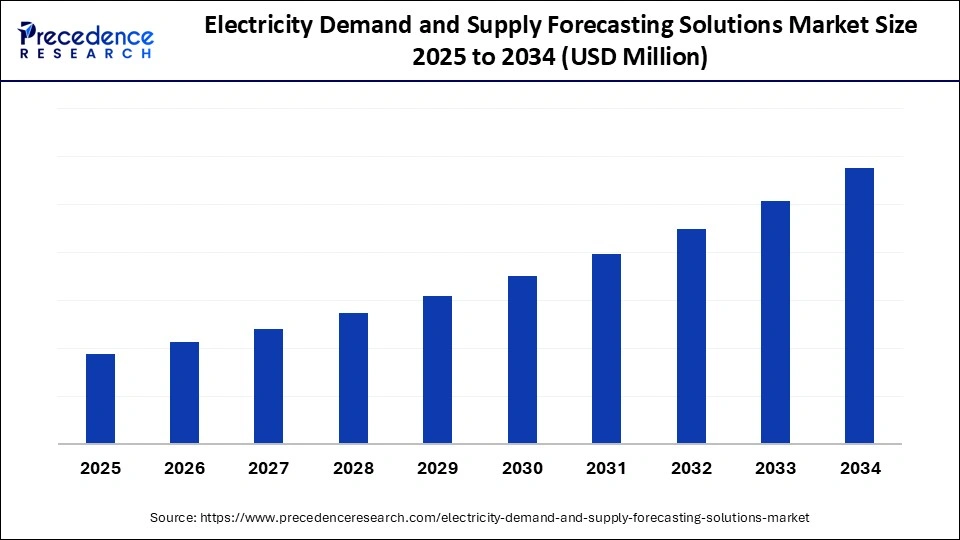

The global electricity demand and supply forecasting solutions market is growing rapidly as utilities adopt AI-driven tools to predict energy needs and optimize grid performance.This market is growing due to the rising need for real-time energy management and accurate load forecasting to balance grid stability and optimize power distribution.

Market Highlights

- North America dominated the market, holding the largest market share of 33% in 2024.

- The Asia Pacific is expected to expand at the fastest CAGR of 19% between 2025 and 2034.

- By solution type, the load/demand forecasting segment held the major market share of 38% in 2024.

- By solution type, the integrated forecasting segment is growing at a remarkable CAGR of 16% between 2025 and 2034.

- By deployment mode, the on-premises/edge segment contributed the largest market share of 52% in 2024.

- By deployment mode, the cloud/SaaS segment is expanding at a strong CAGR of 21% between 2025 and 2034.

- By end user, the utilities & grid operator segment captured the highest market share of 45% in 2024.

- By end user, the aggregators & VPP operators segment is poised to grow at a strong CAGR of 20% between 2025 and 2034.

- By application, the grid operations & balancing segment generated the biggest market share of 38% in 2024.

- By application, the DER forecasting & scheduling segment is expected to expand at a remarkable CAGR of 21% between 2025 and 2034.

Market Overview

Powering the Future: Smart Energy Forecasting on the Rise

The electric demand and supply forecasting solution market is witnessing steady growth as utilities and grid operators use IoT, AI, and advanced analytics to more precisely forecast power consumption patterns. Adoption of solutions is driven by the increasing integration of renewable energy sources and the need for effective grid management. Furthermore, governments across the globe are prioritizing smart grid initiatives, driving market expansion.

Case Study: Siemens Energy Leads AI-Powered Grid Forecasting Transformation

In 2025, Siemens Energy achieved a breakthrough by deploying its AI-driven GridMind forecasting suite, designed to enhance real-time prediction of electricity demand and renewable supply. The system integrated machine learning with weather and consumption data to provide near-perfect short-term forecasting accuracy. This innovation enabled utilities to reduce grid imbalance incidents and optimize power distribution with minimal human intervention. Success positioned Siemens Energy as a global leader in intelligent grid management and marked a key milestone in advancing smart, sustainable, and data-centric energy systems.

Electricity Demand and Supply Forecasting Solutions Market Outlook

As utilities use AI and analytics for more intelligent grid management, the market for electric demand and supply forecasting is expanding. Rapid adoption is being driven by rising energy consumption, the integration of renewable energy sources, and the need for dependable power delivery.

By maximizing the use of renewable energy, cutting waste, and lowering carbon emissions, forecasting solutions promote sustainability. They support global clean energy goals by helping balance generation and demand.

AI and cloud-based forecasting tools for smart grids are being used by startups to spur innovation. Many focused on decentralized energy systems and real-time analytics, drawing significant investor interest.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Solution Type, Deployment mode, End-User, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Emerging Opportunities in Electricity Demand and Supply Forecasting Solutions Market

| Opportunity Area | Key Insights & Market Potential |

| AI-Powered Energy Forecasting | Machine learning models enhance prediction accuracy, helping utilities reduce power losses and improve grid reliability |

| Renewable Energy Integration | Tools optimize solar and wind power use, balancing fluctuating generation with real-time demand |

| Smart Grid Modernization | Smart grids rely on forecasting for automated control, energy efficiency, and reducing transmission loss |

| Decentralized and Microgrid Systems | Localized forecasting improves energy management and supports community power resilience |

| Cloud-based Forecasting Platforms | Scalable and cost-efficient solutions enable faster deployment and remote data access |

| IoT-enabled data intelligence |

Sensor data integration strengthens forecasting accuracy and proactive energy planning. |

The Future Grid Intelligence Matrix: How Forecasting Powers Smart Energy Ecosystems

| Dimension | 2024 (Current State) | 2030 (Forecasted Transformation) | Key Technologies driving change | Strategic Impact in Utilities |

| Data Availability | Limited to SCADA and smart meter data | Integrated IoT, EV charging, and whether satellite feeds | IoT sensors, Edge Computing, Cloud Data Lakes | 10X improvement in real-time data visibility and granularity |

| Forecasting Accuracy | 15% error margin in load forecasting | 5% error margin via AI and ensemble learning | Machine learning, Neural Networks, Reinforcement AI | Reduces grid imbalance penalties and improves reliability |

| Decision Automation | Operator-led manual scheduling | Self-learning automated decision engines | Digital Twins, Predictive Analytics | 60% reduction in manual interventions for grid dispatch |

| Integration with Renewables | Reactive balancing of solar/ wind input | Proactive forecasting and storage alignment | Hybrid AI Forecast Models, Energy Storage Optimization | Maximizes renewable utilization and minimizes curtailment |

| Grid Flexibility | Limited centralized control | Fully decentralized smart grid with adaptive load balancing | Blockchain, Smart Contracts, VPP Systems | Enables dynamic peer-to-peer energy trading |

Electricity Demand and Supply Forecasting Solutions Market Segmental Insights

Solution Type Insights

Load/demand forecasting dominates the electricity demand and supply forecasting solutions market, with a 38% share, as both the residential and commercial sectors are using more electricity. This segment's leadership position is further reinforced by the increased focus on efficient power allocation and real-time grid monitoring. By anticipating short-term load variations, sophisticated AI algorithms are improving accuracy. To achieve more dynamic, responsive forecasting, utilities are also incorporating IoT and smart meter data.

Integrated forecasting suites are the fastest-growing in the exosome therapy market, with a 16% CAGR, because they enable thorough analysis by combining data from various sources, including consumption models and weather data. Because these solutions can provide a unified AI-driven forecasting approach, utilities favor them. These suites enhance coordination between conventional power plants and renewable energy sources by reducing data silos. Scalability and system interoperability are further enhanced by cloud-based integration.

The renewable generation forecasting segment is emerging as a notable segment in the exosome therapy market, motivated by the worlds transition to sustainable energy. The need for forecasting tools that can precisely predict the variability of renewable energy output is rapidly increasing as solar and wind capacity grow. AI and satellite-based weather mapping are helping predict changes in renewable energy production. During times of high volatility, this helps grid operators maintain energy balance

Deployment Mode Inisghts

On-premises/edge solutions dominate the electricity demand and supply forecasting market with a 52% share, as they are reliable for mission-critical energy operations, feature secure architecture, and offer low latency. Localized data management remains preferred by many large utilities to meet stringent regulatory requirements. Real-time grid balancing depends on these systems for instantaneous processing and decision-making capabilities. In areas with strict cybersecurity and data sovereignty laws, they are widely used.

Cloud/SaaS platforms are the fastest-growing segment in the exosome therapy market, with a 21% CAGR, driven by affordability, ease of scalability, and real-time updates. Cloud adoption in the energy sector is being fueled by the shift toward digital grids and remote forecasting. The subscription-based business model gives utilities access to ongoing analytics upgrades while lowering infrastructure costs. Additionally, cloud-based solutions improve multinational operators' cross-regional data collaboration

Managed forecasting services are emerging as a notable segment in the exosome therapy market as utilities increasingly contract out predictive analytics to experts. These services lower operational complexity for grid operators by providing AI-driven insights and ongoing data optimization. They offer real-time model recalibration and anomaly detection, guaranteeing reliable forecasting. Smaller utilities are increasingly choosing service-based models as outsourcing trends gain traction.

End User Insights

Utilities & grid operators dominate the market for electricity demand and supply forecasting solutions, with a 45% share, driven by growing demand for real-time load optimization, smart grid deployment, and demand-supply balancing. Given their extensive operations, forecasting tools are essential for stability and reliability. Grid disruptions can be responded to more quickly thanks to automation and AI integration. Growing investments in grid modernization and digital twin projects also help this segment

Aggregators & VPP operators are the fastest-growing segment of the electricity demand and supply forecasting solutions market, with a 20% CAGR as peer-to-peer power trading and decentralized energy generation become more common. Rapid growth is fueled by their reliance on AI-driven forecasting to optimize distributed resources. EVs and rooftop solar units are examples of distributed assets that use real-time forecasting to balance. The market adoption of VPP operations is further accelerated by increased regulatory support.

Renewable asset owners (wind, solar) are emerging as a notable segment in the exosome therapy market, as they increasingly use forecasting models to anticipate weather-dependent power production, ensuring precise scheduling and minimizing grid imbalances. These instruments reduce curtailment risks and maximize turbine or panel performance. Predictive analytics is becoming a top priority for asset owners looking to maximize profits as renewable portfolios grow worldwide.

The utilities and energy providers segment is growing notably in the electricity demand and supply forecasting solutions market, as power companies manage larger volumes of variable renewable energy and more complex grid operations. As solar, wind, and distributed resources expand, utilities require advanced forecasting tools to maintain reliability, balance loads, and plan generation schedules. Rising regulatory pressure for accurate demand forecasting, increasing peak load uncertainty, and the need for real-time visibility across distribution networks also encourage faster adoption. These solutions help utilities reduce operating costs, prevent outages, and support long-term capacity planning, thereby strengthening their rapid market growth.

Application Insights

Grid operations & balancing dominate the electricity demand and supply forecasting solutions market, holding a 38% share, and are encouraged by the increasing complexity of multi-source grids. To guarantee continuous power delivery and lower transmission losses, utilities depend on precise demand and supply projections. Operators can identify grid stress and prevent outages with advanced analytics. During peak load situations, the emphasis on real-time visualization tools also improves decision-making effectiveness.

DER forecasting & scheduling are the fastest-growing in the exosome therapy market, with a 21% CAGR as distributed generation via EVs, solar rooftops, and storage systems grows. Real-time analytics improve grid stability and scheduling. Optimizing distributed power flow is increasingly enabled by AI forecasting tools and smart inverters. The emergence of decentralized grid structures and microgrids is consistent with this trend

Trading & market bidding are emerging as a notable segment in the exosome therapy market, with energy traders optimizing their bidding strategies in liberalized electricity markets and predicting price fluctuations using predictive tools. By evaluating demand and weather signals, machine learning models are improving trading accuracy. Adoption among trading firms is also being driven by increased volatility in the energy market.

Electricity Demand and Supply Forecasting Solutions Market Region Insights

North America dominates the market, holding a 33% share, backed by a robust smart grid infrastructure, a high level of digital maturity, and proactive regulatory support for the integration of renewable energy sources. Utilities across the region have already deployed advanced metering systems, high-quality sensors, and digital control platforms, making it easier to implement forecasting tools at scale. These conditions allow energy providers to adopt new analytical systems more quickly compared to other regions.

FERC Order 2222 and other government initiatives are encouraging the use of DER forecasting. These policies support broader participation in distributed resources, increasing the need for accurate modeling of rooftop solar, battery storage, and flexible loads. As grid operators manage more distributed assets, demand forecasting becomes an essential capability for ensuring reliability and grid stability.

The U.S. leads the market with extensive use of AI-based forecasting tools, robust R&D investments, and sophisticated smart grid infrastructure. Utilities across the country have deployed advanced meters, digital sensors, and data management systems that support accurate short-term and long-term forecasting. These technologies help operators respond to changing load conditions and improve planning for regional energy needs.

To improve grid reliability, utilities are focusing on renewable balancing and real-time demand prediction. Growing volumes of solar, wind, and distributed energy resources require precise forecasting to avoid congestion, reduce curtailment, and maintain system stability. Real-time analytics help operators adjust generation and manage variability more effectively during peak demand periods.

Asia Pacific is the fastest-growing region in the market with a 19% CAGR, driven by the development of smart energy technologies, industrial growth, and urbanization. Rising electricity consumption across major economies such as China, India, Japan, and South Korea is pushing utilities to deploy more advanced digital tools to manage demand. The rapid expansion of commercial buildings, manufacturing facilities, and residential developments further underscores the need for accurate, timely forecasting.

The need to balance growing electricity demand with renewable energy generation is driving the regions emphasis on forecasting solutions. Countries are adding large volumes of solar, wind, and distributed energy resources, which create variability in power supply and require more robust prediction models. Forecasting tools help grid operators plan generation and maintain stability as renewable penetration continues to rise.

Indias Electricity Demand and Supply Forecasting Solutions Market Trends

India is experiencing growth driven by increased integration of renewable energy sources, digital grid upgrades, and rising power demand. As solar and wind capacity expand across multiple states, grid operators face greater supply variability and rely more on accurate forecasting to maintain stability. Growing urbanization and industrial activity continue to increase electricity consumption, underscoring the need for reliable demand forecasting.

To enhance load prediction and reduce transmission losses, utilities are implementing IoT-based forecasting tools and artificial intelligence. These technologies help collect real-time data from substations, feeders, and meters, allowing utilities to monitor network conditions more closely and improve planning. AI models also support faster decision-making during peak load conditions and help reduce energy wastage.

The Middle East represents a notable regional market where utilities are implementing cutting-edge forecasting technologies to enhance energy efficiency and successfully incorporate renewable sources. Countries across the region are adding large solar and wind projects, which increase variability and require accurate forecasting to maintain grid stability. As energy demand continues to rise with economic development, utilities are depending more on digital tools to plan generation and manage consumption patterns.

The regions efforts to develop smart infrastructure and diversify its energy sources are fostering steady market expansion. National strategies in countries such as the United Arab Emirates and Saudi Arabia emphasize advanced metering, automated control centers, and improved data collection, which create a strong foundation for forecasting systems. These initiatives help reduce stress on grids and support long-term sustainability goals.

UAE Electricity Demand and Supply Forecasting Solutions Market Analysis

The UAE is expanding as utilities invest in AI-powered renewable energy integration and forecasting. Growing solar capacity and large-scale renewable projects require advanced prediction tools to manage generation fluctuations and maintain system stability. Utilities are adopting digital platforms that enable real-time data analysis and support faster operational decisions across the grid.

The need for precise grid management solutions is being driven by the emphasis on solar energy and sustainability goals. National targets for clean energy adoption encourage the use of forecasting systems that can balance demand, minimize curtailment, and improve overall efficiency. These tools also help optimize storage assets and enhance long-term planning.

Electricity Demand and Supply Forecasting Solutions Market Companies

Provides advanced load forecasting, grid automation, and energy management platforms that help utilities balance supply and demand in real time. ABB’s digital solutions integrate AI, edge analytics, and grid-optimization tools to enable reliable forecasting.

Offers energy-efficient power management technologies, smart grid solutions, and digital analytics platforms that support utility-scale load forecasting and distribution system optimization.

Delivers digital grid solutions, forecasting software, and energy management systems designed to support renewable integration, transmission stability, and end-to-end grid planning under the GE Vernova energy transition portfolio.

Provides comprehensive grid management systems, AI-based forecasting tools, and digital substation technologies that help utilities improve resource planning and load prediction accuracy.

Offers automation software, industrial IoT platforms, and predictive analytics tools that enhance utility forecasting, energy efficiency, and grid resilience.

Specializes in smart meters, data analytics, and distributed intelligence platforms used by utilities for demand forecasting, peak load management, and real-time grid monitoring.

Provides advanced power systems, SCADA solutions, and AI-driven energy forecasting tools that improve generation planning and grid reliability for utilities.

Offers integrated energy management platforms such as EcoStruxure that support demand prediction, distributed energy resource (DER) optimization, and digital grid operations.

Provides smart infrastructure and grid digitalization solutions, including AI-powered load forecasting, demand response platforms, and grid planning software for utilities and large energy users.

Delivers IT services, AI models, and utility-specific forecasting solutions that help energy companies manage consumption patterns, improve load predictions, and optimize supply planning.

Recent Developments

- In April 2025, Siemens AG announced the acquisition of Dotmatics for US$5.1 billion to strengthen its life sciences and industrial software portfolio.(Source: https://www.reuters.com)

- In July 2025, Schneider Electric agreed to acquire the remaining 35% stake of its Indian unit (Schneider Electric India) from Temasek for about €5.5 billion to gain full ownership and accelerate growth in India.(Source: https://www.reuters.com)

Electricity Demand and Supply Forecasting Solutions Market Segments Covered in the Report

By Solution Type

- Load/Demand Forecasting

- Renewable Generation Forecasting

- Supply & Resource Forecasting

- Price & Market Forecasting

- Integrated Forecasting Suites

By Deployment Mode

- On-Premise / Edge Deployments

- Cloud / SaaS Platforms

- Managed Forecasting Services (Forecasting-as-a-Service)

By End-User

- Transmission System Operators (TSOs)

- Distribution System Operators (DSOs)

- Utilities & Energy Providers

- Renewable Asset Owners (Wind, Solar)

- Aggregators & Virtual Power Plant Operators

By Application

- Grid Operations & Balancing

- Unit Commitment & Dispatch Optimization

- Trading & Market Bidding

- Distributed Energy Resource (DER) Forecasting

- Capacity Planning & Resource Adequacy

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting