What is Rodenticides Market Size?

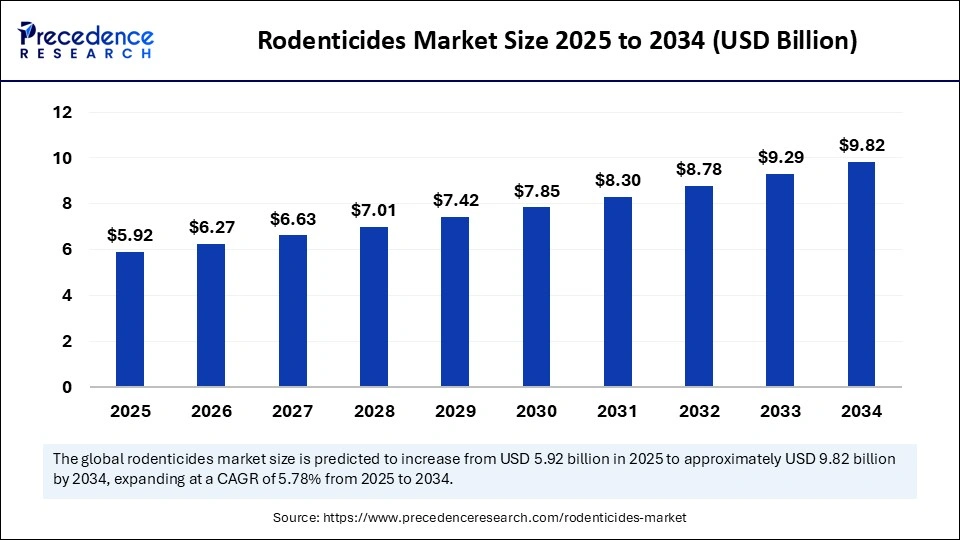

The global rodenticides market size is calculated at USD 5.92 billion in 2025 and is predicted to increase from USD 6.27 billion in 2026 to approximately USD 10.34 billion by 2035, expanding at a CAGR of 5.74% from 2026 to 2035.

Market Highlights

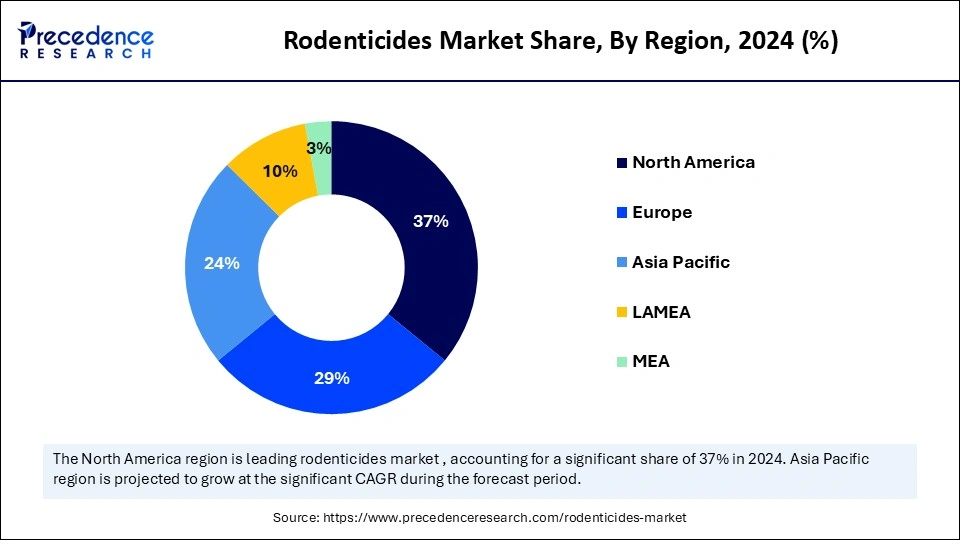

- North America dominated the market, holding the largest market share of 37% in 2025.

- By region, Asia Pacific is expected to expand at the fastest CAGR in the rodenticides market between 2026 and 2035.

- By type analysis, the anticoagulants segment held the largest market share of 65.8% in 2025.

- By type analysis, non-anticoagulants is expected to grow at a remarkable CAGR between 2025 and 2035.

- By form analysis, the Pellets segments held the largest market share in 2025.

- By form analysis, powder is expected to grow at a remarkable CAGR between 2026 and 2035.

- By application mode, the agricultural fields segment held the largest share in the rodenticides market during 2025.

- By application mode, the warehouse sector is projected to grow at a remarkable CAGR between 2026 and 2035.

- By end-user type, the agriculture segment held the largest market share of 33.5% in 2025.

- By end-user type, the pest control segment is expected to grow at a remarkable CAGR between 2026 and 2035.

Market Size and Forecast

- Market Size in 2025: USD 5.92 Billion

- Market Size in 2026: USD 6.27 Billion

- Forecasted Market Size by 2035: USD 10.34Billion

- CAGR (2026-2035): 5.74%

- Largest Market in 2025: North America

- Fastest Growing Market: Asia Pacific

What are the Rodenticides?

The rodenticides market stands at the confluence of public health vigilance and agricultural sustainability. With the increasing threat of rodent infestations across urban and rural ecosystems, the market has evolved into a complex domain driven by innovation, safety, and regulatory precision. From protecting grain storage facilities to ensuring sanitation in megacities, rodenticides play a crucial role in disease prevention and food security. As awareness around vector-borne disease heightens and food wastage due to rodents escalates, global demand for efficient, eco-balanced rodenticides continues to grow. This sector represents not merely pest control but an ongoing commitment to public hygiene and sustainable ecosystems.

Market growth in the rodenticides industry has been primarily driven by surging urbanization, expanding food production chains, and a renewed focus on integrated pest management. The increasing agricultural reliance on rodent control measures has led to the adoption of both chemical and biological rodenticides. Furthermore, the proliferation of commercial warehouses, food storage depots, and hospitality sectors adds to the demand trajectory. The post-pandemic resurgence in hygiene awareness has strengthened the necessary for preventive rodent management solutions. Although environmental concerns challenge traditional formulations, innovation in low-toxicity compounds and biodegradable baits is bridging this gap. Overall, the industry demonstrates robust growth with a shift toward precision-targeted, sustainable solutions.

How is AI contributing to the Rodenticides Industry?

AI technology provides reliable detection of rodents, allows for strategic baiting, and leads to constant monitoring via sensors. Prediction of rodent presence through the models further diminishes the use of chemicals. Data-backed knowledge is a support to pest management systems that are environmentally friendly, and thus, the whole process of pest control is one that is efficient across residential, agricultural, and industrial areas, while compliance is also guaranteed for long periods.

Key Technological Shifts in the Rodenticides Market

Technological shifts in rodenticides are characterized by the integration of automation, IoT-enabled pest surveillance, and biologically inspired bait systems. Smart dispensers capable of remote monitoring reduce human intervention, while data analytics enable precision in control measures. Formulation technology is advancing towards safer anticoagulants and natural deterrents, balancing potency with ecological safety. This digital biological synergy marks a transformative leap in rodent management philosophy.

Market Key Trends in the Rodenticides Market

- Integration of sensors in warehouses, predictive infestation mapping, and community-based control programs are among the defining trends.

- Companies are also emphasizing user-friendly packaging and safe domestic applications.

- The rise of hybrid formulations combining chemical efficiency with biological restraint is setting new performance benchmarks

- The digital pest control platforms are bridging the data gap between producers and users, ensuring traceability and transparency in operations.

Rodenticides Market Outlook

- Industry Growth Overview: The sector's expansion stems from its indispensable role in both food security and infrastructure hygiene. Growth in developing economies, particularly in Asia and Latin America, is stimulating demand for cost-effective, broadband-spectrum rodenticides. Meanwhile, industrialized nations are learning toward non-toxic and species-specific formulations. Mergers and acquisitions have also strengthened the global footprint of major players, while partnerships with agritech companies are fostering the deployment of smart pest detection frameworks. The future of rodenticides lies in harmonizing effectiveness with ecological responsibility.

- Sustainability Trends: Sustainability in the rodenticides market is defined by the evolution of eco-safe compounds, minimal non-target toxicity, and responsible disposal systems. Biodegradable baits using plant-based attractants and microencapsulated formulations are gaining momentum. Moreover, the introduction of predictive analytics and digital pest surveillance tools contributes to reducing chemical overuse. Regulatory frameworks across Europe and North America encourage producers to adhere to green chemistry principles, reinforcing market accountability. As consumer awareness grows, sustainable pest control has transitioned from niche preference to mainstream expectation.

- Startup Economy: Emerging startups are redefining rodent management with tech-driven innovations smart traps, AI-based tracking, and biodegradable bait systems. These enterprises often collaborate with municipalities and agricultural boards, offering subscription-based rodent control solutions. Their agility in product development, combined with sustainability-centric branding, is challenging traditional market incumbents. This wave of entrepreneurial dynamism symbolizes the modernization of a long-established industry.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 5.92 Billion |

| Market Size in 2026 | USD 6.27 Billion |

| Market Size by 2035 | USD 10.34 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.74% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Form Analysis, Application, End Use Analysis, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Urbanization, Food Safety, and Digital Vigilance

Urban sprawl, coupled with rising food contamination incidents, is increasing the need for rodent control. Global grain losses due to rodent attacks have driven governments to strengthen pest control infrastructure. The digital transformation of cities into smart cities necessitates smart pest management systems that integrate analytics and automation. Health-conscious individuals now demand hygienic, toxin-minimized environments, further propelling innovation. Hence, urban density and food security concerns from the cornerstone of the industry's propulsion.

Market Restraint

Environment Caution and Regulatory Structures

The growing ecological scrutiny over chemical use poses significant limitations to the rodenticides market. Stringent regulatory frameworks on second-generation anticoagulants and environmental contamination concerns are pushing companies towards reformulation. Moreover, awareness regarding secondary poisoning of wildlife adds to compliance pressures. These challenges, though restrictive, also stimulate the transition towards safer, sustainable alternatives. The regulatory friction, therefore, serves both as a restraint and redirection for industry evolution.

Market Opportunity

Bio-Based Rodenticides and AI-Surveillance

The emergence of bio-based and AI-assisted rodenticides presents an uncharted frontier for players in the rodenticides market. Plant-extracted toxins, microbially derived repellents, and algorithm-based rodent tracking platforms represent promising opportunities. Agricultural digitization further amplifies the scope for data-driven rodent prevention strategies. In addition, urban governments adopting smart infrastructure projects are increasingly investing in intelligent pest management networks. The convergence of ecology and technology thus defines the next phase of market expansion.

Segment Insights

Type Insights

Why Anticoagulants are Dominating the Rodenticides Market?

Anticoagulants are dominating the rodenticides market, revered for their prolonged efficacy and precision in pest management. Their mechanism, which disrupts blood clotting, ensures a gradual yet decisive extermination process, minimizing bait aversion among rodents. These foundations, often embedded with palatable carriers, have become indispensable in large-scale agricultural and urban pest eradication initiatives. The extended lethality window allows secondary feeders to avoid accidental poisoning, adding a crucial layer of ecological prudence. Moreover, the steady regulatory acceptance of second-generation anticoagulants fortifies their supremacy across continents.

The continued research and development in safer derivatives of anticoagulants underscores the market's inclination toward a balance between efficacy and environmental responsibility. Formulation innovations such as microencapsulation enhance stability and rain fastness, vital for field use. Additionally, the gradual shift toward biodegradable anticoagulants reflects an evolving ethos of sustainability. Governments are promoting regulated yet effective compounds that ensure minimal collateral ecological disturbance. Anticoagulants' compatibility with smart bait stations and automated monitoring systems amplifies their precision. As integrated pest management frameworks gain global traction, these compounds remain the bedrock of dependable rodent control.

Non-anticoagulant rodenticides are emerging as the fastest-growing class, driven by ecological awareness and resistance concerns. Their modes of action raging from hypercalcemia induction to neurotoxicity, offering a fresh arsenal against increasingly resilient rodent populations. The appeal lies in their swift action, reduced environmental persistence, and lower secondary toxicity risks. With agricultural lands witnessing recurrent infestations, non-anticoagulants provide a strategic pivot for farmers seeking safer yet potent alternatives. This segment's expansion is also fueled by the evolution of post-genetics, which demands novel biochemical countermeasures. Manufacturers are leveraging organic and botanical ingredients to forge a new generation of bioactive deterrents.

The market's acceleration is further catalyzed by government-supported research into non-toxic formulations, aligning with the One Health approach. Increasing consumer aversion to chemical residues has propelled the adoption of sustainable practices across food processing and storage facilities. Startups are experimenting with plant-based alkaloids and RNA interference (RNAi) mechanisms for targeted species elimination. These new-age solutions mitigate ecosystem contamination while preserving beneficial fauna. The sector's flexibility in regulatory navigation, coupled with rapid innovation cycles, ensures a dynamic competitive landscape. As public consciousness pivots toward green chemistry, non-anticoagulants are redefining the contours of responsible rodent control.

Form Analysis Insights

Why Pellets are Governing the Rodenticides Market?

The pellets are dominating the rodenticides market, prized for their durability, precise dosing, and broad-spectrum application. Their uniform structure ensures consistent distribution, making them ideal for large-scale deployment across agricultural and industrial terrains. The compression process enhances bait palatability and weather resistance, ensuring prolonged field stability. Pellets also allow incorporation of flavor enhancers and tracking agents, increasing both efficacy and monitoring accuracy. Their compatibility with automated dispensing systems further fortifies their dominance. From storage depots to urban drainage systems, pellets deliver versatility unmatched by any other form.

Continuous technological refinement has yielded pellets with advanced water repellence and UV stability. Manufacturers are investing in biodegradable binders, mitigating long-term soil contamination. Pellets also facilitate controlled release of active ingredients, extending bait longevity while minimizing wastage. Their ease of transport and storability make them the preferred choice in emergency pest control operations. Moreover, the integration of smart sensors in bait stations allows for real-time consumption data, optimizing field interventions. In essence, pellets embody the synergy between practicality, precision, and environmental stewardship.

Powdered rodenticides are emerging as the fastest-growing form, celebrated for their adaptability and micro-targeting capability. Their fine dispersion allows infiltration into rodent burrows, cracks, and hidden cavities unreachable by conventional pallets. This enhances convergence and ensures swift contact-based lethality. Powders are increasingly adopted in indoor environments where bait stations are impractical. Their ability to blend seamlessly with food attractants augments their appeal among pest control professionals. Moreover, the lower dosage requirements make powders an economically viable and ecologically lighter choice.

The recent shift toward dust-free and micro-encapsulated powders marks a leap in formulation sophistication. Such designs prevent accidental inhalation and improve storage stability, ensuring safer handling. The advent of electrostatic application systems has further revolutionized powder deployment, improving adherence and reducing drift. Farmers and warehouse operators increasingly prefer powders for quick interventions in confined zones. Their adaptability to both chemical and natural active agents widens their utility spectrum. With growing emphasis on precision application and worker safety, powders are set to define the next era of smart rodent control solutions.

Application Insights

How are Agricultural Fields the Epicenter of Rodenticidal Demand?

Agricultural fields stand as the dominant application domain in the rodenticides market, absorbing the lion's share of rodenticide consumption. Vast farmlands are perennial targets of rodent invasions that compromise grain yields, root systems, and storage security. Anticoagulant-based baits, integrated with crop protection schedules, ensure sustained safeguarding of agricultural assets. The ease of large-scale broadcast applications reinforces their indispensability in rural pest management. Climate change-induced rodent proliferation has further intensified demand for robust control mechanisms. Consequently, agricultural usage remains the lifeblood of this market's stability.

Government-supported pest eradication campaigns amplify the adoption of rodenticides in agro-economies. Modern farm cooperatives are integrating rodent control into holistic pest management frameworks to maintain crop integrity. The growing penetration of IoT-enabled monitoring in farms enhances early detection and targeted treatment. Additionally, innovations in biodegradable bait matrices resonate with the sustainable farming ethos. Collaborations between agrotech firms and pesticide manufacturers are yielding region-specific formulations tailored to local pest ecologies. This symbiosis ensures agriculture retains its preeminence in the rodenticide value chain.

Warehouses represent the fastest-growing segment, driven by exponential growth in global logistics and e-commerce. As supply chains expand, the need to protect goods, particularly food, textiles, and packaging from rodent damage has escalated. Modern warehouses are integrating smart monitoring systems with real-time alert capabilities, demanding sophisticated rodenticide solutions. The preference for non-anticoagulant and fast-acting agents in these spaces reflects the necessity for discreet, residue-free control. Additionally, regulatory emphasis on hygiene compliance fuels consistent investment in rodent management infrastructure. Warehouses thus symbolize the confluence of technology and sanitation.

The surge in urban warehousing due to same-day delivery models has magnified the pest control imperative. Automated storage systems necessitate rodenticides that act swiftly without mechanical interference. Manufacturers are innovating with odor-neutral and low-dust formulations ideal for enclosed environments. The deployment of AI-driven bait analytics enhances efficiency by mapping infestation hotspots. Moreover, sustainability certifications are becoming central to procurement decisions, favoring eco-conscious solutions. Warehouses are evolving from passive storage units to proactive biosecure ecosystems.

End Use Analysis Insights

Why Agriculture Sector the Foundation of Sustained Rodent Management?

The agriculture sector remains the principal end user of rodenticides, accounting for the largest market proportion. Farm-level infestations cause massive economic losses annually, prompting reliance on structured rodent control programs. Rodenticides integrated with seed protection and grain preservation strategies ensure consistent yields. Anticoagulant pellets remain the tool of choice for their reliability and wide acceptance. As climate irregularities alter rodent breeding cycles, continuous intervention becomes inevitable. Thus, agriculture forms the perennial anchor of rodenticide consumption.

Modern agricultural policies promoting integrated pest management (IPM) have cemented the sector's dependence on regulated rodenticidal applications. Educational campaigns by agro-departments encourage safe handling and ecological consciousness. Moreover, bio-rodenticides employing plant derivatives and microbial metabolites are gaining traction among organic farmers. Innovations in bait dispensers and solar-powered repellents complement chemical measures for holistic protection. Agricultural cooperatives are collaborating with research institutes to develop region-specific rodent behavior studies. Consequently, agriculture's relationship with rodent control continues to evolve from reactive to predictive stewardship.

The pest control industry is the fastest-growing end-use segment, catalyzed by rising urbanization and hospitality infrastructure. With cities expanding vertically, rodent infestations pose severe health and reputational threats. Professional pest management firms are increasingly deploying advanced rodenticides integrated with digital tracking tools. Non-anticoagulant and bio-based formulations dominate urban environments for their low toxicity and minimal odor. The demand surge also stems from compliance-driven sectors such as healthcare, food retail, and aviation. Pest control thus stands at the forefront of commercial biosecurity evolution.

Technological integration defines the segment's acceleration trajectory. AI analytics, pheromone tracking, and automated baiting systems ensure surgical precision. The gig-economy model of urban maintenance has birthed agile pest control startups leveraging subscription-based rodent management. Furthermore, collaborations between municipalities and private firms for citywide rodent mapping exemplify civic innovation. Eco-label certifications for pest management companies are also reshaping consumer trust dynamics. As sustainability becomes synonymous with modern living, pest control services are transitioning into high-tech guardians of hygiene and public welfare.

Regional Insights

What is the U.S. Rodenticides Market Size?

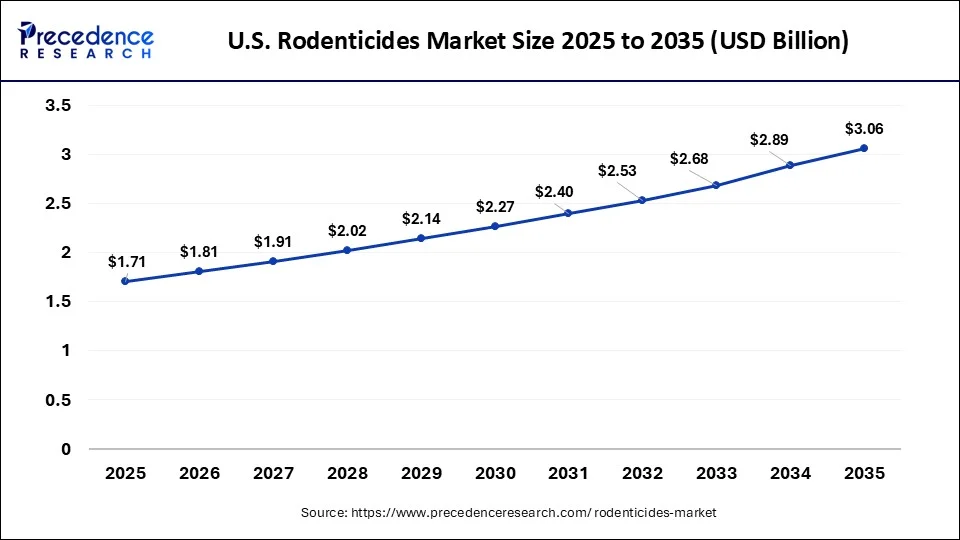

The U.S. rodenticides market size is exhibited at USD 1.71 billion in 2025 and is projected to be worth around USD 3.06 billion by 2035, growing at a CAGR of 5.99% from 2026 to 2035.

Can North American Technological Outpace the Infestation?

North America dominates the global rodenticides market due to its advanced infrastructure, strict sanitation mandates, and mature agricultural sector. Rising incidences of rodent-borne diseases and increased grain storage capacities have boosted demand for intelligent rodent management systems. The integration of smart pest detection networks in commercial buildings and warehouses underscores the region's technological advantage. Furthermore, government-led hygiene programs drive adoption across both residential and industrial spaces.

Country Analysis

In the U.S., the market thrives on the synergy of innovation and compliance. American companies are pioneering eco-conscious formulations and smart baiting systems to align with EPA standards. Public-private collaborations have also expanded pest surveillance networks across urban zones, ensuring timely containment of infestations. The U.S. exemplifies how legislative vigilance and technological prowess can converge to sustain market leadership.

Can the Asia Pacific Market Redefine Pest Control?

Asia-Pacific represents the fastest-growing rodenticides market, fuelled by agricultural modernization and rapid urban expansion. Developing economies are prioritizing food security, prompting large-scale adoption of pest management programs. Rising disposable incomes, increasing awareness of hygiene, and improved supply chain networks are amplifying demand. The growing hospitality and food processing sectors further strengthen regional prospects.

Country Analysis

China, as a focal point, showcases a robust transformation with its emphasis on biotechnological solutions and digital pest monitoring. India, on the other hand, experiences significant governmental intervention in agricultural pest control and community health initiatives. The convergence of traditional practices with modern science is setting the tone for a distinctly localized yet globally competitive rodent management industry.

What Are the Driving Factors of The Rodenticides Market in Europe?

Europe is expected to grow at a significant rate during the forecast period. The market for rodenticides in Europe is changing due to the adoption of strict regulations, which prohibit the use of anticoagulants. The innovators are mainly focusing on coming up with environmentally friendly products and encouraging the use of pest management systems. Pest control methods are being changed by digital monitoring, raising awareness about resistance and compliance-led solutions. The change is a trade-off between environmental protection and effective rodent extermination.

The UK Rodenticides Market Trends:

The UK is determined to establish a rodent control system that is environmentally friendly, and this is especially so due to rules that ban the use of certain anticoagulants. The use of alternative formulations is increasing rapidly. Smart monitoring devices, electronic compliance systems, and the application of resistance-aware management practices are becoming more popular as they not only help in saving costs but also in getting better pest control should be done sustainably

Statistics:

- Germany was the largest rodenticide shipper in 2024 exporting $440,193.82 worth of goods, which translated into 115,321,000 Kg.

- The European Union recorded rodenticide exports of $413,547.74, with the total volume being 113,067,000 Kg.

- The U.S. reported exports of $268,042.04 and a volume of 47,077,300 Kg of rodenticides.

- Hungary's export of rodenticides reached $177,500.85K with 39,556,000 Kg.

- The exports of rodenticides from France amounted to $114,807.39, with the quantity being 21,054,600 Kg.

(Source: https://wits.worldbank.org )

Market Value Chain Analysis

- Raw Material Sources: Rodenticides derive from synthetic anticoagulants, natural extracts, and carrier substrates such as grain-based attractants. Growing preference for renewable sources has led to experimentation with botanical and microbial compounds, enhancing both sustainability and safety profiles.

- Technology Used: Modern rodenticides leverage encapsulation technology, controlled-release mechanisms, and sensor-based distribution units. AI and IoT integrations enable proactive rodent detection and efficient response mechanisms, reducing environmental impact.

- Investment by Investors:Investors are actively funding R&D collaborations between agrotech firms and pest control solution providers. This capital influx supports innovation in low-toxicity and AI-integrated products, reinforcing long-term market resilience.

- AI Advancements: Artificial Intelligence plays a crucial role in predictive pest analytics, autonomous trap design, and infestation pattern mapping. By leveraging machine learning, companies are minimizing waste, optimizing deployment, and enhancing safety across environments..

Top Rodenticides Market Companies

- BASF SE: BASF is a global leader in rodent control innovation, offering advanced formulations like Storm Secure and Selontra, which use cholecalciferol for faster control with lower environmental risk. The company focuses on integrated pest management (IPM) and sustainable chemistry, ensuring effective rodent management while minimizing secondary poisoning and ecological impact.

- Bayer AG: Bayer's rodent control division provides innovative anticoagulant and non-anticoagulant solutions, emphasizing safety, resistance management, and long-term effectiveness. With a commitment to sustainability, Bayer integrates digital pest monitoring and biosecurity into its crop protection and environmental health programs.

- Liphatech, Inc.: Liphatech is a pioneer in anticoagulant rodenticides, credited with developing first- and second-generation actives like Bromadiolone and Difethialone.

Its product line—including FirstStrike, Resolv, and Maki, is known for palatability, efficiency, and advanced bait technology, serving both professional and agricultural sectors globally. - Rentokil Initial plc: Rentokil is one of the world's largest pest control service providers, integrating smart monitoring, digital traps, and data analytics into rodent management systems. Its PestConnect platform enables real-time rodent activity tracking, reducing poison use while enhancing safety, traceability, and sustainability across industries.

- Bell Laboratories, Inc.: Bell Laboratories is a leading manufacturer of rodenticides, traps, and bait stations, known for its science-driven product lines like Contrac, Final, and Protecta. The company focuses on formulation innovation and safety, offering solutions trusted by professionals worldwide for effective and responsible rodent control.

Other Companies in the Market

- Syngenta AG: Provides broad-spectrum pest control products, including rodent management solutions within its crop protection and biosecurity portfolio.

- Neogen Corporation: Offers biosecurity and pest management solutions for food safety and animal protection, including professional-grade rodenticides and monitoring technologies.

- Impex Europa S.L.: Manufactures and distributes rodenticides and pest control chemicals, emphasizing cost-effective formulations and compliance with EU biocidal regulations.

- PelGar International: Focuses on rodenticides and insecticides for professional and agricultural use, offering both anticoagulant and natural-origin pest control solutions.

- JT Eaton & Co., Inc.: Produces rodent control baits, traps, and repellents, serving both residential and commercial pest control sectors with innovative delivery systems.

- SenesTech, Inc.: A biotechnology company developing fertility control rodenticides, such as ContraPest, providing a humane and sustainable alternative to traditional poisons.

- Anticimex Group: A global pest control company using digital and smart rodent monitoring systems, integrating data analytics to enhance precision pest management.

- Ecolab Inc.: Provides food safety and pest elimination services, including eco-friendly rodent control solutions tailored for commercial and industrial environments.

- UPL Limited: Offers crop protection and pest management products, including rodenticides that support agricultural productivity while ensuring environmental safety.

- FMC Corporation: Supplies chemical pest control solutions across agricultural and structural sectors, with a growing focus on next-generation rodent management.

- Nufarm Limited: Develops integrated pest management products, offering rodenticides and herbicides aimed at sustainable and efficient agricultural practices.

- Adama Agricultural Solutions Ltd.: Provides rodenticides and biocontrol products as part of its broad crop protection portfolio, emphasizing environmental stewardship.

- Lodi UK: A UK-based manufacturer of rodenticides and biocidal products, producing professional-grade pest control solutions under its Racumin and Racan brands.

- Pelsis Ltd.: Offers rodent control systems, traps, and monitoring devices, integrating smart pest management technologies for professional and consumer markets.

- Russell IPM Ltd.: Specializes in eco-friendly pest management, using pheromone-based and biological control technologies alongside traditional rodent management products.

Recent Developments

- In October 2025, an unusual natural event known as Thingtam, the gregarious flowering of the bamboo species raw thing, has led to a massive surge in the rodent population, bringing severe distress to farmers across Mizoram. Swarms of rats have ravaged paddy fields, devastating the livelihoods of 3,983 families spread across 122 villages in all 11 districts of the state.(Source: https://timesofindia.indiatimes.com)

- In July 2025, Toxic baits, or rodenticides, commonly used to control rodents in homes and gardens, can inadvertently harm non-target species such as pets, birds, coyotes, and other wildlife. To mitigate these ecological risks, California has enacted several regulations restricting which rodenticides may be used, the methods of their application, and who is authorized to handle them. At present, most rodenticide products are limited to licensed professionals who must adhere to stringent guidelines designed to protect wildlife. Moreover, new legislation, including Assembly Bill 2552, the Poison-Free Wildlife Act, has further curtailed public access to toxic baits intended for managing rats, mice, gophers, voles, and ground squirrels across the state.(Source: https://ucanr.edu)

Segments Covered in the Report

By Type

- Anticoagulants

- Non-Anticoagulants

By Form

- Pellets

- Powders

- Sprays

- Blocks

- Others

By Application

- Agricultural Fields

- Warehouses

- Urban Centers

- Residential

- Others

By End-User

- Agriculture

- Pest Control Companies

- Households

- Others

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content