What is the Security Service Edge (SSE) Market Size?

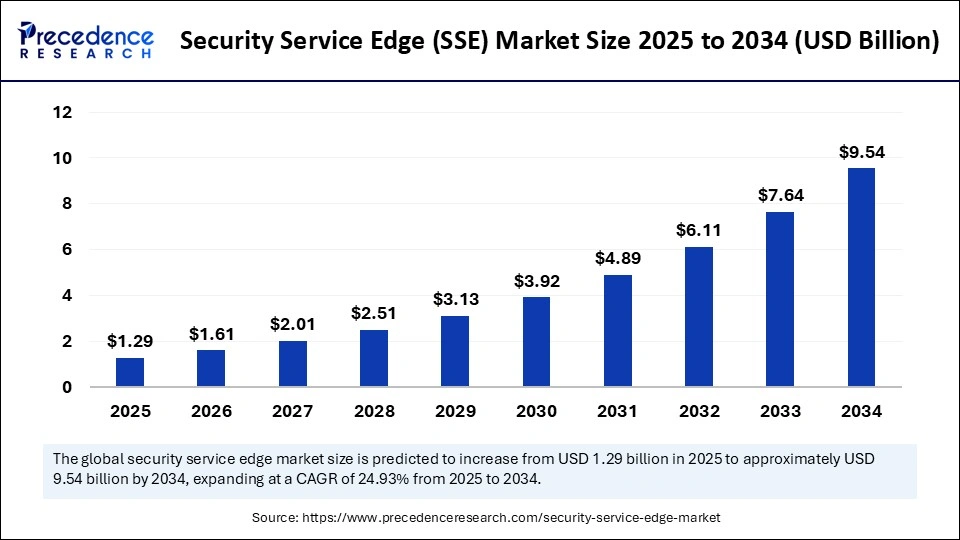

The global security service edge (SSE) market size is calculated at USD 1.29 billion in 2025 and is predicted to increase from USD 1.61 billion in 2026 to approximately USD 9.54 billion by 2034, expanding at a CAGR of 24.93% from 2025 to 2034. The growth of the market is attributed to the increasing need for cloud delivery security solutions that protect remote users, applications, and data across distributed environments.

Security Service Edge (SSE) Market Key Takeaways

- In terms of revenue, the security service edge (SSE) market is valued at $1.29 billion in 2025.

- It is projected to reach $9.54 billion by 2034.

- The market is expected to grow at a CAGR of 24.93% from 2025 to 2034.

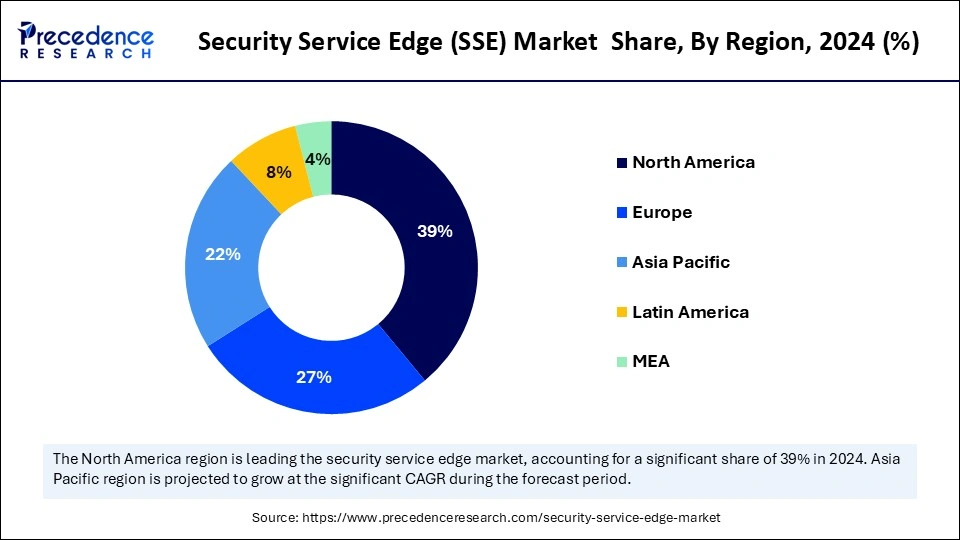

- North America dominated the security service edge (SSE) market with the largest share of 39% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR in the upcoming years.

- By component, the services segment held a biggest share in 2024.

- By component, the solutions segment is expected to grow at the fastest CAGR in the coming years.

- By organization size, the large organizations segment contributed the highest market share in 2024.

- By organization size, the SEMs segments is expected to grow at the fastest CAGR during the forecast period.

- By end-user, the BFSI segment captured the major market share in 2024.

- By end-user, the IT and telecom segment is expected to grow at the fastest CAGR in the upcoming years.

How Does AI Help SSE Companies to Detect Strange or Risky Behavior Better?

SSE companies are using Artificial Intelligence and machine learning to track user behavior, device activity, and data flow across networks in real-time. AI compares current activity with what is deemed normal for that user or device and helps identify anomalous behavior such as accessing restricted apps, downloading large files at odd houses, or logging in from a new location. AI can automatically request additional authentication to block access or sound an alarm when it detects something questionable. AI models also learn over time to improve their ability to identify novel threats without explicit guidance. This implies that businesses can identify risks sooner rather than later before they become significant breaches. By removing false alarms and only highlighting high-risk activity, AI also lessens the workload for IT teams.

Market Overview

The security service edge (SSE) market is experiencing rapid growth, driven by the growing need for cloud-native security solutions that facilitate remote work and IT environments. The increasing demand for integrated security solutions like secure Web Gateway (SWG), Cloud Access Security Broker (CASB), and Zero Trust Network Access (ZTNA) is bolstering the growth of the market. To provide policy-based access and threat protection across devices and locations, SSE platforms integrate these technologies. Improvements in machine learning are artificial intelligence are also helping the market since they improve real-time threat detection and response.

What is Security Service Edge and How Does it Differ from Traditional Network Security Models?

Security service edge (SSE) is a modern cloud-based security framework designed to protect users, devices, and applications wherever they connect. Security services like cloud access security brokers, secure web gateways, and zero trust access are provided by SSE directly from the cloud in contrast to traditional security, which relies on protecting a fixed network perimeter with firewalls and VPNs. By emphasizing continuous verification and threat prevention regardless of location, this strategy supports the growing need for flexible, scalable protection in today's remote and hybrid work environments.

- In January 2024, Zscaler officially launched its SD-WAN solutions, expanding its secure access service edge (SASE) portfolio to offer a single-vendor solution integrating network and security functions. This solution is built utilizing Zscaler Zero Trust AI to help organizations reduce cost and complexity while implementing Zero Trust security across users, devices, and workloads.

(Source: https://www.zscaler.com)

Security Service Edge (SSE) Market Growth Factors

- Rise in remote and hybrid workforces: Organizations need secure, scalable access for employees working outside traditional office boundaries.

- Cloud migration: Enterprises shift workloads to the cloud; there's a growing demand for cloud-native security solutions integrated into access and control frameworks.

- Increasing cybersecurity threats: Sophisticated attacks such as ransomware, phishing, and data breaches push companies to adopt real-time, perimeter-less security architectures like SSE.

- Zero trust architecture adoption: SSE supports Zero Trust principles by verifying users and devices before granting access to applications and data.

- Demand for simplified and integrated security: Enterprises prefer unified platforms that combine secure web gateways (SWG), cloud access security brokers (CASB), and zero trust network access (ZTNA), reducing complexity and cost.

- Regulatory compliance requirements: Data protection laws (e.g. GDPR, HIPAA) require secure access and data usage monitoring, which SSE platforms facilitate effectively.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 9.54 Billion |

| Market Size in 2025 | USD 1.29 Billion |

| Market Size in 2026 | USD 1.61 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 24.93% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Organization Size, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Drivers

Increasing adoption of cloud services and remote work

The need for SSE solutions has been increasing due to the broad use of cloud computing platforms and the rise in remote working arrangements. Traditional perimeter-based security is useless because businesses require safe, easy access to cloud apps and data from anywhere. No matter where a user is located, SSE provides complete protection by limiting access to upholding rules and averting data breaches. The shift from on-premises infrastructure to distributed environments has made network boundaries more fluid, requiring more dynamic and adaptive architecture to scale security easily as their cloud usage grows.

Rising sophistication of cyber threats and the need for zero-trust security

Organizations are seeking zero trust-based security models because of the growing complexity of cyberattacks that target businesses such as ransomware phishing and data exfiltration. SSE is an important factor in the expansion of the market since it combines threat prevention, secure web gateways, and zero trust access control to reduce attack surfaces. Businesses' security needs are constantly changing, necessitating real-time threat intelligence and ongoing monitoring, which SSE platforms are made to provide in the face of sophisticated attacks. This proactive approach helps organizations lower the risk of breaches and preserve business continuity.

Restraints

Concerns over latency and performance issues

Traffic routing through cloud-based SSE service can cause latency and performance degradation for certain organizations. Particularly if the enterprise has bandwidth-intensive applications or SSE providers, global reach is restricted. Pure cloud native SSE deployments may be delayed because of these performance issues which may discourage businesses from implementing SSE completely or lead them to look for hybrid models. The problem is particularly noticeable in sectors where real-time data processing is essential, such as media finance and healthcare. Thus, increasing concerns about latency and performance issues hamper the growth of the security service edge (SSE) market. Although there are still gaps in some areas, providers are making significant investments in increasing points of presence (PoPs) and enhancing network infrastructure to address these problems.

Regulatory and data sovereignty challenges

Many nations have data sovereignty laws that limit the location and methods of processing and storing sensitive data. Complying with these regulations is difficult for SSE solutions, which frequently route traffic through cloud data centers across the globe. Until providers guarantee localized data handling and compliance with regional laws, businesses in highly regulated sectors might be hesitant to fully implement SSE. Furthermore, SSE vendors must quickly adjust to shifting regulatory environments, which makes their operations more complex. In areas with stringent data privacy laws, this frequently leads to slower adoption rates.

Opportunity

Rise in demand for zero-trust security architecture

Zero trust security is becoming a business necessity rather than a specialized framework, creating immense opportunities in the security service edge (SSE) market. SSE ensures that users' devices and applications are continuously validated and acts as the foundation for implementing zero-trust access principles. Building identity-aware adaptive security services that reduce threats of lateral movement and increase operational agility presents an opportunity to improve anomaly detection and identity-based control in zero-trust frameworks.

Component Insights

Why did the services segment dominate the security service edge (SSE) market?

The services segment dominated the market with a significant share in 2024. This is mainly due to the increased demand for professional and managed services, such as risk assessment, threat detection, and compliance support. Companies frequently lack the internal knowledge required to oversee cloud-based security solutions, making service providers crucial. By means of constant monitoring software upgrades and real-time threat mitigation, these services guarantee continuous protection. Furthermore, the demand for advisory and implementation services is increased by the growing need for tailored security strategies across various industries.

The solutions segment is expected to grow at the fastest rate in the coming years. Solutions like secure web gateways, cloud access security brokers, and zero trust network access are gaining traction as companies are digitizing operations and shifting to cloud-first environments. These solutions provide real-time scalable defenses against malware data loss and illegal access. A growing number of vendors are incorporating AI and machine learning into their predictive security analytics solutions. Their growing compatibility with hybrid work models and ease of integration with current IT infrastructures further contribute to their increasing adoption.

Organization Size Insights

What made large organizations the dominant segment in the security service edge (SSE) market in 2024?

The large organizations segment dominated the market in 2024 due to their expansive IT infrastructure, high-value digital assets, and complex security requirements. To defend against cyberattacks, these businesses have the funds and the pressing need to invest in end-to-end cloud-based security frameworks. They frequently deal with sensitive data and operate in several countries, which call for layered compliant security protocols. Additionally, SSE adoption is a strategic priority in their advanced digital transformation journeys because of the size and complexity of their operations; they need strong security posture management, which SSE platforms offer. Additionally, regulatory pressures push big businesses to implement complete security solutions quickly.

The SEMs segment is expected to grow at the fastest CAGR during the forecast period due to increasing concerns over cyber threats and the affordability of cloud-delivered security models. Even smaller businesses must safeguard the endpoints of cloud apps and user data as remote and hybrid work arrangements grow. These days SSE vendors provide SMEs with affordable, scalable solutions with pay-as-you-go pricing and low setup costs. SMEs can deploy SSE platforms with the help of managed service providers without requiring in-house knowledge. The need for protective measures has increased due to the growing frequency of cyberattacks that target smaller businesses. SSE also offers SMEs quicker deployment times and easier security management.

End-User Insights

How did the BFSI segment dominate the security service edge (SSE) market in 2024?

The banking, financial services, and insurance (BFSI) segment dominated the market in 2024 due to stringent data privacy laws, high cyber threat risks, and the digitization of financial services. These organizations deal with sensitive financial data and are frequent targets for breaches, requiring robust, real-time protection. SSE platforms offer secure access to applications, data encryption, and compliance reporting, all crucial for BFSI firms. Additionally, the sector's early cloud adoption and investment capacity accelerate widespread SSE implementation. Increased regulatory scrutiny, such as GDPR and PCI-DSS, further drives investment in security services. The competitive nature of the BFSI industry demands continuous innovation in cybersecurity.

The IT & telecom segment is expected to grow at the fastest CAGR in the upcoming years. IT and telecom companies are adopting SSE rapidly to support remote work, secure application access, and manage vast data flows. As enablers of digital services, they are both users and suppliers of SSE technologies. Agile cloud-native security architectures are necessary for these businesses to manage decentralized operations and fluctuating workloads. There is a growing need for scalable security services in this industry due to the expansion of digital infrastructure and the growing rollout of 5G. Additionally, the incorporation of edge computing makes localized security measures more necessary. SSE is crucial for telecom providers to protect their networks and client information.

Regional Insights

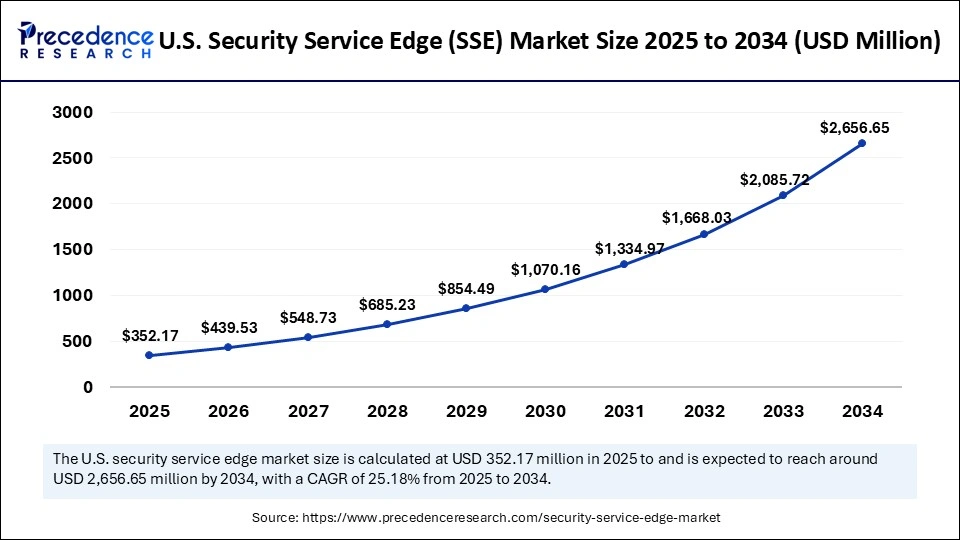

U.S. Security Service Edge (SSE) Market Size and Growth 2025 to 2034

The U.S. security service edge (SSE) market size is evaluated at USD 352.17 million in 2025 and is projected to be worth around USD 2,656.65 million by 2034, growing at a CAGR of 25.18% from 2025 to 2034.

Why did North America dominate the security service edge (SSE) market in 2024?

North America registered its dominance in the market by holding the largest share in 2024. This is mainly due to its mature IT ecosystems, facilitating the seamless deployment of SSE. The region is an early adopter of zero-trust frameworks, supporting market expansion. The country is home to a large number of cloud service providers and tech companies, driving innovation and investment in SSE. Public and private organizations are also pushed toward SSE models by government initiatives such as CISAs with zero-trust mandates. Further bolstering this dominance is the existence of cybersecurity leaders and the high rate of cloud adoption in businesses. SSE adoption across industries is accelerated by the region's cutting-edge digital infrastructure. Growing alliances between commercial enterprises and governmental organizations also contribute to market expansion. Moreover, stringent cybersecurity regulations facilitate market growth.

Asia Pacific is expected to grow at the fastest rate in the upcoming years due to digital transformation across sectors like finance, healthcare, and manufacturing. Stricker cybersecurity regulations and greater awareness of cyber threats are driving the adoption of SSE. A growing number of SMEs in the area that need scalable and affordable security solutions, as well as government-backed digitization initiatives, are also supporting market expansion. Increased internet connectivity and smartphone usage encourage cloud adoption even more. Technology diffusion is accelerated through cooperation between international vendors and local cybersecurity companies.

Europe is considered to be a significantly growing area. The region holds a notable position in the security service edge (SSE) market because of its strict regulatory framework, which forces businesses to adopt advanced security frameworks. This includes GDPR and NIS Directive compliance guidelines. Data privacy and secure cloud adoption are top priorities for many European businesses, which increases demand for SSE platforms. Well-established IT infrastructure and an increasing focus on zero-trust security models are advantageous to the area. Investments in cybersecurity projects and cross-border cooperation within the EU further reinforce market expansion. The existence of numerous cutting-edge cybersecurity startups and well-known suppliers in Europe also propels regional SSE developments.

Security Service Edge (SSE) Market Companies

- Zscaler

- Palo Alto Networks

- Cisco Systems, Inc

- Netskope

- Forcepoint

- Skyhigh Security

- Lookout, Inc.

- Broadcom Inc.

- Cloudflare

- Iboss

Recent Developments

- In February 2025, CrowdStrike unveiled Charlotte AI Detection Triage, an AI-powered system that automates threat triage, reducing manual workload by over 40 hours per week for security teams. The system boasts a high accuracy rate, exceeding 98%, enhancing the efficiency of Security Operations Centers (SOCs).(Source: https://www.crowdstrike.com)

- In March 2025, F5 acquired LeakSignal, a cybersecurity firm specializing in real-time data protection for AI applications. This acquisition enhances F5's Application Delivery and Security Platform (ADSP) with AI-driven data classification, policy enforcement, and compliance monitoring capabilities.(Source: https://tfxcap.com)

- In March 2025, Red Sift announced updates to its cybersecurity platform, introducing AI-powered tools like Red Sift Radar for enhanced threat detection and Dynamic DNS Guardian for real-time monitoring. These tools aim to improve security against phishing, spoofing, and business email compromise (BEC) attacks.(Source: https://blog.redsift.com)

Segments Covered in the Report

By Component

- Solution

- Secure Web Gateways (SWG)

- Firewall-as-a-Service (FWaaS)

- Zero Trust Network Access (ZTNA)

- Cloud Access Security Broker (CASB)

- Others

- Services

- Professional services

- Managed services

By Organization Size

- Large Organization

- SME's

By End-User

- BFSI

- IT & Telecom

- Retail & E-commerce

- Healthcare

- Government

- Manufacturing

- Others

By Region

- North America

- Asia Pacific

- Europe

- Middle East & Africa

- Latin America

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting