PVA 3D Printing Filament Market Size and Forecast 2025 to 2034

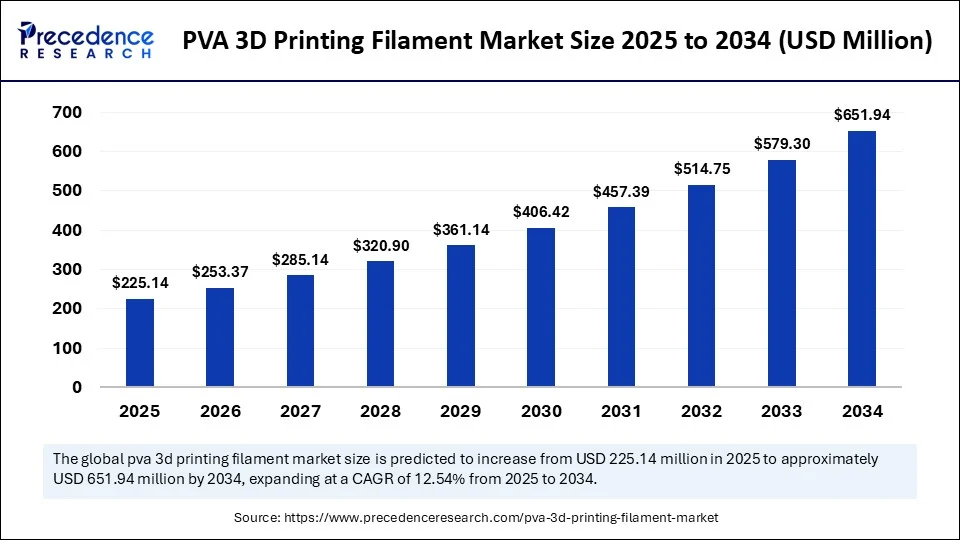

The global PVA 3D printing filament market size accounted for USD 200.05 million in 2024 and is predicted to increase from USD 225.14 millionin 2025 to approximately USD 651.94 million by 2034, expanding at a CAGR of 12.54% from 2025 to 2034. The market growth is attributed to the rising adoption of water-soluble filaments that enable complex prototyping and sustainable additive manufacturing practices.

PVA 3D Printing Filament Market Key Takeaways

- In terms of revenue, the global PVA 3D printing filament market was valued at USD 200.05 million in 2024.

- It is projected to reach USD 651.94 million by 2034.

- The market is expected to grow at a CAGR of 12.54% from 2025 to 2034.

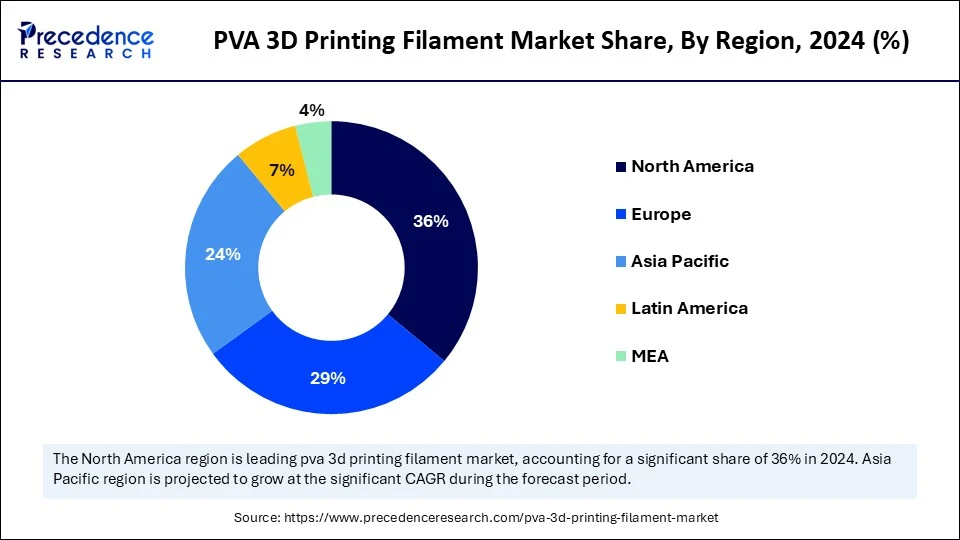

- North America dominated the global PVA 3D printing filament market with the largest share of 36% in 2024.

- Asia Pacific is expected to grow at a notable CAGR from 2025 to 2034.

- By product type/grade, the standard PVA filament segment held the major market share of 50% in 2024.

- By product type / grade, the fast-dissolving PVA segment is projected to grow at a CAGR between 2025 and 2034.

- By form/diameter, the 1.75 mm filament segment contributed the highest market share of 70% in 2024.

- By form/diameter, the bulk / industrial spool formats segment is expanding at a significant CAGR between 2025 and 2034.

- By end-use/application, the support material for prototyping & hobbyist printing segment generated the major market share of 40% in 2024.

- By end-use/application, the industrial/functional supports in the manufacturing segment are expected to grow at a significant CAGR over the projected period.

- By customer type/buyer, the consumer/hobbyist makers segment accounted for the significant market share of 35% in 2024.

- By customer type/buyer, the industrial users & OEMs segment is expected to grow at a notable CAGR from 2025 to 2034.

- By sales/distribution channel, e-commerce marketplaces segment held the largest market share of 59% in 2024.

- By sales/distribution channel, OEM-validated filament programs and direct industrial supply contracts projects are expected to grow at a notable CAGR from 2024 to 2034.

What Is the Impact of Artificial Intelligence on the PVA 3D Printing Filament Market?

Artificial intelligence (AI) will also be of paramount importance to the future of the PVA 3D printing filament market by automating research, manufacturing, and use procedures. Manufacturers implement AI-enhanced material modelling to produce PVA filaments with better water solubility, thermal stability, and uniform print quality. This complements the large demand for reliability support material in complex 3D printing applications. Furthermore, within application domains, AI helps engineers model the contact of PVA supporting materials with main build materials and how their blends can be mixed with tight control over their dissolvability or faster prototyping loops.

U.S. PVA 3D Printing Filament Market Size and Growth 2025 to 2034

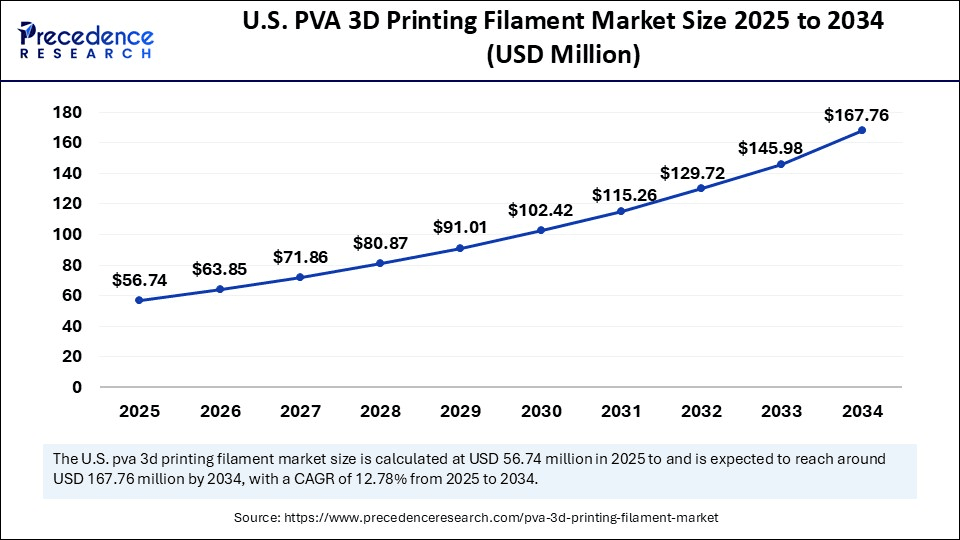

The U.S. PVA 3D printing filament market size was exhibited at USD 50.41 million in 2024 and is projected to be worth around USD 167.76 millionby 2034, growing at a CAGR of 12.78% from 2025 to 2034.

What Makes North America the Largest Regional Contributor to the PVA 3D Printing Filament Market?

North America led the PVA 3D printing filament market, capturing the largest revenue share in 2024, due to the prevalence of adoption of additive manufacturing in aerospace, healthcare, and automotive sectors. The availability of major OEMs, including Stratasys, 3D Systems, and huge reseller channels, helped in infiltrating PVA filaments in prototyping and tooling processes.

Government-led programs, such as those by NIST, also continued to work on the standardization of the AM materials. This led to the emergence of confidence in water-soluble supports via the implementation of new benchmarks and guidance by 2024. Research groups, among them the IDTechEx 2024 report, believe North America is taking charge in creating filaments that support both smart features and multiple materials for printing. Additionally, ASTM International to F42 standards, where the testing methods were updated relating to soluble support filaments in line with industry use, expected to strengthen the market presence in this region.

Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period, owing to the mass manufacturing and increasingly strong reseller ecosystems. Government policies, such as the induced national milestones of AM competitiveness, or the reinforced strategy of Made in China 2025, up to the year 2024, have contributed to the increased local supply chains and to the rapid adoption of the soluble filaments. Moreover, the growing fund trends in advanced materials research, which have an immediate application in PVA automotive prototyping and dental tooling propelling the market in the coming years.

Market Overview

The rise in the use of additive manufacturing in professional applications, including the aerospace and healthcare industries, is spurring the demand for solutions in the PVA 3D printing filament market. They enable easy removal of support structures and increase the complexity of the geometry. In fused deposition modeling (FDM), polyvinyl alcohol (PVA) is used as a supporting filament that is soluble in water. This allows makers to create complex internal features and print them through primary structures with no harm.

Due to PVA-based dissolution processes, decreasing the burdens in terms of chemical solvents and alleviating hazardous waste. These processes are beneficial to the objectives of sustainable manufacturing, as noted by the U.S. Environmental Protection Agency (EPA). According to the Joint Research Centre of the European Commission in 2024, 3D printing ensures that production happens on site, which helps maintain supply chain stability. Schools and research and development laboratories continue to integrate PVA into the curriculum and experimentation, to strengthen design innovation and eliminate manual post-processing. Furthermore, the advanced feature offered by PVA, such as time-saving, environment-friendly prototyping, further propels the market in the coming years.

PVA 3D Printing Filament Market Growth Factors

- Driving Demand for Multi-Material Printing: Growing reliance on dual-extrusion printers is fuelling PVA adoption as a dissolvable support material.

- Boosting Applications in Healthcare: Rising use of 3D-printed anatomical models and surgical guides is driving the need for reliable PVA supports.

- Growing Emphasis on Sustainable Manufacturing: Global initiatives to reduce solvent use and waste are propelling water-soluble PVA integration.

- Rising Academic and Research Utilization: Expanding use of PVA filaments in universities and research labs is boosting experimental prototyping output.

- Fueling Customization in Consumer Products: Increasing preference for personalized designs in fashion, footwear, and household goods is driving filament demand.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 651.94 Million |

| Market Size in 2025 | USD 225.14 Million |

| Market Size in 2024 | USD 200.05 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 12.54% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type / Grade, Form / Diameter, End-Use / Application, Customer Type / Buyer, Sales / Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How Is the Rapid Adoption of Prototyping and Manufacturing Fueling Growth in the PVA 3D Printing Filament Market?

Increasing adoption of 3D printing in prototyping and manufacturing is expected to drive the market. Composites Industries, such as aerospace, automotive, and healthcare, prefer PVA as a support material due to its water-soluble support. They simplify complex geometries in that there is no breaking of the main structures. When engineers undertake a rapid prototyping project, they first enhance efficiency through the use of PVA, which mitigates time wasted in post-processing and creates the fine detail introduced in complex designs. Increasing industrial demand for low-cost prototyping solutions continues to drive consistent growth in this sector.

The increase in multi-material printing is increasing dependence on PVA filaments, especially on dual extrusion printers, due to the demands of the new performance standards. Researchers released a pharmaceutical-grade review, which highlighted how FDM-printed PVA supports provide fast, customizable dosages with better design and release in medical prototyping. Based on the Wohlers Associates 2024 report, industrial users relied more on larger printers able to work with filaments meant for structural uses. Furthermore, the growing interest in sustainable and biodegradable materials is anticipated to accelerate the usage of PVA filaments.

Restraint

Restraint Adoption Due to Limited Thermal Resistance Is Anticipated to Reduce PVA's Applicability

Limited thermal resistance is anticipated to reduce PVA's applicability and further hamper the market growth. The printing temperatures required to print with PVA are relatively low relative to engineering-grade polymers, limiting the materials that can be used in an advanced dual-extrusion system. Failure to withstand a high-heat environment is likely to limit the growth of the PVA filament industry. Additionally, high moisture sensitivity is expected to challenge PVA filament adoption is expected hindering the market.

Opportunity

How Is Intensive R&D Activity Driving Innovation Within the PVA Filament Landscape?

High focus on research and development is estimated to strengthen innovation within the PVA filament landscape, further creating immense opportunities for the players competing in the market. Partnerships between industry players, research institutes, and universities lead to a faster pace of innovation in polymeric formulations. Such R&D activities are working on these challenges, including clogging of the filament, storage stability, to providing reliability in industrial use.

Ongoing innovation encourages competition among manufacturers to position their products with superior PVA solutions to meet any specialized application.

The Fraunhofer Institutes push the boundaries of sustainable plastic research in 2024, with their PLA-based innovations, including the ability to recycle its block copolymers used in flexible packaging. This extends them to low water ingress PVA modification (PVA) shortly to achieve a greater level of recyclability and functionality. Additionally, spurring demand from the healthcare sector is likely to create significant opportunities for PVA filaments.

Product Type / Grade Insights

Is Standard-Grade PVA the Backbone of Growth in the PVA 3D Printing Filament Market?

Standard PVA filament (general purpose) segment dominated the PVA 3D printing filament market in 2024, accounting for an estimated 50% market share. The growth is attributed to users seeking reliable water-soluble supports that blend well with PLA, PETG, and Nylon on dual-extrusion FFF models. Furthermore, the dual-extrusion FFF in North America is using typical PVA grades in common prototyping duties due to the consistency in regulated settings, thus further fuelling the segment.

The fast-dissolving / engineered PVA grades segment is expected to grow at the fastest rate in the coming years, as they offer improved dissolution kinetics and layer adhesion with resistance to swelling in humid environments. Optimized interface layers decrease bathing durations and processing effort in post-processing. This is expected to increase the throughput of service suppliers using dense or internal-channel geometries. Additionally, the sustainability efforts highlight the low-solvent support removal that eliminates water-soluble materials, making fast-dissolving PVA the ideal upgrade for teams expanding multi-material FFF.

Form / Diameter Insights

Why Does the 1.75 mm Format Continue to Dominate the PVA 3D Printing Filament Market?

1.75 mm filament segment held the largest revenue share in the PVA 3D printing filament market in 2024, which held a market share of about 70%, due to its compatibility with extrusion systems used by the bulk of desktop and professional dual-extrusion FFF machines.

High levels of use in education, research laboratories, and prototyping labs further cement this preference, as machine manufacturers standardize slicer profiles implemented and nozzle design of 1.75 mm feeds. Moreover, the 1.75 mm with the strength of ease of calibration and reliability of printing results is expected to fuel the market in the coming years.

Industrial bulk spools (5 kg+) service bureaus/production segment is expected to grow at the fastest CAGR in the coming years, as service providers and contract manufacturers favour high-throughput printing that is characterised by lower downtimes.

The element of handling material in the industrial printers is portrayed as being better managed, as the industrial printers accommodate bulk inputs with ease. This is likely to increase adoption within the aerospace, automotive, and medical models of prototyping. Furthermore, the growing scale-up of production-ready additive manufacturing across the globe is expected to boost the market in the coming years.

End-Use / Application Insights

How Did Prototyping and Design Validation Emerge as the Leading Application in the PVA 3D Printing Filament Market?

Support material to prototyping and personal printing segment dominated the PVA 3D printing filament market in 2024, accounting for 40% market share, due to the wide uptake of desktop dual-extrusion printers in the education and maker space, and early-stage design labs. PVA water-soluble characteristics make it easy to remove complex supports.

This is likely to continue to keep it in favor among users who do not want to engage in cumbersome post-processing to achieve clean overhangs and internal volumes. Moreover, the adoption of standardized testing geometries in science, technology, engineering, and mathematics (STEM) labs, with this trend likely to boost the appeal of PVA as the benchmark soluble filament.

Industrial/functional supports in the manufacturing segment are expected to grow at the fastest rate in the coming years, owing to the enacted importance of efficiency in tooling, fixtures, and functional prototyping by the manufacturers. Enhanced engineered grades able to resist humidity and degrade at a more rapid rate are slated to increase their workflow success rates in production near-areas.

Service bureaus and contract manufacturers are projected to increase PVA use on channels, lattice, and assemblies requiring finer point detailing, with the use of mechanical removal unfeasible. In another study by the Fraunhofer Institute 2024 report, materials and membranes have been cited to save time when advanced water-soluble supports are used in post-processing of aerospace and medical prototyping. Additionally, the increasing demand for soluble supports in composite tooling was cited, mainly in uses that need smooth inner surfaces, facilitating the segment growth.

Customer Type / Buyer Insights

Are Consumer and Hobbyist Makers Driving the Largest Share of the PVA 3D Printing Filament Market?

Consumer/hobbyist makers segment held the largest revenue share in the PVA 3D printing filament market in 2024, accounting for an estimated 35% market share, as cheap dual-extrusion FFF printers and available slicer support settings reduced the cost of using water-soluble PVA supports.

The community expertise, plentitude of tutorials, and on-demand e-commerce continue to help drive home labs and makerspaces' frequent purchases. Furthermore, the easy disposable strategy and safe water-based post-processing are expected to enhance the preference of PVA over solvent-based analogues in homes.

The industrial users & service bureaus segment is expected to grow at the fastest CAGR in the coming years, as the engineered PVA grades enhance rapidity in humidity tolerance, adhesion, and increase dissolution rate on the interface of the interface. Additionally, the further growth is attributed to the PVA use in industrial dual extrusion processes, given the sustainability programs aiming at the reduction of solvents and cleaner shop practice programs.

Sales / Distribution Channel Insights

Why Is E-Commerce the Prime Distribution Hub for the PVA 3D Printing Filament Market?

The e-commerce & marketplace retail segment dominated the PVA 3D printing filament market in 2024, accounting for 50% market share, due to the prioritization of convenience, competitive prices, and a wide variety of materials by consumer and prosumer buyers to source PVA filament.

Larger sites, such as Amazon, MatterHackers, and 3DJake, increased availability of 1 kg spools, and humidity-sealed packaging, as well as bundling options, which are likely to maintain high online market volume. Furthermore, the increase in the development of digital inventory management systems in filament supply chains which made order fulfillment more efficient, thus fuelling the segment.

The OEM-validated filament programs and direct industrial supply contracts segment is expected to grow at the fastest rate in the coming years, as manufacturers and print bureaus in industry require reassurance of reliability, assurance of quality, and integration of workflow. The industrial buyers are expected to focus on direct purchase of multi-kilogram spools and bulk cargos, which eliminates procurement complexity and stabilizes costs of production.

The Society of Manufacturing Engineers 2024 report has highlighted an increasing demand for direct industrial contracts of soluble filament in composite tooling. Additionally, the guaranteed compatibility and vendor-endorsed technical support are expected to facilitate the segment in the coming years.

PVA 3D Printing Filament Market Companies

- 3DXTECH

- AzureFilm d.o.o.

- Bambu Lab

- BASF

- BCN3D

- CP3D / Channel Prime Alliance (private label PVA suppliers)

- DFRobot

- eSUN

- Shenzhen Hello 3D Technology (Hello3D)

- FormFutura

- Gizmo Dorks

- HartSmart / CP3D branded PVA

- Kuraray

- MakerBot

- Gizmo Dorks

- Polymaker

- Polymaker

- Ultimaker

- Volumic

Recent Developments

- In May 2025, Elegoo announced that its Centauri Series of FDM 3D printers will introduce full-color printing by Q3 2025, marking a significant advancement in consumer-grade additive manufacturing. A key highlight is the launch of its Automatic Filament Switching System, which incorporates open-source RFID (Radio Frequency Identification) technology—an industry-first in this category. The system directly challenges Bambu Lab, the current segment leader, by offering RFID-tagged filament spools that communicate material type and color directly to the printer's slicer software. By reducing manual setup and streamlining the workflow, this innovation is projected to set new standards in usability and accessibility for multi-material 3D printing.(Source: https://www.tomshardware.com)

- In June 2025,UltiMaker introduced the UltiMaker S6, a high-speed and accessible 3D printing solution targeted toward engineers, industrial teams, and maintenance operators. Positioned as a cost-effective system without compromising power, the S6 is designed to support a wide range of applications, including functional prototyping, small-scale production, and on-demand repair workflows. Its focus on reliability, scalability, and ease of use strengthens UltiMaker's award-winning product lineup, while offering manufacturers a flexible option to accelerate innovation cycles. The S6 represents UltiMaker's continued commitment to bridging performance and affordability in professional additive manufacturing.(Source: https://manufactur3dmag.com)

Segments Covered in the Report

By Product Type / Grade

- Standard PVA filament (general purpose, water-soluble)

- Fast-dissolving PVA (accelerated solubility)

- High-strength / reinforced PVA (additives for better adhesion/mechanical)

- Low-moisture / stabilised PVA (improved storage/printing reliability)

- Composite PVA (blends with PLA, PEO, or other polymers for tuned properties)

By Form / Diameter

- 1.75 mm filament

- 2.85 / 3.00 mm filament

- Spools (various weights: 0.5 kg, 0.75 kg, 1 kg)

- Bulk / industrial spool formats (5 kg+)

By End-Use / Application

- Support material for prototyping (rapid prototyping, hobbyist)

- Industrial / functional part supports (tooling, fixtures)

- Medical / dental models (supports for complex anatomical prints)

- Aerospace & automotive prototypes (complex internal channels)

- Education & research (universities, labs)

By Customer Type / Buyer

- Consumer/hobbyist makers

- Small & medium enterprises (SMEs) / service bureaus

- Industrial users & OEMs (manufacturing / R&D)

- Education & research institutions

- Medical/dental labs & clinics

By Sales / Distribution Channel

- Direct (manufacturer webstores / OEM supply)

- Distributor / reseller networks (regional filament distributors)

- E-commerce marketplaces (Amazon, MatterHackers, eBay)

- OEM bundled with desktop/industrial printers (printer OEM materials)

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East andAfrica

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting