What is the Semi-Trailer Dealership Market Size?

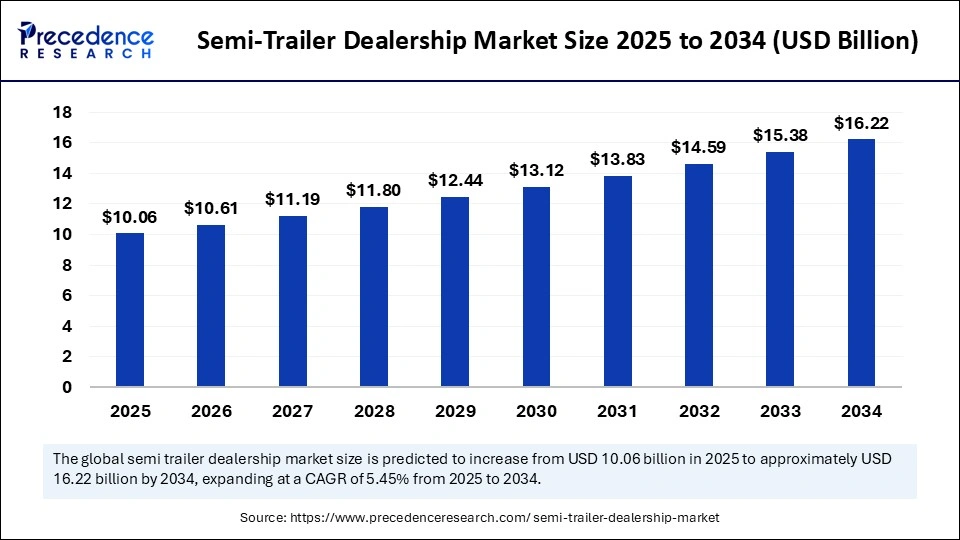

The global semi-trailer dealership market size was calculated at USD 9.54 billion in 2024 and is predicted to increase from USD 10.06 billion in 2025 to approximately USD 16.22 billion by 2034, expanding at a CAGR of 5.45% from 2025 to 2034. The market is growing due to the rising demand for efficient freight transportation, driven by the expansion of logistics and e-commerce industries.

Market Highlights

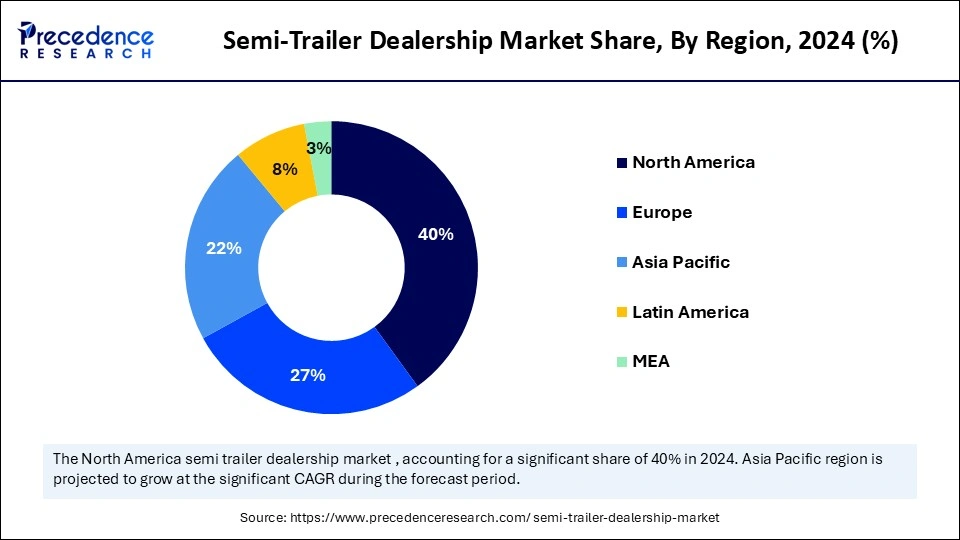

- North America dominated the semi-trailer dealership market with the largest market share of 40% in 2024.

- Asia Pacific is expected to grow at a notable CAGR during the forecast period .

- By trailer type, the dry van trailers segment held the biggest market share of 35% in 2024.

- By trailer type, the refrigerated trailers segment is expected to grow at the fastest CAGR during the forecast period.

- By dealership type, the authorized OEM dealerships segment contributed the highest market share of 45% in 2024.

- By dealership type, the online/digital dealerships segment is expected to grow at the fastest CAGR during the forecast period.

- By sales channel, the new semi-trailers segment captured the maximum market share of 60% in 2024.

- By sales channel, the used semi-trailers segment accounted for the significant share of 40% in 2024

- By service offering, the leasing & financing services segment is expected to grow at the fastest rate during the forecast period.

- By service offering, the customization & retrofit solutions segment led the market in 2024.

- By end user industry, the logistics & transportation companies segment generated the major market share of 50% in 2024.

- By end user industry, the retail & e-commerce segment is expected to grow at the fastest CAGR during the forecast period.

Market Size and Forecast

- Market Size in 2024: USD 9.54 Billion

- Market Size in 2025: USD 10.06 Billion

- Forecasted Market Size by 2034: USD 16.22 Billion

- CAGR (2025-2034): 5.45%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

Market Overview

What Is the Semi-trailer Dealership Market?

The semi-trailer dealership market is witnessing steady growth, driven by an increase in freight volume, the expansion of logistics, and growing demand for dependable post-purchase support, including financing for spare parts and servicing. Dealerships are evolving into full-service hubs that provide maintenance services, digital telematics integration, and fleet management, in addition to serving as sales locations. Businesses focus on strengthening their dealer networks to meet the rising expectations of their customers.

- 10 June 2024: Premier Truck Group acquired River States Truck & Trailer, expanding its dealership footprint into Wisconsin and Minnesota.

(Source: https://investors.penskeautomotive.com)

How Is AI Transforming the Semi-trailer Dealership Market?

Artificial Intelligenceis transforming the semi-trailer dealership market by enablingpredictive maintenance, forecasting demand, and optimizing inventory. Additionally, it enhances customer interaction and streamlines processes, enabling dealers to make more informed decisions more quickly and efficiently overall. Furthermore, strategic planning is supported by AI-driven analytics, which increases market competitiveness.

Semi-Trailer Dealership Market Growth Factors

- E-Commerce & Logistics Expansion: Growing online retail and logistics networks increase semi-trailer sales.

- Fleet Renewal & Leasing: Dealers benefit as companies upgrade or lease fleets for efficiency.

- Technological Advancements: Digital sales platforms and telematics-enabled trailers enhance customer experience.

- Infrastructure Investments: Better transport networks make semi-trailer operations smoother and more reliable.

- Cold Chain Industry Growth: Rising demand for refrigerated trailers boosts dealership opportunities.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 9.54 Billion |

| Market Size in 2025 | USD 10.06 Billion |

| Market Size by 2034 | USD 16.22 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.45% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Trailer Type, Dealership Type, Sales Channel, Service Offering, End User Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Freight and Logistics Demand

The need for more semi-trailers is driven by the growth of the retail e-commerce and logistics sectors, which is prompting dealerships to expand their networks and stock a variety of fleets. This demand is also driving fleet operators to upgrade to new trailers, as it puts pressure on them to deliver goods faster. Dealerships are therefore becoming essential partners in ensuring the effectiveness of the supply chain. Trailer sales are also being driven by rising consumer expectations for dependability and quicker delivery.

Sustainability Shift

The growing demand for alternative fuel-ready models and lightweight trailers is pushing dealerships to expand their product lines. Nowadays, many consumers seek eco-friendly products to comply with green laws and reduce their carbon footprint. By supporting these sustainability objectives, dealerships are positioning themselves for future growth and expansion. Fleets concentrating on ESG commitments are also beginning to recognize dealers who offer eco-friendly models.

Restrains

High Upfront Costs Hinder Market Growth

The substantial infrastructure inventory and service facility investments needed by semi-trailer dealerships may restrict the growth of smaller competitors. Effective competition is also difficult for new entrants due to high capital requirements. Smaller dealerships may struggle to maintain sufficient cash reserves, especially when demand for trailers is unpredictable.

Market Dependency on Logistics Cycles

The semi-trailer dealership market is highly sensitive to fluctuations in freight, transport, and e-commerce cycles. Any slowdown in these sectors can have a direct impact on trailer sales and service revenues. Dealerships often face periods of idle inventory when freight demand decreases. Seasonal variations and global supply chain disruptions can further exacerbate demand fluctuations.

Opportunites

Integration of Digital Fleet Management Solutions

Dealerships can differentiate their offerings by offering data-driven fleet solutions, predictive maintenance, and telematics. This makes dealers strategic partners in addition to increasing service revenue. Early digital solution adoption can attract major fleet operators seeking to enhance operational effectiveness. Furthermore, dealerships can minimize fleet downtime by using predictive analytics to forecast maintenance requirements.

Diversification Into Eco-Friendly and Lightweight Trailers

The growing demand for sustainable transportation solutions creates an opportunity for dealerships to offer lightweight and alternative fuel-ready trailers. This aligns with green regulations and ESG initiatives of fleets. Dealerships can gain market share by promoting environmentally friendly solutions. Promoting eco-friendly trailers can enhance brand reputation among environmentally conscious clients. Offering customization options for alternative fuel models further strengthens our competitive advantage.

Segmental Insights

Trailer Type Insights

Why Did the Dry Van Trailers Segment Dominate the Semi-trailer Dealership Market in 2024?

The dry van trailer segment dominates the semi-trailer dealership market, driven by the widespread use of general cargo transportation across various industries. Logistics and transportation companies choose it because of its cost-effective ease of maintenance and versatility, which guarantees steady demand and market leadership. The fact is that dry van trailers can accommodate a variety of cargo kinds.

The refrigerated trailers segment is experiencing rapid growth due to the increasing demand for temperature-controlled transportation in the pharmaceutical, food, and medical industries. The use of refrigerated trailers is being driven by the growth of e-commerce for perishable goods as well as strict regulations for cold chain logistics. Technological developments in cooling systems also help the market.

Dealership Type Insights

What Made the Authorized OEM Dealerships Segment Dominate the Market in 2024?

The authorized OEM dealerships segment dominated the market in 2024 because they provide comprehensive after-sales services, warranty support, and reliable products. Because they are dependable, guarantee quality, and provide access to authentic parts, customers favor IEM-authorized dealers, which helps maintain their market leadership. Corporate clients, particularly those with large fleets, continue to be drawn to established brand reputations.

The online/digital dealerships segment is the fastest-growing, driven by digital financing options, virtual inventory browsing, and the convenience of remote purchasing. Tech-savvy consumers seeking faster, more personalized shopping experiences are embracing this model. This trend is accelerating due to the growing internet penetration.

Sales Channel Insights

Why Did the New Semi-trailer Segment Dominate the Market for Semi-trailers in 2024?

The new semi-trailer segment is dominating the market due to the preference for the latest technology, lower maintenance costs, and warranties. Businesses investing in fleet expansion and modernization largely rely on new trailers to ensure reliability and efficiency. This segment also benefits from OEM incentives and structured financing programs.

The used semi-trailer segment is growing due to cost-conscious consumers seeking more affordable options for expanding their fleets. The availability of certified pre-owned trailers and leasing options is increasing demand in emerging markets. An increase in interest from small and medium logistics operators also fuels growth.

Service Offering Insights

Why Did the Leasing & Financing Services Segment Dominate the Market in 2024?

The leasing & financing services segment dominates the semi-trailer dealership market in 2024 because it provides companies with the flexibility to purchase semi-trailers without incurring significant upfront investments. For fleet operators seeking to optimize operating efficiency and cash flow, this section is crucial. Market domination is also influenced by favorable financing terms offered by banks and OEMs.

Customization & retrofit solutions are growing rapidly, driven by the need for specialized trailers for niche applications such as refrigerated transport, hazardous goods, and e-commerce deliveries. These services enhance trailer functionality and meet specific industry requirements. Increasing demand for green and energy-efficient retrofits is also supporting growth.

End User Industry Insights

What Made the Logistics & Transportation Companies Segment Dominate the Semi-trailer Dealership Market in 2024?

The logistics & transportation companies segment dominates the market in 2024 because they constantly need dependable trailers and operate a large fleet. This end-user segment's dominant position is maintained by its operational scale and steady demand. The demand in this market is further maintained by growing industrial output and trade volumes.

Retail & e-commerce is growing rapidly, fueled by the surge in online shopping and last-mile delivery needs. This segment drives demand for specialized trailers, including refrigerated and customized trailers, to ensure efficient supply chain operations. Expanding warehouse networks and faster delivery expectations are accelerating trailer adoption.

Regional Insights

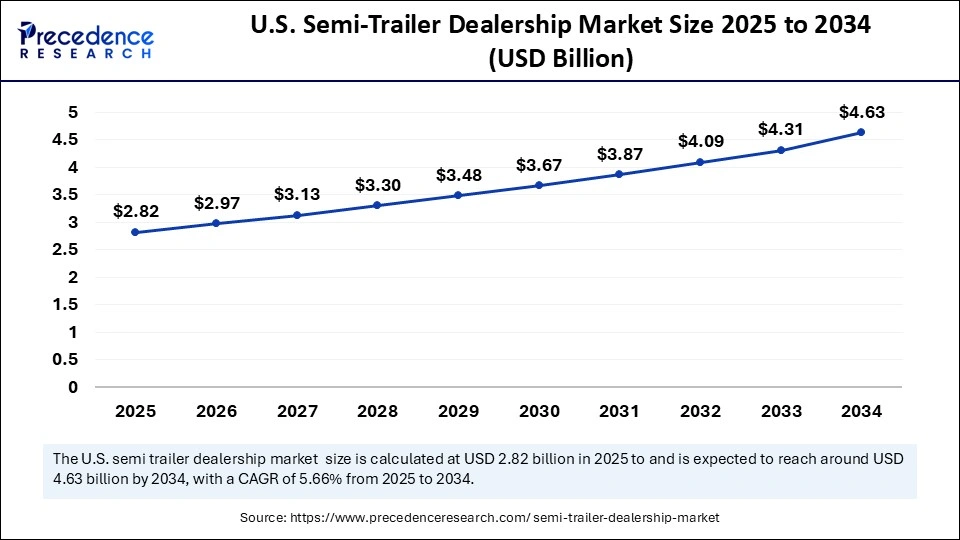

U.S. Semi-Trailer Dealership Market Size and Growth 2025 to 2034

The U.S. semi-trailer dealership market size was evaluated at USD 2.67 billion in 2024 and is projected to be worth around USD 4.63 billion by 2034, growing at a CAGR of 5.66% from 2025 to 2034.

What Made North America Dominate the Semi-trailer Dealership Market in 2024?

North America dominates the semi-trailer dealership market due to a mature logistics infrastructure, high fleet investments, and well-established dealer networks. Strong demand from industrial and commercial transport sectors ensures steady market leadership. Advanced regulations and supportive government policies further reinforce this dominance.

Asia Pacific is growing rapidly, propelled by a surge in logistics and transportation operations, e-commerce growth, and fast industrialization. The market is expanding more quickly as a result of increased fleet modernization projects and infrastructure investments. The market is growing because of urbanization and rising disposable incomes.

Semi-trailer Dealership Market Companies

- Schmitz Cargobull AG

- Wabash National Corporation

- Great Dane LLC

- Utility Trailer Manufacturing Company

- Hyundai Translead

- Krone GmbH & Co. KG

- China International Marine Containers Co., Ltd. (CIMC)

- Manac Inc.

- MAC Trailer Manufacturing Inc.

- Stoughton Trailers LLC

- Vanguard National Trailer Corp.

- Kögel Trailer GmbH

- Wielton S.A.

- Fontaine Trailer Co.

- Pitts Trailers

Recent Developments

- In September 2025, Aurora Parts & Procede Software announced the launch of integrated dealer solutions featuring API-based integrations to streamline operations for commercial trailer dealerships and fleet customers across North America. These solutions aim to improve efficiency, reduce manual errors, and enhance real-time data visibility.(Source: https://www.truckpartsandservice.com)

- In August 2025, FTR announced preliminary July 2025 trailer order totals, reporting 7,794 units ordered, slightly below the market's surprise upswing in June. This report reflects current market demand trends and helps dealers plan inventory and service capacity accordingly.(Source: https://www.truckpartsandservice.com)

- In June 2025, Skoda Auto India announced a comprehensive growth strategy for 2025, including the launch of new vehicle models, significant dealership expansion, and improved customer service initiatives. These efforts are intended to strengthen brand presence and dealer network performance across India.(Source: https://timesofindia.indiatimes.com)

Segments Covered in the Report

By Trailer Type

- Flatbed Trailers

- Dry Van Trailers

- Refrigerated Trailers (Reefers)

- Tanker Trailers

- Fuel Tankers

- Chemical Tankers

- Food-Grade Tankers

- Curtain Side Trailers

- Lowboy Trailers

- Others

- Car Carrier Trailers

- Dump Trailers

By Dealership Type

- Authorized OEM Dealerships

- Independent Dealerships

- Online / Digital Dealerships

By Sales Channel

- New Semi-Trailers

- Used Semi-Trailers

By Service Offering

- Leasing & Financing Services

- Maintenance & Repair Services

- Spare Parts & Accessories

- Customization & Retrofit Solutions

By End User Industry

- Logistics & Transportation Companies

- Construction & Infrastructure Firms

- Retail & E-Commerce

- Agriculture

- Automotive & Manufacturing

- Oil & Gas / Chemical Transport

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting