Smart Card IC Market Size and Forecast 2025 to 2034

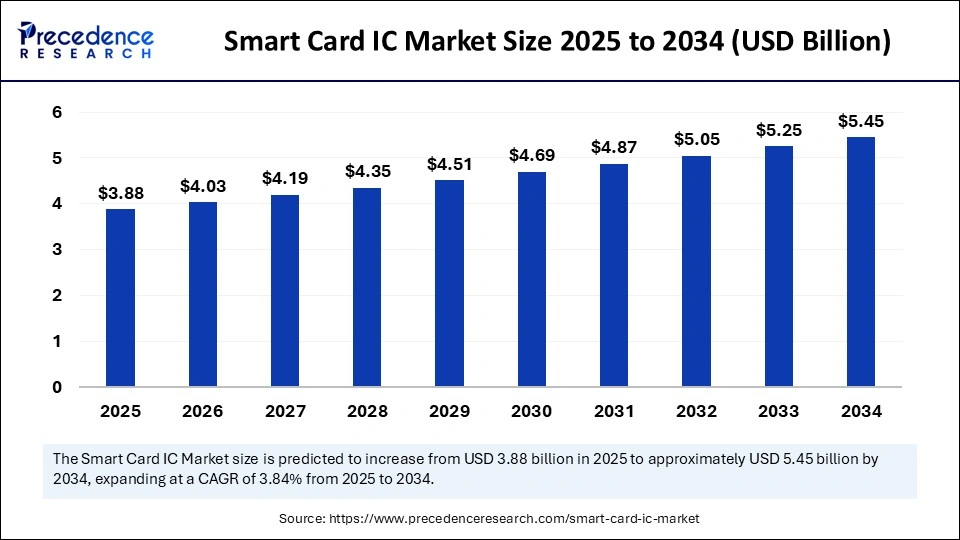

The global smart card IC market size accounted for USD 3.74 billion in 2024 and is predicted to increase from USD 3.88 billion in 2025 to approximately USD 5.45 billion by 2034, expanding at a CAGR of 3.84% from 2025 to 2034.The increased demand for secure identification is propelling the growth of the smart card IC market. Moreover, the rising need for secure and efficient payment systems supports market expansion.

Smart Card IC MarketKey Takeaways

- In terms of revenue, the smart card IC market is valued at $3.88 billion in 2025.

- It is projected to reach $5.45 billion by 2034.

- The market is expected to grow at a CAGR of 3.84% from 2025 to 2034.

- Asia Pacific dominated the global smart card IC market with the largest revenue share in 2024.

- North America is expected to grow at the fastest CAGR from 2025 to 2034.

- By type, the contactless segment held the major revenue share in 2024.

- By type, the contact segment is expected to grow at the highest CAGR during the projection period.

- By architecture, the 16-bit segment dominated the market in 2024.

- By architecture, the 32-bit segment is expected to expand at the fastest CAGR between 2025 and 2034.

- By configuration, the microprocessor-based cards segment contributed the biggest market revenue share in 2024.

- By configuration, the hybrid smart cards segment is expected to expand at a significant CAGR in the coming years.

- By application, the ID cards segment contributed the biggest revenue share in 2024.

- By end-user, the government segment dominated the market in 2024.

- By end-user, the healthcare segment is expected to grow at a significant CAGR over the projected period.

AI Impact on the Smart Card IC Market

Artificial Intelligence technology is revolutionizing the ways authentication, identification, security, and transaction processes. AI algorithms make smart card ICs more robust against cyber threats. AI-driven smart card ICs are improving security standards and personalization, enabling novel functionalities and enhancing user experience. Predictive maintenance of AI tools is helping detect potential issues with smart cards to enhance efficiency and reduce overall downtime, making them ideal for production and deployments. The increased need for high-security systems for transaction data, anomalies, and fraudulent activity are boosting the adoption of AI-powered smart card ICs. AI ensures flexibility, efficiency, accuracy, and optimization of digital processes.

Market Overview

The global smart card IC market is expanding rapidly due to the rising adoption of digital & contactless payments, e-commerce business growth, integration of biometric technology, and government initiatives promoting digital transformation and the use of digital identity cards, like national ID cards, e-passports, and digital city traveling cards. The rapid digitalization has increased the demand for secure identifications and authentications. Companies are increasingly adopting smart card ICs to reduce the risk of identity theft and protect sensitive data. Ongoing technological advancements in smart cards, like the development of more efficient and secure solutions, are contributing to increased demand for advanced smart card IDs. Additionally, emerging trends of smart city projects, e-governance, and smartphone use are fostering market growth.

What are the Major Trends in the Smart Card IC Market?

- Secure Identification: The adoption of identification smart cards has increased for applications like passports, employee ID cards, and national ID cards, fostering market growth.

- Adoption of IoT devices: The use of IoT devices has increased, driving the demand for smart card ICs for secure authentication and access control, contributing to the market growth.

- Advancements in Contactless Technology: The advancements in contactless technologies like contactless smart cards and NFC technology are supporting market expansion.

- Industrial Adoptions: Industries like healthcare, government, telecommunication, IT, banking, and transportation are the major adopters of smart card ICs, shaping the market.

- Government Initiatives: Ongoing government initiatives, policies, and investments in smart card production and use for various applications are driving the market growth.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 5.45 Billion |

| Market Size in 2025 | USD 3.88 Billion |

| Market Size in 2024 | USD 3.74 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 3.84% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Architecture, Configuration, Application, End-user, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increased Demand for Security Solutions

The increased digital transformation and use of contactless payments are driving the need for secure authentication and identification. As a result, the use of biometric authentication for secure payment is rising. This, in turn, boosts the adoption of smart card ICs. The growing adoption of digital payments and e-commerce is also contributing to increased demand for enhanced security. Smart card ICs ensure secure transactions, enhancing customer experience. Additionally, government initiatives like regulations and standards for improving security and preventing identity theft drive the adoption of smart card ICs in various applications, including passports and national ID cards.

Restraint

High Cost

The high cost of smart card ICs is a major factor hampering the growth of the smart card IC market. The implementation of smart card technologies requires high upfront investments in infrastructure. Additionally, the cost associated with the production and integration of smart cards contributes to the burden for small or cost-conscious organizations. Merchants and organizations require investment in readers and terminals, which also adds to the increased cost. Additionally, the shortage of semiconductors is creating a burden for several producers and exporters, making smart card ICs more expensive and less accessible.

The ongoing IEEPA tariffs on the supply chain from countries like Mexico, Canada, and China impact the semiconductor industry.

Opportunity

Mobile Wallet Growth

The rise in the use of contactless payments has increased the popularity of mobile wallets. These wallets require the integration of secure identification and authentication solutions like smart card ICs. Additionally, the ongoing collaborations between smart card manufacturers and industry stakeholders are fostering the development of secure and efficient payment solutions, creating opportunities for more adoption of smart card ICs. The integration of IoT devices in various industries and the adoption of 5G and AI technologies are creating immense opportunities for more secure and efficient smart card ICs.

Type Insights

Why did the Contactless Segment Dominate the Smart Card IC Market in 2024?

The contactless segment dominated the market with the largest revenue share in 2024, driven by increased demand for fast, secure, and more efficient payment solutions. Contactless payment is the most convenient solution. The adoption of contactless smart card ICs has increased, driven by the rising popularity of digital & contactless transactions, especially in e-commerce and retail sectors. Contactless smart card ICs have gained immense popularity for national IDs and passports in the government sector. Memory-based and microcontroller-based are the most popular contactless smart card ICs gaining immense traction, bolstering segmental growth.

The contact segment is expected to grow at the fastest rate in the coming years. The segment growth is attributed to the increasing use of contact smart card ICs in applications like secure identifications, access control, and payment systems, like secure payment cards, and debit and credit cards. The adoption of microprocessors and memory chip-based smart cards is rising. The rising need for secure transactions, access control, and identification in industries like government, BFSI, and transportation is fostering segment growth.

Architecture Insights

How 16-bit Segment Dominate the Market in 2024?

The 16-bit segment dominated the market by capturing the majority of the revenue share in 2024. This is due to its cost-effectiveness and balanced performance. 16-bit ICs are mostly used in identity verification, access control systems, and payment cars for seamless processing. Cost-conscious consumers with a demand for high security and authentication are the major adopters of these ICs. The good balance between computational power and energy consumption offered by 16-bit microcontrollers makes them ideal for the production of smart card ICs for the low-cost and mass-production market.

The 32-bit segment is expected to expand at the fastest CAGR over the forecast period due to its high demand for complex and secure applications. 32-bit ICs have high-performance processing capabilities, making them ideal for complex applications. 32-bit ICs are heavily used in biometric authentications and tokenization in contemporary payment solutions. Companies are employing 32-bit ICs in electronic ID cards and contactless payment cards.

Configuration Insights

What Made Microprocessor-Based Cards the Dominant Segment in 2024?

The microprocessor-based cards segment dominated the smart card IC market with the largest revenue share in 2024. This is mainly due to their increased use of robust security solutions, driven by their ability to handle authentication. Microprocessor-based smart cards enable complex calculations and secure data, increasing their use in high-security applications. The ability of microprocessor-based cards to execute complex cryptographic functions is driving their use in secure access control, banking, and government IDs.

The hybrid smart cards segment is expected to expand at a significant CAGR in the coming years, driven by rising demand for multi-application cards. Industries like BFSI and healthcare are preferring hybrid smart cards for multi-applications, like supporting both contact and contactless functionalities. Hybrid smart cards offer flexibility and convenience, making them ideal for both contact and contactless payments. The ability of these cards to incorporate cutting-edge security features, including encryption and biometric authentication, enhances security and appeal, driving their adoption.

Application Insights

What Made ID Cards the Dominant Segment in the Smart Card IC Market?

The ID cards segment dominated the market with the largest share in 2024 and is expected to grow at a significant rate in the coming years. This is mainly due to the increasing adoption of ID cards in educational institutes and various other businesses. Organizations are the major adopters of ID cards. The segment includes employee ID, citizen ID, e-passport, and driving licenses. The rising need for advanced chip-integrated ID cards is fostering the adoption of smart card ICs. Government implementation of national ID projects and e-passports further creates the need for smart card ICs for secure identification solutions. The dual-interface cards and AI-integrated ID cards are gaining popularity, contributing to segmental growth.

End-User Insights

Why did the Government Segment Dominate the Smart Card IC Market in 2024?

The government segment dominated the market by holding the biggest revenue share in 2024. This is mainly due to the increased use of smart card ICs for various applications, including national IDs, passports, e-licenses, and voter ID cards. Federal and central governments have increased the adoption of smart card ICs for more secure, efficient, flexible, and scalable identification systems in various applications. These ICs offer advanced security features, making them ideal for government applications where security is important.

The healthcare segment is expected to grow at a significant CAGR over the projected period. The segment growth is attributed to the increasing concern over patient data security and privacy. The rising digitalization, use of telemedicine and electronic health records (EHRs), and patient identification cards are driving the need for smart card ICs in the healthcare sector. Smart cards are gaining popularity for electronic prescriptions, enhancing patient care. Additionally, government initiatives and investments for promoting smart card adoptions in the healthcare sector are fostering segment growth.

Regional Analysis

What Factors Contributed to Asia's Dominance in 2024?

Asia Pacific registered dominance in the smart card IC market by capturing the largest share in 2024. This is mainly due to rapid digital transformation, government initiatives, and a robust manufacturing base. Asian countries like China, Japan, and South Korea have a strong manufacturing base of smart cards. These countries' high adoption of smart cards in various applications, including digital payments and biometric solutions, bolstered the growth of the market. Government initiatives to promote digitalization in every sector and extend the use of contactless payments & biometric authentication further support market growth.

India is a rapidly growing market for smart card ICs due to government initiatives to promote digitalization. The Government of India has been investing in digital payment solutions. Additionally, ongoing innovative approaches like e-passports and e-license are expected to make India the leading market over the forecast period.

Indian Government Initiatives in Smart Card IC Market- 2025

- In April 2025, Devendra Fadnavis, chief minister of Maharashtra, launched ‘Mumbai 1,' a unified smart card for public transport across the Mumbai Metropolitan Region (MMR).

(Source: https://timesofindia.indiatimes.com) - From March 2025, Kerala state of India has switched from the smart card format for issuing registration certificates (RC) for vehicles to digital certificates. The plan was launched in February 2025.

(Source: https://www.thehindu.com)

- In March 2025, India introduced e-passports in several cities, which have integrated electronic features with traditional passport design under the Passport Seva Programme 2.0, for secure data storage and improved security features. The country is focusing on expanding e-passport availability for all cities by mid-2025.(Source: https://timesofindia.indiatimes.com)

North American Smart Card IC Market Trends

North America is expected to grow at the fastest rate during the projected timeframe due to factors such as the increased adoption of IoT technologies, the rise of numerous payments, and strong initiatives in smart city projects. North America has a robust technology infrastructure, which drives the adoption of smart card ICs across various industries, including healthcare, finance, IT, and telecommunications. The rise in demand for smart digital transactions, strong adoption of contactless payment solutions, and the existence of key market players like Toshiba, Microchip, and Samsung are fostering production and access to smart card ICs. Additionally, well-established regulatory environments for security and authentication support the adoption of smart card ICs in the region.

The U.S. is the major player in the regional market due to its high adoption of contactless payments and demand for secure identification, like biometric authentication and national ID cards. The ongoing integration of biometrics with blockchain technology is boosting the demand for smart card ICs. Additionally, the government focuses on cybersecurity and promotions of advanced identity verification, like REAL ID, supporting market growth.

European Smart Card IC Market Trends

Europe is a significant player in the smart card IC market. The region is witnessing rapid growth due to the rising demand for contactless payments. There is a rapid shift toward secure and convenient payment methods. Additionally, expanding e-commerce businesses are propelling the demand for cutting-edge online payment solutions. Regions' strong focus on digital innovations and rising concerns over cybersecurity are driving the adoption of smart card ICs.

- In November 2024, GlobalFoundries collaborated with Idemia Secure Transactions (IST), a division of Idemia Group, for two years to deliver IST's new smart card IC. The collaboration is expected to create an “efficient one-stop-shop solution” and a 100% European value chain for the next generation of IST's smart card tech.

(Source: https://www.biometricupdate.com)

Germany is emerging as one of the major forces. The growth of the market in Germany is driven by the increased adoption of digital payments and rising demands for advanced security technologies. The rising e-governance and smart city projects are fostering market growth. The region boasts some of the well-known semiconductor manufacturers and market players, including Samsung, STMicroelectronics, and NXP Technologies, which are expected to boost market growth.

Smart Card IC Market Companies

- Infineon Technologies

- NXP Semiconductors

- STMicroelectronics

- Samsung Electronics

- IDEMIA

- Giesecke+Devrient

- Microchip Technology

- Texas Instruments

- Toshiba Corporation.

- Nations Technologies Inc.

Recent Developments

- In May 2025, Tongxin Microelectronics showcased its latest high-performance security chip technologies for payment IC cards and payment terminals at Seamless Middle East Fintech 2025, at the Dubai World Trade Centre. (Source: https://www.ptinews.com)

- In May 2025, Advanced Card Systems Ltd. announced its participation in Identiverse 2025, from June 3 to 6, 2025, at the Mandalay Bay Resort & Casino in Las Vegas, Nevada, USA, to showcase the company's WalletMate Series and Contact Smart Card Reader and NFC Reader.

(Source: https://www.acs.com.hk) - In February 2025, CardLab Aps launched its next-generation biometric smart card product, “Access”, designed to reduce the requirement of traditional passwords and equipped with the state-of-the-art T-Shape fingerprint sensor. (Source: https://www.fingerprints.com)

Segment Covered in the Report

By Type

- Contact

- Contactless

By Architecture

- 16-bit

- 32-bit

By Configuration

- Memory Cards

- Microprocessor-based Cards

- Dual-interface Cards

- Hybrid Smart Cards

By Application

- SIM Cards

- ID Cards

- Employee IDs

- Citizen IDs

- ePassports

- Driving Licenses

- Financial Cards

- IoT Devices

- Others

By End-user

- IT & Telecommunications

- BFSI

- Government

- Healthcare

- Transportation

- Retail

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content