What is Smoke Detector Market Size?

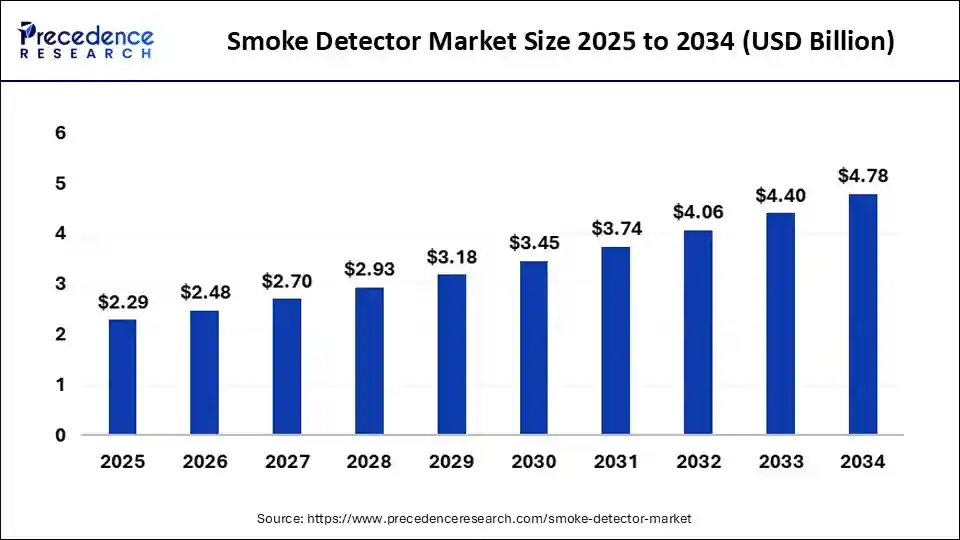

The global smoke detector market size accounted for USD 2.29 billion in 2025 and is predicted to increase from USD 2.48 billion in 2026 to approximately USD 4.78 billion by 2034, expanding at a CAGR of 8.52% from 2025 to 2034. Growing due to increasing fire safety awareness, stringent government regulations, and smart home advancements.

Markket Highlights

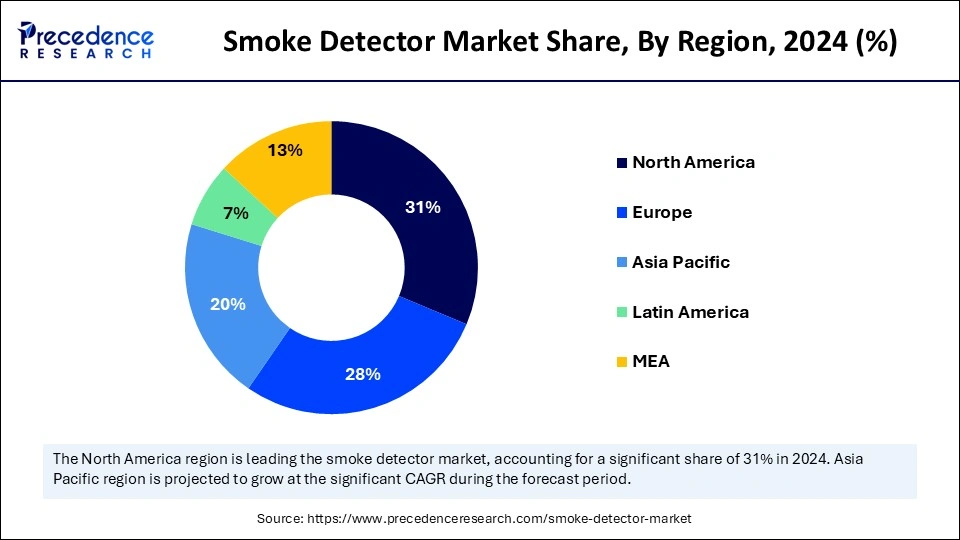

- North America dominated the global market with the largest market share of 31% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR of 8.4% over the period studied.

- By technology, the photoelectric segment has held the biggest market share of 53% in 2024.

- By technology, the dual sensors segment is projected to grow at a CAGR of 9.02% in the coming years.

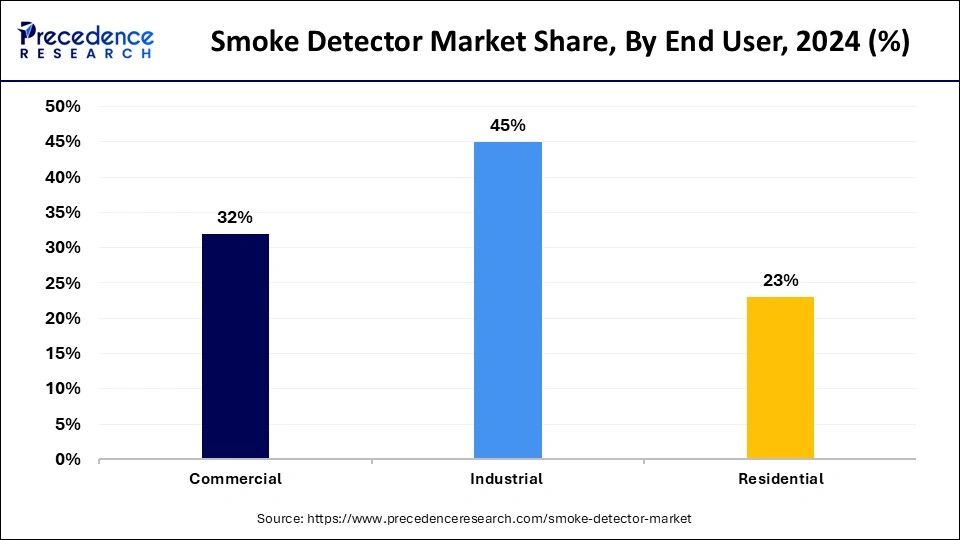

- By end user, the industrial segment contributed the biggest market share of 45% in 2024.

- By end user, the residential segment is anticipated to grow at the fastest CAGR over the projected period.

Strategic Overview of the Global Smoke Detector Industry

The global smoke detector market is experiencing significant growth, driven by increasing awareness of fire safety and strict regulations mandating the installation of fire detection systems in homes, businesses, and industrial facilities. With improvements in wireless connectivity, AI-powered detection, and smart home integration, the industry is changing, and smoke detectors are becoming more effective and user-friendly. Prominent firms such as Honeywell International Inc. Smoke detectors that offer automated emergency responses, remote alerts, and real-time monitoring are leading the way in innovation.

The demand for intelligent smoke detectors with sophisticated sensors and machine learning capabilities is rising in tandem with the speed at which technology is developing. To increase precision and lower false alarms, manufacturers are now creating multi-sensor smoke detectors that integrate photoelectric ionization and heat sensing technologies. Siemens AG and Hochiki Corporation are investing in AI-driven fire detection solutions to enhance safety and reliability, catering to the increasing demand for smarter self-testing and maintenance-free smoke detection systems.

Impact of AI on the Smoke Detector Market

The integration of artificial intelligence (AI) into the smoke detector market has significantly enhanced the efficiency and accuracy of smoke and fire detection. Conventional detectors frequently use basic threshold-based systems, which are vulnerable to false alarms from dust or smoke from cooking. On the other hand, contemporary detectors use sophisticated sensors and machine learning to examine a variety of environmental variables, including temperature variations, smoke patterns, and air quality, before sounding an alarm. By doing this, safety is increased, and emergency responders are only alerted when a real threat exists.

Numerous businesses have already incorporated this cutting-edge technology into their goods. For example, Google Nest Protect greatly reduces needless alarms by using advanced algorithms to distinguish between various types of smoke. In a similar vein, Honeywell has unveiled intelligent fire detection systems for commercial spaces that incorporate predictive analytics to identify possible risks before they become serious. Using multi sensor technology to improve accuracy Bosch is also utilizing intelligent detection solutions in its security systems. These developments are raising the bar for the industry and improving the accuracy and efficiency of fire detection in both residential and commercial settings.

Smoke Detector Market Growth Factors

- Stricter fire safety regulations: Governments worldwide are mandating the installation of smoke detector systems in residential and commercial buildings. Regulatory bodies like NFPA, EN, and BIS are standardizing smoke detector requirements.

- Rising fire accidents: Increasing cases of fire-related incidents are driving the demand for highly efficient smoke detector devices. Early-warning smoke detectors help prevent fatalities and property damage.

- Expanding construction industry: New residential and commercial constructions are fueling demand for modern smoke detectors. Builders are integrating smart smoke detector systems as a default fire safety feature in modern apartments and offices.

- Industrial and commercial fire safety compliance: Strict workplace safety regulations in factories, offices, warehouses, and oil & gas plants are boosting smoke detector adoption. Large industries prefer multi-zone, interconnected smoke detection systems for better safety management.

- Insurance incentives: Many insurance companies offer premium discounts for homes and businesses equipped with certified smoke detectors. This acts as a strong financial motivation for property owners to install fire safety devices.

Market Outlook

- Market Growth Overview: The Smoke Detector market is expected to grow significantly between 2025 and 2034, driven by the rising safety awareness, integration of artificial intelligence (AI) and Internet of Things (IoT) capabilities is transforming, and dual sensor technology.

- Sustainability Trends: Sustainability trends involve extended product life cycles and reduced e-waste, energy efficiency and low power consumption, and smart technology and resource optimization.

- Major Investors: Major investors in the market include The Vanguard Group, Inc., BlackRock, Inc., and State Street Corporation.

Startup Economy: The startup economy is focused on smart home integration, software and service-based models, and niche product developments.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 2.29 Billion |

| Market Size in 2026 | USD 2.48 Billion |

| Market Size by 2034 | USD 4.78 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.52% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, End User, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Rising fire safety regulations

Installing smoke detectors in residential, commercial, and industrial buildings is now required by law due to stricter fire safety regulations enforced by governments and regulatory agencies around the globe. Stable market growth has been fueled by higher compliance rates brought about by stricter enforcement of fire safety and building codes. These days, building managers and real estate developers view fire detection systems as a necessary investment rather than an extravagance. Ensuring compliance with these regulations is also being facilitated by the introduction of intelligent compliance monitoring solutions.

- The U.S. Fire Administration (USFA) is the lead federal agency on fire safety, fire data collection management, public fire education, fire research, and fire service training.?

Increasing fire incident

The increase in incidents involving fire in commercial, industrial, and residential settings has raised awareness of fire safety precautions. The adoption of smoke detectors is growing as a preventative safety measure to lessen risks to life, property damage, and business interruptions. Governments and non-governmental organizations are starting fire safety campaigns that highlight the significance of early fire detection. Businesses are increasingly being compelled to invest in sophisticated fire detection and suppression systems due to the monetary losses incurred by fire disasters in commercial buildings.

Governments and NGOs are launching fire safety campaigns emphasizing proactive fire prevention. High-precision fire safety equipment is being integrated by businesses in an effort to reduce financial losses. With its photoelectric sensing technology and round-the-clock monitoring, AAA Smart Home Security provides smart smoke detectors that improve fire safety efforts by notifying homeowners via smartphone.

- In May 2024, as per the National Crime Records Bureau, over 60 people die every day in India due to fire. Every year, about 25,000 people die due to fires and related causes in India. Women account for about 66% of those killed in fire accidents. Fire accounts for about 6% of the total deaths reported due to natural and unnatural causes.

Restraint

Frequently false alarms leading to consumer frustration

One of the biggest challenges in the smoke detector market is false alarms, which frequently result in irrational emergency reactions and user frustration. Many conventional smoke detectors, particularly those that use ionization, are extremely sensitive to dust building up from bathrooms and cooking fumes, setting off false alarms even in the absence of a true fire hazard. Fire safety is seriously jeopardized since many users disable or remove their smoke detectors due to this inconvenience.

Siemens has unveiled AI-enhanced smoke detection technology that reduces false alarms by using intelligent pattern recognition to distinguish between non-hazardous smoke and actual fire threats. Customer complaints and a decline in confidence in fire safety systems result from the continued production of traditional ionization smoke detectors by numerous older brands, such as Kidde and BRK Electronics, which are still prone to false alarms.

Opportunities

Advancements in detection technology

New innovations in sensor technology, AI-powered fire detection, and machine learning algorithms are significantly improving the accuracy and reliability of products of the smoke detector market. Steam cooking fumes or dust can cause false alarms with traditional detectors, frustrating users and making them turn the devices off. Dual sensor technology (photoelectric + ionization) and heat detection are now used by sophisticated detectors to distinguish between dangerous and innocuous smoke sources.

- In June 2024, Edwards, a division of Carrier Global Corporation, launched Optica. An innovative product that improves early smoke detection in commercial buildings is the Duct Smoke Detector. Multi-criteria sensors are used by the OpticaTM detector to increase response accuracy and decrease false alarms.

Integration with professional monitoring services

Traditional smoke detectors used to sound an audible alarm, but these days, they are being connected to professional monitoring services that are available around the clock to guarantee that fire emergencies are responded to right away, even if the homeowner is not home. By informing residents and emergency personnel, these services shorten response times, minimize property damage, and reduce the possibility of casualties. This change increases the use of smoke detectors by integrating them into a wider ecosystem for fire safety and security.

- In January 2025, Ring introduced a subscription-based monitoring service for its Kidde smart smoke detectors. Subscribers can avail themselves of a professional emergency response team around the clock for just USD 5 a month, which notifies nearby fire departments in the event of a fire.

Segment Insights

Type insights

The photoelectric segment held the dominating share of the smoke detector market in 2024 due to their efficiency in detecting smoldering fires, which are common in homes, offices, and hotels. Photoelectric detectors are preferred over ionization models by governments and regulatory agencies worldwide because they use a light beam to sense smoke particles. In contrast, ionization detectors react quickly to flaming fires, making them more effective at detecting slow-burning fires caused by electrical malfunctions or unattended cigarettes. Photoelectric detectors also demonstrate superior performance in both residential and commercial settings and have lower false alarm rates.

Underwriters Laboratories and the National Fire Protection Association, for instance, support the increased use of photoelectric technology in homes. In this market, major players like Siemens AG, Honeywell International, and Kidde are well-represented and provide cutting-edge photoelectric smoke detection systems with clever connectivity features.

The dual sensor segment is expected to grow at the fastest rate in the market during the forecast period. These detectors are appropriate for both smoldering and fast-flaming fires because of their extensive fire detection capabilities. In large residential complexes, commercial spaces, and mixed-use buildings where various fire hazards exist, this adaptability is especially crucial. The adoption of dual sensor detectors has also increased due to the growing need for intelligent and networked fire detection systems.

Businesses such as first alert BRK Brands and X-Sense are making investments in Internet of Things enabled dual sensors smoke detectors that provide real time notifications to smart phones guaranteeing prompt emergency response times, the expansion of this market is also being accelerated by government programs that support higher fire safety standards in both public and private infrastructures.

End User Insights

The industrial segment held the dominating share of the smoke detector market in 2024 because manufacturing facilities, power plants, chemical factories, and warehouses are at a high risk of experiencing fires. Fire safety is a primary concern because industrial fires can cause significant financial losses, environmental risks, and fatalities. Installing cutting-edge fire detection systems in industrial facilities is required by strict government regulations and workplace safety standards such as those established by the NFPA (National Fire Protection Association) and OSHA (Occupational Safety and Health Administration).

To provide early warning in high-risk situations, industrial smoke detectors frequently integrate with larger fire alarm and suppression systems utilizing technologies such as aspirating smoke detection. Leading firms in this field, including Honeywell, Johnson Controls, and Siemens, offer industrial-grade smoke detection systems designed for dangerous settings. Furthermore, there is a growing need for strong fire safety systems in factories and production facilities due to the growth of industrial infrastructure, particularly in developing nations like China and India.

The residential segment is expected to grow at the fastest rate in the market during the forecast period, driven by rising awareness about fire safety, increasing home automation trends, and supportive government initiatives. Governments around the world have put laws into place mandating smoke detectors in newly built homes and rental properties. States such as California and New York, for instance, have stringent regulations requiring smoke alarms to be installed in every residential unit.

Smart smoke detectors are becoming more common in modern homes. These detectors connect to home automation systems and send alerts straight to the homeowner's smartphone. Companies like Kidde Ring (owned by Amazon) and Nest (a Google subsidiary) are spearheading this change with cutting-edge Wi-Fi-enabled smoked detectors that provide voice alerts and real-time monitoring. The residential segment is the one with the fastest rate of growth for smoke detectors as rising urbanization and rising disposable income levels encourage homeowners to purchase high-quality smoke detection systems.

Regional Insights

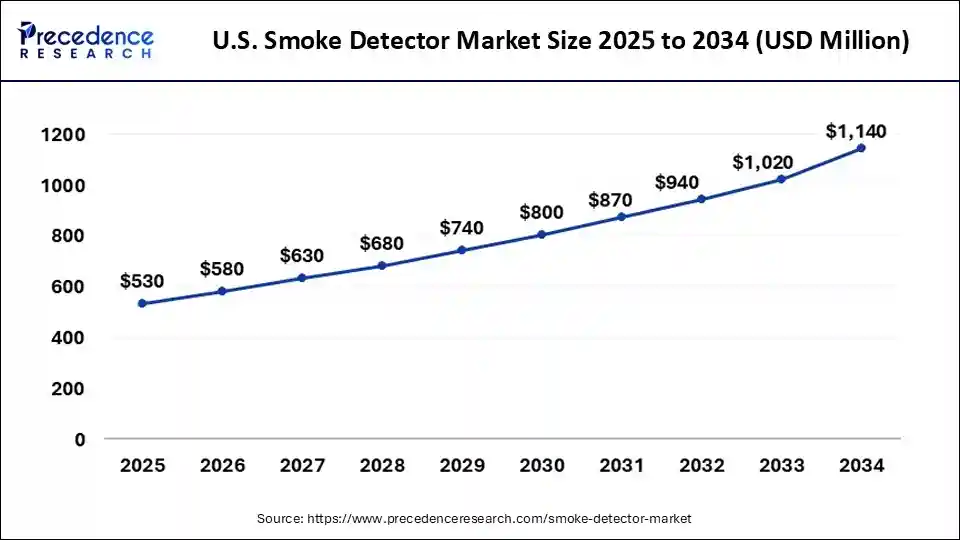

U.S. Smoke Detector Market Size and Growth 2025 to 2034

The U.S. smoke detector market size is exhibited at USD 530 million in 2025 and is projected to be worth around USD 1,140 million by 2034, growing at a CAGR of 8.81% from 2025 to 2034.

North America dominated the smoke detector market with the largest share due to well-established fire safety regulations and high adoption rates in both residential and commercial sectors. Strict building regulations guarantee steady demand by requiring smoke detectors in all newly built and rented properties. Furthermore, widespread installation and routine replacement of antiquated effective public awareness campaigns have reaffirmed the significance of fire safety.

With a growing preference for smart smoke detectors that are in terraces with home automation systems, the area also benefits from ongoing advancements in fire detection technology. Voice alerts, real-time notifications, and remote monitoring are features that many businesses and homeowners are upgrading to. North America's dominant position is further reinforced by insurance incentives for fire safety compliance, which incentivize property owners to purchase dependable smoke detection systems.

Asia Pacific is expected to grow at the fastest rate in the smoke detector market during the forecast period. Strengthened fire safety regulations, growing infrastructure, and fast urbanization. Smoke detector demand has increased because of several countries' governments enforcing mandatory fire safety measures in high-rise residential buildings, offices, and industrial sites. Growing fire hazard incidents have also raised awareness, which has increased adoption in both residential and commercial properties.

- In April 2025, Rashtriya Raksha University (RRU), under the collaboration of its School of Internal Security and SMART Policing and the School of Private, Industrial and Corporate Security Management, successfully conducted a Round Table Meeting of Fire Safety Officers of Gujarat. The session focused on discussing ways to enhance fire safety preparedness, incorporating advanced technologies and empowering frontline personnel through inclusive training initiatives.

Wireless and networked smoke detectors are becoming more and more popular in the area as smart city projects gain traction. Intelligent fire detection systems that offer real-time tracking and immediate alerts are being installed in many urban areas. Furthermore, as fire detection devices become more affordable, middle-class households and small businesses can now afford them, which is driving market expansion.

Europe is currently experiencing the rapid growth in the smoke detector market due to strict fire safety policies and increasing consumer awareness. The market has grown steadily as a result of laws in many nations mandating smoke detectors in all residential and commercial buildings. Furthermore, government programs encouraging battery-operated and energy-efficient smoke detectors have resulted in their widespread use in homes and offices.

The European market is also being shaped by technological developments in wireless and AI-powered fire detection systems. Alarm systems that are connected and send out synchronized alerts to several rooms are becoming more and more popular. Europe is a major market for innovation in the smoke detector sector because of the region's strong emphasis on sustainability and adherence to environmental regulations, which has further stimulated the development of environmentally friendly fire detection solutions.

China Smoke Detector Market Trends

China's integration of smart technology and IoT capabilities caters to tech-savvy consumers who desire remote monitoring and automated home security. The market is seeing a shift toward dual-sensor technology to improve detection accuracy and reduce false alarms, driven by increased public safety awareness. Domestic manufacturers are competing with international players by focusing on cost-effective options, although the broader market is becoming more quality-conscious.

Smoke Detector Market Value Chain Analysis

- Raw Material and Component Sourcing

This initial stage involves the procurement of base materials like plastics for the casing, wiring, batteries (including lithium-ion), and specialized electronic components.

Key Players: Energizer and Panasonic - Design, Engineering, and Manufacturing

In this crucial stage, manufacturers design the smoke detector for functionality, safety compliance, power efficiency, and, increasingly, smart connectivity.

Key Players: Honeywell International Inc., Johnson Controls International PLC, Siemens AG, Resideo Technologies Inc. (including First Alert), and Kidde Fire Safety. - Distribution, Sales, and Marketing

This stage focuses on selling and distributing the finished smoke detectors to various market segments, including residential, commercial, and industrial.

Key Players: The sales and distribution teams of major manufacturers; large retail chains; e-commerce platforms; and specialized fire safety distributors. - Installation and System Integration

This stage involves the physical installation of the smoke detectors in buildings, ranging from simple battery-operated residential units to complex hardwired or wireless interconnected systems in commercial properties.

Key players in Smoke Detector Market and their Offerings

- Honeywell International Inc.: Honeywell contributes significantly to the market with a comprehensive portfolio of residential, commercial, and industrial fire detection systems, including advanced multi-criteria detectors and smart home integration.

- ABB Group: ABB primarily contributes through its electrification and building technologies divisions, providing a range of smoke detectors and integrated building automation solutions focused on safety, efficiency, and smart connectivity.

- Siemens AG: A major player in building technologies, Siemens provides highly reliable fire safety solutions, including sophisticated smoke detectors and complete building management systems, focusing on intelligent technology and compliance with stringent safety standards.

- Hochiki Corporation: Hochiki is a global manufacturer specializing in high-quality, reliable fire alarm equipment, supplying a wide range of conventional and addressable smoke detectors for commercial and industrial applications worldwide.

- Johnson Controls International PLC: Johnson Controls contributes to the market through its extensive range of building products and technologies, offering fire detection systems and smoke detectors under brands like Tyco that integrate with broader safety and security solutions.

- Robert Bosch GmbH: Bosch provides a variety of fire detection technologies as part of its building security and safety solutions, known for reliable sensors and intelligent fire panels that minimize false alarms and ensure early detection.

- Mircom Group: Mircom is a North American-focused company that designs and manufactures fire detection and alarm systems, contributing a broad range of smoke detectors and emergency communication platforms for various building types.

- Kidde Fire Safety: A well-known consumer brand (part of Carrier Global Corporation), Kidde contributes significantly to the residential market with a wide range of battery-powered and hardwired smoke and carbon monoxide alarms, focusing on consumer safety and ease of use.

- TycoFIS (Tyco Fire & Security, now part of Johnson Controls): Tyco leverages its established brand and global reach to supply a vast portfolio of fire protection solutions, including advanced smoke detection systems for commercial, industrial, and institutional markets.

- Nittan Co., Ltd.: Nittan is a Japanese manufacturer specializing in premium fire detection equipment with a strong presence in Asian and European markets, known for reliable photoelectric smoke detectors and innovative fire alarm technology.

Latest Announcement

- In January 2025, Ring announced a partnership with Kidde to launch ring-enabled smart smoke and carbon monoxide alarms. The alarms connect to the Ring app and assist in protecting the home with real-time Ring notifications.

- In March 2025, First Alert, a fire-safety brand, announced a new life-safety collaboration with Google Home, a technology leader in the smart home. The new First Alert Smart Smoke & Carbon Monoxide (CO) Alarm is compatible with the Nest Protect Smart Smoke & CO Alarm.

- In December 2024, Honeywell launched self-testing smoke detectors. Honeywell claims to be the first fire alarm system with EN-approved self-testing smoke detectors that can be tested automatically. The Notifier Inspire fire alarm system with self-test smoke detectors is designed to assist in creating a safer building environment by raising facility managers' awareness of system needs while equipping service providers with digital self-testing tools.

- In January 2024, Hikvision announced a technology partnership with iThermAI to provide AI-based fire and smoke detection solutions. The CEO of iThermAI, Amir Jahanshahi, stated that “Traditional fire systems can't always detect fire or smoke quickly enough, especially in large warehouses or buildings where heat or smoke detectors are located high in the ceiling, or in outdoor or semi outdoor locations where wind is a factor.” This collaboration aims to enhance fire detection capabilities in high-risk environments by integrating iThermAI's algorithms into Hikvision's cameras.

Recent Developments

- In 2025, Siemens announced the launch of an AI-powered fire detection system in April 2025 for industrial applications, using real-time environmental monitoring to minimize false alarms and improve efficiency. To differentiate between innocuous smoke and possible fire hazards, this new system uses self-learning algorithms that continuously adjust to changes in the environment.

- In February 2025, California announced plans to deploy the FireSat network, a constellation of over 50 low-orbit satellites equipped with infrared sensors to improve wildfire tracking and response. The first Firesat satellites are scheduled to launch in 2026, with data provided free to public safety agencies, enhancing resource allocation and firefighting strategies.

Segments Covered in the Report

By Technology

- Photoelectric

- Dual Sensors

- Ionization

By End User

- Commercial

- Industrial

- Residential

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting