What is the Solar Encapsulation Market Size?

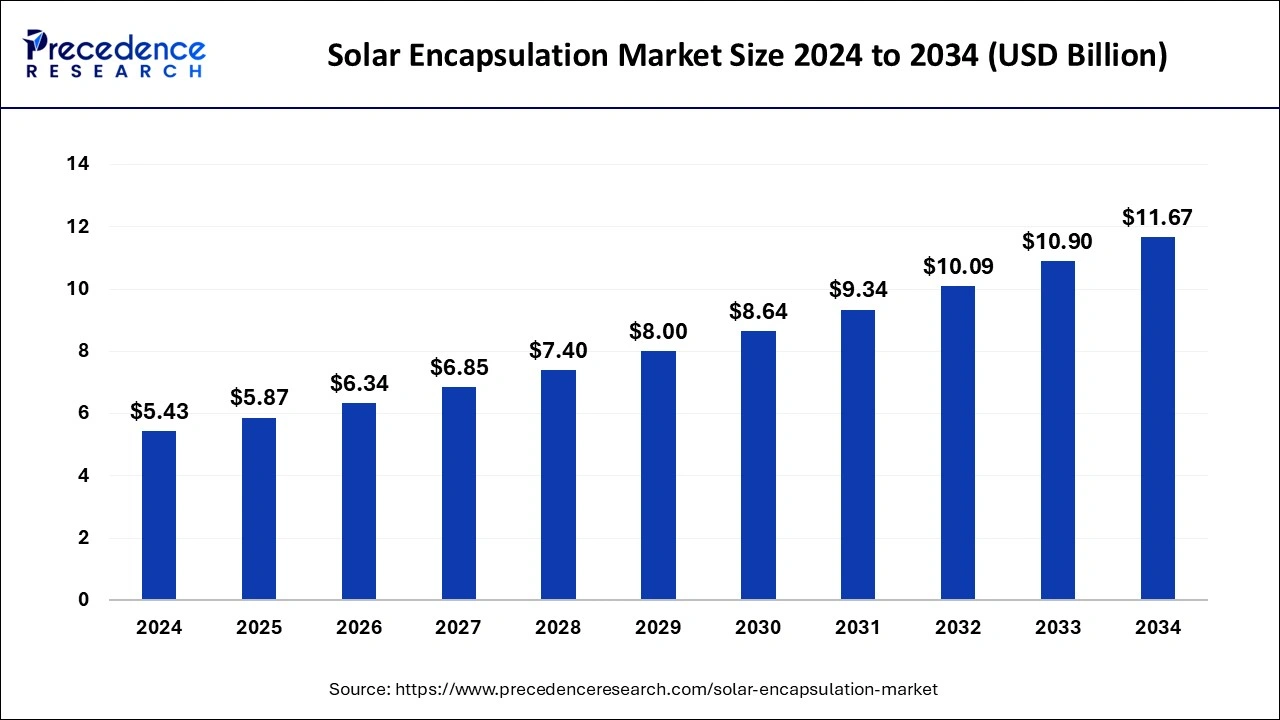

The global solar encapsulation market size accounted for USD 5.87 billion in 2025 and is predicted to increase from USD 6.34 billion in 2026 to approximately USD 12.47 billion by 2034, expanding at a CAGR of 7.83% from 2026 to 2035. The use of renewable energy resources, sustainability, and improvement in environmental conditions are driving the market.

Solar Encapsulation Market Key Takeaways

- The global solar encapsulation market was valued at USD 5.87 billion in 2025.

- It is projected to reach USD 7.83 billion by 2035.

- The solar encapsulation market is expected to grow at a CAGR of 7.83% from 2026 to 2035.

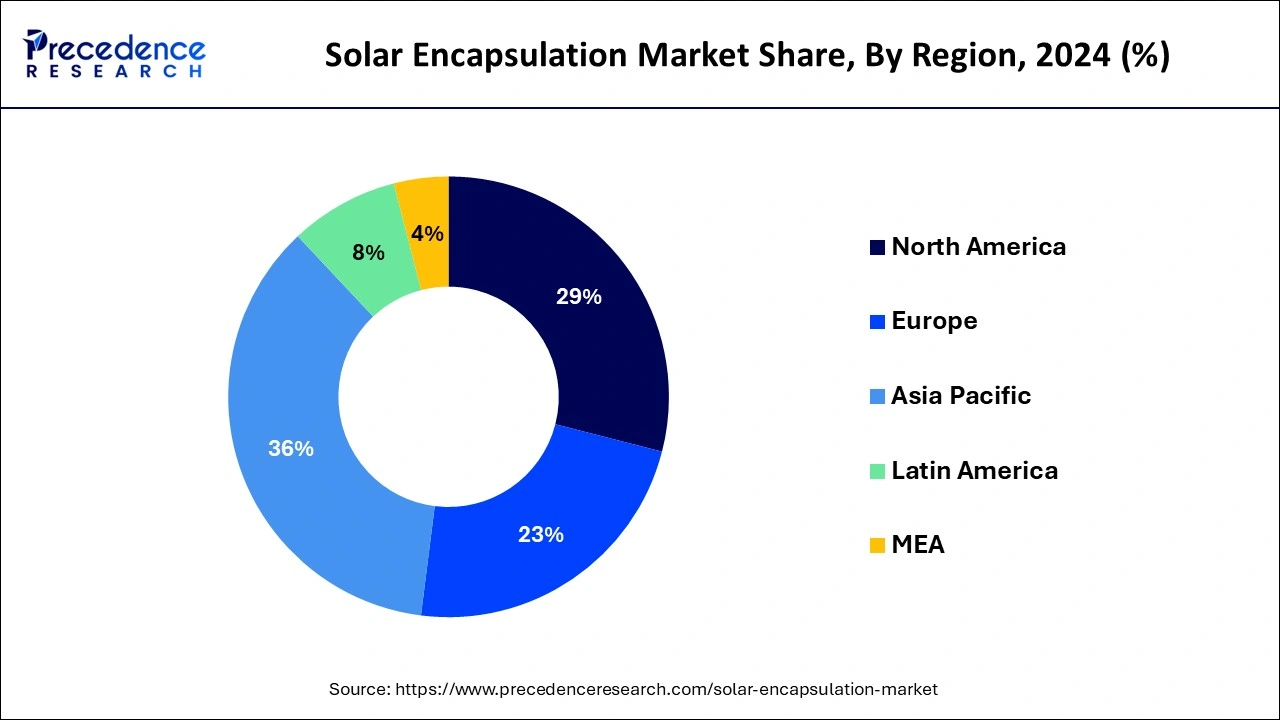

- Asia Pacific dominated the solar encapsulation market in 2025 with 36%.

- Europe is expected to grow at the fastest rate during the forecast period.

- By materials, the ethylene vinyl acetate segment dominated the market in 2025.

- By materials, the thermoplastic polyurethane (TPU) segment is expected to grow at the fastest rate during the forecast period.

- By technology, the crystalline silicon solar technology segment dominated the market in 2025.

- By technology, the thin-film solar technology segment is expected to grow at the fastest rate during the forecast period.

- By end-user, the construction segment dominated the solar encapsulation market in 2025 and is also expected to grow at the fastest rate during the forecast period.

Market Overview

The solar encapsulation market is experiencing significant growth due to factors such as the demand for solar photovoltaics. (PV) Worldwide, there has been a huge rise in the production of solar PV in some countries. Increasing awareness about the encapsulant technology among people and the booming demand for solar encapsulant technology, solar encapsulant technology is used in electronic, automotive, and construction applications; in these applications, solar encapsulant technology use is found highest in construction applications. There are some benefits of using solar enclosures, such as protecting solar panels against climate change and rust. This increases the demand in the market. Along with that, there is investment by key players, and government support also plays a significant role in the market growth.

Solar Encapsulation Market Growth Factors

- The rise in urbanization has led to a higher demand for solar panels. As a result, the demand for solar encapsulation has also increased, making it the primary factor driving the market.

- Rising awareness about solar encapsulation and its benefits, such as increased longevity and increased attack strength of solar cells; due to this, more people are adopting it.

- Government policies such as tax credits, subsidies, and financial incentives influenced homeowners and businesses to invest in solar encapsulation. Some key players also invest in the solar encapsulation industry, which contributes to market growth.

- Research and development to improve existing technology and develop better insulation materials is also beneficial for the market growth.

Key Solar Encapsulation Market Trends

- Governments all over the world are focusing on strengthening their domestic module production process to reduce import dependency, which in turn will accelerate demand for key PV components, including encapsulants.

- The market is also witnessing growing investments in solar projects across emerging economies, which are helping in fostering innovation and creating robust encapsulation materials.

- There is also a rising shift towards high-power density modules and advanced cell architecture. Advancements of technologies like heterojunction and TOPCon, along with the ability to offer superior optical transmission, mechanical durability, and electrical insulation, are also gaining momentum in the market.

- The market is also witnessing an increasing focus on module aesthetics and performance in rooftop and BIPV installations, which will increase the adoption of customized encapsulation materials.

Solar Encapsulation Market Outlook

- Industry Growth Overview: Between 2026 and 2035, the solar encapsulation market is anticipated to grow rapidly, driven by the global shift toward renewable energy and decreasing costs of photovoltaic (PV) systems. The growing number of utility-scale, commercial, and residential solar projects is driving demand for high-performance encapsulants that withstand moisture, mechanical damage, and UV exposure. Advances in the technology of cross-linkable EVA, POE, and other polymer-based films are improving module efficiency and lifespan. Additionally, the market is expected to continue expanding due to rising PV installations, enhanced durability, and new materials.

- Sustainability Trends: Sustainability is becoming a key factor in the market as governments and end-users increasingly demand environmentally friendly, recyclable, and low-VOC materials. Manufacturers are also investing in bio-based polymers, recyclable POE films, and low-volatile EVA alternatives. This ensures they have less environmental impact and maintain high levels of transparency and mechanical stability. Stricter EU and North American environmental policies are driving sustainable materials research, encouraging innovation in both coating and crosslinking, as well as additive technologies.

- Global Expansion:Leading encapsulant manufacturers are extending their global reach to ease supply chain bottlenecks. In Southeast Asia, especially in Vietnam, Thailand, and Malaysia, substantial investments have been made in production capacity to support the rapidly expanding PV installation. They are also entering Latin America and Eastern Europe, motivated by increased government incentives and renewable energy goals.

- Major Investors:The market is drawing attention from private equity and strategic investors because of its high growth potential, alignment with renewable energy, and strong ESG credentials. Investment is flowing toward companies that are developing improved EVA, POE, and bio-based polymer film solar modules. Recently, firms like KKR, Blackstone, and Temasek have invested in polymer and encapsulant producers, highlighting that the industry is profitable and driven by technology.

- Startup Ecosystem:The solar encapsulation startup ecosystem is rapidly expanding, with new companies focusing on sustainable, high-performance, and cost-effective polymer films. Bi-based and recyclable alternatives to EVA and POE, such as Solugen (USA) and Enkay Polymer (India), are in development and offer higher efficiency in modules by reducing environmental impact. These startups are utilizing venture capital funding to grow their production, advance their research and development, and broaden their markets worldwide.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 7.83% |

| Market Size in 2025 | USD 5.87 Billion |

| Market Size in 2026 | USD 6.34 Billion |

| Market Size by 2035 | USD 12.47 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Materials, Technology, and End-User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Cost reduction

The installation cost of solar panels is high, and continuous protection from weather conditions such as intense sunlight, rain, and UV radiation is needed. Without the protection, the solar panels will wear and tear quickly, requiring high replacement or repair costs. The use of solar encapsulation increases the shelf-life of solar panels, reducing the cost of repairing and replacing them.

Sustainable solutions and increased demand for encapsulation

There is a growing need for environmentally sustainable solutions and to reduce carbon footprints globally. This shift towards renewable energy sources has resulted in a high demand for solar panels. Growing urbanization has further increased the need for solar panels, which in turn has raised awareness about the benefits of renewable energy. The installation of solar panels directly impacts the utilization of solar encapsulation.

Restraint

Recycling challenges and degradation of solar encapsulation materials

The complexity of recycling solar encapsulation materials can be a significant restraint for the solar encapsulation market. Existing solar PV panels were not designed to be recycled. The materials for encapsulating solar panels are hard to separate and also make the recycling process of solar panels difficult. This process is not only labor-intensive but also quite complex, which means it's not always cost-effective to recycle solar panels. If they are still recycled, some valuable materials inside often end up being lost or not fully recovered, which can be a real downer for the environment, and this can be a restraint for the market. To reduce the restraint, research & development can be done to improve existing materials used to develop solar encapsulations and also develop new and better materials so that encapsulations can be recycled easily.

For instance, according to research published in Nature Communications, the researchers developed a product that is a room-temperature non-destructive encapsulation of the self-crosslinked fluorosilicone polymer, which enables heat stability sustainably and able perovskite solar cells.

Opportunities

Research and development of encapsulation materials

Development in encapsulation presents a great opportunity for the solar encapsulation market. Research and development can be used to find a more cost-effective way to protect solar panels. By using materials and methods that are cheaper and more efficient, companies can make solar panels more affordable and easier to produce. This not only helps in making solar energy more accessible but also encourages more people to use it. Plus, solar panels can last longer and perform better, and it will be easy to recycle them, which is great for the environment and sustainability.

Adoption of off-grid solar systems

The adoption of off-grid solar equipment is a big opportunity for the solar encapsulation market. The need for renewable energy resources is increasing day by day, and solar energy is a major source. Off-grid solar panels are systems that are not connected to electricity grids but are collected to solar panels for energy generation. The increased adoption of off-grid solar systems will increase the use of solar panels, which will increase solar encapsulation.

Material Insights

The ethylene vinyl acetate segment dominated the solar encapsulation market in 2024. Ethylene-vinyl acetate (EVA) is made from ethylene and vinyl acetate, and this ethylene vinyl acetate (EVA) is used in excellent foamability performance and is lightweight. This material is also used in sports, footwear, and leisure applications and, due to flexibility, is used in solution packaging. Ethylene vinyl acetate has several benefits, such as staying powerful at low temperatures, giving good gloss and clarity, stress-cracking and maintaining its opposition to UV radiation, and keeping hot-melt bond waterproof possessions. Because of these reasons, demand for ethylene vinyl acetate (EVA) is increasing and leading to market growth.

- For instance, in February 2024, according to ChemAnalyst, the US ethylene vinyl acetate improved market dynamics because of bullish sentiments in the US EVA market.

The thermoplastic polyurethane (TPU) segment is expected to grow at the fastest rate during the forecast period. Thermoplastic polyurethane, also known as TPU, is used in various applications; due to the use of this material in new products, TPU is used as a replacement for other materials. Here are some benefits of thermoplastic polyurethane, such as TPU's unique structure, which allows high resilience & greater versatility. TPU is very durable and tough, making it convenient for different semi and soft, rigid applications; TPU can be utilized both as a soft engineering thermoplastic or tough rubber; it's smoothly sterilized and washed, and thermoplastic polyurethane is also superior low-temperature flexibility. Because of these benefits, the demand for thermoplastic polyurethane (TPU) is increasing worldwide and leading to market growth.

Technology Insights

The crystalline silicon solar technology segment dominated the solar encapsulation market in 2024; crystalline silicon PV cells that are used in commercially available solar panels, crystalline silicon solar are more cost-efficient than thin film technology, crystalline silicon technology needs less production process to complete, and this technology is environmentally friendly also contains no harmful material, due to these benefits crystalline silicon solar demand is booming in the market.

The thin-film solar technology segment is expected to grow in the solar encapsulation market during the forecast period. Thin-film solar technology is utilized to convert light energy into electrical energy. In the market, demand for this technology is booming because of its benefits, such as thin-film solar panels being light or other than they are more flexible due to their thin construction.

End-user Insights

The construction segment dominated the solar encapsulation market in 2024 and is also expected to grow in the market during the forecast period. In the construction industry, the use of solar panels is very high, especially in households and other types of buildings. Encapsulation materials are needed to protect solar panels against various factors, including UV radiation, moisture, high temperature, and oxidation. These things can affect solar panels, which increases the demand for solar encapsulation in the construction industry.

Regional Insights

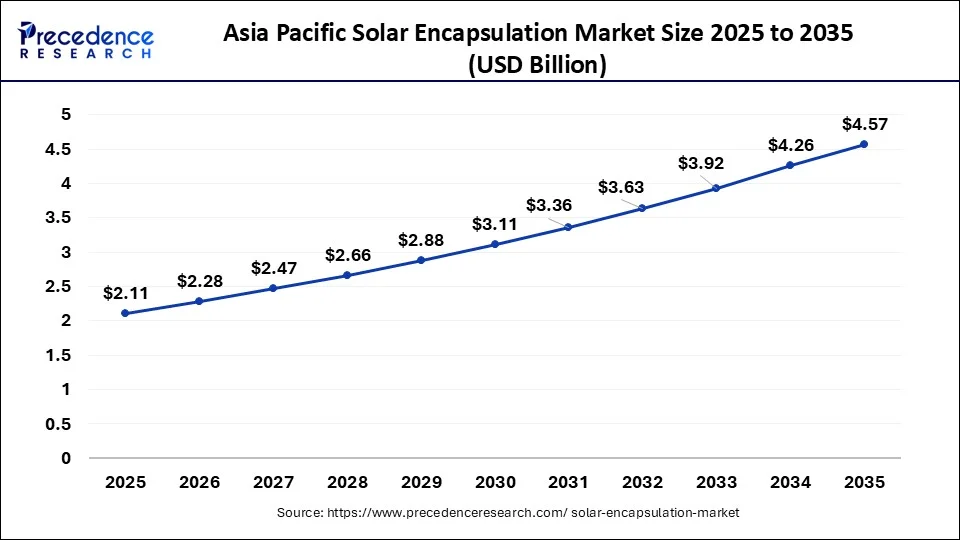

What is the Asia Pacific Solar Encapsulation Market Size?

The Asia Pacific solar encapsulation market size was exhibited at USD 2.11 billion in 2025 and is projected to be worth around USD 4.57 billion by 2035, growing at a CAGR of 8.03% from 2026 to 2035.

What Made Asia Pacific the Dominant Region in the Market?

Asia Pacific dominated the solar encapsulation market in 2025. Some countries have an incredible manufacturing infrastructure and great technology, which reduces the manufacturing cost of solar cells. In some countries, the use of solar encapsulation is growing, such as South Korea's use of encapsulation in producing different devices, including semiconductors, consumer electronics, and displays. China is also using encapsulation in the manufacturing sector; encapsulation is a vast range of products, including computers, consumer electronics, and smartphones. Along with that, in Asia Pacific, Japan is also a booming country in the market; Japan uses solar encapsulation mostly in automobiles and electronics, and technological advancements include semiconductors, consumer electronics, and electronics manufacturing. In Japan, the adoption of solar encapsulation is increasing frequently, which leads to market growth.

- In August 2025, Company Alishan Green Energy launched a coated back sheet in India for solar module encapsulation.

China Solar Encapsulation Market Trends

China's market is growing rapidly as the country remains the world's largest solar panel manufacturer and expands both domestic installations and export capacity, leading to higher demand for high-performance encapsulation materials in module assembly. Encapsulation polymers like EVA continue to dominate due to cost-effectiveness and wide use, while alternatives such as EPE are gaining traction as producers diversify material portfolios.

India Solar Encapsulation Market Trends

India's market is growing rapidly as the country accelerates solar capacity additions to meet ambitious renewable energy targets, driving demand for reliable encapsulant materials in photovoltaic modules. Ethylene vinyl acetate (EVA) remains the dominant material due to its proven performance and cost-effectiveness, while alternatives like POE and TPO are gaining traction for enhanced durability and resistance to harsh climates.

What Potentiates the Growth of the European Solar Encapsulation Market?

Europe is expected to grow during the forecast period; in Europe, the adoption of solar encapsulation is booming in some countries, such as the United Kingdom. In this country, the demand for solar encapsulation is increasing in the automotive industry and renewable energy sectors. The automotive industry depends on encapsulation in different applications, including sensors, automotive electronics, and control units. Encapsulation also helps to protect these elements from powerful operating conditions and confirm their longevity. The UK is investing in renewable energy infrastructure.

- In February 2025, Company Fraunhofer ISE launched module TEC in Europe to advance solar PV modules.

Germany Solar Encapsulation Market Analysis

Germany is a key contributor to the European solar encapsulation market because of its ambitious renewable energy goals and regulatory initiatives promoting sustainable PV solutions. There is increasing investment in research and development of anti-reflective, low-yellowing films, resulting in product innovation. Germany is also a major regional hub for high-quality, durable encapsulant technologies, contributing to market growth.

Why is North America Considered a Significantly Growing Area in the Market?

North America is also experiencing significant growth in the solar encapsulation market. In this region, people are aware of solar encapsulation and their benefits. In this region, some countries such as the US experienced remarkable growth, and in the U.S., government initiatives and policies such as tax credits, subsidies, and state-level incentives, the U.S. ongoing research and development are helping to develop new technology and enhance solar encapsulation materials so that they can survive in unfavorable conditions.

For instance, U.S. company Solutia Solar is an advanced solar encapsulant provider for long-term durability and high-performance solar modules. They are the world's leading supplier of films for automotive, architectural, and photovoltaic applications. Along with that, Canada is also showing significant growth in the market. Canadian Solar is one of the largest suppliers of solar photovoltaic modules worldwide, and it is also one of the largest power plant developers.

How is the Opportunistic Rise of Latin America in the Solar Encapsulation Market?

Latin America is experiencing an opportunistic rise in the market, with Brazil and Chile emerging as key players due to their strong solar resources. These countries are increasingly investing in both utility-scale and distributed PV systems. The limited local production of encapsulants in the region has caught the attention of international encapsulant companies, eager to invest and meet the rising demand.

Brazil leads the market in Latin America, driven by its abundant solar resources and government incentives for utility-scale and distributed PV installations. The country's reliance on imported high-quality EVA and POE films has attracted foreign investment from international encapsulant suppliers. The rising demand for durable, high-quality materials for long-term operations is expected to influence the market.

What Factors Drive the Growth of the Middle East and Africa (MEA) Solar Encapsulation Market?

The market in the Middle East and Africa (MEA) is driven by the high solar irradiance in the Gulf Cooperation Council (GCC) member states. North Africa, in particular, is driving strong demand for PV modules and encapsulation materials that withstand harsh desert conditions. With local encapsulant manufacturing still underdeveloped, foreign suppliers are positioned to take the lead by providing durable EVA, POE, or silicone-based films.

The UAE is expected to lead the solar encapsulation market in the Middle East and Africa because of its ambitious solar megaprojects and high solar irradiance levels. The increasing use of high-efficiency modules in residential, commercial, and industrial buildings is also likely to boost demand for encapsulants. The strategic location of key solar projects is a key factor that sets market leaders in the region apart.

Solar Encapsulation Market Value Chain Analysis

- Raw Material Sourcing:The base for solar encapsulants lies in high-purity polymers such as EVA (ethylene-vinyl acetate), POE (polyolefin elastomers), and other specialty resins, along with additives for UV stability, crosslinking, and adhesion.

Key Players: Arkema, Dow Inc., DuPont, Mitsui Chemicals - Encapsulant Sheet / Film Production: Raw polymers are processed into sheets or films of specific thickness and performance characteristics, ensuring optimal transparency, durability, and mechanical strength.

Key Players: RenewSys, Solutia (now Eastman), SK Nexilis, Hanwha Solutions - Module Lamination & Assembly: Encapsulant films are used to encapsulate PV cells during lamination, bonding the front glass and backsheet while providing mechanical protection, moisture resistance, and electrical insulation.

Key Players: First Solar, JinkoSolar, Trina Solar, LONGi Solar - Solar Module Testing & Quality Assurance: Encapsulated modules undergo testing for efficiency, mechanical stress, thermal cycling, and long-term durability to ensure performance under diverse environmental conditions.

Key Players: TUV Rheinland, Intertek, UL Solutions, DNV - Distribution & Integration: Finished solar modules with encapsulants are shipped to EPCs (Engineering, Procurement, and Construction firms), utility-scale projects, and residential/commercial solar integrators.

Key Players: SunPower, Canadian Solar, Tesla Energy, SMA Solar

Solar Encapsulation Market Companies

- Arkema (France): A global specialty materials company that provides high-performance polymers (like PEKK), adhesives, and sustainable resins used in advanced composites and thermoplastic prepregs.

- Specialized Technology Resources (STR, US): Historically known for solar-grade EVA encapsulants (used in photovoltaics) and polymer testing / QA services, though the company announced dissolution in 2023.

- RenewSys (India): A manufacturer of solar encapsulants and backsheet materials, developing EVA and POE-based specialty polymers for solar module applications.

- Solutia: (Note: Solutia was acquired by Eastman Chemical in 2008; now part of Eastman's specialty chemicals business), historically known for specialty additives, stabilizers, and polymer modifiers.

- Mitsui Chemicals (Japan): Offers a broad portfolio including specialty chemicals for electronics (semiconductor materials), high-performance polymers, green/bio-based materials, and composite materials.

- Borealis (Austria): A chemicals and polyolefins provider that produces base polymers, polyolefins, and specialty materials that feed into high-performance plastics and chemical applications.

- Kuraray (Japan): Known for specialty polymers and elastomers, including high-performance fibers, advanced resins, and chemical intermediates used in composites and specialty applications.

- Hanwha (South Korea): Active in materials and chemical solutions, particularly in high-performance resins, solar-energy related polymers, and advanced composite materials.

- Targray (Canada / Global): Provides advanced materials and supply chain services, including specialty chemicals, raw materials for energy storage (batteries), and solar-material chemicals.

Recent Developments

- In November 2025, First Solar unveiled a new manufacturing facility in the Midwest, aimed at increasing its production capacity for solar modules. This expansion is significant as it not only enhances First Solar's operational capabilities but also aligns with the growing trend of localized production, which can mitigate supply chain disruptions. This facility is expected to create numerous jobs, further solidifying First Solar's commitment to sustainable economic growth in the region.

(First Solar Inaugurates New $1.1 Billion AI-Enabled Louisiana Manufacturing Facility - LED | Louisiana Economic Development) - In October 2023, Shanghai-based AIKO launched its cutting-edge solar cell products, including solar encapsulation technology, in Australia at the All-Energy exhibition in Melbourne.

- In March 2023, the Chemical conglomerate DOW, a US-based company, launched photovoltaic (PV) product solutions for PV module assembly and line with six silicone-based sealants.

Segments Covered in the Report

By Materials

- Ethylene-vinyl Acetate (EVA)

- Thermoplastic polyurethane (TPU)

- Ionomers

- Polydimethylsiloxane

- Polyvinyl Butyral

- Polyolefin

By Technology

- Crystalline Silicon Solar

- Thin-film Solar

By End-User

- Construction

- Automotive

- Electronics

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting