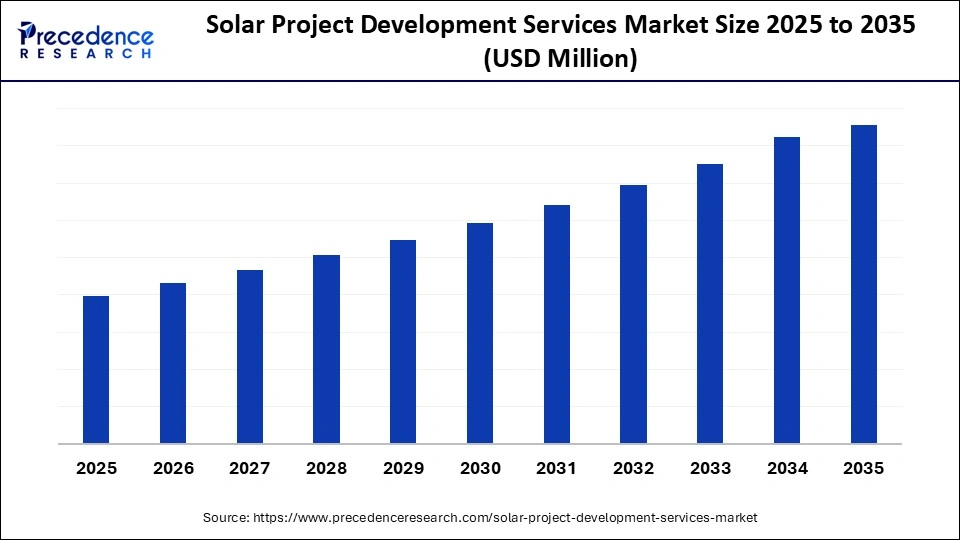

What is the Solar Project Development Services Market Size?

The global solar project development services market focuses on end-to-end solar solutions, including site assessment, permitting, engineering, procurement, and project execution for utility-scale and rooftop projects.The solar project development services market is driven by rising global solar installations, favorable policies, and increasing investments in clean energy infrastructure.

Market Highlights

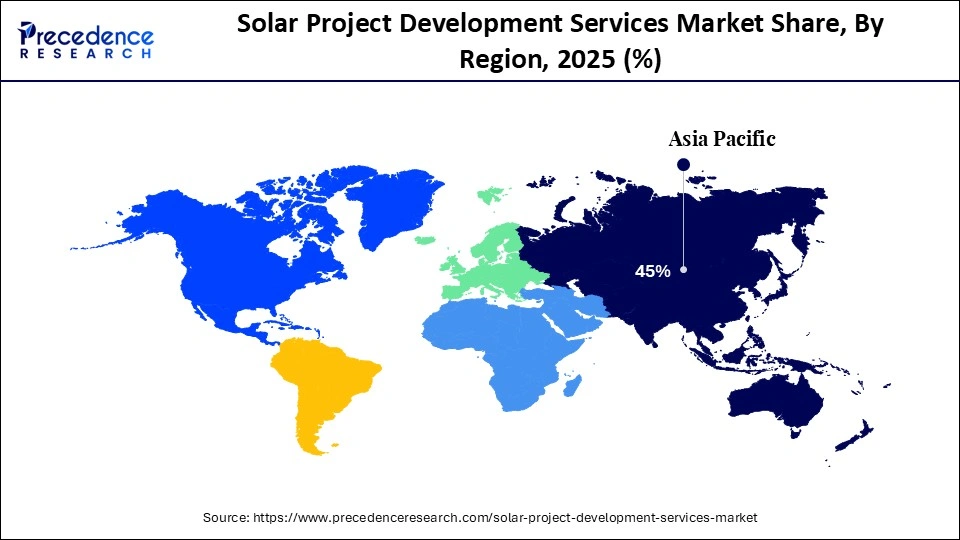

- Asia Pacific dominated the market, holding the largest market share of 45% in 2025.

- The Middle East & Africa is expected to expand at the fastest CAGR of 19.50% between 2026 and 2035.

- By service type, the engineering and design services segment held the biggest market share of 32% in 2025.

- By service type, the financial modeling & PPA structuring segment is expected to grow at a CAGR of 16.40% between 2026 and 2035.

- By technology, the solar photovoltaic (PV) segment contributed the highest market share of 85% in 2025.

- By technology, the floating solar (floatovoltaics) segment is growing at a healthy CAGR of 22% between 2026 and 2035.

- By deployment model, the integrated ePC + development services segment captured the largest share of 48% in 2025.

- By deployment model, the third-party developments as a service (DaaS) segment is set to grow at a 18.30% CAGR between 2026 and 2035.

- By end-user, the utility companies & IPPs segment accounted for the largest market share of 45% in 2025.

- By end-user, the renewable energy investors & funds segment is poised to grow at a strong CAGR of 18% between 2026 and 2035.

Market Overview

The global solar project development services market includes all professional, technical, financial, and regulatory services required to plan, design, permit, construct, commission, and operate utility-scale, commercial & industrial (C&I), and distributed solar power projects. These services span site assessment, feasibility studies, resource analysis, engineering design, permitting, environmental approvals, grid interconnection studies, procurement, EPC management, project financing, PPA structuring, asset management, and operations & maintenance (O&M). Market growth is driven by the global renewable energy transition, declining solar costs, corporate decarbonization targets, government incentives, the expansion of utility-scale solar parks, and the digitalization of project development workflows.

As the world increasingly emphasizes the importance of developing sustainable energy, solar development service providers are becoming essential strategic partners for developers, investors, and utilities seeking a reliable platform to implement their projects. Market growth is driven by the global shift to renewable energy, corporate net-zero commitments, and the continuous decrease in photovoltaic technology costs, making solar increasingly competitive with traditional power sources. Additionally, government subsidies, green financing initiatives, and the expansion of major solar parks continue to support market growth.

Impact of AI on the Solar Project Development Services Market

AI is significantly influencing the solar project development services market by improving accuracy, efficiency, and speed at all stages of development. AI-driven site evaluation systems analyze the terrain, irradiance, grid proximity, and other environmental factors within minutes, which is much faster than traditional feasibility studies. Machine learning models optimize plant design by accurately predicting energy production, modeling panel arrangements, and shading effects. AI also supports financial modeling by forecasting energy output, project returns, and risks. Additionally, ECV is used in building management and construction to improve progress monitoring and quality control.

Solar Project Development Services Market Outlook

- Industry Growth Overview: The market is growing because of the decreasing solar technology prices and rising worldwide demand for clean, stable, and low-carbon power solutions. Furthermore, regulatory support and expanded grid integration plans are driving the market.

- Global Expansion: The market is growing worldwide due to increasing demand for renewable energy, supportive government policies, and rising investments aimed at reducing carbon emissions and dependence on fossil fuels. Emerging regions offer strong opportunities, driven by untapped solar potential, declining solar technology costs, and expanding infrastructure development supported by international funding and public–private partnerships.

- Major Investors: Major investors in the market include government bodies, utility companies, independent power producers, and private equity and infrastructure funds. They contribute by financing large-scale solar projects, supporting technology deployment, enabling grid integration, and accelerating project development through long-term investments and strategic partnerships.

- Startup Ecosystem: The startup ecosystem is flourishing, and companies are developing AI-based project optimization, automated permit process, digital twins, and sophisticated O&M analytics. The ability to minimize development risk, enhance forecast accuracy, and expedite the project schedule is attracting significant venture capital from new entrants.

Market Scope

| Report Coverage | Details |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Middle East & Africa |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Service Type, Technology, Deployment Model, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Service Type Insights

Why Did the Engineering & Design Services Segment Lead the Market in 2025?

The engineering & design services segment led the solar project development services market with a 32% share in 2025 because accurate system design, feasibility analysis, and site optimization are critical to maximizing project efficiency and returns. Advanced conceptual and detailed engineering are used to optimize plant layout and performance, as well as the selection of components and the system. Electrical, civil, and structural design services are provided to meet grid code requirements, safety standards, and long-term durability. As project complexity increased, such as with hybrid solar-storage plants, larger utility-scale facilities, and challenging terrains, the need for high-precision engineering became critical.

The financial modeling & PPA structuring segment is expected to grow at the fastest CAGR of 16.40% during the forecast period, driven by the need for precise project valuation, risk analysis, and bankable contract formats. The use of advanced financial models is becoming popular among developers, investors, and utilities to predict energy yields, returns, and long-term cash flows. As the process of corporate decarbonization accelerates, the PPA organization has become extremely important.

The feasibility studies & site assessment segment is expected to grow significantly in the coming years, as these services are crucial in the early stages to help developers determine land suitability, solar resource potential, and environmental restrictions. Developers also increasingly prioritize early-stage risk reduction and accurate project planning. Detailed assessments help optimize site selection, ensure regulatory and environmental compliance, and improve financial viability, making them essential for securing investments and long-term project success.

Technology Insights

What Made Solar Photovoltaic (PV) the Leading Segment in the Solar Project Development Market?

The solar photovoltaic (PV) segment led the market while holding a 85% share in 2025. This is mainly due to its declining installation costs, scalability across residential to utility-scale projects, and shorter development timelines. Advancements in PV efficiency and widespread policy support further accelerated adoption compared to other solar technologies.

The floating solar segment is expected to grow at the fastest CAGR of 22% during the forecast period due to land shortages, the rise in water-based projects, and increased efficiency caused by cooler operating environments. Installing solar systems on reservoirs, lakes, hydropower dams, and other industrial water bodies optimizes land use and reduces water evaporation. Floating PV is able to combine with hydropower plants to enhance grid stability and capacity. Thus, this technology is gaining attention in areas where land scarcity is a major concern.

Deployment Model Insights

Why Did the Integrated EPC + Development Services Segment Lead the Solar Project Development Services Market?

The integrated EPC + development services segment led the market with a 48% share in 2025. This model reduces the complexity of the coordination process, accelerates schedules, and increases cost predictability by simplifying the engineering, procurement, building, and development processes. By combining engineering, procurement, construction, and development under a single framework, these services offer stronger risk management, better design-to-build integration, and enhanced financing support. Their ability to manage permitting, grid connectivity, supply chains, and O&M transition makes projects more bankable, particularly for large utility-scale solar parks, reinforcing their market dominance.

The third-party DaaS segment is expected to grow at a 18.30% CAGR in the coming years as more developers outsource specialized feasibility, permitting, engineering, and financing to expert service providers. This model allows asset owners, IPPs, and investors to scale their projects without large in-house teams, providing flexibility, modularity, and cost-effective development support. DaaS companies offering digital workflows, AI-based resource evaluation, and risk prediction systems are becoming increasingly popular as the market becomes more competitive, and the regulatory environment grows more complex.

The developer-led BOT/BOOT models segment is expected to grow significantly over the forecast period, driven by demand for long-term revenue stability and asset ownership. The developers have operational control in the initial years of the project and can leverage cash flow stability from power purchase contracts to sell the assets to investors. These models are particularly appealing in emerging markets, where utilities seek to participate privately to reduce capital requirements at the start-up stage. BOT/BOOT also enhances flexibility in financing, risk sharing, and the development of small-volume solar parks.

End-User Insights

How Does the Utility Companies & IPPs Segment Dominate the Market in 2025?

The utility companies & IPPs segment dominated the solar project development services market with a 45% share in 2025 due to their leadership in developing large-scale solar parks that demand advanced engineering, complex permitting, and long-term power purchase agreements. Their strong access to capital, established regulatory relationships, and ability to collaborate with integrated EPC providers position them as key contributors to global solar capacity additions. Moreover, rising national renewable energy targets and expanding transmission infrastructure are driving utilities and independent power producers to increasingly adopt solar projects to support decarbonization strategies.

The renewable energy investors & funds segment is expected to grow at a 18% CAGR in the upcoming period due to rising confidence in solar projects as long-term, low-risk investments backed by stable cash flows from power purchase agreements. Institutional investors such as private equity firms, pension funds, and ESG-focused funds increasingly rely on professional development services to ensure project bankability, regulatory compliance, and optimized returns. Additionally, the expansion of secondary solar asset markets and the growing availability of high-quality project pipelines are further accelerating demand for specialized solar project development expertise.

The commercial & industrial enterprises segment is growing significantly as businesses adopt solar systems to lower their operating costs, meet sustainability goals, and secure a reliable energy supply. These enterprises require customized development solutions, including comprehensive feasibility studies, rooftop and ground-mounted system designs, regulatory approvals, and innovative financing options such as corporate PPAs or lease agreements. Energy supply resilience is being strengthened as more companies install behind-the-meter solar and hybrid solar-plus-storage systems. Online permit systems and scalable engineering solutions are speeding up the deployment of warehouses, factories, data centers, and retail facilities.

Regional Insights

What Made Asia Pacific the Dominant Region in the Global Solar Project Development Services Market?

Asia Pacific dominated the global market with the highest market share of 45% in 2025, thanks to its strong renewable energy ambitions, high urbanization rates, and robust government-backed solar policies. China, India, Japan, South Korea, and Australia expanded their utility-scale and distributed solar project pipelines with improved grid infrastructure and lower project development costs. The region benefits from established local manufacturing, trained EPC companies, and competitive financing, which speed up project execution. The rapid growth of solar parks, floating solar projects, and rooftop solar systems has increased demand for advanced development services, making Asia Pacific the leading region for solar project development worldwide.

China Solar Project Development Services Market Trends

China is leading the market in Asia Pacific with its extensive installation plans, strong policy support, and unmatched capacity to produce modules, inverters, and tracking systems. The country is developing large-scale utility solar projects, hybrid renewable parks, and grid-parity initiatives across desert regions like Xinjiang and Inner Mongolia. Another major effort by China involves expanding distributed rooftop solar in residential and commercial sectors nationwide. The grids are rapidly modernizing, interconnection opportunities are increasing, and investments in energy storage integration are creating complex development opportunities. Additionally, digital project planning, AI-assisted resource analysis, and automation in construction are establishing China as an innovation hub within the global solar industry.

Why is the Middle East & Africa Considered the Fastest-Growing Region in the Solar Project Development Services Market?

The Middle East & Africa (MEA) is expected to grow at the fastest CAGR of 19.50% during the forecast period due to increasing energy diversification efforts and high solar irradiance. Countries like the UAE, Saudi Arabia, Egypt, Morocco, and South Africa are among the emerging nations accelerating the development of utility-scale solar plants as part of their ambitious national clean energy initiatives. The region is also establishing gigawatt-scale solar parks, hybrid solar-plus-storage projects, and green hydrogen developments. Improved regulatory transparency and longer PPAs continue to grow, attracting advanced solar development services in MEA markets.

South Africa Solar Project Development Services Market Analysis

South Africa is a key player in the MEA market as the country faces rising power demand, grid instability, and a strong need to diversify its energy sources. REIPPP continues to be a major driver, with large-scale solar projects and numerous international developers showing interest in the Renewable Energy Independent Power Producer Vanam Program. The increasing adoption of C&I, especially in the mining, industrial, and commercial sectors, highlights the importance of feasibility studies that support project development, EPC coordination, and financing expertise. Frequent load-shedding has sped up the development of rooftop and utility-scale solar-plus-storage projects. Moreover, improved regulatory reforms, better licensing opportunities for private sector generation, and increased investor confidence are strengthening South Africa's role in the African solar development landscape.

What Potentiates the North American Solar Project Development Services Market?

The market in North America is growing thanks to favorable federal incentives, significant investments by the business sector, and the expansion of utility decarbonization requirements. The U.S. Inflation Reduction Act (IRA) has greatly enhanced the economic cost benefits of the project by offering tax credits, incentives for domestic manufacturing, and long-term policy certainty. The implementation of C&I solar, solar parks, and community solar programs is rapidly expanding in both the U.S. and Canada. The demand for advanced systems, such as solar-plus-storage, grid modernization programs, and engineering solutions, is driven by the need to design, finance, and develop digital services.

U.S. Solar Project Development Services Market Trends

The market in the U.S. is driven by rising utility-scale installations, expanding distributed generation, and increasing corporate PPA activity. Developers are streamlining project timelines through AI-based resource assessment, automated design tools, and advanced interconnection modeling, while domestic manufacturing of modules, inverters, and components under the Inflation Reduction Act (IRA) is strengthening supply chain reliability. States such as Texas, California, Florida, and Arizona continue to lead installations, with growing adoption of solar-plus-storage systems, community solar projects, and access to long-term financing further supporting market growth.

Top Companies in the Solar Project Development Services Market & Their Offerings

- NextEra Energy: Offers EPC, storage, and long-term asset management solutions and develops large-scale solar projects.

- LONGi Green Energy Technology: It provides high-efficiency module-supported solar project development and EPC services to its global utility projects.

- JinkoSolar: Turnkey solar development backed by state-of-the-art PV modules and a full fleet of engineering and building facilities.

- Adani Green Energy Ltd: It focuses on utility-scale solar development that has end-to-end development, land acquisition, and grid commissioning.

- TotalEnergies: Invests in global solar projects, and it has high capabilities in financing, engineering, grid integration, and renewable portfolio development.

Other Major Companies

- Brookfield Renewable

- Tata Power Solar

- Canadian Solar

- Sterling and Wilson Solar

- Waaree Energies

- First Solar

- Azure Power

- ReNew Power (ReNew Energy Global PLC)

- Mahindra Susten

- Vikram Solar

- Lightsource bp

- L&T Solar (Larsen & Toubro)

- Jakson Group

- CleanMax Enviro Energy Solutions

- Onix Renewable Ltd.

Recent Development

- In October 2025, Kalpa Power launched WATTBANK, a productized battery energy storage service for commercial and industrial enterprises. The service provides 50% savings on evening peak tariffs from day one.(Source: https://www.mercomindia.com)

Segments Covered in the Report

By Service Type

- Feasibility Studies & Site Assessment

- Solar Resource Analysis

- Land & Environmental Assessment

- Engineering & Design Services

- Conceptual & Detailed Engineering

- Electrical/Civil/Structural Design

- Permitting & Regulatory Approvals

- Grid Interconnection Studies

- Project Management & EPC Support

- Financial Modeling & PPA Structuring

- Procurement & Vendor Management

- Construction Supervision & Commissioning

- Asset Management & O&M Advisory

By Technology

- Solar Photovoltaic (PV)

- Fixed-Tilt Systems

- Single-Axis Tracking Systems

- Bifacial Module Integration

- Concentrated Solar Power (CSP)

- Parabolic Trough

- Solar Tower

- Floating Solar (Floatovoltaics)

By Deployment Model

- Integrated EPC + Development Services

- Stand-Alone Development Consulting

- Developer-Led BOT/BOOT Models

- Third-Party Development-as-a-Service (DaaS)

By End-User

- Utility Companies & IPPs

- Commercial & Industrial Enterprises

- Government & Municipal Bodies

- Renewable Energy Investors & Funds

- Residential Developers/Installers

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting