Sport App Market Size and Forecast 2025 to 2034

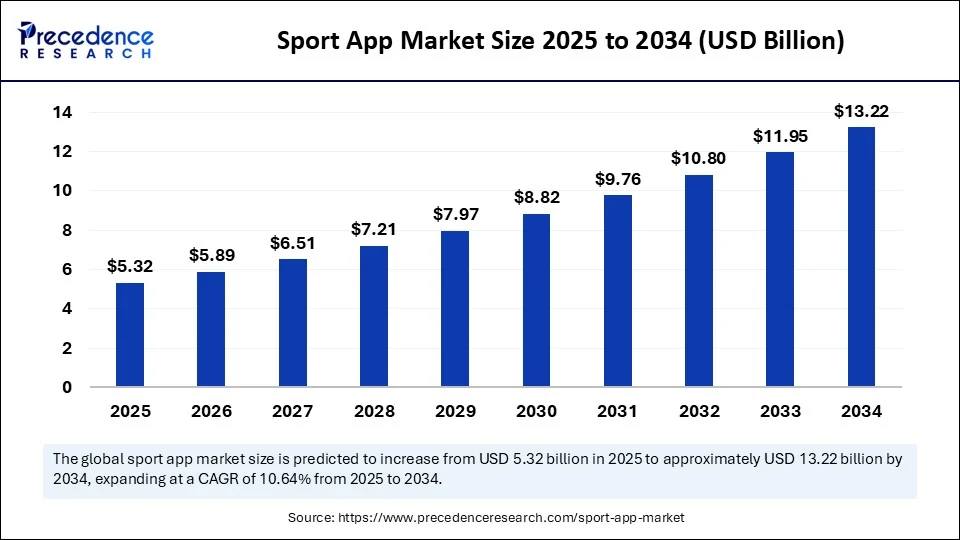

The global sport app market size was estimated at USD 4.81 billion in 2024 and is predicted to increase from USD 5.32 billion in 2025 to approximately USD 13.22 billion by 2034, expanding at a CAGR of 10.64% from 2025 to 2034. The increasing popularity of esports and fantasy sports, live sports streaming services, penetration of reliable internet connectivity, and increasing awareness regarding health and fitness are driving the growth of the market.

Sport App Market Key Takeaways

- In terms of revenue, the global sport app market was valued at USD 4.81 billion in 2024.

- It is projected to reach USD 13.22 billion by 2034.

- The market is expected to grow at a CAGR of 10.64% from 2025 to 2034.

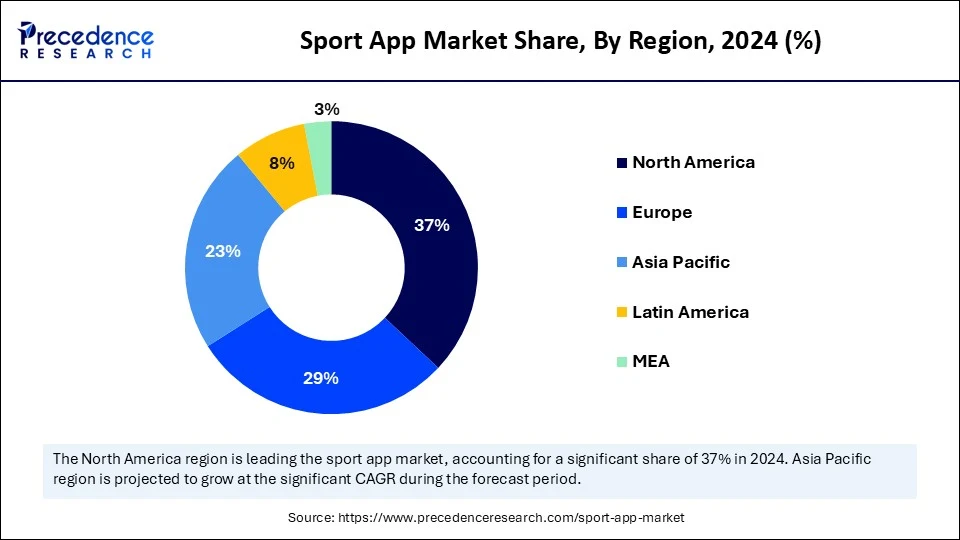

- North America dominated the sport app market with the largest share of 37% in 2024.

- Asia Pacific is estimated to expand at the fastest CAGR during the forecast period.

- By type of app, the fitness and training apps segment led the market with the biggest share in 2024.

- By type of app, the fan engagement and social sports apps segment is expected to witness the fastest growth in the coming years.

- By sports category, the general fitness and multiple sports apps segment contributed the highest market share in 2024.

- By sports category, winter and extreme sports apps segment is likely to grow at the fastest rate in the upcoming period.

- By user type, the consumers (amateurs, fitness enthusiasts) segment captured the largest market share in 2024.

- By user type, the sports organizations and broadcasters segment is expected to expand at the fastest CAGR during the projection period.

- By platform, the mobile apps segment led the market in 2024.

- By platform, the web/desktop apps segment is expected to grow at the fastest rate in the market in the upcoming period.

- By revenue model, the freemium (free + premium features) segment held the major market share in 2024.

- By revenue model, the pay-per-view/paywall segment is expected to grow rapidly over the projected period.

Impact of AI on the Sport App Market

Artificial intelligence is revolutionizing the sport app market by boosting user experiences, personalizing content, and improving performance analysis. AI is invaluable for athletes, as it assesses training and offers insights through data analytics, thereby enhancing performance. Handling the substantial traffic is essential for live sports streaming services. AI algorithms analyze vast amounts of data to provide personalized experiences. It is used to analyze performance data, optimize training regimens, and predict player movements, leading to improved strategies and outcomes. AI also increases user engagement and provides deeper insights into the sport. AI-driven chatbots offer instant support and information, enhancing user satisfaction.

AI is vital in live streaming apps, ensuring a seamless experience. In fantasy sport apps, AI-based analytics provide crucial insights from vast databases, informing strategies and yielding exceptional results. AI-driven platforms also optimize team and resource management, leveraging player strengths for better outcomes.

U.S. Sport App Market Size and Growth 2025 to 2034

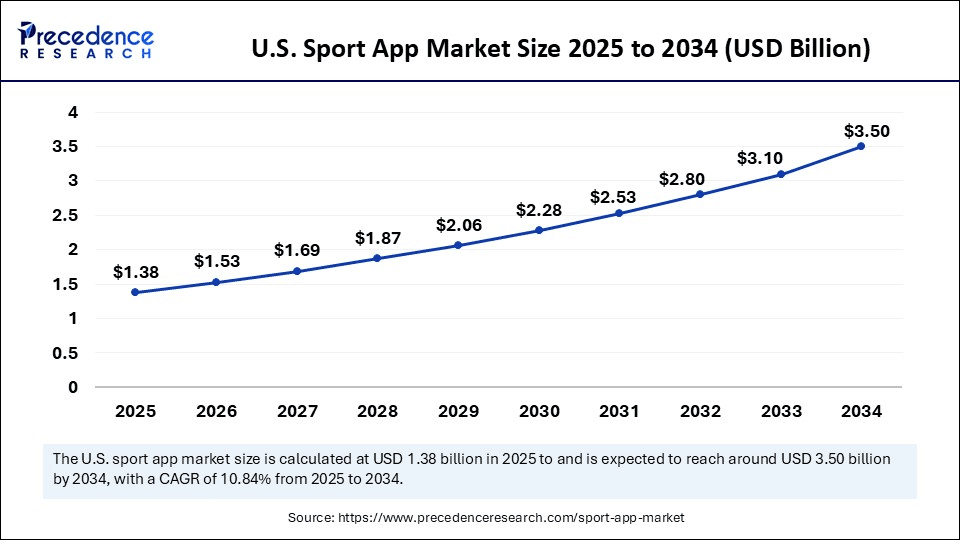

The U.S. sport app market size was exhibited at USD 1.25 billion in 2024 and is projected to be worth around USD 3.50 billion by 2034, growing at a CAGR of 10.84% from 2025 to 2034.

What Made North America the Dominant Region in the Sport App Market?

North America dominated the market with the largest share in 2024. This is mainly due to its robust technological infrastructure, widespread smartphone penetration, and the availability of high-speed network connectivity. There is a high adoption of sports apps as a means of entertainment. The region is home to a large number of market players, driving innovation. Moreover, the presence of major sports leagues and teams contributes to the regional market. There is a high demand for live-streaming sports, making sports apps the preferred choice.

Why is the Europe Showing Notable Growth in the Sport App Market?

The strong sporting culture and presence of digital ecosystems are driving the growth of the European sports apps market. Users strongly adopt a deep-rooted passion for sports, such as football, which is one of the popular games in the European region, which significantly creates demand for various sports streaming apps.

The interactive features enabled in these apps have enhanced the overall experience, which is one of the primary reasons for growth in the European region, where users want to be part of the games, and these interactive platforms make them feel that way while increasing customer engagement and leading to more popularity of the app.

Why is Asia Pacific Showing the Fastest Growth in the Sport App Market?

Asia Pacific is expected to grow at the fastest CAGR during the forecast period. The region's rapid growth is supported by the increasing use of smartphones and widespread internet access, creating a strong foundation for sports apps. Countries like China and India are seeing a surge in demand for sports content on digital platforms. Popular leagues such as the Indian Premier League fuel the adoption of fantasy sports and skill-based gaming apps. In addition, the rise of eSports further supports regional market growth.

Market Overview

The sport app market refers to mobile and web-based software applications designed to enhance, monitor, or enable engagement in sports-related activities. These apps cater to individual users (athletes, fans), teams, coaches, sports professionals, or sports media platforms. The market encompasses fitness and training apps, live sports streaming apps, fantasy sports apps, team management and analytics platforms, and fan engagement and social sports platforms. These apps are widely used by consumers, sports organizations, and broadcasters, with functionality spanning from performance tracking and fan interaction to AI-based coaching and immersive viewing experiences.

Sport App Market Growth Factors

- The rising adoption of fitness and training apps, driven by increased interest in active lifestyles, is boosting the growth of the market.

- The widespread use of smartphones has made sports content accessible anytime, anywhere, contributing to market growth.

- Technological advancements have made live sports streaming seamless, allowing a large audience to access games via mobile apps and web platforms.

- Fantasy games have also gained immense popularity in recent times, which are supported by live streaming apps, boosting the growth of the market.

- The growing popularity of eSports is creating new opportunities for sports apps to provide live streaming, news, and tournament information.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 13.22 Billion |

| Market Size in 2025 | USD 5.32 Billion |

| Market Size in 2024 | USD 4.81 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 10.64% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type of App, Sports Category, User Type, Platform, Revenue Model, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Technological Advancements and Widespread Internet and Smartphone Penetration

Technological advances have enabled personalized experiences in sports apps, significantly contributing to the growth of the sport app market. Innovations such as augmented reality (AR), virtual reality (VR), and advanced data analytics provide immersive content and deeper insights into sports. These platforms provide real-time updates, enabling users to access scores, statistics, live game broadcasts, detailed analysis, and game history from any location. This convenience enhances the overall experience compared to traditional sources, offering information at the user's discretion. The app tailors content based on the user's preferences, personalizing the feed to match their individual choices. Moreover, the widespread availability of smartphones and reliable and fast internet allows more people to easily access sports apps, boosting user numbers.

Restraint

Intense Competition in the Market and High Subscription Costs Due to Expensive Copyright Deals

Intense competition from both existing and new market entrants, coupled with low entry barriers, is squeezing revenue and profitability. Many players offer free initial services to attract users. High copyright costs force streaming platforms to raise subscription prices, making them unaffordable for many. This leads to subscriber churn and hinders market growth. The increasing number of subscription services can lead to user fatigue, as people may hesitate to subscribe to multiple apps. Moreover, these apps require a stable internet connection, which can limit accessibility in areas with poor connectivity, hindering market growth.

Opportunity

Partnerships with Sports Leagues and Teams

Partnerships with sports leagues and teams create immense opportunities in the sport app market. These collaborations grant access to exclusive content, like live games and player interviews, boosting user engagement and app usage. Such partnerships enhance credibility, as users trust apps associated with their favorite teams. This also expands the user base by tapping into the massive fan bases of sports leagues. Moreover, these collaborations create monetization opportunities through advertising and subscriptions, benefiting both the app and the sports organizations. They also provide valuable data on fan behavior, enabling personalized user experiences and refined app offerings, driving overall market growth.

Type of App Insights

Why Did the Fitness & Training Apps Segment Dominate the Market in 2024?

The fitness & training apps segment dominated the sport app market with the largest share in 2024. The popularity of sports apps stems from their large user base, drawn to features like fitness tracking, workout guidance, and live sports streaming. Fitness tracking, in particular, is a major component, offering personalized coaching and guidance in a cost-effective manner, which greatly impacts daily health and fitness routines. The growing health-conscious population is likely to support segmental growth.

The fan engagement & social sports apps segment is expected to grow at the fastest rate in the upcoming period. This is mainly due to the increasing use of social media. The rise of social media has fundamentally changed how fans interact with sports. Social sports apps capitalize on this trend by integrating social features, allowing users to share their experiences, discuss games in real time, and connect with other fans. This creates a sense of community and belonging, which users highly value.

Sports Category Insights

How Does the General Fitness & Multiple Sports Apps Segment Dominate the Market in 2024?

The general fitness & multiple sports apps segment dominated the market with the highest share in 2024. The dominance of this segment arises from its broad appeal, encompassing a wide audience, unlike specialized fitness and sports apps. These apps cater to the general public by offering various features, such as basic workouts, tracking, exercise routines, and lifestyle monitoring, which appeals to the large audience seeking fitness guidance.

The winter and extreme sports apps segment is expected to grow at the highest CAGR over the projection period. This is mainly due to the increased sports and adventure activities such as bikepacking, outdoor adventures, extreme tracking on mountains, etc. The increased enthusiasm among the public for mountain biking, cycle touring, etc, is creating substantial demand for these apps.

User Type Insights

What Made Consumers the Dominant Segment in the Sport App Market?

The consumers (amateurs, fitness enthusiasts) segment dominated the market, capturing the largest revenue share in 2024. Among the general public, awareness regarding health and fitness has increased, boosting the adoption of fitness & training apps, which help them monitor growth, provide guidance, and set fitness goals based on activity levels. Fitness apps benefit from wearable technology, offering precise activity tracking and data. This provides users with insights to create effective, personalized plans. These apps provide consumers with workout plans, nutrition advice, and all the guidance needed to achieve fitness goals.

The sports organizations & broadcasters segment is expected to grow at the fastest rate over the forecast period. The sports organizations and broadcasters segment is projected to experience the most rapid growth during the forecast period. Approximately 70% of these entities utilize real-time analytics platforms to gain a competitive edge in sports games. Data analytics apps are used for operational optimization of game plans, schedule tracking, logistics, and resource management. This aids in developing effective strategies, making informed decisions, and leveraging insights into opponent strategies and team strengths.

Platform Insights

Why Did the Mobile Apps Segment Dominate the Sport App Market in 2024?

The mobile apps (iOS/Android) segment dominated the market with a major revenue share in 2024. This is primarily due to the increased penetration of smartphones and internet connectivity. The widespread availability of mobile devices and rapid internet connectivity, particularly with the advent of 5G technology, enhances accessibility to sports streaming, fitness guidance, and fantasy apps. The user-friendly interfaces and diverse features of mobile apps further solidify their popularity, as they are easily navigable by users with varying levels of technical expertise.

The web/desktop apps segment is expected to expand at the highest CAGR in the upcoming period. The growth of the segment is attributed to the extensive features and seamless integration capabilities of these apps. Desktop platforms are ideal for handling complex data analytics, including detailed graphs and insights, which may be limited on mobile apps due to processing power and screen size constraints.

Revenue Model Insights

How Does the Freemium (Free + Premium Features) Segment Dominate the Market in 2024?

The freemium (free + premium features) segment dominated the sport app market with the highest share in 2024. The dominance of the segment stems from its core structure, offering users a basic set of services for free while charging for additional, premium features. This approach attracts users with the initial free offerings, making them more likely to subscribe for extra services compared to platforms that require immediate payment. This strategy is the main reason behind the freemium segment's strong position in the market.

The pay-per-view/paywall segment is expected to experience the fastest growth. This segment primarily features premium services tailored for a high-end clientele. The rising demand for exclusive, premium content and services is boosting the growth of the segment. Consumers are increasingly willing to pay for high-quality, specialized information and expert guidance, especially in areas like health and fitness, where validated insights can lead to tangible benefits. This shift in consumer behavior, valuing premium content, is driving the rapid expansion of this segment.

Sport App Market Companies

- Nike Training Club

- Strava

- Adidas Running (Runtastic)

- MyFitnessPal

- Under Armour (MapMyRun, MapMyFitness)

- ESPN App

- CBS Sports

- DAZN

- Dream11

- FanDuel

- Zova

- Coach's Eye

- TeamSnap

- Hudl

- Bleacher Report

- OneFootball

- WHOOP

- Betradar

- SofaScore

- Kooora App

Recent Developments

- In December 2024, The Sports Authority of Andhra Pradesh (SAAP) introduced ‘Kreeda App' in India. This first-of-its-kind mobile application is designed to modernize and streamline sports management across the state.

(Source: https://timesofindia.indiatimes.com) - In September 2024, Outside, a media company, acquired MapMyFitness apps from Under Armour. MapMyFitness is a suite of mapping technology apps from Under Armour. a suite of GPS-based tracking apps across different sports apps such as MapMyRide, MapMyRun and MapMyWalk apps etc.

(Source: https://www.axios.com)

Segments covered in the report

By Type of App

- Fitness & Training Apps

- Fantasy Sports Apps

- Live Sports Streaming Apps

- Team & Player Management Apps

- Sports Betting Apps

- Fan Engagement & Social Sports Apps

By Sports Category

- General Fitness & Multiple Sports Apps

- Football/Soccer Apps

- Cricket Apps

- Running & Cycling Apps

- Basketball Apps

- Tennis & Racket Sports Apps

- Winter and Extreme Sports Apps

By User Type

- Consumers (Amateurs, Fitness Enthusiasts)

- Professional Athletes & Teams

- Sports Fans

- Coaches & Trainers

- Sports Organisations & Broadcasters

By Platform

- Mobile Apps (iOS/Android)

- Wearable-Integrated Apps

- Web/Desktop Apps

By Revenue Model

- Freemium (Free + Premium Features)

- Subscription-Based

- In-App Purchases

- Advertising-Supported

- Pay-Per-View / Paywall

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting