What is the Tax Tech Market Size?

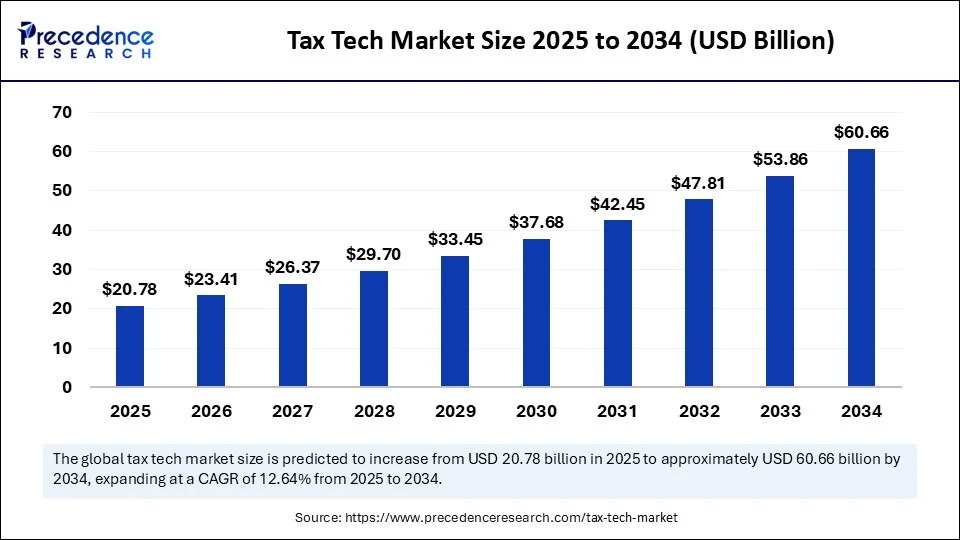

The global tax tech market size is accounted at USD 20.78 billion in 2025 and predicted to increase from USD 23.41 billion in 2026 to approximately USD 60.66 billion by 2034, expanding at a CAGR of 12.64% from 2025 to 2034. The rising demand for centralized tax technologies to provide scalable and automated solutions is driving the growth of the global tax tech market. Rising IT spending and the use of advanced data analytics are boosting market growth globally.

Tax Tech MarketKey Takeaways

- The global tax tech market was valued at USD 18.45 billion in 2024.

- It is projected to reach USD 60.66 billion by 2034.

- The market is expected to grow at a CAGR of 12.64% from 2025 to 2034.

- North America dominated the global tax tech market with the largest share of 39% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR in the coming years.

- By component, the software segment held the biggest market share in 2024.

- By component, the services segment is expected to grow at the fastest CAGR during the forecast period.

- By tax type, the indirect tax segment accounted for a considerable share in 2024.

- By tax type, the property tax segment is anticipated to grow at a significant CAGR during the studied years.

- By technology, the Artificial Intelligence (AI) and Machine Learning (ML) segment led the global market in 2024.

- By technology, the blockchain segment is expected to grow at a notable CAR in the coming years.

- By enterprise size, the large enterprises segment contributed the highest market share in 2024.

- By enterprise size, the small and medium enterprises (SMEs) segment is projected to grow at the fastest CAGR in the future years.

- By industry vertical, the Banking, Financial Services, and Insurance (BFSI) segment held the highest market share in 2024.

- By industry vertical, the Retail & E-commerce segment is projected to grow rapidly during the forecast period.

Impact of AI on the Tax Tech Market

Artificial intelligence is significantly transforming tax technology by automating several tasks, improving accuracy, and enhancing fraud detection. AI helps tax professionals with higher-value tasks. The ability of AI to analyze vast amounts of data, optimization, provide real-time data-driven decisions, and use predictive analytics makes it an impressive choice in tax technology to improve efficiency and accuracy, reduce costs, and regulatory compliance. The rapid shift toward digitalization is a major factor in increasing the popularity and acceptance of AI in tax management solutions. Large enterprises are implementing AI with their existing system and software to automate routine tax compliance and reporting to comply with regulatory requirements and improve accuracy.

A survey report published by the EY Tax and Finance Operations (TFO) in November 2024 finds generative AI (GenAI) will help transform tax and finance functions, helping to address inefficiencies, talent shortages, and compliance with emerging reporting obligations, including those related to global minimum taxes. While 87% of chief financial officers (CFOs) and tax leaders say GenAI will drive increased efficiency and effectiveness, up from 15% in 2023, three in four (75%) say they are only in the early stages of their GenAI journey.

(Source: https://www.ey.com)

What are the Major Requirements of Tax Tech?

The tax tech market involves solutions for tax-related activities. It includes software, platforms, and services that automate and streamline tax processes. The tax tech market is witnessing rapid growth, driven by the increasing need for tax compliance, the rising adoption of cloud-based solutions, and the growing complexity of tax regulations. Additionally, the market benefits from the automation of manual tasks, the improvement of data analytics, and the integration of AI to boost efficiency and accuracy.

Tax Tech Market Growth Factors

- Tax Regulation and Complexity: The increased use of e-commerce has increased the complexity of tax regulations, driving the need for advanced tax management software and services to enhance compliance and accuracy.

- Digitalization: Digital transformation in industries is driving demand for cutting-edge tax management solutions to manage financial applications and goods and services tax more efficiently and accurately.

- Small and Medium-sized Enterprises Demand: The demand for advanced tax management solutions has witnessed growth in small and medium-sized enterprises for more productivity and efficiency.

- Adoption of Cloud Computing: Industries are adopting cloud computing in tax management to enhance scalability, accessibility, and cost-effectiveness.

- Demand for Tax Automation: Businesses worldwide have increased demand for automation solutions for tax management, driving innovation and development of tax technology solutions.

Tax Tech Market Outlook:

- Global Expansion: A rise in regulatory complexity, the universal efforts into the digital revolution, and the integration of AI and cloud-based platforms are assisting the overall progression.

- Major Investor: In November 2025, Avalara, a provider of tax and compliance technology, closed an equity investment from a consortium spearheaded by BlackRock's Private Financing Solutions.

- Startup Ecosystem: In April 2025, Kintsugi, a San Francisco-based startup, received Series B funding to facilitate a cloud-based platform for automated sales tax management.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 60.66 Billion |

| Market Size in 2025 | USD 20.78 Billion |

| Market Size in 2026 | USD 23.41 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 12.64% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Tax Type, Technology, Enterprise Size, Industry Vertical, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Drivers

Shift Toward Digital Tax Administration

Digital tax strategies are becoming transformative for tax technology. Organizations are focusing on implementing digital tax technologies to improve efficiency and compliance and streamline taxpayer experiences. Additionally, government initiatives and investments in digitalization encourage tax leaders to adopt digital tax administrations. Growing adoption of cutting-edge technologies like AI, blockchain technology, and cloud computing is shifting toward offering scalable, secure, transparent, more efficient, and cost-effective tax administrations. Changing regulatory conditions and sustainability demands have increased focus on tax transparency, making it a significant need to leverage digital tax technologies.

- In April 2025, the Income Tax Department introduced e-Pay Tax, a new digital feature that makes it simpler and faster for individuals and businesses to pay their tax dues online, to provide a smooth, user-friendly experience right from the comfort of your home.

Restraint

High Costs and Data Security Concerns

High costs associated with tax tech solutions are a major factor restraining the growth of the tax tech market. Integrating new systems with existing IT infrastructure is complex, requiring substantial investments in software and hardware. This creates challenges for small businesses. Moreover, tax technologies store sensitive financial data, leading to increased concerns over data privacy and security. This may deter potential organizations from investing in tax technologies.

Opportunity

Increasing Tax Compliance

The growing complexity of tax regulations and the need for accurate reporting create immense opportunities in the tax tech market. Governments worldwide have imposed regulations and tax laws, driving demand for advanced tax tech solutions to improve tax strategies. Ongoing innovative approaches in the development of businesses navigate complex regulations, offering a significant step in the advancement of tax technology. Businesses are implementing innovative software, including tax compliance software, tax risk management solutions, and regulatory reporting solutions, to improve tax regulations and services. Tax tech solutions help businesses to reduce regulatory compliance and improve accuracy & efficiency to streamline their compliance processes.

Component Insights

Why Did the Software Segment Dominate the Market in 2024?

The software segment dominated the tax tech market with the largest share in 2024. This is mainly due to the increased need for automation, accuracy, scalability, and flexibility in tax tech solutions. Tax software helps to enhance accuracy and ensure regulatory tax compliance. Businesses are rapidly adopting cloud-based tax software solutions to improve flexibility and scalability in business requirements and comply with changing tax regulations.

The services segment is expected to grow at the fastest CAGR during the forecast period. Businesses are driving demand for tax tech services, including implementation services, support, and outsourcing services for navigating complex tax regulations and ensuring compliance. Services provide customized solutions to specific business requirements, helping to improve the effectiveness of tax management and compliance. The GST and IT sectors are the major adopters of tax tech management services.

Tax Type Insights

How Does Indirect Tax Segment Dominate the Tax Tech Market in 2024?

The indirect tax segment dominated the market with a major share in 2024. This is mainly due to the continuous evolution of indirect tax. Indirect tax regulations include sales tax, GST, and VAT. The rising cross-border transactions and globalization have increased indirect tax compliance requirements, driving the need for tax tech solutions. Additionally, the digitalization of the indirect tax enables businesses to comply with regulations.

The property tax segment is anticipated to grow at a significant rate during the studied years due to the rising importance of property tax compliance. Tax tech solutions help businesses ensure accuracy and fairness in property tax compliance. Tax tech solutions help with property tax assessment, including valuation, appeals, and reporting. The growing need for automation in property tax management and reporting is fueling the segment's growth.

Technology Insights

What Made Artificial Intelligence (AI) and Machine Learning (ML) the Dominant Segment in 2024?

The Artificial Intelligence (AI) and Machine Learning (ML) segment dominated the tax tech market with the biggest revenue share in 2024. This is primarily due to the increased need for automation to streamline tax processes. The government is promoting the use of Artificial Intelligence (AI) and Machine Learning (ML) to enable tax technologies to enhance development and infrastructure enhancements. AI and ML can automate several tasks, reduce manual errors, and improve efficiency. Businesses are implementing AI and ML with tax technology solutions for advisory, reporting, filing, anomaly detection, and data analytics applications.

The blockchain segment is expected to grow at a notable rate in the coming years due to the rising implementation of blockchain technology in tax policies for formulation, adoption, and engagement. Blockchain technology offers great transparency, security, efficiency, and data integrity. Efficient and effective tax administration, such as the VAT system, driving blockchain implementation, is essential to strengthen the system and enhance parties' trust.

Enterprise Size Insights

Why Did the Large Enterprise Segment Dominate the Tax Tech Market in 2024?

The large enterprise segment dominated the market by capturing the largest revenue share in 2024 due to the shift of large enterprises toward the adoption of tax tech solutions for the management of taxes and compliance with regulatory compliance and requirements. Rapid digital transformation in large enterprises is fueling this shift. Complexity of tax regulations and high-volume transaction base drive demand for tax tech solutions in large enterprises.

On the other hand, the small and medium enterprises (SMEs) segment is projected to grow at the fastest CAGR in the future years. The significant growth of small and medium enterprises is driving the adoption of tax tech solutions to comply with tax compliance requirements and administrative procedures. Small and medium enterprises are rapidly adopting digital solutions to streamline operations, including tax tech solutions.

Industry Vertical Insights

What Made BFSI the Dominant Segment in the Tax Tech Market in 2024?

The banking, financial services, and insurance (BFSI) segment dominated the market with a major share in 2024. This is mainly due to their vast tax data, requiring automation to streamline workflows. The rapid adoption of mobile banking, digital wallets, and chatbots is driving the need for tax tech solutions. Additionally, rising ‘Tax Transformation 2.0' outlines driving transformative initiatives in the BFSI sector. Key companies and government bodies are investing heavily in tax tech solutions for the BFSI sector to handle complex tax regulations and high volumes of transactions.

For instance, in February 2025, Fifteenth, a tax solution built to serve the unique needs of founders, investors, executives, and tech professionals with complex financial situations, raised $8.25 million in seed funding to scale up tax preparation.

The retail & e-commerce segment is expected to grow at the highest CAGR during the forecast period. The growth in global e-commerce and cross-border payments is driving the adoption of tax tech solutions for calculations, accuracy, and compliance with regulatory requirements. The government of various countries has allowed foreign direct investments to promote e-commerce businesses, fueling the expansion of the retail & e-commerce sector. This expansion has made it difficult to manage tax policies & rules; the implementation of tax tech solutions like tax management solutions helps improve accuracy, reduce downtime, and enhance overall transparency.

Regional Insights

Emergence of Digital Initiative is Fueling Europe

With a notable growth of the tax tech market in Europe, it is mainly propelled by the ongoing initiatives in the digital sector, such as the European Union's approval of the ViDA package, with rules targeted to be introduced into force by 2030 (full interoperability by 2035). This initiative will mandate digital reporting commitments and e-invoicing for cross-border transactions, focusing on minimising VAT fraud and compliance expenses.

Leveraging Public Sector Platforms: Accelerates the German Market

The substantial growth of the German market is explored by the ELSTER (Elektronische Steuererklärung) is a major electronic tax filing system utilised by individuals and businesses to submit tax returns and communicate with tax authorities. Whereas, the BZStOnline is the Federal Central Tax Office's online portal for managing cross-border reporting and other international tax obligations.

Emphasis on Simplifying Tax Administration is Impacting MEA

The prospective growth of the tax tech market in MEA will be propelled by the incorporation of transforming digital platforms that can streamline tax administration. Like, the UAE Federal Tax Authority (FTA) introduced the EmaraTax digital platform for simplifying tax administration, e-filing, and compliance. In recent days, they have also issued legislation for a Domestic Minimum Top-Up Tax (DMTT) effective from fiscal years starting on or after January 1, 2025.

Stepping Towards E-invoicing & ETS: Expands the African Market

Specifically, Uganda has been putting efforts into the transformation of pivotal e-invoicing and ETS launch, which has shown a 30% growth in tax collections. Alongside, they are implementing the evolution of data analytics for the detection of discrepancies between buyer and seller reports.

Key Players Offerings:

- Ernst & Young Global Limited- A major company prominently offers a comprehensive suite of tax technology solutions and services.

- Consulting Services LLP- It provides services, like tax technology and automation, digital tax solutions, and data analytics.

- Vertex Inc.- A significant leader specialising in multiple tax types and are delivered through a platform that unites with existing ERP, e-commerce, and procurement systems.

- Avalara, Inc.- It explored Avalara AvaTax, a core tax calculation engine that transfers highly precise, real-time sales and use tax, VAT, GST, and industry-specific tax calculations.

- KPMG Assurance- A company implementing assurance services regarding the execution and operation of tax technology.

Tax Tech Market Companies

- Ernst & Young Global Limited

- Consulting Services LLP

- Vertex Inc.

- Avalara, Inc.

- KPMG Assurance

- Transfer Pricing Associates BV

- Grant Thornton Advisors LLC

- Deloitte Touche Tohmatsu Limited

- SAP SE

- Wolters Kluwer N.V.

- Thomson Reuters

- Sovos Compliance

- Xero Limited

- TaxJar

Resent Developments

- In March 2025, EY collaborated with NVIDIA AI to launch EY.ai Agentic Platform to drive multi-sector transformation, starting with tax, risk, and finance domains.

- In March 2025, Town, a U.S.-based start-up specializing in SME tax solutions, debuted with an $18 million seed round led by venture capital firm First Round Capital.

Segments Covered in the Report

By Component

- Software

- Tax Compliance Software

- Tax Planning and Management Software

- Others

- Services

- Implementation Services

- Support and Maintenance

- Others

By Tax Type

- Direct Tax

- Indirect Tax

- Property Tax

- Payroll Tax

- Others

By Technology

- Robotic Process Automation (RPA)

- Big Data and Analytics

- Natural Language Processing (NLP)

- Blockchain

- Artificial Intelligence (AI) and Machine Learning (ML)

- Others

By Enterprise Size

- Large Enterprises

- Small and Medium Enterprises (SMEs)

By Industry Vertical

- Pharmaceutical & Healthcare

- Banking, Financial Services, and Insurance (BFSI)

- IT and Telecom

- Retail & E-commerce

- Oil & Gas

- Manufacturing

- Government

- Others

By Region

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting