Telematics Control Unit Market Size and Forecast 2025 to 2034

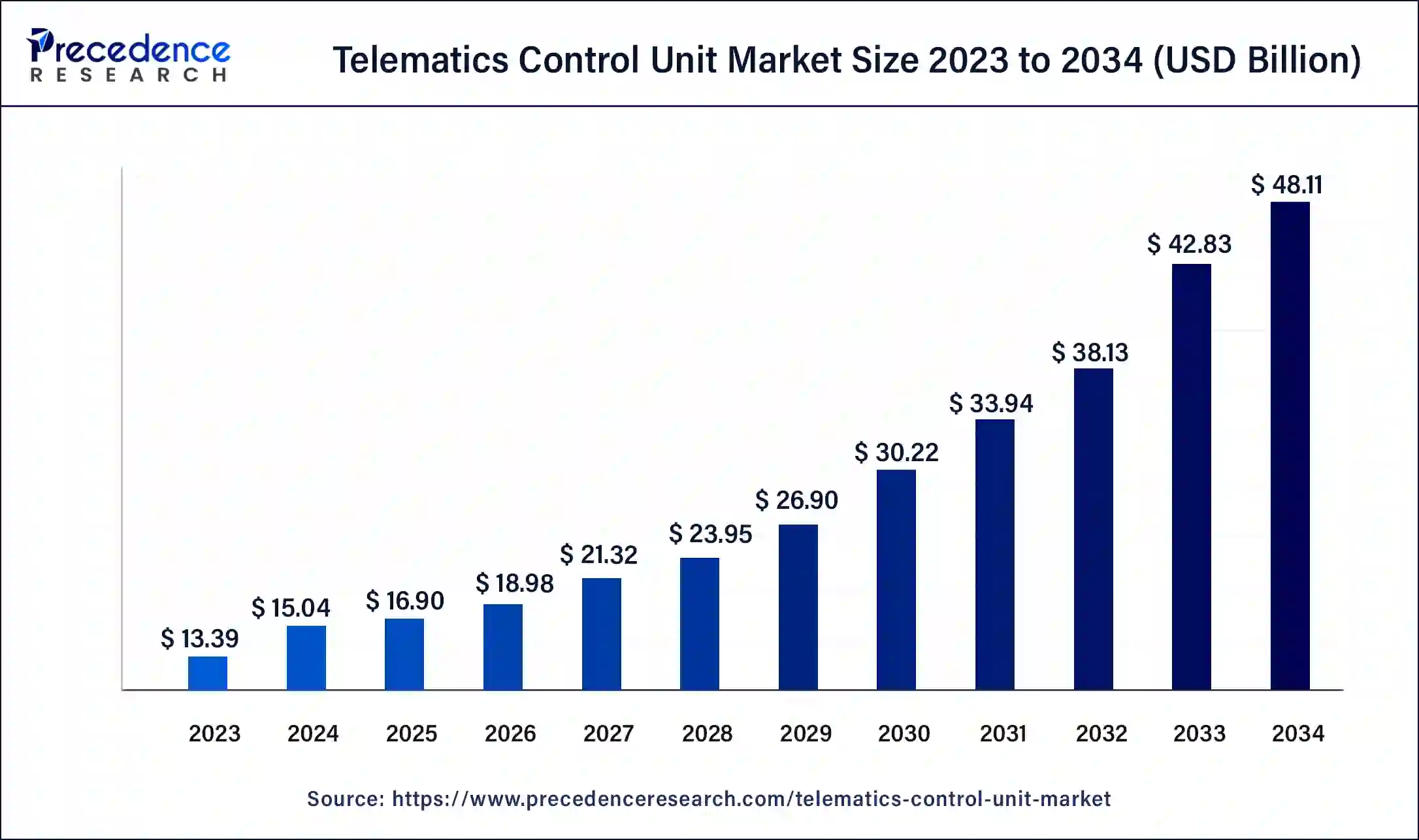

The global telematics control unit market size was estimated at USD15.04 billion in 2024 and is predicted to increase from USD 16.83 billion in 2025 to approximately USD 48.99 billion by 2034, expanding at a CAGR of 12.60% from 2025 to 2034. The telematics control unit market is driven by the growing need for sophisticated ADAS (advanced driving assistance systems).

Telematics Control Unit Market Key Takeaways

- In terms of revenue, the telematics control unit market is valued at $16.83 billion in 2025.

- It is projected to reach $48.99 billion by 2034.

- The telematics control unit market is expected to grow at a CAGR of 12.60% from 2025 to 2034.

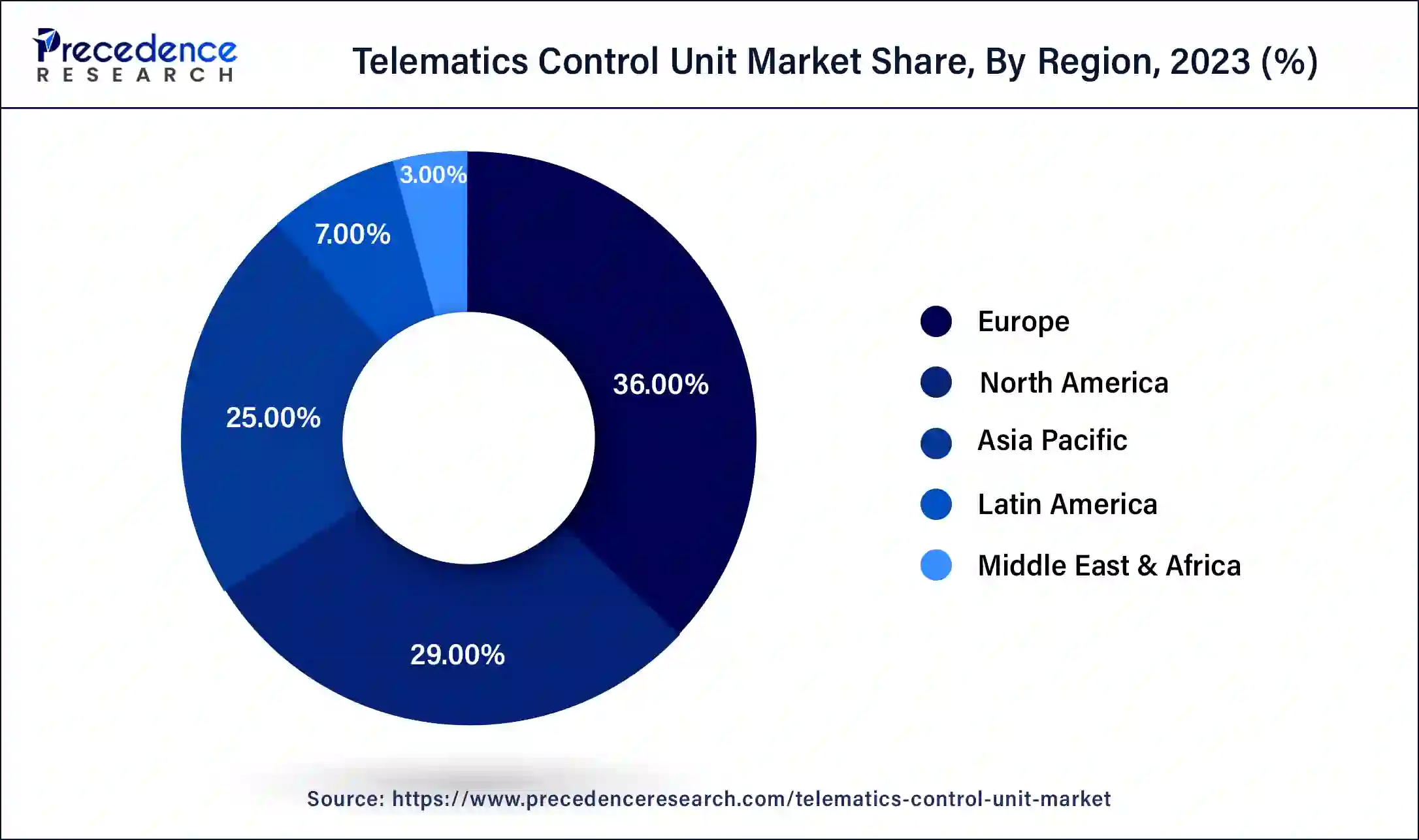

- Europe dominated the telematics control unit market with the largest market share of 35.44% in 2024.

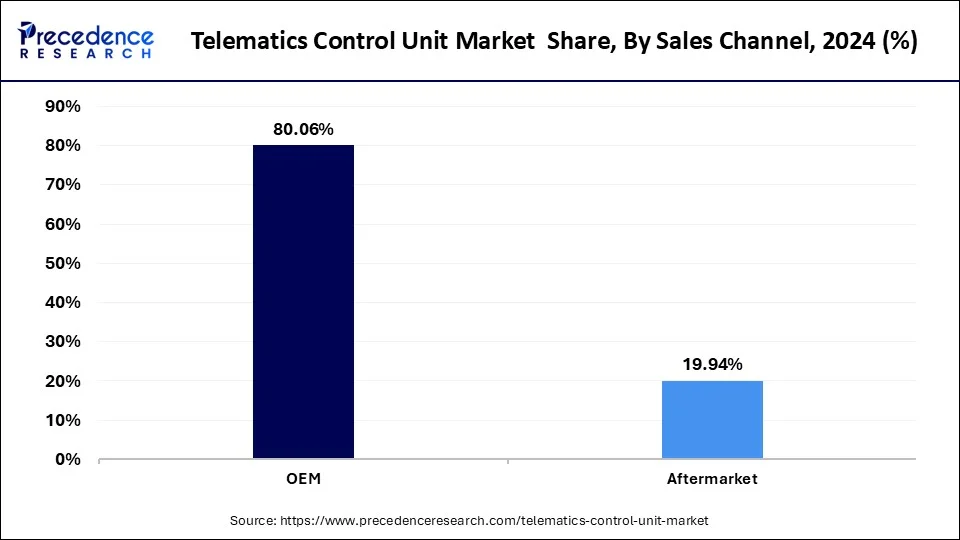

- By sales channel, the OEM segment captured the biggest market share of 80.06% in 2024.

- By sales channel, the aftermarket segment is observed to be the fastest growing CAGR of 13.3% during the forecast period.

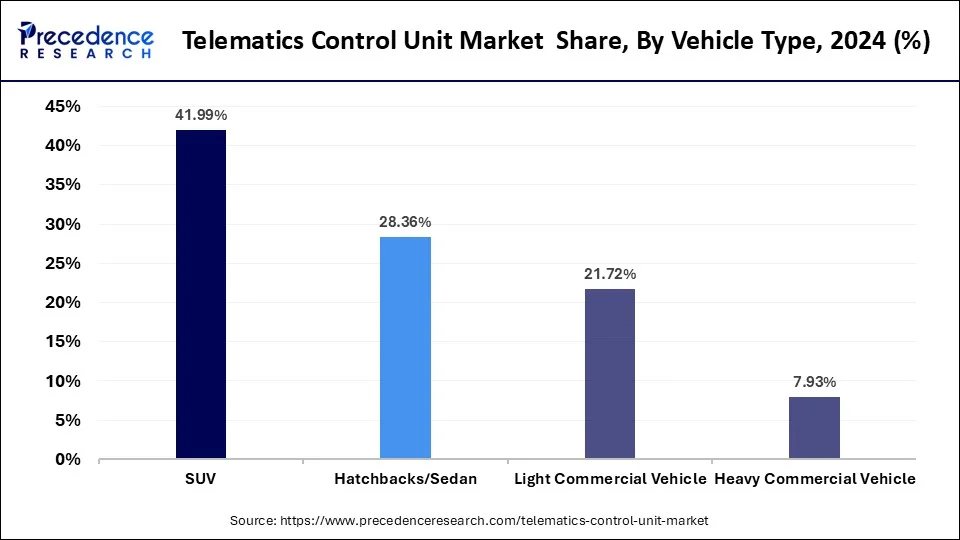

- By vehicle type, the SUV segment contributed the highest market share of 41.99% in 2024.

- By vehicle type, the hatchbacks segment is observed to be the fastest growing CAGR of 13.3% during the forecast period.

- By application, the insurance segment generated the major market share of 33% in 2024.

- By application, the safety and security segment shows a significant CAGR of 13.9% during the forecast period.

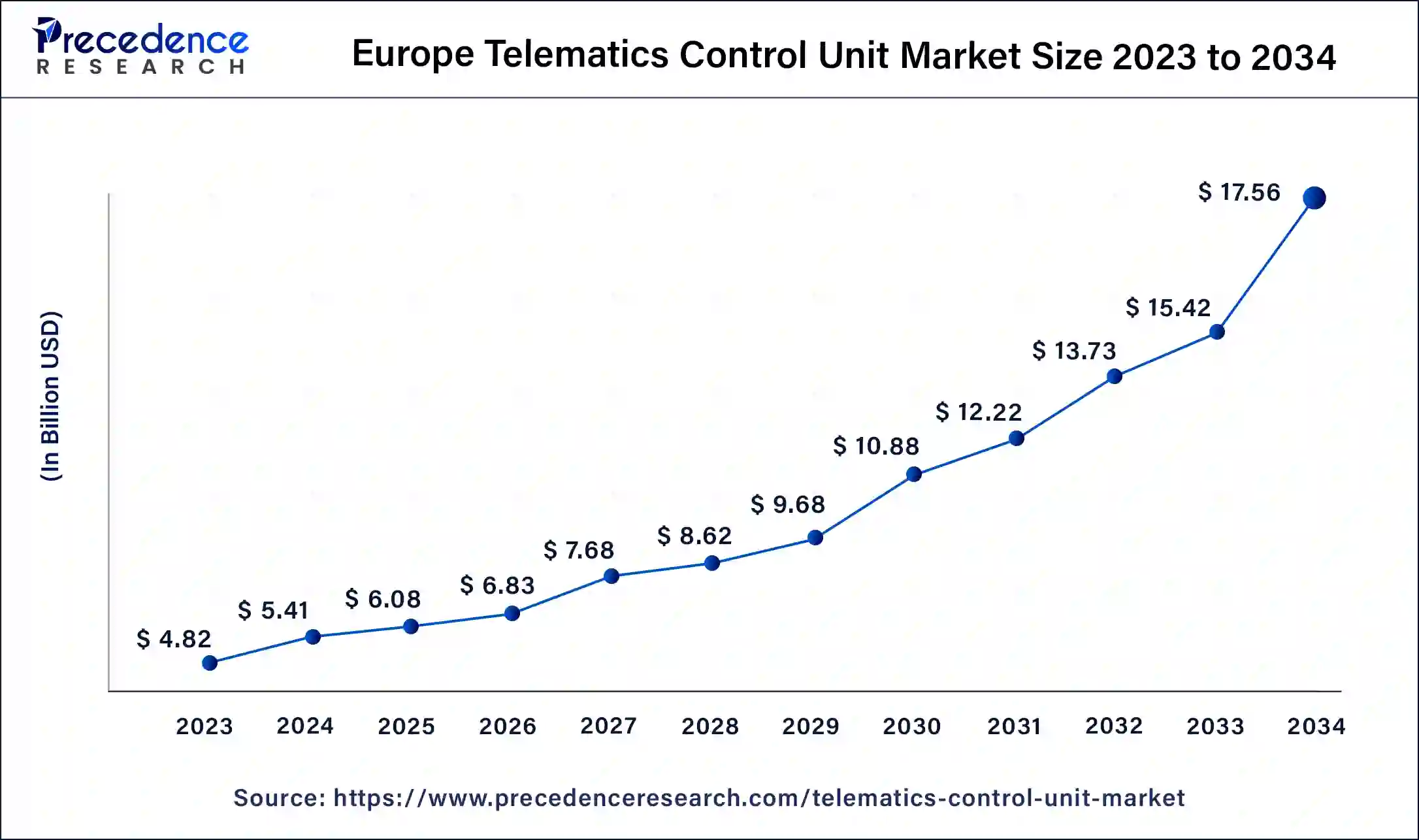

Europe Telematics Control Unit Market Size and Growth 2025 to 2034

The Europe telematics control unit market size was exhibited at USD5.33 billion in 2024 and is projected to be worth around USD 16.05 billion by 2034, poised to grow at a CAGR of 11.70% from 2025 to 2034.

Europe held the dominating share of the telematics control unit market in 2024. Europe is home to some of the world's leading automotive manufacturers, such as Volkswagen, BMW, and Daimler, who are at the forefront of integrating advanced telematics systems into their vehicles. European governments have implemented stringent regulations and initiatives promoting vehicle safety, emissions reduction, and connectivity. Programs like the European Union's eCall mandate, which requires new cars to have telematics systems that automatically contact emergency services in the event of an accident, have significantly boosted the TCU market.

North America had a notable share in the telematics control unit market in 2024. North American consumers have demonstrated a significant affinity for cars with cutting-edge technology, such as telematics systems. Demand has surged as people become more conscious of the advantages of telematics, which include enhanced convenience, safety, and fuel efficiency. Telematics is becoming essential to modern cars due to the rise of linked cars and the Internet of Things (IoT), which meets consumer expectations for intelligent and connected experiences. North America's leadership in the market has been further reinforced by significant investments in telematics technology and strategic alliances between automakers, IT firms, and suppliers.

These partnerships have resulted in the creation of integrated telematics solutions that provide a wide range of services, including fleet management, car diagnostics, entertainment, and navigation.

Asia-Pacific is observed to be the fastest growing in the telematics control unit market during the forecast period. The deployment of connected and autonomous car technology is accelerating throughout the region. The need for telematics control units is rising as these technologies become increasingly dependent on sophisticated telematics systems to operate. TCUs are necessary for entertainment, vehicle-to-everything (V2X) connectivity, remote diagnostics, and real-time navigation in connected cars. TCUs are becoming increasingly crucial for enabling autonomous features as the car industry progresses toward autonomous driving.

Advanced in-car connectivity capabilities like internet access, streaming services, and real-time navigation are becoming increasingly popular among consumers in the Asia-Pacific area. Due to increasing consumer demand, automakers are encouraged to install TCUs and other cutting-edge telematics systems in their cars. The region's TCU market is expanding mainly due to the trend toward connected lives and the demand for better in-car entertainment.

How Is Vehicle Safety Awareness Impacting the Latin American Telematics Market?

The Latin American telematics control unit market is expected to witness significant growth over the forecast period, driven by increasing awareness of vehicle safety and the expanding adoption of fleet management solutions. Countries such as Brazil and Mexico are the regional leaders, where the automotive industries are developing steadily, and the connected vehicle technology is being upgraded. A movement towards digital technologies in automobiles is experienced in these countries, especially in the monitoring of vehicles, vehicle security, and communication.

Moreover, the automotive industry in Latin America is rapidly adopting innovative technologies, and leading carmakers in the world are showing great support. Telematics is also promoted by government policies aimed at bringing about greater vehicle safety standards and environmentally friendly modes of transport. Technology development, meeting the increasing consumer desire, and the regulatory backs the positions to be the rich ground to promote the growth of the industry and make Latin America a fast-growing telematics control unit hub over the next few years.

Market Overview

The telematics control unit (TCU) in contemporary cars is crucial for controlling several wireless communication and vehicle tracking functions. It provides connectivity and telematics services by integrating many technologies, such as GPS, telecoms (GSM, 4G, 5G), and occasionally Wi-Fi. These services can include entertainment systems, remote vehicle monitoring, car diagnostics, emergency call systems (eCall), navigation, and over-the-air software updates. Advanced driving assistance systems (ADAS) and connected car features rely heavily on TCUs. They make it possible for automobiles, infrastructure, and other linked equipment to communicate in real time to improve traffic management and road safety. TCUs gather data about vehicle usage, driving habits, and maintenance requirements. Vehicle manufacturers, fleet managers, and insurance providers can all benefit from this data.

- According to the data released by the China Passenger Car Association (CPCA), in March 2025, passenger car retail sales in China reached 1.94 million units, a year-on-year increase of 14.4% and a month-on-month increase of 40.2%, bringing 2025 Q1's cumulative retail volume to 5.127 million units, a year-on-year increase of 6.0%.

Passenger Vehicle Retail Sales and Production Volume in March'2025

| Passenger Vehicles | Sales Volume | Y-on-Y Change | Production Volume | Y-on-Y Change |

| Sedan and hatchback | 9,02,000 | 14.30% | 1.046 million | 8.70% |

| SUV | 9,49,000 | 16.70% | 1.257 million | 9.20% |

| MPV | 89,000 | -4.60% | 1,08,000 | 7.30% |

| Total | 1.94 million | 14.40% | 2.412 million | 8.90% |

Telematics Control Unit Market Trends

- The government is considering permitting companies that deliver broadband-from-space, including Bharti Group-backed One Web and Jio Satellite Communications, to offer wireless access to compatible phone customers. Jio Satellite Communications is the Satcom division of Reliance Jio.

Telematics Control Unit Market Growth Factors

- Combining V2X with 5G technologies to improve data throughput and communication.

- Creation of sophisticated algorithms for data analysis and processing.

- Lowering hardware prices and more reasonably priced components being available.

- Creation of cloud-based data management and analysis tools.

- Increasing inclination towards linked automotive amenities such as entertainment, remote diagnostics, and navigation.

- Raising awareness of TCUs' advantages in terms of security and safety.

- Global auto manufacturing is rising, which is increasing the need for TCUs.

- Cutting-edge telematics solutions are needed since electric and hybrid vehicles are becoming increasingly popular. This drives the growth of the telematics control unit market.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 48.99 Billion |

| Market Size in 2025 | USD 16.83 Billion |

| Market Size in 2024 | USD 15.04 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 12.60% |

| Largest Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Sales Channel, Vehicle Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing demand for connected cars

Consumers today demand the same ease and connectivity from their cars as their smartphones and other personal electronics. Real-time navigation, streaming services, internet surfing, and social media access are just a few of the capabilities that connected cars offer. TCUs enable a strong telematics infrastructure, which is necessary for these services. The market for telematics control units and the requirements for these functionalities are expanding. Telematics system use is accelerating due to government restrictions to reduce emissions, increase vehicle efficiency, and improve road safety. For example, regulations about pollution control and fleet monitoring frequently mandate that cars have TCUs installed. This drives the growth of the telematics control unit market.

Increasing awareness of vehicle safety and security

Modern buyers are prepared to spend more on cars with the newest safety innovations since they are becoming more conscious of the safety features of vehicles. Features like automated emergency braking, lane deviation alerts, and collision avoidance systems are becoming increasingly popular. TCUs are critical in making these features possible and boosting their market uptake.

Restraint

High initial costs

Research and development expenditures are high when creating a telematics control unit. Businesses need to invest in software development, hardware design, and ensuring the device complies with strict vehicle regulations. The high initial expenses of this procedure are attributed to the need for specialized tools, experienced engineers, and a substantial amount of time. TCUs handle sensitive data regularly; therefore, adhering to data protection laws is essential. Development costs may increase if strong security measures are implemented, and compliance is guaranteed. The world of technology is changing quickly, particularly in electronics and telecommunications. To be competitive, businesses must upgrade their TCUs often, which drives up R&D expenses. Furthermore, OEMs and customers may be reluctant to spend money on pricey, high-tech systems that might soon become antiquated due to fears of obsolescence. This limits the growth of the telematics control unit market.

Opportunity

Growth in electric vehicles

EVs demand careful route planning, particularly regarding the locations of charging stations. TCUs improve the driving experience by offering real-time traffic updates and navigation. They provide crucial security features like geofencing, anti-theft systems, and vehicle tracking in shared mobility circumstances. EVs don't emit any pollutants from their tailpipes, but TCUs assist in reporting and monitoring energy efficiency and consumption, which helps ensure that environmental rules are followed.

TCUs supply the information needed for usage-based insurance (UBI) models, which enable insurers to give specialized coverage depending on driving patterns and vehicle use. This opens an opportunity for the growth of the telematics control unit market.

Sales Channel Insights

The OEM segment dominated the telematics control unit market with a share of 80.06%in 2024. owing to the surge in the rate of deployment of TSUs in newly manufactured vehicles. OEM (Original Equipment Manufacturer) telematics refers to technology solutions integrated directly into vehicles by the manufacturer. TCUs to offer features like infotainment, over-the-air updates, and advanced driver-assistance systems. Without any hardware or devices, the vehicle can effectively send and record data. OEM telematics generally provides seamless data communication and tracking capabilities. OEM-embedded telematics control unit is crucial for companies to enhance the safety of their vehicles and maximize operational efficiency. On the other hand, the aftermarket segment accounted for considerable growth in the global telematics control unit market over the forecast period. The growth of the segment is mainly driven by the rapid expansion of the automotive industry globally, along with the increasing demand to install telematics boxes from the aftermarket. Aftermarket telematics systems are installed in vehicles after the purchase. These systems can be customized to meet evolving consumers' specific needs. However, they may require additional hardware installation and often could be limited in terms of data precision in comparison with OEM systems.

The aftermarket segment is observed to be the fastest growing in the telematics control unit market during the forecast period. Modern telematics systems, now standard in new cars, are absent from many older cars. Demand for aftermarket TCUs is rising as owners and fleet managers look to enhance their vehicles with cutting-edge capabilities. Older models lack capabilities like remote diagnostics, GPS navigation, vehicle tracking, and real-time data analytics. These devices make these features possible. The aftermarket industry is expanding due to the growing appeal of old automobiles. The necessity of equipping secondhand cars with contemporary telematics systems is growing along with the demand for them. Adding cutting-edge amenities to used cars through aftermarket TCUs increases their marketability and appeal to consumers.

Telematics Control Unit Market Revenue, By Sales Channel, 2022-2024 (USD Billion)

| By Sales Channel | 2022 | 2023 | 2024 |

| OEM | 9.7 | 10.8 | 12.0 |

| Aftermarket | 2.4 | 2.7 | 3.0 |

Vehicle Type Insights

The SUV segment led the telematics control unit market with the share of 41.99% in 2024. The growth of the segment is attributed to the growing demand for SUVs globally. SUVs are increasingly becoming more popular as they offer versatility in terms of passenger and cargo space, especially among city dwellers, families, and adventure seekers. They often have larger interiors compared to sedans or hatchbacks. Modern SUVs integrate various advanced safety features such as multiple airbags, adaptive cruise control, lane-keeping assistance, electronic stability control, Advanced Driver Assistance Systems (ADAS), and others to enhance driver confidence and overall safety.

Such factors are contributing to the rising sales of this segment. On the other hand, the hatchbacks segment accounted for considerable growth in the market over the forecast period, owing the evolving consumer preferences, fuel efficiency, and rapid technological innovation. Hatchbacks are small-sized passenger cars, and the demand for hatchbacks has significantly increased as more buyers value affordable and ecologically friendly automobiles. The rising integration of Telematics Control Units (TCUs) into these vehicles, enhancing both the driver's experience and the car's overall capabilities

Telematics Control Unit Market Revenue, By Vehicle Type, 2022-2024 (USD Billion)

| By Vehicle Type | 2022 | 2023 | 2024 |

| SUV | 5.1 | 5.7 | 6.3 |

| Hatchbacks/Sedan | 3.4 | 3.8 | 4.3 |

| Light Commercial Vehicle | 2.6 | 2.9 | 3.3 |

| Heavy Commercial Vehicle | 1.0 | 1.1 | 1.2 |

Application Insights

The insurance segment held the major market share of 33% in 2024. owing to the growing demand for usage-based insurance (UBI), along with the rising adoption of connected vehicles globally. Insurance telematics is the integration of telecommunication and data collection technologies into the insurance industry to effectively monitor driving behavior and vehicle usage. Telematics devices play a crucial role in tracking various factors such as braking, speed, location, mileage, and other valuable insights, assisting insurers to accurately assess risk and adjust premiums based on actual driving behavior. Moreover, consumers are increasingly looking for personalized and cost-effective policies, which boosts their popularity during the forecast period.

- In August 2024, Zuno, a general Insurance company, announced the launch of a usage-based insurance policy for motor vehicles in India. The new feature, termed as Pay How You Drive (PHYD) allows user to assess their driving skills and generate a point-based score (Zuno Driving Quotient or ZDQ) for every drive undertaken by the user. This score helps Zuno determine the quality of driving behaviour by the user and entitles them to up to 30% discounts on insurance premiums, which can be availed at the time of annual insurance renewal.

On the other hand, the safety and security segment is projected to grow at a CAGR of between 2025 and 2034. The segment's growth is driven by the rising focus of vehicle manufacturers toward introducing advanced safety and security systems to align with the government norms and evolving consumer demand. TCUs allow for real-time communication between the car and emergency personnel, which speeds up reaction times and may even save lives in the event of a collision

Telematics Control Unit Market Revenue, By Application, 2022-2024 (USD Billion)

| By Application | 2022 | 2023 | 2024 |

| Information and Navigation | 1.5 | 1.7 | 1.9 |

| Safety and Security | 2.7 | 3.1 | 3.5 |

| Fleet/ Asset Management | 1.7 | 1.9 | 2.2 |

| Insurance Telematics | 4.0 | 4.5 | 5 |

| Infotainment System | 1.2 | 1.3 | 1.5 |

| Others | 0.8 | 0.9 | 1 |

Telematics Control Unit Market Companies

- Robert Bosch GmbH

- Harman International Inc.

- Denso Corporation

- Embitel

- LG Electronics

- Valeo SA

- Infineon Technologies

- Continental AG

- Ficosa International SA

Recent Developments

- In January 2025, Zonar unveiled the Zonar LD Telematics Control Unit (TCU), which enhances the intelligence and security of fleet operators regarding their vehicles. TCU would install more quickly, work with more vehicles, and offer better diagnostics, including towing detection and cold start tracking. Zonar has realized the rise in demand for data-rich, easy-to-use fleet management solutions that would accommodate the rising necessities needed in the backdrop of the rising e-commerce.

(Source: https://www.prnewswire.com) - In October 2024, Cummins Inc. announced their partnership with Bosch Global Software and KPIT to release their Eclipse CANought, an open-source project and telematics platform in commercial vehicles. This was under the bigger Open Telematics project to minimize the expenses of the telematics original application development in commercial vehicles.

(Source: https://www.fleetequipmentmag.com) - In April 2024, at Auto China in Beijing, Marelli, a top provider of mobility technology to the automotive industry, will unveil Pro Connect, a fully integrated cluster featuring 5G telematics and infotainment. Pro Connect is aimed at the Chinese market, where many OEMs combine telematics and cockpit features for entry- and mid-segment cars to better balance price and performance.

- In February 2024, according to the company, the Harman Ready Connect 5G Telematics Control Unit (TCU) has been released. This unit is a pioneer in connected car solutions globally. Using new Snapdragon Digital Chassis linked car technologies from Qualcomm Technologies, Inc.; this unit aims to democratize automotive connectivity and push the frontiers of connectivity.

Segments covered in the report

By Sales Channel

- OEM

- Aftermarket

By Vehicle Type

- SUV

- Hatchbacks/Sedan

- Light Commercial Vehicle

- Heavy Commercial Vehicle

By Application

- Information and Navigation

- Safety and Security

- Fleet/ Asset Management

- Insurance Telematics

- Infotainment System

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting