What is the Textured Vegetable Protein Market Size?

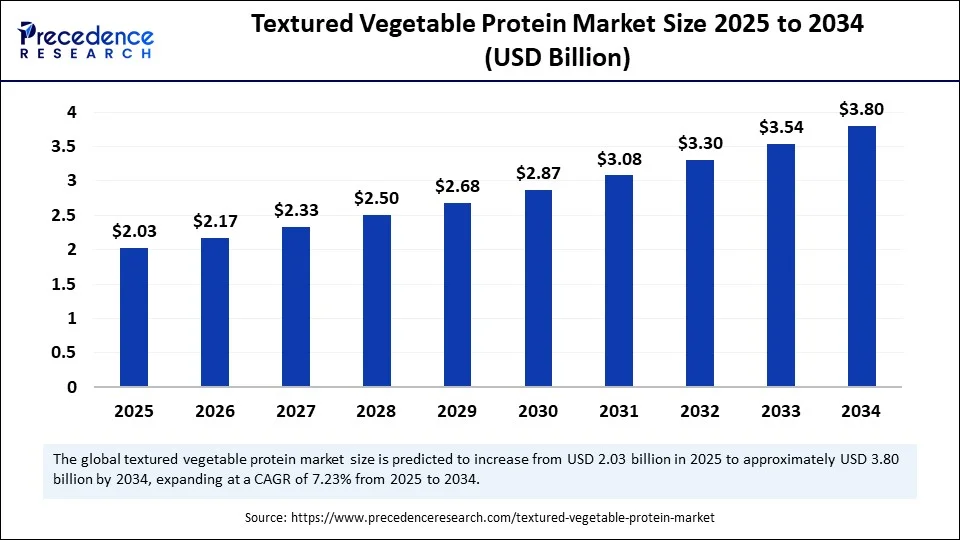

The global textured vegetable protein market size is calculated at USD 2.03 billion in 2025 and is predicted to increase from USD 2.17 billion in 2026 to approximately USD 3.80 billion by 2034, expanding at a CAGR of 7.23% from 2025 to 2034. The growth of the market is driven by rising demand for plant-based, high-protein meat alternatives worldwide.

Market Highlights

- Asia Pacific dominated the textured vegetable protein market with the largest share in 2024.

- North America is expected to expand at a significant rate in the market between 2025 and 2034.

- By product type, the textured soy protein segment held the largest share of the market in 2024.

- By form, the chunks segments dominated the market in 2024.

- By form, the granules segment is expected to grow at a significant CAGR over the forecast period.

- By distribution channel, the business to consumer segment held the largest market share in 2024.

- By distribution channel, the business to business segment is expected to grow at a remarkable CAGR between 2025 and 2034.

Market Size and Forecast

- Market Size in 2025: USD 2.03 Billion

- Market Size in 2026: USD 2.17 Billion

- Forecasted Market Size by 2034: USD 3.80 Billion

- CAGR (2025-2034): 7.23%

- Largest Market in 2024: Asia Pacific

- Fastest Growing Market: North America

What is Textured Vegetable Protein?

Textured Vegetable Protein (TVP) is a processed soy product with a texture that mimics ground meat. It is a complete, affordable, plant-based protein source that offers a meat-like texture and is rich in fiber, vitamins, and minerals. TVP supports health with its low-fat, cholesterol-free profile, making it a vital food for vegetarians and vegans. It's also a heart-healthy alternative to animal products, helping to manage appetite and weight while providing essential nutrients and promoting food sustainability.

The textured vegetable protein market involves the production and sale of plant-based proteins primarily derived from soy, wheat, and peas. These proteins serve as alternatives to meat in various food products. Market growth is driven by rising health awareness, the shift toward plant-based diets, and the cost-effectiveness and sustainability of TVP. Increasing consumer awareness of the environmental impact of animal agriculture and ethical concerns around animal welfare are also pushing demand for plant-based alternatives like TVP.

TVP's versatility spans a wide range of food categories, including ready-to-eat meals, snacks, and bakery products, making it a valuable ingredient for food manufacturers. Its production requires fewer natural resources and generates significantly lower greenhouse gas emissions compared to animal protein, positioning it as a sustainable choice for environmentally conscious consumers.

Key Technological Shift in the Textured Vegetable Protein Market

Key technological shifts in the textured vegetable protein market include the incorporation of artificial intelligence (AI) and big data analytics for personalized product development and supply chain optimization, advancements in extrusion technology to create more realistic meat-like textures, and the use of alternative plant-based protein sources beyond soy, such as pea protein. AI helps analyze consumer data (taste preferences, dietary needs, regional trends) to develop customized TVP products that better match market demand, leading to more targeted and successful product launches. AI tools analyze consumer sentiment and market trends across regions, helping companies stay ahead of shifting preferences toward cleaner labels, alternative protein sources, or sustainable packaging.

Textured Vegetable Protein Market Outlook

- Industry Growth Overview: The textured vegetable protein industry is poised for robust growth between 2025 and 2034, driven by rising consumer demand for plant-based, high-protein, and sustainable food options. Ethical and health concerns linked with animal products, the rising adoption of flexitarian diets, and even advancements in food technology that enhance TVP's flavor and texture further contribute to the market.

- Major Investors: Large multinational corporations are investing in product innovation, sustainable sourcing, and strategic collaborations to meet the growing global demand for plant-based meat substitutes. Several firms are actively investing in the latest technologies and products to enhance TVP's functionality and even achieve a more meat-like texture. Companies are forming strategic alliances to stretch their market share and raise profitability within the competitive TVP industry.

- Global Expansion: The growing international demand for plant-based foods is encouraging companies to expand the reach of textured vegetable protein (TVP) into new markets. As awareness of sustainable eating and health-conscious diets rises worldwide, manufacturers are scaling up their operations and distribution to meet the global demand for meat alternatives, such as TVP.

What are the Major Trends Influencing the Growth of the Textured Vegetable Protein Market?

- Demand for Meat-Like TVP: TVP is increasingly used in products designed to closely mimic the texture and taste of meat, appealing to the growing population of vegetarians, vegans, and flexitarians.

- Expansion in Emerging Markets: The Asia Pacific region, particularly China and India, offers significant growth potential due to large vegetarian populations and strong soybean cultivation for raw material sourcing.

- Diversification of Raw Materials in TVP: While soy remains the primary source for TVP, there is growing interest in diversifying raw materials. Proteins from peas, chickpeas, and faba beans are gaining traction, addressing both allergy concerns and consumer demand for allergen-free alternatives.

- Use of Allergen-Friendly Alternative in TVP: Pea protein, in particular, is seeing increased usage due to its allergen-friendly, gluten-free, and sustainable properties.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 2.03 Billion |

| Market Size in 2026 | USD 2.17 Billion |

| Market Size by 2034 | USD 3.80 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.23% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Form, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increased Health Consciousness Among Consumers

Increased health consciousness among consumers is a major factor driving the growth of the textured vegetable protein market. TVP, primarily soy-based, is a complete protein containing all essential amino acids, making it an excellent substitute for those avoiding animal protein. It can be processed to mimic the texture, flavor, and form of meat, such as ground meat, chunks, or pulled meat, making it ideal for plant-based burgers, sausages, and ready meals. Growing awareness of health issues like obesity, diabetes, and cardiovascular diseases is driving consumers to seek healthier food options, boosting demand for plant-based alternatives like TVP.

Restraint

Consumer Perception Challenges

Despite improvements, lingering doubts about TVP's texture, taste, and processing methods persist. Many consumers still view TVP as inferior or overly processed compared to meat and newer plant-based alternatives. Although it has a fibrous, meat-like structure, some find its texture mushy, dry, or inconsistent, especially in older formulations or improperly prepared products, posing a barrier to wider acceptance.

Segment Insights

Product Type Insights

What Made Textured Soy Protein the Dominant Segment in the Market in 2024?

The textured soy protein segment dominated the textured vegetable protein market with the largest share in 2024 and is likely to continue its upward trajectory throughout the forecast period. This is primarily due to soy's high protein content, cost-effectiveness, and excellent functional properties , including texture and flavor absorption, combined with the increasing consumer demand for plant-based diets and the established global soy supply chain. Soy protein is a complete protein that contains all the essential amino acids, which helps appeal to consumers seeking nutritious meat alternatives. Textured soy protein serves as a crucial base for creating meat-like products, such as burgers, sausages, and nuggets.

Form Insights

How Does the Chunks Segment Lead the Textured Vegetable Protein Market?

The chunks segment led the market in 2024 and is expected to continue its growth trajectory in the upcoming period. This is mainly due to their desirable meat-like texture and versatility, making them a considered ingredient for meat substitutes and ready-to-eat meals. Chunks mimic the fibrous texture and even chewiness of real meat, providing consumers a familiar as well as satisfying experience. Their ease of preparation and ability to serve as a meat extender make them attractive to households, restaurants, and also food manufacturers.

The granules segment is expected to expand at a significant CAGR over the forecast period because granules offer versatile usage across various food applications, such as soups, sauces, snacks, and ready-to-eat meals. Their ease of handling, quick rehydration, and ability to absorb flavors make them a popular choice for manufacturers aiming to create diverse, convenient, and cost-effective plant-based products.

Distribution Channel Insights

Why Did the Business to Consumer Segment Dominate the Market in 2024?

The business to consumer segment dominated the textured vegetable protein market while holding the largest share in 2024. This is because it directly reaches health-conscious consumers through widespread retail outlets and online platforms, enabling effective promotion of TVP's nutritional benefits and versatility. This approach enables effective marketing of TVP's nutritional benefits and versatility, leveraging trends such as veganism and clean eating to boost sales and accessibility. Brands use B2C channels to highlight TVP's low-fat, cholesterol-free, and sustainable qualities, tapping into consumer interests in health, eco-friendliness, and plant-based diets.

The business to business segment is expected to grow at the fastest CAGR in the coming years, driven by rising demand for high-protein, sustainable, and plant-based foods. TVP serves as a versatile, cost-effective, and functional ingredient with a lower environmental footprint than animal protein. It offers a high-protein, low-fat, cholesterol-free alternative that aligns with consumer preferences for healthy eating and reduced environmental impact. Advances in food processing and extrusion technology are enhancing TVP's taste, texture, and overall palatability, making it more attractive to consumers and increasing its appeal for B2B adoption.

Regional Insights

What Made Asia Pacific the Dominant Region in the Textured Vegetable Protein Market?

Asia Pacific dominated the textured vegetable protein market by capturing the largest share in 2024 due to a growing demand for plant-based diets driven by environmental concerns, health consciousness, and cultural dietary preferences for vegetarianism. Consumers are increasingly seeking nutrient-rich, low-fat, and plant-driven protein sources to combat lifestyle-related diseases. Countries such as China and India are key soybean producers, ensuring a stable and inexpensive raw material supply for TVP manufacturers.

China is a major contributor to the Asia Pacific textured vegetable protein market due to its large population, rising health and environmental consciousness, government fund for plant-based diets, and a strong, cost-effective soybean supply chain important for TVP production. The Chinese government's commitment to protein options and sustainability goals thus encourages the adoption of plant-based foods.

India is emerging as a major player in the market due to its vast vegetarian population and agriculture land. The Indian government is also offering incentives and support to farmers cultivating protein-rich crops such as soybeans, peas, and chickpeas, primary raw materials for TVP. These programs ensure a stable, cost-effective supply chain for TVP manufacturers and enhance market scalability.

What Factors Support the Growth of the North America Textured Vegetable Protein Market?

North America is expected to expand at a significant CAGR in the market, driven by a growing health-conscious population and increasing demand for plant-based meat alternatives. Key factors supporting this growth include robust investments by major food companies, advanced food processing and agricultural infrastructure ensuring a consistent supply, wider availability of TVP products in retail stores, and supportive government initiatives promoting sustainable food choices. Consumers are becoming more aware of the health benefits associated with reducing meat consumption and are actively seeking plant-based protein options. The broad availability of plant-based products, including those containing TVP, in supermarkets and online platforms further encourages widespread consumer access and adoption.

The U.S. plays a major role in the market due to its strong food processing infrastructure and advanced technologies that enable the development of innovative TVP products with improved texture and flavor to meet consumer expectations. Additionally, the well-established supply chain makes TVP a cost-effective and accessible protein option compared to animal-based proteins, appealing to budget-conscious consumers and institutional buyers.

How is the Opportunistic Rise of Latin America in the Textured Vegetable Protein Market?

Latin America is experiencing an opportunistic rise in the market, driven by rising health consciousness, changing dietary habits, and growing interest in plant-based diets. The region benefits from a robust agricultural base, particularly in soybean production, especially in Brazil and Argentina, ensuring a steady and cost-effective supply of raw materials for TVP. The regional market growth is further supported by an expanding flexitarian population and a growing number of product innovations that incorporate traditional local ingredients appealing to regional tastes.

Brazil plays a key role in the market and is expected to maintain its regional dominance because of its large population, a growing middle class with higher disposable incomes, and rising environmental awareness. The country's strong agricultural sector and well-developed soybean supply chain offer a solid base for cost-effective TVP production. In response to consumer demand for healthier and more sustainable food choices, Brazilian manufacturers are expanding their product lines to appeal to a wider audience.

What Potentiates the Growth of the Middle East and Africa Textured Vegetable Protein Market?

The market in the Middle East and Africa is driven by growing health concerns, rapid urbanization, and a strong emphasis on food security. Although the region accounts for a small share of the global market, it is growing rapidly, driven by demand for affordable, nutritious protein sources. While soy protein consumption is high, there is increasing interest in non-soy, allergen-free alternatives and in adopting modern, sustainable processing technologies to reduce dependence on imports.

Saudi Arabia dominates the market, fueled by the government's initiative that promotes investment in sustainable agriculture and food technology. Although cultural preferences for traditional meat persist, rising health consciousness and environmental awareness, especially among the young, urban population, are boosting demand for plant-based meat substitutes. Strategic partnerships and government backing for local production are establishing the country as a regional leader in advanced protein solutions.

What Makes Europe a Notably Growing Area in the Textured Vegetable Protein Market?

Europe is expected to grow at a notable rate in the upcoming period. The European market is characterized by stringent regulations and a significant shift toward vegan, vegetarian, and flexitarian diets driven by health and ethical concerns. The market is driven by demand for clean-label, non-GMO, and sustainable protein sources, leading to a strong focus on alternative proteins such as pea, wheat, and fava bean to address soy allergy concerns. The presence of major global players like Roquette and Beneo, along with substantial R&D investments, is fostering innovation in flavor, texture, and applications in high-value products.

Germany dominates the market in Europe, with a strong emphasis on sustainability and a well-established infrastructure for plant-based food production. The market is supported by key industry players such as Beneo GmbH and the country's leading role in the European Union's push for plant-based food innovation. Driven by a health-conscious consumer base and a commitment to reducing the environmental impact of food consumption, the German market is focusing on sophisticated, high-quality TVP products that closely mimic the texture and taste of meat.

Government Initiatives Supporting the Textured Vegetable Protein Market

|

Country Focus |

Initiative Type |

Description & Market Impact |

|

Global/Multi-national |

R&D Funding & Incentives |

Investment in research to improve TVP quality; grants for local processing facilities. |

|

EU, China, U.S. |

Sustainability/Climate Policy |

Policies promoting plant-based diets to meet climate goals drive demand for TVP. |

|

United States, EU |

Public Procurement |

Initiatives for plant-based options in public institutions (schools/canteens) create a high-volume market. |

|

India, EU |

Food Security/Protein Independence |

Programs encourage domestic protein crop production and reduce reliance on imports. |

|

U.S. |

Regulatory & Labeling Clarity |

FDA establishes clear labeling standards; fosters consumer trust and market stability. |

|

China |

National Strategic Plans |

Integration of alternative proteins into national agricultural plans diversifies protein sources. |

Textured Vegetable Protein Market Value Chain Analysis

- Raw Material Sourcing: The value chain begins with sourcing raw materials such as soybeans, peas, chickpeas, and other plant-based proteins. The quality, availability, and sustainability of these raw materials directly impact the efficiency and cost-effectiveness of TVP production, making supplier relationships and agricultural practices critical.

- Processing and Manufacturing: Raw materials undergo processes like defatting, grinding, and extrusion to create TVP with desired textures and nutritional profiles. Advances in extrusion technology enhance the texture, taste, and appearance of TVP, allowing manufacturers to meet evolving consumer preferences for meat-like products.

- Product Development and Innovation: R&D teams focus on formulating TVP products with improved flavors, textures, and nutritional benefits. This stage often involves the incorporation of alternative protein sources, use of AI for personalized product design, and continuous improvements to meet dietary trends and allergen concerns.

- Packaging and Branding: Effective packaging preserves product freshness and extends shelf life, while branding communicates TVP's benefits such as plant-based nutrition, sustainability, and versatility. Attractive packaging also helps capture consumer attention in competitive retail environments and online marketplaces.

- Distribution and Logistics: TVP products are distributed through multiple channels including retail stores, online platforms, and foodservice providers. Efficient supply chain management ensures product availability, reduces costs, and maintains quality, which is essential for market penetration and consumer satisfaction.

- End Consumers: The final stage involves a diverse consumer base seeking healthier, sustainable, and affordable protein alternatives. Consumer feedback and changing preferences continually influence product offerings, driving innovation and adaptation throughout the entire value chain.

Textured Vegetable Protein Market Companies

Tier I – Market Leaders

These companies are dominant players with extensive global reach, substantial production capacities, and significant brand recognition.

- Archer Daniels Midland Company (ADM):A leading global food processing and commodities trading corporation, ADM is a major supplier of soy-based TVP products.

- Cargill, Incorporated:A multinational corporation providing agricultural, food, and industrial products, Cargill is a significant producer of textured vegetable proteins.

- Roquette Frères:A global leader in plant-based ingredients, Roquette specializes in pea-based proteins and has a strong presence in the market.

- Ingredion Incorporated:A global ingredient solutions provider, Ingredion offers a range of plant-based proteins, including TVP products.

- Vippy Industries Ltd:An Indian company specializing in soy-based products, Vippy Industries is a significant player in the TVP market.

Tier II – Established Regional Players

These companies have a strong regional presence and contribute significantly to the market but on a smaller scale than Tier I.

- Axiom Foods, Inc.:A U.S.-based company specializing in plant-based protein ingredients, Axiom Foods offers a variety of TVP products.

- Sonic Biochem Extraction Pvt Ltd:An Indian company known for producing soy-based ingredients, including textured vegetable proteins.

- Bunge Limited:A global agribusiness and food company, Bunge produces a range of plant-based proteins, including TVP.

- MGP Ingredients, Inc.:A U.S.-based company that manufactures specialty proteins and starches, including textured vegetable proteins.

Tier III – Emerging and Niche Players

These companies are smaller or newer entrants with specialized offerings or regional focus.

- Bob's Red Mill Natural Foods:A U.S.-based company known for natural and organic products, including textured vegetable proteins.

- Wilmar International Limited:A Singapore-based agribusiness group, Wilmar produces a variety of plant-based ingredients, including TVP.

- Sojaprotein:A Serbian company specializing in soy-based products, including textured vegetable proteins.

- Gushen Biological Technology Group Co., Ltd.:A Chinese company known for producing soy-based ingredients, including textured vegetable proteins.

Recent Developments

- In August 2025, ADM announced that it is taking steps to streamline and potentially strengthen its global soy protein production network, enhancing efficiency and positioning itself to better serve customers worldwide by leveraging operational excellence at its recently recommissioned soy protein facility and other facilities across its global network.

(Source: https://investors.adm.com) - In August 2025, V2food, an Austalian-based producer of plant-based meat, collaborated with Ajinomoto Co., Inc. and acquired the plant-based chicken startup, Daring Foods. The acquisition target is to “accelerate plant-based protein innovations.” Daring Foods, based in Los Angeles, will continue to operate under its own brand name.

(Source: https://www.foodbusinessnews.net)

Exclusive Expert Analysis on the Textured Vegetable Protein Market

The global textured vegetable protein market is poised for robust expansion, underpinned by accelerating shifts in consumer dietary paradigms and heightened demand for sustainable protein alternatives. As macroeconomic and socio-environmental imperatives coalesce, the market exhibits pronounced opportunities driven by escalating health consciousness, ethical consumption patterns, and regulatory frameworks incentivizing plant-based innovations.

Foremost, the proliferation of flexitarian, vegetarian, and vegan demographics catalyzes an unprecedented demand trajectory for TVP products, which uniquely balance nutritional completeness with cost-efficiency and functional versatility. The confluence of advancements in extrusion technology and precision ingredient engineering further augments product palatability and consumer acceptance, mitigating historical sensory deficits that constrained market penetration.

Geographically, emerging economies in the Asia-Pacific region, buoyed by expansive vegetarian populations and augmented agricultural infrastructure, represent fertile grounds for penetration and growth. Concurrently, mature markets in North America and Europe demonstrate escalating consumer willingness to transition towards cleaner-label, environmentally congruent protein sources, supported by robust supply chain mechanisms and progressive policy interventions.

However, despite the optimistic outlook, market participants must strategically navigate challenges including consumer skepticism regarding textural and sensory attributes, fragmented regulatory landscapes, and competitive pressures from emerging alternative proteins. Nonetheless, these challenges concurrently serve as catalysts for innovation, fostering differentiation and value creation.

Segment Covered in the Report

By Product Type

- Textured soy protein

- Others

By Form

- Granules

- Flakes

- Chunks

- Others

By End User

- Business to Business

- Business to Consumer

By Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting