What is the Hydrolyzed Vegetable Protein Market Size?

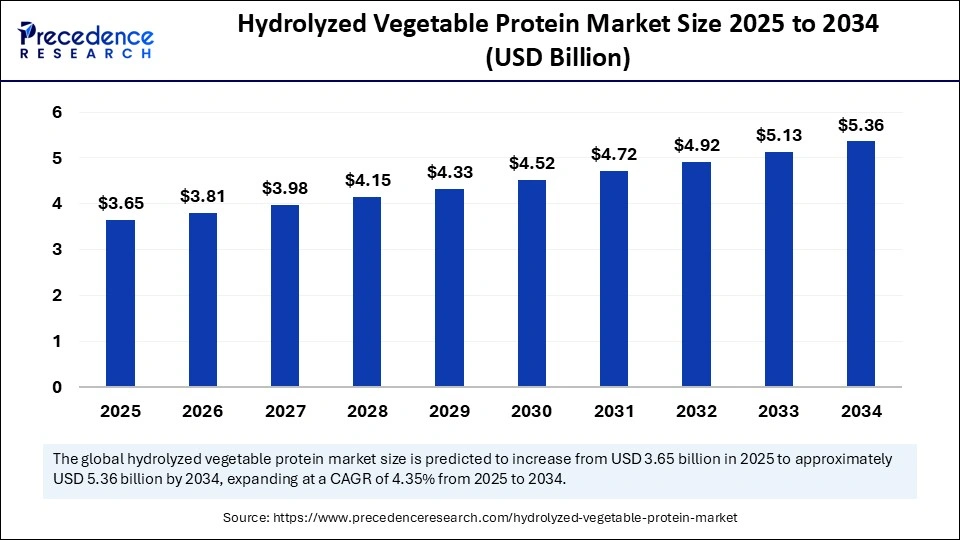

The global hydrolyzed vegetable protein market size is accounted at USD 3.65 billion in 2025 and predicted to increase from USD 3.81 billion in 2026 to approximately USD 5.59 billion by 2035, representing a CAGR of 4.35% from 2026 to 2035. The increased demand for plant-based alternatives and convenience food is driving the global market. The growing emphasis on clean label and natural ingredients is further contributing to this growth.

Hydrolyzed Vegetable Protein Market Key Takeaways

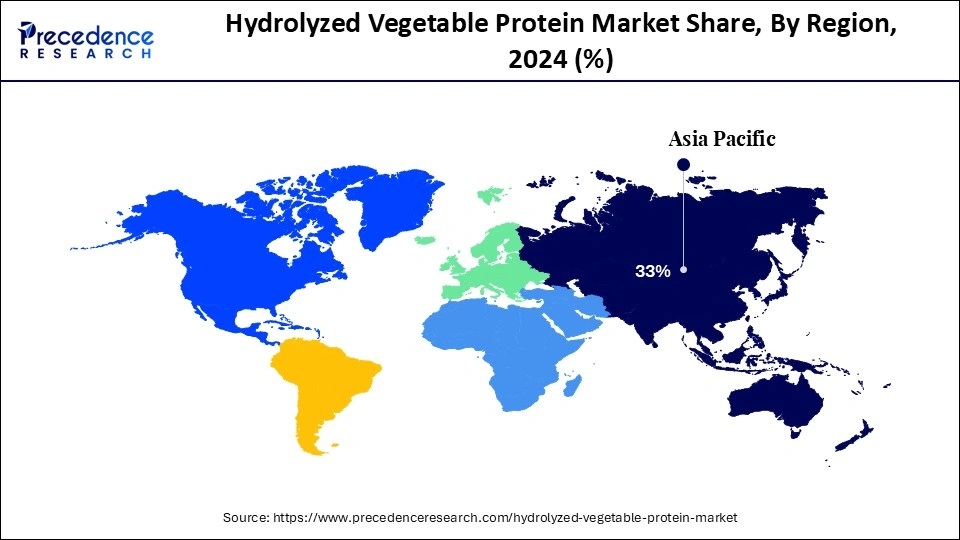

- Asia Pacific dominated the global hydrolyzed vegetable protein market with the largest share of 33% in 2025.

- North America is expected to grow at a significant CAGR from 2026 to 2035.

- By source, the soy segment contributed the largest market share in 2025.

- By source, the pea segment is expected to grow at a notable rate at a CAGR between 2026 and 2035.

- By process, the acid hydrolysis segment led the market in 2025.

- By process, the enzymatic hydrolysis segment will grow at a notable CAGR between 2026 and 2035.

- By application, the food and beverage segment contributed the highest market share in 2025.

- By application, the nutraceuticals segment will grow rapidly between 2026 and 2035.

- By distribution channel, the business-to-business (B2B) segment generated the major share in 2025.

- By distribution channel, the business-to-consumer (B2C) segment will grow at a significant CAGR between 2026 and 2035.

How is AI Optimizing Hydrolysis Efficiency and Yield in the Hydrolysis Vegetable Protein Market?

Artificial intelligence is optimizing hydrolysis efficiency and yield in the hydrolyzed vegetable protein market by facilitating predictive control and real-time monitoring of enzymatic reactions, guaranteeing that proteins consistently break down into the appropriate peptides. To optimize output and minimize batch variability, machine learning algorithms examine temperature, pH, enzyme concentration, and reaction times.

By using less energy and waste, this not only improves the functionality and flavour development of proteins but also the owners' production costs. The competitiveness of hydrolyzed vegetable protein in food and beverage applications is being strengthened by manufacturers who are achieving higher yields, improved quality, and faster scalability by combining AI with sophisticated sensors and process automation.

Market Overview

The hydrolyzed vegetable protein market refers to the global industry involved in the production, distribution, and utilization of plant-based proteins obtained by acid, enzymatic, or other hydrolysis processes. HVP is widely used as a flavor enhancer, umami booster, and functional protein ingredient in the food and beverage, nutraceuticals, cosmetics, and pharmaceutical industries. The market's growth is driven by rising demand for clean-label ingredients, plant-based proteins, and processed food consumption, alongside advancements in sustainable production technologies.

Key regulatory news for hydrolyzed vegetable protein involves stricter labelling requirements in the U.S. due to FDA guidance on allergens, sodium, and plant-based products, as well as Europe's Novel Food Regulation and the EU Food Information to Consumers Regulation, which demand pre-market approval, safety assessments, and clearer origin and nutritional information. Manufacturers face higher compliance costs and longer timelines to meet these evolving standards, but companies that adapt can gain a competitive edge by developing compliant and innovative HVP variants, such as non-GMO or allergen-free options.

Hydrolyzed Vegetable Protein Market Growth Factors

- Rising demand for plant-based proteins: Consumers are increasingly adopting vegan, vegetarian, and flexitarian diets, driving preference for sustainable alternatives like HVP.

- Clean-label and natural ingredient trend: Food and beverage companies are reformulating with HVP as a natural flavor enhancer and protein source, replacing artificial additives.

- Expanding applications in food and beverages: HVP is widely used in soups, sauces, seasonings, ready-to-eat meals, and snacks for its umami flavor and functional properties.

- Technological advancements: AI-driven process optimization, automation, and enzymatic innovations are improving hydrolysis efficiency, yield, and cost-effectiveness.

- Sustainability concerns: Growing awareness of the environmental impact of animal proteins is boosting demand for eco-friendly plant-based protein sources.

- Supportive regulatory and health trends: Increasing health awareness, government support for plant-based food innovations, and regulations promoting clean ingredients foster market expansion.

Market Outlook of the Hydrolyzed Vegetable Protein Market:

- Industry Growth Overview: There is an increase in the hydrolyzed vegetable protein market due to the growing consumption of processed foods, the continued movement toward clean label reformulation, as well as the increased interest in plant-based flavor enhancers in the food and beverage industries globally.

- Sustainability Trends: Companies are focusing their efforts on sustainable practices for sourcing non-GMO soy and wheat products, minimizing waste generated through the use of chemical hydrolysis processes, and using enzymatic processing techniques to reduce electrical consumption and their impact on the environment.

- Global Expansion: The standardization of food formulation among multinational manufacturers, which permits them to produce hydrolyzed vegetable protein for global market demand, in addition to the growing demand for hydrolyzed vegetable protein used as food flavoring that meets the required industry standards of consistency, scalability, and shelf-stability.

- Startup Ecosystem: Several new businesses are entering the hydrolyzed vegetable protein market to provide consumers with fermentation-based Hydrolysis products, reduced allergen formulations, and low-sodium hydrolyzed vegetable protein alternatives that are focused on the premium, organic, and functional food market segments.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 5.59 Billion |

| Market Size in 2025 | USD 3.65 Billion |

| Market Size in 2026 | USD 3.81 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 4.35% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Source, Process, Application, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Shift Towards Plant-Based Diets

The demand for plant-based protein sources like HVP is being driven by the gradual rise in vegetarianism, veganism, and flexitarian diets. Customers are actively looking for substitutes that offer sustainability and nutritional value. HVP is becoming a popular option as major food brands reformulate their menus and retail products to lessen their reliance on animal proteins as plant-based lifestyles become more popular. This trend is particularly prominent in North America and Europe.

Flavour Enhancing Properties

In soups, sauces, seasoning, and instant meals, HVP is indispensable due to its umami flavor and capacity to enhance flavors. HVP is being used by manufacturers as a natural flavor enhancer in place of artificial additives like MSG, as consumers seek healthier but tastier options. Its adaptability makes it well-liked in the food service and packed food sectors. The global adoption of the hydrolyzed vegetable protein market is also being fueled by the growing demand for Asia cuisines, which mainly rely on savory flavor profiles.

Restraints

Health concerns related to processing methods

Conventional acid hydrolysis of vegetable proteins can produce 3-MCPD, a potentially hazardous substance that raises questions about safety and health. Manu regions' regulatory bodies have imposed stringent restrictions on these contaminants, forcing procedures to switch to more expensive enzymatic procedures. This raises production costs and puts obstacles in the way of smaller market participants.

High production and processing costs

Compared to synthetic substitutes like MSG, the production of HVP, particularly through enzymatic hydrolysis, necessitates larger operational costs, specialized knowledge, and sophisticated equipment. Profit margins are frequently lowered by these cost pressures, especially in markets where consumers are extremely price sensitive. The inability of smaller manufacturers to compete may prevent wider adoption in areas where consumers have less purchasing power. Costlier raw materials make matters worse.

Opportunities

Rising adoption of plant-based diets worldwide

The growing popularity of flexitarian and vegan lifestyles is predicted to fuel demand for sustainable protein substitutes like HVP. Customers are constantly searching for natural flavor enhancers and meat alternatives that respect environmental and ethical principles. This gives HVP manufacturers a huge opportunity to establish themselves as pioneer in plant-based innovation. Businesses that provide customized products to this market segment are likely to gain a sustained market share.

Expanding applications across food and beverage segments

HVP is not just used in savory seasonings; it is also being utilized increasingly in ready-to-eat meals, soups, snacks, instant noodles, and sauces. As the global convenience food industry expands, HVPs' function as an affordable flavor enhancer becomes increasingly important. A new application area is being opened by emerging categories like fortified beverages and snacks with added protein. Because of its great adaptability, producers can diversify their sources of income across several food categories.

Source Insights

Why did the soy segment dominate the hydrolyzed vegetable protein market in 2025?

The soy segment remains the dominant source in the hydrolyzed vegetable protein market because it's more affordable than other plant proteins, has a high protein content, and has established supply chains. In the production of HVP, it has been the most favored raw material, especially for Asian dishes, sauces, and prepared foods. Because of its robust umami flavor and widespread acceptance in both developed and emerging markets, soy is the industry leader in this field. Furthermore, its ability to work with various processing techniques guarantees manufacturers' scalability.

The pea segment is emerging as the fastest-growing source for HVP, driven by consumer demand for sustainable, non-GMO, and allergy-free substitutes. The high digestibility and suitability of pea-based HVP for soy- and gluten-free diets make it appealing for use in clean-label foods and nutraceuticals. Pea protein is rapidly becoming popular around the world as vegan and flexitarian diets become more popular. The growth trajectory of pea protein is further accelerated by increasing investment in processing facilities.

Process Insights

Why did the acid hydrolysis segment dominate the hydrolyzed vegetable protein market in 2025?

The acid hydrolysis segment remains the dominant process in HVP production due to its cost-effectiveness and faster protein breakdown capability. This method enables large-scale, consistent output, making it the preferred choice for mass-market food and seasoning producers. Despite regulatory scrutiny around byproducts, acid hydrolysis continues to lead because of its efficiency and affordability in developing economies. Its long-established industrial infrastructure also makes it difficult to replace in price-sensitive regions.

The enzymatic hydrolysis segment is the fastest-growing process in the hydrolyzed vegetable protein market, as it addresses safety and clean-label concerns associated with acid hydrolysis. This method improves nutritional value, reduces harmful compounds, and aligns with consumer demand for natural processing methods. Though more expensive, advancements in enzyme technology and AI-driven optimization are making it increasingly viable for premium applications. Its ability to support organic and health-focused certifications gives it a strong future outlook.

Application Insights

Why did the food and beverages segment dominate the hydrolyzed vegetable protein market in 2025?

The food and beverages segment dominates HVP applications, since the ingredient is frequently found in processed foods, soups, sauces, snacks, and instant noodles. Because of its capacity to improve flavor while preserving cost-effectiveness, it is crucial for large-scale food production. Convenience food consumption is on the rise worldwide, and this market segment is expected to continue dominating. Additionally, alliances between top F&B brands and ingredient suppliers guarantee consistent long-term demand.

The nutraceuticals segment represents the fastest-growing application of HVP, driven by the growing demand for functional foods and supplements, as well as increased health consciousness. Athletes, the elderly, and consumers who prioritize wellness can all benefit from hydrolyzed proteins because they are simpler to digest. As businesses add HVP to protein powders, fortified snacks, and dietary supplements, this market is expanding rapidly. Its appeal among consumers who are health-conscious is being further enhanced by ongoing product innovation and high-end launches.

Distribution Channel Insights

Why did the B2B segment dominate the hydrolyzed vegetable protein market in 2025?

The business-to-business (B2B) segment dominates the market as bulk procurement by food manufacturers and nutraceutical companies drives most of the demand. Large supply contracts, long-term partnerships, and cost benefits from economies of scale strengthen this channel's leadership. Global food processing industries continue to rely heavily on B2B trade for consistent, large-volume supplies of HVP. The predictability of B2B contracts also provides stability to producers in volatile raw material markets.

The business-to-consumer (B2C) segment is the fastest-growing channel backed by the quick growth of direct-to-consumer and e-commerce brands. Plant-based protein supplements and clean-label products are increasingly being bought by health-conscious consumers through online marketplaces. Online platforms are a strong growth driver for HVP sales because of their accessibility, range of options, and digital promotions. This expansion is further fueled by growing mobile shopping trends and digital literacy in developing nations.

Regional Insights

Asia Pacific Hydrolyzed Vegetable Protein Market Size and Growth 2026 to 2035

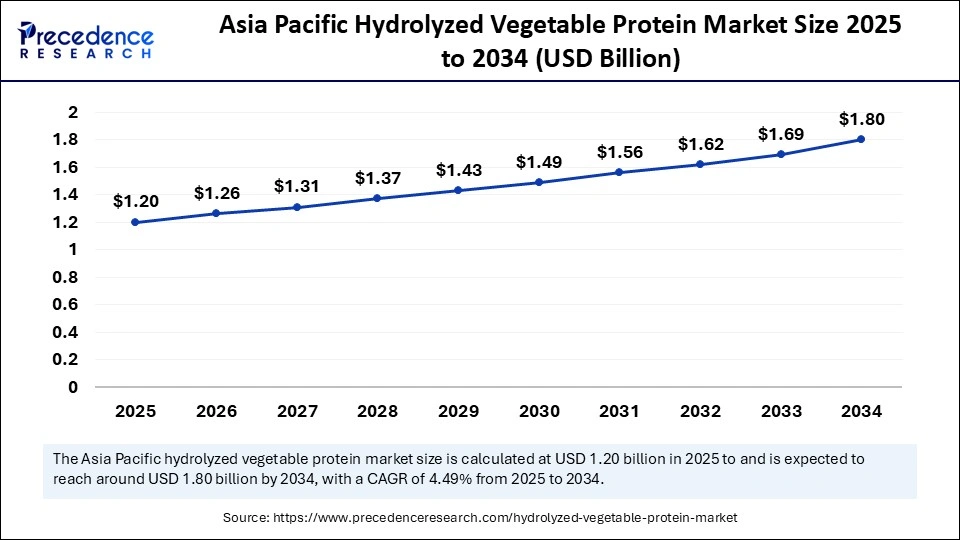

The Asia Pacific hydrolyzed vegetable protein market size is exhibited at USD 1.20 billion in 2025 and is projected to be worth around USD 1.91 billion by 2035, growing at a CAGR of 4.76% from 2026 to 2035.

What made the Asia Pacific dominate the hydrolyzed vegetable protein market?

Asia Pacific dominates the global hydrolyzed vegetable protein market because of its robust soy production base, high savory food consumption, and rising demand for packaged meals and instant noodles. The region's considerable population and changing dietary habits reinforce its position as a leader. Its dominance is further reinforced by the presence of major food companies. Furthermore, the growth of convenience food chains and increased urbanization broadens the region's consumer base.

North America is the fastest-growing region in the hydrolyzed vegetable protein market, led by strong consumer demand for clean-label, plant-based, and nutraceutical products. Rising health awareness, growth in vegan populations, and regulatory emphasis on safe and sustainable production are driving adoption. Premiumization of food and dietary supplements also adds momentum to market growth. Supportive investments in plant-based innovation and advanced processing facilities give North America a competitive edge.

Europe: The Clean-Label Reformulation Hub

Due to strict food label regulations and high consumer knowledge of natural ingredients, Europe has strongly adopted hydrolyzed vegetable protein as an alternative to artificial flavors. Demand from sauces, soups, and plant-based foods drives the use of HVP in Europe, with support from leading-edge R&D and sustainability-oriented manufacturing processes.

Germany has been the fastest-growing country in the region because there are so many food ingredient exports and ongoing innovations within the area of savoury flavor solutions.

Latin America: Emerging Processed Food Powerhouse

The processed food industry in Latin America is becoming bigger as a result of urbanization and other factors, contributing to the increase in demand for HVP. The cost-effective nature of flavor enhancement and the growing amount of snack consumption will drive growth throughout Latin America.

Brazil's rapidly developing food processing industry and the increasing demand for seasoning blends will help drive the adoption of HVP in the country.

Middle East & Africa (MEA): Flavor Innovations Continues to Grow

The MEA region continues to grow due to the growing number of packaged food products, the influx of large amounts of flavoring agents to the region, and an emerging food service segment. The expansion of MEA food service segments further increases HVP demand based on consumer taste preferences, continuing toward the savoury.

Saudi Arabia's investments in food manufacturing and the growing demand for savoury flavor enhancers in the country continue to propel the market's growth in the MEA region.

Value Chain Analysis

- Raw Material Procurement (Farms, Fisheries, etc.): R&D in HVP focuses on sourcing high-quality soy, wheat, corn, pea, rice, and fish proteins, with an emphasis on sustainable and ethical practices. Innovations aim to improve protein extraction and enhance nutritional quality. Key players include Archer Daniels Midland, Cargill, Kerry Group, and Ingredion.

- Retail Sales and Marketing: Marketing plans emphasize plant-based, clean-label, and adaptable protein products. Businesses prioritize consumer education, sustainability, and product adaptability for a variety of foods, including snacks, sauces, and soups. Supermarkets, specialty shops, and internet platforms are all used for distribution. Key players include ADM, Cargill, Kerry Group, DuPont, and Ingredion.

- Waste Management and Recycling: Efficient waste management in HVP production recovers valuable proteins from plant and fish by-products. Techniques like enzymatic hydrolysis help reduce waste while producing functional protein ingredients. Key players include Cargill, DuPont, Kerry Group, and DSM.

Hydrolyzed Vegetable Protein Market Companies

- Kerry Group plc

- Ajinomoto Co., Inc.

- Tate and Lyle PLC

- DSM-Firmenich AG

- Archer Daniels Midland Company (ADM)

- Cargill, Incorporated

- Givaudan SA

- Symrise AG

- Sensient Technologies Corporation

- Ingredion Incorporated

- CHS Inc.

- Exter B.V.

- Prinova Group LLC

- Titan Biotech Ltd.

- Agropur Cooperative

Recent Developments

- In June 2025, PRNewswire, Ajinomoto Health and Nutrition North America, Inc. (AHN), a global leader in amino acid manufacturing, celebrated the opening of its renovated Quality Control Laboratory. Ajinomoto Health and Nutrition North America, Inc. opened the USD 2.1 million quality control lab in Raleigh, NC.

(Source: https://www.wjhl.com) - In March 2025, Herbal Isolates, a leading company in the industry, developed a unique Hydrolyzed Vegetable Protein using proprietary technology that meets European standards. Their process ensures that the levels of 3-MCPD conform to CODEX guidelines, providing customers with high-quality, safe products. As a result, many customers who previously used Chinese HVP have now switched to Herbal Isolates, positioning the company as one of the leading HVP manufacturers in India and a trusted supplier for several major clients.(Source: https://www.keysermackay.com)

Segments Covered in the Report

By Source

- Soy

- Corn

- Wheat

- Pea

- Rice

- Sunflower

- Potato

- Other Sources

By Process

- Acid Hydrolysis

- Enzymatic Hydrolysis

- Other Processes

By Application

- Food and Beverages

- Soups and Sauces

- Ready-to-Eat Meals

- Meat Products

- Snacks

- Seasonings

- Others

- Nutraceuticals

- Pharmaceuticals

- Cosmetics and Personal Care

- Animal Feed

- Others

By Distribution Channel

- Business-to-Business (B2B)

- Business-to-Consumer (B2C)

- Supermarkets/Hypermarkets

- Online Retail

- Specialty Stores

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content