In-vitro Inflammatory Bowel Disease Diagnostics Market Size and Forecast 2025 to 2034

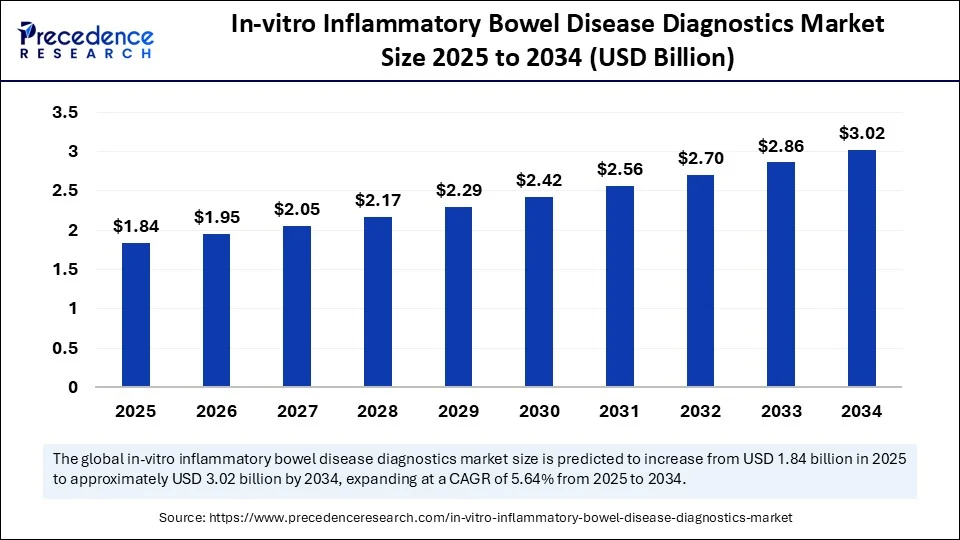

The global in-vitro inflammatory bowel disease diagnostics market size was calculated at USD 1.74 billion in 2024 and is predicted to increase from USD 1.84 billion in 2025 to approximately USD 3.02 billion by 2034, expanding at a CAGR of 5.64% from 2025 to 2034. The in-vitro inflammatory bowel disease diagnostics market is driven by rising IBD prevalence, advancements in diagnostic technologies, and increasing demand for personalized medicine.

In-vitro Inflammatory Bowel Disease Diagnostics Market Key Takeaways

- In terms of revenue, the global in-vitro inflammatory bowel disease diagnostics market was valued at USD 1.74 billion in 2024.

- It is projected to reach USD 3.02 billion by 2034.

- The market is expected to grow at a CAGR of 5.64 % from 2025 to 2034.

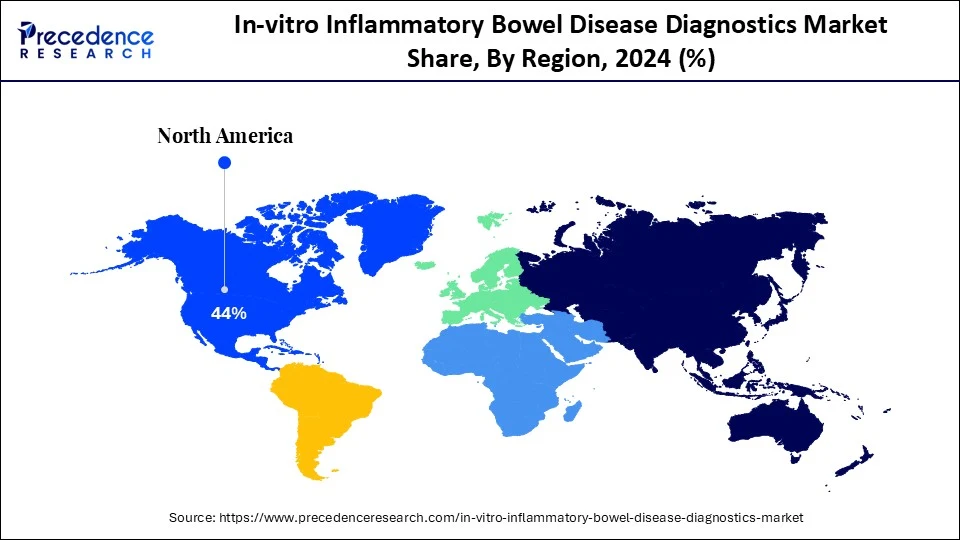

- North America dominated the global market with the largest share of 44% in 2024.

- Asia Pacific is anticipated to witness the fastest growth during the forecasted years.

- By test type, the biomarker tests segment captured the biggest market share of 39% in 2024.

- By test type, the molecular diagnostics tests segment is anticipated to show considerable growth over the forecast period.

- By disease type, the Crohn's disease segment contributed the highest market share of 56% in 2024.

- By disease type, the ulcerative colitis segment is anticipated to grow at a significant CAGR over the forecast period.

- By sample type, the stool segment held the largest market share 42% in 2024.

- By sample type, the saliva/other fluids segment is anticipated to grow at the highest CAGR over the forecast period.

- By end-user, the hospitals segment generated the major market share of 40% in 2024.

- By end-user, the specialized gastroenterology clinics segment is anticipated to experience the fastest growth over the forecast period.

- By technology, the immunoassays segment accounted for remarkable market share of 46% in 2024.

- By technology, the molecular diagnostics segment is anticipated to show considerable growth over the forecast period.

How is AI Integration Transforming In-vitro IBD Diagnostics?

The use of AI in in-vitro inflammatory bowel disease diagnostics is revolutionizing how the disease is detected, monitored, and treatment planning. AI can analyze large amounts of data with high precision and speed using machine learning algorithms, such as endoscopic images, histological samples, and biomarker profiles. This enhances the stage of diagnosis, reduces the factor of human error, and enables earlier identification of IBD disorders such as Crohn's disease and ulcerative colitis. Additionally, AI is enhancing drug discovery and clinical research by providing directional data trends and identifying potential targets in large datasets.

U.S. In-vitro Inflammatory Bowel Disease Diagnostics Market Size and Growth 2025 to 2034

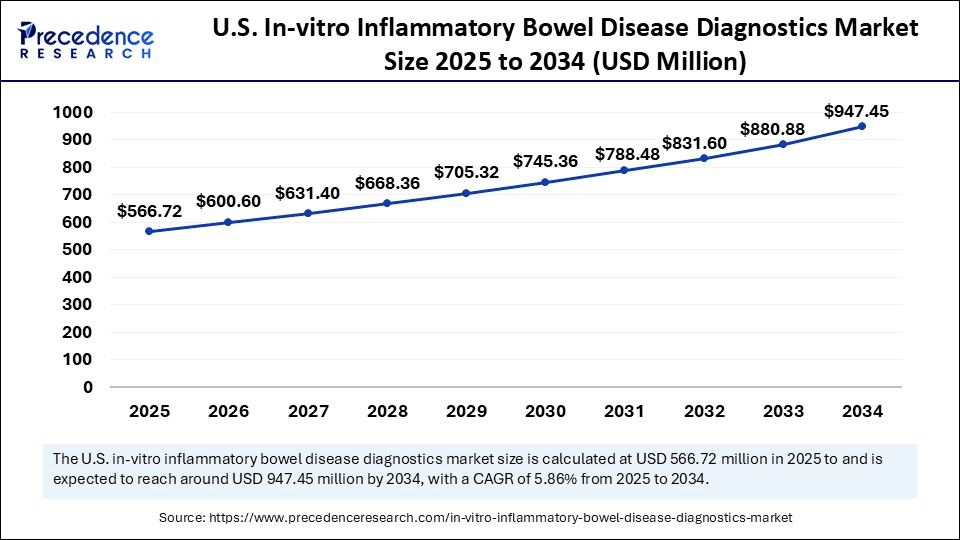

The U.S. in-vitro inflammatory bowel disease diagnostics market size was evaluated at USD 535.92 million in 2024 and is projected to be worth around USD 947.45 million by 2034, growing at a CAGR of 5.86% from 2025 to 2034.

What Made North America the Dominant Region the In-vitro Inflammatory Bowel Disease Diagnostics Market in 2024?

North America led the global market with the highest market share of 44% in 2024. Its leadership is driven by advanced healthcare infrastructure, high awareness of IBD, and readily available diagnostic services. The region's market is highly innovative, fueled by leading diagnostic firms, educational institutions, and research organizations focused on gastrointestinal diseases. The trend towards early diagnosis and treatment, coupled with a growing emphasis on personalized medicine, is boosting the popularity of biomarker- and molecular-based diagnostics. Strong collaboration between public health departments and businesses further supports comprehensive diagnostics coverage.

The U.S. significantly contributes to North America in-vitro inflammatory bowel disease diagnostics. The high prevalence of IBD, including Crohn's disease and ulcerative colitis, coupled with increasing demand for timely and accurate diagnoses, drives the market. High healthcare spending and the adoption of innovative diagnostic technologies in the U.S. further accelerate market growth. Government programs promoting personalized healthcare solutions also contribute to the widespread adoption of in-vitro diagnostics in clinical practice, supporting market growth.

Why is Asia Pacific Experiencing the Fastest Growth in the In-vitro Inflammatory Bowel Disease Diagnostics Market?

Asia Pacific is expected to grow at the fastest CAGR during the forecast period. The regional market growth is driven by the expansion of the region's healthcare infrastructure, the increasing incidence of IBD, and rising awareness of the importance of early diagnosis and management. India, China, and Japan are key contributors to the regional market. The adoption of personalized medicine and non-invasive diagnostic methods is also gaining traction.

Healthcare reforms and significant investments in modernizing the healthcare system in China have created a favorable environment for advanced diagnostic technologies. Government initiatives aimed at enhancing the management and early detection of chronic diseases are driving the adoption of in-vitro diagnostic tests for IBD. Additionally, a strong domestic manufacturing base, coupled with partnerships with foreign diagnostic firms, is enhancing the availability of affordable, high-quality testing procedures.

What are the Major Factors Driving the Growth of the European In-vitro Inflammatory Bowel Disease Diagnostics Market?

The European in-vitro inflammatory bowel disease diagnostics market is expected to grow at a notable rate, driven by robust healthcare systems, rising IBD cases, and advancements in diagnostic tools. Europe boasts well-established diagnostic laboratories, research facilities, and gastroenterology centers, enabling early diagnosis and effective disease monitoring. Germany and France are key contributors to this growth, due to substantial investments in medical research and health programs.

The UK is a major market within the European IBD diagnostics sector. The rising incidence of IBD, particularly among young adults, necessitates convenient and reliable diagnostic methods. Advanced in-vitro diagnostics are supported by National Health Service (NHS) policies focused on chronic disease management and collaborations with research and private diagnostic providers. Furthermore, the UK's focus on precision medicine and genomic studies promotes the adoption of molecular diagnostics.

Market Overview

The in-vitro inflammatory bowel disease diagnostics market refers to diagnostic tests and kits used to detect and monitor inflammatory bowel diseases such as Crohn's disease and ulcerative colitis using in-vitro techniques, performed outside the body in controlled lab environments. These diagnostics include blood, stool, and tissue-based tests aimed at identifying biomarkers like calprotectin, lactoferrin, CRP, and specific antibodies. In-vitro diagnostics (IVD) help with early detection, disease differentiation, disease activity monitoring, and treatment response assessment. Rising IBD prevalence, patient awareness, demand for non-invasive tests, and advancements in molecular diagnostics are driving market growth.

The in-vitro inflammatory bowel disease diagnostics market is experiencing strong growth, driven by an increase in IBD cases, including Crohn's disease and ulcerative colitis. Heightened awareness among healthcare professionals and patients has led to earlier disease detection and improved management. Technological advancements in in-vitro diagnostics, such as biomarker-based tests and non-invasive procedures, are enhancing diagnostic accuracy and patient compliance. Market expansion is further supported by a strong healthcare infrastructure, growing research investments, and the adoption of point-of-care testing, making in-vitro diagnostics a vital component of effective IBD management on a global scale.

What Factors are Fueling the Growth of the In-vitro Inflammatory Bowel Disease Diagnostics Market?

- Increasing incidence of IBD: A major factor boosting the growth of the market is the increasing global prevalence of Crohn's disease and ulcerative colitis. This rise in IBD cases significantly increases the demand for accurate diagnostics to properly identify the condition.

- Enhancements on Diagnostics: Diagnostic processes are becoming more accurate and efficient due to constant innovations in diagnosing, such as the application of biomarker-based assays, molecular diagnostics, and non-invasive forms of diagnosis. These advancements enable the detection of IBD faster and more accurately, allowing for better disease management, response, and ultimately, more robust market growth.

- Demand for Personalized Medicine: The trend toward individualized IBD treatment necessitates diagnostics that inform therapeutic decisions. In vitro assessments of disease status and treatment response are crucial for tailoring interventions, thereby boosting the diagnostics market's growth.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 3.02 Billion |

| Market Size in 2025 | USD 1.84 Billion |

| Market Size in 2024 | USD 1.74 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.64% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Test Type, Disease Type, Sample Type, End User, Technology, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Focus on Early Detection and Disease Monitoring

The growing emphasis on early diagnosis and treatment significantly boosts the in vitro IBD diagnostics market. As medical professionals recognize the importance of early intervention for chronic conditions like Crohn's disease and ulcerative colitis, demand for specific, non-invasive diagnostic methods is increasing. Early identification allows for timely therapeutic intervention, preventing disease complications, improving long-term treatment outcomes, and enhancing quality of life. Biomarker assays and molecular profiling, using in-vitro diagnostic tests, enable clinicians to monitor disease activity and detect flare-ups early. Furthermore, early detection minimizes costly surgeries and hospitalizations, leading to cost savings within healthcare systems.

Restraint

Limited Awareness and Accessibility

Limited awareness and access hinder the in-vitro inflammatory bowel disease diagnostics market, particularly in developing and under-resourced regions. IBD's symptoms, such as weight loss, abdominal pain, and diarrhea, can be easily mistaken for less severe conditions, leading to misdiagnosis and delayed medical care. The lack of specialized diagnostic laboratories, a shortage of trained gastroenterologists, and insufficient health education among the population further exacerbate the problem. These access gaps slow market penetration, emphasizing the need for targeted awareness campaigns, medical personnel training, and improved diagnostic capabilities in emerging markets.

Opportunity

Growing Emphasis on Personalized Medicine

The heterogeneous nature of IBD necessitates personalized medicine, tailoring treatments to individual patient genetics, molecules, and clinical profiles. In-vitro type of diagnostic tools play a crucial role as they help in molecular profiling, biomarker analysis, as well as genetic testing that helps in disease stratification in a more accurate manner. The diagnostics help clinicians choose the most favorable therapeutic approach, reducing trial-and-error treatment strategies and leading to better patient outcomes. The pressure is growing to make in-vitro diagnostics more advanced to accommodate the introduction of more personalized care into healthcare systems worldwide. The trend helps improve the quality of clinical decisions, as well as making disease management strategies more efficient and cost-effective.

Test Type Insights

Why Did the Biomarker Tests Segment Dominate the In-Vitro Inflammatory Bowel Disease Diagnostics Market in 2024?

The biomarker tests segment led the market while holding a 39% share in 2024. Measuring biomarkers is a vital test used to identify specific bodily components correlated with IBD, providing clinicians with crucial information about the disease's presence, severity, and activity. Common biomarker targets include fecal calprotectin, fecal lactoferrin, C-reactive protein (CRP), and erythrocyte sedimentation rate (ESR). These tests utilize ELISA, immunochemistry, and PCR to analyze blood, stool, or tissue samples, providing highly accurate and non-invasive diagnostic tools. Their ability to enable early diagnosis, monitor treatment response, and support personalized medicine approaches has fueled their increasing popularity. The growing emphasis on patient-specific treatment, combined with the global trend toward early diagnosis of chronic diseases, continues to drive demand for biomarker-based tests.

The molecular diagnostics tests segment is expected to grow at a significant CAGR over the forecast period. The segment encompasses advanced testing methods, such as PCR-based panels, specific genotyping of key mutations (e.g., NOD2, IL23R), and next-generation sequencing (NGS), offering in-depth insights into the genetic and molecular aspects of IBD. These tests are highly sensitive and specific, allowing clinicians to detect and predict disease progression and treatment response. Molecular diagnostics are crucial for patient stratification, the development of individualized therapies, targeted treatments, and the prospective selection of patients for clinical trials or innovative treatments. Demand is further driven by the increasing use of precision medicine, greater awareness of IBD's genetic component, and technological advancements that have improved the availability and affordability of these tests.

Disease Type Insights

What Made Crohn's Disease the Dominant Segment in the In-Vitro Inflammatory Bowel Disease Diagnostics Market in 2024?

The Crohn's disease segment held a 56% market share in 2024. Crohn's disease is a lifelong condition that affects the gastrointestinal system, often penetrating deeper into the tissues. It is detected and monitored using in vitro diagnostic tools, such as biomarker tests, including C-reactive protein (CRP), fecal calprotectin, and genetic markers. The rising prevalence and disease burden, along with increased clinical interest in differentiating Crohn's disease from other gastrointestinal disorders (both in vivo and in vitro), are driving demand for more advanced, disease-specific diagnostics. Furthermore, the identification of new biomarkers and molecules related to Crohn's, the development of novel diagnostic methods, and personalized treatment approaches are accelerating the discovery of new biomarkers and molecular targets for the disease.

The ulcerative colitis segment is expected to grow at the highest CAGR in the market. Ulcerative colitis is a chronic inflammatory disease confined to the colon and rectum, characterized by persistent inflammation and ulceration of the intestinal lining. Accurate and timely diagnosis is crucial to prevent severe complications like colorectal cancer or toxic megacolon. Common diagnostic tests for ulcerative colitis include stool biomarkers, blood inflammatory markers, and imaging or endoscopic assessments. Molecular diagnostics and the identification of disease-specific biomarkers are also enhancing diagnostic accuracy. With the healthcare industry's focus on early diagnosis and disease monitoring, the ulcerative colitis market is poised for robust growth, supported by ongoing research and development, increased access to diagnostic tools, and a greater emphasis on preventive and personalized care.

Sample Type Insights

How Does the Stool Segment Dominate the Market in 2024?

The stool segment led the market while holding a 42% share of the in-vitro inflammatory bowel disease diagnostics market in 2024. The high specificity of stool tests, their non-invasive nature, and high patient compliance make stool-based diagnostics a preferred method for diagnosis. Fecal calprotectin and lactoferrin are commonly used as biomarkers in fecal samples to detect IBD, distinguishing it from other gastrointestinal disorders with functional issues, like irritable bowel syndrome. Stool-based testing is affordable and can be widely implemented, especially in outpatient settings, and can even be performed at home. Technological advancements have improved the sensitivity and specificity of stool tests, enhancing their clinical utility.

The saliva/other fluids segment is expected to grow at a significant CAGR over the forecast period. This segment encompasses lab analysis of saliva, blood plasma, serum, and urine, offering alternatives to stool-based or biopsy-based screening. The increasing demand for non-invasive, rapid, and accessible mobile diagnostic solutions drives segmental growth. Saliva-based diagnostics, in particular, are gaining popularity due to their ease of sampling, cost-effectiveness, and suitability for repeated sampling in settings like outpatient clinics or home visits. Advances in molecular diagnostics have enabled the identification of various inflammatory and genetic molecular biomarkers in these fluids, facilitating early detection and the development of personalized treatment plans.

End-user Insights

How Does the Hospitals Segment Dominate the In-Vitro Inflammatory Bowel Disease Diagnostics Market in 2024?

The hospitals segment held a 40% market share in 2024, as hospitals serve as the primary healthcare center for diagnosing, treating, and managing inflammatory bowel diseases. Equipped with advanced diagnostic facilities, hospitals conduct a wide range of in vitro examinations, including biomarker tests, molecular diagnostics, and standard screening tests. Patients favor hospitals due to high patient volume, specialized medical staff, and comprehensive medical services. Furthermore, hospitals actively participate in medical research and trials, acting as key sources for validating new diagnostic devices and identifying biomarkers. As the global IBD patient population continues to grow, hospitals require faster and more precise diagnostic tools, driving the demand for high-quality, rapid tests.

The specialized gastroenterology clinics segment is expected to grow at a rapid pace in the in-vitro inflammatory bowel disease diagnostics market. The growth of the segment is attributed to the increasing number of specialized gastroenterology departments and the growing emphasis on precision medicine, which are fueling the demand for in-vitro diagnostics. These clinics specialize in diagnosing and treating gastrointestinal disorders, providing patients with expert care and advanced diagnostic tools. The demand for diagnostic services in outpatient facilities is rapidly increasing as more individuals seek early diagnosis and regular monitoring for conditions like Crohn's and ulcerative colitis. Additionally, these centers often collaborate with research institutions and diagnostic companies to test new solutions, accelerating the adoption of innovative testing technologies.

Technology Insights

Why Did the Immunoassays Segment Dominate the Market in 2024?

The immunoassays segment led the market while holding a 46% share in 2024. Enzyme-linked immunosorbent assay (ELISA), chemiluminescent immunoassay (CLIA), and other immunoassays are widely used to measure key inflammatory markers like C-reactive protein (CRP), fecal calprotectin, TNF-alpha, IL-6, and IL-1 beta in blood or stool samples. These tests are crucial for diagnosing IBD, assessing disease activity, and evaluating treatment response. ELISA is favored for its accuracy, cost-effectiveness, and ease of use in routine clinical settings. CLIA, with its broader dynamic range and enhanced sensitivity, is increasingly used for precise quantification of low-abundance biomarkers. Immunoassays are relatively fast, with quick turnaround times, making them suitable for mass screening in hospitals and outpatient clinics.

The molecular diagnostics segment is expected to grow at a significant CAGR over the forecast period. Advanced techniques like polymerase chain reaction (PCR), genotyping, and next-generation sequencing (NGS) offer high precision and provide in-depth insights into the molecular and genetic aspects of inflammatory bowel disease. Molecular testing identifies genetic mutations (e.g., NOD2, IL23R) and disease-specific biomarkers, essential for diagnosis, prognosis, and personalized therapy. Compared to traditional methods, molecular assays are more sensitive, specific, and can analyze multiple targets simultaneously, aiding in patient stratification and monitoring disease progression. The increasing adoption of precision medicine and easier access to genetic and microbiome data drive this segment's growth.

In-vitro Inflammatory Bowel Disease Diagnostics Market Companies

- Abbott Laboratories

- Thermo Fisher Scientific

- Roche Diagnostics

- Bio-Rad Laboratories

- Siemens Healthineers

- Becton, Dickinson and Company (BD)

- Danaher Corporation (Beckman Coulter)

- QuidelOrtho Corporation

- Calpro AS

- Immundiagnostik AG

- TechLab, Inc.

- Prometheus Biosciences (a part of Merck)

- Epitope Diagnostics, Inc.

- Myriad Genetics

- Genova Diagnostics

- Biomerica Inc.

- Eurofins Scientific

- GenoSensor Corporation

- Alfa Scientific Designs, Inc.

- F. Hoffmann-La Roche Ltd.

Recent Developments

- In June 2024, AbbVie revealed the U.S. Food and Drug Administration (FDA) approved SKYRIZI 80mg (risankizumab-rzaa) as an adult treatment of moderately to severely active ulcerative colitis, becoming the first drug of IL-23-specific inhibitor approved in both ulcerative colitis and Crohn's disease. SKYRIZI has received four indications on a total of immune-mediated inflammatory diseases.(Source: https://news.abbvie.com)

- In February 2023, American Laboratory Products has introduced Calprotectin Immunoturbidimetric Assay into its gastrointestinal (GI) diagnostic products line through commercializing the project in December 2023 d and that the 510(k) clearance, issued by the American Food and Drug Administration (FDA) in June 2023, allowed the sale and marketing of the Calprotectin Immunoturbidimetric Assay of ALPCO. It is a Calprotectin Immunoturbidimetric Assay, which is cleared in the US as an in vitro diagnostic product that is used to diagnose the inflammatory bowel disease (IBD), including ulcerative colitis (UC) and Crohn's disease (CD). (Source:https://www.nsmedicaldevices.com)

- In October 2023, Teva Pharmaceutical Industries Ltd. and Sanofi signed an agreement to collaborate to co-develop and co-commercialize their TEV 574 assets, which are on Phase 2b clinical trial in the treatment of Ulcerative Colitis and Crohn's disease, which are inflammatory bowel diseases.(Source: https://ir.tevapharm.com)

Segments Covered in the Report

By Test Type

- Biomarker Tests

- Fecal Calprotectin

- Fecal Lactoferrin

- C-reactive Protein (CRP)

- Erythrocyte Sedimentation Rate (ESR)

- Serological Tests

- Anti-Saccharomyces Cerevisiae Antibodies (ASCA)

- Perinuclear Anti-Neutrophil Cytoplasmic Antibodies (pANCA)

- Molecular Diagnostics Tests (Fastest Growing)

- PCR-based Panels

- Genotyping (e.g., NOD2, IL23R mutations)

- Next-Generation Sequencing (NGS)

- Stool Tests

- Others

- Immunohistochemistry

- Flow Cytometry-based Markers

By Disease Type

- Crohn's Disease

- Ulcerative Colitis

- Indeterminate Colitis

By Sample Type

- Stool

- Blood

- Tissue Biopsy

- Saliva/Other Fluids

By End User

- Hospitals

- Clinical & Diagnostic Laboratories

- Academic & Research Institutions

- Specialized Gastroenterology Clinics

By Technology

- Immunoassays (ELISA, CLIA)

- Molecular Diagnostics (PCR, NGS)

- Hematology Analyzers

- Microbiological Culture

- Point-of-Care (POC) Devices

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting