What is the Transgenic Animals Market Size?

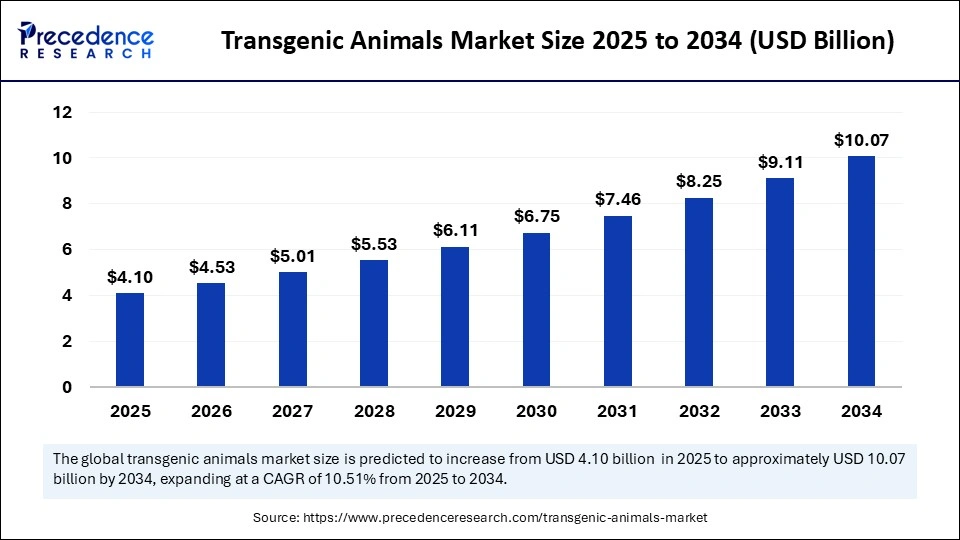

The global transgenic animals market size accounted for USD 3.71 billion in 2024 and is predicted to increase from USD 4.10 billion in 2025 to approximately USD 10.07 billion by 2034, expanding at a CAGR of 10.51% from 2025 to 2034. The transgenic animals market is an emerging sector within biotechnology, focusing on the genetic modification of animals to enhance specific traits or produce valuable products. As advancements in genetic engineering and biotechnology continue to evolve, the market is expected to witness significant growth.

Market Highlights

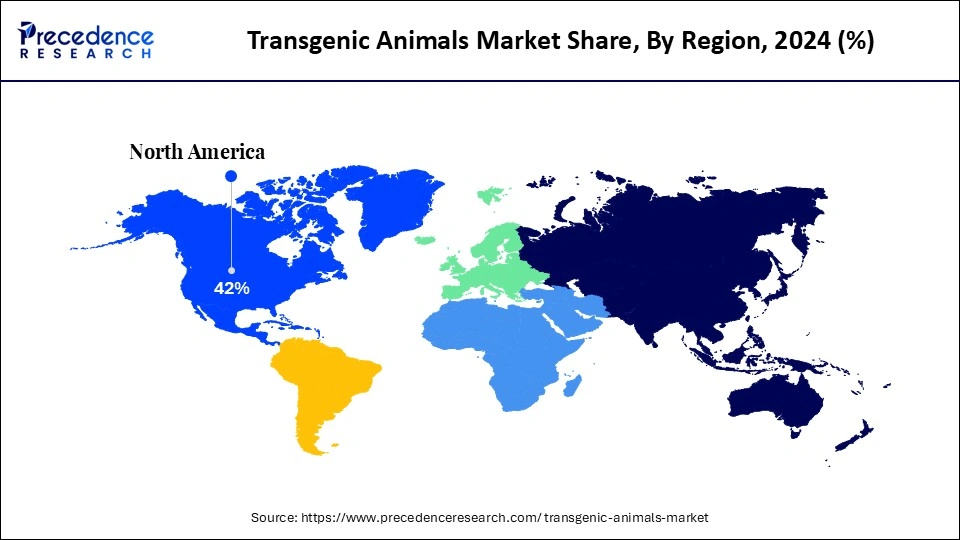

- North America dominated the market, holding the largest market share of 42% in 2024.

- Asia Pacific is expected to expand at the fastest CAGR in the market between 2025 and 2034.

- By animal type, the mice segment held the largest market share, at 55%, in 2024.

- By animal type, the pig is expected to grow at a remarkable CAGR between 2025 and 2034.

- By technology type, the CRISPR-Cas9 segments held the largest share, accounting for 45% of the transgenic animals market in 2024.

- By technology type, TALENs is expected to grow at a remarkable CAGR between 2025 and 2034.

- By application, the biomedical research & gene studies segment held the largest share of 40% in the transgenic animals market during 2024.

- By application, drug discovery & therapeutic protein development are expected to grow at a remarkable CAGR between 2025 and 2034.

- By end-user, the biotechnology & pharmaceutical companies segment held the largest share of 38% in the transgenic animals market in 2024.

- By end-user, contract research organizations are expected to grow at a remarkable CAGR between 2025 and 2034.

Market Size and Forecast

- Market Size in 2024: USD 3.71 Billion

- Market Size in 2025: USD 4.10 Billion

- Forecasted Market Size by 2034: USD 10.07 Billion

- CAGR (2025-2034): 10.51%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

What is Encompassed in the Transgenic Animals Market?

The transgenic animals market refers to the industry focused on genetically modifying animals to introduce foreign DNA, thereby enabling the expression of specific traits or proteins. These animals are widely used in biomedical research, pharmaceutical development, toxicology testing, and agriculture. Transgenic models enable researchers to more effectively mimic human diseases, test the safety of drugs, and study the functions of genes than traditional models. Additionally, transgenic livestock are being developed to produce therapeutic proteins, improve disease resistance, and enhance productivity. Advancements in CRISPR-Cas9, TALENs, and other gene-editing technologies are driving rapid progress in this field.

The market integrates biotechnology companies, academic research centers, and pharmaceutical organizations, with applications across healthcare, veterinary science, and agriculture. Advancements in genetic engineering technologies fuel the transgenic animals market.

North America currently leads the market for transgenic animals, holding the largest share, while the Asia Pacific region is anticipated to experience the fastest growth rate. Mice dominate the market by animal type, but pigs are expected to show significant growth in the coming years. CRISPR-Cas9 technology is the leading method for genetic modification, with TALENs also gaining popularity. The applications of transgenic animals in biomedical research, drug discovery, and agriculture highlight their importance in advancing scientific and medical technologies.

Key Technological Shift in the Transgenic Animals Market

The most consequential technological shift is the maturation of precise, multiplex genome-editing platforms that enable targeted, predictable, and heritable genetic modifications with minimal off-target effects. These tools, combined with advanced embryology, refinements in somatic cell nuclear transfer, and inducible expression systems, enable the creation of models that replicate human disease states or produce complex biologics in animal milk, eggs, or serum. Parallel progress in cryopreservation, assisted reproduction, and phenotyping accelerates the propagation and distribution of validated lines, thereby enhancing the propagation and distribution of validated lines. Together, these advancements transform transgenic animals from artisanal curiosities into robust, reproducible assets for research and production.

Transgenic Animals Market Outlook

- Industry Growth Overview: Industry growth is underpinned by three interconnected drivers: improved genome-editing precision, rising demand for biopharmaceuticals, and the need for more predictive preclinical models. CRISPR and successor technologies have lowered the entry barriers to creating nuanced models, enabling both large pharmaceutical companies and nimble biotechs to commission bespoke lines of research. Contract providers and dedicated breeding facilities are expanding capacity to meet demand, creating a service market that complements in-house capabilities. However, scaling from small-batch research colonies to regulated production herds entails significant capital, operational expertise, and long timelines, moderating the pace of expansion.

- Sustainability Trends: Sustainability considerations are reshaping practices within the transgenic animal ecosystem, prompting investments in welfare-oriented housing, reductions in resource intensity, and lifecycle assessments for animal-produced biologics. Efforts to minimise feed, water, and energy footprints in research and production facilities align with broader ESG demands from investors and purchasers. There is also a growing emphasis on replacing or reducing animal use where viable alternatives exist, with transgenic models reserved for use cases where no surrogate exists. Ultimately, circularity in waste management and ethical sourcing will become increasingly important factors in procurement and facility accreditation.

- Major Investors: Capital originates from strategic pharmaceutical investors, life-sciences venture funds, and a subset of private equity players who see durable value in biologics and platform technologies. Large biopharma firms often invest via partnerships or minority stakes to secure access to bespoke models and production routes. Governmental grants and translational research funds de-risk foundational work, while impact-minded investors sometimes support projects with clear public-health benefits. In summary, the investor base strikes a balance between long-horizon science bets and strategic industrial positioning.

- Startup Economy: The startup landscape is effervescent: boutique firms specialise in genome editing, reproducible model generation, and ethical breeding-as-a-service, while others focus on transgenic livestock for protein production. Many spin out of academic labs, retaining deep technical IP and hiring talent in translational biology. Startups frequently partner with CROs and CDMOs to bridge the chasm between proof-of-concept and regulatory-grade production. Their agility fuels rapid prototype cycles even as scale-up remains capital-intensive.

Market Key Trends

- Platformisation suppliers offering modular, commissionable model libraries and licensing models.

- Convergence of model generation with biomanufacturing.

- Increasing outsourcing to specialised breeding and model-as-a-service providers.

- Heightened regulatory focus on animal welfare, traceability, and biosecurity.

- Growth of inducible and reversible transgenic systems to improve safety and ethics.

- Consolidation of suppliers as incumbents acquire niche innovators.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 3.71 Billion |

| Market Size in 2025 | USD 4.10 Billion |

| Market Size by 2034 | USD 10.07 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 10.51% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Latin America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Animal Type, Technology, Application / Use Case, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Precision Models, Predictable Outcomes

A primary driver is the unambiguous scientific value of transgenic animals in producing precise, mechanistic insights and predictive preclinical data that reduce clinical attrition. Bespoke models can more faithfully mimic human pathophysiology than generic systems, enabling targeted drug development and biomarker discovery. For biologics, transgenic livestock can produce therapeutic proteins at scale, offering potential cost and capacity advantages. The ability to tailor models to specific molecular hypotheses attracts both capital and collaborative interest. Consequently, demand grows where translational risk is high and the value of predictive fidelity is tangible.

Restraint

Ethics, Regulation, and the Cost of Fidelity

Significant restraints include ethical concerns, stringent regulatory requirements, and the substantial cost and time required to develop, validate, and maintain transgenic lines. Public scrutiny over animal modification and welfare can slow approvals and provoke moratoria in sensitive jurisdictions. Regulatory heterogeneity across regions complicates global deployment and commercialisation strategies. Furthermore, maintaining genetic stability and reproducibility across generations imposes continuous operational burdens. Collectively, these factors raise the effective price of entry and temper rapid market proliferation.

Opportunity

Pharming and Precision Pathology

The most luminous opportunity lies in pharming using transgenic livestock to manufacture complex therapeutic proteins and in supplying highly predictive disease models that accelerate drug development. Pharming can offer scalable, cost-efficient routes to biologics that are otherwise difficult to express in cell culture. High-fidelity animal models can reduce phase-III failures by enabling better candidate selection and dosing strategies. Coupled with CDMO partnerships and novel IP-licensing models, these opportunities can create new revenue streams and industrial ecosystems. Hence, translational and production opportunities anchor the market's commercial promise.

Segment Insights

Animal Type Insights

Why Mice are Leading the Transgenic Animals Market?

Mice hold pride of place as the dominant model organism in the transgenic animal industry, contributing nearly 55% of the market share. Their genetic malleability, short reproductive cycles, and well-mapped genomes make them indispensable in biomedical research. From oncology to neurology, transgenic mice have become the living testbeds of modern science, providing insights that cannot be gleaned from in vitro studies alone. Their ubiquity in laboratory research has created a deep ecosystem of suppliers, protocols, and standardized practices. Moreover, the scalability of mouse colonies ensures steady access for both academic institutions and industry labs. This preeminence makes mice the undisputed cornerstone of the transgenic animal landscape.

The sustained reliance on mice stems from their cost-effectiveness and the depth of accumulated research knowledge. Pharmaceutical companies value them for early-stage drug screening, while geneticists deploy them for modeling human diseases with remarkable fidelity. Over the years, refinements in genome-editing tools, such as CRISPR, have only reinforced their indispensability. Even with emerging alternatives, mice continue to be the primary choice for testing therapeutic hypotheses. Their use also accelerates timelines, enabling researchers to iterate quickly and generate statistically significant results. As a result, mice not only dominate the market quantitatively but also shape its methodological norms.

Pigs are rapidly emerging as the fastest-growing sub-segment, driven by their anatomical and physiological similarities to humans. Their organs are increasingly studied for xenotransplantation, offering a potential solution to the global organ shortage crisis. In parallel, pigs serve as biological factories in pharming, engineered to produce therapeutic proteins and antibodies in milk or blood. This dual utility positions pigs at the frontier of translational science and regenerative medicine. The complexity of their genome has historically been a challenge, but advances in precise editing technologies have unlocked their potential. Thus, pigs represent a transformative trajectory in transgenic research.

Beyond medicine, pigs are prized for their scalability and potential to reshape the economics of biologics. Their capacity to express complex human proteins at scale could redefine production costs and accessibility. At the same time, xenotransplantation studies hold profound societal significance, offering hope to patients languishing on transplant waitlists. Ethical debates persist, but scientific progress continues unabated. Pharmaceutical companies and biotech firms alike are investing heavily in porcine-based platforms, underscoring their rising strategic value. Consequently, pigs stand as the vanguard of the next great leap in transgenic applications.

Technology Insights

Why is CRISPR-Cas9 Foremost in the Transgenic Animals Market?

CRISPR-Cas9 is a revolutionary gene-editing technology that has transformed the field of genetic engineering, accounting for a 45% share of the transgenic animals market. It enables precise modifications of an organism's DNA, allowing scientists to add, delete, or alter specific genetic sequences with remarkable accuracy. Utilizing a guide RNA to direct the Cas9 enzyme, researchers can target particular DNA sequences within the genome, making the editing process both efficient and scalable. This technology has a wide range of applications, from agricultural improvements to therapeutic interventions in human medicine. The simplicity and cost-effectiveness of CRISPR-Cas9 have democratized access to advanced genetic research, empowering labs worldwide. As ongoing research continues to uncover new methods and applications, CRISPR-Cas9 remains at the forefront of biotechnology innovation.

The impact of CRISPR-Cas9 extends beyond research laboratories, influencing various industries, including healthcare and agriculture. In medicine, it holds the potential to correct genetic defects, treat diseases, and enhance the efficacy of therapies. Additionally, CRISPR-Cas9 is being explored for its ability to create genetically modified crops with improved yields and resistance to pests and diseases. However, ethical considerations surround the use of this technology, particularly regarding human germline editing. The ability to alter genetic material raises questions about long-term effects and the potential for unintended consequences. Consequently, a robust regulatory framework and ongoing public discourse are crucial for guiding the responsible use of CRISPR-Cas9 technology.

TALENs, although overshadowed by CRISPR in terms of market dominance, are experiencing a surge in adoption of genome editing tools. Their appeal lies in reduced off-target effects, making them particularly valuable for precise therapeutic applications. In contexts where regulatory scrutiny demands uncompromising accuracy, TALENs are proving indispensable. They also demonstrate superior reliability in creating stable, long-term modifications compared to other tools. Pharmaceutical companies and CROs are increasingly incorporating TALENs into niche applications.

The growth of TALENs is a testament to the market's appetite for diverse editing modalities. While CRISPR may dominate general-purpose use, TALENs find strength in specialized, high-stakes domains. Advances in design software and delivery systems have streamlined their usability, reducing earlier technical barriers. Their use in developing therapeutic proteins and engineered cell lines is expanding rapidly. Moreover, the regulatory community's trust in TALENs is fostering their adoption in clinical-stage programs. Thus, TALENs' trajectory symbolizes the market's maturation into a multipronged toolkit of genetic engineering.

Application Insights

Why Is Biomedical Research & Gene Studies in Transgenic Animals Market?

The biomedical research and gene studies segment is a cornerstone of the transgenic animals market, accounting for 44% of the market share. Transgenic animals provide invaluable models that enable scientists to explore gene functions and accurately mimic human diseases, surpassing the capabilities of traditional methods. This capability is pivotal for understanding complex biological processes and evaluating therapeutic strategies. As researchers strive to dissect the genetic underpinnings of diseases, these animals facilitate innovative approaches in developing new treatments. Moreover, the demand for precision medicine continues to elevate the need for robust animal models, solidifying the importance of transgenic organisms in biomedical research. As a result, this segment is expected to maintain its leadership position while driving advancements in both gene studies and therapeutic interventions.

Within the transgenic animals market, the drug discovery segment is projected to experience the most rapid growth in the coming years. Companies are increasingly recognizing the value of transgenic models in streamlining the drug development process and improving the predictability of drug efficacy and safety. By utilizing these animals, researchers can conduct more relevant preclinical trials that reflect human physiological responses. The capabilities offered by advanced gene-editing technologies, like CRISPR, are further enhancing the speed and precision of drug discovery efforts. As pharmaceutical companies focus on reducing time-to-market and improving success rates for new therapeutics, the demand for transgenic animals in this field is expected to surge. Consequently, this segment is emerging as a key driver of innovation and growth within the broader biotechnology landscape.

End User Insights

How Are Biotechnology & Pharmaceutical Companies Directing the Market?

Biotechnology and pharmaceutical companies dominate as end users, representing approximately 38% of the market. Their reliance on transgenic models stems from the high stakes of drug discovery and therapeutic validation. By deploying engineered animals, these companies can assess efficacy, toxicity, and metabolic pathways before advancing to human trials. This de-risking function is invaluable in reducing billion-dollar failures. Furthermore, transgenic platforms support the production of novel biologics, a key focus of modern pharmaceutical development. Hence, their commanding market share reflects both scale and necessity.

Biotechnology and pharmaceutical companies play a crucial role in advancing healthcare by discovering and developing innovative therapies. These companies leverage cutting-edge technologies, such as genomics and bioinformatics, to identify potential drug targets and streamline the drug development process. Collaborations between biotech firms and pharmaceutical companies often lead to the successful translation of research into commercial products, benefiting patients and improving health outcomes. Additionally, biotechnology firms focus on developing biologics, including monoclonal antibodies and gene therapies, which have revolutionized treatment options for various diseases. The integration of artificial intelligence and machine learning in drug design is also enhancing the efficiency and effectiveness of these companies. As they continue to address unmet medical needs, this sector remains a significant driver of economic growth and scientific advancement.

CROs are emerging as the fastest-growing end users in the transgenic animal ecosystem. The outsourcing trend drives their rise, as pharmaceutical companies seek to optimize efficiency and reduce costs. CROs provide specialized expertise and infrastructure, allowing sponsors to access transgenic platforms without incurring capital expenditures. Their global networks make them especially attractive for companies entering new therapeutic domains. Moreover, CROs are adept at navigating regulatory requirements across jurisdictions, a key advantage for multinationals. Their agility and scalability make them indispensable partners in accelerating research timelines.

Regional Insights

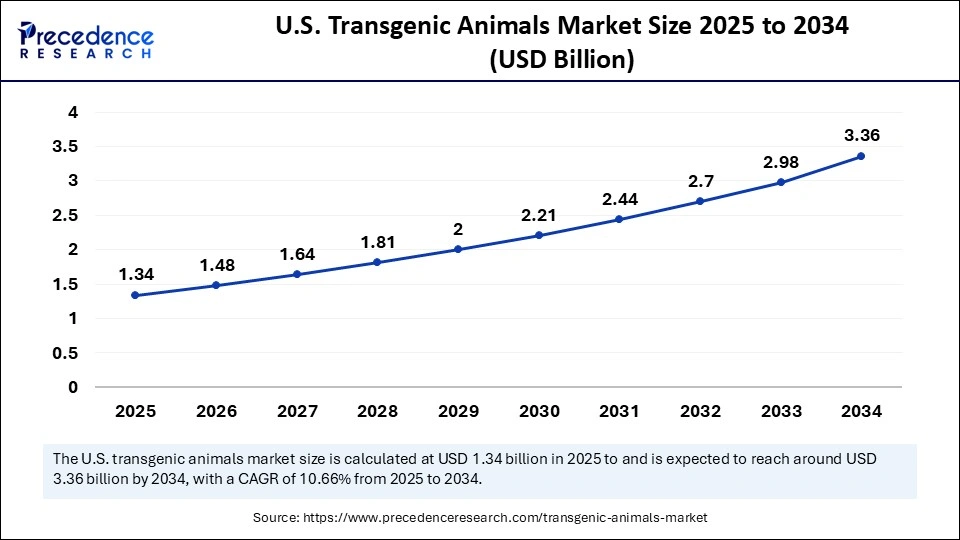

U.S. Transgenic Animals Market Size and Growth 2025 to 2034

The U.S. transgenic animals market size was evaluated at USD 1.22 billion in 2024 and is projected to be worth around USD 3.36 billion by 2034, growing at a CAGR of 10.66% from 2025 to 2034.

How is North America the Rising Star in the market for transgenic animals?

North America continues to hold the largest share of the transgenic animals market, accounting for an impressive 42% in 2024. This dominance can be attributed to robust infrastructure, significant investments, and a well-established biotechnology sector. The region is home to numerous leading companies and research institutions focused on genetic engineering and transgenic research. Furthermore, strong regulatory frameworks facilitate innovation while ensuring safety and compliance. The presence of a skilled workforce and cutting-edge technology further enhances North America's competitive edge. As global demand for transgenic products rises, North America is well-positioned to maintain its leadership.

Why Asia Pacific Fastest Growing?

Conversely, the Asia Pacific region is projected to experience the fastest growth in the transgenic animals market from 2025 to 2034. Driven by increasing investments in biotechnology and research, the region is rapidly climbing the market ladder. Countries like China and India are beginning to enhance their capabilities in genetic modification, signaling a shift towards innovation. The growing population and rising demand for agricultural productivity further fuel this acceleration. Collaborative efforts between governments and the private sector are expected to bolster research initiatives, paving the way for advancements. As the region embraces modern technology, its growth potential in the transgenic market remains remarkable.

Transgenic Animals Market: Value Chain Analysis

- Raw Material Sources: Essential inputs include high-quality cell lines, validated genetic constructs (vectors, gRNAs), and reproductive biology consumables such as culture media and cryoprotectants. The procurement of GMP-grade reagents and pathogen-free breeding stock is crucial to ensure reproducibility and regulatory compliance.

- Technology Used: Core technologies encompass CRISPR and advanced editing nucleases, somatic cell nuclear transfer techniques, inducible expression systems, and high-throughput phenotyping platforms. Complementary tools include single-cell omics for validation and automated husbandry systems for standardised colony maintenance.

- Investment by Investors: Investors prioritise platform companies that can supply reproducible models at scale and entities that combine model generation with downstream biomanufacturing potential. Strategic pharma investments often aim to secure exclusive access to models or to vertically integrate production capabilities.

- AI Advancements: AI and machine learning assist in candidate gene selection, predicting off-target edits, and correlating genotype with phenotype from multi-omic datasets. Predictive models also optimise breeding decisions and husbandry parameters, improving colony health and yield.

Transgenic Animals Market Companies

- Novozymes A/S – World leader in industrial enzymes, providing biocatalysts for food, feed, bioenergy, and pharmaceuticals.

- DuPont de Nemours, Inc. (IFF) – Offers enzymes for food, beverage, and bio-based solutions through its Nutrition & Biosciences division.

- DSM-Firmenich – Supplies specialty enzymes for nutrition, health, and sustainable industrial applications.

- Codexis, Inc. – U.S. biotech company focused on engineered enzymes for pharmaceuticals, food, and industrial bioprocessing.

- AB Enzymes GmbH (Associated British Foods) – Produces enzymes for baking, food processing, animal feed, and technical industries.

- Amano Enzyme Inc. – Japanese company specializing in enzymes for food, pharmaceuticals, and diagnostics.

- BASF SE – Provides enzymes and biocatalysts for detergents, food, feed, and biofuel industries.

- Thermo Fisher Scientific Inc. – Offers research and diagnostic enzymes for biotechnology, pharmaceuticals, and healthcare.

- Chr. Hansen Holding A/S – Supplies enzymes, cultures, and natural ingredients for dairy, food, and agriculture.

- Dyadic International, Inc. – Develops enzyme expression systems for biopharma, industrial enzymes, and alternative proteins.

- Biocatalysts Ltd. – UK-based company specializing in custom enzyme development and fermentation solutions.

- EnzymeWorks, Inc. – Focuses on enzyme engineering and biocatalysis solutions for green chemistry and drug development.Sanofi (Genzyme for Therapeutic

- Enzymes) – Provides therapeutic enzymes for rare diseases and biopharmaceutical applications.

- Creative Enzymes – U.S.-based provider of enzyme products, assays, and custom enzyme services for research and industry.

- Advanced Enzyme Technologies Ltd. – Indian company producing enzymes for food, animal nutrition, and pharmaceuticals.

Recent Developments

- In September 2025, while OTT viewers were captivated by the direwolves in Game of Thrones and efforts for their de-extinction were underway, numerous other species were also undergoing various stages of conservation or attempts to bring them back from the brink of extinction. Indian documentary filmmaker Mayurica Biswas vividly remembers following the unfolding events in Kenya, where scientists were working to save the northern white rhino from disappearing forever. After the original surrogate rhino succumbed to a flood, a similar but not identical southern white rhino was inseminated by a team from Germany, marking a bold leap into uncharted scientific territory.(Source: https://indianexpress.com)

- In March 2025, Colossal Biosciences reported the birth of a “woolly mouse” — a genetically modified mouse engineered with mammoth-like traits — as a step toward their broader goal of creating an elephant calf with mammoth features.(Source: https://time.com)

Segments Covered in the Report

By Animal Type

- Mice

- Rats

- Rabbits

- Sheep

- Goats

- Pigs

- Cattle

- Others (zebrafish, chickens, etc.)

By Technology

- CRISPR-Cas9

- TALENs (Transcription Activator-Like Effector Nucleases)

- Zinc Finger Nucleases (ZFNs)

- Microinjection

- Nuclear Transfer (Cloning)

- Others

By Application / Use Case

- Biomedical Research & Gene Function Studies

- Drug Discovery & Development

- Toxicology & Safety Testing

- Production of Therapeutic Proteins (Pharming)

- Xenotransplantation Research

- Agricultural Improvements (growth traits, disease resistance)

- Others

By End User

- Biotechnology & Pharmaceutical Companies

- Academic & Research Institutes

- Contract Research Organizations (CROs)

- Veterinary Research Centers

- Agricultural Research Bodies

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting