What is the Veterinary CRO And CDMO Market Size?

The global veterinary CRO and CDMO market size was estimated at USD 7.73 billion in 2025 and is anticipated to reach around USD 17.15 billion by 2035, expanding at a CAGR of 8.30% from 2026 to 2035. The veterinary CRO and CDMO market growth is attributed to the driving purpose to deliver trusted and innovative solutions to customers through advanced would-class treatment and therapies for healthier and happier animals.

Veterinary CRO and CDMO Market Key Takeaways

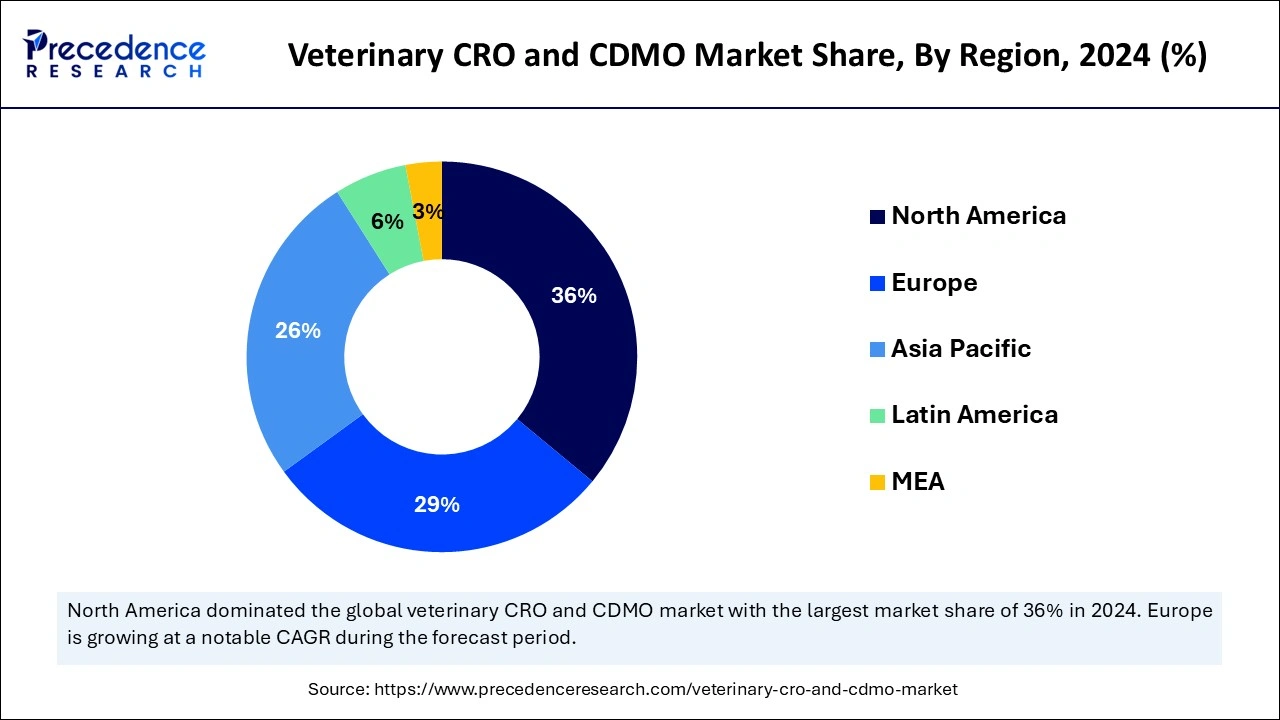

- North America contributed more than 35% of revenue share in 2025.

- Europe region is estimated to observe the fastest expansion during the forecast period.

- By Animal Type, the livestock animal segment has held the highest market share of 47% in 2025.

- By Animal Type, the companion animal segment is expected to expand at the fastest CAGR of 11.8% between 2026 to 2035.

- By Service Type, the development segment contributed more than 32% in 2025.

- By Service Type, the discovery segment is expected to grow at the fastest CAGR over the projected period.

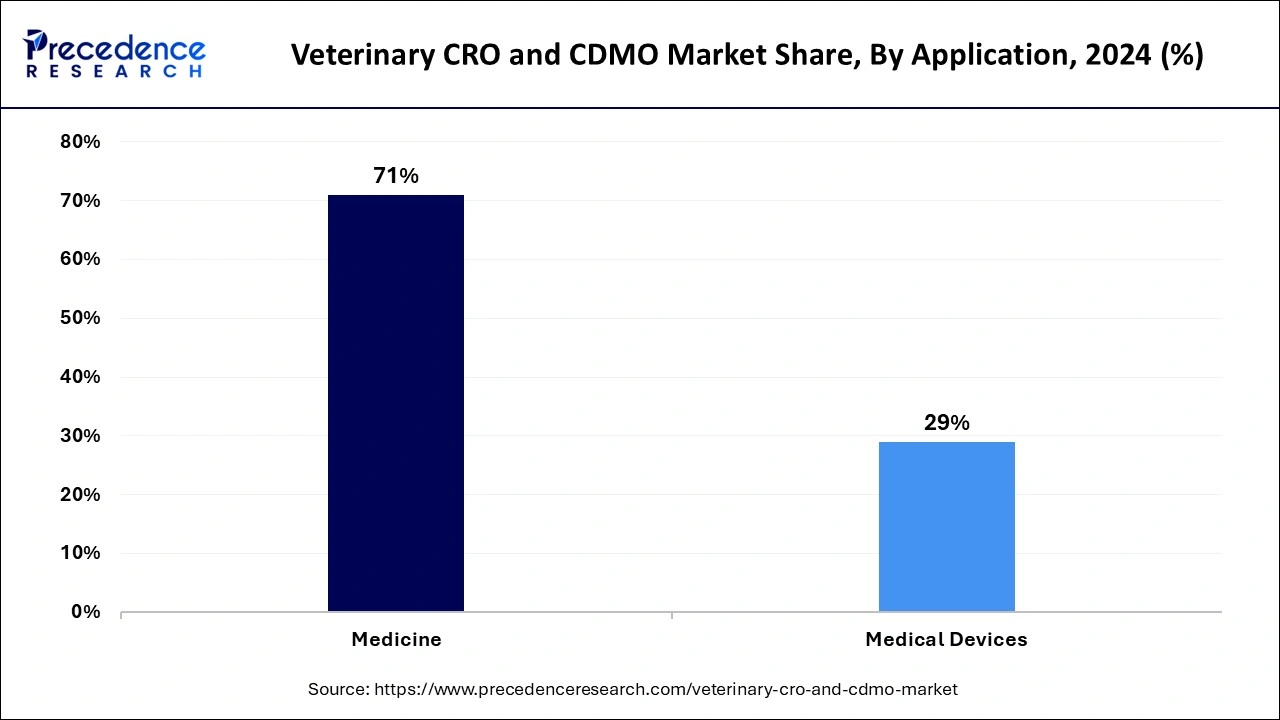

- By Application, the medicine segment had the highest market share of 71% in 2025.

- By Application, the medical devices segment is anticipated to expand at the fastest CAGR over the projected period.

What is the Veterinary CRO And CDMO?

- The Veterinary Contract Research Organization (CRO) and Contract Development and Manufacturing Organization (CDMO) market pertains to the sector focused on outsourced research, development, and manufacturing services for veterinary pharmaceuticals andbiotechnologyproducts.

- Its nature involves comprehensive support for veterinarydrug discovery, preclinical andclinical trials, and manufacturing processes, enabling pharmaceutical companies to expedite product development while ensuring compliance with regulatory standards.

- The market addresses the demand for cost-effective and specialized solutions in the veterinary healthcare industry, offering a range of services, from formulation development to regulatory submission, to meet the unique needs of animal health product developers.

How AI is changing the Veterinary CRO And CDMO Market?

The incorporation of artificial intelligence in veterinary medicine has the potential to revolutionize the industry. AI will help in treatment decisions and optimize the accuracy and safety of diagnostic decisions. This fast-paced technological advancement is utilized in veterinary clinical practice which enhances the deliverance of veterinary care and improves outcomes. The application of AI in antimicrobial resistance (AMR) research, cancer research, vaccine development and drug design innovations are transforming the industry. Overall AI's contribution to animal health (AH) for disease diagnosis, precise diagnosis with minimal errors, enhancement of risk assessment and target-specific intervention.

Veterinary CRO And CDMO Market Growth Factors

- With the growing global pet population, there is an increase in creating animal health products and livestock production which drives the development of veterinary medicines and vaccines.

- Expanding regulatory requirements necessitate comprehensive testing and compliance, increasing the reliance on CRO and CDMO services.

- Collaborations between industry players and contract organizations also contribute to innovation and market expansion.

- The pursuit of novel therapies, including gene therapies and biologics, presents opportunities for service providers to offer specialized expertise.

- The increasing demand for specialized veterinary medicines and biologics to cater to diverse animal species drives the need for CRO and CDMO services.

- The surge in zoonotic diseases and the One Health approach emphasize the importance of veterinary pharmaceuticals, boosting research and development efforts.

- The adoption of advanced technologies such as pharmacovigilance and real-world evidence generation further propel the market growth.

Market Outlook

- Industry Growth Overview: The number of pet owners who outsource therapeutic demand biologics to improve speed increases.

- Major investors: Zoetis, Elanco, Merck Animal Health, Boehringer Ingelheim, Charles River, and Inotiv are the investors.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 8.30% |

| Market Size in 2025 | USD 7.73 Billion |

| Market Size by 2035 | USD 17.15 Billion |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Animal Type, By Service Type, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Growing global pet population and intensified livestock production

The expanding global pet population is a significant driver of surging market demand for the veterinary CRO And CDMO market. With more people embracing pets as companions, there is a heightened need for specialized veterinary medicines and treatments. This surge in demand necessitates the expertise and services of CRO and CDMO providers to develop and manufacture innovative pharmaceuticals, vaccines, and therapeutic solutions tailored to the diverse health needs of companion animals, fostering substantial growth in the veterinary pharmaceutical industry.

Moreover, intensified livestock production significantly surges the market demand for the veterinary CRO and CDMO market. As livestock farming operations expand and become more intensive, there is a heightened need for veterinary pharmaceuticals, vaccines, and innovative treatments to ensure the health and productivity of animals. This demand drives increased research and development activities, and veterinary companies increasingly turn to CRO and CDMO services for expertise and support in developing, testing and manufacturing these essential products. Consequently, intensified livestock production propels the growth of the veterinary CRO and CDMO market.

Restraints

Quality control and regulatory hurdles

Quality control is a critical restraint on market demand for the veterinary CRO and CDMO markets. Ensuring consistent product quality and safety in the production of veterinary pharmaceuticals is resource-intensive and time-consuming. The need for rigorous quality control measures can lead to extended timelines and increased costs, affecting the affordability and accessibility of these vital products.

Manufacturers and service providers must navigate complex quality assurance processes to meet regulatory standards, potentially impacting market competitiveness and hindering overall growth in the industry. Moreover, regulatory hurdles represent a significant restraint on the market demand for the veterinary CRO and CDMO market.

Adherence to stringent and ever-evolving animal health regulations globally demands substantial resources and a deep understanding of regulatory complexities. Navigating these hurdles often leads to delays in product development and increased compliance costs, impacting the overall timeline and cost-effectiveness of outsourcing services. Consequently, regulatory challenges can hinder market growth, making it essential for service providers to invest significantly in navigating these complexities to ensure market accessibility and compliance.

Opportunities

Technological integration and pharmacovigilance services

Technological integration significantly surges the market demand for the veterinary CRO and CDMO markets. The integration of advanced technologies, including artificial intelligence, data analytics, and digital platforms, significantly enhances research and development efficiency within the veterinary CRO and CDMO markets. These technologies streamline drug development processes, improve data management, and enable real-time monitoring.

As a result, the delivery of safe and effective veterinary pharmaceuticals is expedited, ensuring that innovative solutions reach the market more efficiently, benefiting both animal health and the industry as a whole. As the industry embraces technological advancements, service providers offering integrated technological solutions become increasingly sought after, driving higher demand for their specialized services in the veterinary healthcare sector. Moreover, Pharmacovigilance services play a crucial role in surging the market demand for the veterinary CRO and CDMO market.

These services ensure the safety and monitoring of veterinary pharmaceuticals in the market, addressing regulatory compliance and consumer safety concerns. As animal health regulations become more stringent, the need for robust pharmacovigilance support grows. Veterinary companies increasingly rely on CRO and CDMO service providers offering pharmacovigilance expertise to navigate complex safety reporting requirements, thereby fostering trust, compliance, and market demand for their products and services.

Segment Insights

Animal Type Insights

According to the animal type, the livestock animal segment has held a 47% revenue share in 2025. Livestock animals in the veterinary CRO and CDMO market refer to animals raised for various purposes, including meat, milk, and other agricultural products. Trends in this sector highlight the increasing demand for specialized veterinary pharmaceuticals and vaccines for livestock health and productivity. With the intensification of livestock production, there is a growing need for research and development services to ensure the safety and efficacy of animal health products.

Furthermore, the growing emphasis on sustainable and eco-friendly practices in livestock farming is serving as a catalyst for innovation within the veterinary CRO and CDMO markets. This focus on sustainability is propelling the development of novel veterinary solutions tailored specifically for livestock animals, aligning with the industry's commitment to responsible and environmentally-friendly agricultural practices.

- In September 2024, the University of Kentucky of Agriculture, Food and Environment received USDA funds for a 5-year project to advance the utilization of drone technology in livestock management. The project is called Precision Livestock Management: Cattle Monitoring and Herding Using Cooperative Drones.

The companion animal segment is anticipated to expand at a significantly CAGR of 11.8% during the projected period. In the veterinary CRO and CDMO market, companion animals refer to pets, such as dogs, cats, and small mammals, which share close bonds with humans. The trend in this segment shows a growing focus on personalized healthcare solutions for companion animals. This includes the development of specialty drugs, advanced diagnostics, and tailored treatments, mirroring the increasing importance of pets in people's lives. Additionally, the demand for telehealth services for companion animals has surged, enabling remote consultations and monitoring, further emphasizing the trend toward more personalized and accessible veterinary care.

- In October 2024, Elanco Animal Health Incorporated, an American pharmaceutical company which produces medicines and vaccinations for pets and livestock, announced their new product which is FDA-approved – Credelio Quattro (lotilaner, moxidectin, praziquantel, and pyrantel chewable tablets). This is the first and only canine oral parasiticide to protect against 6 parasites in 1 such as fleas, heartworms, ticks, hookworms, roundworms and 3 different species of tapeworms.

Service Type Insights

The development segment held the largest market share of 32% in 2025. In the veterinary CRO and CDMO market, the development service type pertains to research and development activities for veterinary pharmaceuticals and biologics. This includes formulation development, preclinical and clinical trials, and regulatory support. Emerging trends in the veterinary CRO and CDMO Market encompass a heightened focus on personalized veterinary medicine, the rapid advancement of gene therapies and biologics, and the integration of cutting-edge technologies like artificial intelligence and real-world evidence generation. These dynamic trends underscore the industry's commitment to innovation, emphasizing the creation of bespoke, safe, and highly effective solutions tailored to meet the specific healthcare needs of animals.

The Discovery segment is projected to grow at the fastest rate over the projected period. In the veterinary CRO and CDMO market, the "Discovery" service type refers to the initial phase of research and development, where novel compounds and treatment approaches are identified and evaluated for their potential in veterinary pharmaceuticals. This phase involves target identification, lead optimization, and preclinical testing. Trends in the Discovery services segment include a focus on innovative drug candidates, especially in areas such as zoonotic disease prevention and personalized medicine for animals. Advancements in genomics and bioinformatics have also accelerated the discovery process, allowing for the identification of new drug targets and the development of more effective veterinary therapies.

Application Insights

In 2025, the medicine segment had the highest market share of 71% on the basis of the application. In the veterinary CRO and CDMO market, the application of medicine refers to the development and manufacturing of pharmaceuticals, vaccines, and therapeutic solutions for animal health. A prominent trend in this sector includes a growing focus on personalized and species-specific medicines, aligning with the increasing awareness of tailored treatments for diverse animal species. Furthermore, innovations in gene therapies and biologics are gaining traction, offering novel approaches to address various veterinary healthcare needs. These trends reflect the industry's commitment to advancing veterinary medicine to enhance the well-being of animals worldwide.

The medical devices is anticipated to expand at the fastest rate over the projected period. In the veterinary CRO and CDMO market, the application of medical devices refers to the development and manufacturing of veterinary medical equipment and diagnostic devices. This encompasses a wide range of products, including imaging systems, surgical instruments, monitoring devices, and diagnostic tools tailored for animal healthcare. Trends in this segment include the increasing demand for advanced veterinary medical devices, driven by the growing focus on animal health and the rise in specialized treatments. Additionally, innovations in telemedicine and remote monitoring devices are shaping the future of veterinary diagnostics and care, offering convenience and accessibility to veterinarians and pet owners.

Regional Insights

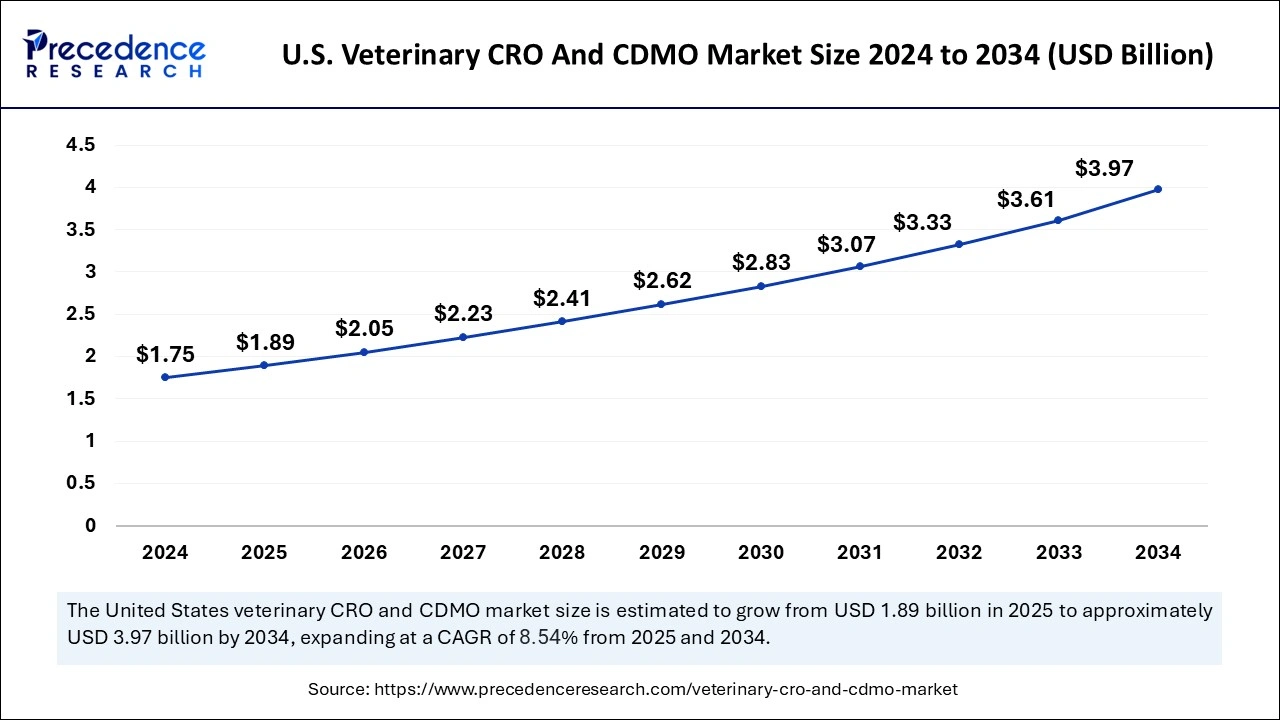

What is the U.S. Veterinary CRO and CDMO Market Size?

The U.S. veterinary CRO and CDMO market size accounted for USD 1.89 billion in 2025 and is expected to be worth around USD 4.28 billion by 2035 growing at a CAGR of 8.52% from 2026 to 2035.

North America has held the largest revenue share 35% in 2025. In North America, the veterinary CRO and CDMO market exhibit several trends. The region sees agrowing focus on personalized medicine for pets, driving the development of specialized veterinary pharmaceuticals and services. The emphasis on regulatory compliance and pharmacovigilance is increasing, ensuring the safety of veterinary drugs. Additionally, collaborations between academic institutions and industry players foster innovation, and the adoption of advanced technologies, such as AI and data analytics, is enhancing research and development efficiency. North America remains a leading hub for animal health innovation, with a strong emphasis on providing cutting-edge solutions for veterinary medicine.

U.S. Veterinary CRO And CDMO Market Trends

The U.S. has the highest share with the developed research infrastructure and a high level of R and D. The companion animal therapeutics take up the majority of the demand. Pharmaceutical companies and CRO CDMO strategic alliances can speed up time to market in support of an innovation-driven pipeline in veterinary medicine.

Europe is the fastest growing. In Europe, the veterinary CRO and CDMO market are witnessing notable trends. The region places a strong emphasis on animal welfare and stringent regulatory compliance, driving demand for high-quality veterinary pharmaceuticals. Collaborations between European pharmaceutical companies and CRO/CDMO service providers are fostering innovation. Additionally, the increasing pet ownership and awareness of animal health contribute to market growth, particularly in Western European countries. The market is also embracing digitalization, with advanced technologies like telemedicine and digital health records becoming integral to veterinary research and development processes, ensuring efficient services and product delivery.

Germany Veterinary CRO And CDMO Market Trends

Germany is a firm grounded in the growth of biologic vaccines. A high regulatory environment enhances the demand for compliant CDMO services. Pan-European consolidation improves the integrated services in development, manufacturing, and regulatory skills in veterinary therapeutics.

Value Chain Analysis of the Veterinary CRO And CDMO Market

- R&D: To find optimized animal health molecules, which are safe and efficacious against experimental validation.

Key players: Zoetis, Boehringer Ingelheim, Elanco - Clinical Trials and Regulatory Approvals: Testing in target animals, obtaining compulsory authorizations from health authorities.

Key players: Charles River Laboratories, Labcorp Drug Development - Formulation and Final Dosage Preparation: The active ingredients are combined into stable forms of administration.

Key players: Vetio, Argenta, TriRx Pharmaceutical Services - Packaging and Serialization: Packages are sealed with tracking codes that guarantee the integrity of veterinary products.

Key players: Sharp (Packaging Services), Catalent, Vetter - Hospitals, Pharmacies: Logistical movement that supplies the completed veterinary products to the points of animal care.

Key players: Covetrus, Henry Schein Animal Health

Veterinary CRO And CDMO Market Companies

- Covance Inc. (a LabCorp Company): Offers end-to-end drug development, such as preclinical safety assessment, clinical trials, and central laboratory services.

- Charles River Laboratories International, Inc.: Offers animal research models, toxicology services, and provides support to avian vaccine veterinary candidates.

- PAREXEL International Corporation: Providing regulatory consulting for biopharmaceutical development, quickening world therapeutic approval in animals.

Other Major Key Players

- ICON plc

- Pharmaceutical Product Development, LLC (PPD)

- Syneos Health

- WuXi AppTec

- Medpace

- Envigo

- Vetio Animal Health

- Clinipace

- MPI Research

- Veterinary Research Management (VRM)

- VetPharm, Inc.

- Merck Animal Health

Recent Developments

- In September 2025, Sai Life Sciences launched Unit VI, a new veterinary-API facility in Bidar, India, to meet rising demand for veterinary medicines and fulfill regulatory requirements. The facility supports animal-health sponsors and contract customers alongside its main API site.

(Source: https://www.drugdiscoverytrends.com ) - In July 2024, Nova Holding's portfolio company Invetx acquires Dechra Pharmaceuticals, a global specialist in veterinary pharmaceuticals and related products business. They aim to treat various chronic and serious animal diseases by formulating a species-specific cure which optimises and extends life.

- In August 2024, Akston Biosciences Corporation, a protein therapeutics developing and manufacturing for animal health companies makes a strategic partnership with Purdue University. Together they intend to co-develop an anti-cPD-L1 monoclonal antibody (mAB) immunotherapy to treat cancer in dogs.

Segments Covered in the Report

By Animal Type

- Companion Animals

- Livestock Animals

By Service Type

- Discovery

- Development

- Manufacturing

- Packaging & Labeling

- Market Approval & Post-marketing

By Application

- Medicines

- Medical Devices

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting