What is Underground Wires and Cables Market Size?

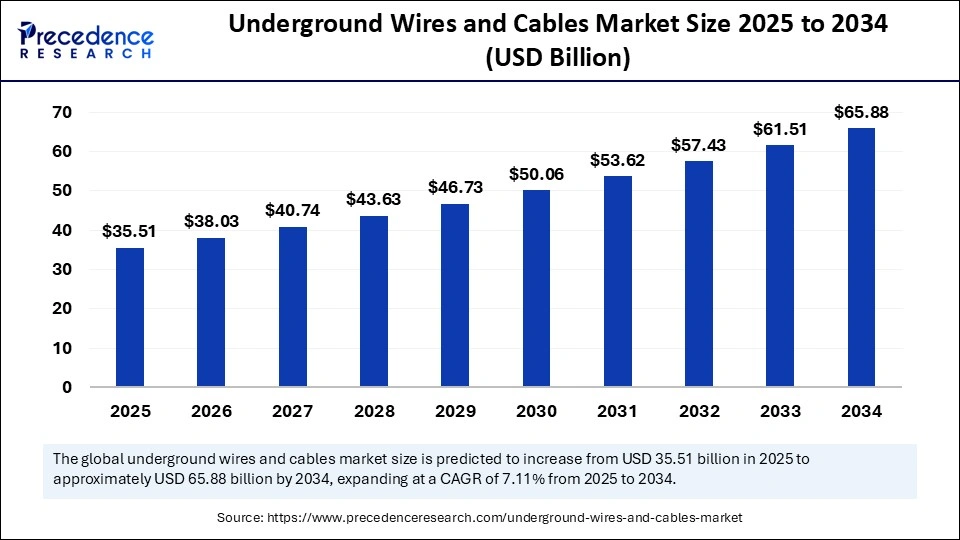

The global underground wires and cables market size is calculated at USD 35.51 billion in 2025 and is predicted to increase from USD 38.03 billion in 2026 to approximately USD 65.88 billion by 2034, expanding at a CAGR of 7.11% from 2025 to 2034. The market growth is attributed to rising investments in reliable power infrastructure and increasing adoption of advanced underground cabling technologies that enhance efficiency, safety, and sustainability.

Market Highlights

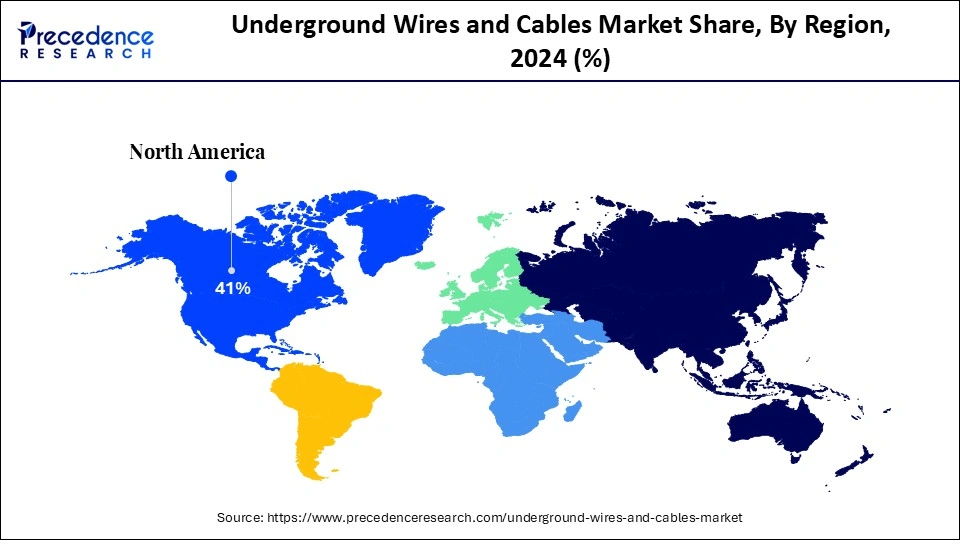

- The North America accounted for the largest market share of 41% in 2024.

- The Asia Pacific segment is expected to grow at the fastest of 8.5% from 2025 to 2034.

- By type, the power cables segment accounted for the largest market share of 45% in 2024.

- By type, the communication cables segment is growing at a CAGR of 7.5% between 2025 and 2034.

- By installation type, the direct burial segment held the major market share of 42% in 2024.

- By installation type, the duct installation segment is set to experience the fastest CAGR of 7% from 2025 to 2034.

- By material, the metallic conductors (copper & aluminum) segment contributed the largest market share of 48% in 2024.

- By material, the non-metallic composite materials segment is anticipated to grow at a CAGR of 8% between 2025 and 2034.

- By voltage rating, the up to 1 kV (low voltage) segment dominated the market, accounting for an estimated 38% market share in 2024.

- By voltage rating, the above 220 kV (extra high voltage) segment expanding at a strong CAGR of 7.2% from 2025 to 2034.

- By application, the power transmission & distribution segment captured the biggest market share of 40% in 2024.

- By application, the renewable energy projects segment is growing at a CAGR of 7.5% from 2025 to 2034.

- By end user, the utility companies segment accounted for the highest market share of 43% in 2024.

- By end user, the renewable energy development segment is expected to grow at a strong CAGR of 7.5% from 2025 to 2034.

- By insulation materials, the cross-linked polyethylene (XLPE) segment held the largest market share of 36% in 2024.

- By insulation materials, the ethylene propylene rubber (EPR) segment is growing at a CAGR of 7% from 2025 to 2034.

Market Size and Forecast

- Market Size in 2025: USD 35.51 Billion

- Market Size in 2026: USD 38.03 Billion

- Forecasted Market Size by 2034: USD 65.88 Billion

- CAGR (2025-2034): 7.11%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

What are Underground Wires and Cables?

The surge in the integration of renewable energy sources leads to the need to have underground wires and cables. The existing power systems require effective transmission of energy from distant solar and wind farms to central grids. Thus, governments invest in the construction of underground and submarine cable systems, eliminating weather risk and losses.

In 2025, the World Bank approved funding to improve Turkiye's power transmission system, including increasing underground cables to allow 1.7 GW of new renewable generation capability. The modernization of urban infrastructure programs in 2024 has led to the deployment of more underground cables in India and West Africa to improve grid reliability. Furthermore, the rise in technological advances in materials, jointing systems, and cable system designs is expected to fuel the market.(Source: https://www.hvdcworld.com)

Impact of Artificial Intelligence on the Underground Wires and Cables Market

The underground wires and cables industry is rapidly being transformed by artificial intelligence (AI), enhancing the efficiency, reliability,, and safety of the entire value chain. Furthermore, the smart analytics allow the energy providers to balance the loads more efficiently, decreasing transmission losses and increasing grid stability.

Growth Factors

- Growing Adoption of Smart Grid Technologies: Rising deployment of smart grid infrastructure is driving demand for integrated underground cabling solutions that enable real-time monitoring and automated control.

- Boosting Urban Electrification Projects: Rapid urban expansion and modern metro developments are propelling investments in buried power and communication networks for safer and more reliable energy distribution.

- Rising Focus on Disaster-Resilient Infrastructure: Increasing awareness of climate-related hazards is fuelling the replacement of overhead lines with underground cables to reduce outage risks from storms, floods, and extreme weather.

- Driving Industrial Electrification and Automation: Expanding industrial zones and adoption of high-voltage machinery are stimulating demand for durable underground cabling systems capable of handling heavy electrical loads.

Global Trends, Investments, and Developments in the Underground Wires and Cables Industry

- Global Energy Investment Surge: In 2024, global energy investment surpassed USD 3 trillion, with USD 2 trillion allocated to clean energy technologies and infrastructure, marking a significant shift towards sustainable energy systems.

- Renewable Energy Consumption Growth: Between 2024 and 2030, renewable energy consumption in power, heat, and transport sectors is projected to increase by nearly 60%, elevating the share of renewables in final energy consumption to approximately 20% by 2030.

- Grid Capacity Expansion Requirement: To meet climate commitments, over 80 million kilometers of grid infrastructure need to be added or refurbished globally by 2040, effectively doubling the existing grid length.

- Regional Cable Developments: In the UK, the approval of five new subsea power cable projects by Ofgem aims to link the UK's power grids with those in Germany, Ireland, and Northern Ireland, enhancing energy security and supporting the transition to net-zero emissions by 2030.

- Low-Carbon Aluminum Supply: Norwegian company Hydro has signed a long-term agreement worth approximately EUR 1 billion with Danish company NKT to supply low-carbon aluminum wire rod for enhancing Europe's grid infrastructure. This supply, amounting to around 274,000 metric tons from 2026 to 2033, supports the EU's plan to modernize electricity grids for a cleaner energy transition.

- Underground Cable Deployment:The United States is a major investor in smart city infrastructure, allocating approximately USD 10.5 billion in 2024 through the Grid Resilience and Innovation Partnerships (GRIP) Program to modernize grid infrastructure, including underground cable systems

(Source: https://iea.blob.core.windows.net)

(Source:https://www.iea.org)

(Source: https://www.iea.org)

(Source:https://www.wirecable.in)

(Source: https://eepower.com)

(Source: https://www.nkt.com)

(Source: https://www.energy.gov)

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 35.51 Billion |

| Market Size in 2026 | USD 38.03 Billion |

| Market Size by 2034 | USD 65.88 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.11% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type,Installation Type, Material, Application,Voltage Rating, End user,Insulation Material, andRegion |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How Is the Growing Demand for Reliable Power Transmission Driving the Expansion of the Underground Wires and Cables Market?

Increasing demand for reliable power transmission is expected to drive the market. Fast urbanization and industrial development mean that the delivery of power needs to be regular. This is forcing utility companies to invest in an underground cabling system. The International Energy Agency records that the world has been increasing its power demand by 2.2% in 2024, which is placing a strain on networks to upgrade and scale.

High-voltage underground wires can be used to control grid overloading in highly populated regions and minimize the vulnerability to weather-related losses. The statistics on total electricity consumption in the U.S. in 2024 reach 4,097 billion kWh. That further supports the necessity of investing in the transmission and distribution. Furthermore, the rising technological advancements in cable materials and design are estimated to accelerate adoption in the coming years.

(Source: https://www.iea.org)

(Source: https://www.dws.com)

Restraint

High Installation and Maintenance Costs Hampering the Growth of the Underground Wires and Cables Market

High installation and maintenance costs are anticipated to hamper market growth. The installation of underground cables requires a lot of excavation, specialized tools, and technical expertise, which greatly increases initial project costs as compared to overhead lines. These monetary obstacles slow out massive implementation and lower the adoption rate of buried networks in cost-sensitive areas. Furthermore, the complex fault detection and repair procedures are expected to restrain market growth.

Opportunity

What Role Do Surging Investments in Infrastructure and Industrial Projects Play in Strengthening the Market?

Surging investments in urban infrastructure and industrial projects are anticipated to create immense opportunities for the players competing in the market. Mega city developments, high-rise commercial buildings, and large-scale industrial zones have high demands for electricity, data, and communications, which are met by extensive underground cabling.Governments heavily invest in modern transport systems and smart city projects, concentrating their demand on underground distribution and feeder cables.

According to the GlobalData project database, 205 rail construction projects broke ground in 2024, with a combined cost of USD 389.32bn. Furthermore, the high focus on safety and environmental sustainability is likely to influence market expansion.

Segment Insights

Type Insights

Which Product Type Dominated the Underground Wires and Cables Market in 2024?

The power cable segment dominated the underground wires and cables market in 2024, holding a market share of about 45% due to increased investment in transmission and distribution infrastructure. Furthermore, the utilities have planned 5-year replacement and reinforcement programs in the urban cores continue to spur the high demand for high-capacity underground power cables.

The communication cables segment is expected to grow at the fastest rate in the coming years, with an expected CAGR of 7.5%. Owing to the high rates of fiber rollouts in 5G backhaul, urban broadband, and smart city connectivity in the ground and underground, to be resilient and managed by right of way. Moreover, the strict deadlines on urban fiberisation and municipal IoT initiatives, when combined, will help maintain a significant pace of underground communication-cable development until 2034.

Installation Type Insights

Which Installation Type Held the Largest Share in the Underground Wires and Cables Market in 2024?

The direct burial segment held the largest revenue share in the underground wires and cables market in 2024, accounting for an estimated 42% market share, as the trenching-and-lay costs are lower in rural and long-distance installations.

They shorten the initial timeline of the project and allow for complexity in non-urban settings. Furthermore, direct-burial designs are chosen by engineers when the cable is to work at lower voltages, further boosting the segment.

The duct installation segment is expected to grow at the fastest CAGR in the coming years, accounting for 7% growth rate, due to urbanization and the need to protect high-value fiber and power infrastructure in overloaded rights-of-way.

Municipal planners and utilities began to specify duct systems and micro-ducts to allow easier future upgrades and less repetitive excavation. Additionally, the Standard bodies and industry guidance promote increased duct deployment in smart-city and transit projects.

Material Insights

Which Material Led the Underground Wires and Cables Market in 2024?

The metallic conductors segment dominated the underground wires and cables market in 2024, holding a market share of about 48% due to their electrical conductivity and widely accepted cores for transmitting high currents. Moreover, rod producers and cable-makers provide stable feedstock pipelines, which are expected to continue dominating the production of metallic conductors due to near-term grid upgrades.

The non-metallic / composite materials segment is expected to grow at the fastest rate in the coming years, with an anticipated CAGR of 8%, driven by research into lightweight and hybrid designs that incorporate fibers or doped carbon to enhance mechanical performance. Furthermore, the growing focus on lifecycle environmental impact and new recycling strategies for composite systems is likely to expand the purchasing requirements in the coming years.

Voltage Rating Insights

Which Voltage Rating Segment Controlled the Underground Wires and Cables Market in 2024?

Up to 1 kV (low voltage) segment held the largest revenue share in the underground wires and cables market in 2024, accounting for an estimated 38% market share, due to the accelerating urban electrification, residential buildings, and small-scale industrial development.

The World Bank Global Electrification Platform in 2024 forecasted that almost 97% of the global population was connected to the electrical grid. This underlined the increase in underground cabling to access last-mile connections, thus further fuelling the segment growth.

The above 220 kV (Extra High Voltage) segment is expected to grow at the fastest CAGR in the coming years, accounting for 7.2% of market share. Owing to the continuous investment in long-distance power transmission and cross-border interconnection activities. Furthermore, the increased focus on grid resiliency, climate adaptation, and interregional power trading is expected to solidify EHV cables as a major facilitator of next-generation power infrastructure.

Application Insights

Which Application Dominated Demand for Underground Wires and Cables in 2024?

The power transmission & distribution segment dominated the underground wires and cables market in 2024 that holding a market share of about 40%, since aging grid networks in developed and emerging economies are expanding and becoming increasingly modernized Moreover, the efficient policy frameworks that facilitate grid efficiency, safety and sustainable transmission infrastructure are expected to continue to dominate this segment over the coming decade.

The renewable energy projects segment is expected to grow at the fastest rate in the coming years, accounting for 7.5% market share. Owing to the global move towards decarbonization and the inclusion of renewable sources in centralized grids, the acceleration of these changes is rapid. As IRENA 2024 reports, the total capacity additions of renewable sources were over 473 GW. They indicate the rapid increase in investments in offshore renewable installations, solar, and wind.

Such projects continue to rely on high-end underground and submarine cables to evacuate power and interconnect effectively. Furthermore, the trend towards using sustainable materials and integrating energy storage is set to further facilitate the use of underground cabling solutions in renewable energy infrastructures worldwide.

End User Insights

Which End User Segment Held the Largest Share in the Underground Wires and Cables Market in 2024?

In 2024, the utility companies segment held the largest revenue share in the underground wires and cables market, accounting for an estimated 43% due to their extensive presence in large-scale power transmission and distribution infrastructure. Additionally, the growing number of incidents of climatic disturbances, such as storms and floods, has influenced utilities in areas like Europe, North America, and East Asia to focus on the buried cabling systems.

The renewable energy developers segment is expected to grow at the fastest CAGR in the coming years, accounting for 7.5% of the market share, due to the fast development of solar, wind, and offshore renewable energy projects. The need for specialised underground and submarine cable systems has increased considerably. They provide connectivity between renewable production locations and major transmission grids, thus further boosting the market.

Insulation Material Insights

Which Insulation Material Was Most Widely Used in Underground Wires and Cables in 2024?

The cross-linked polyethylene (XLPE) segment dominated the underground wires and cables market in 2024, holding a market share of about 36% due to its high thermal performance, low dielectric loss, and established reliability in medium- and high-voltage applications.

XLPE manufacturing scales reduce the unit costs of production and reduce the lead times of large projects. Moreover, the ongoing advancements in XLPE compounding and cross-linking technology will increase their use in the coming years.

The ethylene propylene rubber (EPR) segment is expected to grow at the fastest rate in the coming years, accounting for a 7% market share, due to the increasing demand for flexible insulation, heat resistance, and halogen-free insulation in demanding installation environments. Additionally, certain sectors, such as oil and gas, mining, and some industrial industries, demand the use of EPR owing to its chemical resistance, thus boosting the segment.

Regional Insights

U.S. Underground Wires and Cables Market Size and Growth 2025 to 2034

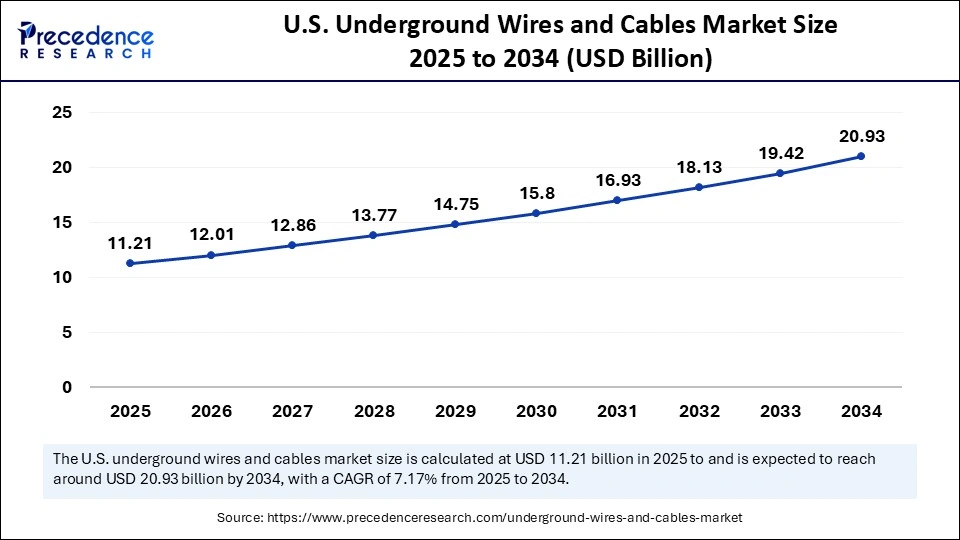

The U.S. underground wires and cables market size is exhibited at USD 11.21 billion in 2025 and is projected to be worth around USD 20.93 billion by 2034, growing at a CAGR of 7.17% from 2025 to 2034.

North America led the underground wires and cables market, capturing the largest revenue share in 2024, accounting for an estimated 41%. This was due to fast-tracked grid modernization efforts, urgent resilience projects to overcome extreme-weather threats, and the need to replace old transmission infrastructure. Massive grid upgrades in 2024 were backed with federal funding and competitive grant programs, such as the DOE GRIP, to bolster underground and hardened infrastructure.

Driving North America to Be the Underground Cable Leader

In 2024, the United States remained the leading source of the underground wires and cables market in North America, driven by massive investments in grid modernization and renewable energy integration. In the United States, the documented electricity consumption was extremely high, approximately 4,097 billion kWh in 2024.

This led to the overload of the transmission and distribution systems and the initiation of a specific program of undergrounding and strengthening. Additionally, the massive growth in data centers and electrification policy has led to concentrated load growth in urban regions, prompting cities and utilities to focus on buried high-capacity cables in the coming years.(Source: https://www.dws.com)

Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period, accounting for 8.5% of the market share. Owing to the high rate of urbanization, colossal renewable energy developments, and national plans for infrastructure. They focused on the creation of resilient underground networks in the high-density corridors. In 2024, over 80% of the world's energy demand growth was concentrated in emerging and developing economies, leading to increased grid growth and the laying of underground cables in the Asia-Pacific.

China - Driving the Fastest Growth in Asia-Pacific

China controlled the Asian-Pacific market for underground wires and cables to support intensive urbanization and renewable energy development strategies. The national programs, such as the New Infrastructure Plan and HVDC corridor projects, focused on connecting the solar and wind farms in the western provinces to the urban demand centers in the east.

State Grid Corporation of China (SGCC) expedited the process of installing cross-linked polyethylene (XLPE) and high-voltage underground cables, which are conducive to climate resilience and reduce transmission loss. The incorporation of renewable energy into the grid in some provinces increased the demand for underground cables. Furthermore, urban megaprojects like the metro rail construction in Shanghai and Beijing require small, dense underground cables, which further fuel the market in this region.

The Europe region is expected to hold a notable revenue share of the market due to the modernization of existing power grids, the development of urban infrastructure, and the high penetration of renewable energy. The European standards established by the IEC and CENELEC were used to design and install cables to facilitate long-term safety, sustainability, and interoperability between member states.

Germany: Growth of Underground Cables in Europe

The European underground wires and cables market had Germany as the engine in 2024, with ambitious energy transition, grid resilience projects driving the energy transition under the program of Energiewende. Moreover, powerful policy assistance, high-level technology implementation, and the inclusion of renewable energy infrastructure, Germany the top underground cabling center in Europe.

Underground Wires and Cables Market – Value Chain Analysis

- Raw Material Sourcing

The foundation of underground cable production lies in the procurement of high-quality raw materials such as copper, aluminum, PVC, XLPE, and other insulating polymers.

Key Players: Southwire Company LLC, Prysmian Group, Nexans S.A., LS Cable & System Ltd., Jiangsu Zhongtian Technology Co. Ltd. (ZTT)

- Chemical Synthesis and Processing

Raw polymers and metals undergo chemical processing and treatment to enhance electrical conductivity, thermal resistance, and mechanical durability.

Key Players: Dow Inc., Borealis AG, Sabic, Sumitomo Chemical

- Compound Formulation and Blending

Processed materials are blended into specialized compounds for insulation, jacketing, and fire-retardant layers to meet application-specific standards.

Key Players: Hengtong Group, Elsewedy Electric, Taihan Electric Wire Co. Ltd., Fujikura Ltd.

- Quality Testing and Certification

Manufacturers conduct rigorous electrical, thermal, and mechanical testing, along with compliance checks against international standards (IEC, IEEE, BIS, CENELEC) to ensure reliability.

Key Players: Intertek, UL (Underwriters Laboratories), TÜV Rheinland, CSA Group, KEMA (DNV)

- Packaging and Labeling

Cables are packaged in reels, drums, or spools with protective coverings and accurate labeling for voltage rating, insulation type, and application.

Key Players: Prysmian Group, Nexans, Southwire Company LLC, Polycab India Ltd.

- Distribution to Industrial Users

Completed underground cables are supplied to utilities, construction firms, industrial zones, and renewable energy projects for installation in power grids and smart city infrastructure.

Key Players: National Grid (UK), Power Grid Corporation of India Limited (PGCIL), DEWA, KEPCO, Siemens Energy Transmission

- Waste Management and Recycling

End-of-life cables undergo recycling processes to recover metals and polymers, reducing environmental impact and supporting circular economy initiatives.

Key Players: Prysmian Group, Nexans, LS Cable & System Ltd., Elsewedy Electric

- Regulatory Compliance and Safety Monitoring

Continuous monitoring ensures adherence to national and international safety standards, environmental regulations, and grid performance norms during manufacturing, installation, and operation.

Key Players: OSHA, CEA India, CENELEC, IEC, ISO, METI Japan

Top Vendors in the Underground Wires and Cables Market & Their Offerings:

- Nexans Group: Nexans is a global leader in cable manufacturing, offering advanced underground and submarine power transmission systems for utilities and renewable energy grids. The company focuses on high- and extra-high-voltage cables, smart grid integration, and sustainability through recyclable materials and low-carbon cable production. Its projects span large-scale energy infrastructure and urban power networks worldwide.

- LS Cable and System: LS Cable and System is a leading South Korean cable manufacturer producing high-voltage and ultra-high-voltage underground cables for power transmission and industrial applications. The company invests heavily in smart energy solutions and digital grid monitoring. Its technologies are widely used in renewable integration, especially in solar and wind farm interconnections.

- NKT Cables: NKT Cables designs and manufactures high-voltage underground and submarine cable systems, primarily serving European and offshore renewable energy markets. The company emphasizes sustainable production and efficient energy transmission solutions for long-distance power links. Its expertise extends to turnkey project installation and maintenance for major grid operators.

- Southwire Company, LLC: Southwire is one of North America's largest cable manufacturers, specializing in medium- and high-voltage underground power cables for utilities, commercial, and industrial sectors. The company is known for advanced insulation technologies and fire-resistant materials that enhance cable safety and longevity. Southwire is also advancing smart grid-ready and renewable-compatible cable systems.

- The Furukawa Electric Co., Ltd.: Furukawa Electric develops innovative underground and submarine power cables that combine copper, aluminum, and optical fiber elements for efficient energy and data transmission. Its high-voltage cable systems are widely used in urban infrastructure and renewable power grids. The company focuses on material innovation and next-generation transmission technology for sustainable power delivery.

Other Underground Wires and Cables Market Companies

- General Cable: Manufactures a wide range of underground power and communication cables, focusing on high-voltage and medium-voltage solutions for energy distribution and infrastructure projects.

- Investment Company: Engages in regional cable manufacturing and infrastructure investments, supporting the development of underground transmission and distribution networks.

- JPS Holdings AG: Provides underground cabling systems with an emphasis on power transmission efficiency, durability, and integration with renewable energy infrastructure.

- Riyadh Cables Group: The leading cable manufacturer in the Middle East, offering power, control, and communication cables optimized for underground and harsh environmental conditions.

- Wuxi Jiangnan Cable Co., Ltd.: Produces a complete range of underground power cables and conductors, focusing on high-voltage transmission and urban infrastructure applications.

Recent Developments

- In June 2025, Sumitomo Electric Industries, Ltd. began installing its 525kV XLPE High-Voltage Direct Current (HVDC) underground cable system for the Corridor A-Nord project in Germany, marking a major step forward in one of the nation's most critical energy infrastructure developments.

- In June 2025, LyondellBasell (LYB) and Maillefer collaborated to deliver a technically advanced, recyclable power cable system. By combining high-performance polypropylene materials, cutting-edge compounding, and state-of-the-art cable manufacturing technology, the partnership introduced a robust PP-based solution for medium and high-voltage cable insulation and semiconductive screens, offering a sustainable alternative to conventional XLPE systems.

- In August 2025, Surya Roshni, a leading Indian brand in lighting, fans, home appliances, steel, and PVC pipes, entered the wires and cables segment with the launch of its Turbo Flex range. This line combines safety, durability, and versatility, targeting both modern households and commercial establishments, thereby strengthening its foothold in the electrical solutions market.

(Source: https://sumitomoelectric.com)

(Source: https://www.electricalindia.in)

(Source: https://www.mojo4industry.com)

(Source: https://www.teknorapex.com)

(Source: https://www.angelone.in

(Source: https://www.lyondellbasell.com)

Segments Covered in the Report

By Type (Product Type)

- Power Cables

- Low Voltage (LV) Cables (≤1 kV)

- Medium Voltage (MV) Cables (1–33 kV)

- High Voltage (HV) Cables (33–220 kV)

- Extra High Voltage (EHV) Cables (>220 kV)

- Communication Cables

- Fiber Optic Cables

- Coaxial Cables

- Copper Cables / Twisted Pair Cables

- Control & Instrumentation Cables

- Specialty Cables (Fire-Resistant, Armored, Submarine, etc.)

By Installation Type

- Direct Burial

- Duct Installation

- Trough / Trench Installation

- Submarine / Underwater Installation

- Others (Tunnels, Conduits, etc.)

By Material

- Metallic Conductors

- Copper

- Aluminum

- Non-Metallic Conductors / Composite Materials

- Optical Fiber

- Hybrid Conductors (Optical + Power Transmission)

By Voltage Rating

- Up to 1 kV (Low Voltage)

- 1–33 kV (Medium Voltage)

- 33–220 kV (High Voltage)

- Above 220 kV (Extra High Voltage)

By Application

- Power Transmission & Distribution

- Transmission Networks

- Distribution Networks

- Telecommunications

- Broadband Internet Infrastructure

- 5G & Mobile Communication Networks

- Data Centers & Cloud Connectivity

- Industrial Infrastructure

- Oil & Gas

- Mining

- Manufacturing Plants

- Transportation Infrastructure (Railways, Airports, Ports)

- Commercial & Residential Buildings

- Renewable Energy Projects

- Wind Farms (Onshore & Offshore)

- Solar Power Installations

- Other Clean Energy Infrastructure

By End User

- Utility Companies (Power Transmission & Distribution Utilities)

- Telecommunication Operators

- Industrial Enterprises

- Construction & Real Estate Developers

- Government & Municipal Authorities

- Renewable Energy Developers

By Insulation Material

- Cross-Linked Polyethylene (XLPE)

- Polyvinyl Chloride (PVC)

- Ethylene Propylene Rubber (EPR)

- Polyethylene (PE)

- Others (Silicone Rubber, Halogen-Free Compounds)

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting