What is the Unsaturated Polyester Resin Market Size in 2026?

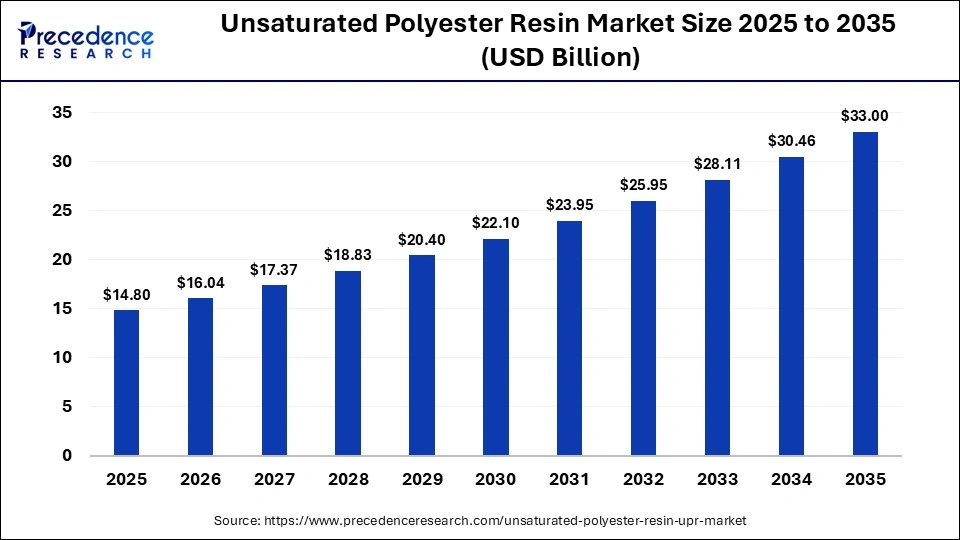

The global unsaturated polyester resin market size was calculated at USD 14.80 billion in 2025 and is predicted to increase from USD 16.04 billion in 2026 to approximately USD 33.00 billion by 2035, expanding at a CAGR of 8.35% from 2026 to 2035.The major drivers for the market of unsaturated polyester resin are increasing infrastructural investments and increased use of lightweight, eco-friendly products in various types of industries, such as the automobile industry.

Key Takeaways

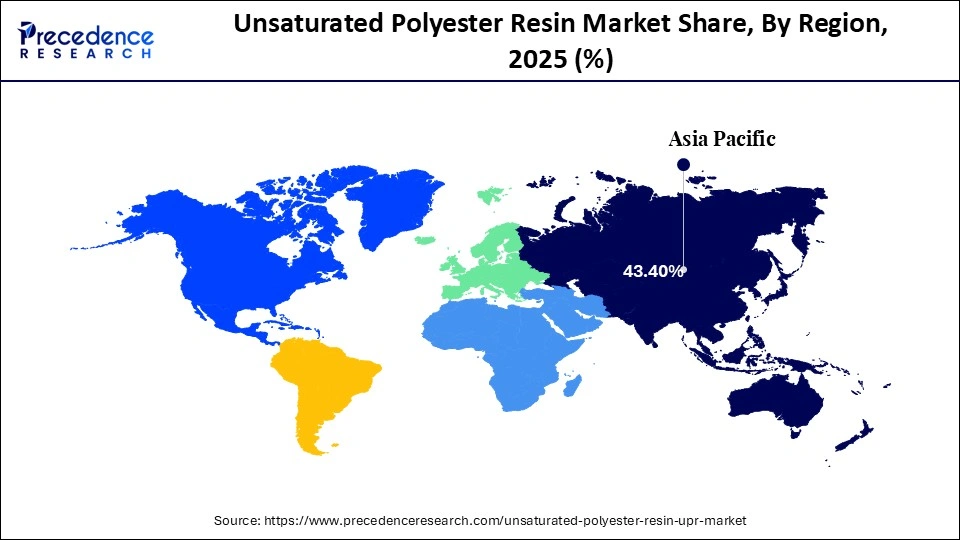

- Asia Pacific was the dominant region in theunsaturated polyester resin market with a market share of approximately 43.4% in 2025.

- North America is expected to be the fastest-growing region in the market of unsaturated polyester resin, with a higher CAGR over the projected period.

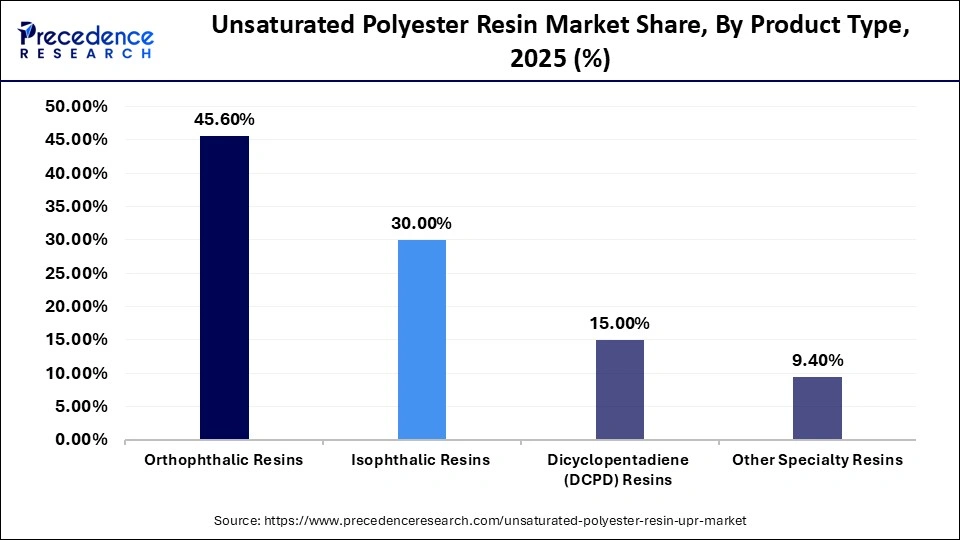

- By product type, the orthophthalic resins segment dominated the market with a market share accounting for approximately 45.6% in 2025.

- By product type, the dicyclopentadiene resins segment is expected to be the fastest-growing segment during the prediction period.

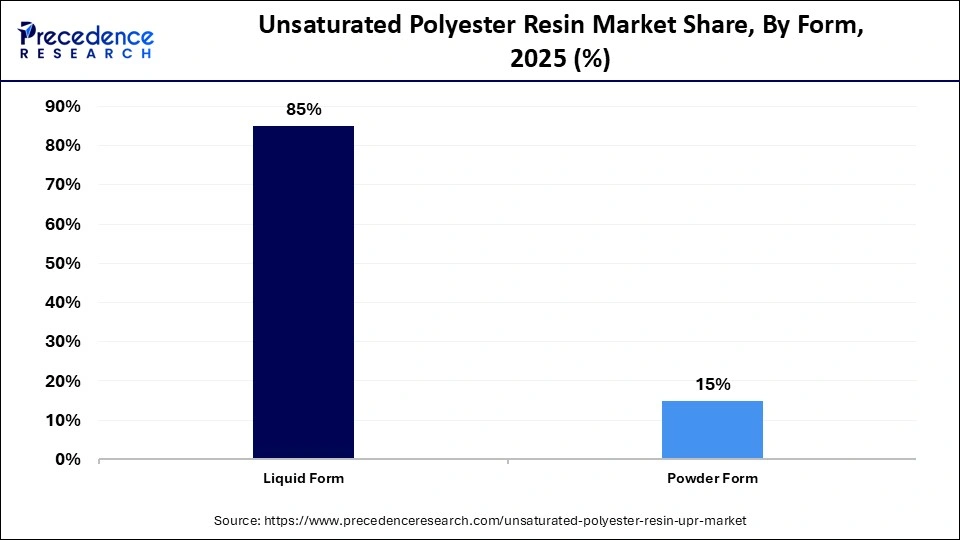

- By form, the liquid form segment led with a market share of approximately 85.0% in 2025.

- By form, the powder form segment is expected to be the fastest-growing segment over the predicted period.

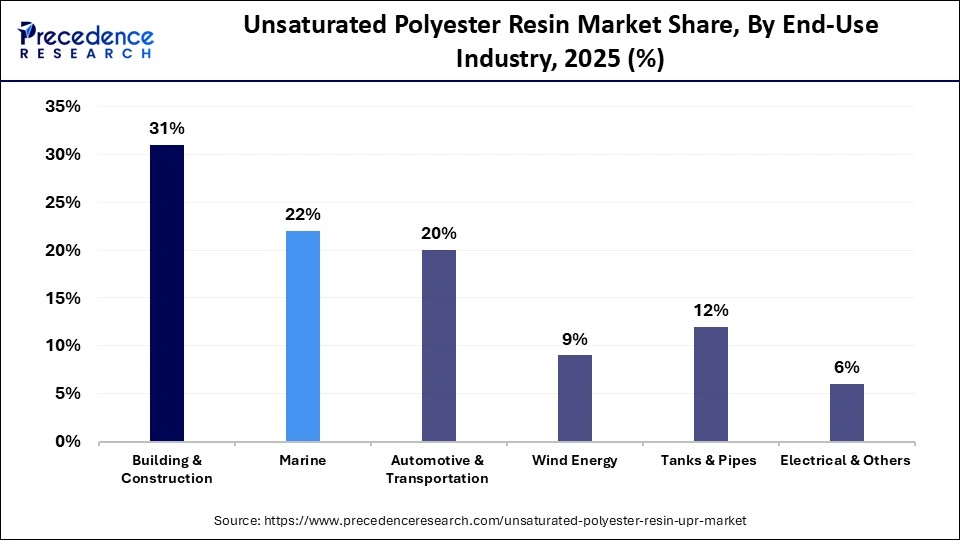

By end-use industry, the building and construction segment dominated the market with a market share of approximately 31.0% in 2025. - By end-use industry, the wind energy segment is expected to be the fastest-growing segment during the forecast period.

Market Overview

Unsaturated polyester resin (UPR) is a linear thermosetting polymer compound with an unsaturated double bond and an ester bond. It cures from liquid to solid through chemical cross-linking, using styrene. UPR is formed by condensation polymerization of saturated dihydric alcohol or unsaturated dihydric acid dihydric alcohol. It has high strength, good chemical resistance, durability, and is easy to process.

The unsaturated polyester resin market is witnessing steady growth driven by rising urbanization, leading to rising infrastructural investments, industrial expansion, and rising demand for durable, lightweight, and high-strength materials. Due to their excellent mechanical strength, corrosion resistance, and cost-effectiveness, these resins are highly used in glass fiber reinforced plastics, construction materials, marine components, automotive parts, coatings, and adhesives. They are used in construction, transportation, and infrastructure development due to their ability to withstand moisture, chemicals, and extreme temperatures. Increased adoption of electric vehicles is driving the demand for UPR-based composite components. The market is expected to experience consistent expansion due to its broad applications and various advantages.

What is the Role of AI and the Unsaturated Polyester Resin Market?

AI is playing a crucial role in the unsaturated polyester resin market. It assists in manufacturing optimization, product development, and supply chain efficiency. AI assists in monitoring curing temperature, viscosity, and reaction time in real-time, improving product consistency and reducing wastage of material, therefore enabling process control. AI-assisted machine algorithms are used to analyse equipment data to predict defects or failures, which reduces downtime and maintenance costs in a production plant.

To accelerate research and development, chemical interaction simulations are conducted using AI models to design new formulations of resin that can deliver better strength, durability, and lower emissions. Computer vision systems are used for quality inspection and to detect surface defects, improper curing, or inconsistencies in composite products. For large-scale manufacturing, AI is used to forecast raw material demand, optimize inventory, and improve the supply chain. AI assists in identifying alternative raw materials and processing conditions that supports development of low-VOC and bio-based resins.

Unsaturated Polyester Resin Market Trends

- Growing Demand for Sustainabili: The Bio-Based Resins: Sustainability is the major trend in the market. With rising environmental concerns and regulatory standards pressures, there is a rising demand for bio-E-based unsaturated polyester resins. Manufacturers are investing in eco-friendly, renewable raw materials to develop low-emission formulations and meet environmental regulations.

- Technological Advancements: Advancements in manufacturing technologies, such as nanotechnology, improved curing methods, and advanced production techniques, are improving resin strength, durability, and efficiency of resin formulation. Innovation in manufacturing technologies enables a shift towards high-performance resin grades.

- Increasing Automotive and Industrial Applications: The automotive industry is demanding lightweight composite materials to improve fuel efficiency, reduce emissions, and improve vehicle performance. The properties of resin, such as lightweight material, corrosion resistance, and durability, drive its demand in automotive, construction, marine, electrical, and wind energy sectors.

- Regulatory Push for Low-VOC Products: In compliance with regulatory standards and environmental regulations, manufacturers are encouraged to develop safer, low-emission resin formulations.

- Infrastructure Expansion: Emerging economic growth is leading to rapid urbanization, industrialization, and infrastructure development, which demands durable and cost-effective composite materials.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 14.80 Billion |

| Market Size in 2026 | USD 16.04 Billion |

| Market Size by 2035 | USD 33.00 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 8.35% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Form, End-Use Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Product Type Insights

How Did the Orthophthalic Resins Segment Lead the Market?

The orthophthalic resins segment led the unsaturated polyester resin market with a market share of approximately 45.6% in 2025, due to its durability, toughness, and strong chemical and thermal resistance. Due to these properties, it is widely used in the automotive, marine, and construction industries. It is widely used as boat decks, laminates, polymer concrete, and roofing sheets. Their low raw material cost and robust processing window make it suitable for large-scale production, strengthening market adoption. Due to their superior chemical resistance, flexibility, and high tensile strength, they are widely used in composite or fiberglass manufacturing.

The dicyclopentadiene resins segment is estimated to be the fastest-growing segment with a high CAGR during the projected period. It is a modified polyester used to address the performance gap where standard grades fall short. Automotive components, electrical enclosures, and chemical storage systems are increasingly using this resin due to its properties, such as heat resistance, hydrolytic stability, toughness, and low shrinkage. The market is driven by rapid demand for lightweight, long-lasting materials and high-performance resins.

Form Insights

How Did the Liquid Form Segment Dominate the Unsaturated Polyester Resin Market?

The liquid form segment dominated the market of unsaturated polyester resin with a market share of approximately 85.0% in 2025. It offers higher flexibility, ease of handling, and efficient strengthening wet-out. They support fabrication methods such as hand lay-up, spray, infusion, and filament winding with consistent curing even at room temperature. The fluid nature gives versatility in applications, enabling uniform coverage in coatings and adhesives, and accelerates the time to market for new parts.

The powder form segment is expected to be the fastest-growing segment over the projected period. They provide a solvent-free, environmentally friendly method that reduces VOC emissions, enhancing workplace safety and regulatory compliance. Powder form delivers weather-resistant finishing on heat-sensitive substrates, reduces curing energy by allowing thermal or UV cure cycles. Increasing demand for decorative panels and protective coatings for composite parts, with advancements in research and development, is accelerating the market.

End-Use Industry Insights

What Made the Building and Construction Segment Dominant in the Market?

The building and construction segment dominated the unsaturated polyester resin market with a share of approximately 31.0% in 2025. The dominance is due to the high demand from the housing sector for affordable, durable, and low-maintenance materials in housing and development as a result of population growth. The resins are highly used in roof panels, tiles, water tanks, and insulation. Rapid urbanization is the major driving factor in the resin market in the building and construction sectors.

The wind energy segment is estimated to be the fastest-growing segment during 2026-2035. The segment is growing at a faster rate due to the increasing installation of wind turbines and the global expansion of renewable energy capacity. The resins are used in the manufacturing of blades of wind turbines due to their lightweight nature, durability, corrosion resistance, and cost-effectiveness. As governments invest heavily in renewable energy projects, the demand for wind energy increases, which further drives the market for unsaturated polyester resin.

Regional Insights

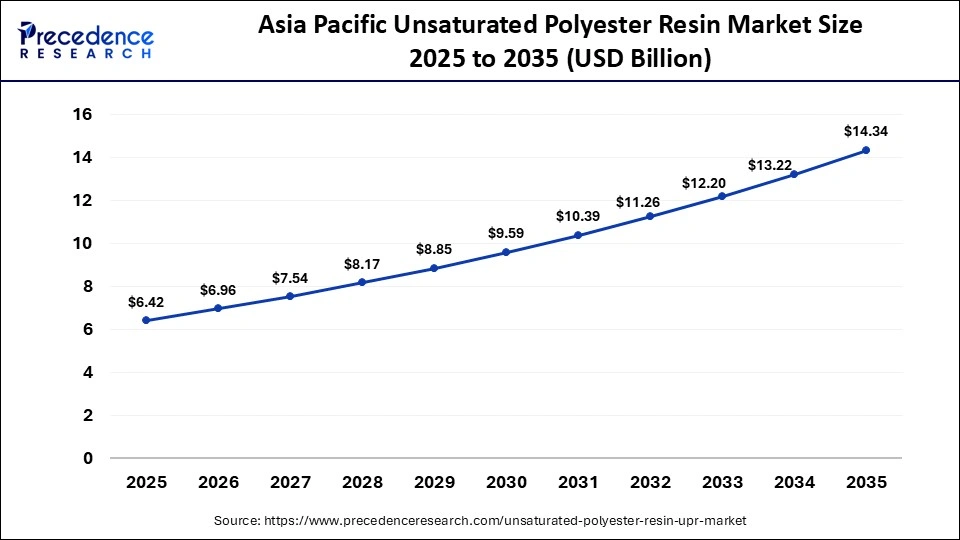

Asia Pacific Unsaturated Polyester Resin Market Size and Growth 2026 to 2035

The Asia Pacific unsaturated polyester resin market size is expected to be worth USD 14.34 billion by 2035, increasing from USD 6.42 billion by 2025, growing at a CAGR of 8.37% from 2026 to 2035.

What Factors Have Driven the Dominance of Asia Pacific in the Market?

Asia Pacific dominated the unsaturated polyester resin market with a share of approximately 43.4% in 2025. It is driven by rapid urbanization, industrialization, and large infrastructure development in countries like China, India, and Japan. In response, there is growing demand for durable, lightweight, and chemically resistant materials for construction, automotive, and consumer goods sectors. Increased awareness and adoption of sustainable practices are demanding eco-friendly and cost-effective formulations. The developing sector of renewable energy, the wind energy sector in Asian countries, boosts the use of unsaturated polyester resin in the manufacturing of wind turbine blades, contributing to market expansion.

The region is adopting technological innovations and has strong industrial ecosystems. Increasing demand from the automotive, marine, and building industries continues the expansion of the market. Major players are strengthening their presence through innovations and strategic partnerships. The dynamic industrial growth, regulatory support, and expanding end-use sectors are the key drivers of the market growth.

India Market Trends Analysis

The unsaturated polyester resin market in India is expanding steadily, driven by rising demand from construction, automotive, and renewable energy sectors due to rapid urbanization and infrastructure investment. Increasing adoption of composites for lightweight, durable applications supports ongoing market growth.

What Makes North America the Fastest-Growing Region in the Market?

The North America region is the fastest-growing region in the unsaturated polyester resin market during the projected period. The market demand is rising due to the replacement of aging infrastructure and consistent spending on advanced composite materials. Aging water systems, utility networks, and public facilities are undergoing recreations, driving demand for corrosion-resistant, durable, and cost-effective materials. Growth in recreational marine activities and aftermarket repair services further boosts the market expansion.

The U.S. Unsaturated Polyester Resin Market Trends Analysis

In the U.S., rising residential development and ongoing development for water management and sanitation infrastructure continue to drive consumption of resins in bathroom fixtures, storage tanks, and corrosion-resistant components. The region has well-established supply chains and strong regulatory frameworks that promote sustainable market growth. Technological advancements in the manufacturing of resins and the integration of AI are strengthening the market. Leading manufacturers play a vital role in boosting the market growth with steady end-use industry demands and infrastructure development.

Europe Unsaturated Polyester Resin Market Trends

Europe's market is witnessing significant growth, driven by a shift towards sustainable materials and evolving regulatory frameworks. Environmental policies led by the European Union are promoting investments in eco-friendly practices and low-emission resin technologies. Germany and France are the leading countries due to their regional demand for advanced manufacturing sectors and strong focus on research and development. Strategic collaborations and expanding production capabilities are enhancing the innovation-focused market landscape.

Europe is expected to show steady market growth due to strong demand from end-use industries such as automotive manufacturing, building and construction renovations, rail interiors, and wind energy. The region is adopting advanced composite materials and high-performance resin grades that meet regulatory and environmental requirements.

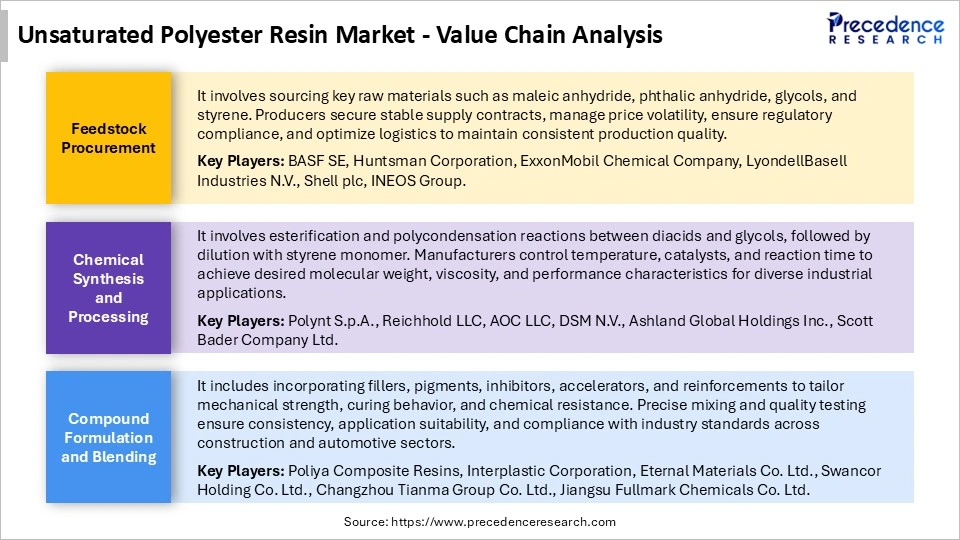

Unsaturated Polyester Resin Market Value Chain Analysis

Unsaturated Polyester Resin Market Companies

- Polynt-Reichhold Group (Italy/USA)

- AOC (USA)

- INEOS Enterprises (UK)

- Ashland Inc. (USA)

- BASF SE (Germany)

- Scott Bader Company Ltd. (UK)

- Allnex GmbH (Germany)

- DIC Corporation (Japan)

- Dow Inc. (USA)

- Eternal Materials Co., Ltd. (Taiwan)

- UPC Technology Corporation (Taiwan)

- Satyen Polymers Pvt. Ltd. (India)

- Interplastic Corporation (USA)

- Swancor Holding Co., Ltd. (Taiwan)

- Tianhe Resin Co., Ltd. (China)

Recent Developments

- In November 2025, to obtain several hundred tonnes of bio-based unsaturated polyester resin (UPR), global composites firm Exel Composites has signed a new supply contract with Polynt, an Italian chemical manufacturer. (Source: https://www.manufacturingmanagement.co)

- In June 2025, Bowden Chemicals, a chemical distributor based in the UK, secured a government grant to create unsaturated polyester resins (UPR) using bio-based components. (Source: https://www.argusmedia.com)

Segments Covered in the Report

By Product Type

- Orthophthalic Resins

- Dicyclopentadiene (DCPD) Resins

By Form

- Liquid Form

- Powder Form

By End-Use Industry

- Building and Construction

- Wind Energy

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting