U.S. Dental Equipment Market Size and Forecast 2025 to 2034

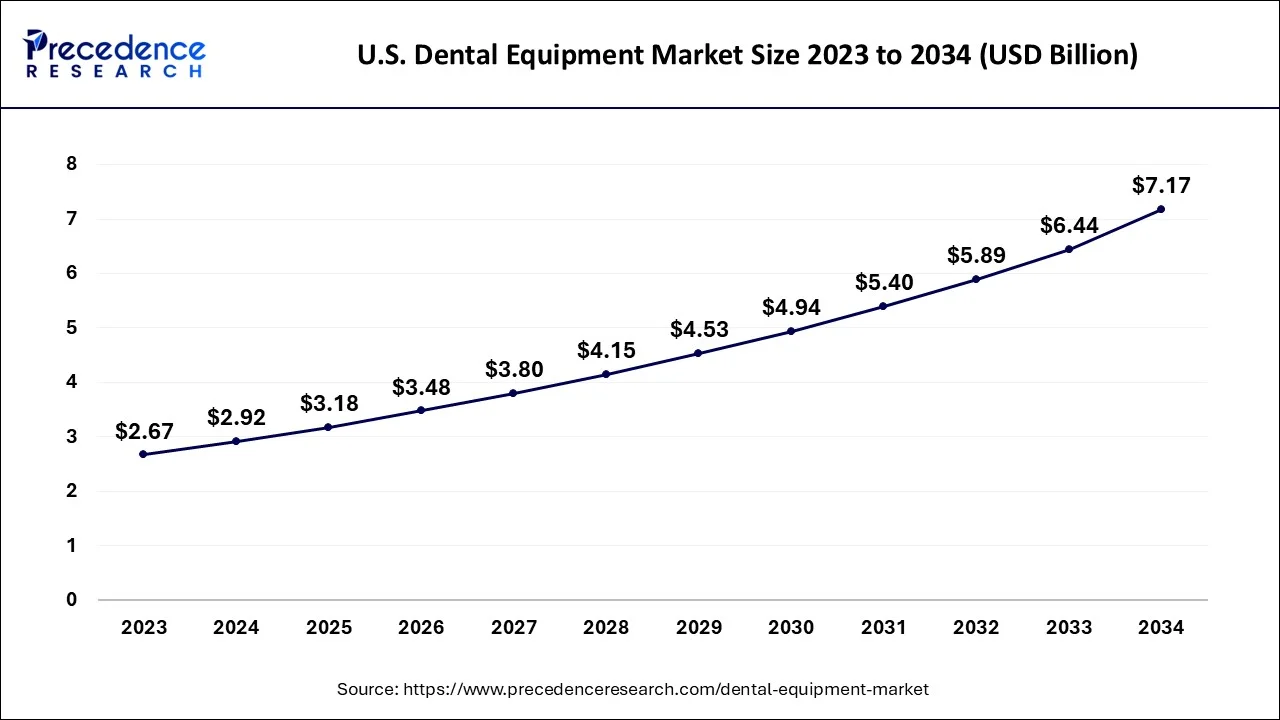

The U.S. dental equipment market size accounted for USD 2.92 billion in 2024 and is predicted to increase from USD 3.18 billion in 2025 to approximately USD 7.17 billion by 2034, expanding at a CAGR of 9.40% from 2025 to 2034. The U.S. dental equipment market is growing due to shifting demographics with a growing aging population.

U.S. Dental Equipment MarketKey Takeaways

- In terms of revenue, the U.S. dental equipment market was valued at USD 2.92 billion in 2024.

- It is projected to reach USD 7.17 billion by 2034.

- The market is expected to grow at a CAGR of 9.40% from 2025 to 2034.

- By product type, the systems & parts segment held the largest share in 2024.

- By product type, the dental lasers segment is expected to grow at the fastest CAGR during the forecast period.

Impact of AI on the U.S. Dental Equipment Market

The future of Artificial Intelligencein dental equipment centers on integration with AR/VR, robotics, and Internet of Things to create highly accurate, automated, as well as personalized systems for diagnosis, treatment planning, and even prosthetics. AI-poweredsoftware will improve image analysis, enhance robotic precision in procedures, and allow customized digital designs for dental restorations. AI algorithms will enhance the accuracy along with efficiency of analyzing dental images such as radiographs and also intraoral scans, contributing to earlier disease detection and even more precise diagnoses. AI will be used to advance predictive models for conditions such as toothaches and oral pathologies, assisting to prevent issues before they become severe.

AI will permit faster and more consistent design as well as fabrication of custom prostheses, significantly decreasing laboratory time. The future includes combining AI with IoT (Internet of Things), edge computing, 5G, and blockchain for improved tele dentistry and even data management.

Market Overview

The significance of the U.S. dental equipment market lies in its important role in improving oral health via the adoption of advanced technology, driven by factors such as an aging population and growing knowledge of oral hygiene. Digital solutions like 3D printing and even intraoral scanners are transforming procedures, enhancing efficiency and patient results. The U.S. market is acknowledged by the rapid integration of technologies such as AI-powered diagnostics, digital impressions, 3D printing for prosthetics, and laser dentistry.`

These innovations enhance the efficiency, accuracy, and comfort of dental procedures. A flourishing segment of the U.S. dental equipment market, cosmetic dentistry reflects the rising desire for aesthetic enhancements, boosting the need for high-tech scanners along with treatment planning systems

- According to the 2022 WHO Global Oral Health Status Report, oral diseases affect nearly 3.5 billion people globally, with three out of four individuals living in middle-income countries.

- About 90% of United States adults 20 years and older have experienced at least one cavity.

- Approximately 42% of United States adults have periodontal (gum) disease. (Source: https://www.forbes.com)

U.S. Dental Equipment MarketGrowth Factors

- A significant and rising elderly population in the U.S. faces higher rates of oral health issues, like periodontal disease and tooth loss, needing more frequent and specialized dental care.

- Growing recognition of the significance of oral health and the availability of educational campaigns are contributing to more people seeking dental care, boosting the need for equipment.

- Dental practices are increasingly accepting digital technologies as well as integrating them into their workflows for better efficiency along with personalized treatment.

- The market is being transformed by technologies like AI-powered diagnostics, digital imaging (including CBCT), 3D printing for dental prosthetics, and laser dentistry, which enhance treatment accuracy, efficiency, as well as patient outcomes.

- Greater access to dental insurance along with supportive reimbursement policies are just making dental treatments more affordable, uplifting people to utilize services and thus increasing demand for equipment.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 7.17 Billion |

| Market Size in 2025 | USD 3.18 Billion |

| Market Size in 2024 | USD 2.92 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.40% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Shift in Technologies Incorporated in Dental Sector:

The rapid acceptance of new technologies such as CAD/CAM systems, AI-driven diagnostics, digital impressioning, and even 3D printing in U.S. dental equipment boost market growth by enhancing diagnostic precision, decreasing patient invasiveness, streamlining treatments, and improving overall patient experience and results. New dental chairs as well as equipment incorporate innovative features programmed for improved patient comfort and even clinician well-being, making procedures which are more accessible and less daunting.

Restraint

Lack of Reimbursement

The lack of adequate dental insurance reimbursement restricts the U.S. dental equipment market by shifting most expenses to patients, which restricts their financial ability and even willingness to afford costly procedures and the developed equipment required to perform them. When individuals bear most of the expenses, their decision to choose treatment is heavily impacted by financial feasibility, contributing to a reduced need for treatments demanding expensive equipment. Procedures such as dental implants, which use expensive equipment and even consumables, face higher hurdles to adoption because of being categorized as cosmetic and also receiving poor reimbursement.

Opportunity

Innovation of Sustainable Dental Equipment

Sustainable dental equipment presents significant opportunities for the U.S. dental market by aligning with rising consumer need for eco-friendly practices, decreasing operational costs via mitigating regulatory risks, energy and water efficiency, fostering innovation in materials and even equipment design, and improving a practice's reputation as eco-friendly conscious. The thrust for sustainability impulse innovation, contributing to new technologies as well as products that can offer forward-thinking dental practices a competitive edge. Incorporating waterless suction units, closed-loop water systems, and low-flow faucets remarkably reduces water consumption. Shifting to digital record-keeping decreases paper waste, and even telehealth services can reduce travel emissions.

Product type insights

How did the systems & parts segment dominate the in the U.S. dental equipment market in 2024?

The systems & parts segment dominates the U.S. dental equipment market due to high need for advanced diagnostic and even precision tools such as CAD/CAM systems, digital radiography, and CBCT devices, which enhance accuracy and efficiency. The acceptance of digital dentistry technologies, which includes CAD/CAM (computer-aided design/computer-aided manufacturing) systems, is a key growth driver. These systems permit for the rapid, precise, and customized production of dental prosthetics, like bridges, crowns, and implants. Dental providers are investing in high-tech equipment to enhance the accuracy and efficiency of procedures, ultimately contributing to better patient results and improved productivity in dental labs.

The dental lasers segment is witnessing the fastest growth as it offers faster recovery, less pain, and less complications compared to conventional methods. Lasers can decrease anxiety linked with traditional dental drills and also procedures. Lasers are versatile methods used in treatments ranging from cavity extraction as well as tooth whitening to gum shaping and even periodontal treatment. The widespread occurrence of periodontal disease together with gingivitis is driving the need for soft tissue lasers, which are greatly effective for these conditions. The impact on preventive healthcare works with the capabilities of dental lasers, by creating an attractive option for both routine and also complex dental care.

- In January 2022, BIOLASE, Inc. and EdgeEndo announced that the FDA 510(k) authorization of the EdgePRO system for endodontists, assisting in a more effective cleaning as well as disinfection option within root canal procedures. The new laser-assisted microfluidic irrigation apparatus provides a developed solution to current cleaning along with disinfection techniques, without disrupting the procedure workflow or adding substantial expenses on a per-procedure basis. (Source:https://www.biolase.com)

Value Chain Analysis

- R&D

R&D in U.S. dental equipment includes developing new and enhanced products by researching market demand and advancing technology, targeting on areas such as AI-driven diagnostics, 3D printing for customized apparatus, bioceramic implants with improved bone integration, and tele dentistry solutions to fund evolving patient care and aesthetic demands.

Key players: Dentsply Sirona, Envista Holdings Corporation

- Patient Support and Services

Today's dental chairs are programmed with both the patient and practitioner in mind, providing adjustable features, enhanced ergonomics, as well as integrated technology to facilitate optimal treatment results. This exploration will not only feature the technological strides made in dental equipment but also underscore the significance of creating a patient-centric environment that emphasis comfort and reduces anxiety.

Key players: Henry Schein, Benco Dental, and Patterson Companies

U.S. Dental Equipment Market Companies

- Midmark Corporation

- Takara Belmont Corporation

- Ultradent Products Inc.

- Millennium Dental Technologies

Recent Developments

- In July 2025, Midmark Corp., a leading dental solutions supplier focused on designing clinical environments to enhance care delivery, disclosed two new promotions programmed to assist dentists and dental organizations in investing in high-performance equipment for their operatory as well as imaging needs.(Source:https://www.midmark.com)

- In February 2025, Millennium Dental Technologies, Inc. declared that it had received a new U.S. Patent for laser-assisted periodontal procedures. The announcement corresponds with Gum Disease Awareness Month, which is acknowledged by official proclamation in multiple territories, in all 50 states, as well as numerous Canadian provinces, to encourage early detection and treatment.

Segments Covered in the Report

By Product Type

- Dental Radiology Equipment

- Intra-Oral

- Digital X-ray Units

- Digital Sensors

- Extra-Oral

- Digital Units

- Analog Units

- Intra-Oral

- Dental Lasers

- Diode Lasers

- Quantum well lasers

- Distributed feedback lasers

- Vertical cavity surface-emitting lasers

- Heterostructure lasers

- Quantum cascade lasers

- Separate confinement heterostructure lasers

- Vertical external-cavity surface-emitting lasers

- Carbon Dioxide Lasers

- Yttrium Aluminium Garnet Lasers

- Systems & Parts

- Instrument Delivery Systems

- Vacuums & Compressors

- Cone Beam CT Systems

- Cast Machine

- Furnace and Ovens

- Electrosurgical Equipment

- Other Systems and Parts

- CAD/CAM

- Laboratory Machines

- Ceramic Furnaces

- Hydraulic Press

- Electronic Waxer

- Suction Unit

- Micro Motor

- Hygiene Maintenance Devices

- Sterilizers

- Air Purification & Filters

- Hypodermic Needle Incinerator

- Other Equipment

- Chairs

- Hand Piece

- Light Cure

- Scaling Unit

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting