What is the U.S. Dental Insurance Market Size?

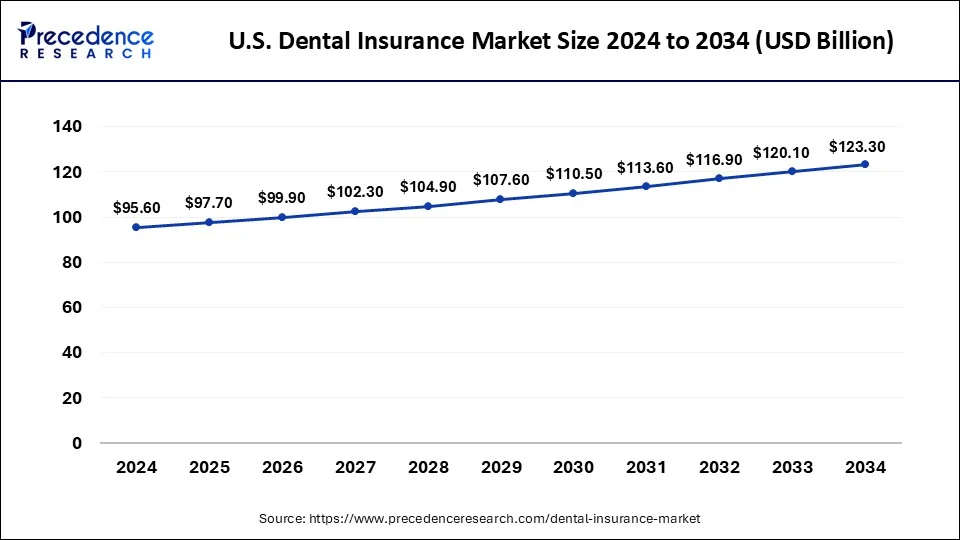

The U.S. dental insurance market size is calculated at USD 97.7 billion in 2025 and is predicted to increase from USD 99.9 billion in 2026 to approximately USD 126.5 billion by 2035, expanding at a CAGR of 2.62% from 2026 to 2035. The increasing awareness regarding the healthcare policies are driving the expansion of the market.

Market Highlights

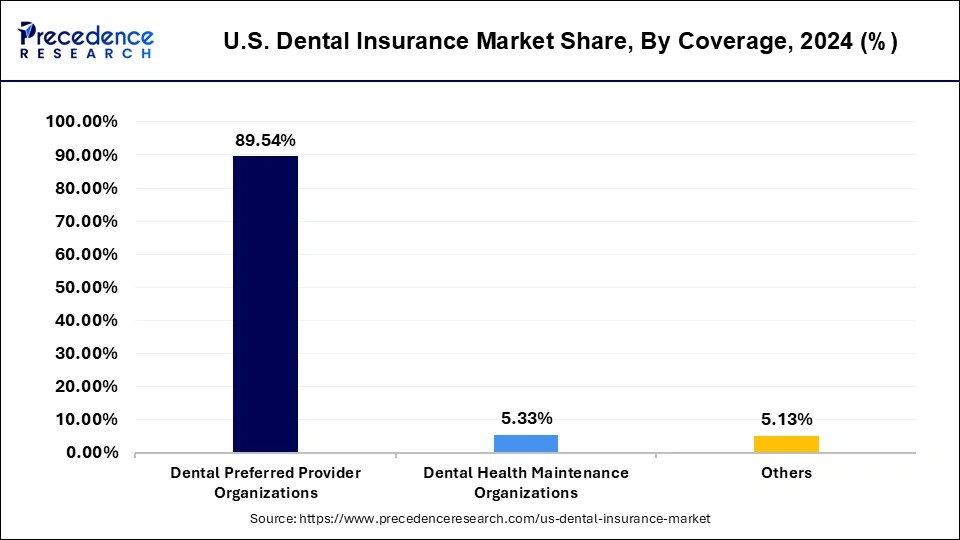

- By coverage, the dental preferred provider organizations segment has held the major market share of 89.56% in 2025.

- By coverage, dental health maintenance organizations are expected to be the fastest-growing in the market during the forecast period.

- By procedure, the preventive segment contributed the largest market share of 50% in 2025.

- By procedure, the major segment is expected to experience the fastest growth in the market during the forecast period.

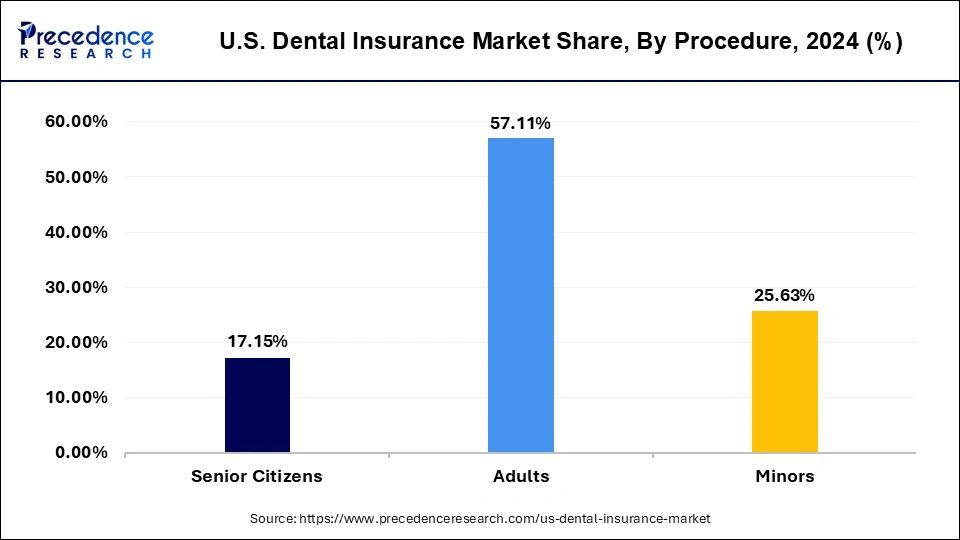

- By demographics, the adults segment captured the biggest market share of 57% in 2025.

- By demographics, the senior citizens segment is expected to be the fastest-growing in the market during the forecast period.

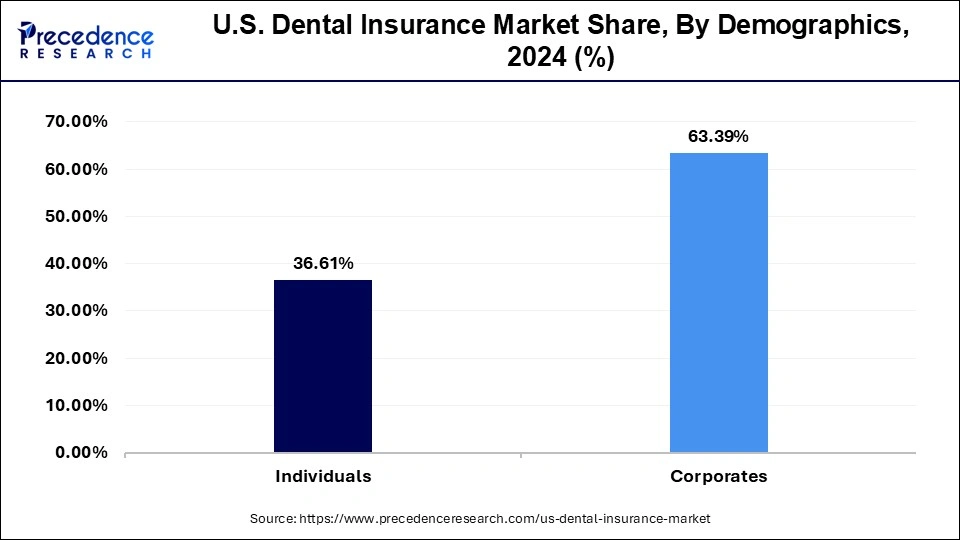

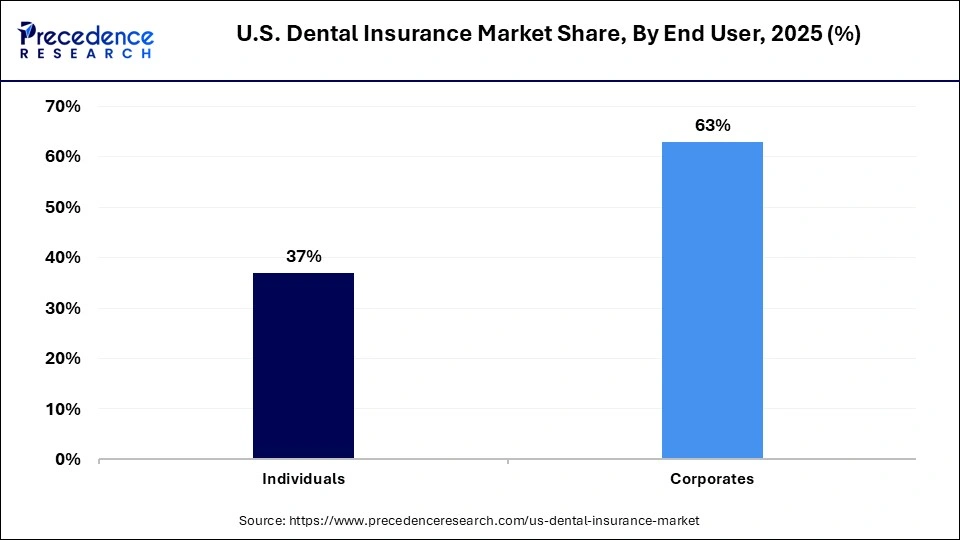

- By end users, the corporates segment accounted for a major market share of 63% in 2025.

Market Overview

Dental insurance is the one of the part of the medical insurance that used in the treatment and medicational procedures of the dental care. Dental insurance is works on the way, in return of the premium payments, it will pay a certain cost of the treatment of the dental procedures. Dental insurance is generally covered preventive care like emergency treatment, cleansing, and examination, X-rays, and fillings. Dental insurance will pay the cost of the treatment or procedures directly to the hospitals, clinics, or service providers which is totally depends upon the terms and conditions of the policy.

There are several type of the dental insurance coverages includes PPOs, indemnity plans, and HMOs. Dental insurance helps in the coverage the cost of the individual and families treatment. The rising prevalence of the dental problems in the Unites States due to the aging population and the acceptance of sedentary lifestyle are driving the growth of the U.S. dental insurance market.

According to the American Dental Association, in the U.S., the overall health spending increased by 3.8% in 2024 compared to dental spending, which increased by 2.5%. National dental expenditures were USD 174 billion in 2023, representing 3.6% of total health expenditures.

In recent years, the dental care spending from government programs has increased. Government program spending increased by 18% from 2022 to 2024, largely due to Medicare. In fact, of the USD 4 billion increase in U.S. dental spending, more than USD 3 billion was accounted for by Medicare. On the other hand, Medicaid accounted for the other USD 1 billion increase.

U.S. Dental Insurance Market Growth Factors

- The rising healthcare infrastructure and the technological advancements in the healthcare industry is results in the high cost of the medical facilities which driving the demand for the U.S. dental insurance market.

- The increasing shift in lifestyle, the higher consumption of the junk food, alcohol, and smoking is causing the increasing chances of the dental and oral problems in the population that are driving the demand for the dental treatment which driving the expansion of the market.

- The increasing awareness about dental treatment and the rising government support with maintaining the fluctuation in cost of the dental treatment by the dental insurances that will boosts the growth of the market.

- The availability of several health insurance with the different benefits in the treatment procedures that influencing the growth of the market.

- The integration of the technologies in the insurance policies for the addition of value-added services in the dental insurance which driving the growth of the market.

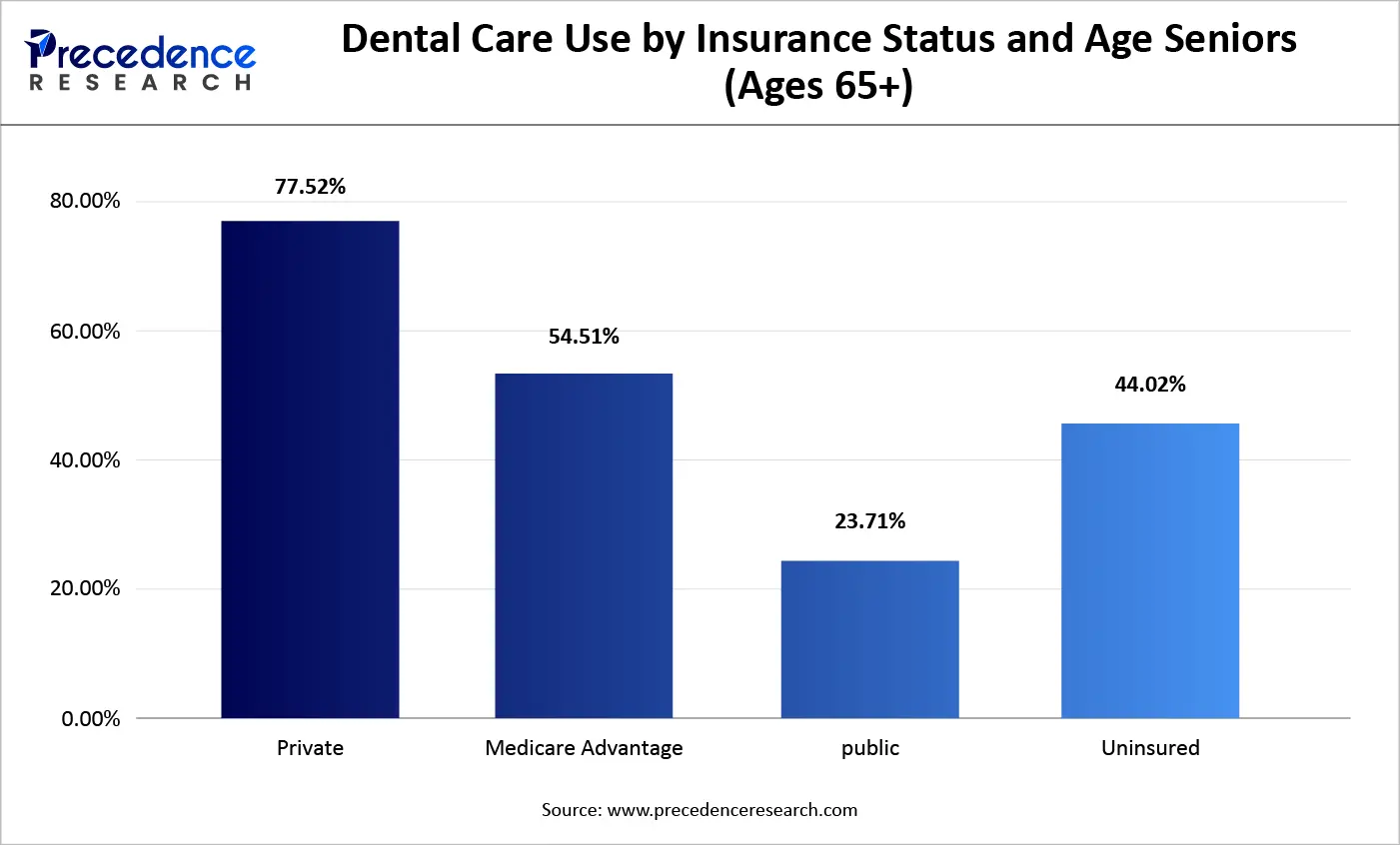

In 2022, dental care use among U.S. seniors (ages 65+) varied substantially by insurance status, with data from the Medical Expenditure Panel Survey showing that about 51% of seniors had a dental visit, reflecting a rebound to near pre-COVID levels. Seniors enrolled in Medicare Advantage (MA) plans with a dental benefit had higher utilization at 55% compared with overall senior averages, while those with private dental insurance outside of MA saw even higher use at 77.52% in the same year.

National Health Interview Survey estimates indicate that 63.7% of adults age 65 and older had a dental visit in the past year, with higher rates observed among those with coverage versus those without. As of 2024, over 54.51% of Medicare beneficiaries were enrolled in Medicare Advantage plans, making MA dental benefits a growing component of coverage for the senior population, although comprehensive dental benefits remain uncommon in many plans.

U.S. Dental Insurance Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 97.7 Billion |

| Market Size in 2026 | USD 99.9 Billion |

| Market Size by 2035 | USD 126.5 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 2.62% |

| Dominating Region | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Coverage, Procedure, Demographics, and End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

The increase in trend in the healthcare coverages

The rise in the trend in the healthcare coverages and the increasing awareness regarding the dental treatment and beneficial properties of the dental insurance are driving the growth of the market. In the United States there are approximately 90% of the population are covered with some kind of the healthcare insurance coverage. The rising trend in the healthcare coverage improve the access of the better health outcomes, lower death rates, and improved productivity. U.S, residents are mostly covered with some variety of coverages from public or private sources. Some are purchased by the individual markets like Medicaid, Medicare, or Veterans Affairs programs (public sources) and some are covered through their employers. In the recent year, there are 20 million individuals are newly covered by some type of the healthcare insurance coverage. Thus the rising awareness about the healthcare coverages are driving the expansion of the U.S. dental insurance market.

Restraint

High expenses of dental insurances

Dental insurances are generally costlier in the United States which creates a hindering factor for the U.S. dental insurance market to grow. High insurance premiums may attract regulatory scrutiny, especially if they are deemed to be unfairly pricing out certain demographic groups or contributing to healthcare access disparities. This can result in increased regulatory pressure on insurers and potential changes to pricing practices. Expensive insurance premiums may contribute to market saturation, where only a portion of the population can afford or are willing to pay for dental insurance. This limits the potential for market expansion and competition, as insurers may struggle to attract new customers or retain existing ones.

Opportunity

Integration of digital health

The rising shift of the digital infrastructure in the healthcare insurance market for the improvization of facilities and accessibility of the insurance benefits creates an opportunity for the U.S dental insurance market to grow. The digital tools are playing an important role in the promotion of healthcare insurance. The integration of machine learning and analytics improves the engagement of the proactive members of the insurance, serves the service demand, solves issues, and communication gaps before awareness about the problems. The integration of the technologies such as artificial intelligence, and automation in the insurance market by the major healthcare insurance players in the United States are contributing to the revolutionizing the shape of the health insurance market.

Segments Insights

Coverage Insights

The dental preferred provider organizations segment dominated the U.S. dental insurance market with the highest share of 89.56 in 2025. The dental PPOs (preferred provider organizations) are one of the most commonly used dental insurance that is made to help with the higher cost of the dental treatment and procedures. The preferred provider organizations provide several dental insurance plans which offer the low cost of the insurance and give preferable choices in the selection of dentists. It is the insurance plans that cover the wide network of dental professionals or dentists which offer the treatment at discounted prices.

The dental health maintenance organizations segment is expected to be the fastest growing in the market during the forecast period. The DHMOs (dental health maintenance organizations) are one of the most reputed dental insurance plans with the coverage of various discounted dental insurance policies and the wider network of dentists. The dental health maintenance organizations are also known as the Capitalization Plan and the least expensive dental insurance plan.

U.S. Dental Insurance Market Revenue, By Coverage, 2023-2025 (USD Billion)

| Coverage | 2023 | 2024 | 2025 |

| Dental Preferred Provider Organizations | 83.8 | 85.6 | 87.5 |

| Dental Health Maintenance Organizations | 5 | 5.1 | 5.2 |

| Others | 4.8 | 4.9 | 4.9 |

Procedure Insights

The preventive segment dominated the U.S. dental insurance market share of 50% in 2025. Preventive dental care comprises proactive measures taken by patients to prevent oral diseases and ensure a lifelong healthy smile. This includes daily practices such as brushing with fluoride toothpaste, regular flossing, maintaining a balanced diet, and scheduling routine oral exams and professional cleanings.

Dental insurance plans prioritize preventive dental care due to its crucial role in oral health. Consequently, these services are often covered at 100 percent with minimal or no deductibles or co-pays, resulting in minimal out-of-pocket costs for policyholders. Preventive services are not subtracted from the annual maximum benefit in certain plans, emphasizing the significance of encouraging regular preventive dental practices among policyholders.

Dental X-ray costs vary based on the specific type required, typically between $100 and $200. Considering a preventive measure guarding against more intricate and costly treatments like root canals or cavity treatments, dental insurance plans often cover at least one routine X-ray annually. Additionally, many plans cover X-rays prescribed by another healthcare professional. However, elective X-rays chosen by the patient as add-ons are less likely to be covered by insurance policies. Understanding these coverage nuances helps patients make informed decisions about their dental care.

The major segment is expected to experience the fastest growth rate in the market during the forecast period. Major dental services encompass complex procedures and surgeries, such as dental implants, which are extensive treatments addressing issues that could have been prevented or mitigated with earlier preventive care. These services often involve lengthy or intricate procedures. Typically, if a dental procedure requires anesthesia surgery or falls within the realm of orthodontics, it is categorized as a major dental service. These comprehensive procedures are essential for addressing significant dental concerns, requiring specialized skills and expertise.

U.S. Dental Insurance Market Revenue, By Procedure, 2023-2025 (USD Billion)

| Procedure | 2023 | 2024 | 2025 |

| Major | 19.7 | 20.2 | 20.7 |

| Basic | 27.3 | 27.9 | 28.6 |

| Preventive | 46.6 | 47.5 | 48.4 |

Demographics Insights

The adults segment dominated the U.S. dental insurance market with the largest share of 57% in 2025. The increasing prevalence of dental treatment in adults due to the shift in lifestyle that may cause the increasing number of dental problems in the adult population. The higher purchase rate of the dental insurance policies by the adults in any type of medium like public or private or purchase by the individuals or the employers that contributing to the expansion of the U.S. dental insurance market.

The senior citizens segment is expected to be the fastest growing in the market during the forecast period. The increasing cases of the dental problems in the geriatric population or the senior citizens due to the aging factors that are driving the demand for the dental insurance for aiming to reduce the treatment and procedural cost in the dental care. The increasing availability of the low-cost insurance coverages for the senior citizens are further propelling the growth of the market.

U.S. Dental Insurance Market Revenue, By Demographics, 2023-2025 (USD Billion)

| Demographics | 2023 | 2024 | 2025 |

| Senior Citizens | 16 | 16.4 | 16.9 |

| Adults | 53.4 | 54.6 | 55.9 |

| Minors | 24.1 | 24.5 | 24.9 |

End-user Insights

The corporates segment dominated the market with the largest share in the market share of 63% in 2025. Corporate dental insurance is designed to help and cover the treatment plans for the company team members. The corporate insurance comes from the employee beneficiaries and improves the staff's wellbeing and maintains the company culture.

The corporate dental insurance covers preventive treatment such as routine examinations, virtual routine examinations, teeth scale and polishes and x-ray scans. Restorative treatment, orthodontic treatment, emergency treatments such as treatment for severe pain, treatment if patients are unable to eat, treatment for conditions that pose a health threat, prescription charges, emergency call out fees. Injury treatment, and oral cancer are also covered under the segment.

U.S. Dental Insurance Market Revenue, By End-user, 2023-2025 (USD Billion)

| End-user | 2023 | 2024 | 2025 |

| Individuals | 34.3 | 35 | 35.8 |

| Corporates | 59.3 | 60.6 | 61.8 |

U.S. Dental Insurance Market Companies

- Ameritas Mutual Holding Company

- DentalPlans.com Inc

- Spirit Dental

- UnitedHealth Group

- Principal Financial Group

- Blue Cross Blue Shield Association

Recent Developments

- In May 2024, National Dental Care plan announced the launch of Canada's $13 billion national dental care plan.

- In December 2024, DoseSpot expanded its offerings into the dental sector with pVerify for Dental, a software solution designed to streamline insurance eligibility verification for dental practices. This software allows dental professionals to instantly access patient insurance details. The system provides a customized overview of coverage rather than generic plan benefits. The software integrates with existing patient management systems and taps into a vast network of over 1,500 payers, including both medical and dental insurance providers, to quickly determine if specific treatments are covered.

- In March 2025, Sun Life U.S. and DentaQuest announced a three-year, USD 825,000 partnership extension with TeamSmile to expand access to dental care for underserved children. The collaboration focuses on TeamSmile's free dental clinics and the Dental Home Project, which connects children to local primary dentists for long-term care. The program has shown significant success, with over 80% of children without a dental home being matched with providers, and nearly 80% attending their first follow-up appointment.

- In September 2024, KeyCorp announced a relationship, which includes a minority investment, with Zentist, a leading cloud-based insurance revenue cycle management (RCM) software provider for dental support organizations (DSOs) across the country. KeyBank will introduce Zentist's Remit AI software to its extensive network of DSOs, providing access to a transformative tool that enhances dental insurance revenue cycle management operations.

Segments Covered in the Report

By Coverage

- Dental Preferred Provider Organizations

- Dental Health Maintenance Organizations

- Others

By Procedure

- Major

- Basic

- Preventive

By Demographics

- Senior Citizens

- Adults

- Minors

By End-user

- Individuals

- Corporates

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting