What is the U.S. Digital Health Market Size?

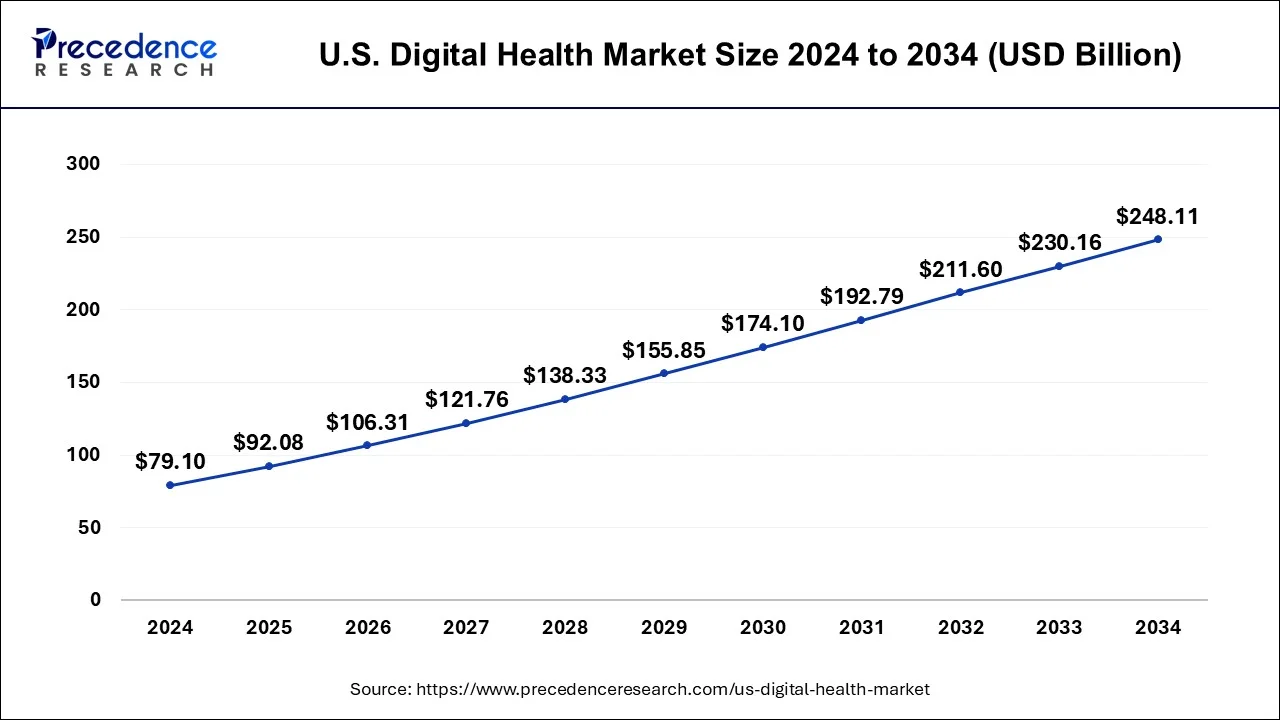

The U.S. digital health market size is estimated at USD 92.08 billion in 2025 and is predicted to increase from USD 106.31 billion in 2026 to approximately USD 266.47 billion by 2035, poised to grow at a CAGR of 11.21% from 2026 to 2035. The U.S. digital health market is driven by the growing incidence of chronic illnesses in conjunction with population aging.

Market Highlights

- By component, the services segment dominated the market in 2025.

- By component, the hardware segment is growing at a faster rate during the forecast period.

- By technology, the telehealthcare segment dominated the market in 2025.

- By technology, the mHealth segment is expected to witness the fastest rate of expansion during the forecast period.

Market Size and Forecast

- Market Size in 2025: USD 92.08 Billion

- Market Size in 2026: USD 106.31 Billion

- Forecasted Market Size by 2035: USD 266.47Billion

- CAGR (2026 to 2035): 11.21%

U.S. Digital Health Market Overview

The U.S. digital health market refers to the industry sector focused on leveraging digital technologies to improve healthcare delivery, enhance patient outcomes, and streamline healthcare operations within the United States. This market encompasses a wide range of digital health solutions, including telemedicine, electronic health records (EHRs), mHealth applications, wearable devices, remote patient monitoring systems, healthcare analytics, and artificial intelligence (AI) applications. With telecommunications technology, telemedicine allows for remote diagnosis, monitoring, and treatment of patients. It makes it possible for medical professionals to treat patients wherever they may be, which enhances access to care, particularly in underserved and rural areas.

The U.S. mental health issue has sparked the creation of digital mental health solutions that provide people in need with readily available, expandable, and stigma-free care. Mobile apps, chatbots, and online treatment platforms offer self-help tools, mindfulness exercises, and on-demand counseling to address a range of mental health issues.

U.S. Digital Health Market Data and Statistics

- The Digital Health Advisory Committee was established by the US Food and Drug Administration (FDA) to address some critical issues in digital health, such as product interoperability and the efficient use of artificial intelligence/machine learning (AI/ML) in 2023. The committee is intended to bring together external experts from various disciplines.

- With Honeywell's solution, vital signs are tracked using cutting-edge sensor technology through a skin patch in April 2023. The data is instantly sent to healthcare practitioners via mobile devices and an online dashboard.

- In November 2022, Veradigm declared Veradigm has joined the Point of Care Marketing Association (POCMA), a charity dedicated to promoting the Point of Care (POC) channel's continuous expansion through advocacy and education.

Growth Factors

- Cost-effective solutions are sought after by both patients and providers, and digital health presents an opportunity for both affordability and efficiency.

- Preference for wearables and smartphone apps that make healthcare convenient and accessible, promoting the growth of the U.S. digital health market.

- Fitness trackers and smartwatches are becoming increasingly popular for gathering data and monitoring health.

- Having widespread access to broadband and mobile internet makes it easier to implement digital health solutions.

- Insurance companies' coverage of virtual consultations is expanding.

- Emphasis on the interoperability and user-friendly design of digital health solutions.

- Convenience and pandemic experiences have led to a rise in the acceptability of virtual consultations and remote care services.

U.S. Digital Health Market Scope

| Report Coverage | Details |

| U.S. Market Size in 2025 | USD 92.08 Billion |

| U.S. Market Size in 2026 | USD 106.31 Billion |

| U.S. Market Size by 2035 | USD 266.47Billion |

| Growth Rate from 2026 to 2035 | CAGR of 11.21% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Component, and Technology |

Market Dynamics

Drivers

Rising demand for accessible and convenient healthcare

Increasing numbers of patients want their healthcare to be as easy to use and convenient as other digital services they use daily, like banking or shopping. Thanks to the growth of mobile health applications, people may now more easily manage chronic diseases, maintain exercise goals, and obtain health information on their cell phones. Digital health platforms help patients and healthcare providers share health information, which improves care coordination and allows for more individualized treatment regimens. Thereby, the rising demand for accessible and convenient healthcare solution offers a driver for the U.S. digital health market.

Escalating healthcare costs

To increase productivity, lower costs, and improve patient outcomes, the focus has been shifted toward creative digital solutions due to the rising costs of traditional healthcare delivery methods. Ultimately, digital health technology can help reduce rising healthcare costs by providing opportunities to improve resource use, streamline processes, and provide more individualized care.

Restraint

Digital divide and accessibility barriers

Many people need access to digital devices and high-speed internet, which is essential for digital health services. This is especially true for those living in rural or economically disadvantaged areas. This limits their access to other digital health options, such as health apps and telemedicine. More digital literacy and abilities may be required for some population segments, especially older persons and those with lower educational attainment. These people may need help using mobile health apps or navigating complicated health websites, which limits their potential to take advantage of advancements in digital health. Many digital health platforms and technology could not be entirely usable by people with disabilities, such as hearing or vision problems. Some people need more features, such as captioning or screen reader compatibility, to fully interact with digital health resources.

Opportunities

Developing AI-powered diagnostics and decision-support tools

Artificial intelligence (AI) can swiftly and reliably evaluate enormous volumes of medical data, producing more accurate diagnosis and treatment suggestions. This may lead to lower medical expenses and improved patient outcomes. AI algorithms can evaluate patient data to customize interventions and treatments to each patient's needs. This enhances patient happiness and the efficiency with which healthcare is delivered. AI-powered diagnostic tool development and implementation are made more accessible by the increasingly favorable regulatory climate in the United States for digital health advances. Thereby, the AI-powered solutions offer lucrative opportunities for the U.S. digital health market to expand.

Utilizing AI-powered chatbots and virtual assistants

Chatbots and virtual assistants can interact with patients in real time, offering prompt answers to questions, appointment booking, prescription reminders, and health education. This improves patient involvement and motivates them to participate actively in their medical journey. AI-powered solutions can assist patients in following treatment regimens and drug schedules by providing individualized support and reminders, eventually improving patient outcomes.

These tools can gather, and process enormous amounts of data produced by patient interactions. Healthcare providers can more efficiently personalize their services by using this data to acquire insights into patient preferences, behaviors, and health patterns.

Segments Insights

Component Insights

The services segment dominated the U.S. digital health market in 2025. The need for services that encourage the adoption of digital health is rising along with the need for effective and easily accessible healthcare solutions. The COVID-19 pandemic has expedited the implementation of remote healthcare delivery, which has resulted in a notableexpansion of telehealth services. Demand has increased for service providers that offer telehealth platforms and associated services.

The hardware segment is observed to be the fastest growing in the U.S. digital health market during the forecast period. To improve patient care, increase productivity, and lower healthcare costs, healthcare providers are progressively integrating digital health devices into their operations. This involves tracking treatment progress and monitoring patients' health in clinical settings with smart scales, blood pressure monitors, and glucose meters. By enabling more prompt treatments and minimizing the need for in-person visits, remote patient monitoring technologies assist in remotely monitoring patients' health. These tools are invaluable for treating long-term illnesses and guaranteeing patients in underserved or rural locations receive continuous treatment.

Technology Insights

The telehealthcare segment dominated the U.S. digital health market in 2025. Patients no longer need to travel to a regular healthcare facility or wait long to receive care due to telehealth. Because its services reduce overhead related to maintaining physical facilities, they are more affordable for patients and doctors than in-person appointments. There is a growing demand for telehealth services since many patients find telemedicine appointments more convenient and flexible.

The mHealth segment is the fastest growing segment in the U.S. digital health market during the forecast period. The increasing use of tablets and smartphones has produced a ready platform for providing healthcare services and acquiring medical data. Through mobile health apps, consumers may easily access healthcare services, keep track of their health, make appointments, access medical data, and chat with healthcare professionals from anywhere.

Fitness trackers, meal planners, medicine reminders, and symptom checkers are just a few of the individualized health management tools many mHealth apps provide, enabling users to take charge of their health. The COVID-19 pandemic has increased the demand for mHealth solutions that facilitate remote diagnosis, virtual consultations, and digital prescriptions by hastening the implementation of telehealth services.

U.S. Digital Health Market Companies

- BioTelemetry Inc

- eClinicalWorks

- Allscripts Healthcare Solutions Inc

- iHealth Lab Inc

- AT & T

- Honeywell International Inc

- Athenahealth Inc.

- Cisco Systems

- McKesson Corporation

Recent Developments

- In January 2024, LillyDirectTM, a revolutionary digital healthcare experience for Americans with diabetes, migraines, and obesity, was introduced by Eli Lilly & Company. LillyDirect provides resources for managing diseases, such as direct home delivery of some Lilly medications via third-party pharmacy dispensing services, individualized support, and access to independent healthcare providers.

- In July 2023, The Peterson Health Technology Institute (PHTI) was established by the Peterson Center on Healthcare. This nonprofit organization offers unbiased assessments of cutting-edge medical technologies to enhance patient care and reduce expenses.

Segments Covered in the Report

By Component

- Software

- Hardware

- Services

By Technology

- Telehealthcare

- Telehealth

- Video Consultation

- LTC Monitoring

- Telecare

- Remote Medication Management

- Activity Monitoring

- Telehealth

- mHealth

- Apps

- Fitness Apps

- Medical Apps

- Wearables

- Glucose Meter

- BP Monitor

- Pulse Oximeter

- Neurological Monitors

- Sleep Apnea Monitor

- Others

- Apps

- Digital Health Systems

- E-prescribing Systems

- Electronic Health Records

- Health Analytics

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting