What is the U.S. Live Cell Imaging Market Size?

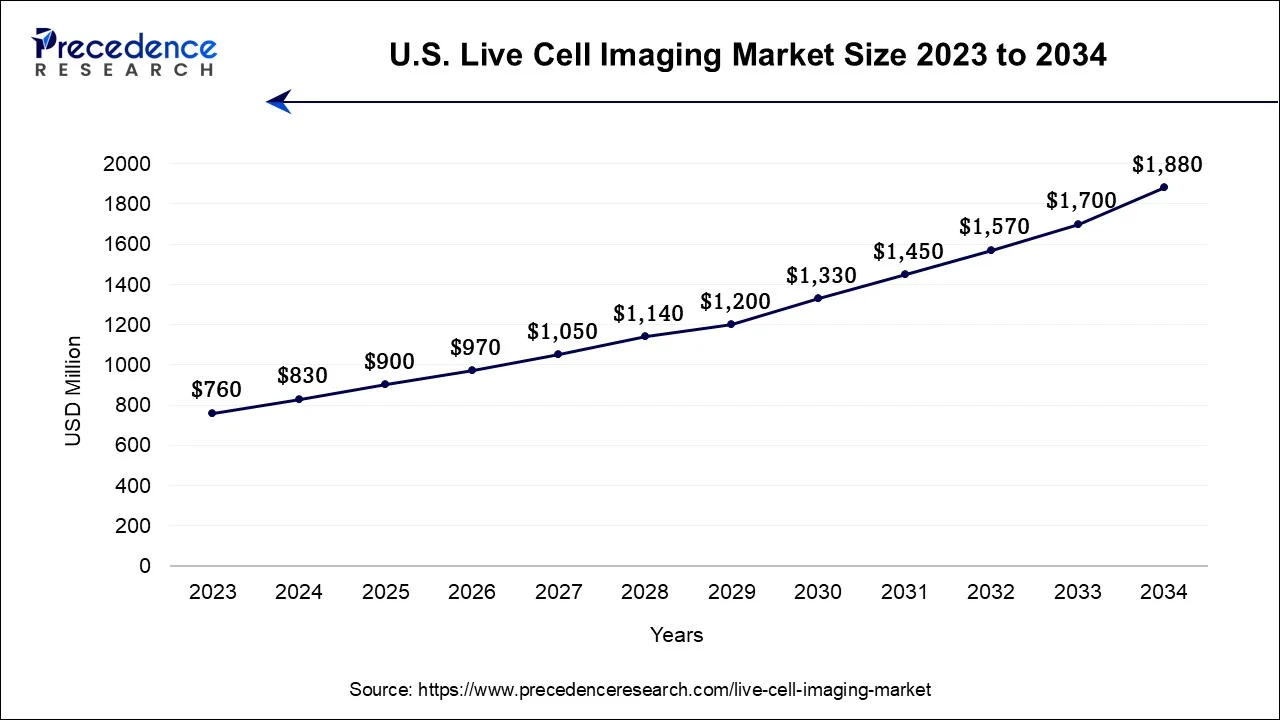

The U.S. live cell imaging market size accounted for USD 900 million in 2025 and is predicted to increase from USD 970 million in 2026 to approximately USD 2,026.67 million by 2035, expanding at a CAGR of 8.46% from 2026 to 2035. The U.S. industry for live cell imaging is witnessing unprecedented growth, driven by surging R&D spending by pharmaceutical and biotechnology companies, rising cancer incidence, and technological advancements, such as AI-driven image analysis and super-resolution microscopy.

Market Highlights

- By product, the equipment segment held the largest market share in 2025.

- By product, the software segment is expected to grow at a remarkable CAGR between 2026 and 2035.

- By application, the cell biology segment contributed the major market share in 2025.

- By application, the developmental biology segment is expanding at a remarkable CAGR between 2026 and 2035.

- By technology, the fluorescence resonance energy transfer (FRET) segment held the largest share in 2025.

- By technology, the high content screening (HCS) segment is set to grow at a notable CAGR between 2026 and 2035.

U.S. Live Cell Imaging Market Overview

The U.S. live cell imaging market is driven by the country's large concentration of federally funded biomedical research institutions, advanced academic medical centers, and pharmaceutical research hubs. Live-cell imaging enables U.S.-based researchers to observe biological samples over extended periods under controlled physiological conditions, supporting detailed investigation of cellular processes such as cell division, migration, differentiation, and apoptosis. This capability is central to U.S. biomedical research, where dynamic, time-resolved data is increasingly prioritized over static endpoint analysis.

Live-cell imaging plays a critical role in U.S. cancer research programs, particularly within National Cancer Institute-designated cancer centers. According to the National Cancer Institute's 2023 research methodology documentation, live-cell imaging is widely used to study tumor cell heterogeneity, metastatic progression, immune cell interactions, and treatment-induced cellular responses. These applications are essential for understanding therapy resistance and adaptive signaling pathways that cannot be captured by fixed-tissue imaging or bulk molecular assays.

In the United States, live-cell imaging is also a core analytical tool in neuroscience research, supported by long-term federal initiatives such as the BRAIN Initiative. According to the National Institute of Neurological Disorders and Stroke's 2022 research tools overview, live-cell imaging enables real-time visualization of synaptic activity, axonal transport, and neuronal network development. These capabilities support research into neurodevelopmental disorders, neurodegenerative diseases, and synaptic plasticity, which are priority areas within U.S. public health research funding.

How Are AI-Driven Innovations Reshaping the U.S. Live Cell Imaging Market?

As technology continues to evolve, the integration of artificial intelligence (AI) and machine learning holds great potential to accelerate growth in the U.S. live cell imaging market by streamlining data analysis and discovery processes. Advanced AI algorithms pave the way for new possibilities in automated prediction of cellular behavior and drug screening. AI tools improve diagnostic accuracy and early disease detection by identifying patterns and abnormalities in live-cell images, thereby improving patient outcomes. AI integration enables high-throughput, automated analysis of live cells, which assists pharmaceutical/biotechnology companies in making faster decisions in preclinical research. AI algorithms process the massive volumes of data generated by advanced imaging systems, automation minimizes human error, and speeds up the analysis of complex cellular processes.

In January 2025, Revvity, Inc. unveiled its groundbreaking Phenologic.AI software, designed to redefine cellular imaging workflows for its Harmony and Signals Image Artist software packages. The Phenologic.AI software leverages pre-trained deep learning models to analyze brightfield images, providing an additional multiplexing channel and streamlined workflows for live cell analysis. This significant advancement expands the possibilities for understanding cellular behaviors and disease mechanisms.

U.S. Live Cell Imaging Industry Outlook

- Industry Growth Overview: Between 2026 and 2035, the industry is expected to grow at an accelerated pace. The growth of the U.S. live cell imaging market is driven by rapid advancements in microscopy technologies, increasing investment in R&D activities, the rising burden of chronic diseases, and a strong emphasis on personalized medicine. Additionally, rising funding for biomedical research and rapid technological advancements, such as Artificial Intelligence in High Content Screening (HCS) for faster drug discovery, are expected to propel growth in the U.S. live cell imaging sector.

- Geographical Expansion: Several leading players in the U.S. live cell imaging industry are expanding their global reach through various strategic initiatives. Their strategies involve significant investments, R&D focused on AI integration and automation, and forming partnerships to strengthen their product portfolios and geographical presence, especially in the fast-growing market.

- Major Investors: Several major strategic investors and key players are actively engaged in the U.S. live cell imaging market. These entities increasingly invest in R&D, strategic acquisitions, and product innovation (AI integration, automation) to drive market growth in the coming years. For instance, in January 2025, Molecular Devices, LLC., launched the ImageXpress HCS.ai High-Content Screening System. This fifth-generation high-content imager is distinguished by its ability to quickly capture crystal-clear images of complex cell models, acquire detailed data with intuitive software, and offer deep insights leveraging AI-driven analysis.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 900 Million |

| Market Size in 2026 | USD 970 Million |

| Market Size by 2035 | USD 2,026.67 Million |

| Market Growth Rate from 2026 to 2035 | CAGR of 8.46% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Application, and Technology |

Segmental Insights

Product Insights

What Caused the Equipment Segment to Lead the U.S. Live Cell Imaging Market?

Equipment: The segment held the largest market share in 2025, driven by the increasing demand for user-friendly, automated, and more advanced equipment, such as multi-photon/super-resolution microscopy. Automated systems streamline workflows, handle massive datasets, and offer reliable results to meet the research needs. Equipment in the live cell imaging market includes specialized microscopes, stage incubators, cameras, and imaging chambers. Additionally, integrating artificial intelligence into these systems enables automated cell tracking and analysis. These systems are increasingly adopted by academic research laboratories, pharmaceutical R&D centers, and contract research organizations to support long-duration time-lapse experiments with minimal manual intervention. Continuous improvements in optical resolution, imaging speed, and environmental stability further reinforce demand for equipment across oncology, neuroscience, and stem cell research applications.

Software: This segment is expected to grow at a remarkable CAGR between 2026 and 2035 in the U.S. live cell imaging market, as software services play a crucial role in extracting meaningful biological insights. AI/ML tools analyze massive datasets from live imaging and provide deeper insights into complex cellular behaviors. Software enables real-time monitoring and provides insight into dynamic processes in cancer research, cell biology, and regenerative medicine. Advanced image analysis platforms support segmentation, classification, and quantification of cellular events at single-cell and population levels. Growing emphasis on data reproducibility, standardized workflows, and integration with laboratory information systems is further accelerating the adoption of specialized live-cell imaging software solutions.

Application Insights

Which Segment Dominated by the Application in the U.S. Live Cell Imaging Market?

Cell Biology: This segment dominates the U.S. live cell imaging market, holding a majority share. The segment's growth is attributed to robust research infrastructure, rising R&D funding, and the expansion of established biotechnology & pharmaceutical sectors. Live cell imaging in cell biology involves observing and studying cellular processes within living cells. Live cell imaging assists in understanding complex cellular dynamics and advancing drug discovery.

Developmental Biology: This segment is expected to be the fastest-growing in the U.S. live cell imaging sector. In developmental biology, live cell imaging is crucial for observing how living cells change over time and for studying the dynamics of cell division, migration, differentiation, and signaling in real-time. Several government and private sectors are increasingly funding the life sciences, driving demand for advanced live cell imaging technologies.

Technology platform Insights

What Caused the Fluorescence Resonance Energy Transfer (FRET) Segment to Dominate the U.S. Live Cell Imaging Market?

Fluorescence Resonance Energy Transfer (FRET): This segment dominates the U.S. live cell imaging market. Fluorescence Resonance Energy Transfer (FRET) is a prominent technology that measures molecular proximity by transferring energy from an excited donor fluorophore to an acceptor fluorophore. This technology is used to visualize protein interactions, signaling pathways, protein dynamics, and to track nanoparticles in cells. This technology is widely adopted to monitor protein-protein interactions, molecular conformational changes, and cellular signaling events.

High content screening (HCS): The segment is set to be the fastest-growing in the U.S. live cell imaging market. The segment's growth is driven by increasing demand for faster screening, growing demand for drug discovery, and the integration of 3D models. HCS enables real-time, multi-parameter cellular analysis to understand various diseases, including genetic disorders, cancer, and infectious disorders. AI integration in High-Content Screening (HCS) enables high-throughput, automated analysis of live cells at unprecedented scale, assisting pharmaceutical companies in performing detailed phenotypic screening and making data-driven decisions in preclinical research.

U.S. Country Analysis

The U.S. live cell imaging market is concentrated in established biotech and academic clusters that supply deep talent pools, core facilities, and venture funding. The Boston-Cambridge cluster and the San Francisco Bay Area remain dominant innovation centers, with San Diego, the BioHealth Capital Region, and the Research Triangle also hosting significant activity in imaging, single-cell, and cell therapy R&D. These hubs concentrate instrument buyers, high-content imaging service providers, and early-adopter pharmaceutical teams, creating dense local demand for advanced microscopes, stage incubators, and imaging consumables.

Federally funded research centers and university core facilities form the backbone of U.S. live-cell imaging demand because they operate multi-user platforms that purchase and maintain high-end equipment and software. National Cancer Institute-designated cancer centers and NIH-supported core facilities routinely host confocal, spinning-disk, multi-photon, and super-resolution systems used for long-duration live imaging and translational studies. The presence of 70+ NCI-designated centers and numerous NIH-funded cores ensures predictable institutional procurement cycles and recurring demand for service contracts, calibration, and consumables.

Regulatory expectations for mechanistic and time-resolved data in support of IND-enabling studies and cell and gene therapy submissions reinforce the adoption of live-cell imaging in preclinical and translational pipelines. The U.S. Food and Drug Administration's guidance on in vitro pharmacology and on developing cellular and gene therapy products signals that time-resolved, mechanism-focused assays are valuable for demonstrating safety and mode of action during preclinical evaluation. This regulatory context increases willingness among large pharma and CROs to invest in validated live-imaging platforms and software that support GLP-aligned workflows.

Top Players in the U.S. Live Cell Imaging Market

- Danaher Corporation

- PerkinElmer, Inc.

- Thermo Fisher Scientific Inc.

- Revvity

- GE Healthcare

- BD (Becton, Dickinson and Company)

- Agilent Technologies, Inc.

Recent Developments

- In June 2025, Ramona announced the launch of a live-cell imaging system that significantly improves speed and throughput for analyzing cells. The Vireo system uses miniaturized video microscopes and real-time image processing through artificial intelligence. Ramona said in a news release that Vireo can help give scientists better, faster insights into drug discovery.(Source: https://www.ncbiotech.org)

- In May 2025, Leica Microsystems expanded its research microscope lineup with the addition of the Viventis LS2 Live light-sheet microscope, designed to provide high-quality imaging for studying complex biological systems down to the cellular level, thereby enhancing research into health, disease, and biology. The new Viventis LS2 Live light-sheet fluorescence microscope provides a unique, multi-view, multi-position light-sheet imaging approach to illuminate life in its entirety.(Source: https://clpmag.com)

Segments Covered in the Report

By Product

- Equipment

- Consumable

- Software

By Application

- Cell Biology

- Developmental Biology

- Stem Cell & Drug Discovery

- Others

By Technology

- Time-lapse Microscopy

- Fluorescence recovery after photobleaching (FRAP)

- Fluorescence resonance energy transfer (FRET)

- High content screening (HCS)

- Others

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting