What is Veterinary Parasiticides Market Size?

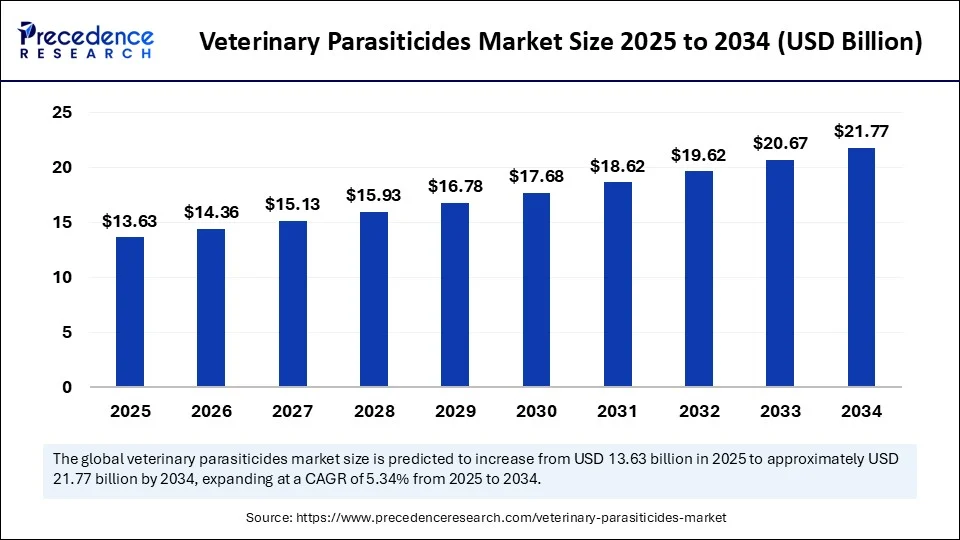

The global veterinary parasiticides market size accounted for USD 13.63 billion in 2025 and is predicted to increase from USD 14.36 billion in 2026 to approximately USD 21.77 billion by 2034, expanding at a CAGR of 5.34% from 2025 to 2034. The growth of the veterinary parasiticides market is driven by the increased pet ownership, growth in livestock population, and increased awareness about animal health and wellness.

Market Highlights

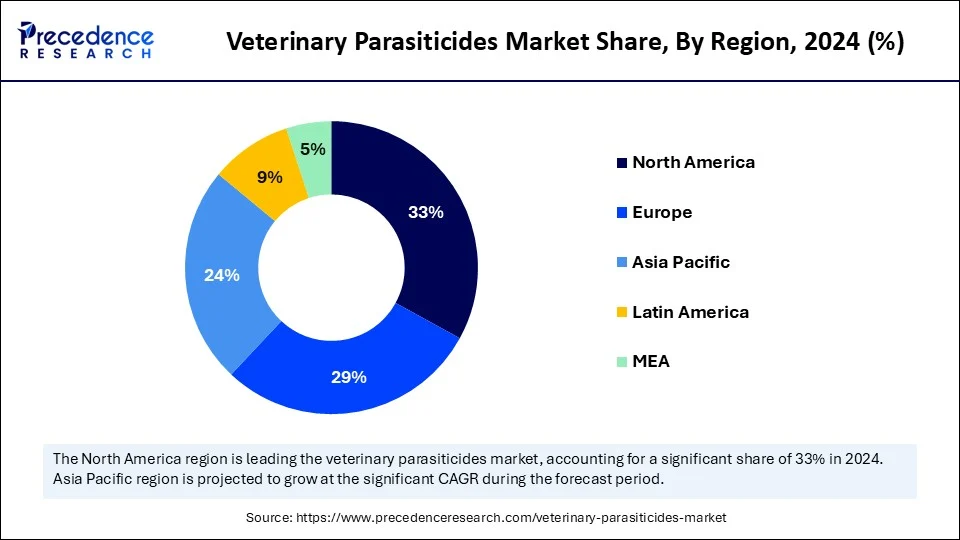

- Asia Pacific is expected to expand at the fastest CAGR in the market between 2025 and 2034.

- By product type, the end parasiticides segment held 41% of market share in 2024.

- By product type, the endectocides segment is anticipated to grow at a remarkable CAGR between 2025 and 2034.

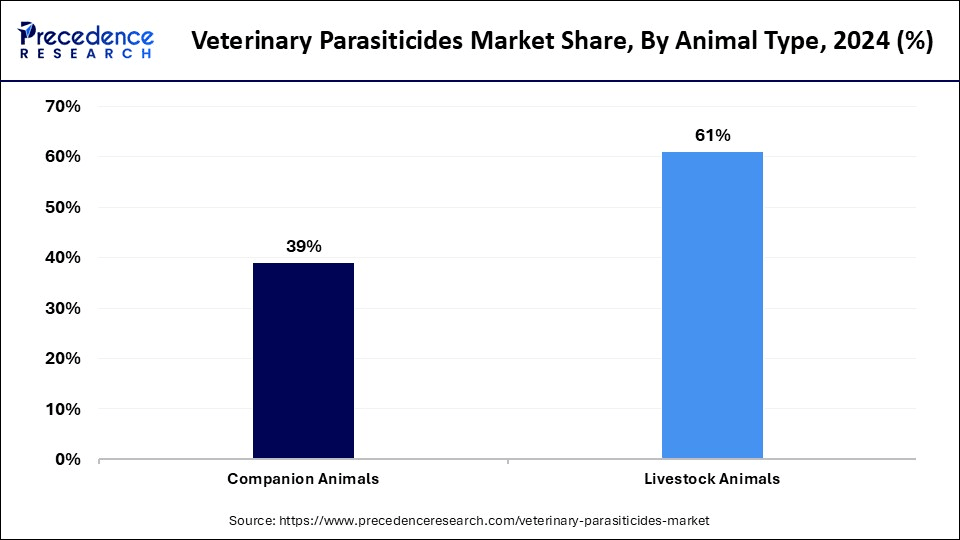

- By animal type, the livestock animals segment captured 61% of market share in 2024.

- By animal type, the companion animals segment is expected to expand at a notable CAGR over the projected period.

- By mode of administration, the oral segment held 47% of market share in 2024.

- By mode of administration, the topical segment is expected to expand at a significant CAGR over the forecast period.

- By distribution channel, the veterinary clinics/hospitals segment held 51% market share in 2024.

- By distribution channel, the online pharmacies segment is expected to expand at the fastest CAGR over the projected period.

- By end user, the farmers & livestock owners segment held 57% of market share in 2024.

- By end user, the pet owners segment is expected to expand to the highest CAGR over the projected period.

Market Overview

The veterinary parasiticides market encompasses pharmaceutical agents used to eliminate or control internal and external parasites in animals. These products are vital in maintaining animal health, enhancing livestock productivity, and preventing the transmission of zoonotic diseases. Veterinary parasiticides include endoparasiticides (targeting internal parasites), ectoparasiticides (targeting external parasites), and endectocides (targeting both). They are administered across companion animals and livestock via oral, injectable, topical, or other routes, and are distributed through veterinary hospitals, retail pharmacies, or online platforms.

Impact of AI in the Veterinary Parasiticides Market

Artificial intelligence is already disrupting the veterinary parasiticides market by enhancing drug discovery & development, as well as improving diagnostics. AI has the potential to accelerate the identification of novel drug targets of parasiticides. AI tools also enhance the accuracy in the detection of parasiticides. At VMX 2025, industry leaders showcased AI-based diagnostic tools, including IDEXX analyzers and DAISY AI, that will enable earlier detection of parasites and remote monitoring. The Animal Health Institute indicates that AI-based image analysis for fecal egg counts and predictive models is already employed in clinics.

The One Health movement, evident at BVA Live, also encourages the veterinary industry to utilize AI to more accurately identify parasiticides, leading to reduced parasite resistance, decreased environmental runoff, and fewer veterinary visits. From smartphone parasite diagnostics to smarter drug discovery, AI is rapidly evolving to enhance precision treatment in veterinary parasitic control.

Veterinary Parasiticides MarketGrowth Factors

- Rising Pet Ownership: Pet ownership has been increasing worldwide, which drives the demand for healthcare products, including those intended for routine parasite control.

- Growing Demand for Livestock Products:The increasing demand for meat, dairy, and other animal products drives a need for parasite control to enhance animal health and productivity.

- Product Formulation Opportunities: The rising development of novel formulations of parasiticides with enhanced mechanisms of action and long-acting efficacy contributes to market growth.

- Increased Government and Regulatory Support: Public health campaigns and animal welfare programs have the potential to increase regular parasite intervention, especially in developing regions.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 13.63 Billion |

| Market Size in 2026 | USD 14.36 Billion |

| Market Size by 2034 | USD 21.77 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.34% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Animal Type, Mode of Administration, Distribution Channel, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Prevalence of Foodborne Diseases and Zoonotic Infections

The growing prevalence of foodborne diseases and zoonotic infections is a major factor driving the growth of the veterinary parasiticides market. Because animals frequently transmit infections to humans, with the transmission occurring through food, water, or direct contact, both the government and health agencies, such as the European Food Safety Authority (EFSA) and the ECDC, highlight the importance of improving parasite control. The European Union One Health 2023 Zoonoses Report indicates a significant rise in foodborne infections in Europe. The most reported zoonoses in humans were campylobacteriosis (148,181 cases) and salmonellosis (77,486 cases).

Similarly, the U.S. CDC has reported an increase in the occurrence of Cyclospora, Vibrio, and STEC in 2023. The combination of the emergence of new diseases, zoonotic infections, and foodborne infections will spur stricter veterinary protocols, routine deworming, and parasite monitoring, encouraging veterinarians to adopt a strategy that prioritizes parasiticides at the forefront of human-animal health.

Restraint

Are More Stringent Global Regulations Affecting Veterinary Parasiticides Market Growth?

One of the most significant factors restraining the growth of the veterinary parasiticides market is stringent regulatory requirements. Over the past few years, regulatory agencies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) have imposed strict approval processes for veterinary drugs due to growing concerns surrounding antimicrobial and antiparasitic resistance.

According to the FDA's Center for Veterinary Medicine (2023), the approval of a new veterinary drug (such as a parasiticide) typically takes 7–10 years and consists of extensive clinical trials and safety assessments. In a similar manner, according to EU Regulation 2019/6, new parasiticides must also include stricter guidelines on environmental safety and the management of resistance. These regulatory updates play a crucial role in promoting public health and animal health; however, they can also restrict innovation and increase the costs of novel parasiticides.

Opportunity

Could Eco-Friendly and Natural Parasiticides Be the Next Wave of Veterinary Product Development?

There is a significant opportunity for growth in eco-friendly and natural parasiticides. With growing concerns about the environment, there is a high demand for eco-friendly parasiticides, particularly those derived from natural sources. The UK is urging veterinarians to reduce environmental damage and limit the use of traditional flea treatment products, as their acute harm to wildlife has sparked a compelling movement toward eco-friendly alternatives. Consumers are increasingly preferring organic and plant-based food products (neem, garlic, essential oils), combined with the recent increased demand for multi-pet households.

Introducing sustainable parasiticides that have superior efficacy and a minimal environmental footprint, further enhancing brand differentiation. These parasiticides may attract pet owners seeking safer, eco-friendly, and responsible veterinary care. This focus on eco-friendly and natural parasiticides aligns with consumer values, while planning for potentially more stringent regulations on chemical parasiticides in the future, allowing first movers to build a sustainable competitive advantage in the long run.

Segment Insights

Product Type Insights

Why Did the Endoparasiticides Segment Dominate the Veterinary Parasiticides Market in 2024?

The endoparasiticides segment dominated the market with the largest share in 2024. This is primarily due to their increased use in managing internal parasites, such as roundworms, tapeworms, and protozoa. Some subtypes of endoparasiticides, like anthelmintics and antiprotozoals, are widely used in livestock to maintain herd health and productivity. It is crucial to prevent internal parasites in animals, as they can lead to weight loss, reproductive issues, and reduced milk production, especially in beef and dairy cattle, as well as swine.

The endectocides segment is expected to grow at the fastest rate in the upcoming period. This is primarily due to the increasing adoption of endectocides, particularly macrocyclic lactones and isoxazolines, for controlling both internal and external parasites. They are increasingly becoming the preferred choice to enhance animal health, since one product will treat two types of parasites. Endectocide products, including ivermectin, expanded from cattle, sheep, and swine to companion animals, including dogs and cats. Additionally, the adoption of endectocides is growing because of increased awareness of broad-spectrum solutions and concerns about parasite resistance to older anthelmintic and anti-parasitic drugs.

Animal Type Insights

Which Animal Type Segment Dominate the Market in 2024?

The livestock animals segment dominated the veterinary parasiticides market with a major share in 2024. This is primarily due to the increased production of livestock, particularly cattle and goats. There is a strong emphasis on controlling internal parasites in livestock because they can pose several health risks, resulting in decreased milk and egg production. For this reason, the regular use of parasiticides to control parasites in sheep, goats, poultry, and swine has become a standard preventative measure.

The companion animals segment is likely to grow at the highest CAGR during the projection period. The growth of the segment is attributed to the rising ownership of dogs and cats, along with awareness of parasite-borne zoonotic diseases among pet owners. Pet owners are seeking preventive care due to the increased humanization of pets. There is a significant increase in pet healthcare spending by pet owners to prevent flea, tick, and heartworm. The growing concerns over pet health & wellness further boost the demand for parasiticides.

Mode of Administration Insights

What Made Oral the Dominant Segment in the Veterinary Parasiticides Market in 2024?

The oral segment maintained its dominance in the market, holding the largest share in 2024. This is because of the increased demand for convenient formulations. Oral administration is effective, economical, and convenient for both livestock and companion animals. Tablets, chewables, and liquids are each commonly found in mass deworming programs, as they are simple to administer in or through feed, or to give directly. This route of administration enables accurate dosing and has rapid absorption, making it a great route for endoparasitic treatment. Oral parasiticides are also widely available and are well accepted in both prescription and over-the-counter delivery systems, allowing for a wide range of consistency of use across different animal types.

The topical segment is expected to grow at the fastest rate over the forecast period. There is considerable appeal to consumers for these products because they are easy to use, non-invasive, and often specifically targeted at ectoparasites like fleas, ticks,, and mites. In livestock, pour-on styles are more commonly used to treat large herds when oral dose administration is not practical for the species. New formulations that last longer and are more water resistant have made topical delivery a popular and reliable alternative to traditional routes of administration.

Distribution Channel Insights

How Does the Veterinary Clinics & Hospitals Segment Dominate the Market in 2024?

The veterinary clinics & hospitals segment led the veterinary parasiticides market in 2024, as veterinarians are the trusted source for diagnosis, treatment recommendations, and guidance on products, particularly for livestock producers and pet owners. Clinics guarantee that the proper drug and dosage are used in the correct way, helping prevent excessive misuse or the development of drug resistance. The level of dependence on veterinary services for preventive and curative care remains strong, continuing to position them as the leading distributor of parasiticide products.

The online pharmacies segment is expected to grow at the fastest CAGR in the coming years. These pharmacies are revolutionizing vet care by providing convenience (and better prices) with the option of home delivery for many parasiticides. Pet ownership is leading to a higher acceptance of new technologies and the increase in online pharmacies, particularly with urban pet owners, with websites which provide 'direct to consumer options' seeing substantial growth. These channels provide an easy refill of routine preventative treatments and the opportunity for pet parents to 'comparison-shop' for brands, prices, and ingredients. The combination of online orders and telemedicine has increased since the pandemic and continues to solidify this channel in the ever-changing veterinary care landscape.

End User Insights

Why Did the Farmers & Livestock Owners Segment Dominate the Market in 2024?

The farmers & livestock owners segment dominated the veterinary parasiticides market in 2024, as they need to maintain herd health and production. Certain types of parasite control are normal aspects of commercial animal farming such as meat, milk, and eggs that consumers expect to be safe, healthy, and of high quality. This group of end-users is highly reliant on scheduled dosing and veterinary consultation. Government livestock health programs and food safety requirements further entrench their use of parasiticides.

The pet owners segment is expected to expand at the fastest CAGR during the projection period due to the growing awareness about pet health, disease prevention, and zoonotic threats. Today's pet owners are proactive consumers and tend to actively search for monthly parasite preventatives, especially for fleas, ticks, and heartworms. With emerging trends such as pet insurance policies, subscription services for pet medications, and an increase in the frequency of veterinary visits, pet owners are becoming some of the largest drivers of innovation and demand in the parasiticide space, particularly in urban and semi-urban areas.

Regional Insights

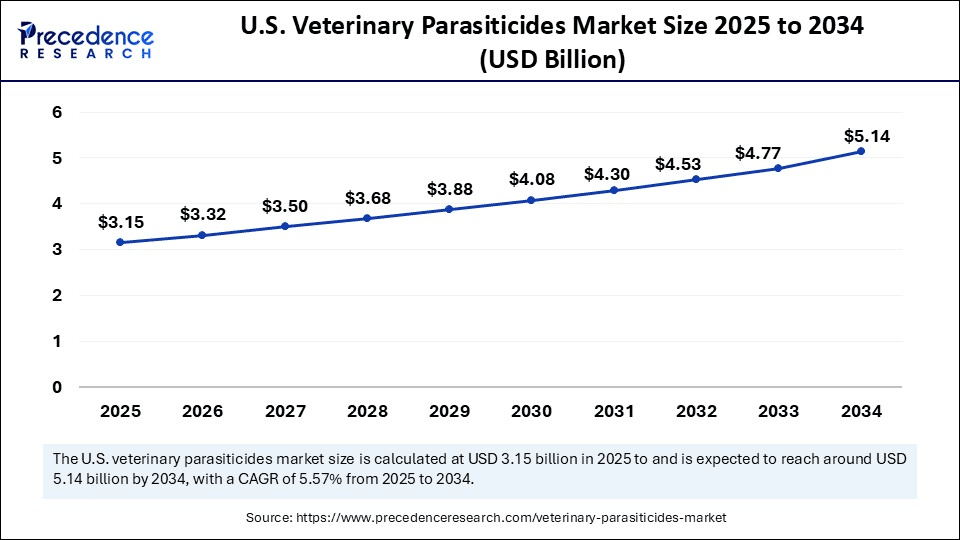

U.S. Veterinary Parasiticides Market Size and Growth 2025 to 2034

The U.S. veterinary parasiticides market size is exhibited at USD 3.15 billion in 2025 and is projected to be worth around USD 5.14 billion by 2034, growing at a CAGR of 5.57% from 2025 to 2034.

How Does North America Sustain Dominance in the Veterinary Parasiticides Market?

North America dominated the market with the largest share in 2024. This is mainly due to its sophisticated animal healthcare infrastructure and a robust veterinary regulatory framework. There is a heightened awareness of the health and wellness of pets and livestock. The region has a robust pharmaceutical research and development (R&D) ecosystem, with the presence of several key market players who are actively launching new products in the parasiticide category. Programs such as the U.S. Food and Drug Administration's Antiparasitic Resistance Management Strategy (ARMS), which promotes sustainable and welfare-based antiparasitic drug usage for animal health, facilitate the long-term growth of the market in the region.

The U.S. is a major contributor to regional market growth, thanks to its well-established animal healthcare system, higher pet expenditures, and increased adoption of farm biosecurity practices. The U.S. Department of Agriculture (USDA) supports multiple programs for the control of diseases in livestock, which has resulted in increased access to parasiticides at several facilities. Additionally, the FDA's Antiparasitic Resistance Management Strategy (ARMS) plays a crucial role in educating veterinarians and producers on the responsible use of drugs. Along with regulatory clarity from the FDA, increased awareness of animal health and the availability of novel pharmacological options support market growth.

- In July 2025, Merck Animal Health announced that Bravecto Quantum (fluralaner extended-release injectable) received FDA approval for the treatment of fleas and ticks in dogs and puppies ≥ 6 months. This new product is expected to be available at veterinary clinics and hospitals nationwide by August 2025.

What Makes Asia Pacific the Fastest-Growing Region in the Veterinary Parasiticides Market?

Asia Pacific is expected to grow at the fastest rate in the market as a result of an increasing livestock population and growing awareness of animal health. Countries such as India and China are investing heavily in modernizing their agricultural and veterinary sectors to enhance food safety, improve livestock productivity, and promote antibiotic stewardship. An increasing middle class and a growing adoption rate of pets in urban areas will continue to support the demand for parasiticides. Government programs aimed at preventing the spread of infections and other diseases in animals can lead to increased adoption of parasiticides.

India is a significant player in the market due to its substantial livestock population and a strong commitment to animal welfare. India produces a large volume of both milk and poultry, which requires strong disease control and effective parasite management for livestock. India's National Animal Disease Control Program (NADCP) is pushing for province-wide deworming and disease prevention, boosting the demand for parasiticides.

What Potentiates the Growth of Europe in the Veterinary Parasiticides Market?

Europe is expected to see significant growth in the market in the upcoming period due to government action plans and new product approvals. The new EU Veterinary Medicines Regulation provides the regulatory framework for the EU, including updated pharmacovigilance (PV) systems across EU Member States. The British Veterinary Association (BVA) launched a new policy on the responsible use of parasiticides in grazing animals, which further supports market expansion. France leads the market in Europe thanks to strong biosecurity programs and government-led livestock disease control initiatives, creating steady demand for preventive parasite treatments. Additionally, rising pet ownership and increasing spending on companion animal care boost parasiticide sales.

How is the Opportunistic Rise of Latin America in the Veterinary Parasiticides Market?

Latin America is experiencing an opportunistic rise in the market, fueled by high livestock density, especially in Brazil and Argentina, and rising demand for animal‑derived food products, which drives strong demand for preventive parasite control. In April 2025, the region reported that over 65% of livestock in disease-free zones without vaccination were protected through the complete eradication of foot-and-mouth disease. Pharmaceutical companies in the region launched many programs to promote a more rational use of parasiticides in farming.

Brazil is a major player in the market in Europe. There is a high demand for parasiticides in the livestock sector due to high parasite pressure and economic losses from infestations. At the same time, a growing pet ownership is fueling the uptake of parasiticides for companion animals. Government initiatives focused on parasiticides regulation, animal health, and One Health approaches also contribute to the regional market growth.

What are the Major Factors Driving the Growth of the Market in the Middle East and Africa?

The veterinary parasiticides market in the Middle East and Africa (MEA) is driven by several factors. Firstly, government programs aim to improve the overall animal health and control diseases. Secondly, collaboration between regional and global market players to enhance the availability of veterinary health products, including parasiticides. Moreover, a rise in companion animal ownership (especially in urban GCC states) and growing awareness of pet health are driving demand for parasiticides.

Saudi Arabia leads the market in the Middle East and Africa, supported by government initiatives to boost domestic meat and dairy production, which is increasing demand for parasite control and preventive veterinary care. The National Center for the Prevention and Control of Plant Pests and Animal Diseases is working to improve animal health services like immunization bookings and disinfection permits by launching a digital health platform. In July 2024, Saudi Arabia initiated a SR175 million contract for a veterinary laboratory.

Veterinary Parasiticides Market Companies

- Zoetis Inc.

- Boehringer Ingelheim Animal Health

- Elanco Animal Health

- Merck Animal Health (MSD Animal Health)

- Norbrook Laboratories

- Ceva Santé Animale

- Dechra Pharmaceuticals

- Vetoquinol

- Virbac

- Chanelle Pharma

- Phibro Animal Health

- Bimeda Animal Health

- Huvepharma

- Zydus Animal Health

- Ourofino Saúde Animal

- Ashish Life Science

- KRKA

- Kyoritsu Seiyaku

- Indian Immunologicals

- Neogen Corporation

Recent Developments

- In September 2024, Elanco received FDA approval for Zenrelia (ilunocitinib) tablets, a once-daily oral JAK inhibitor for controlling pruritus and atopic dermatitis in dogs 12 months and older. (Source: https://www.elanco.com)

- In January 2025 Credelio Quattro, with its diverse mixture of six species of parasites, is now available for veterinarians across the nation to order, offering the widest parasite protection in a single monthly chewable tablet. (Source: https://www.dvm360.com)

- In January 2025, Elanco launched Credelio Quattro, a monthly chewable tablet offering broad-spectrum protection against six parasites in dogs. Combining four active ingredients, it's now available through U.S. veterinarians as a convenient all-in-one solution.(Source: https://my.elanco.com)

Segments Covered in the Report

By Product Type

- Endoparasiticides

- Anthelmintics

- Antiprotozoals

- Ectoparasiticides

- Insecticides

- Acaricides

- Endectocides

- Macrocyclic lactones (e.g., ivermectin, moxidectin)

- Isoxazolines

By Animal Type

- Companion Animals

- Dogs

- Cats

- Others (birds, rabbits, etc.)

- Livestock Animals

- Cattle

- Sheep & Goats

- Poultry

- Swine

- Others (horses, camels, etc.)

By Mode of Administration

- Oral

- Tablets

- Chewables

- Liquids

- Topical

- Spot-on

- Sprays

- Pour-on

- Injectable

- Others

By Distribution Channel

- Veterinary Clinics/Hospitals

- Retail Pharmacies

- Online Pharmacies

- Feed Stores & Cooperatives

By End-User

- Veterinarians

- Pet Owners

- Farmers & Livestock Owners

- Animal Welfare Organizations

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting