Virtual Care Market Size and Forecast 2024 to 2034

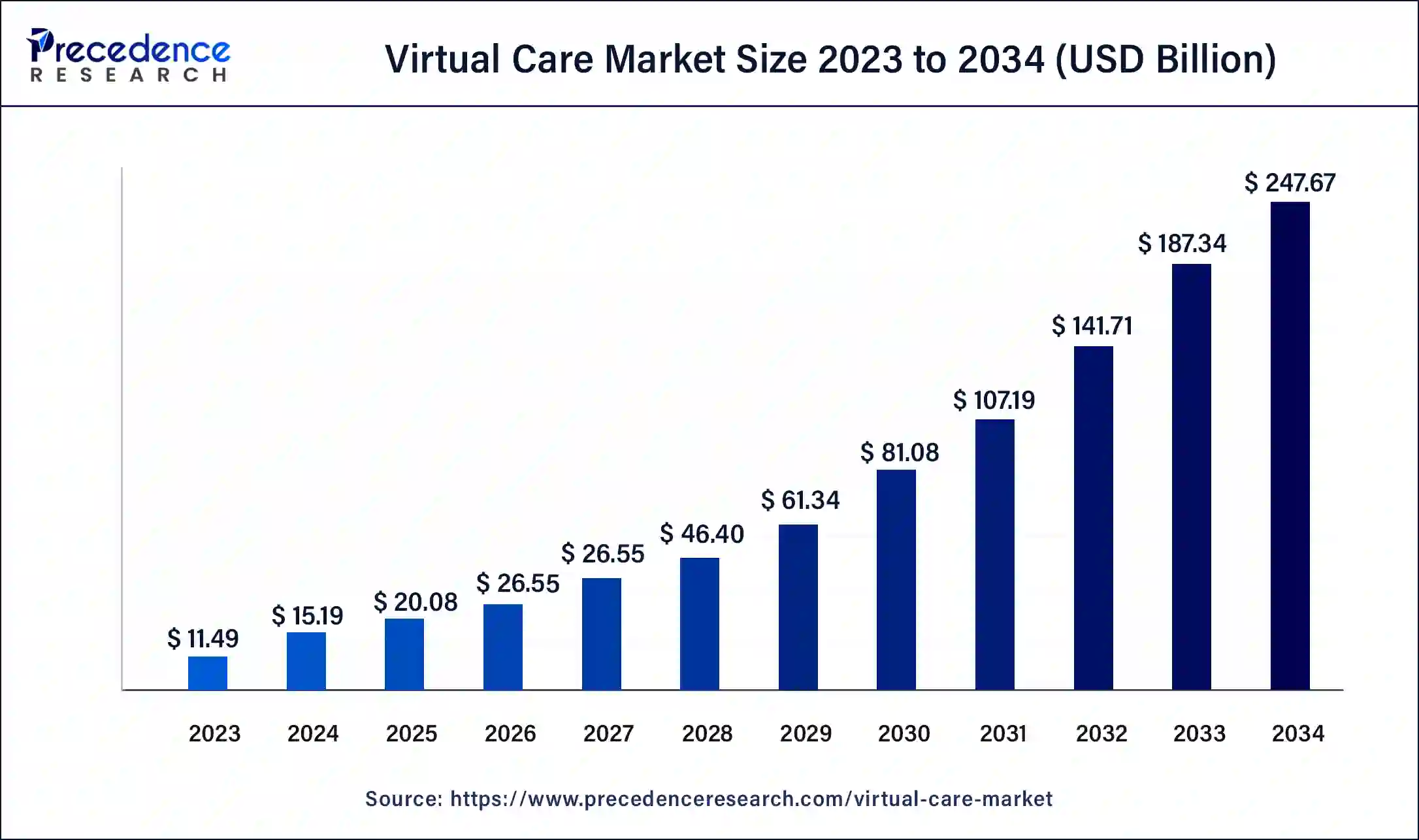

The global virtual care market size was estimated at USD 15.19 billion in 2024 and is predicted to increase from USD 20.08 billion in 2025 to approximately USD 247.67 billion by 2034, expanding at a CAGR of 32.20% from 2025 to 2034. The rising developments in the healthcare industry across the world are driving the growth of the virtual care market.

Virtual Care Market Key Takeaways

- In terms of revenue, the global virtual care market was valued at USD 15.19 billion in 2024.

- It is projected to reach USD 247.67 billion by 2034.

- The market is expected to grow at a CAGR of 32.20% from 2025 to 2034.

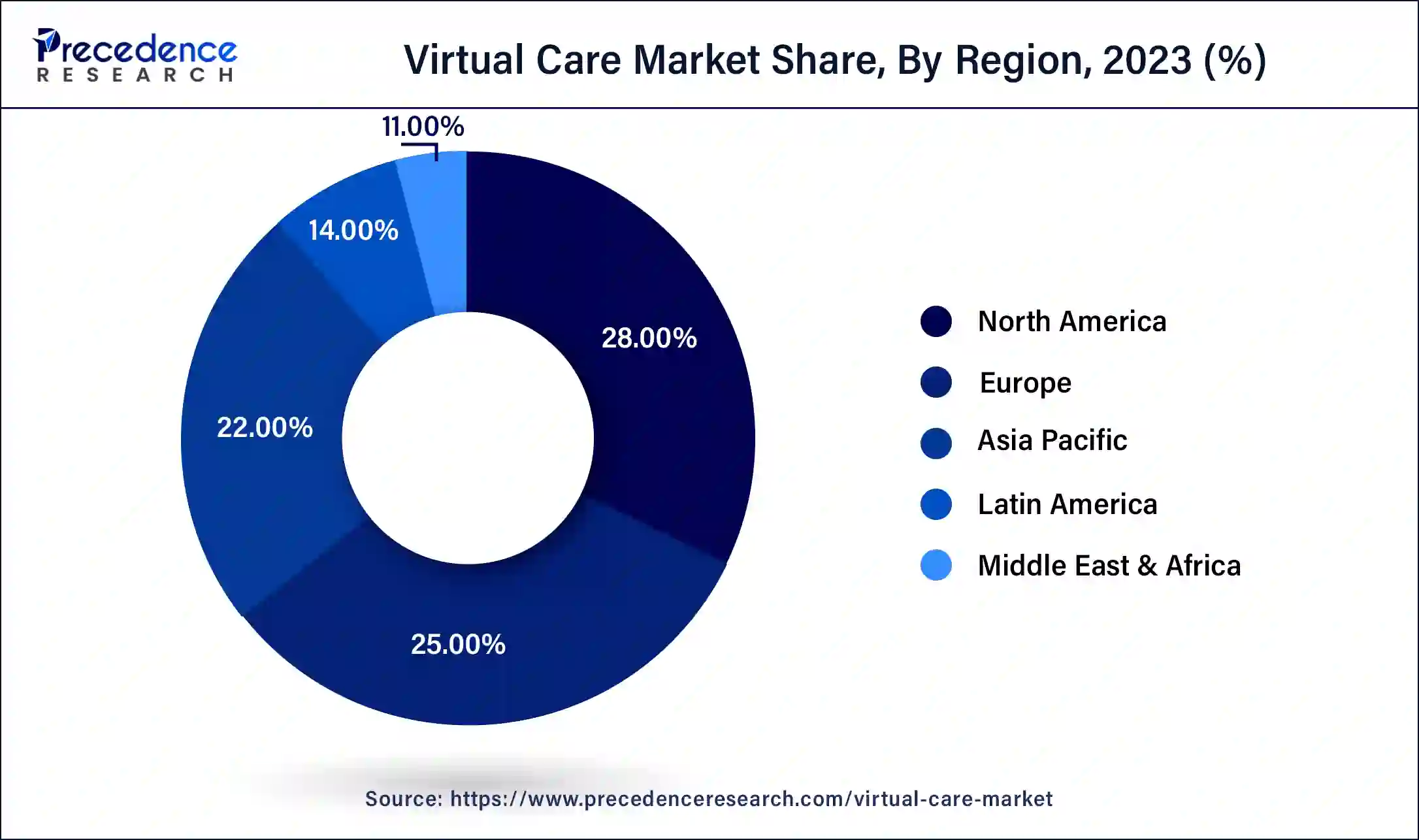

- North America led the global market with the highest market share of 28% in 2024.

- By service type, the telemedicine segment is expected to hold the largest market share in 2024.

- By technology type, the video conferencing segment captured the biggest revenue share in 2024.

- By end-user, the patients segment registered the maximum market share in 2024.

U.S. Virtual Care Market Size and Growth 2024 to 2034

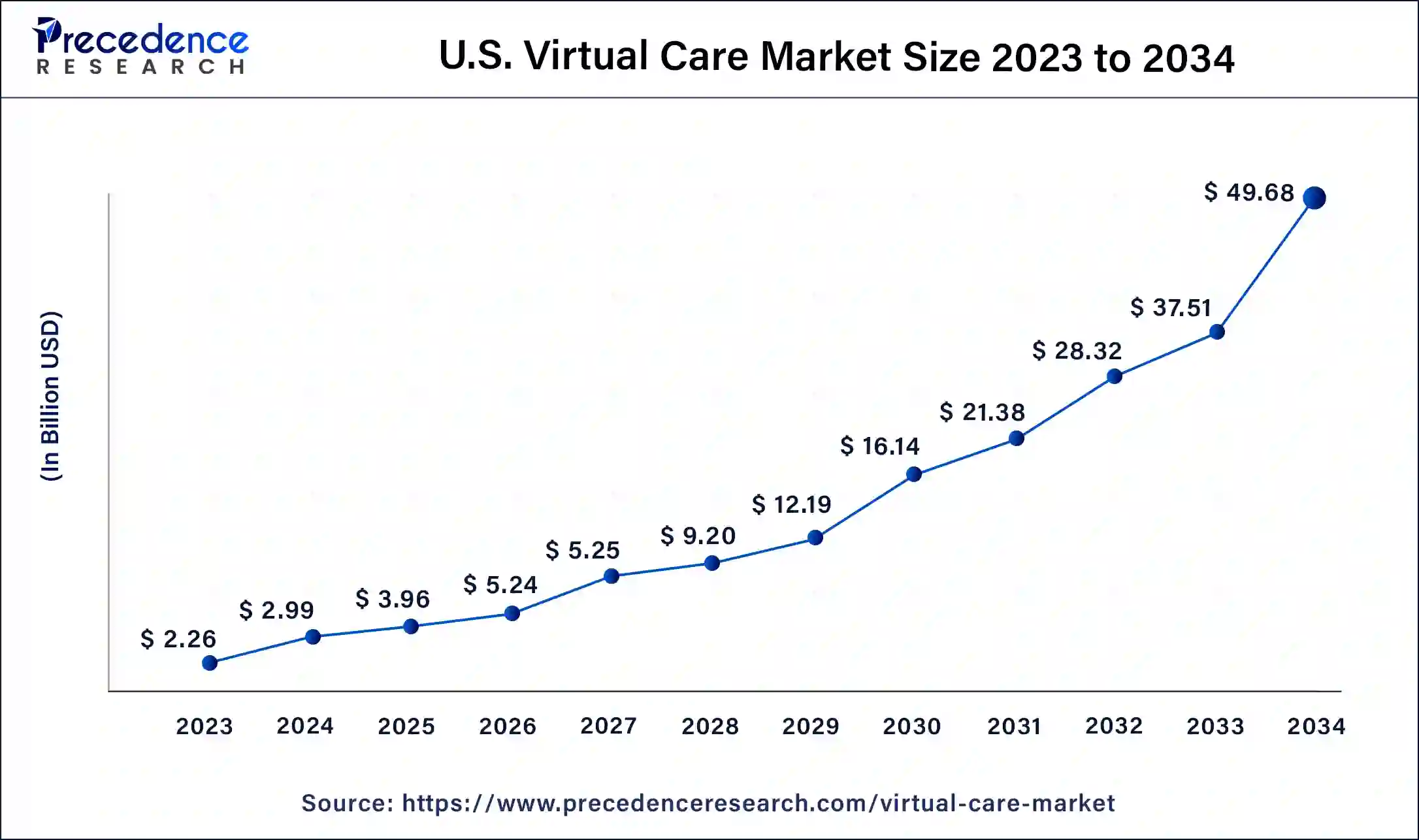

The U.S. virtual care market size was estimated at USD 2.98 billion in 2024 and is predicted to be worth around USD 48.54 billion by 2034, at a CAGR of 32.45% from 2025 to 2034.

North America held the largest virtual care market share in 2024 and is expected to maintain its dominance throughout the forecast period. The growth of this region is mainly driven by the rising government initiatives in countries such as the US, Canada, and Mexico to develop theremote healthcare sector in this region. Also, growing advancements in science and technology, along with the high disposable income of the people, are likely to boost the market growth. The rising developments in the telecommunication sector, along with the presence of a well-developed IT industry, are driving the market growth in this region. Moreover, the availability of high-grade internet facilities, along with the growing penetration of smartphones, has boosted the market growth in this region. The growing adoption of e-consultation services, along with rising developments in AI infrastructure, propels the market growth in this region. Furthermore, the presence of several virtual care companies, such as AMD Global Telemedicine, American Well, Wheel, Teladoc Health, BioTelemetry, and others, boost the growth of the virtual care market.

- In May 2024, the FDA (the U.S. Food and Drug Administration) announced a new initiative named ‘the Home as a Health Care Hub' for developing remote healthcare across the U.S.

- In June 2024, Wheel launched an AI-driven Horizon platform. This launch aimed at integrating AI technology in a virtual care platform to enhance the capabilities of digital health solution providers and life sciences companies across the U.S.

Asia Pacific is expected to be the fastest-growing region during the forecast period. The growth of this region is mainly driven by the rising developments in the medical devices industry across countries such as India, China, Japan, Israel, and others. Also, the growing interest from the public and private sectors in development & research for developing virtual care industries has boosted the market growth. The rise in a number of government initiatives to develop the healthcare sector, along with increasing government investment in strengthening the healthcare sector, is driving the market growth. Furthermore, the presence of several local virtual care market players, such as Intouch Technologies, Halodoc, Speedoc, Jio Health, and others, drives the growth of the virtual care industry.

- In the budget of 2023-2024, the Ministry of Health and Family Welfare received an amount of Rs 89,155 crore from the Indian government for developing health research and health & family welfare.

- In July 2023, Speedoc announced a partnership with Parkway Shenton. This partnership is done to provide 24*7 virtual care to patients across the Asia-Pacific region.

Market Overview

The virtual care market is an important industry in the healthcare domain. This industry deals in providing remote monitoring of patients across the world. The virtual care market is expected to grow significantly with the increase in government initiatives to develop the healthcare sector in different parts of the world. This industry mainly consists of several components, including software, hardware, and services. Virtual care comprises several modes of communication that mainly include real-time virtual health, remote patient monitoring, and store and forward. It also consists of several delivery modes, such as web/app-based, cloud-based, and on-premises. This industry comprises many end users that mainly include healthcare providers, patients, employer groups government organizations, and payers. This industry is likely to grow exponentially with the growth in the healthcare and IT sector.

- In February 2024, GE HealthCare collaborated with Biofourmis. This collaboration aimed at developing and expanding virtual care at-home solutions.

Virtual Care Market Growth Factors

- The technological advancements in the healthcare industry are expected to drive the growth of the virtual care market.

- The rise in government initiatives for strengthening the medical sector has driven market growth.

- The ongoing developments in the AI industry across the world foster market growth.

- The increasing adoption of online consulting and integration of modern technologies in telemedicine has boosted the market growth.

- The rising investments from public and private sector entities for developing the virtual care industries also boost the market growth.

- The growing penetration of the internet, along with the rising use of mobile phones across the world, drives the market growth.

- The increasing application of telemedicine in post-operative and rehabilitation care boosts the market growth.

- The advancements in the telecommunication industry propel market growth.

- The rising advancements in video enhancement technologies are likely to boost the market growth positively.

- The growing trend of medical wearables devices for remote monitoring of patients fosters virtual care market growth to some extent.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 247.67 Billion |

| Market Size in 2024 | USD 15.19 Billion |

| Market Size in 2025 | USD 20.08 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 32.2% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service Type, Technology Type, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Virtual Care Market Dynamics

Drivers

Growing use of smartphones for telehealth

The growing demand for telemedicine across the world increases the demand for smartphones with superior features. Also, the rising proliferation of smartphones has increased the demand for online consulting services for patients suffering from various diseases. By using smartphones, patients can seek advice from the best doctors remotely. This, in turn, boosts the market growth. The advancements in IT sectors associated with the development of healthcare applications for smartphones have developed rapidly in present times. Moreover, virtual care companies have started launching new mobile applications to provide superior telemedicine services to people across the world.

- In April 2024, Cedars-Sinai launched a mobile app named ‘Cedars-Sinai Connect.' This app supports virtual healthcare for children and Spanish speakers in California and allows people to access the best healthcare professionals for chronic, acute, and preventive care.

Rising adoption of virtual care services by military officials

The demand for virtual care services has increased in the military department due to the rise in warfare across different parts of the world. During warfare, the soldier may get injured at any time and require emergency treatment to be cured, which, in turn, drives the growth of the virtual care market in military operations. Moreover, several government initiatives for developing telemedicine services for military purposes are likely to boost the market growth.

- In March 2024, the U.S. Défense Health Agency launched a new digital tool named ‘My Military Health.' Through this tool, military officials will get 24*7 doctor consultations across the U.S.

Restraint

Data breaches and the high cost of telemedicine

The virtual care industry is developing significantly with the growing trend of online healthcare across the world. However, there are various problems associated with virtual care. Firstly, there are security issues due to data breaches and online consultations between doctors and patients. Secondly, the deployment of virtual care systems in hospitals and other organizations is also growing rapidly in present times. Thus, security issues, along with the high cost associated with virtual care systems, are expected to restrain the growth of the virtual care market.

Opportunity

Integration of AI in virtual care

The virtual care industry has developed rapidly due to the advancements in modern sciences and technologies. The ongoing development of modern technologies, such as AI, has contributed significantly to the development of the telemedicine sector. The integration of AI in virtual care helps to enhance the overall quality of remote medical consulting. Thus, the integration of AI technologies in the virtual world is expected to create ample growth opportunities for market players in the future.

- In February 2024, Virtua Health announced it would partner with Care.ai. This partnership aims to integrate AI technology into a virtual care platform to optimize patient care and improve the experience of consultation among doctors and patients.

Service Type Insights

The telemedicine segment dominated the virtual care market in 2023, accounting for the largest market share. The segment growth is mainly attributed to the increasing adoption of telemedicine due to its ability to provide remote medical treatment and consultations. This service enables patients to connect with physicians and doctors through video calls, making healthcare more accessible, particularly in remote areas. The timesaving and convenient aspects of telemedicine increased its popularity. It minimizes the need for physical hospital visits, reducing costs and travel time for patients.

The telehealth segment is anticipated to expand rapidly during the forecast period, owing to the rising demand for convenient and accessible healthcare services. Telehealth encompasses a wide range of services, including clinical as well as non-clinical services, such as health education, continuing medical education, and administrative meetings. It accelerates the overall efficiency of healthcare services by streamlining information and communication sharing. Moreover, it provides continuous follow-up care and monitoring, supporting chronic disease management.

- For instance, In June 2024, Apollo Telehealth launched a telemedicine-driven primary health center (PHC) in Borobeka, Manipur, in collaboration with the Government of Manipur. The aim behind this launch was to improve healthcare access for communities affected by recent conflicts.

Technology Type Insights

The video conferencing segment led the market in 2023 due to the increased demand for remote consultation. This advanced technology enables face-to-face or live consultations between healthcare providers and patients. Video conferencing platforms like Microsoft Teams, Zoom, and specialized telehealth software have become essential in the virtual care industry. The HD audio and video quality offered by these platforms guarantees clear communication, which is necessary for accurate treatment and diagnosis.

The mobile health applications segment is expected to expand at the fastest growth rate in the near future. Mobile health apps provide various services, such as virtual consultations, medication reminders, health tracking, and appointment scheduling. The increasing number of health apps and widespread use of smartphones are contributing to segmental growth. Mobile health applications empower patients and offer convenience to manage their health more effectively.

Moreover, the growing adoption of wearable devices is projected to drive the segment. Wearable devices, such as smartwatches and fitness trackers, gather health data like sleep patterns and physical activity. This data is valuable for both healthcare providers and patients, enabling timely and personalized interventions, thereby enhancing the quality of care.

- For instance, In August 2022, GOQii, the preventive healthcare devices player, launched GOQii Stream devices and Smart Vital Ultra for youth and young adults. The aim behind this launch was to encourage them to lead an active and healthy lifestyle.

End-user Insights

The patients segment dominated the market in 2023 due to the increased awareness about the benefits of virtual care among patients. Virtual care solutions reduce frequent visits to hospital, reducing travel time and enhancing convenience. The increased use of remote monitoring devices, mobile health apps, and telemedicine has made healthcare more accessible, particularly in underdeveloped and remote areas. Moreover, the heightened patient demand for personalized care contributed to the segment's growth.

The healthcare providers segment is expected to expand at a rapid pace during the forecast period. Healthcare providers use virtual care solutions to manage health records, monitor patients remotely, and offer consultations efficiently. Virtual care apps help healthcare providers reduce the burden on physical health facilities, improve care coordination, and reach more patients. The ability to provide remote monitoring services and telemedicine has become a vital element of modern healthcare practices.

- For instance, In May 2024, TeleRare Health launched its new platform to provide virtual care appointments for individuals with ongoing care. This platform provides molecular diagnostics and connects patients with expert clinicians.

Virtual Care Market Companies

- AMD Global Telemedicine

- American Well

- BioTelemetry

- GlobalMedia Group

- Koninklijke Philips

- Resideo Life Care Solutions

- Medtronic

- Teladoc Health

- InTouch Technologies

- Vivify Health

Recent Developments

- In June 2024, MetroHealth partnered with MUSC Health. This partnership is done to launch a virtual telehealth company named ‘Ovatient.' This company will allow patients to consult with physicians remotely.

- In May 2024, TeleRare Health launched a new virtual care platform. Through this launch, the company aims to offer virtual care appointments for patients suffering from rare diseases.

- In May 2024, Monstarlab partnered with eVisit. This partnership aimed at developing virtual care platforms across Asia.

- In May 2024, Owensboro Health launched a virtual nursing program. Through this launch, the virtual nursing model will act as an additional resource to help patients during emergency situations.

- In February 2024, AvaSure launched AvaSure Episodic. AvaSure Episodic is a new virtual care platform that allows video calling among nurses and patients in the US and Canada.

Segments Covered in the Report

By Service Type

- Telemedicine

- eHealth

- Telehealth

- Mental Health Services

- Chronic Disease Management

- Others

By Technology Type

- Video Conferencing

- Wearable Devices

- Mobile Health Applications

- Health Information Systems

- Remote Monitoring Devices

By End-user

- Healthcare Providers

- Patients

- Insurance Companies

- Employers

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content