Vital Signs Monitoring Devices Market Size and Growth 2025 to 2034

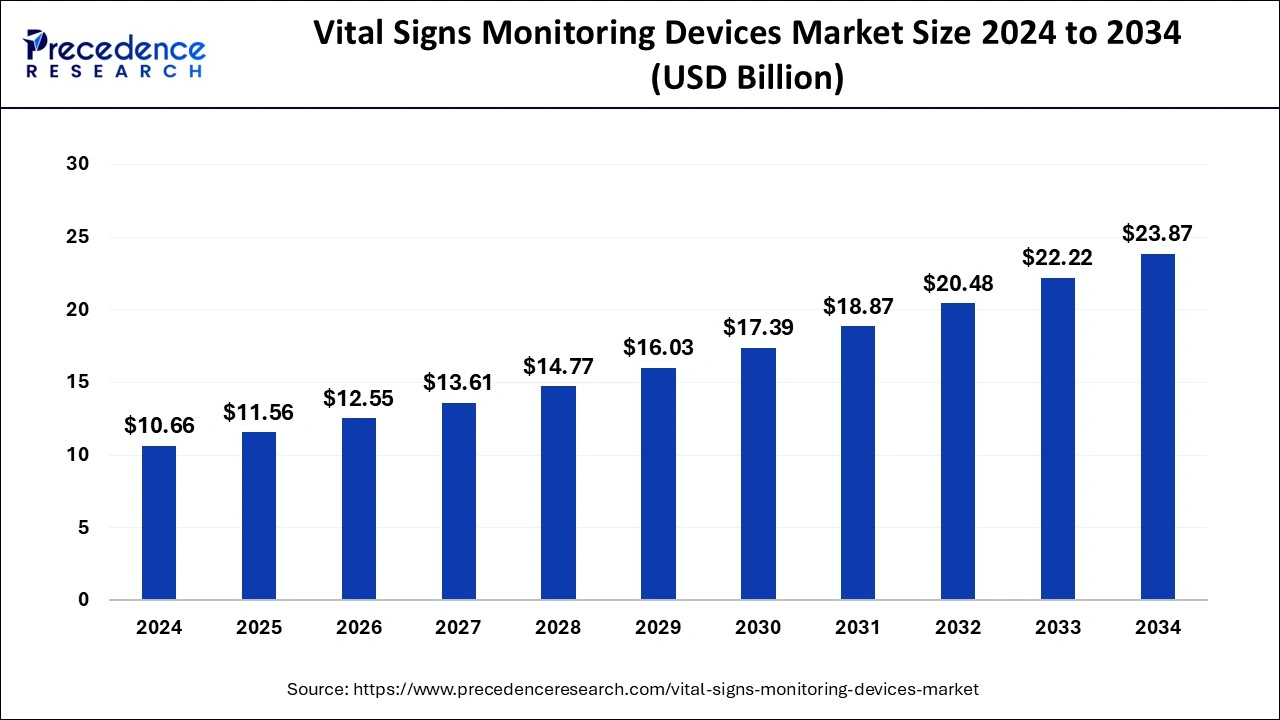

The global vital signs monitoring devices market size was estimated at USD 10.66 billion in 2024 and is predicted to increase from USD 11.56 billion in 2025 to approximately USD 23.87 billion by 2034, expanding at a CAGR of 8.39% from 2025 to 2034. Vital sign monitoring must be done continuously due to the increased prevalence of chronic diseases such as diabetes, hypertension, and cardiovascular disorders. The need for the vital signs monitoring devices market is fueled by this.

Vital Signs Monitoring Devices MarketKey Takeaways

- The global vital signs monitoring devices market was valued at USD 10.66 billion in 2024.

- It is projected to reach USD 23.87 billion by 2034.

- The market is expected to grow at a CAGR of 8.39% from 2025 to 2034.

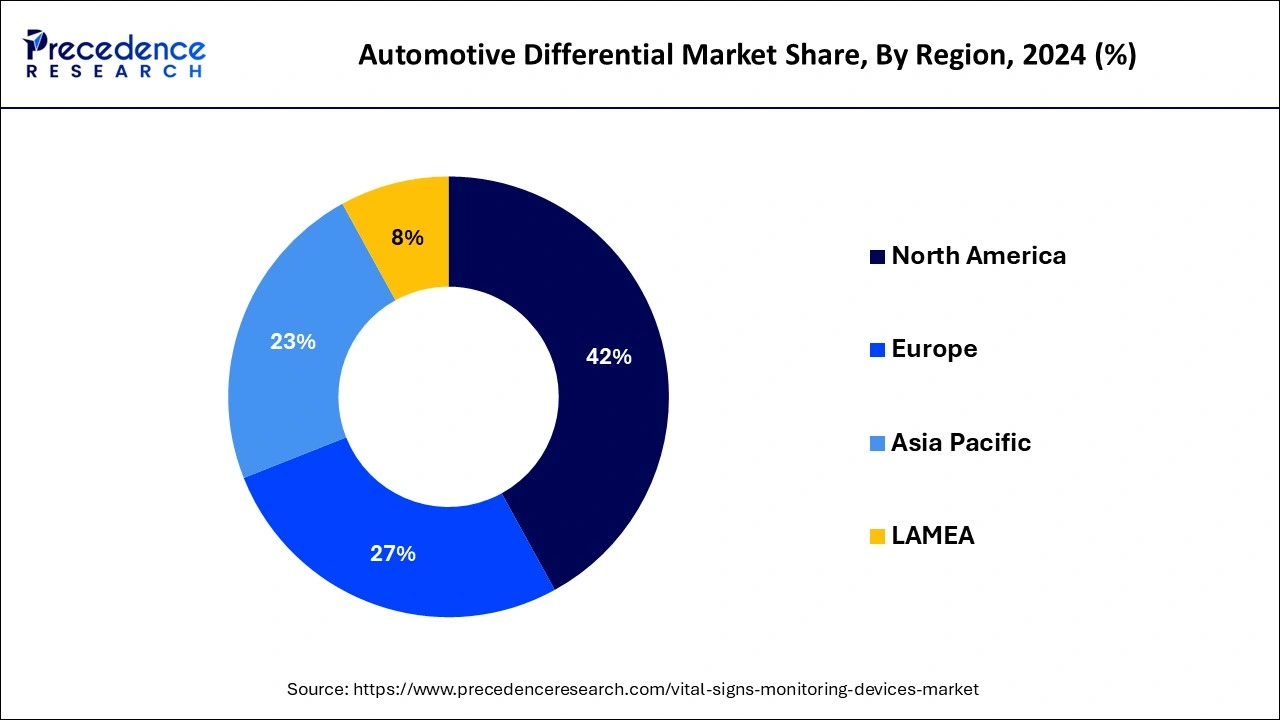

- North America dominated the market with the largest revenue share of 42% in 2024.

- Europe is expected to host the fastest-growing market in the upcoming years.

- The blood pressure monitors segment has held a major revenue share of 49% in 2024.

- The pulse oximeters segment is expected to witness the fastest growth in the market throughout the forecast period.

- The hospitals segment has recorded more than 36% of revenue share in 2024.

- The ambulatory centers segment is expected to grow rapidly in the market during the forecast period.

U.S. Vital Signs Monitoring Devices Market Size and Growth 2025 to 2034

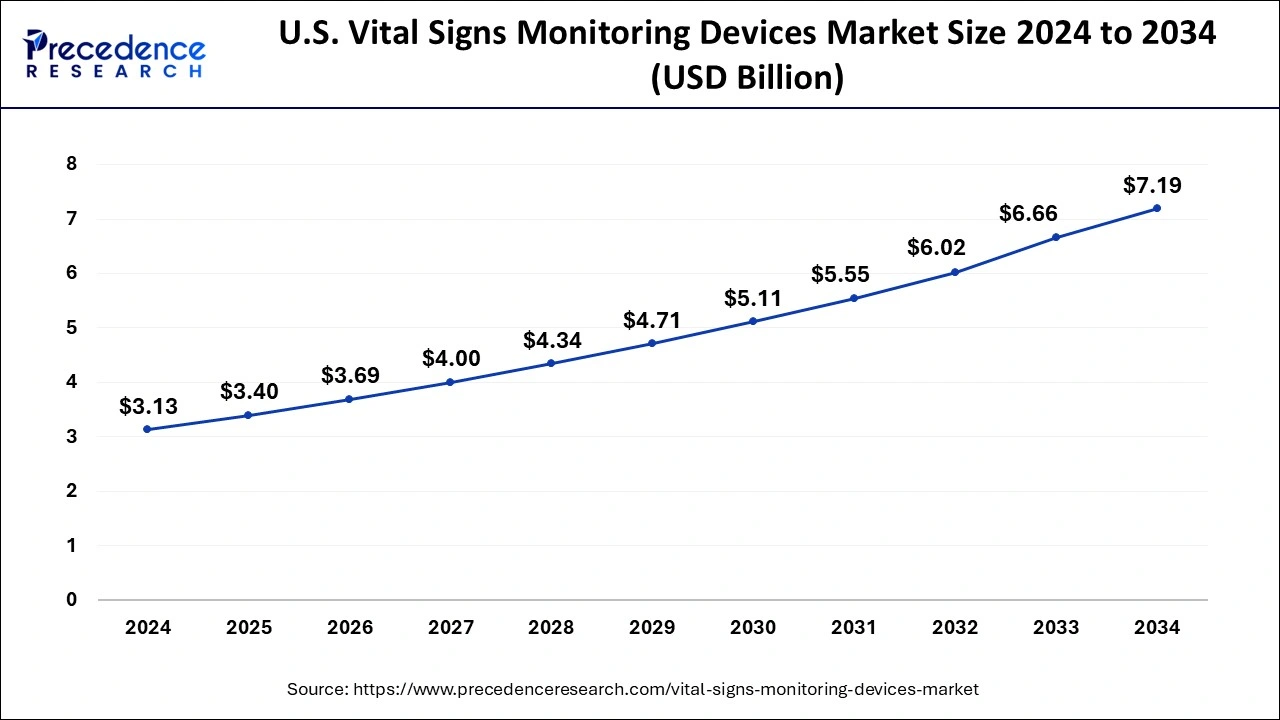

The U.S. vital signs monitoring devices market was valued at USD 3.13 billion in 2024 and is expected to be worth around USD 7.19 billion by 2034, at a CAGR of 8.67% from 2025 to 2034.

North America holds the largest share of the vital signs monitoring devices market. In recent years, North America's market for vital sign monitoring equipment has grown steadily. Numerous variables, such as the rising incidence of chronic illnesses, the development of monitoring devices through technology, and the aging population in the area, are responsible for this expansion. Product types, such as temperature monitoring devices, pulse oximeters, and blood pressure monitors, are used to segment the market. The market is further divided into segments according to end-users, which include home care settings, clinics, ambulatory surgical centers, and hospitals. More emphasis has been placed on the COVID-19 pandemic's significance for ongoing vital sign monitoring, particularly in critical care environments.

- According to the Centers for Disease Control and Prevention, Heart disease is one of the leading causes of death in the United States, with one person dying every 33 seconds from cardiovascular disease. Nearly 695,000 people in the United States died from heart disease in 2021, which is 1 in every five deaths. It is estimated that 805,000 people suffer from heart attacks in the United States every year.

- According to the Commonwealth Fund report published in January 2023, the United States spends roughly 18 percent of its GDP on health care. The U.S. spends 3 to 4 times more on health care than South Korea, New Zealand, and Japan.In addition, the rising adoption of key market strategies by the key market players to such as acquisition and collaboration, is anticipated to propel the regional growth in the coming years. For instance, in February 2025, BioIntelliSense, a pioneer in continuous health monitoring and clinical intelligence, announced a partnership with Hicuity Health, a provider of tech-enabled virtual care services, to offer fully managed, end-to-end continuous patient monitoring to U.S. health systems.

Europe is expected to host the fastest-growing vital signs monitoring devices market in the upcoming years. Because of its aging population, Europe has a higher incidence of chronic illnesses and ailments that call for ongoing vital sign monitoring. The pandemic has brought attention to how critical it is to keep an eye on vital indicators, particularly oxygen saturation levels and breathing rate. Devices like pulse oximeters are in higher demand as a result of this. Patient demand and cost-effectiveness are driving the growing trend toward home healthcare. Devices that monitor vital signs are essential for providing efficient home-based care. Platforms for telemedicine have become increasingly popular, particularly in the wake of the pandemic. In order to monitor patients' health remotely and take appropriate action when needed, vital signs monitoring devices are a critical component of remote patient monitoring systems.

Market Overview

Technology developments, the growing elderly population, and the rising incidence of chronic diseases have all contributed to the market's continuous expansion for the vital signs monitoring devices market. In both professional and domestic environments, these devices are essential for keeping an eye on patients' vital indicators, such as blood pressure, heart rate, temperature, and respiration rate.

Devices that monitor vital signs continuously and identify anomalies early are essential for managing these illnesses because they reduce the risk of complications and hospitalizations. Vital signs monitoring devices are designed to meet the demands of the older population, who need regular health parameter monitoring to manage age-related conditions and preserve their quality of life.

The trend toward remote patient monitoring has increased demand for wearable and portable vital sign monitoring equipment, particularly in the wake of the COVID-19 epidemic. With the use of these gadgets, medical professionals can remotely and in real-time monitor their patients' vital signs, facilitating early intervention and minimizing the need for in-person visits.The regulatory environment surrounding medical devices, such as those that monitor vital signs, is always changing, and more and more focus is being placed on data privacy, accuracy, and product safety. In order to obtain market acceptance and preserve customer confidence, manufacturers must make sure that all regulatory standards are met. There are many competitors in the fiercely competitive vital signs monitoring device market, ranging from major multinational organizations to small and medium-sized businesses.

Vital Signs Monitoring Devices MarketGrowth Factors

- The prevalence of chronic illnesses like diabetes, respiratory conditions, and cardiovascular ailments rises as the world's population ages and lifestyles alter. Devices for monitoring vital signs are essential for controlling and keeping an eye on these disorders, which propels the vital signs monitoring devices market.

- Globally, as healthcare costs rise, especially in emerging nations, there is a corresponding increase in investment in healthcare infrastructure, which includes purchasing sophisticated medical equipment like vital sign monitors.

- Preventive healthcare practices are becoming more and more important in an effort to lighten the load on healthcare systems. The vital signs monitoring devices market makes it possible to identify health problems early, which allows for prompt intervention and preventive actions.

- Particularly in the wake of the COVID-19 pandemic, telemedicine and remote patient monitoring are becoming more and more popular. Devices for monitoring vital signs are essential to remote patient monitoring because they enable medical professionals to keep an eye on patients' health from a distance, which propels the vital signs monitoring devices market.

- Patients' desire for home-based healthcare solutions is driving up demand for portable, user-friendly vital sign monitoring equipment that they may operate on their own. This pattern helps to drive the market's growth.

- The need for these devices is increased by rising awareness among patients and healthcare professionals of the value of routine vital sign monitoring for improved treatment of chronic illnesses and early diagnosis of health concerns.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 10.66 Billion |

| Market Size in 2024 | USD 3.13 billion |

| Market Size by 2034 | USD 22.22 Billion |

| rowth Rate from 2025 to 2034 | CAGR of 8.51% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Telemedicine and remote patient monitoring

The healthcare sector has seen a change because of telemedicine and remote patient monitoring, especially in the vital signs monitoring devices market. These technologies have many advantages, such as better patient outcomes, cost savings, and expanded access to healthcare. Significant expansion and innovation are now taking place in the market for vital sign monitoring devices used in telemedicine and remote patient monitoring. Monitoring devices for vital signs are being combined with telemedicine systems so that patient and provider data can be shared easily. The global aging population is driving rising demand for remote monitoring solutions to help older people with age-related health concerns and chronic illnesses.

Restraint

Data security concerns

Given the sensitive nature of the information being transferred and kept, data security issues are important in the vital signs monitoring devices market. Devices that monitor vital signs gather extremely private health information. Any security lapse on these devices could allow unwanted access to this private data, jeopardizing patient privacy. It is essential to guarantee the data's integrity. Any manipulation of vital sign data carries a significant risk to patient safety since it may result in inaccurate diagnoses or treatments. Ensuring that only authorized individuals have access to patient data is ensured by putting strong authentication systems and access controls in place. This covers safeguards, including biometric identification, role-based access control, and password protection.

Opportunity

Chronic disease management

Globally, the prevalence of chronic diseases is rising as a result of changing lifestyles, and an aging population is driving the vital signs monitoring devices market. The need for vital sign monitoring tools that can help with the appropriate management of these illnesses is fueled by this trend. Devices that monitor vital signs are essential for the early diagnosis and proactive treatment of chronic illnesses, which helps to avoid complications and save medical expenses. Patient-centric care is becoming more and more important, giving people the tools they need to take charge of their health and actively manage their diseases. Devices for monitoring vital signs that are accurate, easy to use, and offer useful information help to change the paradigm in favor of patient empowerment.

Product Insights

The blood pressure monitors segment held the largest share of the vital signs monitoring devices market in 2024. The market for vital sign monitoring devices includes a variety of medical equipment, such as blood pressure monitors, that are used to measure different physiological parameters. These devices are essential for personal use by people keeping an eye on their own health and in hospital settings. High blood pressure, often known as hypertension, is a prevalent medical disease that requires frequent monitoring to be effectively managed. Blood pressure monitors are in high demand for both home and clinical settings due to the rising prevalence of hypertension. A number of variables, including the growing cost of healthcare services and the desire for telehealth and remote monitoring, are contributing to the growing trend of home-based healthcare.

The pulse oximeters segment is expected to witness the fastest growth in the vital signs monitoring devices market throughout the forecast period. In healthcare, pulse oximeters are now standard parts of vital sign monitoring equipment. These instruments are used to test the blood's oxygen saturation level (SpO2) and pulse rate. They are frequently used in a variety of medical contexts, including clinics, hospitals, ambulances, and even home healthcare settings. Pulse oximeters remain indispensable elements of vital signs monitoring apparatuses, serving a fundamental role in patient care in diverse healthcare contexts. We may anticipate more advancements in pulse oximetry technology and its incorporation into increasingly complex monitoring systems as healthcare systems change and technology advances.

End-use Insights

The hospitals segment led the vital signs monitoring devices market in 2024. Because so many patients need round-the-clock care, hospitals are big users of vital sign monitoring equipment. Hospital departments such as emergency rooms, intensive care units (ICUs), operating rooms, general wards, and specialized units, including neonatal ICUs and cardiac care units (CCUs), are the main sources of this demand. Proper and timely vital sign monitoring is essential for improving clinical results and patient safety. Hospitals invest in dependable monitoring equipment in order to improve patient care, quickly identify anomalies, and prevent unfavorable outcomes. It is imperative for manufacturers to guarantee that their products comply with regulatory standards, such as FDA certification in the U.S. and CE marking in the EU.

The ambulatory centers segment is expected to grow rapidly in the vital signs monitoring devices market during the forecast period. An important part of the vital signs monitoring devices market is played by ambulatory centers. Patients can obtain medical attention at these outpatient centers without having to remain overnight. Vital sign monitoring systems are widely used at such institutions to continuously monitor the health status of their patients. These gadgets include, among other things, temperature, blood pressure, pulse oximeter, and ECG monitors. Patients who don't need to be admitted to the hospital but still require routine medical treatment might find a supervised environment in ambulatory centers, which provides a compromise between inpatient and outpatient care. In order to promptly intervene and treat patients, vital signs monitoring devices are essential to these efforts since they allow medical practitioners to identify anomalies or changes in patients' vital signs early on.

Vital Signs Monitoring Devices Market Companies

- Koninklijke Philips NV

- Medtronic Plc

- Nihon Kohden Corp

- GE HealthCare Technologies Inc

- OMRON Corp

- Nonin Medical Inc

- SunTech Medical Inc

- Masimo Corp

- Contec Medical Systems Co Ltd

- Baxter International Inc.

Recent Development

- In May 2024, Vivalink, a leading provider of digital healthcare solutions, announced the launch of its comprehensive technology solution designed for mobile cardiac telemetry (MCT) and Holter monitoring. The solution integrates remote patient monitoring (RPM) technologies and advanced arrhythmia detection algorithms, streamlining deployment and enhancing patient care to meet the increasing demand for efficient ambulatory ECG monitoring solutions.

- In June 2024, Masimo, a leading provider of medical technology and hospital automation solutions, announced a strategic partnership with the Cleveland Clinic, a nonprofit academic medical center, to improve hospital-based remote patient monitoring (RPM), including TeleCritical Care. The aim is to provide tools for clinicians that offer enhanced situational awareness and clinical decision support for hospitalized patients.

- In January 2024, Apollo Hospital Seshadripuram, a renowned multi-specialty hospital in Bangalore, partnered with LifeSigns, a leading AI-powered health monitoring technology company. The collaboration aims to empower the hospital with a cutting-edge 24/7 wireless and remote patient monitoring system, marking a significant milestone in the advancement of precision healthcare and proactive patient management.

- In January 2024, A pioneer in clinical-grade wearable technology and digital health, Blue Spark Technologies, Inc., is introducing VitalTraqTM, a multi-sensor remote patient monitoring platform that is the first of its kind. Remote Photoplethysmography (rPPG), one of the most innovative contactless vital sign measurement sensors available today, is a feature of VitalTraq.

Segment Covered in the Report

By Product

- BP Monitors

- Pulse Oximeters

- Temperature Monitoring Devices

- Others

By End-use

- Hospitals

- Physician's Office

- Home Healthcare

- Ambulatory Centers

- Emergency Care Centers

- Other

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting