What is the VR eSport Venue Insurance Market Size?

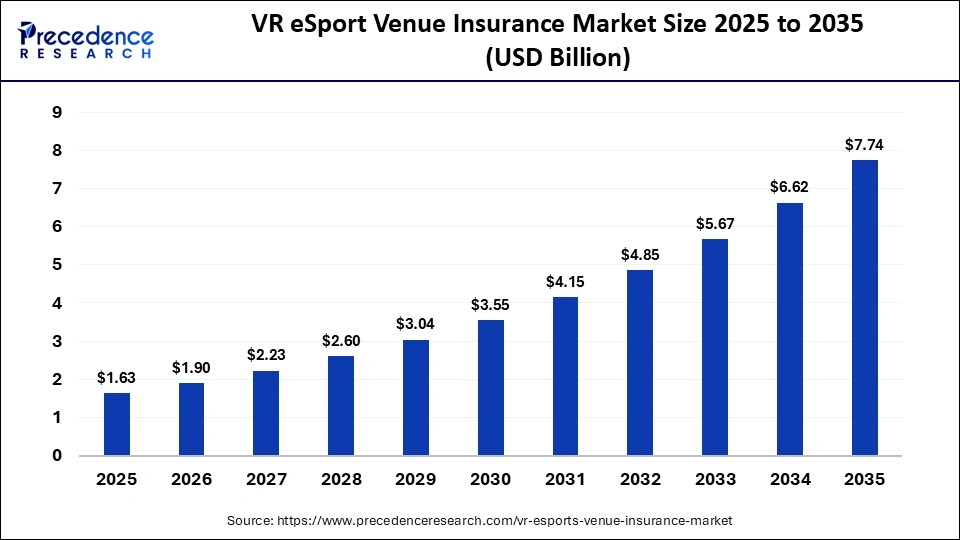

The global VR eSport venue insurance market size accounted for USD 1.63 billion in 2025 and is predicted to increase from USD 1.90 billion in 2026 to approximately USD 7.74 billion by 2035, expanding at a CAGR of 16.85% from 2026 to 2035. This market is growing due to the rising popularity of virtual reality gaming arenas and the increasing need for specialized coverage against equipment damage, liability, and event-related risks.

Market Highlights

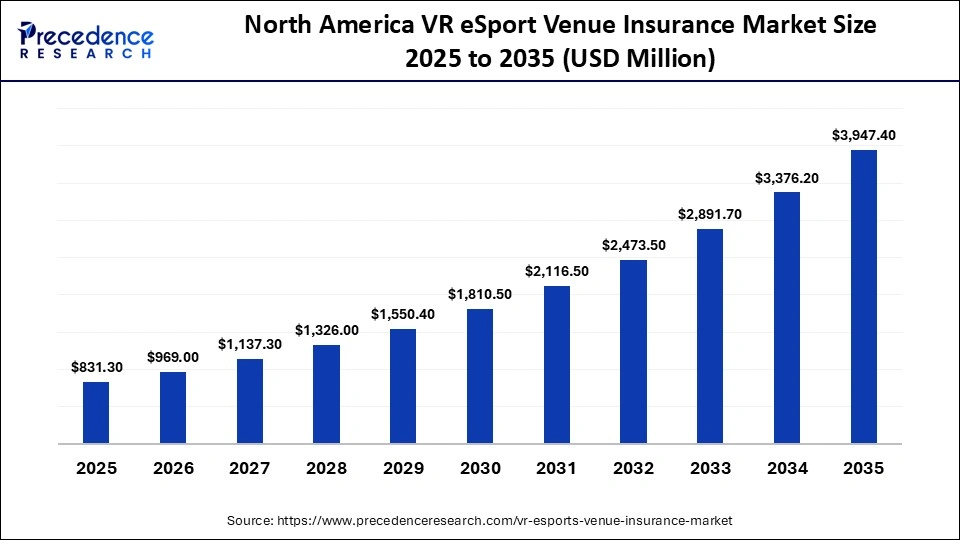

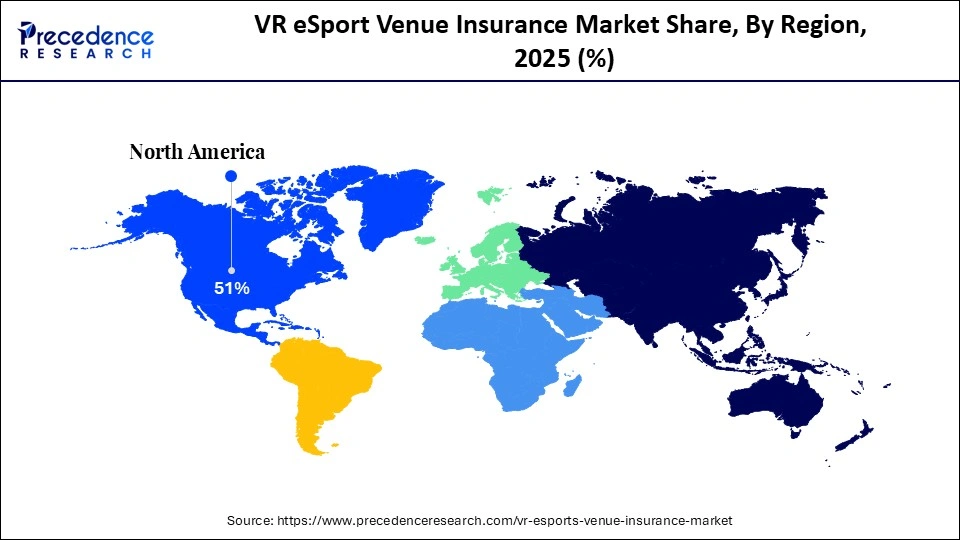

- North America dominated the VR eSport venue insurance market with the largest market share of 51% in 2025.

- Asia Pacific is expected to grow at the fastest CAGR between 2026 and 2035.

- By coverage type, the liability insurance segment generated the biggest market share in 2025.

- By coverage type, the property insurance segment is expected to expand at a significant CAGR between 2026 and 2035.

- By venue type, the hybrid LBVR centers segment contributed the highest market share in 2025.

- By venue type, the dedicated VR eSports arenas segment is expected to grow at a strong CAGR between 2026 and 2035.

- By end-user, the venue owners segment held a major market share in 2025.

- By end-user, the event organizers segment is expected to expand at the fastest CAGR from 2026 to 2035.

- By distribution channel, the brokers segment generated the biggest market share in 2025.

- By distribution channel, the online platforms segment is expanding at the fastest CAGR between 2026 and 2035.

Market Overview

The VR eSports venue insurance market is growing rapidly due to the rising demand for immersive gaming experiences that propels the growth of VR gaming arenas and esports venues worldwide. By protecting high-value equipment, covering player injuries, and managing event-related liabilities, specialized insurance solutions help operators lower their financial risks. While Asia-Pacific is emerging with new VR hubs and competitive gaming events, North America and Europe lead adoption due to advanced gaming infrastructure and established esports ecosystems. Insurers are also introducing flexible, customizable policies to accommodate different gaming formats and venue sizes, further supporting market growth.

How is AI Transforming the VR eSports Venue Insurance Market?

Artificial Intelligence is reshaping the VR eSports venue insurance market by facilitating real-time monitoring, dynamic premium pricing, and more intelligent risk assessment. Insurers can reduce underwriting uncertainty by using AI-driven analytics to more accurately assess crowd behavior, equipment usage patterns, cyber risks, and accident probabilities. Through automated fraud detection and damage assessment, machine learning models also facilitate quicker claims processing. AI-powered insurance solutions improve operational safety insights, increase risk prediction, and provide venue operators with more specialized coverage options because VR venues rely significantly on sophisticated hardware and digital infrastructure.

Trends in the VR eSports Venue Insurance Market

- Rising Popularity of VR Gaming: A growing number of VR arcades and esports centers increases demand for insurance.

- Customized Insurance Policies: Insurers are offering tailored coverage for equipment, liability, and event risks.

- Integration of Technology: There is a rising use of AI and IoT for real-time risk monitoring and claims processing.

- Expansion in Emerging Regions: Rapid growth of VR hubs and competitive gaming events in emerging regions is boosting the demand for insurance.

- Event-Specific Coverage: The demand for Policies for tournaments, VR competitions, and temporary pop-up arenas is rising.

- Focus on Player Safety: Coverage includes injuries, accidents, and health-related liabilities.

- Cyber Risk Protection: Insurance addressing data breaches, hacking, and digital fraud in VR systems is in high demand.

- Partnerships with VR Developers: Collaborations between VR developers are rising to offer bundled solutions for venue and equipment insurance.

Future Growth Outlook

- Untapped SME Gaming Centers: Insurance adoption is expanding among small and medium-sized VR gaming venues, helping these operators mitigate risks and encourage investment in immersive gaming experiences.

- Global Expansion: Insurers are entering emerging VR markets across Asia-Pacific, Latin America, and the Middle East to capitalize on the growing popularity of VR gaming and esports in these regions.

- Technology-Driven Solutions: Companies are leveraging AI, IoT, and blockchain technologies to provide smarter risk management, real-time monitoring, and efficient claims processing for VR venues.

- Event Sponsorship Integration: Insurance packages are being offered in conjunction with gaming tournaments and esports events, providing coverage for event-related liabilities and enhancing sponsorship opportunities.

- Customized Liability Packages: Player-centric and venue-centric coverage options are being developed to address the unique risks associated with VR gaming experiences.

- Collaboration with VR Equipment Manufacturers: Insurers are partnering with VR hardware manufacturers to offer joint solutions that protect high-value equipment and reduce financial exposure.

- Growth in Competitive VR Esports: The rising number of professional VR esports leagues is driving demand for specialized insurance that covers both participants and venues.

- Hybrid Insurance Models: Comprehensive policies combining property, cyber, and liability coverage are emerging to provide holistic protection for VR gaming operators and stakeholders.

How is VR eSports Venue Insurance Supporting the Growing Gaming Industry?

VR eSports venue insurance is supporting the growing gaming industry by providing tailored coverage that addresses the unique risks of virtual reality arenas and competitive gaming spaces. It protects operators against property damage, equipment failure, and liability arising from player injuries or accidents during immersive gameplay. By mitigating financial risks, this insurance encourages investment in VR gaming infrastructure, enables safer experiences for participants, and fosters the expansion of esports venues.

How Does VR eSports Venue Insurance Deliver Strong ROI?

VR eSports venue insurance offers a strong ROI by safeguarding digital infrastructure, high-value gaming equipment, and overall venue operations against unforeseen losses. Comprehensive coverage minimizes financial disruptions caused by accidents, cyberattacks, or equipment damage, ensuring business continuity. Data-driven risk assessment and specialized policy structures enhance premium accuracy and profitability for insurers. As VR gaming arenas continue to expand globally, recurring renewals and customized coverage models further strengthen long-term revenue potential and investment returns.

How are Government Initiatives Supporting the Growth of the VR eSport Venue Insurance Market?

Through the introduction of favorable regulations and financial support for technology adoption and digital entertainment infrastructure, government initiatives are progressively supporting the expansion of the VR e-sport venue insurance market. Indirectly raising demand for specialized insurance solutions, subsidies, and grants for VR and esports startups, assisting venues in modernizing their infrastructure. Insurers are encouraged to create customized coverage products by regulatory frameworks that support safety standards in virtual environments. Further propelling market expansion are public-private partnerships that aim to increase tourism and youth participation in exports. Yax incentives for digital gaming zones and innovation hubs also encourage the establishment of new VR venues, expanding the insurable asset base.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.63 Billion |

| Market Size in 2026 | USD 1.90 Billion |

| Market Size by 2035 | USD 7.74 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 16.85% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Coverage Type, Venue Type, End-User, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Coverage Type Insights

What made liability insurance the dominant segment in the VR eSport venue insurance market?

The liability insurance segment dominated the market with the largest share in 2025 because VR venues carry a significant risk of player injuries, equipment-related mishaps, and third-party claims. Collisions and falls are frequent in immersive games that require physical movement. Venue owners place a high priority on liability insurance to guard against court costs and compensation demands. There was an even greater need for comprehensive liability policies as a result of growing regulatory compliance requirements, contributing to the segment's dominance.

The property insurance segment is expected to grow at a significant rate over the forecast period due to significant investments made by VR venues in costly gaming rigs, sensor headsets, and digital infrastructure. Damage, theft, or technical issues can result in significant monetary losses. Operators are choosing more extensive asset protection as venue sizes increase and hardware upgrades become more common. This segment is expanding due to the growing price of sophisticated VR gear.

Venue Type Insights

Why did the hybrid LBVR centers segment dominate the VR eSport venue insurance market?

The hybrid LBVR centers segment dominated the market in 2025 because they house eSports competitions, entertainment events, and casual gaming all under one roof. Higher insurance requirements in the segment result from their varied operations, which boost foot traffic and revenue streams. Crowd control and equipment damage are just two of the many risks that these facilities must deal with. They thus account for a greater proportion of insured venues.

The dedicated VR eSports arenas segment is expected to grow at the fastest CAGR in the coming years because professional VR competitions and competitive gaming leagues are becoming more and more popular. These venues host high-value events with large audiences and significant sponsorship involvement, creating a rising need for specialized coverage for broadcasting equipment, cyber risks, and event liabilities. The expansion of professional VR esports is driving strong demand for tailored insurance solutions in this segment.

End-User Insights

Why did the venue owners segment dominate the VR eSport venue insurance market?

The venue owners segment dominated the market while holding the largest share in 2025 because they bear the primary financial and operational risks associated with running gaming arenas. This includes coverage for high-value VR equipment, property damage, player injuries, and event-related liabilities. As VR eSports venues often host large audiences and high-stakes tournaments, venue owners prioritize comprehensive insurance solutions to protect their investments, ensure uninterrupted operations, and comply with regulatory and safety requirements.

The event organizers segment is expected to grow at the fastest CAGR in the coming years due to the rising sponsored competitions, VR tournaments, and esports events internationally. Event organizers often require high-value short-term coverage for cancellation event liability and equipment protection. Exposure to financial risk rises dramatically with prize pools and sponsorship investments. This increases the need for specific short-term insurance plans.

Distribution Channel Insights

Why did the brokers segment dominate the VR eSport venue insurance market?

The brokers segment dominated the market by holding a major share in 2025. This is because brokers act as intermediaries who connect VR venue operators with insurers, helping tailor coverage to the unique risks of gaming arenas. They offer specialized policy frameworks made to account for exposures related to gaming, cyber, and events. Brokers also help with negotiation, claims handling, and risk assessment. They are the go-to middlemen for venue operators because of their advisory experience.

The online platforms segment is expected to grow at the fastest CAGR in the coming years due to the increasing digitization of insurance services and the tech-savvy nature of VR gaming operators. Online channels offer quick policy comparisons, instant quotes, simplified underwriting, and faster claims processing, making them highly convenient for venue owners and event organizers. Additionally, digital platforms enable insurers to provide customized coverage options, flexible pricing models, and real-time support, aligning well with the fast-paced and innovation-driven esports ecosystem.

Regional Insights

How Big is the North America VR eSport venue insurance Market Size?

The North America VR eSport venue insurance market size is estimated at USD 831.30 million in 2025 and is projected to reach approximately USD 3,947.40 million by 2035, with a 16.86% CAGR from 2026 to 2035.

Why did North America dominate the VR eSport venue insurance market?

North America dominated the VR eSport venue insurance market by capturing the largest share in 2025. The region's dominance in the market is attributed to its sophisticated VR infrastructure, robust esports ecosystem, and large number of commercial gaming venues. The area has reputable insurance companies that provide tech-driven, specialized coverage. Liability exposure is increased by large-scale tournaments and increased consumer participation. There is a high demand for comprehensive insurance policies, which is likely to sustain its leading position in the market.

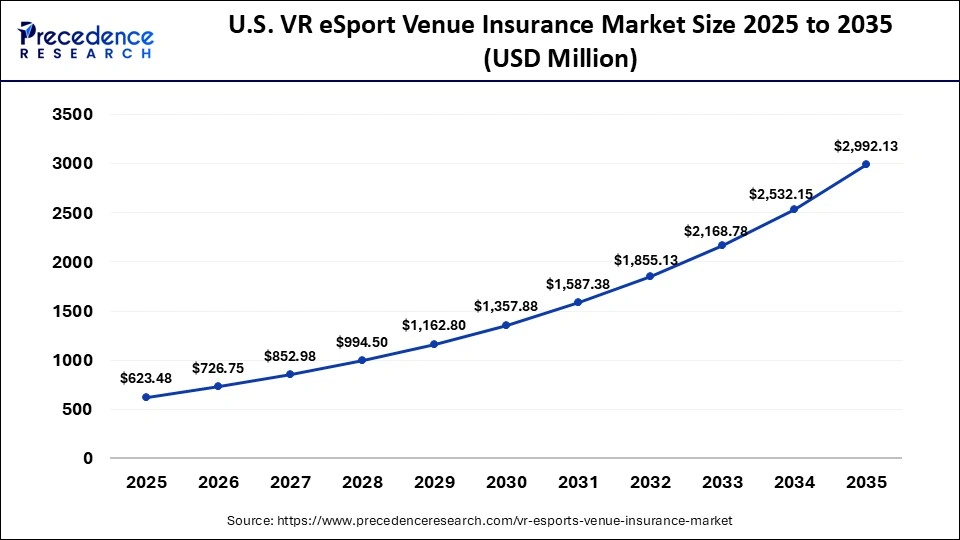

What is the Size of the U.S. VR eSport venue insurance Market?

The U.S. VR eSport venue insurance market size is calculated at USD 623.48 million in 2025 and is expected to reach nearly USD 2,992.13 million in 2035, accelerating at a strong CAGR of 16.98% between 2026 and 2035.

U.S. VR eSport Venue Insurance Market Trends

The U.S. VR eSports venue insurance market is experiencing steady growth as competitive esports arenas and VR gaming venues expand across major cities. Insurers are offering specialized coverage for public liability, cyber risks, equipment damage, and event-related disruptions to address the unique exposures of these venues. Additionally, advanced underwriting models and insurtech partnerships are enabling providers to deliver more tailored, data-driven insurance solutions that meet the evolving needs of venue operators.

How is the opportunistic rise of Asia Pacific in the Market?

Asia Pacific is expected to grow at the fastest CAGR in the coming years because of growing gaming culture, fast urbanization, and rising investments in VR entertainment hubs. Esports communities are growing in nations like South Korea, China, Japan, and India. With the rising disposable income, there is a significant rise in spending on immersive gaming experiences. Venue development is being accelerated by government support for gaming infrastructure and digital innovation. The demand for insurance has been increasing in the region due to the rise in VR entertainment startup activity. The market potential is further strengthened by the growth of regional esports leagues.

India VR eSport Venue Insurance Market Trends

India's VR eSports venue insurance market is at an early yet rapidly growing stage, driven by the expansion of virtual reality arcades and esports centers across urban areas. Insurance providers are increasingly offering coverage for equipment protection, asset security, and public liability risks to support venue operators. Rising youth participation and the growing popularity of competitive gaming are fueling the demand for more structured and specialized insurance solutions in the country.

Who are the Major Players in the Global VR eSport Venue Insurance Market?

The major players in the VR eSport venue insurance market include Allianz SE, American International Group, Inc. (AIG), Aon plc, Arthur J. Gallagher & Co., AXA XL, Beazley, Berkshire Hathaway Specialty Insurance, Chubb Limited, CNA Financial, Esport Insure, Everest Re Group, Farmers Insurance, Founder Shield, Hiscox, K&K Insurance, Liberty Mutual, and Lloyd's of London.

Recent Developments

- In September 2025, Willis announced the launch of a new Global Risk Engineering team comprising nearly 200 engineers across 30 countries to provide unified risk assessments. This team integrates property and casualty expertise with data science to offer technology-driven solutions aimed at strengthening client resilience and lowering the total cost of risk.(Source: https://www.wtwco.com)

- In June 2025, Nazara Technologies announced the launch of Pokerverse, a VR-led platform providing an immersive, 3D poker experience for global players. This initiative marks Nazara's entry into the immersive gaming sector, utilizing VR and AI. The company aims to leverage social interaction and high-fidelity visuals to capture the Metaverse market.(Source: https://www.business-standard.com)

- In September 2024, A-G Specialty Insurance, a leader in niche insurance solutions, announced the acquisition of eSportsInsurance, a provider of insurance products for amateur youth and adult sports nationwide. This strategic move expands A-G Specialty's portfolio with tailored coverage and risk management solutions for sports associations, teams, camps, clinics, and events, reinforcing its commitment to the growing sports insurance market.(Source: https://agspecialtyinsurance.com)

Segments Covered in the Report

By Coverage Type

- Property Insurance

- Liability Insurance

- Business Interruption Insurance

- Cyber Insurance

- Others

By Venue Type

- Dedicated VR Esports Arenas

- Hybrid LBVR (Location-Based VR) Centers

- Pop-up & Temporary Tournament Spaces

- VR Gaming Lounges/Cafés

By End-User

- Venue Owners

- Event Organizers

- Esports Teams

- Others

By Distribution Channel

- Direct Sales

- Brokers

- Online Platforms

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting