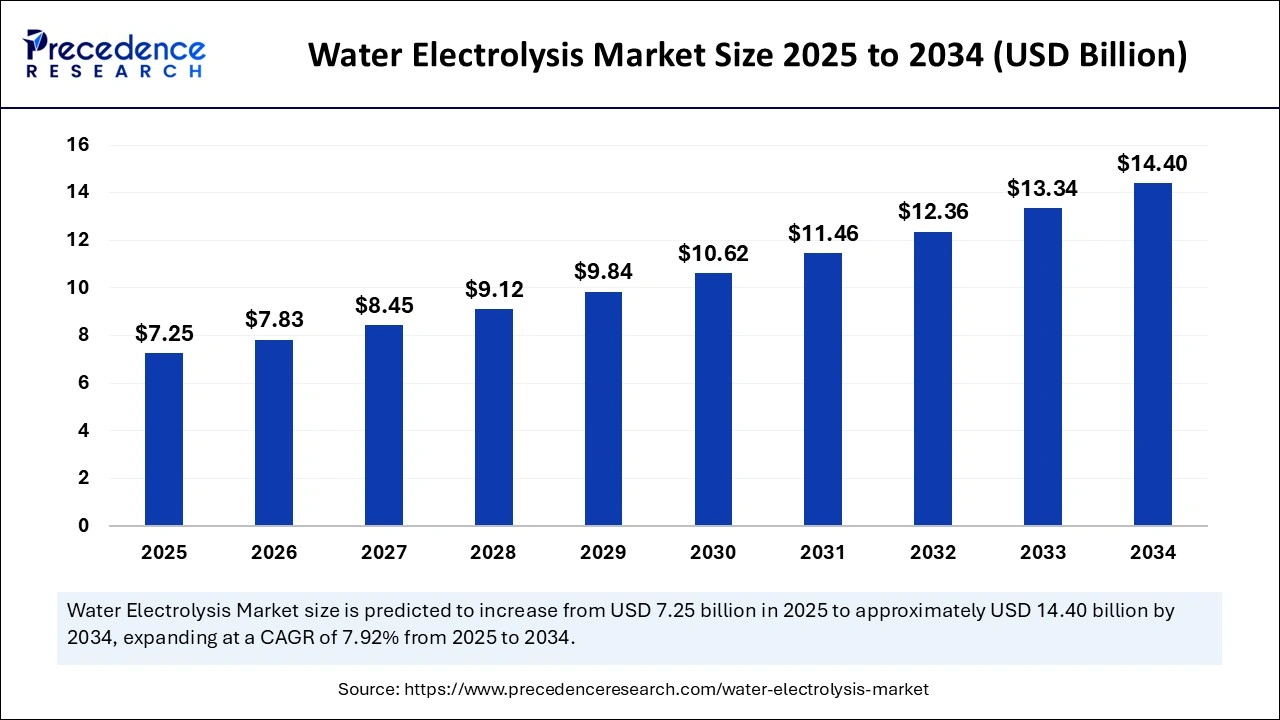

What is the Water Electrolysis Market Size?

The global water electrolysis market size is calculated at USD 7.25 billion in 2025 and is predicted to increase from USD 7.83 billion in 2026 to approximately USD 15.41 billion by 2035, expanding at a CAGR of 7.83% from 2026 to 2035.

Water Electrolysis Market Key Takeaways

- In terms of revenue, the water electrolysis market was estimated at $7.25 billion in 2025.

- The water electrolysis market is valued at $7.25 billion in 2025.

- It is projected to reach $15.41billion by 2035.

- The market is expected to grow at a CAGR of 7.83% from 2026 to 2035.

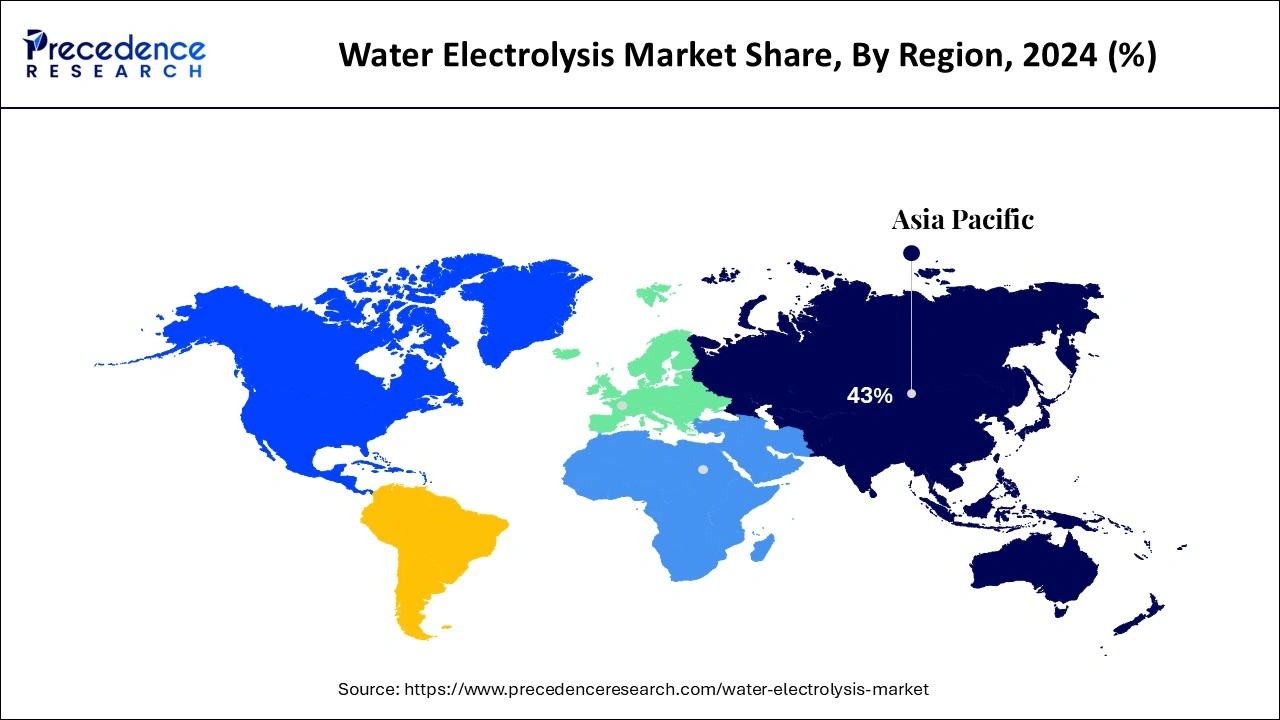

- Asia Pacific dominated the global market by holding more than 43% of revenue share in 2025.

- North America is expected to grow at the fastest CAGR during the forecast period.

- By product, the alkaline water electrolysis segment held the major revenue share of 59% in 2025.

- By product, the proton exchange membrane segment is expected to grow at the fastest CAGR during the forecast period of 2026 to 2035.

- By end-use, the chemicals segment accounted for the largest revenue share of 43% in 2025.

- By end-use, the power plants segment is anticipated to grow with the highest CAGR during the studied years.

Market Overview

Increased attention to decarbonization of industrial sectors is likely to propel the expansion of the water electrolysis market, as the world continues to transform into low-emission energy systems. Electrolysis of water is a high technology in which electricity is used to decompose water (H?O) into hydrogen and oxygen. This process when run on renewable sources of energy produce green hydrogen that is a zero-carbon fuel which use in powering energy storage, transport, power generation, and industrial activity. Governments across the world have stepped up investments on electrolyzer infrastructure to align with climate targets.

In 2024, domestic Department of Energy (DOE) set aside USD 7 billion to create Regional Clean Hydrogen Hubs that favor deployment of water electrolysis systems that driven by renewables. Furthermore, the increase in government directives for green hydrogen application in industries, such as refining, chemical, and heavy transport are likely to support the long-term demand for water electrolysis solutions.(Source: https://carboncredits.com)

Impact of Artificial Intelligence on the Water Electrolysis Market

Artificial intelligence (AI) facilitates advancements in water electrolysis due to simplification of operations and enhancement of the overall system performance. Engineers use AI in monitoring and controlling values, such as current density, temperature and electrolyte concentration in real time. This analytics helps to achieve maximum generation of Hydrogen and minimal energy wastage. The manufacturers embed AI-powered predictive models to conduct proactive maintenance, which minimizes the downtime of systems and the lifespan of equipment.

Water Electrolysis Market Growth Factors

- Growing Renewable Energy Capacity: Rapid expansion of solar and wind energy installations is expected to drive the integration of water electrolysis for green hydrogen production.

- Supportive Hydrogen Policies: Implementation of national hydrogen strategies across countries such as Japan, Australia, and Canada is projected to strengthen electrolyzer deployment.

- Industrial Sector Electrification: Increasing efforts to electrify industrial processes using hydrogen are anticipated to fuel demand for electrolyzers.

- Advancements in Electrolyzer Technology: Continuous innovation in solid oxide and PEM electrolyzers is likely to enhance efficiency and reduce production costs.

- Public-Private Partnerships: Strategic collaborations between governments and major energy firms are expected to accelerate the scaling of water electrolysis projects.

- Hydrogen in Heavy-Duty Transport: Rising adoption of hydrogen fuel in trucks, buses, and trains is projected to boost electrolyzer demand for transport applications.

- Off-Grid Power Applications: Growing use of green hydrogen in remote and off-grid energy systems is likely to drive water electrolysis deployment in rural and island regions.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 15.41 Billion |

| Market Size in 2025 | USD 7.25 Billion |

| Market Size in 2026 | USD 7.83 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 7.83% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Outlook,End-use Outlook, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How Is Increasing Demand for Green Hydrogen Driving Electrolysis Adoption?

Increasing demand for green hydrogen is anticipated to accelerate the market growth in the coming years. The raising need for green hydrogen is expected to drive the growth of water electrolysis systems. Industries in transportation, power generation, and chemicals, actively, endeavor towards cleaner source of energy to achieve decarbonization levels.

Electrolysis does not release the greenhouse gasses when supplied by renewable power to manufacture hydrogen making it part of the national hydrogen agenda in Europe, Japan, and the U.S. Developers of projects prefer water-based electrolysis over fossil-fuel based hydrogen because they have sustainability goals to meet and support from the regulators.

Such a shift enhances the investments targeted toward manufacture and implementation of electrolyzers in massive energy ventures.

The International Energy Agency (IEA) in 2024 declared that global electrolyzer capacity was more than doubled in a year as compared to 2022 and the estimation was that more than 1.2 million tonne of low-emission hydrogen was expected from newly installed electrolyzer. Furthermore, in 2024 update on the REPowerEU plan by the European Commission, Europe promised to produce 10 million tonnes of renewable hydrogen by 2030 while preferring the electrolysis-driven supply, thus further fuelling the market.

Restraint

Limited Efficiency of Electrolysis Technologies Restraining Large-Scale Hydrogen Production

The limited efficiency of current electrolysis technologies is anticipated to affect large-scale hydrogen production is expected to hinder the market growth. Despite that great strides have been achieved, a lot of the available electrolyzer technology is still inefficient. Electrolysis consumption of electrical energy is very high and the overall conversion efficiency tends to be low as compared to other means of producing hydrogen. The production of hydrogen through water electrolysis is still expensive, particularly with the integration of intermittent renewable energy sources, thus further hindering the market expansion.

Opportunity

Surging Government Funding and Policy Support Driving Electrolysis Technology Deployment

Surging government funding and policy support are likely to creating immense opportunities for the players competing in the market. High amount of money spent by the government and policy facilitation are likely to trigger massive adoption of electrolysis technologies. The national hydrogen strategies of the EU, U.S., and South Korea spend large sums of money to promote research, demonstration, and infrastructure development.

Grants, tax incentives, and guaranteed offtake agreements minimize the financial risks for the manufacturers of electrolyzers and project developers. The presence of governmental support increases market confidence, speeding-up production scale-up and cross-sector uptake.

In the European Union, in 2025, as a part of the REPowerEU initiative, €5 billion be spent to develop the technologies to produce hydrogen with emphasis on the water electrolysis. Furthermore, the policy-informed initiatives emphasize the growing contribution of government backing in expediting the growth of market for electrolysis technologies. (Source:https://hydrogeneurope.eu)

Segment Insights

Product Insight

Proton exchange membrane segment dominated the water electrolysis market during the forecasting period, due to its high efficiency, compact composition, and the capacity to function under variable loads. This makes it very suitable for amalgamation with renewable energy sources, such as wind and sun. The same is true with PEM electrolyzers, which have a quick response time and are expected to continue dominating in markets where renewable power supply is variable. In 2023, PEM electrolysis accounts for roughly 45% of the overall electrolyzer market, as informed by reports from International Renewable Energy Agency (IRENA). Furthermore, the regions that have set an aggressive decarbonization target is expected to fuel the market in the coming years.

The alkaline water electrolysis segment is observed to grow at the fastest CAGR during the forecast period, owing to the lower cost of capital and established technology. Popularity of this segment stems from the longer history of operations and cost-efficiency of the alkaline electrolyzers in the large-scale production of hydrogen. These systems run even at high efficiency using lower initial investment than in PEM systems.

According to the International Energy Agency (IEA), the demand for large-scale hydrogen production shall grow, favoring AWE in cost-competitive measures for industrial purposes. Furthermore, the governments in critical countries, including China and the U.S. inclined to promote massive AWEs build up to fulfill hydrogen production thresholds, thus driving their demand in the coming years.

End-use Insights

Chemicals segment held the largest revenue share in the water electrolysis market during the forecasting period, due to the powerful demand for hydrogen in industrial use in ammonia production, petroleum refining, and synthesis of methanol. The increasing demand for ammonia, and with the change of interest of the industry to cleaner methods of hydrogen production, has led to greater adoption of water electrolysis. Furthermore, the growing adoption of electrolyzer in chemical manufacturing, which are in line with national carbon-neutral missions, thus further boosting the market.

Power plants segment is seen to grow at the fastest CAGR during the predicted timeframe owing to the governments around the world striving to decarbonize the energy systems. Green hydrogen's integration with power generation is now picking up momentum for its ability to store renewable energy and offer a cleaner version of fossil fuels. Hydrogen be used as baseload and a mode of energy storage, especially through fuel cells or as such, a direct fuel in gas turbines. Additionally, the growing demand for zero-emission power generation and energy storage solutions also be contributing to an increased rate of adoption of water electrolysation technologies in this space.

Regional Insights

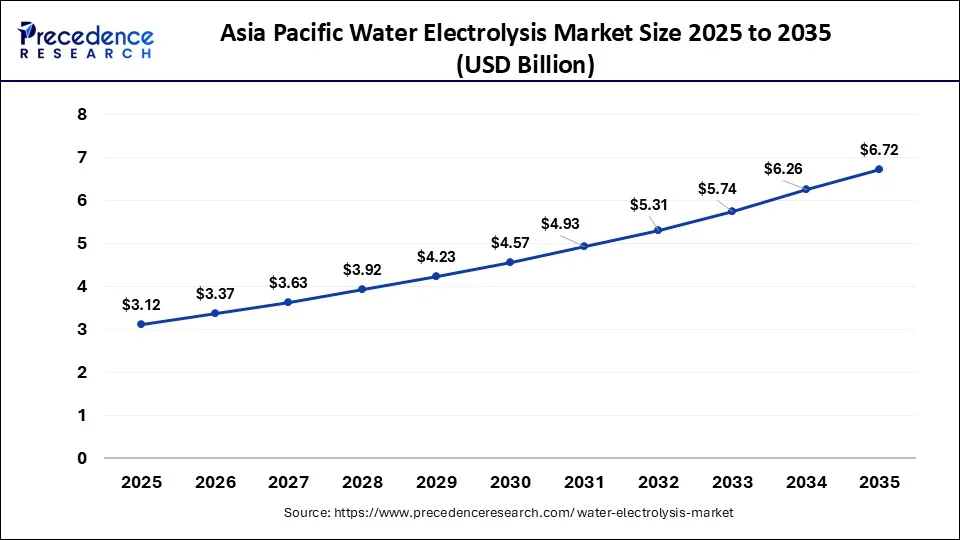

What is the Asia Pacific Water Electrolysis Market Size?

Asia Pacific water electrolysis market size was exhibited at USD 3.12 billion in 2025 and is projected to be worth around USD 6.72 billion by 2035, growing at a CAGR of 7.97% from 2026 to 2035.

Asia Pacific led the water electrolysis market, capturing the largest revenue share in 2025, owing to the strong hydrogen demand from the industrial hubs of China, Japan, South Korea, and Australia. China dominated the region in terms of the electrolyzer capacity additions, following its resolve to decarbonize industries, including steel, cement and chemicals. Chinese government's Hydrogen Industry Development Plan (2021–2035) has clearly spelt out a roadmap on how green hydrogen use be expanded making the region a target for electrolyzer manufacturers.

Japan's national hydrogen strategy and South Korea's Hydrogen Economy Roadmap further boosted the movement by boosting infrastructure and R&D. In 2024, the Ministry of Ecology and Environment of China again supported the green hydrogen pilot projects in Inner Mongolia and Gansu to revitalize the regional supremacy in the adoption of clean energy.

- In the year 2025, Japan's Ministry of Economy, Trade and Industry (METI) launched a new funding package worth USD 113 million to promote the PEM electrolyzer technology and the hydrogen distribution networks. Furthermore, the Asia Pacific's tech advancement and state-supported efforts continued to strengthen its dominant position in the deployment of electrolyzers.

North America is anticipated to grow at the fastest CAGR in the market during the forecast period, due to growth in investments in clean hydrogen infrastructure and favorable federal policies. The momentum is being spearheaded by the United States through the 2022 Inflation Reduction Act and the 2021 Infrastructure Investment and Jobs Act which channeled large funds for the green hydrogen initiatives.

Canada also spends much effort popularizing hydrogen development and provincial strategies that go hand-in-hand with its national Hydrogen Strategy presented by Natural Resources Canada. In terms of pilot-scale electrolyzer projects combined with solar and wind power facilities, California and Texas state leads. In the update of the DOE's Hydrogen Shot in 2025, the U.S. intends to make the cost of clean hydrogen $1/kg by 2031, with electrolysis being a main part. Furthermore, the increasing partnership between utilities and manufacturers of electrolyzers and the growing clean energy developers make North America a fast-growing region in the world's water electrolysis market.

What are the advancements in the Water Electrolysis Market in Europe?

Europe is witnessing significant growth in the market and will continue to grow throughout the forecast period. This growth is driven by the implementation of various government initiatives that are aimed at reducing carbon emissions, the rising demand for clean energy sources, and strategic investments being made by multinational corporations that want to establish green hydrogen supply chains. Countries like Chile, Brazil, and Argentina are leading players in the region.

Chile Water Electrolysis Market Trends: Chile has plans for multi-gigawatt green hydrogen facilities and is carrying out collaborations between local governments and international energy firms. These projects will not only help to boost the market size but also foster technological advancements and cost reductions.

Europe region is expected to hold a notable revenue share, as high policy commitments and large-scale funding programs for the development of green hydrogen. Germany, France, and the Netherlands-type countries are leading multibillion-euro initiatives that aim at scaling up renewable hydrogen in transport, industry, and energy sectors. The well-established regulatory frameworks in the region, the dedicated hydrogen backbones and blending mandates are expected to continue spurring growth. Strategic partnerships between electrolyzer companies and those of utilities providers in addition to the EU based grants have done even better to propel projects on a faster implementation schedule.

According to reports of Germany's Federal Ministry for Economic Affairs and Climate Action in 2025, over 500 MW of electrolyzer capacity entered into construction with the support by the national decarbonization targets. The Netherlands also launched a 2024 hydrogen import scheme using the port of Rotterdam, to promote green hydrogen trade with African and the Middle East countries. Additionally, the Europe's tough green transition policies and inter-governmental cooperation are set to bolster Europe's leadership position in hydrogen production by way of water electrolysis.

What are the key trends in the Water Electrolysis Market in the Middle East and Africa?

The Middle East and Africa is growing at a steady rate in the market. Countries like the United Arab Emirates and Saudi Arabia are leading players in the region as they are leveraging their abundant renewable energy resources, especially solar and wind, in order to develop large-scale electrolysis projects. Governments all across the region are actively investing in sustainable water purification technologies in order to meet the rising water demand. Additionally, the surge in environmental concerns and push for eco-friendly solutions has propelled the market even further.

Saudi Arabia Water Electrolysis Market Trends: The ongoing urbanization and expanding infrastructure projects in the region help support the need for decentralized water treatment systems, thus leading to market expansion. The country aims to become a global hub for green hydrogen production, supported by strategic initiatives such as Saudi Arabia's Vision 2030.

Water Electrolysis Market Companies

- Asahi Kasei Corporation

- Cummins Inc.

- Hitachi Zosen Corporation

- ITM Power PLC

- Nel ASA

- Plug Power Inc.

- Siemens Energy AG

- Teledyne Energy Systems Inc. Ltd.

- ThyssenKrupp AG

- Toshiba Energy Systems & Solutions Corporation

Recent Developments

- In January 2024, Nel ASA secured a significant purchase order for 10 MW of alkaline electrolyzer equipment. This order reflects the growing demand for large-scale electrolysis solutions and reinforces Nel's position as a leading provider in the renewable hydrogen market. The company continues to expand its production capabilities to meet increasing global demand. (Nel ASA: Receives purchase order for 10 MW of electrolyser equipment from Samsung C&T | Nel Hydrogen)

- In May 2025, INEOS Electrochemical Solutions, a subsidiary of chemical industry leader INEOS, has officially introduced "Hydraeon," its latest innovation in green hydrogen production. Purpose-built for industrial-scale applications, Hydraeon is a modular alkaline water electrolyser system leveraging proven chlor-alkali electrolysis technology. Available in standard 25MW and 100MW configurations, the solution is designed to meet the growing demand for scalable, efficient, and cost-effective hydrogen infrastructure across energy-intensive sectors. The launch further reinforces INEOS' commitment to accelerating the global green hydrogen economy.(Source: https://fuelcellsworks.com)

- In May 2025, Samsung Engineering & Architecture (Samsung E&A), a global energy solutions provider, has announced the launch of CompassH2, a next-generation green hydrogen production platform developed in partnership with Norwegian electrolyser leader Nel. Designed to deliver industry-leading performance and cost-efficiency, CompassH2 aims to set new benchmarks in reducing the Levelised Cost of Hydrogen (LCOH). The official unveiling will take place at the World Hydrogen Summit 2025 on 21 May in Rotterdam Ahoy, Netherlands. This strategic collaboration aligns both companies at the forefront of hydrogen innovation, paving the way for more commercially viable clean energy solutions worldwide. (Source: https://decarbonisationtechnology.com)

- In December 2024, Toyota Motor Corporation has been selected by Japan's Ministry of Economy, Trade and Industry (METI) for its Support Program for Building GX Supply Chains. The approved initiative includes Toyota's new production strategy for fuel cells and water electrolysis systems critical to hydrogen supply. The program is part of the broader GX Promotion Act, which supports the transition to a decarbonized, growth-oriented economic structure. By fostering domestic supply chain capabilities and leveraging Japan's technological strengths—including those of small and medium-sized enterprises—the initiative positions Toyota as a key player in establishing a resilient hydrogen manufacturing ecosystem and advancing national carbon neutrality goals.(Source: https://global.toyota)

Latest Announcements by Industry Leaders

In March 2025

- In March 2025 BASF has officially inaugurated Germany's largest proton exchange membrane (PEM) electrolyzer at its flagship Ludwigshafen site, marking a significant milestone in the company's decarbonization journey. With a connected load of 54 megawatts, the state-of-the-art facility is designed to produce up to one metric ton of zero-carbon hydrogen per hour, supplying the site with a crucial low-emission chemical feedstock. The project, completed after a two-year construction phase, was celebrated in a ceremony attended by Katrin Eder, Rhineland-Palatinate State Minister for Climate Protection, Environment, Energy, and Mobility, and Udo Philipp, State Secretary at the German Federal Ministry for Economic Affairs and Climate Action.

- Katja Scharpwinkel, BASF SE Board Member and Site Director Ludwigshafen, emphasized the project's strategic importance: "The commissioning of the electrolyzer enables us to support our customers in achieving their climate targets by offering products with a reduced carbon footprint. Simultaneously, we are gaining valuable experience in integrating and operating this technology at our largest Verbund site—bringing us one step closer to transforming Ludwigshafen into a low-emission production hub." BASF acknowledged the strong support provided by both federal and state governments in advancing the implementation of this flagship hydrogen initiative, which stands as a cornerstone of Germany's energy transition strategy.(Source: https://www.basf.com)

Segments covered in the report

By Product Outlook

- Alkaline Water Electrolysis

- Proton Exchange Membrane

- Solid Oxide Electrolyte (SOE)

By End-use Outlook

- Chemicals

- Electronics & Semiconductor

- Others

- Petroleum

- Pharmaceuticals

- Power Plants

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting