Wire and Cable Polymer Market Size and Forecast 2025 to 2034

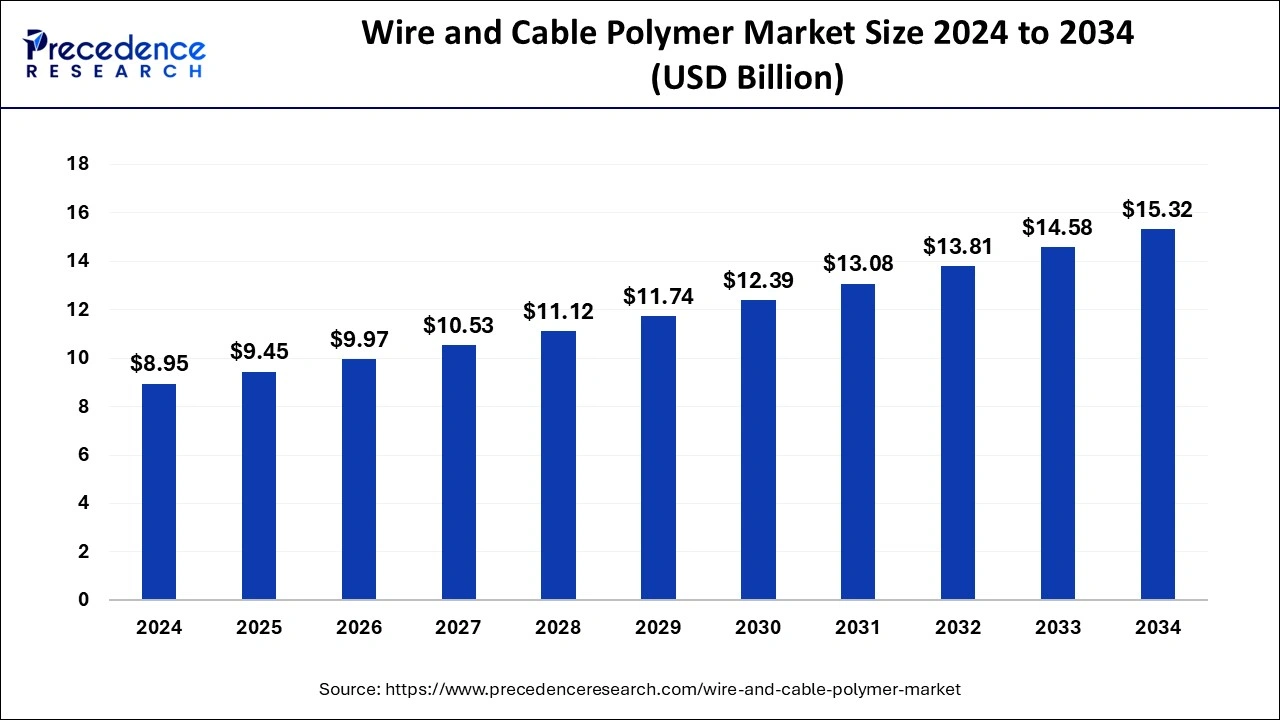

The global wire and cable polymer market size was estimated at USD 8.95 billion in 2024 and is predicted to increase from USD 9.45 billion in 2025 to approximately USD 15.32 billion by 2034, expanding at a CAGR of 5.52% from 2025 to 2034. The transition of the automobile industry to hybrid and electric vehicles (EVs) calls for sophisticated wiring systems that depend on high-performance wire and cable polymers.

Wire and Cable Polymer MarketKey Takeaways

- The global wire and cable polymer market was valued at USD 8.95 billion in 2024.

- It is projected to reach USD 15.32 billion by 2034.

- The wire and cable polymer market is expected to grow at a CAGR of 5.52% from 2025 to 2034.

- North America led the market with the largest share in 2024.

- By type, the Polyethylene segment held the largest share in the market and is expected to sustain the position throughout the forecast period.

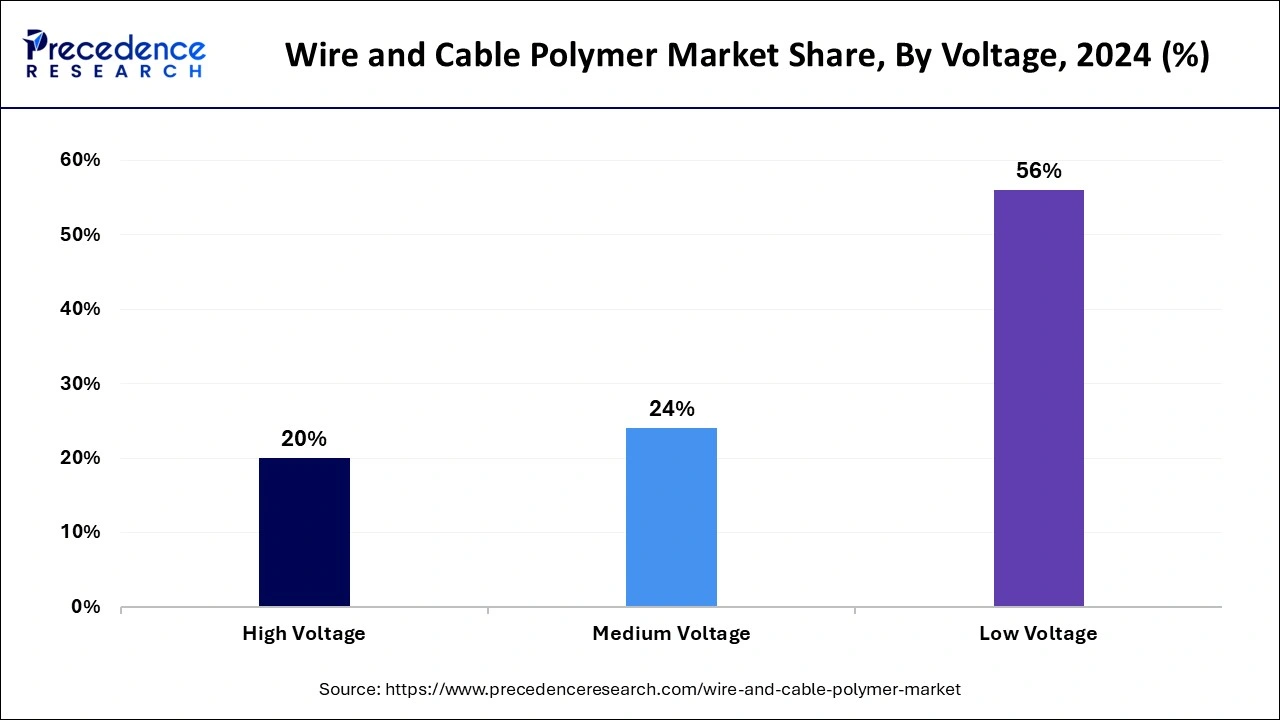

- By voltage, the low voltage segment held the largest share in the wire and cable polymer market in 2024.

- By application, the building wire segment held the largest share in the market in 2024.

Market Overview

The wire and cable polymer market is a subset of the larger polymers industry, which includes a broad range of materials used in a variety of industries, such as electronics, construction, automotive, and packaging. Polymers are utilized as jacketing and insulation materials for wire and cable applications in order to shield and insulate electrical conductors. The growing demand for energy and telecommunications infrastructure worldwide has been driving the market for wire and cable polymers. In particular, emerging nations are rapidly industrializing and urbanizing, which increases demand for wire and cable products. This involves initiatives to create recyclable materials, cut down on manufacturing waste, and boost production processes' energy efficiency.

By region, the market dynamics can change. For example, the emphasis may be on product innovation, sustainability, and regulatory compliance in developed markets such as North America and Europe. On the other hand, developing infrastructure and satisfying the rising demand for telecoms and power may be the main priorities in developing regions like Asia-Pacific and Latin America.

The wire and cable polymer market is significantly shaped by environmental concerns and regulatory norms. Regulations controlling fire safety, environmental effects, and product safety encourage innovation and have an impact on material selection. The existence of both international and local firms defines the market. To increase their market share and diversify their product offerings, major firms frequently use tactics including collaborations, mergers and acquisitions, and new product releases.

Wire and Cable Polymer MarketGrowth Factors

- The need for wire and cable polymers for power transmission, telecommunications, and construction applications is driven by an increase in infrastructure developments, which include urbanization, industrialization, and construction activities.

- Specialized wire and cable polymers are in greater demand as a result of the growing use of renewable energy sources like solar and wind power, which calls for the development of efficient transmission systems.

- By providing better materials for a range of applications, developments in polymer chemistry, such as the creation of high-performance polymers with improved mechanical, electrical, and thermal properties, support the expansion of the wire and cable polymer market.

- The wire and cable polymer market is expected to rise as a result of the widespread use of high-speed internet and data transmission services, which has increased demand for sophisticated cables and wires. This is especially true for high-performance polymers that can meet demanding data transmission specifications.

- Investments in smart grid infrastructure and government programs to increase electrification in rural and urban areas increase demand for wire and cable polymers, which are utilized in power distribution and transmission systems. The use of innovative wire and cable polymers that fulfill regulatory criteria while providing increased performance and environmental benefits is driven by stringent regulations relating to energy efficiency, safety, and environmental sustainability.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 5.52% |

| Market Size in 2025 | USD 9.45 Billion |

| Market Size by 2034 | USD 15.32 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Type, By Voltage, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rising investments in renewable energy

Energy cables are becoming more and more necessary to transfer electricity from renewable energy sources like solar and wind power to the grid. Specialized polymers are frequently needed for these cables in order to provide insulation and protection from the elements. The move to more renewable energy sources has been hastened by the emphasis on lowering carbon emissions and preventing climate change. Consequently, enterprises are making investments in the infrastructure needed for renewable energy, including the wiring and cabling required for these systems.

Enhancing the performance of wire and cable polymers is the focus of research and development activities due to the growing emphasis on sustainability and energy efficiency. This involves creating novel materials that are tailored to the unique needs of applications involving renewable energy and have enhanced mechanical, thermal, and electrical qualities. Thereby, the rising investment in renewable energy is observed to act as a driver for the wire and cable polymer market.

Restraint

Substitution by wireless technologies

When it comes to mobility and flexibility, wireless technologies surpass conventional connectivity. This is especially helpful for applications like wearables, smart homes, and industrial settings where there is a need for frequent reconfiguration or constant movement. Expanding and scaling needs can be met by wireless networks with ease, negating the need for major infrastructure modifications or rewiring. Applications with varying connectivity requirements or quickly changing surroundings benefit greatly from this scalability.

The dependability and performance of wireless connections have increased due to advancements in wireless technology, making them more dependable for mission-critical applications. Reliability in demanding situations is further improved by signal optimization techniques and redundancy features. The emergence of wireless technologies is observed to hamper the overall demand of polymers, as multiple industries are prone to adopt wireless solutions owing to the convenience. Thereby, the substitution of wireless technologies is observed to create a hampering factor for the wire and cable polymer market.

Opportunity

Investments in infrastructure

Infrastructure expenditures in high-voltage cables are required to transfer electricity from remote renewable energy producing sites to metropolitan centers, as interest in renewable energy sources like wind and solar grows. Investing in fiber optic cables and high-speed data transmission connections becomes crucial as the demand for high-speed internet and data transmission rises. The telecommunications infrastructure is anchored by these cables, which facilitate the growth of 5G connectivity and internet networks. The need for specialized cables made to endure challenging working circumstances is driven by the expansion of industries including aerospace, automotive, and construction. The development of polymer formulations suited for certain industrial applications may be the main focus of investments.

Type Insights

The Polyethylene segment held the largest share in the wire and cable polymer market in 2024. Polyethylene resins find extensive application in the insulation and jacketing of electrical cables and wires. They offer superior electrical insulation qualities, shielding conductors from outside influences and stopping electrical leaks. Because polyethylene has a high dielectric strength, it can be used in applications like power and telecommunications lines where protection against high voltages is needed. Because of the flexibility provided by polyethylene resins, wires and cables can bend and twist without breaking or shattering. This flexibility is essential in applications where the cable can be repeatedly moved or routed through small places.

Polyethylene resins are ideal for outdoor and harsh environment applications because of their superior resistance to weathering, moisture, and chemicals. Due to its low cost in comparison to other polymer materials, polyethylene is widely used in the wire and cable polymer market. It is an appealing choice for both indoor and outdoor cable applications because of its affordability. Extrusion, injection molding, blow molding, and other processes are simple ways to process polyethylene resins, which enables producers to create wires and cables in a variety of sizes and forms to satisfy specific needs. In wire and cable applications, polyethylene resins usually meet industry standards and laws, such as those pertaining to flame retardancy and environmental laws like RoHS (Restriction of Hazardous Substances) and REACH.

Voltage Insights

The low voltage segment held the largest share in the wire and cable polymer market share of 56% in 2024. Low voltage cables are used in many different industries, such as industrial equipment, telecommunications, automobile wiring harnesses, building wiring (for lighting, power distribution, and appliances), and telecommunications. Because they provide insulation and defense against environmental elements including heat, moisture, and chemicals, polymers are essential to low voltage cables. The performance levels of various polymers vary, and their selection is dictated by the particular needs of the intended use.

Technological developments, infrastructural growth, urbanization, and the growing demand for a steady supply of energy all have an impact on the demand for low voltage cables. It is anticipated that the need for low voltage cables would increase as economies and industries develop. The wire and cable polymer market is very competitive, with major players constantly innovating to meet changing customer demands, cut costs, and improve product performance. These companies frequently invest in RandD to develop new polymer formulations and manufacturing techniques.

Application Insights

The building wire segment dominated the wire and cable polymer market in 2024. The wire and cable polymer market includes a range of polymers that are utilized in the production of wires and cables for a number of uses, including construction, automotive, telecommunications, electrical wiring, and others. Because of their insulating qualities, flexibility, durability, and resistance to environmental elements including heat, moisture, and chemicals, polymer materials are chosen in the production of wire and cables. PVC's superior electrical qualities, flame resistance, and affordability make it one of the most used polymers for jacketing and insulating wires and cables. Because of their superior electrical qualities, flexibility, and resistance to environmental stress cracking, low-density polyethylene (LDPE) and high-density polyethylene (HDPE) are frequently utilized in wire and cable applications.

XLPE is a better material for high-voltage power cables and other demanding applications because it has better mechanical and thermal qualities than regular polyethylene. Particularly in situations where resistance to chemicals and high temperatures is required, PP is frequently used in wire and cable insulation and jacketing. Because of its superior electrical qualities and tolerance to environmental conditions, EPR is a synthetic rubber that is frequently employed as insulation in medium- and high-voltage cables. Because fluoropolymers are so resistant to heat and chemicals, they are a good choice for specialized applications including industrial, automotive, and aerospace wiring that deal with harsh environments.

Regional Analysis

North America dominated the wire and cable polymer market in 2024. The construction industry is the main source of demand for wire and cable polymers since it installs wiring in residential, commercial, and industrial structures. Furthermore, industries like telecommunications and the automobile industry greatly increase the need for specialized wires and cables. North America has a competitive wire and cable polymer market, with a number of major manufacturers present. These businesses compete on the basis of things like customer service, innovation, pricing, and product quality.

The wire and cable polymer market in the region is adopting eco-friendly polymer alternatives and recycling programs as a result of a growing emphasis on sustainability and environmental concerns. The market for wire and cable polymers faces difficulties due to fluctuating raw material prices and the requirement to continuously spend in RandD in order to maintain market competitiveness.

During the projected timeframe, Asia Pacific is expected to witness the rapid expansion rate in the wire and cable polymer market. The Asia Pacific region's nations are rapidly industrializing and urbanizing, which is driving up demand for the construction of infrastructure, particularly power distribution and transmission networks. This increases the market for the polymer materials used in the fabrication of wires and cables by driving demand for them.

Higher energy needs are a result of industrialization and population growth. Consequently, the demand for wire and cable polymers is driven by the ongoing need to upgrade and expand electrical infrastructures. The transition to sustainable energy sources like wind and solar necessitates large capital expenditures for new transmission and distribution networks. In the Asia Pacific area, this increases demand for wire and cable polymers.

Wire and Cable Polymer Market Companies

- Dow Inc.

- BASF SE

- Solvay SA

- Arkema SA

- Mitsui chemicals, Inc.

- Borealis AG

- LG chem Ltd

Recent Developments

- In Feburary 2024, At its new 168-acre facility in Fitzgerald, Georgia, Modern Dispersions, a worldwide producer of thermoplastic compounds and concentrates, has finished and put into service the first stage of a multifaceted production expansion. The company's new 400 million lb/yr plant is located across the street from its current one, and it will increase masterbatch capacity by 100 million lbs a year. The business will talk about its expanded production capabilities during the NPE 2024 show, which takes place in Orlando, Florida, from May 6–10.

Segment Covered in the Report

By Type

- Polyethylene

- Polypropylene

- Polyvinyl chloride

- Polybutylene Terephthalate

- Halogen Free fire Retardant

- HFFR_XLPE

- LDPE

- HDPE

- LLDPE

- Photovoltaic Compound

- Nylon

- EVA

By Voltage

- Low Voltage

- Medium voltage

- High voltage

By Application

- Building wire

- Medium voltage distribution lines

- Industrial cable

- Special Cables

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting