What is the Wound Closure Market Size?

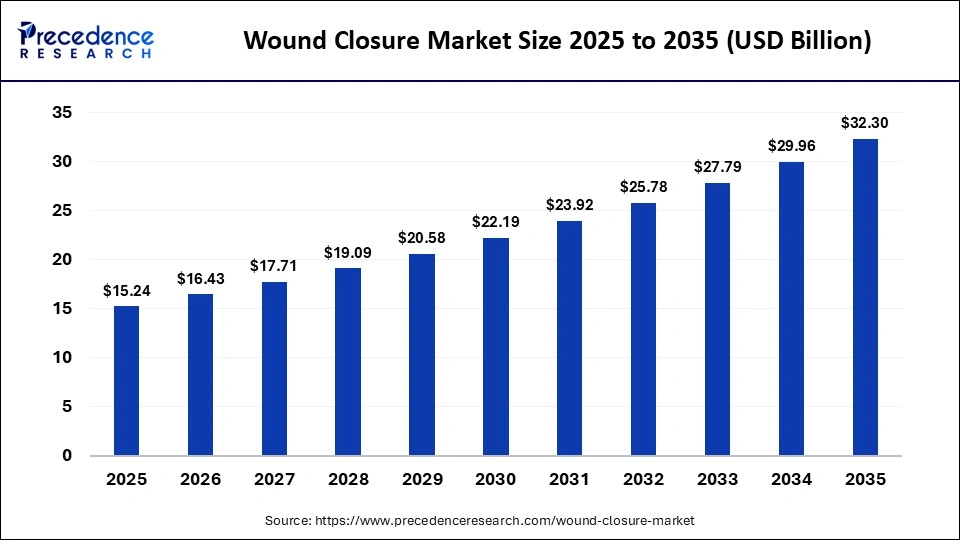

The global wound closure market size was calculated at USD 15.24 billion in 2025 and is predicted to increase from USD 16.43 billion in 2026 to approximately USD 32.30 billion by 2035, expanding at a CAGR of 7.80% from 2026 to 2035. This market is growing due to rising surgical procedures, increasing trauma cases, and the growing demand for faster healing and minimally invasive treatment options.

Market Highlights

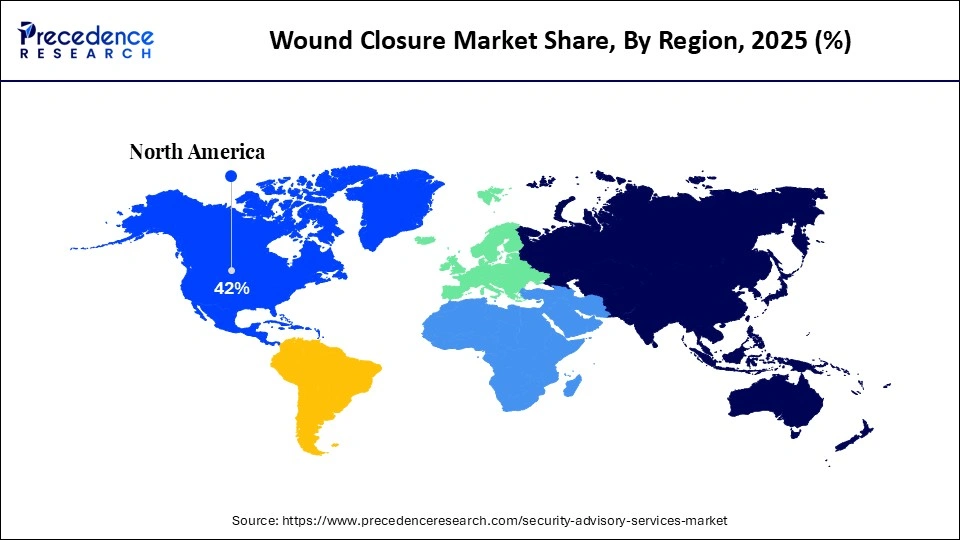

- North America dominated the global wound closure market by holding a 42% share in 2025.

- Asia Pacific is expected to grow at the fastest CAGR of 8.2% between 2026 and 2035.

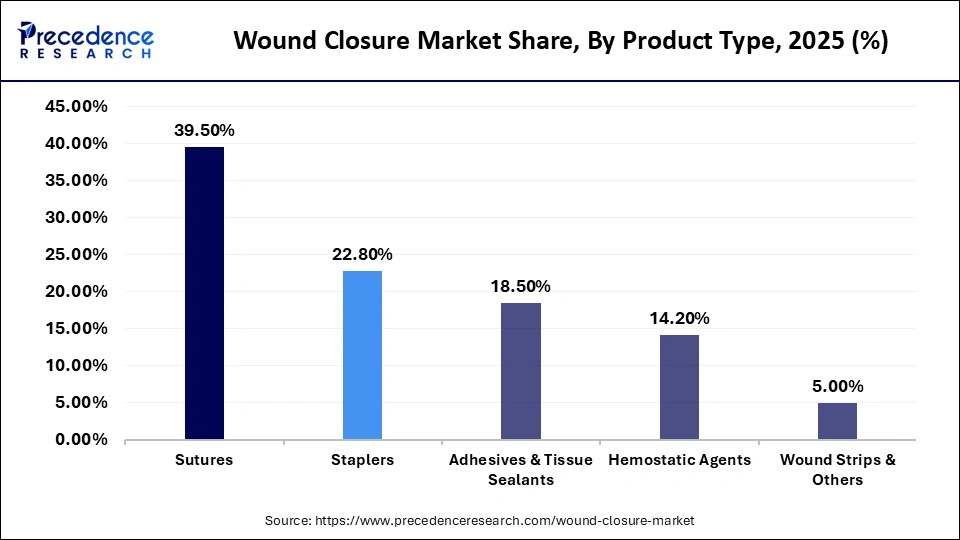

- By product type, the sutures segment generated the biggest market share of approximately 39.5% in 2025.

- By product type, the adhesives & tissue sealants segment is expected to expand at the fastest CAGR of 11% between 2026 and 2035.

- By application, the general surgery segment contributed the highest market share of approximately 29.4% in 2025.

- By application, the cosmetic & plastic surgery segment is expected to expand at the fastest CAGR of 9.3% between 2026 and 2035.

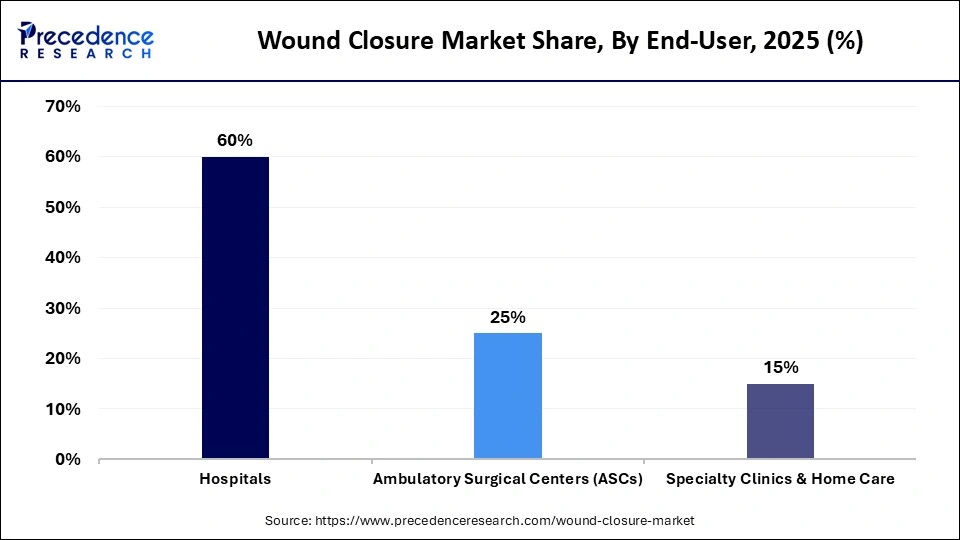

- By end-user, the hospitals segment held a major market share of approximately 60% in 2025.

- By end user, the ambulatory surgical centers (ASCs) segment is expected to expand at the fastest CAGR from 2026 to 2035.

What Drives the Wound Closure Market?

The wound closure market is expanding steadily due to an increase in the number of surgeries performed, an increase in the number of trauma injuries and chronic wounds, and a growing demand for sutures, staples, sealants, and adhesives that speed up healing and lower the risk of infection. Technological advancements in wound closure products, such as advanced dressings, sutures, and biological adhesives, are enhancing treatment outcomes, speeding up recovery, and minimizing complications. Additionally, the growing adoption of minimally invasive surgeries and increased awareness about effective wound care are further boosting demand for innovative wound closure solutions across healthcare settings.

In June 2025, Johnson & Johnson MedTech (Ethicon) launched the ETHICON 4000 Stapler, an advanced surgical stapling system with 3D Staple Technology for improved staple line integrity and reduced surgical leaks and bleeds across open and laparoscopic procedures. This launch supports the growing shift toward precision-driven and minimally invasive surgical wound closure solutions. It also highlights increasing investment in smart surgical devices that enhance consistency and surgeon confidence.

What are the Key Trends Influencing the Market?

- Rising Surgical Procedures: Growth in elective and emergency surgeries is increasing demand for wound closure solutions.

- Shift Toward Minimally Invasive Procedures: Preference for laparoscopic and robotic surgeries drives adoption of advanced closure devices.

- Adoption of Advanced Sutures & Staples: Barbed sutures, absorbable staples, and tissue adhesives are gaining traction.

- Smart & Digital Integration: AI, sensors, and predictive maintenance are being applied to improve device performance.

- Growth in Non-Suture Closure Methods: Tissue adhesives, sealants, and adhesive strips are increasingly used for faster healing.

- Focus on Patient Safety & Infection Reduction: Devices with antimicrobial coatings or precision design reduce post-surgical complications.

Future Market Outlook

- Expansion in Emerging Markets: Growing healthcare infrastructure in regions like Asia Pacific, Latin America, and the Middle East is increasing access to advanced wound closure solutions, driving market growth.

- Innovation in Biodegradable & Absorbable Devices: The demand for eco-friendly and patient-safe closure solutions is on the rise, with innovations in biodegradable and absorbable devices that offer better healing and fewer complications.

- Growth in Outpatient & Ambulatory Surgical Centers: Smaller healthcare facilities are increasingly adopting easy-to-use, advanced closure devices to enhance patient care and reduce recovery times.

- Integration of AI & Smart Technologies: The use of AI for predictive analytics and workflow optimization in wound care is improving efficiency, treatment outcomes, and patient monitoring.

- Rising Chronic Wound & Trauma Cases: The increasing prevalence of chronic conditions and trauma cases is driving demand for advanced wound closure solutions in hospitals and clinics.

- Strategic Partnerships & M&A: Companies are expanding their market presence and technology offerings through strategic partnerships and mergers & acquisitions, enhancing their competitive edge in the wound care sector.

How is AI Influencing the Wound Closure Market?

Artificial intelligence is increasingly integrated into surgical workflows and wound closure solutions, enhancing operational efficiency, reducing errors, and improving precision. AI-powered sensors in smart surgical staplers and suturing devices can monitor tissue tension, predict device performance, and provide real-time feedback to surgeons, allowing for more accurate and efficient procedures. This leads to lower healthcare costs, faster procedures, improved patient outcomes, and a reduced risk of complications, ultimately driving the adoption of AI-enhanced wound closure technologies in the medical field.

How are advanced wound closure products beneficial to healthcare providers?

Advanced wound closure products are beneficial because they speed up wound healing, reduce the risk of infections, and minimize postoperative complications, leading to better patient outcomes. They also shorten procedure times and hospital stays, improve cosmetic results, and lower readmission rates. Overall, these advantages help healthcare providers improve efficiency, optimize resource utilization, and reduce long-term treatment costs.

How do regulatory frameworks shape the wound closure market?

Regulations governing product safety, biocompatibility, and clinical performance have a major influence on the wound closure market. Wound closure devices must comply with stringent approval pathways such as FDA 510(k) clearances and CE marking requirements in regions like North America and Europe, ensuring high standards of patient safety. However, these complex regulatory processes can extend development timelines and increase manufacturing costs, creating entry barriers for smaller companies while favoring firms with strong regulatory expertise.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 15.24 Billion |

| Market Size in 2026 | USD 16.43 Billion |

| Market Size by 2035 | USD 32.30 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 7.80% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Application, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Product Type Insights

What made sutures the dominant segment in the wound closure market?

The sutures segment led the market with a 39.5% share in 2025 due to their widespread application in diverse surgical procedures, versatility, and proven clinical performance. For deep and complex wounds, sutures are preferred for providing consistent healing, precise wound closure, and robust tensile strength. Their ongoing popularity in both developed and emerging healthcare markets stems from their cost-effectiveness, availability in multiple materials, and surgeons' familiarity with their use.

The adhesives & tissue sealants segment is expected to grow at the fastest CAGR of 11% throughout the forecast period. The growth of the segment is fueled by rising demand for faster, minimally invasive wound closure. By reducing scarring, these products enhance cosmetic outcomes, decrease procedure duration, and lower infection risk. Advances in biocompatible formulations and increased use in outpatient care and cosmetic treatments further propel segment growth.

Application Insights

Why did the general surgery segment dominate the wound closure market?

The general surgery segment dominated the market with a 29.4% market share in 2025. This is because of the increased volume of surgical procedures, including common operations like appendectomies, hernia repairs, and abdominal surgeries that routinely require wound closure. Sutures, staples, and sophisticated closure devices are always in demand because these procedures call for reliable and long-lasting wound closure methods. Additionally, the growing prevalence of chronic diseases, trauma cases, and emergency surgeries has further increased the reliance on wound closure products in general surgery.

The cosmetic & plastic surgery segment is expected to grow at a significant CAGR of 9.3% in the upcoming period, driven by growing demand for cosmetics and reconstructive procedures. Advanced wound closure techniques that encourage quicker healing and better cosmetic outcomes are preferred by both patients and surgeons. The increase in demand for minimally invasive cosmetic procedures also drives the segment.

End User Insights

What made hospitals the leading segment in the wound closure market?

The hospitals segment dominated the market with the largest share of 60% in 2025. This is because hospitals serve as the primary center for inpatient emergencies and complex surgical procedures. Hospitals oversee a variety of surgeries that call for dependable wound closure products backed by cutting-edge facilities and knowledgeable surgical teams. Strong product consumption in hospital settings is still fueled by high patient inflows and the availability of comprehensive post-operative care.

The ambulatory surgical centers (ASCs) segment is expected to expand at the highest CAGR in the coming years. The growth of the segment is driven by the rising shift toward cost-effective healthcare delivery and outpatient surgeries. ASCs prefer wound closure products that enable faster procedures, quicker recovery, and reduced complication risks, aligning with their efficiency-focused care model. Moreover, the increasing volume of minimally invasive procedures in ASCs is accelerating the adoption of advanced wound closure solutions.

Region Insights

How Big is the North America Wound Closure Market Size?

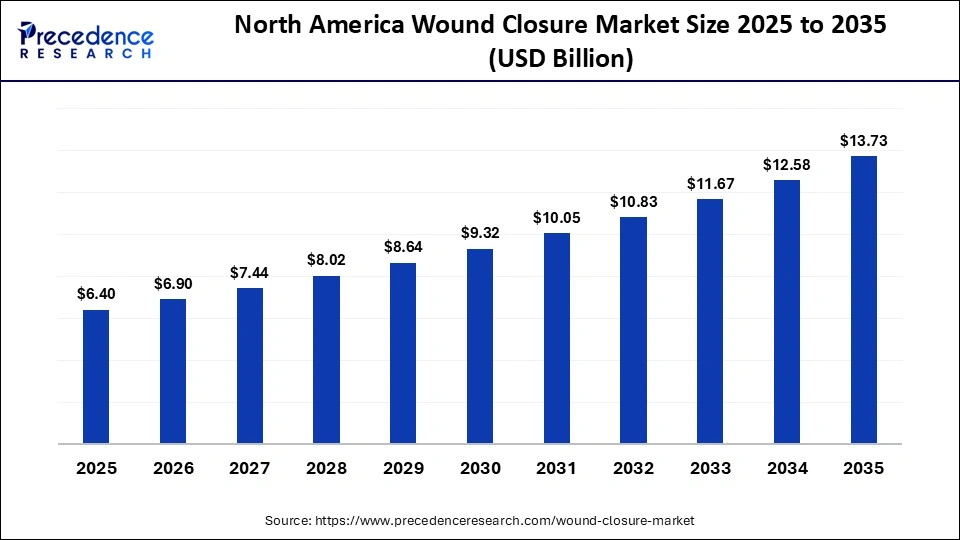

The North America wound closure market size is estimated at USD 6.40 billion in 2025 and is projected to reach approximately USD 13.73 billion by 2035, with a 7.93% CAGR from 2026 to 2035.

What made North America the dominant region in the wound closure market?

North America dominated the wound closure market while holding a major share of 42% in 2025. The region's dominance in the market is attributed to the high volume of surgical procedures, sophisticated healthcare infrastructure, and early adoption of cutting-edge wound closure technologies. Market leadership is further reinforced by robust reimbursement systems and the existence of significant medical device manufacturers. The rapid increase in trauma and chronic wound cases significantly boosted the demand for wound care solutions. Additionally, the strong presence of ambulatory surgical centers and outpatient care facilities is accelerating demand for advanced and easy-to-use wound closure devices.

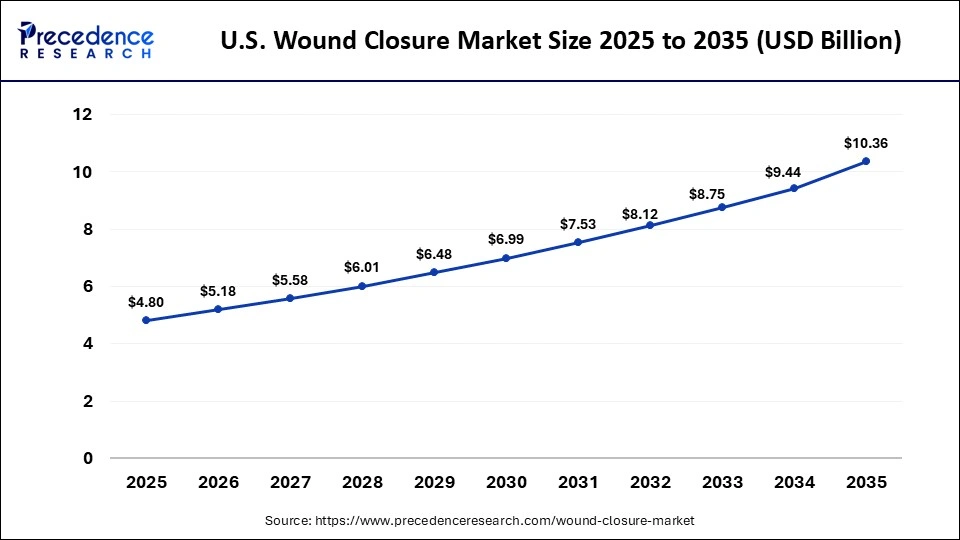

What is the Size of the U.S. Wound Closure Market?

The U.S. wound closure market size is calculated at USD 4.80 billion in 2025 and is expected to reach nearly USD 10.36 billion in 2035, accelerating at a strong CAGR of 8.00% between 2026 and 2035.

U.S. Wound Closure Market Trends

The U.S. leads the North American wound closure market due to the high volume of surgical procedures, advanced hospital infrastructure, and early adoption of innovative wound closure products such as tissue adhesives, sutures, and staples. Market leadership is further reinforced by the strong presence of leading medical device manufacturers and favorable reimbursement policies. In addition, the high prevalence of chronic wounds, including diabetic foot ulcers and pressure ulcers, continues to drive sustained demand for advanced wound closure solutions.

What Makes Asia Pacific the Fastest-Growing Region in the Market?

Asia Pacific is expected to grow at the fastest CAGR of 8.2% throughout the forecast period, driven by expanding hospital infrastructure, increasing surgical volumes, and improved access to healthcare. Rapid adoption of advanced wound care technologies in countries such as China and India, along with rising medical tourism and greater healthcare awareness, is accelerating market growth. Additionally, the region's large patient population and the growing incidence of trauma, burns, and chronic diseases requiring surgical intervention continue to fuel demand for wound closure solutions.

India Wound Closure Market Trends

The market in India is growing, driven by rising surgical volumes, expanding healthcare infrastructure, and increasing adoption of advanced wound care products. Growth is further supported by the expansion of medical tourism, improved access to surgical services, and greater awareness of infection prevention and faster healing solutions. Additionally, government initiatives to upgrade public hospitals and expand surgical capacity are playing a key role in supporting market growth.

Wound Closure Market Value Chain Analysis

Who are the Major Players in the Global Wound Closure Market?

The major players in the wound closure market include Ethicon (Johnson & Johnson), Medtronic plc, 3M / Solventum, Smith+Nephew, B. Braun SE, Baxter International Inc., ConvaTec Group PLC, Molnlycke Health Care AB, Stryker Corporation, Integra LifeSciences, Cardinal Health, Coloplast, Teleflex Incorporated, and Peters Surgica.

Recent Developments

- In November 2025, Xtant Medical announced the commercial launch of CollagenX, a bovine collagen particulate product designed to promote surgical wound healing and help mitigate surgical site infection risks through improved tissue support.

- In January 2026, Baxter International introduced its next-generation Artiss fibrin sealant spray, featuring improved flow control and faster polymerization for use in burn care and plastic reconstructive surgeries.

- In March 2025, Convatec showcased its strongest advanced wound care innovation pipeline at the European Wound Management Association (EWMA) 2025 conference, highlighting new solutions for chronic and hard-to-heal wounds and supporting startup partnerships.

- In May 2025, MediWound provided a corporate update reporting progress on its EscharEx Phase III trial for venous leg ulcers and expansion of NexoBrid manufacturing capacity to full operations by year-end 2025.

- In 2026, BioLargo's subsidiary Clyra Medical Technologies plans to launch ViaCLYR advanced wound irrigation and antimicrobial solution, in early 2026, expanding distribution through a national partnership with Advanced Solution LLC.

Segments Covered in the Report

By Product Type

- Sutures

- Staplers

- Adhesives & Tissue Sealants

- Hemostatic Agents

- Wound Strips & Others

By Application

- General Surgery

- Cosmetic & Plastic Surgery

- Orthopedic Surgery

- Cardiovascular Surgery

- Obstetrics & Gynecology

By End-User

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics & Home Care

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting