What is the Electronic Components Market Size?

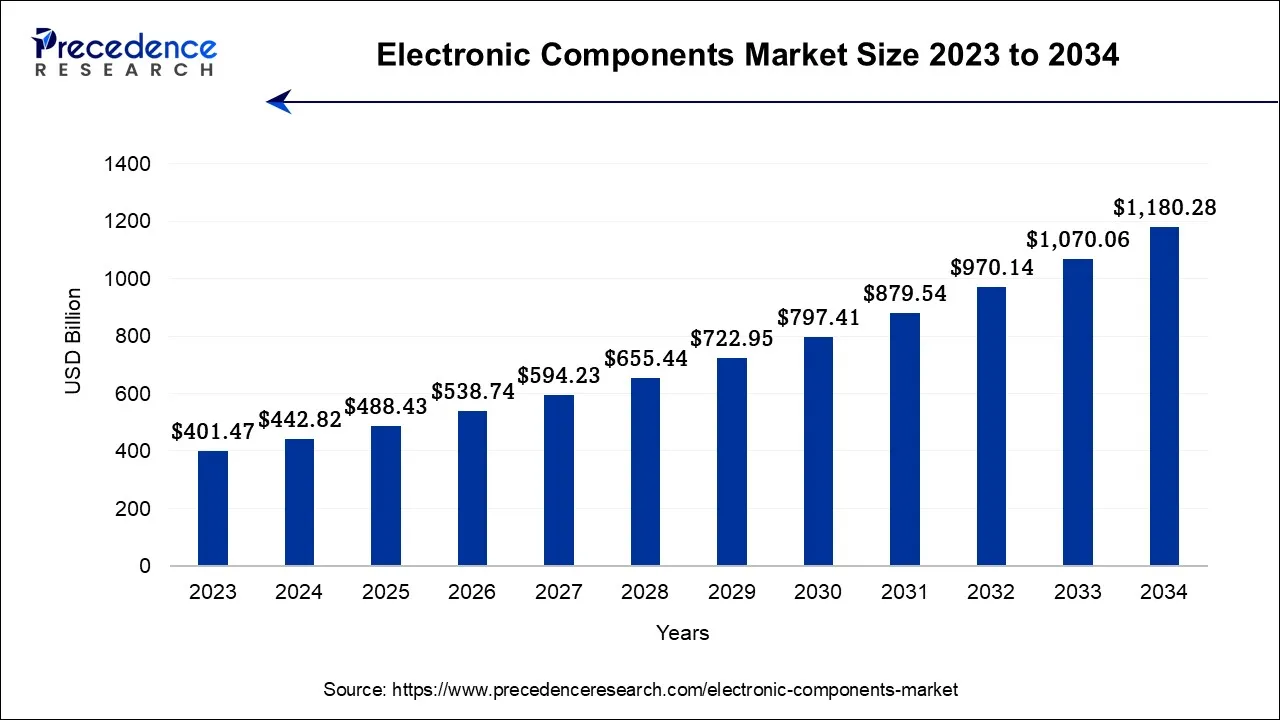

The global electronic components market size is calculated at USD 488.43 billion in 2025 and is predicted to increase from USD 538.74 billion in 2026 to approximately USD 1283.63 billion by 2035, expanding at a CAGR of 10.14% from 2026 to 2035.

Electronic Components Market Key Takeaways

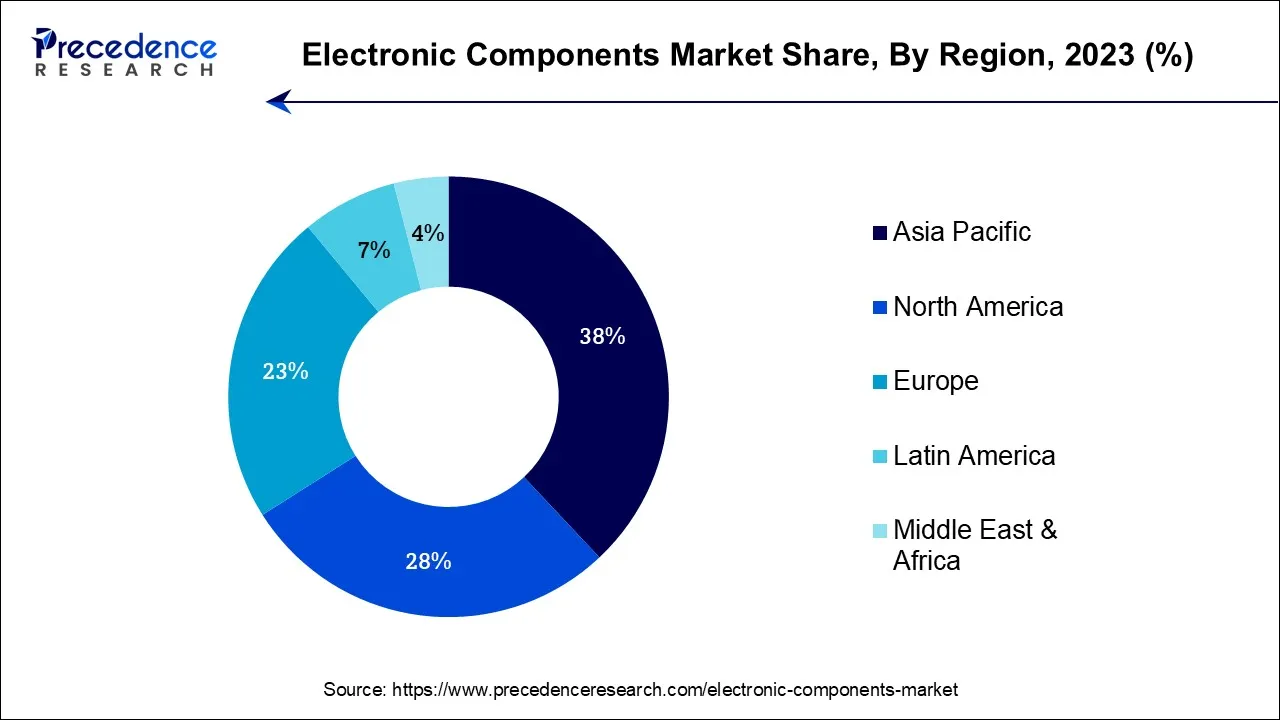

- Asia Pacific is expected to dominate the market from 2026 to 2035.

- By Type, the active segment is expected to capture the largest market share over the forecast period.

- By Application, the automotive segment is expected to grow at the highest CAGR over the forecast period.

Electronic Components: The Building Blocks Powering Modern Technology and Innovation

Electronic components are fundamental elements that make up electronic circuits and devices, playing a crucial role in modern technology. They are the building blocks that enable the manipulation and control of electrical signals, allowing devices to perform a wide range of functions. From simple switches to complex microprocessors, electronic components form the foundation of everything from everyday consumer electronics to advanced industrial systems. The world of electronics revolves around the concept of using various components to create circuits that can process, transmit, and store information in the form of electrical signals.

These signals can represent data, perform calculations, generate sounds, display images, and many other applications. Electronic components can broadly be classified into two main categories which are passive and active components. Passive components do not require an external power source to perform their basic functions. They interact with electrical signals but do not amplify or generate them. Besides, the active components require an external power source to perform their functions. They can amplify, switch or modulate electrical signals.

Electronic Components Market Growth Factors

By 2025, the GSMA predicts that 5G networks will reach 1.2 billion connections or one-third of the world's population. The rising integration of 5G network services across the globe is observed to boost the demand for electronic components. The market growth is being driven by several factors such as increasing demand for consumer electronics, the rollout of 5G networks and the growth of high-speed data communication, advancements in IoT, and increasing industrial automation.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 488.43Billion |

| Market Size in 2026 | USD 538.74 Billion |

| Market Size by 2035 | USD 1283.63 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 10.14% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Type and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Electronic Components Market Dynamics

Driver

Growing demand for robots across the industry

Product manufacturers are implementing robots to automate some of the repetitive procedures due to rising demand across economies. An estimate of the penetration of industrial robots is provided by the Robotic Industries Association, which states that more than 250,000 industrial robots have been installed in the United States alone. Additionally, due to the growing use of smart manufacturing systems, in which these robots play a crucial role, the industrial robotics market has been seeing enormous demand over the past ten years. Every section of the robot receives signals and power to engage its functions through passive and interconnecting electronic components. Therefore, the aforementioned facts drive the market growth during the forecast period.

Restraint

Decrease in the profit margins of manufacturers

Hardware prices are decreasing as a result of advances in device technology, but they are still rising as a result of the ongoing demand for increasingly complex and specialized products. The cost of passive and active components is being directly impacted by product counterfeiting. In addition, the prices of interconnects and passive components have decreased as a result of the fierce rivalry between players from different locations. The price of developing new products or goods driven by cutting-edge technology is negatively impacted by this. Therefore, this is expected to hamper the market growth during the forecast period.

Opportunity

Increasing adoption in the automotive sector

The transition to lane-keeping and adaptive cruise control as Advanced Driver Assistance Systems (ADAS) and higher levels of vehicle autonomy are increasing demand for interconnects and passive components. More passives are required by infotainment systems as well. The need for passive components will also rise as more vehicles move to hybrid and eventually entirely electronic powertrains. As well as advanced ECUs, regenerative braking, and battery-charging techniques, hybrid cars require sophisticated ECUs to regulate the changeover between electric and internal combustion engine (ICE) driving.

The difficulty of operating a hybrid powertrain is replaced in fully electric cars by the struggle to get a predictable range, quick charging, and adequate performance out of still-evolving battery technology. To handle the flow of enormous amounts of electrical energy, all of this necessitates sophisticated sensing, reliable communications, and substantial usage of power electronics devices and their accompanying circuitry. Thus, this is expected to offer a potential opportunity for market growth during the forecast period.

Segment Insights

Type Insights

Based on the type, the global electronic components market is segmented into active, passive and electro-mechanic. The active segment is expected to capture the largest market share over the forecast period. The segment growth is attributed to the increasing application of active components in various industries including consumer electronics, automotive, telecommunication, industrial automation and others. Moreover, the growing product launches are expected to propel the market growth. For instance, in January 2023, Renesas unveiled a new intelligent power device (IPD) for automobiles that manage power distribution in cars flexibly and safely to satisfy the demands of the next E/E (electrical/electronic) designs. Thus, this is expected to drive market growth during the forecast period.

Application Insights

Based on the application, the global electronic components market is segmented into automotive, communication, computing, industrial and others. The automotive segment is expected to grow at the highest CAGR over the forecast period. To attract customers, automakers all over the world concentrate on incorporating different electronics and technologies.

The market for automobile electrical components has been significantly impacted by the rising demand for premium and ultra-luxury automobiles. The usage of electronic components in automobiles has expanded recently due to the rising reliance of these cars on safety systems and other electronic components. It is common practice to employ electronic components to improve the performance and efficiency of powertrain systems. These parts provide communication between the powertrain systems of a car and allow sensor signals to be exchanged, all while controlling the systems' functions. Sensors for throttle position, transmission fluid temperature, and turbine speed are all utilized in powertrain systems.

On the other hand, the communication segment is expected to capture a significant market share over the forecast period. The use of electronic components in the telecommunications sector is anticipated to increase throughout the projected period due to technological advances such as the transition from 4G to Voice over Long-Term Evolution (LTE/4G) and 5G. Network equipment, remote controllers, mobile phones, landlines, set-top boxes, and base stations are a few examples of telecommunication applications. Moreover, the telecom industry is using more and more electronic components as a result of the smartphone industry's notable expansion and the mobile handset market's subsequent rise. Thus, these factors are anticipated to drive the market over the forecast period.

Regional Insights

What is the Asia Pacific Electronic Components Market Size?

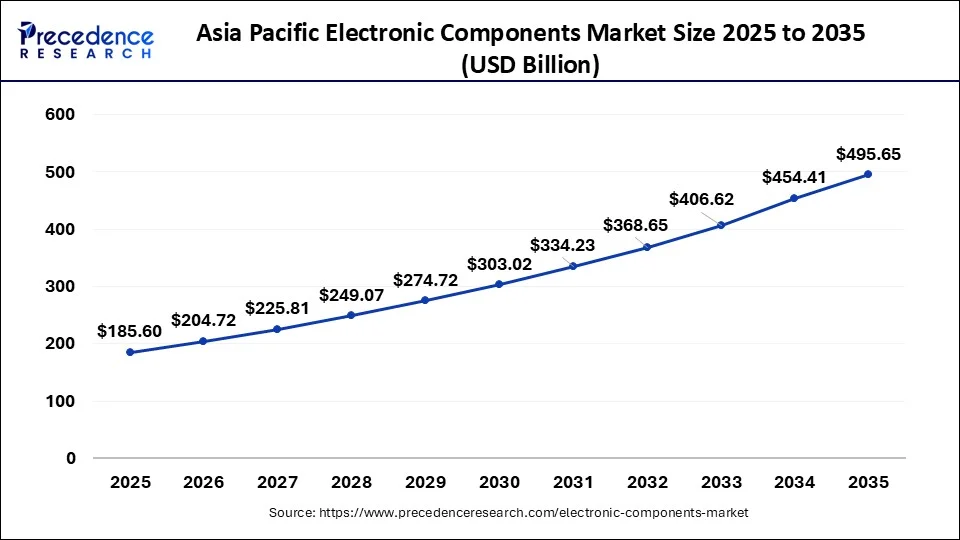

The Asia Pacific electronic components market size is accounted for USD 185.60 billion in 2025 and is projected to be worth around USD 495.65 billion by 2035, poised to grow at a CAGR of 10.32% from 2026 to 2035.

Asia Pacific is expected to dominate the market over the forecast period.This is due to labor being inexpensiveness, raw materials being easily accessible, and production costs being low in this area. Moreover, the market for passive and interconnecting electronic components has been steadily expanding due to the strong demand for consumer electronics made in Asia Pacific, particularly in China and India. The country has seen a sharp increase in demand for computers, as well as other electronic devices like mobile phones, LED displays, and multipurpose processors, due to growing income levels and improving living standards.

Moreover, there is a growing international market for low-cost consumer electronics made in China. The Chinese government has consistently supported research and development (R&D) endeavors and encouraged the establishment of industrial parks in Chinese cities to facilitate the manufacture of electronic components. Additionally, the Indian government is offering several incentives to enterprises that spend $400 million within the projected term. Thus, this is expected to drive the market growth in the region.

India Electronic Components Market Analysis

India's market is expanding rapidly due to rising demand for consumer electronics, smartphones, automotive electronics, and industrial automation. Government initiatives promoting local manufacturing, such as “Make in India” and semiconductor policies, along with increasing foreign investments, a growing skilled workforce, and expanding domestic supply chains, are driving market growth and strengthening India's position in the global electronics industry.

What Drives the Market in North America?

North America has a substantial electronic components market, driven by its advanced technological infrastructure and strong presence in industries such as automotive, consumer electronics, aerospace, telecommunications, and healthcare. The demand for smartphones, tablets, laptops, wearables, and other consumer electronic devices drives the need for various electronic components like microprocessors, sensors, displays, and memory chips. Moreover, Leadingsemiconductor and electronic component manufacturers, including Intel, Texas Instruments, Qualcomm, Broadcom, and NVIDIA, have a significant presence in North America. Many startups and smaller companies are also active in designing and producing electronic components. Therefore, the aforementioned statements are expected to propel the market growth during the forecast period.

U.S. Electronic Components Market Analysis

The U.S. market is growing due to increasing demand for consumer electronics, automotive electronics, and industrial automation. Rapid adoption of advanced technologies like IoT, AI, and 5G, coupled with strong semiconductor manufacturing capabilities and high R&D investment, drives innovation and expansion, supporting the country's leadership in the market.

Europe: A Significant Region

Europe is considered a significant region in the electronic components market due to the increasing adoption of advanced technologies such as electric vehicles, industrial automation, and IoT devices. Strong focus on innovation, supportive government policies, and investments in semiconductor manufacturing and research contribute to market expansion. Additionally, rising demand for high-performance consumer electronics and renewable energy systems drives growth across the region.

UK Electronic Components Market Analysis

The UK's electronic components market is growing significantly due to rising demand for consumer electronics, electric vehicles, and industrial automation solutions. Government support for technology innovation, increasing investments in semiconductor manufacturing, and adoption of advanced technologies like IoT and 5G further drive growth. Expansion of smart infrastructure and digitalization initiatives also boosts market development.

Latin America Electronic Components Market: Supply Chain Shifts and Demand Dynamics

Latin America's market shows notable growth during the forecast period. It is driven by the expansion through urban adoption along with public infrastructure projects, but faces macroeconomic volatility, such as currency and political risk. Brazil is the primary market; others present opportunistic expansion. Regulatory regimes vary; import duties along with complex taxes can inflate landed costs.

Argentina Electronic Components Market Trends

Argentina's market is driven by increasing consumer need for smart devices, wearable technology, and home automation products. Rapid urbanization and growing disposable incomes have expanded the customer base for electronic gadgets, boosting component demand.

MEA Electronic Components Market: Technology Adoption and Regional Trends

MEA's market shows rapid growth during the forecast period. It is driven by the rise of 5G infrastructure deployment, Internet of Things applications, and electric vehicle adoption, which has driven producers to innovate new product designs. It aims for higher efficiency, miniaturization, and improved durability to meet harsher environmental conditions prevalent in various parts of the MEA region.

Oman Electronic Components Market Trends

Oman's market is driven by the decreased reliance on oil, which is driving investment in mining, fisheries, manufacturing, and tourism, supported by enhanced credit ratings and foreign investment incentives. Significant investments in facilities, at Muscat International Airport and logistics free zones, are driving efficiency and regional connectivity.

The UAE Electronic Components Market Trends

The UAE electronic components market is experiencing robust growth, driven by the expanding demand for advanced electronics in sectors such as consumer electronics, telecommunications, automotive, and industrial automation. With the rise of smart cities, IoT (Internet of Things), and AI-driven technologies, there is an increasing demand for semiconductors, sensors, circuit boards, and power electronics.

Value Chain Analysis for the Electronic Components Market

- Raw Material Procurement:It focused on acquiring essential inputs, like silicon, copper, rare earth elements, and even specialized chemicals, required for manufacturing semiconductors, printed circuit boards, along with passive components.

Key Players: Henkel AG & Co. KGaA, DuPont de Nemours, Inc., Heraeus Materials Technology GmbH - Wafer Fabrication:It includes hundreds of steps over several months, including photolithography, deposition, along with etching, to build up complex electrical structures in layers.

Key Players: Applied Materials, Lam Research, Tokyo Electron, KLA Corporation - Photolithography and Etching:These are the fundamental, sequential processes in the electronics components market utilized to transfer intricate, microscopic, and nanoscopic circuit designs onto semiconductor substrates such as silicon wafers to create microprocessors, integrated circuits (ICs), and MEMS devices.

Key Players: Canon Inc., SMEE, EV Group, SÜSS MicroTec SE

Electronic Components Market Companies

- STMicroelectronics: Provides microcontrollers, sensors, power management ICs, and analog and digital semiconductor solutions for automotive, industrial, and consumer electronics applications.

- Murata: Offers capacitors, sensors, wireless modules, and electronic components for mobile devices, automotive systems, and industrial applications.

- Amphenol: Supplies interconnect solutions, connectors, sensors, and cable assemblies for automotive, aerospace, and industrial electronics markets.

- Texas Instruments: Delivers analog and embedded processing semiconductors, microcontrollers, and sensors for industrial, automotive, and consumer electronics.

- NXP Semiconductors: Provides microcontrollers, connectivity solutions, sensors, and secure ICs for automotive, IoT, and industrial applications.

- Kyocera: Offers electronic components, including capacitors, resistors, connectors, and communication modules for automotive, industrial, and consumer electronics.

- Omron: Supplies sensors, switches, relays, and automation components for industrial, automotive, and healthcare electronic systems.

Other Major Key Playes

- ABB

- ON Semiconductor

- Infineon Technologies

- TDK Corporation

- Samsung Electro-Mechanics

- Analog Devices, Inc.

Recent Developments

- In February 2024, Murata expanded its lineup of high-Q monolithic ceramic chip capacitors (MLCC) with the GJM022 series, featuring 100 V ratings for high-frequency applications like cellular communication modules.

(Source: murata.com ) - In January 2024, Panasonic Industrial Automation partnered with Mouser Electronics for global distribution of its advanced sensors, programmable controllers, human-machine interfaces, servo motors, and industrial automation solutions.

(Source: iiotnewshub.com ) - In June 2023, ZF began producing Advanced Driver Assist Systems (ADAS) technology at its electronics factory in Monterrey, Nuevo Leon, and extended its manufacture of these technologies. This is ZF's first manufacturing project in the state of Nuevo Leon, and it employs 120 people. Its primary concentration is on producing cutting-edge electronic parts for passenger cars, which contributes to increased occupant safety. With a 100-degree horizontal field of vision and a 1.8-megapixel image sensor, the Smart Camera 4.8 is the first monocular camera that allows for features like Automatic Emergency Braking (AEB), Adaptive Cruise Control (ACC), and Lane Keeping Assist (LKA). The company started producing these cameras in large quantities.

- In March 2023, a global challenge to engineers and innovators worldwide to build the next big thing, the 21st Create the Future Build Contest is being sponsored by Mouser Electronics, Inc., the New Product Introduction (NPI) leaderTM enabling innovation. Reiterating their 10-year sponsorship of the tournament, esteemed manufacturers Intel and Analog Devices, Inc. join Mouser as co-sponsors. SAE Media Group, an SAE International Company, is in charge of producing the competition. The contest's primary sponsor is COMSOL as well.

- In May 2023, an upgrade to Sourcengine's Application Program Interface (API) has been released by Sourceability, a worldwide distributor of electrical components, under the name SourcengineTM Order API. The cutting-edge solution makes it possible for material requirement planning (MRP) and enterprise resource planning (ERP) divisions to contact thousands of suppliers worldwide and expedite the procurement process. Developed for mid-sized manufacturers using ERP/MRP systems, the API enables companies to find, price, and buy electronic components without having to leave their internal systems, saving time spent monitoring vendors and procurement lists. In contrast to its rivals, Sourcengine's API is not constrained by the amount of stock it can hold. The marketplace is dependent on the alliances the business has built with more than 3,500 suppliers globally.

Segments Covered in the Report

By Type

- Active

- Passive

- Electro Mechanic

By Application

- Automotive

- Communication

- Computing

- Industrial

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting