What is the AAV Gene Therapy Market Size?

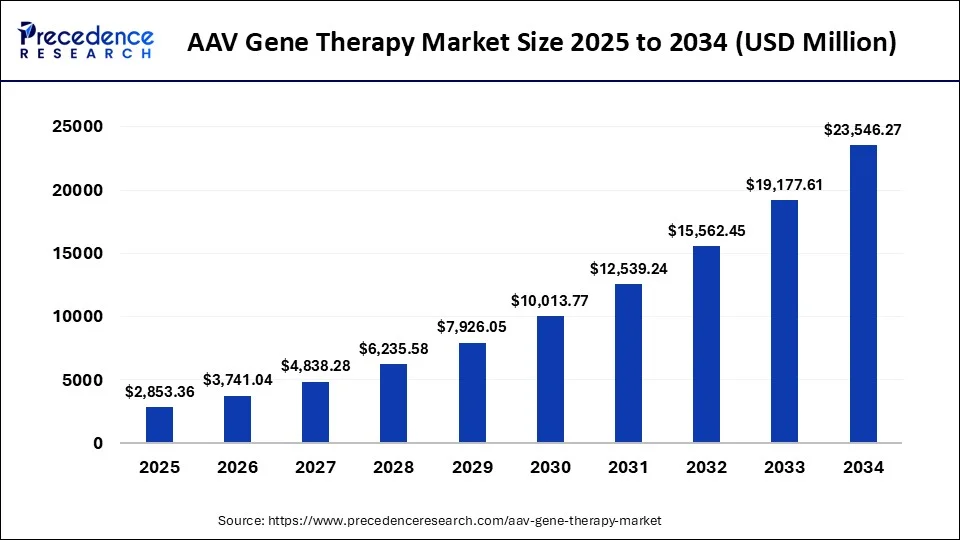

The global AAV gene therapy market size is valued at USD 2,853.36 million in 2025 and is predicted to increase from USD 3,741.04 million in 2026 to approximately USD 23,546.27 million by 2034, expanding at a CAGR of 26.43% from 2025 to 2034. The market is driven by rising approvals, expanding therapeutic applications, and increasing investments in advanced genetic treatment innovations.

AAV Gene Therapy Market Key Takeaways

- North America dominated the global AAV gene therapy market with the largest market share of 42.19% in 2024.

- Asia Pacific is estimated to expand at the fastest CAGR between 2025 and 2034.

- By therapeutic area, the neurological disorders segment captured the biggest market share of 29.4% in 2024.

- By therapeutic area, the muscular disorders segment is anticipated to grow at the fastest CAGR between 2025 and 2034.

- By vector serotype, the AAV9 segment contributed the highest market share of 27.60% in 2024.

- By vector serotype, the engineered/synthetic/hybrid capsids segment is expected to expand at a notable CAGR over the projected period.

- By route of administration, the intravenous (I.V.) segment held the maximum market share of 36.80% in 2024.

- By route of administration, the intrathecal (I.T.) segment is expected to expand at a notable CAGR over the projected period.

- By application stage, the clinical therapies segment captured the biggest market share of 48.7% of the market share in 2024.

- By the application stage, the commercialized therapies segment is expected to expand at a notable CAGR over the projected period.

- By manufacturing type, the in-house manufacturing segment accounted or the significant market share of 54.1 in 2024.

- By manufacturing type, the CDMOs / vector production facilities segment is expected to expand at a notable CAGR over the projected period.

- By end-user, the pharmaceutical & biotechnology companies segment generated the major market share of 52.8% in 2024.

- By end-user, the contract research organizations (CROs) segment is expected to expand at a notable CAGR over the projected period.

Market Size and Forecast

- Market Size in 2026: USD3,741.04 Million

- Market Size in 2025: USD 2,853.36 Million

- Forecasted Market Size by 2034: USD 23,546.27 Million

- CAGR (2025-2034): 26.43%

- Largest Market in 2024: North America

Market Overview

The AAV gene therapy market is based on treatments that utilize an adeno-associated virus vector to transfer a corrective gene into the patient's cells. These vectors are attractive tools for gene therapy because they are not disease-causing, provide stable expression of the gene, and can be used for a variety of genetic diseases. The market includes all aspects of the design of the vector, clinical development, and commercialization of therapies aimed at both rare and chronic diseases. With its expanded use in neurology, ophthalmology, and metabolic diseases, AAV gene therapy is one of the transformative areas of modern health care and biotechnology.

AI Transforming AAV Gene Therapy: Faster Design and Actual Risks

Advances in artificial intelligence are advancing AAV vector engineering since it predicts capsid fitness and reduces all the trial-and-error in the lab, causing selection of candidates to happen much quicker than through conventional methods. In response, industry participants are creating end-to-end AI tool chains. On October 24, 2024, Roche and Dyno Therapeutics launched a collaboration worth over US$1 billion to develop next-generation AAV vectors using AI-based capsid engineering for neurological gene therapies. (Source: https://www.businesswire.com)

- However, high-profile negative events remind the developers that enhanced design tools and more predictions are needed with various attentions to clinical monitoring recent observations about negative outcomes in AAV gene therapy highlight how the design in AAV gene therapy needs careful validation.

AAV Gene Therapy MarketGrowth Factors

- Expanding Product Pipeline: The significant increase in clinical trials and investigational products indicates strong pipeline growth. This growth is driving innovation with many products in the pipeline that are progressing toward regulatory approval and market availability.

- Advancements of Vector Engineering:Modern advances with AAV vectors will improve tissue specificity, increase gene transfer efficiency, and provide longer-lasting expression. These advances will help address the prior limitations of AAV vectors and can extend the therapeutic indications to other genetic and acquired conditions.

- Increasing Regulatory Approvals: Increasing regulatory approval, combined with favorable regulatory pathways or expedited designations, will lead to accelerated patient access to the AAV gene therapy market. Increased patient access to the market can also enhance investor confidence in AAV Gene Modifications by providing access to the market in a shorter time frame.

- Increasing Strategic Collaborations: Partnerships between biotech, pharmaceutical, and academic institutions will facilitate the discussion of knowledge, funding, and infrastructure. These partnerships will lead to global-oriented strategies for large-scale research, manufacturing, and commercialization.

Market Scope

| Report Coverage | Details |

| Market Size in 2026 | USD 3,741.04 Million |

| Market Size in 2025 | USD 2,853.36 Million |

| Market Size by 2034 | USD 23,546.27 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 26.43% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Therapeutic Area/Disease Indication, Vector Serotype, Route of Administration, Application Stage, Manufacturing Type, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

What is causing the growth of global AAV gene therapy?

The recent wave of regulatory approvals for AAV-based therapies for new (previously untreatable) rare and neurological diseases is perhaps the largest driving force, particularly when direct gene delivery to the central nervous system (CNS) is required. For example, in November 2024, the U.S. FDA approved Kebilidi (eladocagene exuparvovec-tneq), the first AAV gene therapy delivered directly into the brain, for the treatment of aromatic L-amino acid decarboxylase (AADC) deficiency. (Source: https://www.fda.gov)

- Similarly, Beqvez (fidanacogene elaparvovec) was approved in April 2024 in the U.S. and EU for hemophilia B. (Source: https://www.pfizer.com)

Restraint

What is the primary restraint delaying the universal use of AAV gene therapy?

One of the most critical limiting factors for AAV-based therapies is immunogenicity – the body's immune response neutralizes or attacks the vector, so it is less safe and efficacious, and building a population-screening barrier for patients in clinical trials. Recent studies demonstrate that many people will have neutralizing antibodies against the most common AAV serotypes (e.g., AAV1, AAV2) that will preclude them from clinical trial participation. However, immunogenicity often negates or complicates repeated dosing, necessitates large vector doses (with associated adverse event risk), and limits AAV therapy to a subset of patient populations that have little chance of expanding globally.

Opportunity

Can hereditary retinal diseases (HRDs) be the opportunity for broader AAV gene therapy success?

A combination of scientific fit, regulatory momentum, and the sheer volume of candidates in the pipeline for rare eye diseases, hereditary retinal diseases are an emerging and robust opportunity for AAV gene therapies. The eye is relatively immune-privileged, so vector delivery will have more benign side effects, and many retinal genetic syndromes can be attributed to single-gene mutations. As a case in point, in early 2025, MeiraGTx began a Phase 1 dose-escalation trial of an AAV5-hRKp.RPGR vector for X-linked retinitis pigmentosa (XLRP). The pipeline also includes AAV-CNGA3 (for achromatopsia) and the development of therapies for many other HRDs that have received Rare Pediatric Disease or Orphan Drug designations. (Source: https://www.clinicaltrials.gov)

Segment Insights

Therapeutic Area Insight

Which therapeutic area has a higher share of the AAV gene therapy market?

Neurological disorders are the current leading area for AAV gene therapy, fueled by the increasing incidence of diseases such as spinal muscular atrophy and Parkinson's disease. AAV's unique ability to cross the blood-brain barrier and thereby allow for targeted delivery to the CNS bolsters its use for some of the hardest-to-treat neurological diseases, as well as sustained therapeutic corrections.

Muscular disorders are emerging as the fasted growing area, driven by the influx of therapies for conditions such as Duchenne muscular dystrophy. The increase in initial clinical trials, FDA designations, and novel vector delivery methods is fostering momentum and adoption, demonstrating strong growth potential for muscle-targeted AAV gene therapy advancements.

Vector Serotype Insights

Why is AAV9 leading in the AAV gene therapy market?

The leading position of AAV9 in the segment is driven by its established track record to cross the blood–brain barrier, enabling systemic and CNS-targeted delivery. Moreover, the approved clinical applications and successful treatments of rare neurological diseases provide justification for AAV9's dominance in the new generation of AAV-based therapeutics.

The category of engineered and hybrid capsids is projected to grow the fastest as they help overcome important limitations of the natural serotypes, including immune responses and tissue specificity. Their engineered capabilities allow for enhanced safety, higher transduction efficiency, and a targeted approach to AAV gene delivery and therapy, which are all additional justifications for this class of AAV gene delivery innovation.

Route of Administration Insights

Which route of administration has a larger share of the AAV gene therapy market?

The intravenous route remains dominant since it can provide systemic distribution of AAV vectors, so it is ideally suited for when gene delivery to a large area of the body is warranted. Its clinical applications are growing, and it is often cited for ease of administration across a number of therapeutic areas, such as muscular and metabolic disorders.

There is a rapidly evolving interest in intrathecal delivery because it circumvents systemic circulation and enables direct delivery to the central nervous system. Overall, intravenous delivery presents the potential to reduce the AAV vector dose, enhance safety, and bolster efficacy for neurological disorders, including spinal muscular atrophy, Huntington's disease.

Application Stage Insights

Which application stage dominates the AAV gene therapy market in 2024?

Clinical therapies are the main segment, as many AAV-based therapies are currently being studied clinically. Increased trial pipelines in neurological, muscular, andocular conditions indicate the dominance of this stage while demonstrating healthy investment in gene therapy from the industry and regulatory momentum in the development of gene therapy.

Commercialized therapies are expected to be the fastest-growing segment as more AAV-based therapies transition from clinical status to market approval. The continued global approval of gene therapy and greater access for patients around rare and life-threatening conditions are leading to faster utilization and growing the commercial segment more rapidly.

Manufacturing Type Insights

Which manufacturing dominates the AAV gene therapy market in 2024?

In-house manufacturing is the predominant production model among larger pharmaceutical and biotechnology firms, which seek complete control over all AAV vector manufacturing steps, from design through production, to manage quality and reliability in support of proprietary processes. This also creates an opportunity for rapid scaling of clinical programs and offers uniqueness and tailored processing for particular therapeutic use.

Contract Development and Manufacturing Organizations (CDMOs) are growing the fastest in the AAV manufacturing market, supported by a rise in outsourcing to CDMO companies by small and mid-size biotechnology companies. With limited in-house AAV capacity, the need for advanced capabilities and cost-effectiveness drives biopharmaceutical manufacturers to rely heavily on specialized CDMOs for their AAV vector design and manufacturing.

End-User Insights

Why are pharmaceutical and biotechnology companies leading the AAV gene therapy market?

Pharmaceutical and biotechnology companies are the leading developers of AAV-based therapies, driving innovation alongside research and commercialization. Their ability to invest, create partnerships, and interact with legislation will be vital in developing AAV gene therapy across a range of therapeutic areas.

Contract Research Organizations, or CROs, are forecast to grow fastest with the increasing outsourcing of preclinical and clinical studies. CROs offer expertise, infrastructure, and efficiency, allowing biotech companies and emerging companies the resources and opportunity to shorten the time to market while conserving assets on preclinical discovery through commercialization.

Regional Insights

North America dominated the global AAV gene therapy market, holding the largest market share of 42.19% in 2024. The strong position North America's strong has is due to its robust clinical pipelines, large and overlapping biotech clusters, and superior manufacturing capacity for vectors that reduce translational friction. The region boasts an experienced base for clinical trials, frequent engagement between regulators and the industry, and numerous translational funding sources, which collectively reduce the time required for investigational new drug (IND) filings and pivotal studies for AAV candidates. Recent peer-review summaries and regulatory reports highlight multiple FDA-cleared AAV programs and pivotal trials that continue to concentrate in U.S. centers of excellence, providing a structural advantage for proof of concept in AAV candidates and reducing the risk for later-stage investment.

The U.S. concentrates specialized clinical sites, experienced principal investigators, and contract, academic, and synergy organizations capable of AAV good manufacturing practices (GMP) production, and permitting cohort expansion and bridging studies to occur more rapidly. Ongoing AAV trial registrations at U.S. sites and more recent FDA reviews demonstrate active pipelines in neurology, ophthalmology, and hemophilia, with sponsor engagement using U.S. regulatory precedent to build global registrational programs for AAV in neurology, ophthalmology, and hemophilia.

How is Asia Pacific becoming the fastest-growing hub for the AAV gene therapy market?

The factors supporting Asia-Pacific growth are strong improvements in clinical-trial infrastructure, growing levels of local research and development (R&D) investment, and modernization of regulations that ease time and cost burdens for clinical trials. Several Asia-Pacific markets have increased manufacturing capacity for vectors and incentivized local sponsorship with expedited investigational new drug (IND) pathways and increased local trial approvals; this creates an appealing area for global developers to partner and/or to launch.

China is clearly differentiating itself at scale: increasing local funding for biotech, rapid growth in the number and types of AAV clinical trials, and significant local contract manufacturing organizations (CMOs) developing good manufacturing practice (GMP) capacity for AAV products. The combination of regulatory reforms and pilot trial pathways for advanced therapies places early-phase trials on accelerated timelines, and increasingly sophisticated clinical centers are standing up complex AAV protocols in CNS and ophthalmic indications.

Value Chain Analysis

- Research and Development: R&D is the foundation and includes genetic engineering, AAV vector design, and preclinical studies. There is a strong focus on innovation, safety, and effectiveness to address areas of unmet medical need.

- Vector Manufacturing: This part of the process consists of manufacturing large quantities of high-quality viral vectors. Significant quality assurance, scalable production, and adherence to regulatory guidelines are vital to provide reliable and consistent therapeutic output.

- Clinical Trials: Rigorous multi-phase clinical trials evaluate the safety and effectiveness of the therapy. Coordinated efforts among research institutes, pharmaceutical companies, and regulatory agencies assist the therapy as it progresses to patient access.

- Regulatory Approvals: The therapy undergoes strict regulatory scrutiny to achieve marketing authorisation. Adherence to guidelines of safety, ethics, and effectiveness assists in receiving approval from regulators like the FDA, EMA, or other national regulatory agencies.

- End Users (Hospitals and Clinics): Hospitals, specialty clinics, and research hospitals provide the therapy to patients. Sufficiently trained healthcare professionals, adequate infrastructure, and patient support programs are critical to ensure systematic therapy use.

AAV Gene Therapy Market Companies

- Advanced Energy Industries, Inc.

- MKS Instruments, Inc.

- Samco Inc.

- PVA TePla AG

- Axcelis Technologies, Inc.

- Lam Research Corporation

- ULVAC, Inc.

- Plasma Etch, Inc.

- PIE Scientific LLC

- Tokyo Electron Limited (TEL)

- Trion Technology, Inc.

- Diener Electronic GmbH and Co. KG

- Nordson MARCH

- Veeco Instruments Inc.

Recent Developments

- In April 2025, the U.S. Pharmacopeia (USP) launched a package of reference standards, materials, and other resources to provide a clear understanding for developers and manufacturers of AAV-based gene therapies. Fouad Atouf, Ph.D., Senior Vice President of Global Biologics for USP, stated, “Innovative AAV-based therapies are approved and in development for many therapeutic categories, including previously untreatable genetic and rare diseases.”

(Source: https://www.usp.org) - In September 2024, Asimov, the synthetic biology company advancing the design and production of therapeutics, launched the AAV Edge System, an inclusive group of tools for adeno-associated viral (AAV) gene therapy design and manufacturing.(Source: https://www.asimov.com)

Segments Covered in the Report

By Therapeutic Area/Disease Indication

- Neurological Disorders

- Spinal Muscular Atrophy (SMA) (e.g., Zolgensma)

- Parkinson's Disease

- Alzheimer's Disease

- Rett Syndrome

- Amyotrophic Lateral Sclerosis (ALS)

- Canavan Disease

- Aromatic L-amino acid decarboxylase (AADC) Deficiency

- Huntington's Disease

- Friedreich's Ataxia

- Ophthalmic Disorders

- Leber Congenital Amaurosis (LCA) (e.g., Luxturna)

- Retinitis Pigmentosa

- Wet Age-related Macular Degeneration (AMD)

- Stargardt Disease

- Choroideremia

- Hematologic Disorders

- Hemophilia A (e.g., Roctavian)

- Hemophilia B (e.g., Hemgenix)

- Thalassemia

- Sickle Cell Disease

- Muscular Disorders

- Duchenne Muscular Dystrophy (DMD) (e.g., Elevidys)

- Limb-Girdle Muscular Dystrophy (LGMD)

- Metabolic Disorders

- Alpha-1 Antitrypsin Deficiency

- Phenylketonuria (PKU)

- Glycogen Storage Diseases

- Hereditary Lipoprotein Lipase Deficiency (LPLD) (e.g., Glybera - though withdrawn)

- Rare Genetic Disorders (Other)

- Mucopolysaccharidosis (MPS)

- Batten Disease

- Cystic Fibrosis

- Sanfilippo Syndrome

- Oncology/Cancer

- Various cancer types where AAVs are used for targeted delivery of anti-cancer genes.

- Cardiovascular Diseases

By Vector Serotype

- AAV1

- AAV2

- AAV3

- AAV4

- AAV5

- AAV6

- AAV7

- AAV8

- AAV9

- AAV10

- AAV11

- AAV12

- Engineered/Synthetic/Hybrid Capsids

By Route of Administration

- Intravenous (I.V.)

- Intrathecal (I.T.) (for CNS delivery)

- Intraocular (I.O.) (e.g., intravitreal, subretinal)

- Intramuscular (I.M.)

- Intracerebral

- Subcutaneous

- Local/Direct Injection (e.g., into specific organs)

By Application Stage

- Preclinical Therapies

- Clinical Therapies

- Phase I

- Phase II

- Phase III

- Commercialized Therapies

By Manufacturing Type

- In-house Manufacturing

- CDMOs/Vector Production Facilities

By End-User

- Pharmaceutical and Biotechnology Companies

- Academic and Research Institutes

- Contract Research Organizations (CROs)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting