Adhesives Dispersions Market Size and Forecast 2025 to 2034

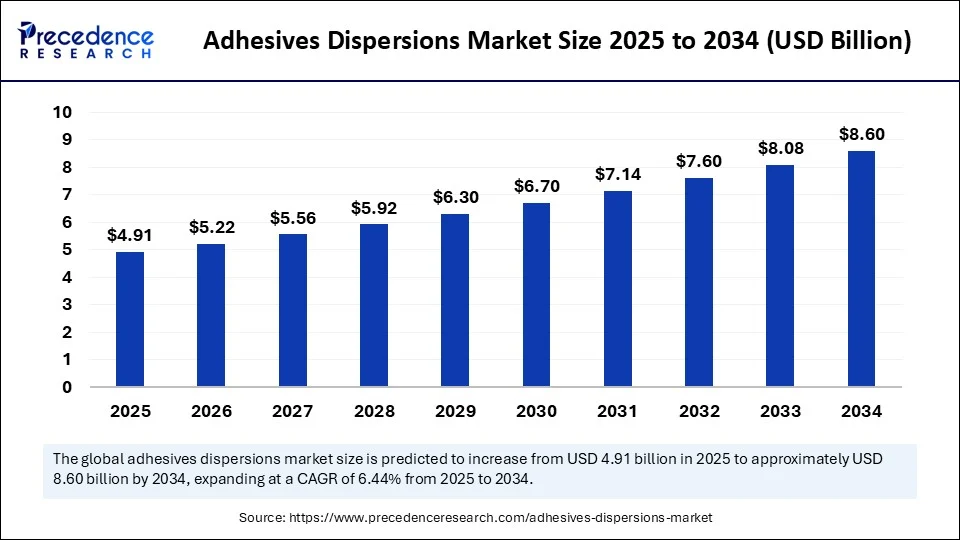

The global adhesives dispersions market size was calculated at USD 4.61 billion in 2024 and is predicted to increase from USD 4.91 billion in 2025 to approximately USD 8.60 billion by 2034, expanding at a CAGR of 6.44% from 2025 to 2034. The market is growing due to rising demand for eco-friendly, water-based bonding solutions across the packaging, automotive, construction, and textile industries.

Adhesives Dispersions Market Key Takeaways

- In terms of revenue, the global adhesives dispersions market was valued at USD 4.61 billion in 2024.

- It is projected to reach USD 8.60 billion by 2034.

- The market is expected to grow at a CAGR of 6.44% from 2025 to 2034.

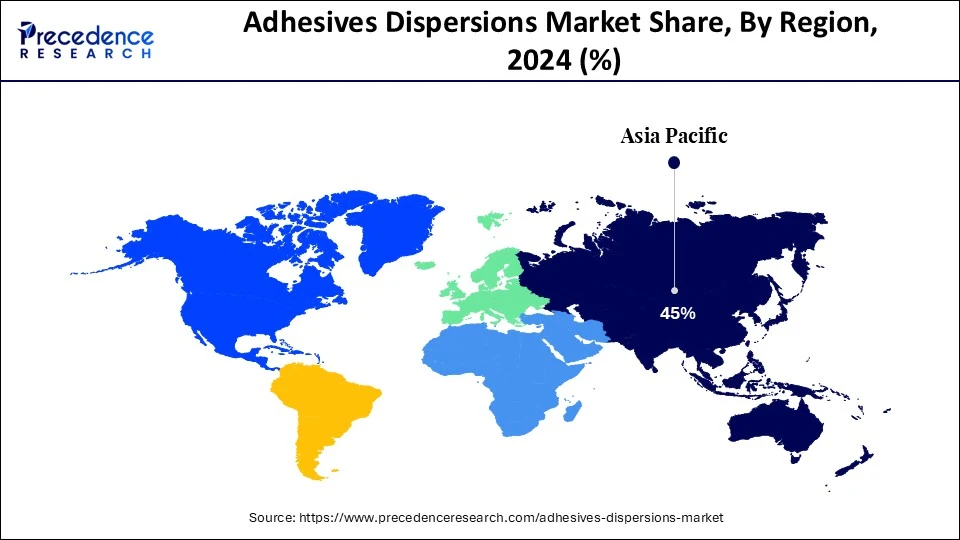

- Asia Pacific dominated the market by holding the largest market share of 45% in 2024.

- North America is expected to grow at the fastest rate during the forecast period in the adhesives dispersions market.

- By polymer/chemistry, the acrylic dispersions segment held the largest share of the market at 40% in 2024.

- By polymer/chemistry, the polyurethane dispersions (PUD/hybrids) segment is expected to grow at the fastest rate during the forecast period.

- By product form/technology, the water-borne dispersions/emulsion adhesives segment held the largest market share at 70% in 2024.

- By product form/technology, the reactive dispersions segment is projected to grow at the fastest rate in the adhesives dispersions market.

- By functionality/type of adhesive, the non-structural/general-purpose dispersions segment contributed the largest market share of 45% in 2024.

- By functionality/type, the pressure-sensitive adhesive (PSA) dispersions segment is emerging as the fastest-growing.

- By application, the packaging and paperboard segment accounted for the highest market share of 30% in 2024.

- By application, the hygiene & nonwovens segment is expected to grow at the fastest rate during the forecast period.

- By end-user industry, packaging and converting segment generated the biggest market share of 35% in 2024.

- By end-user industry, the healthcare & hygiene segment and the automotive segment are both expected to grow at the fastest rate during the forecast period.

- By distribution channel, the direct sales segment contributed the major market share of 55% in 2024.

- By distribution channel, the distributors & chemical wholesalers segment is the fastest-growing segment.

What Has Been the Impact of AI on the Adhesives Dispersions Market?

The adhesives dispersions market has been impacted significantly by artificial intelligence (AI), which improves production efficiency, quality assurance, and product development. By simulating and optimizing adhesive formulations for particular performance requirements, manufacturers can reduce trial-and-error in research and development thanks to AI-powered predictive analytics. Real-time production line monitoring by machine learning algorithms can detect process deviations and guarantee constant viscosity, bonding strength, and curing times. Businesses can reduce expenses and waste by optimizing the procurement of raw materials with the aid of AI-driven demand forecasting. AI is also enhancing sustainability by locating environmentally friendly substitutes for raw materials and streamlining production procedures to reduce emissions and energy use. This technological integration allows for more specialized high-performance adhesive dispersion solutions for sectors like packaging, automotive, and healthcare, and accelerates innovation cycles.

- On 12 June 2024, Henkel announced the use of AI-driven formulation optimization to accelerate adhesive and sealant product development.

(Source: https://globalchemicalnews.com) - On 21 March 2024, 3M announced AI integration into supply chain operations for better demand forecasting in adhesives.

(Source: https://globalchemicalnews.com)

Asia Pacific Adhesives Dispersions Market Size and Growth 2025 to 2034

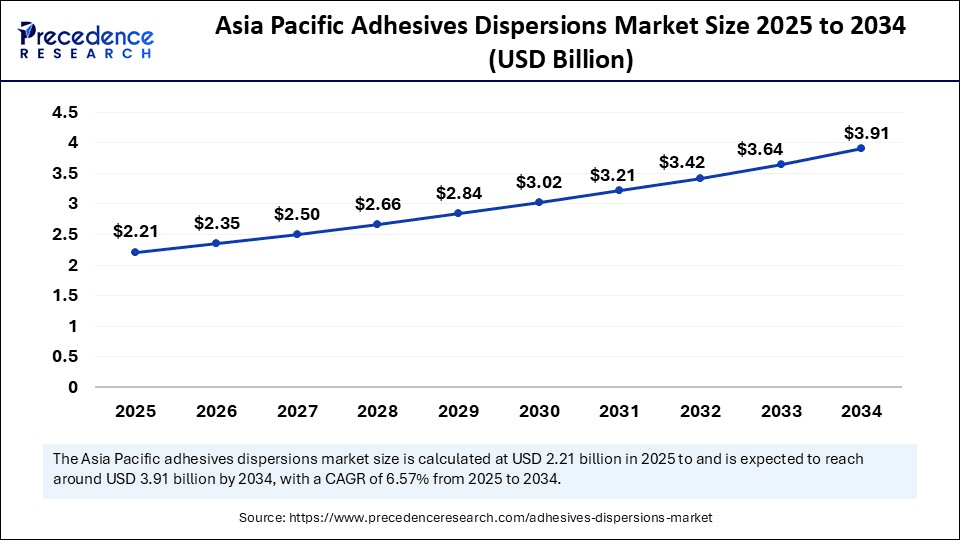

The Asia Pacific adhesives dispersions market size is evaluated at USD 2.21 billion in 2025 and is projected to be worth around USD 3.91 billion by 2034, growing at a CAGR of 6.57% from 2025 to 2034.

Why Did Asia Pacific Dominate the Adhesives Dispersions Market in 2024?

Asia Pacific dominated the adhesives dispersions market in 2024 mainly because of its strong manufacturing base in the construction, automotive, and packaging industries. The area benefits from a robust industrial supply chain, affordable production capacity, and a high level of domestic demand for adhesive solutions from a variety of end-use industries. Its position is further strengthened by the quick development of infrastructure and the expanding use of waterborne adhesive dispersions in converting and packaging applications. Furthermore, the existence of many regional manufacturers guarantees ongoing dominance by facilitating competitive pricing and consistent market penetration.

North America is growing fastest due to increasing emphasis on low volatile organic compounds, environmentally friendly solutions, and developments in high-performance adhesive technologies. The market is expanding due to the region's high demand for specialty packaging in healthcare and hygiene applications. Strict environmental regulations and large R&d investments are driving manufacturers to develop sustainable and creative adhesive dispersion formulations. Adoption is also accelerating across industries due to the growing emphasis on recyclable and renewable materials and the rise in automotive lightweighting trends.

Market Overview

The adhesives dispersions market is witnessing steady growth, fueled by the growing trend toward environmentally friendly water-based adhesives that provide excellent bonding strength, low emissions of volatile organic compounds, and adaptability to a variety of substrate combinations. The growing need for lightweight, strong, and high-performance bonding technologies, as well as regulatory pressures for greener materials, has led to the widespread use of these dispersions in packaging, construction, automotive, textile, and woodworking applications. Product adoption is also being boosted by developments in formulation technology, which allows for quicker curing times and better resistance to heat, moisture, and chemicals. The market is also anticipated to grow in the upcoming years due to the fast industrialization of emerging economies and the growing trend of substituting safer eco eco-friendly adhesives for solvent-based ones.

- On 8 July 2025, APPLIED Adhesive acquired BTmix and HG Adhesive Dispensing to expand its adhesive dispensing and cartridge filling capabilities.

(Source: https://www.prnewswire.com)

Adhesives Dispersions Market Growth Factors

- Rising demand for eco-friendly, low-VOC adhesives.

- Growth in packaging, especially e-commerce and food sectors.

- Expanding construction and infrastructure projects.

- Automotive lightweight driving requires advanced bonding needs.

- Technological advancements are improving performance.

- Industrial growth in emerging economies is boosting usage.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 8.60 Billion |

| Market Size in 2025 | USD 4.91 Billion |

| Market Size in 2024 | USD 4.61 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.44% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Polymer / Chemistry, Product Form / Technology, Functionality / Type of Adhesive, Application, End-User Industry, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How Has the Shift Towards Sustainable, Water-Based Adhesive Solutions Changed the Adhesives Dispersions Market?

Water-based adhesive dispersions have lower volatile organic compound emissions, are less toxic, and are safer to handle. Industries are increasingly using them in place of solvent-based products. These adhesives provide excellent bonding properties while supporting sustainability objectives. Demand is being further increased by consumers' growing preference for eco-friendly products. Companies are spending a lot of money on R&D to improve performance without sacrificing environmental advantages. Products in a variety of industries are changing as a result og this change.

Expanding Applications Across End-Use Industries

Due to their excellent bonding properties and versatility, adhesive dispersions are being utilized more and more in the construction industry for panel lamination, flooring, tiling, and insulation. They facilitate dependable labeling, lamination, and sealing of food, drink, and e-commerce packages in the packaging industry. They are used for fabric finishing and bonding in the textile industry, as well as for interior trim, lightweight materials, and vibration damping in the automotive industry. Adhesive dispersions' adaptability enables producers to serve several rapidly expanding markets at once.

Restraints

How Have Fluctuating Raw Materials Prices Slowed Adhesives Dispersions Market Growth?

Acrylic emulsions, vinyl acetate monomers, and polyurethane dispersions are among the petroleum-based inputs that are essential to the adhesive dispersions industry. Unpredictable cost fluctuations may result from supply chain interruptions, natural disasters, or geopolitical unrest, as well as volatility in crude oil prices. Production budgets are directly impacted by these swings, which also compel manufacturers to either absorb the costs or pass them on to customers, potentially reducing their competitiveness. A major obstacle to profitability and market sustainability for smaller producers can be the volatility of raw material prices.

Intense Market Competition and Price Pressure

Numerous regional companies and multinational behemoths coexist in the adhesives dispersions market, resulting in a competitive environment that drives down costs. Since many products have comparable performance requirements, differentiation frequently depends more on cost competitiveness and branding than on technical superiority. Aggressive discounting, declining margins, and lower R&D budgets for innovations are possible outcomes of this. Price wars between domestic and foreign competitors exacerbate competition in merging markets, making it harder for smaller businesses to thrive.

Opportunities

How Is the Expansion in E-commerce and Flexible Packaging Going to Change the Adhesives Dispersions Market?

Reliable, robust and quick drying adhesives are in high demand for flexible packaging labelling nd corrugated boxes due to the rapid expansion of online retail. In line with worldwide trends toward circular economy principles, adhesive dispersions work well with recyclable and compostable packaging materials. Manufacturers can obtain a competitive advantage by providing dispersion-based adhesives tailored for automated high-speed packaging lines as e-commerce continues to grow in emerging economies.

High Growth Potential in Emerging Economies

Construction, automotive, and packaging industries are experiencing increased demand due to rapid urbanization, industrial development, and infrastructure expansion in regions such as the Asia Pacific, Latin America, and Africa. These markets offer adhesives dispersion manufacturers a perfect setting for business expansion, thanks to favorable government regulations for manufacturing and foreign direct investment. Local manufacturing facilities have the potential to lower logistics costs, meet domestic demand more quickly, and overtake imported goods in the marketplace.

Polymer/Chemistry Insights

Why did the acrylic dispersions segment dominate the adhesives dispersions market in 2024?

The acrylic dispersions segment held the dominant share in the adhesives dispersions market because of their exceptional resistance to weathering and UV light, strong adherence to a variety of substrates, and outstanding versatility. They are a popular option in construction paperboard and packaging applications where strength and clarity of vision are crucial. Their market dominance is further cemented by the fact that their water-based formulation complies with expanding sustainability regulations.

- On 18 June 2025, Trinseo launched LIGOS, a 9210 new all-acrylic latex binder designed for flexible flooring adhesives offering high peel strength and water-based eco benefits.(Source: https://adhesives.org)

The polyurethane dispersions (PUD/hybrids) segment is set to be the fastest growing as they are appropriate for demanding end-use industries like automotive textiles and high-performance coatings because of their remarkable mechanical qualities, flexibility, and chemical resistance. Particularly in upscale industrial and specialty adhesive applications, the growing use of hybrid PUDs, which combine the environmental advantages of water-based systems with the durability of polyurethane, is speeding up market penetration.

Product Form/Technology Insights

Why Did Water Waterborne Dispersions Segment Dominate the Adhesives Dispersions Market in 2024?

The water-borne dispersions/emulsion adhesives segment is dominating the adhesives dispersions market in 2024 as industries increasingly shift toward low-VOC and environmentally friendly formulations. They offer ease of application, strong bonding strength, and compatibility with a wide range of substrates. Regulatory pressures in Europe and North America have further pushed manufacturers to adopt water-based systems over solvent-based alternatives, driving their widespread usage in packaging, furniture, and textiles.

The reactive dispersions segment is expected to grow rapidly as they are motivated by their exceptional performance in high-demand applications where strong chemical bonds, heat resistance, and rapid curing are essential. Demand has been boosted by the growth in electronics assembly, sophisticated packaging, and luxury car interiors since these systems provide accuracy, robustness, and efficiency while using less energy.

Functionality/ Type of Adhesive Insight

Why Did Non-structural/General-Purpose Segment Dominate the Adhesives Dispersions Market in 2024?

The non-structural/general-purpose segment dominated the adhesives dispersions market in 2024 due to its affordability and wide range of applications in commonplace tasks like labels, paper conversion, and light-duty packaging. For high-volume cost-conscious industries, their versatility and ease of formulation make them the preferred option, guaranteeing their sustained market dominance.

Meanwhile, the pressure-sensitive adhesives dispersions segment is expected to grow rapidly as demand surges in tapes, labels, hygiene products, and medical dressings. Their unique property of forming bonds under light pressure without heat or solvent activation meets the needs of fast-paced manufacturing and consumer convenience. The rise of e-commerce packaging and personal care products further boosts their adoption.

Application Insights

Why Did the Packaging & Paperboard Segment Dominate the Adhesives Dispersions Market in 2024?

The packaging & paperboard segment led the adhesives dispersions market, driven by the consumer goods e-commerce and food and beverage industries. Strong, adaptable, and recyclable bonding solutions are provided by adhesive dispersions, which are perfect for laminations, cartons, and corrugated boxes. Water-based dispersions are becoming more and more popular in the packaging industry, thanks to sustainability initiatives.

On the other hand, the hygiene & nonwovens segment is poised to grow rapidly in the coming years because of aging populations, growing health consciousness, and a rise in the demand for personal care items. To meet stringent healthcare standards, adhesive dispersions used in diapers, sanitary products, and wound care provide skin-friendliness, breathability, and long-lasting adhesion.

End-User Industry Insights

Why Did the Packaging & Converting Segment Dominate the Adhesives Dispersions Market in 2024?

The packaging & converting segment dominated the market for adhesivesdispersions in 2024, driven by the worldwide trend toward packaging options that are recyclable, lightweight, and sustainable. For consumer goods packaging, adhesive dispersions are essential because they provide strong bonding, adhere to food safety regulations, and satisfy the demands of high-speed production lines.

The healthcare and hygiene segment, along with the automotive sector, are jointly expected to be the fastest-growing by end-users in the forecast period. In healthcare, rising demand for medical tapes, surgical drapes, and wearable devices drives adhesive innovation. In the automotive industry, dispersions are increasingly used for lightweight interior assemblies, acoustic insulation, and trim bonding, aligning with trends toward fuel efficiency and EV adoption.

Distribution Channel Insights

How Did Direct Sales Drive Demand in the Adhesives Dispersions Market in 2024?

The direct sales segment registered its dominance over the market in 2024 because precise technical cooperation and specialized adhesive formulations are required. Large manufacturers in the packaging, automotive, and healthcare sectors favor direct sourcing to maintain long-term supplier relationships and guarantee consistent quality, technical support, and just-in-time delivery.

Simultaneously, the distributors & chemical wholesalers segment is projected to expand rapidly in the market for adhesives dispersions in the coming years because precise technical cooperation and specialized adhesive formulations are expected to drive demand due to larger manufacturers entering in the packaging, automotive, and healthcare sectors favor direct sourcing to maintain long-term supplier relationships and guarantee consistent quality, technical support, and just-in-time delivery.

Adhesives Dispersions Market Companies

- Jowat SE

- Kleiberit Klebstoffe

- Weiss Chemie + Technik

- Wacker Chemie

- Cementos Capa

- Master Bond

- Delo Industrial Adhesives

- Kohesi Bond

- 3M Company

- Permabond LLC

Recent Developments

- In June 2025, Techcon announced the launch of a new side-up side (SBS) dispensing line for 2-component adhesives and sealants (available in 50 ml and 200 ml sizes with mixing ratios of 1:1, 2:1, and 10:1)(Source: https://www.prnewswire.com)

- In March 2025, Meridian Adhesives Group unveiled its Penang Application Development Center (ADC) in Malaysia, enhancing technical and R&D capabilities in Asia for electronics division adhesive applications.(Source: https://padhesive.com)

- In July 2025, APPLIED Adhesives completed the acquisition of BTmix (a manufacturer of static mixers and adhesive cartridges) and HG Adhesive Dispensing (a provider of adhesive dispensing and cartridge filling equipment) to broaden their parts and equipment offerings.(Source: https://www.prnewswire.com)

Segments Covered in the Report

By Polymer / Chemistry

- Acrylic Dispersions

- Styrene-Butadiene (SBR) Dispersions

- Polyvinyl Acetate (PVAc) Dispersions

- Ethylene-Vinyl Acetate (EVA) Dispersions

- Polyurethane Dispersions (PUD) / Polyurethane Hybrid Dispersions

- Other (e.g., silicone-modified, nitrile-based dispersions)

By Product Form / Technology

- Water-borne Dispersions / Emulsion Adhesives

- Solvent-borne Dispersions (low-solvent systems)

- Reactive Dispersions (crosslinkable/heat/UV-reactive)

- Radiation-curable Dispersions (UV/EB)

- Hot-melt Dispersion blends / thermoplastic dispersions

By Functionality / Type of Adhesive

- Pressure-Sensitive Adhesives (PSA) dispersions

- Structural / High-strength dispersions

- Non-structural / General-purpose dispersions

- Tackifiers & Primer dispersions

- Coating-grade adhesive dispersions

By Application

- Packaging & Paperboard (labels, cartons, lamination)

- Wood & Furniture (edge bonding, laminates, flooring)

- Tapes & Labels (pressure-sensitive tapes, self-adhesive labels)

- Hygiene & Nonwovens (diapers, wipes, medical tapes)

- Construction & Building (panel bonding, flooring adhesives)

- Automotive (interior trim, headliners)

- Footwear & Leather Goods

- Specialty Industrial (electronics, composites, medical devices)

By End-User Industry

- Packaging & Converting

- Building & Construction

- Furniture & Woodworking

- Healthcare & Hygiene

- Automotive & Transportation

- Consumer Goods & Textiles

- Electronics & Industrial Manufacturing

By Distribution Channel

- Direct Sales (B2B / OEM contracts)

- Distributors & Chemical Wholesalers

- System Integrators & Co-packers

- Online B2B Marketplaces

By Region

- Asia-Pacific

- North America

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting