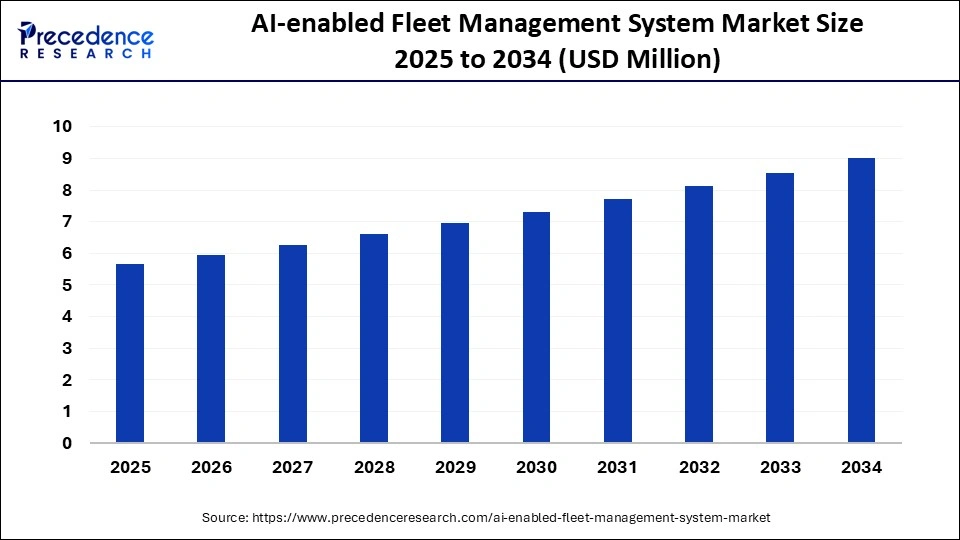

AI-enabled Fleet Management System Market Size and Forecast 2025 to 2034

Explore the AI-enabled fleet management system market trends, innovations, and growth forecast driving smart logistics and real-time vehicle insights. The growth of the market is attributed to the rising need to improve operational efficiency and reduce costs.

AI-enabled Fleet Management System MarketKey Takeaways

- North America dominated the AI-enabled fleet management system market in 2024.

- Asia Pacific is expected to expand at the fastest CAGR between 2025 and 2034.

- By component, the solutions segment held the largest revenue share in 2024.

- By component, the services segment is expected to grow at the fastest CAGR during the forecast period.

- By vehicle type, the commercial vehicle segment captured the biggest market share in 2024.

- By vehicle type, the passenger cars segment is expected to grow at a significant CAGR in the upcoming period.

- By deployment mode, the cloud segment held the largest market share in 2024.

- By deployment mode, the on-premises segment is expected to grow at a remarkable CAGR between 2025 and 2034.

- By end-user, the transportation and logistics segment contributed the highest market share in 2024.

- By end-user, the automotive segment is expected to grow at the highest CAGR during the forecast period.

How AI Helps in Fleet Management?

Artificial Intelligence driven systems monitor engine performance and component wear in real-time, allowing fleet operators to predict potential failures before they happen. This proactive approach helps avoid unexpected breakdowns, reduces maintenance costs, and extends the vehicle's lifespan. Advanced AI algorithms analyze traffic patterns, weather conditions, and past journey data to dramatically optimize routes. This not only improves delivery accuracy but also reduces fuel consumption and driver fatigue.

Moreover, it has been studied that AI supportselectric vehicle fleets by selecting energy-efficient routes and planning smart charging cycles. This maximizes battery usage and lowers operating expenses, enhancing the overall sustainability of the fleet. The fusion of edge computing and 5G enables real-time data capture from vehicles, which AI systems process instantly for efficient maintenance and performance analysis, reducing manual interventions.

Market Overview

AI-enabled fleet management systems convert vehicle and driver data into actionable insights. Using machine learning and predictive analytics, these systems optimize route planning, anticipate maintenance needs, and enhance safety, creating a more intelligent and efficient approach to managing fleet operations. The fleet management industry is undergoing a profound transformation as artificial intelligence takes the wheel in optimizing fleet operations across industries. With the growing need for efficiency, safety, and cost-effectiveness in transport and logistics, AI has emerged as a game-changer, transforming traditional vehicle tracking into a dynamic, predictive, and autonomous ecosystem. These systems leverage real-time data from GPS, onboard diagnostics, sensors, and driver behavior analytics to provide fleet managers with actionable insights.

AI enhances routing decisions, enables preventive maintenance, supports fuel optimization, and even predicts delivery delays before they occur. Moreover, the integration of AI with IoT and 5G technologies is facilitating instant communication between vehicles and command centers, boosting the responsiveness and agility of fleet operations. As commercial fleets grow and complexity, industries ranging from logistics and public transportation to utilities and field services are increasingly adopting AI-powered systems.

AI's ability to analyze historical data and adapt to live changes in road conditions, weather, and traffic patterns makes it a vital asset in reducing operational costs and enhancing customer satisfaction. With sustainability gaining ground, AI is also instrumental in managing electric vehicle fleets, predicting charging requirements, scheduling low-cost energy use, and optimizing range. AI-enabled fleet management systems are gaining traction in several industries due to regulatory pressure for emissions and the need for round-the-clock logistics efficiency.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Authentication, Component,Deployment, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Need for Data-driven Insights, Regulatory Pressures, and Focus on Sustainability

The rising need for data-driven insights to improve operational efficiency is one of the major factors driving the growth of the AI-enabled fleet management system market. AI provides valuable insights into fleet performance, enhancing decision-making and strategy planning. Fleet operators are under pressure to minimize environmental impact while improving productivity, boosting the adoption of AI solutions in fleet management. The market is also fueled by a convergence of technological innovation. Fleet operators are demanding intelligent systems that offer predictive insights, adaptive routing, and autonomous decision-making. This demand has changed the market dynamics from a reactive service model to a proactive, data-driven solution ecosystem.

The rise in e-commerce, real-time delivery expectations, and global supply chain complexity has placed immense pressure on logistics companies to evolve. AI technology provides the essential backbone to meet these expectations by minimizing idle time, reducing fuel consumption, preventing breakdowns through predictive maintenance, and enhancing driver performance. Fleet operators now prioritize systems that offer end-to-end visibility across all assets and integrate easily with ERP/CRM software and comply with region-specific transportation regulations.

Restraint

High Implementation Costs and Security Concerns

The high initial cost associated with the implementation of AI-enables systems remains a major barrier, especially for smaller fleets. The cost of AI-based sensors, analytics platforms, and skilled personnel can deter widespread adoption. Data privacy and cybersecurity concerns also limit the widespread adoption of AI-enabled systems. As fleets become connected and centralized, the threat of data breaches or system hacks increases, especially in autonomous vehicle environments. Some operators still rely on manual reporting, fearing job displacement or complexity in adopting smart systems. The infrastructure limitations, especially in rural or underdeveloped regions, can reduce the effectiveness of AI-based systems that rely on uninterrupted connectivity and real-time data flow.

Opportunity

Focus on Automation

The biggest market opportunity lies in mid-sized and large fleet operators seeking to digitize and automate their processes. As AI systems become more cost-effective, even smaller players in logistics, public transport, and waste management are expected to invest in intelligent fleet optimization. Another huge opportunity is in electric vehicle fleet management. As businesses worldwide are shifting to EVs, AI-enabled systems are essential to manage the charging infrastructure, monitor battery health, and identify routes based on energy efficiency and range predictions. Some regions are witnessing rapid urbanization, expansion of logistics infrastructure, and increased smartphone penetration, creating fertile ground for AI-enabled fleet management systems. AI also opens new revenue streams via data monetization, enabling fleet operators to offer insights to insurance companies, municipalities, and manufacturers.

Component Insights

Why did the Solutions Segment Dominate the AI-enabled Fleet Management System Market?

The solutions segment dominated the market with the largest share in 2024. This is mainly due to the essential role of AI solutions like systems and software in enhancing the efficiency of fleet operations. These solutions form the core infrastructure for AI-enabled fleet management systems, encompassing intelligent routing, predictive maintenance, fuel analytics, telematics, real-time monitoring, and automated scheduling. These systems offer operational benefits such as fuel savings, reduced downtime, and better asset utilization, which are all critical factors for large fleet operators. The increased demand for data-driven insights further bolstered the segmental growth. The software helps analyze real-time data regarding weather patterns and traffic conditions, leading to route optimization.

On the other hand, the services segment is expected to grow at the highest CAGR in the upcoming years. The growth of the segment is attributed to the rising demand for professional services such as integration, training, and support. As the adoption of AI-enabled fleet management systems rises, fleet operators require ongoing assistance to update software, resolve system errors, train staff, and comply with evolving regulations. Managed service models are gaining traction, especially among small-to-mid-sized fleets that lack dedicated IT teams.

Vehicle Type Insights

What Made Commercial Vehicles the Dominant Segment in the Market?

The commercial vehicles segment dominated the AI-enabled fleet management system market with the largest share in 2024. Commercial vehicles, including trucks, vans, and delivery fleets, are the lifeblood of logistics and supply chains. Operators of these fleets are under pressure to reduce costs and improve operational efficiency, making them prime candidates for AI-enabled fleet management systems. High fuel consumption, long routes, and maintenance costs demand smarter solutions. AI-enabled fleet management helps them minimize idle time, predict failures, and optimize routes, leading to significant cost savings. Their operational complexity and sheer volume bolster the growth of the segment.

Meanwhile, the passenger cars segment is expected to grow at a significant CAGR in the upcoming period. The growth of the segment is attributed to the rise of ride-sharing, car rental, and chauffeur services. These services rely heavily on route optimization, driver behavior analysis, and predictive maintenance features that AI systems handle efficiently. Additionally, smart city initiatives and autonomous vehicle development are boosting the adoption of AI in passenger cars, contributing to segmental growth.

Deployment Mode Insights

Why did the Clod Segment Dominate the AI-enabled Fleet Management System Market?

The cloud segment dominated the market by capturing most revenue share in 2024. This is mainly due to the scalability, flexibility, and cost-efficiency of cloud platforms. Small fleet operators and startups benefit from lower upfront costs, real-time updates, and easy integration of cloud solutions with mobile apps. Cloud platforms support remote access, faster deployment, and seamless software upgrades, making them attractive for geographically dispersed fleets. The shift toward Software-as-a-Service (SaaS) models is accelerating the growth of the segment.

The on-premises segment is expected to grow at a remarkable CAGR during the forecast period. Despite the rise of cloud adoption, many fleet operators still prefer on-premises models for data privacy, control, and integration with legacy infrastructure. Fleet data is often tied to customer identities, routes, or high-value cargo. This sensitive data raises concerns over data privacy. Hence, fleet operators opt for on-premises systems that give them full ownership of their servers, data flow, and security protocols. The preference for in-house management and reduced dependency on external providers further support segmental growth.

End-User Insights

Why Does the Transportation and Logistics Segment Dominate the Market?

The transportation and logistics segment dominated the AI-enabled fleet management system market with a major revenue share in 2024. Transportation and logistics companies handle complex fleet networks, making them the largest consumer of AI-based systems. These businesses rely on timely deliveries, route optimization, cost control, and compliance with fuel and labor regulations. AI enhances route optimization while enabling real-time asset tracking and fleet lifecycle management, all are vital for enhancing operational efficiency.

On the other hand, the automotive segment is expected to grow at the highest CAGR during the forecast period. The automotive sector is undergoing a tech revolution, with electric vehicles (EVs), connected cars, and autonomous driving leading the charge. AI-enabled fleet systems are vital for monitoring battery health, managing vehicle diagnostics, tracking emissions, and enabling remote operations. OEMs and Tier 1 suppliers are increasingly embedding AI features in their fleets for testing and logistics purposes, making this one of the fastest-growing end-user segments.

Regional Insights

Why did North America Dominate the AI-Enabled Fleet Management Market?

North America dominated the market by capturing the largest share in 2024. This is mainly due to its early adoption of AI technology, robust infrastructure, and presence of major fleet operators across logistics, construction, ride-sharing, and e-commerce. The U.S. and Canada have an extensive network of warehousing hubs and distribution centers, creating a strong foundation for AI-driven fleet management systems. Additionally, fleet operators in North America are under constant pressure to improve operational efficiency, meet ESG goals, and comply with stringent emissions and fleet safety regulations.

AI-enabled fleet management systems provide solutions for route optimization, predictive maintenance, fuel monitoring, driver behavior analysis, and real-time asset tracking, all of which are given high priority by fleet operators in this region. Moreover, North America is home to leading tech companies and telematics firms, who are investing heavily in integrating AI with IoT and cloud platforms. Fleet operators here are not only users but also collaborators in pilot projects, beta testing, and feedback loops with AI developers, further cementing the region's dominance.

Why is Asia Pacific Experiencing the Fastest Growth?

Asia Pacific is expected to grow at the fastest CAGR during the projection period, driven by rising logistic operations, the rise of e-commerce, and the rising demand for last-mile delivery, particularly in countries like China, India, Japan, South Korea, and Australia. The rising number of small- to mid-sized fleet operators across urban and rural areas are looking for cost-effective, AI-based solutions to manage fuel usage, optimize delivery routes, and ensure timely service.

Governments around the region are supporting this growth through smart city initiatives, transportation digitization, and EV adoption policies. While the AI infrastructure is still developing in some nations, the low initial cost of cloud-based solutions, availability of mobile-friendly fleet apps, and local innovations tailored to regional needs make the Asia-Pacific market dynamic and full of untapped potential. Strategic partnerships with international tech providers and home-grown startups are further accelerating this upward trend.

What Opportunities Exist in Europe?

Europe is considered to be a significantly growing area. The growth of the AI-enabled fleet management system market in Europe is attributed to its aggressive sustainability goals, emphasis on emission reduction, and a shift toward electrification and smart transportation. Countries like Germany, France, the UK, and the Netherlands are investing in intelligent transport systems and encouraging fleet operators to digitize for better transparency and compliance. European fleet companies face stringent regulations under EU policies, such as Euro 7 norms and carbon reduction frameworks, pushing them to adopt AI for real-time vehicle diagnostics, efficient routing, and energy management.

Additionally, urban congestion, low-emission zones, and high fuel prices are incentivizing firms to invest in AI for fuel-saving and route efficiency. The region also benefits from government incentives and subsidies for smart mobility and digital infrastructure, helping both large and mid-sized fleets transition to AI-enabled systems faster. With a mature telematics ecosystem and innovation hubs, Europe is accelerating toward becoming a tech-forward, eco-efficient fleet hub.

AI-enabled Fleet Management System Market Companies

- Geotab

- Trimble Inc.

- Omnitracs

- TomTom Telematics

- Zonar Systems

- Mix Telematics

- Gurtam

- Inseego Corp.

- KeepTruckin

- Masternaut

- Chevin Fleet Solutions

- Donlen Corporation

- LeasePlan USA

- Wheels, Inc.

- Omnicomm

- Motive

- CalAmp

- Verizon Connect

- Samsara

- Teletrac Navman

- Ctrack

- Element Fleet Management

- Zubie

- Microlise

- Fleet Complete

- Bendix Commercial Vehicle Systems

- Aptiv

Recent Developments

- In April 2025, Azuga announced the launch of its new line of Next-Gen SafetyCams: the SafetyCam Plus and SafetyCam Pro. This new line of AI-powered video solutions is designed to revolutionize fleet safety, reduce liability, and empower proactive risk prevention.

(Source: https://www.businesswire.com) - In January 2025, ZF launched SCALAR, a digital fleet management platform, at the Bharat Mobility Expo 2025 in New Delhi. The system optimizes operations for commercial vehicle fleets in India through artificial intelligence and predictive analytics.

(Source: https://www.autocarpro.in)

Segments Covered in the Report

By Component

- Solutions

- Services

By Vehicle Type

- Commercial Vehicles

- Passenger Cars

By Deployment Mode

- On-Premises

- Cloud

By End-User

- Transportation and Logistics

- Automotive

- Retail

- Construction

- Others

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- MEA

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting