What is the AI in Warehousing Market Size?

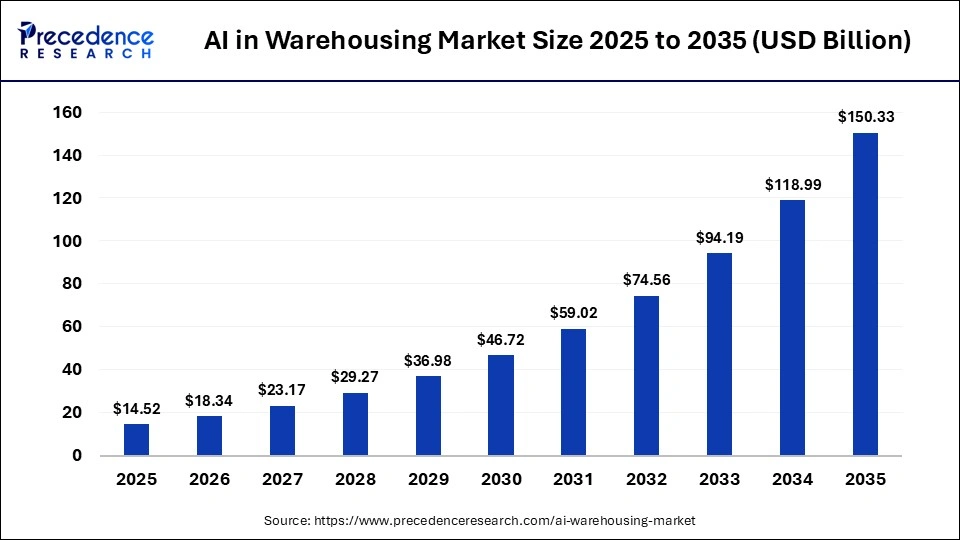

The global AI in warehousing market size accounted for USD 14.52 billion in 2025 and is predicted to increase from USD 18.34 billion in 2026 to approximately USD 150.33 billion by 2035, expanding at a CAGR of 26.33% from 2026 to 2035. This market is growing due to rising demand for real-time inventory visibility, automated operations, and data-driven decision-making to improve efficiency and reduce costs.

Market Highlights

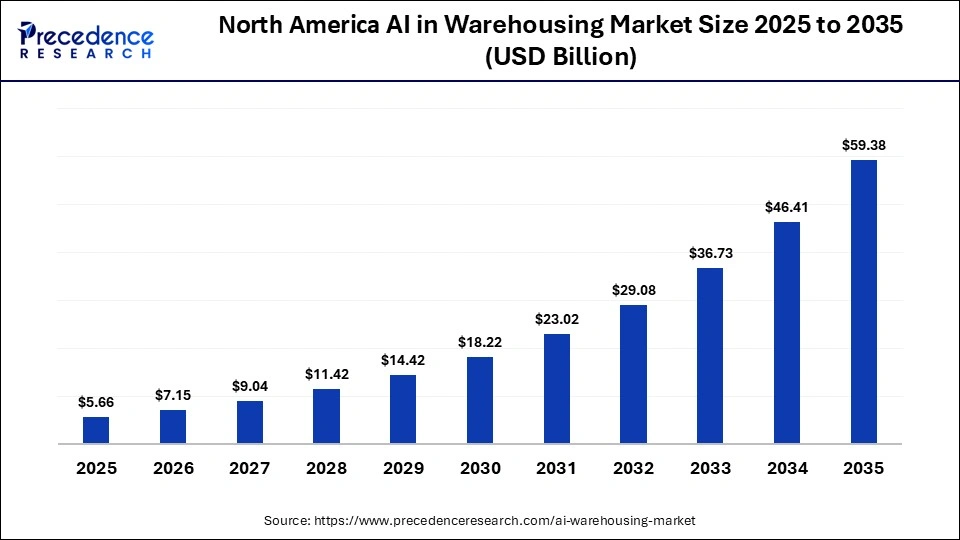

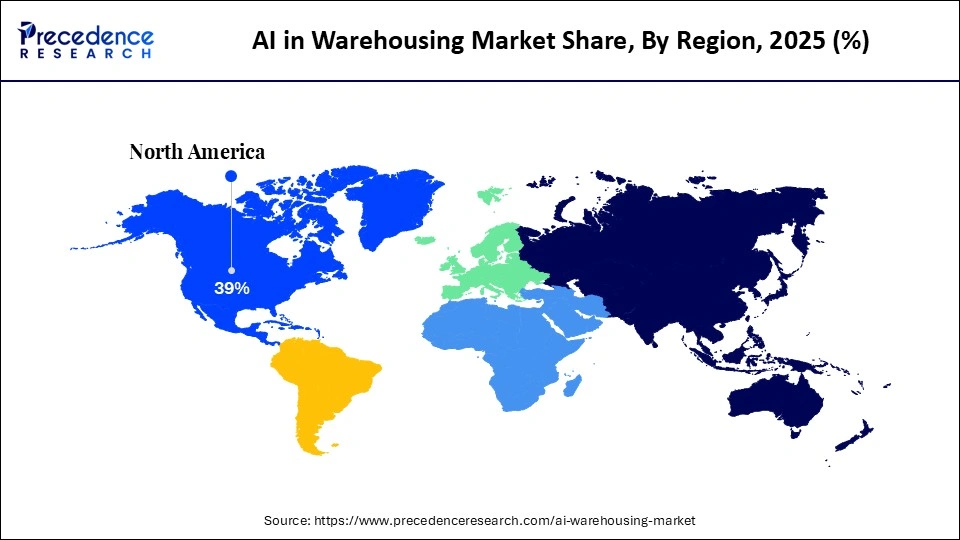

- North America dominated the AI in warehousing market with a revenue share of approximately 39% in 2025.

- Asia Pacific is expected to grow at the fastest CAGR between 2026 and 2035.

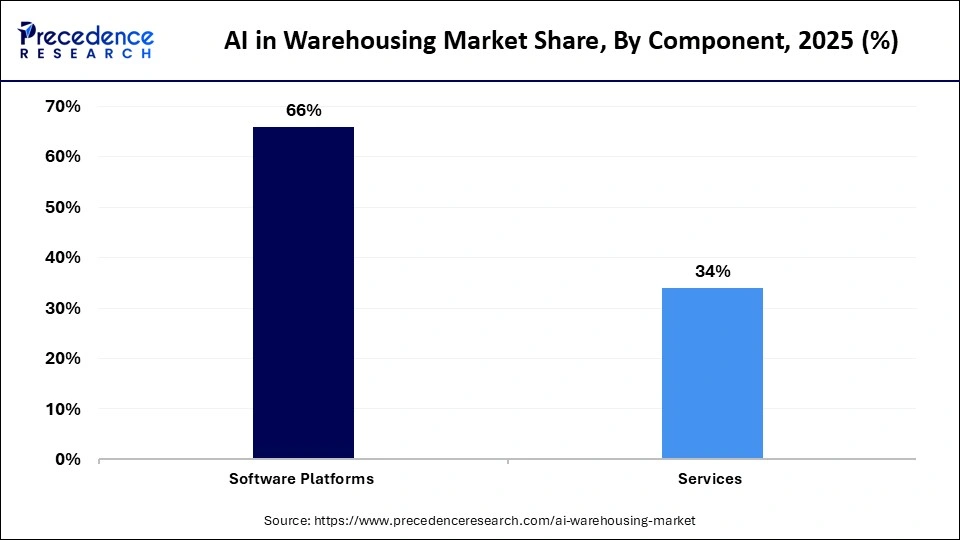

- By component, the software platforms segment held the biggest market share of approximately 66% in 2025.

- By component, the services segment is expected to expand at the fastest CAGR between 2026 and 2035.

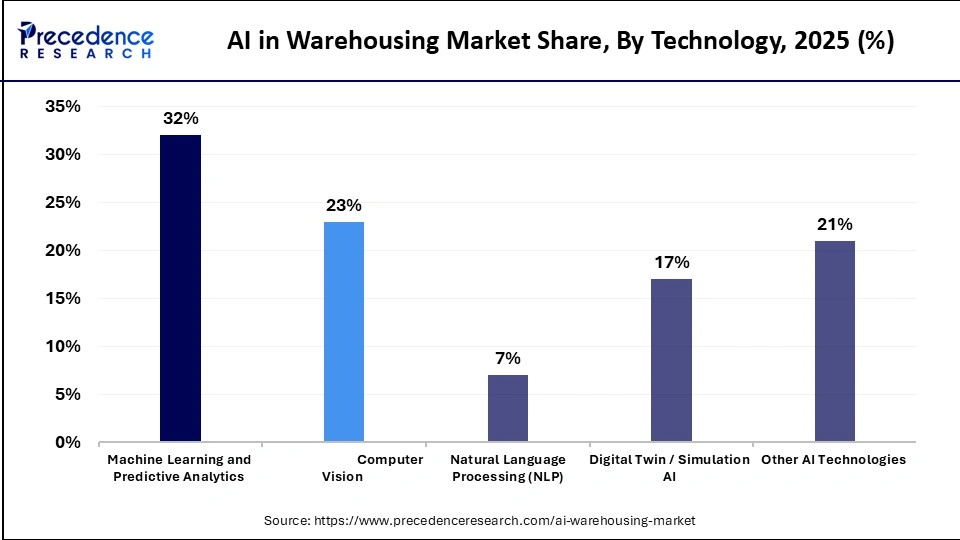

- By technology, the machine learning & predictive analytics segment contributed the highest market share of approximately 32% in 2025.

- By technology, the digital twin / simulation AI segment is expected to grow at a strong CAGR between 2026 and 2035.

- By application, the warehouse operations optimization segment held a major market share of approximately 26% in 2025.

- By application, the robotics & automation intelligence segment is expected to expand at the fastest CAGR from 2026 to 2035.

- By warehouse type, the e-commerce fulfillment warehouses segment held the biggest market share of approximately 36% in 2025.

- By warehouse type, the cold chain warehouses segment is expected to expand at the fastest CAGR between 2026 and 2035.

Market Overview

The AI in warehousing market is witnessing a robust growth, as businesses use intelligent technologies more frequently to improve demand forecasting, automate picking and sorting, optimize inventory management, and boost overall operational effectiveness. Warehousing is being forced to invest in AI-driven solutions like robotics and computer vision due to growing e-commerce volumes, labor shortages, and the need for quicker, error-free fulfillment.

Companies like Amazon have deployed AI-powered robotics and machine learning solutions to streamline operations, reduce costs, and enhance delivery speeds globally. This integration of AI enables real-time data analytics, smart inventory management, and energy-efficient operations, providing competitive advantages to warehouse operators.

Amazon Robotics is a widely cited example of AI transforming warehouse operations globally. Amazon's fulfillment centers use AI‑driven robotics, machine learning, and computer vision to automate tasks such as picking, sorting, and transporting goods. The company has deployed over 750,000 mobile robots and robotic arms powered by AI to navigate warehouse floors, optimize routes, and handle inventory tasks, resulting in faster order fulfillment and reduced operational costs.

What are the Major Trends Influencing the AI in Warehousing Market?

- Robotics & Automation Expansion: Increasing adoption of AI-powered robots and automated guided vehicles (AGVs) to optimize picking, sorting, and transporting operations.

- Predictive Maintenance: Use of AI and IoT sensors to forecast equipment failures, reduce downtime, and lower maintenance costs.

- Advanced Inventory Forecasting: AI-driven demand prediction and stock placement to minimize overstock, stockouts, and spoilage.

- Integration with IoT & Smart Devices: Warehouses leveraging IoT devices for real-time tracking, data collection, and workflow optimization.

- Energy & Sustainability Optimization: AI-based systems controlling lighting, HVAC, and equipment schedules to reduce energy consumption and carbon footprint.

- Real-Time Analytics & Decision Support: AI dashboards providing actionable insights to optimize operations, identify bottlenecks, and improve warehouse responsiveness.

- E-Commerce-Driven AI Adoption: Growing e-commerce volumes are driving investment in AI technologies for faster, accurate, and cost-efficient fulfillment.

- Government & Policy Support: Government initiatives and incentives in regions like China, India, and Southeast Asia are encouraging AI integration in logistics and warehouse automation.

Future Growth Outlook

- Expansion in E-Commerce Warehousing: AI adoption in e-commerce fulfillment centers optimizes high-volume order processing, reducing errors, labor costs, and delivery times.

- Predictive Maintenance Services: Developing AI solutions for predictive maintenance presents an opportunity to reduce downtime, extend equipment life, and offer subscription-based analytics services.

- Energy Efficiency & Sustainability Solutions: Warehouses can leverage AI to lower energy consumption, minimize carbon footprints, and provide ESG-compliant operations, attracting eco-conscious clients and investors.

- AI-Driven Warehouse Analytics Platforms: Offering real-time data dashboards and predictive analytics services for warehouse operations helps companies make smarter decisions and improve efficiency.

- Integration with Robotics & Automation Providers: Partnerships with robotics manufacturers and automation companies can accelerate the deployment of AI-powered robotic systems, creating cross-industry collaboration opportunities.

- Expansion in Asia Pacific and Emerging Markets: Rapidly growing logistics hubs in China, India, and Southeast Asia present untapped opportunities for AI-based warehouse solutions due to government support and foreign investments.

- Smart Cold Chain & Perishable Goods Management: AI optimizes storage, temperature monitoring, and inventory forecasting in cold chain warehouses, reducing spoilage and ensuring compliance with safety standards.

- Customized AI Solutions for SMEs: Developing affordable, scalable AI solutions tailored for small and medium-sized warehouses opens a large underserved market segment.

What ROI Benefits are Driving AI Adoption in Warehousing?

AI adoption in warehousing delivers a strong return on investment by significantly reducing operating costs, labor dependency, and inventory holding losses. AI-powered demand forecasting, predictive maintenance, and automated picking systems improve order accuracy and throughput, leading to faster fulfillment and lower error rates. As a result, warehouses leveraging AI solutions often achieve better space utilization, reduced downtime, and quicker payback periods, making AI a financially attractive investment for both large enterprises and emerging e-commerce players.

How Does AI Improve Inventory and Space Optimization?

AI optimizes inventory placement in warehouses by analyzing seasonal trends, demand patterns, and real-time order data. Frequently picked items are positioned in easily accessible locations, while slower-moving inventory is stored in less critical areas, maximizing space utilization. This approach enables faster order fulfillment, reduces the need for excess storage, and improves overall productivity and energy efficiency.

In addition, AI helps minimize spoilage and environmental impact by predicting overstocking and potential waste, especially for perishable or high-turnover goods. By optimizing shelf organization and storage density, businesses can lower operating costs while maintaining a more sustainable and eco-friendlier warehouse footprint.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 14.52 Billion |

| Market Size in 2026 | USD 18.34 Billion |

| Market Size by 2035 | USD 150.33 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 26.33% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Component, Technology, Application, Warehouse Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Component Insights

What Made Software Platforms the Dominant Segment in the AI in Warehousing Market?

The software platforms segment dominated the market with a 66% share in 2025 because they provide the backbone for integrating AI-driven tools across multiple warehouse operations. These platforms enable real-time inventory management, predictive demand forecasting, and automated workflow optimization, helping warehouses operate more efficiently and accurately. Businesses are depending more and more on software platforms to optimize order processing, inventory control, and general warehouse operations.

The services segment is expected to grow at the fastest rate in the market, driven by the growing need for services related to system integration implementation and consulting. As warehouses embrace cutting-edge AI solutions, the need for professional services to successfully implement, modify, and maintain these technologies increases. The need for expert service support to guarantee seamless implementation is increasing, contributing to segmental growth.

Technology Insights

Why Did the Machine Learning & Predictive Analytics Segment Dominate the Market?

The machine learning & predictive analytics segment dominated the AI in warehousing market while holding a 32% market share in 2025. This is because it enables warehouses and logistics providers to anticipate demand, optimize inventory, and improve operational efficiency with high accuracy. The dominance of this segment is further reinforced by its demonstrated ability to improve decision-making and efficiency through data-driven insights. Businesses that use predictive analytics are able to predict busy times and adjust staffing levels appropriately.

The digital twin / simulation AI segment is expected to expand at the fastest CAGR in the upcoming period, driven by the requirement for virtual modeling of warehouse operations, which enables businesses to forecast possible disruptions, optimize layouts, and test scenarios without interfering with actual operations. By mimicking equipment failures before they happen, this technology reduces downtime and increases safety. Additionally, rising investments in smart warehouses and Industry 4.0 initiatives are accelerating adoption, as businesses seek more efficient, flexible, and resilient warehousing operations.

Application Insights

How Does the Warehouse Operations Optimization Segment Lead the Market?

The warehouse operations optimization segment led the AI in warehousing market with a 26% share in 2025. This is because it directly improves efficiency, accuracy, and throughput across storage, picking, packing, and inventory management processes. Its dominance is further reinforced by the growing demand for faster order fulfillment, real-time inventory tracking, and data-driven operational decisions in modern supply chains.

The robotics & automation intelligence segment is expected to grow rapidly in the coming years, driven by the growing use of AI-powered conveyor systems, automated picking systems, and autonomous robots that speed up order fulfillment and minimize manual labor. Furthermore, rising labor costs, labor shortages, and the push for 24/7 warehouse operations are further accelerating the adoption of robotics and automation intelligence solutions.

Warehouse Type Insights

Why Did the E-Commerce Fulfillment Warehouses Segment Dominate the Market?

The e-commerce fulfillment warehouses segment dominated the AI in warehousing market with a major market share of 36% in 2025. This is because of the increased preference for online shopping and the demand for quick, precise order fulfillment. AI technologies in these warehouses, such as automated picking, sorting, and real-time inventory management, help streamline operations, reduce errors, and speed up delivery times, which are critical for customer satisfaction. Additionally, the need to handle fluctuating order volumes and returns efficiently has made e-commerce fulfillment centers a primary driver of AI adoption in warehousing.

The cold chain warehouses segment is expected to grow rapidly over the projection period because these facilities require precise temperature control, inventory monitoring, and timely distribution for perishable goods like food, pharmaceuticals, and vaccines. AI-powered solutions help predict demand, optimize storage conditions, and automate monitoring, reducing spoilage and ensuring regulatory compliance. Increasing demand for fresh and temperature-sensitive products, along with stricter safety standards, is driving rapid adoption of AI technologies in cold chain operations.

Region Insights

How Big is the North America AI in Warehousing Market Size?

The North America AI in warehousing market size is estimated at USD 5.66 billion in 2025 and is projected to reach approximately USD 59.38 billion by 2035, with a 26.50% CAGR from 2026 to 2035.

What Made North America the Dominant Region in the AI in Warehousing Market?

North America dominated the AI in warehousing market by holding a 39% share in 2025. This is mainly due to the high adoption of cutting-edge technology, robust infrastructure, and large investments in supply chain solutions. Large logistics firms and warehouse operators in the region heavily use AI solutions to streamline their operations. The region's leadership in the market is also reinforced by early adoption of Industry 4. 0 technologies and strong government support.

What is the Size of the U.S. AI in Warehousing Market?

The U.S. AI in warehousing market size is calculated at USD 4.25 billion in 2025 and is expected to reach nearly USD 44.83 billion in 2035, accelerating at a strong CAGR of 26.57% between 2026 and 2035.

U.S. AI in Warehousing Market Trends

The U.S. dominates the market within North America due to the strong presence of major e-commerce and logistics companies, widespread adoption of Industry 4.0 solutions, and advanced technological infrastructure. Artificial intelligence tools such as robotics, machine learning, and predictive analytics are extensively used to optimize warehouse operations, improve order accuracy, and reduce operating costs. Additionally, substantial investments in R&D and supportive government initiatives promoting automation and smart logistics further reinforce U.S. leadership in the market.

What Makes Asia Pacific the Fastest-Growing Region in the AI in Warehousing Market?

Asia Pacific is expected to grow at the fastest rate in the coming years, fueled by the rapid expansion of e-commerce, government initiatives supporting warehouse automation, and rising investments in AI technologies by logistics hubs in China, India, and Southeast Asia. Additionally, increasing foreign investments and partnerships is accelerating AI adoption in the region. The region is witnessing the rapid deployment of AI-powered robotics, predictive analytics, and smart warehouse management systems. This trend is positioning Asia Pacific as a global leader in innovative and sustainable warehousing solutions.

India AI in Warehousing Market Trends

India is emerging as one of the fastest-growing markets for AI in warehousing, driven by rising investments in AI-enabled logistics solutions, rapid e-commerce expansion, and the increasing need for cold chain management. Warehouses are adopting automation, robotics, and predictive analytics to optimize supply chain operations and efficiently manage high order volumes. Additionally, government support for digital infrastructure and growing foreign investment in logistics technology are accelerating AI adoption across the country.

Who are the Major Players in the Global AI in Warehousing Market?

The major players in the AI in warehousing market include Amazon Web Services (AWS), IBM Corporation, Microsoft Corporation, Oracle Corporation, SAP SE, Google Cloud, Blue Yonder, Infor, Manhattan Associates, ABB Ltd., Amazon Robotics, AutoStore, Berkshire Grey, Covariant, Daifuku Co., Ltd., Dematic (KION Group), Geek+, GreyOrange, Honeywell Intelligrated, KNAPP AG, Locus Robotics, Swisslog, and Symbotic.

Recent Developments

- In January 2026, GrubMarket announced its Monitoring AI Agent for the GrubAssist platform. This AI-driven tool continuously scans business data to detect and alert users of critical operational anomalies and market shifts. The launch aims to replace manual data monitoring with automated, real-time intelligence for food supply chain operations.(Source: https://www.prnewswire.com)

- January 2026, Nord Modules announced its collaboration with KUKA to expand its AMR ecosystem by introducing top modules for KUKA's autonomous mobile robots [Nord Modules]. This partnership aims to provide standardized solutions for heavy-payload transport in warehouse and industrial settings.(Source: https://www.nord-modules.com)

Segments Covered in the Report

By Component

- Software Platforms

- AI-enabled WMS modules

- Warehouse analytics platforms

- Robotics orchestration software

- Services

- Integration & deployment

- Consulting & workflow redesign

- Managed services

By Technology

- Machine Learning & Predictive Analytics

- Computer Vision

- Natural Language Processing (NLP)

- Digital Twin/Simulation AI

- Other AI Technologies

By Application

- Inventory Optimization & Demand Forecasting

- Warehouse Operations Optimization (slotting, picking, routing)

- Robotics & Automation Intelligence

- Labor Management & Workforce Optimization

- Predictive Maintenance & Asset Monitoring

- Security, Loss Prevention & Compliance

By Warehouse Type

- E-commerce Fulfillment Warehouses

- Retail Distribution Centers

- Manufacturing Warehouses

- Cold Chain Warehouses

- Other Warehouse Types

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting