What is the AI-Powered Edge Robotics Market Size?

The global AI-powered edge robotics market is witnessing rapid growth as manufacturers deploy edge-enabled robots for real-time analytics, autonomous operations, and process optimization.The market is witnessing substantial growth due to the increasing need for real-time automation and decision-making across various industries. Furthermore, the proliferation of IoT devices, rollout of 5G networks, and the critical need for operational efficiency and reduced latency in applications like manufacturing and autonomous vehicles are contributing to market growth.

AI-Powered Edge Robotics Market Key Takeaways

- Asia Pacific held approximately 40% share of the market in 2024.

- North America is expected to grow at the fastest CAGR from 2025 to 2034.

- By robot type, the industrial robots segment dominated the market with around 45% share in 2024.

- By robot type, the collaborative robots (cobots) segment is expected to grow at a significant CAGR from 2025 to 2034.

- By AI capability, the machine learning & deep learning segments led the market with a 40% share in 2024.

- By AI capability, the computer vision & imaging segment is expected to witness the fastest growth during the foreseeable period.

- By application, the manufacturing & assembly segment held the largest market share of about 42% in 2024.

- By application, the logistics & warehousing segment is expected to expand at the fastest CAGR during the foreseeable period.

- By end user, the automotive segment led the market while holding a 35% share in 2024.

- By end user, the pharmaceuticals & healthcare segment is expected to grow at the fastest CAGR during the foreseeable period.

- By deployment mode, the on-premises segment held the largest market share of about 50% in 2024.

- By deployment mode, the edge-cloud integrated segment is expected to expand at the fastest CAGR during the projection period.

What is AI-Powered Edge Robotics?

The AI-powered edge robotics market refers to the sector focused on robots integrated with AI and edge computing technologies, enabling real-time data processing, autonomous decision-making, and adaptive control at the device level without relying on centralized cloud systems. These robots are deployed across various industries, including manufacturing, logistics, healthcare, retail, and agriculture, to enhance operational efficiency, safety, and precision. Edge AI enables low-latency responses, enhanced security, and energy-efficient processing for critical tasks like object recognition, predictive maintenance, and autonomous navigation. The market growth is driven by the adoption of Industry 4.0, increasing demand for automation, advancements in AI hardware and sensors, and the need for fast and reliable decision-making in dynamic environments worldwide.

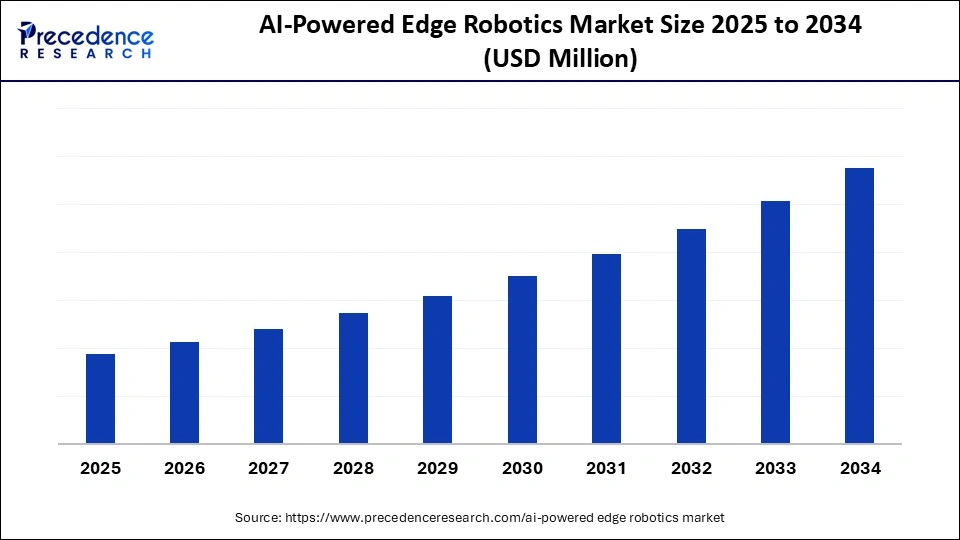

AI-Powered Edge Robotics Market Outlook

- Market Growth Overview: The market is poised for rapid growth between 2025 and 2034, fueled by rising industrial automation, IoT proliferation, and 5G network expansion. There is a high demand for autonomous mobile robots (AMRs), collaborative robots (cobots), and specialized service robots in the healthcare and logistics & warehousing sectors, which is likely to support market growth.

- Sustainability Trends: There is a strong focus on developing energy-efficient robots, implementing environmentally friendly manufacturing techniques, and leveraging AI to optimize resource utilization and minimize waste. Robotics advancements are also contributing to environmental goals through applications like precision agriculture and smart recycling.

- Global Expansion: Market leaders are expanding their reach into emerging regions, such as the Asia Pacific, Latin America, and Eastern Europe, driven by local demand, lower costs, and supportive government initiatives that promote robotics adoption. North America maintains its market dominance due to its strong R&D and technological infrastructure.

- Major Investors: Venture capital, private equity, and strategic investors are actively entering the market, drawn by high margins and alignment with Industry 4.0 and 5.0. Companies like Nvidia and Microsoft are investing in and integrating edge AI into their core products and services.

- Startup Ecosystem: The startup landscape is maturing, with innovation focused on edge AI hardware, real-time vision systems, and Robotics-as-a-Service (RaaS) models. Emerging firms are attracting significant funding for scalable, specialized solutions.

Market Scope

| Report Coverage | Details |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Robot Type, AI Capability, Application, End User / Industry Vertical, Deployment Mode, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Demand for Real-Time, Low-Latency Decision-Making and Processing

The primary driver for the AI-powered edge robotics market is the increasing demand for real-time, low-latency decision-making and processing in various industries, particularly manufacturing and logistics, to enhance efficiency, safety, and cost savings. Industries are increasingly adopting automation to enhance production rates, accuracy, and efficiency, while reducing costs and minimizing human errors. Edge AI enables robots to perform complex data analysis and make decisions independently, eliminating the need for cloud connectivity, which is crucial for applications requiring low latency, such as autonomous systems.

Restraint

High Initial Investment and Complexity

The main restraint in the AI-powered edge robotics market is the high initial investment and complexity of integrating these systems. Advanced robotics requires substantial upfront costs for hardware, software, and compatibility with existing infrastructure. This presents challenges for small and medium-sized businesses. Integrating these sophisticated systems into legacy setups can be complex and time-consuming, needing specialized expertise across multiple engineering fields, which can slow down and limit adoption across industries.

Opportunity

Incorporation of Embodied AI

The key future opportunity in this market lies in incorporating embodied AI to develop more intelligent, autonomous, and adaptable robots. By combining high-performance edge computing with large, multimodal AI models, robots can process complex sensor data locally and in real-time. This enables them to understand and interact with their physical environment in a more advanced, human-like way. This technology is advancing robotics beyond predictable environments, such as factories, into complex, unstructured settings like homes, farms, hospitals, and public spaces.

Segment Insights

Robot Type Insights

What Made Industrial Robots the Dominant Segment in the Market in 2024?

The industrial robots segment dominated the AI-powered edge robotics market with around 45% share in 2024. This is primarily due to their established role in manufacturing, where AI integration enhances precision and efficiency for tasks such as welding and assembly, thereby driving demand across core sectors like automotive and electronics. Edge robotics, powered by AI, enables robots to make real-time decisions by processing data from sensors locally, thereby improving adaptability and responsiveness in dynamic environments. This leads to lower labor costs and higher output, facilitating their widespread adoption across various industries.

The collaborative robots (cobots) segment is expected to expand at the fastest CAGR in the coming years. This is primarily due to their flexibility, safety, and cost-effectiveness, making them accessible to small and medium enterprises and allowing humans and robots to collaborate. This human-robot collaboration is essential for Industry 5.0, where cobots handle repetitive tasks while humans provide creativity and decision-making. They are easier to program, often with tablet interfaces or hand-guiding, and can be integrated into existing production areas without the need for complex safety fencing.

AI Capability Insights

How Does the Machine Learning & Deep Learning Segment Lead the Market in 2024?

The machine learning & deep learning segment led the AI-powered edge robotics market while holding about 40% share in 2024. This is primarily due to its key role in equipping robots with the crucial ability to learn, adapt, and make decisions based on experience, enabling real-time autonomous operation in complex, unpredictable environments at the edge of the network. This learning capability is essential for tasks like object recognition, motion control, and predictive maintenance, directly improving a robot's performance and efficiency in distributed settings by reducing downtime.

The computer vision & imaging segment is expected to grow at the fastest rate in the upcoming period. This is due to rapid advancements in AI, deep learning, and neural networks, which are driving demand for automated quality control, object recognition, and decision-making in complex environments. The technology is increasingly adopted in sectors like automotive for autonomous driving, manufacturing for quality control, healthcare for diagnostics, and logistics, expanding robotics applications across diverse fields with increased efficiency.

Application Insights

Why Did the Manufacturing & Assembly Segment Dominate the AI-Powered Edge Robotics Market?

The manufacturing & assembly segment dominated the market with approximately 42% share in 2024, primarily due to its early and aggressive adoption of automation to enhance productivity, precision, and operational efficiency. These robots offer the greatest potential for tangible benefits like enhanced precision, increased speed, and improved quality control. AI-powered robots can adapt to changing conditions, identify patterns, and execute complex tasks, making them invaluable for smart factories to scale operations and respond to market demands more effectively. Automation helps alleviate labor shortages and enables skilled workers to focus on more complex, high-value tasks, thereby boosting overall workforce efficiency.

The logistics & warehousing segment is expected to grow rapidly due to persistent labor shortages, rising e-commerce demands, faster delivery expectations, and the ability of AI edge robotics to provide real-time data processing for optimized workflows and automated decision-making. These technologies enable warehouses to operate more efficiently through automated inventory management, picking, sorting, and predictive maintenance, increasing throughput and accuracy.

End User Insights

Why Did the Automotive Segment Hold the Largest Market Share in 2024?

The automotive segment captured about 35% share of the AI-powered edge robotics market in 2024. This is due to the industry's need for enhanced manufacturing efficiency, quality control, autonomous vehicle development, and the increasing complexity of vehicle designs, especially in electric models. AI algorithms can identify inefficiencies in manufacturing and operations, optimize engine performance, and predict potential accidents, contributing to safer and more sustainable transportation. The push for autonomous vehicles and advanced driver-assistance systems requires sophisticated AI-powered edge robotics, fueling significant investment.

The pharmaceuticals & healthcare segment is expected to expand at the fastest rate in the market due to the critical need for precision, safety, and real-time responsiveness in highly regulated and sensitive environments. AI's ability to accelerate drug discovery, personalize treatments, improve diagnostic accuracy, and streamline clinical trials, all while maintaining high precision, supports segmental growth. Moreover, segment growth is driven by advancements in AI-driven drug design, robotic assistance in drug manufacturing and patient care, and the increasing need for data-driven decision-making in a complex and evolving field, supporting surgeries and remote patient care.

Deployment Mode Insights

What Made On-Premises the Dominant Segment in the AI-Powered Edge Robotics Market?

The on-premises segment dominated the market, holding about 50% share in 2024. This is due to its ability to offer low-latency processing, enhanced data security, and full control over robotic operations, which are critical in industries where real-time decision-making and handling of sensitive data are paramount. There is an increased need for better data privacy, security, and regulatory compliance, especially in sectors that handle sensitive information, which prefer on-premises deployment over cloud-based solutions. This model enables local data processing, minimizing risks associated with external servers and ensuring that organizations retain control. Industries such as healthcare and defense, which face stringent data confidentiality and regulatory requirements, benefit significantly from on-premises solutions to maintain compliance for large enterprises with specific operational needs.

The edge-cloud integrated segment is expected to grow at a significant rate in the coming years, as it combines the real-time processing power of the edge with the extensive capabilities of the cloud, offering a hybrid approach that reduces latency, lowers bandwidth use, and boosts security. This enables local data processing and continuous cloud-based model training. This hybrid approach allows for dynamic scaling of AI capabilities, leveraging edge resources for local tasks while utilizing the cloud's power for complex computations.

Regional Insights

How Did Asia Pacific Dominate the AI-Powered Edge Robotics Market in 2024?

Asia Pacific dominated the AI-powered edge robotics market with around 40% share in 2024. This is due to its advanced manufacturing ecosystems, a strong focus on automation to tackle labor shortages, and robust government support for technological progress. Countries like China, Japan, and South Korea have sophisticated manufacturing sectors in electronics, automotive, and consumer goods, improving precision and efficiency on production lines. This high demand for industrial automation is supported by government policies, funding, and strategic plans that accelerate the adoption of robotics and AI in the region.

China AI-Powered Edge Robotics Market Trends

China plays a unique role by leveraging its vast manufacturing ecosystem. Its aggressive national strategies, massive industrial base, and rapid adoption of smart manufacturing and AI technologies also support market growth. Under initiatives such as Made in China 2025 and its AI development plans, the country has made significant investments in AI, robotics, and edge computing to modernize its manufacturing sector, reduce labor dependency, and enhance global competitiveness.

India AI-Powered Edge Robotics Market Trends

India is an emerging player in the market, driven by strong government backing and a vibrant startup ecosystem. The IndiaAI Mission and initiatives like Digital India BHASHINI promote the development of indigenous AI models and integrate AI into digital infrastructure, thereby boosting the manufacturing, logistics, healthcare, and defense sectors. Notable Indian startups, such as CynLr, Ati Motors, Perceptyne, Systemantics, and Addverb, are developing specialized robotic solutions. Moreover, government initiatives and incentives to promote AI across all sectors support market growth.

Why is North America Considered the Fastest-Growing Region?

North America is expected to experience the fastest growth in the upcoming period due to its advanced tech infrastructure, strong private and public investments, high demand for automation across industries, and a vibrant ecosystem of both major tech firms and innovative startups. The region is home to many leading and pioneering technology companies, including Google, Microsoft, and NVIDIA, alongside numerous AI and robotics startups. Edge robotics combines AI with edge computing, enabling robots to process data locally for real-time decision-making, a capability essential for autonomous systems. Its leadership in AI innovation, robust R&D ecosystem, and early adoption of advanced technologies across sectors such as manufacturing, healthcare, logistics, and defense also contribute to regional market growth.

Country-level Investments & Funding Trends for AI-Powered Edge Robotics Market

- U.S: Leading global investor with $470.9 billion, focusing on generative AI, semiconductors, and national security infrastructure. The private sector invested $109.1 billion in 2024 alone.

- China: Second largest investor with $119.3 billion, concentrating on autonomous vehicles, smart manufacturing, and healthcare AI. China has also established significant national AI and venture capital funds.

- UK: Allocated $28.2 billion for public service integration, AI safety research, and healthcare applications.

- Germany: Allocated $11.3 billion, with a focus on industrial automation, manufacturing AI, and legal frameworks.

- India: Investing $11.1 billion through the IndiaAI Mission for infrastructure, R&D, and applications in healthcare, agriculture, and education.

AI-Powered Edge Robotics Regulatory Landscape: Global Regulations

| Country/Region | Regulatory Body | Regulatory Approach | Key Initiatives |

| EU | European Artificial Intelligence Office, national authorities | EU AI Act (2024): Risk-based regulation with strict rules for "high-risk" systems | Regulatory Sandboxes, AI Continent Action Plan |

| U.S. | Existing federal agencies (e.g., FTC, EEOC) and state-level laws | No comprehensive federal law; a patchwork of existing rules applied to AI; state laws also enacted | National AI Initiative, AI Action Plan, promote the export of AI |

| China | CAC, Ministry of Science and Technology, Ministry of Public Security | Multi-level framework with national strategies and sector-specific laws (e.g., Generative AI Measures 2023) | Made in China 2025, Ethical Norms for New Generation AI |

| UK | Sector-specific regulators (e.g., ICO, FCA); potential new AI Authority | Pro-innovation, principles-based approach using existing laws, guidance, and principles | AI Safety Institute (AISI), AI Opportunities Action Plan |

| India | Ministry of Electronics and Information Technology (MeitY) | Currently relies on guidelines and sector-specific strategies; aims to support innovation and combat bias | IndiaAI Mission, Digital Personal Data Protection Act (DPDP), National Strategy on Robotics |

Top Companies Operating in the AI-Powered Edge Robotics Market

Tier I – Major Players

These companies are the dominant forces in the AI-powered edge robotics market. They have significant investments in AI, edge computing, and robotics integration, often offering end-to-end solutions. Each holds a substantial individual market share, and collectively they control nearly half of the total market.

- NVIDIA Corporation

- Intel Corporation

- Qualcomm Technologies, Inc.

- ABB Ltd.

- Siemens AG

Tier II – Mid-Level Contributors

These companies maintain a strong presence and actively contribute to the edge robotics ecosystem through specialized products or services in industrial automation, cloud AI, edge platforms, or robotics systems. While not individually dominant, they play critical roles in enabling edge AI adoption across sectors.

- FANUC Corporation

- Rockwell Automation, Inc.

- Microsoft Corporation

- Amazon Web Services (AWS)

- Huawei Technologies Co., Ltd.

Tier III – Niche and Regional Players

These are smaller or specialized companies, often focusing on niche applications such as collaborative robots, industrial IoT integrations, or specific verticals like healthcare or logistics. Many are regional leaders or emerging startups with innovative offerings but limited global scale.

- KUKA AG

- Bosch Group

- CloudMinds

- GreyOrange

- Kinova Robotics

- Other regional players and AI robotics startups

Recent Developments

- In September 2025, Abu Dhabi's Technology Innovation Institute (TII) and NVIDIA have launched the Middle East's first NVIDIA AI Technology Center to develop next-gen AI models and robotics platforms. The joint lab will leverage TII's multidisciplinary research and NVIDIA's advanced AI and edge GPU chips to accelerate work on humanoids, quadrupeds, and robotic arms.(Source: https://indianexpress.com)

- In May 2025, Etron Technology and DeCloak Intelligences received the 2025 COMPUTEX Best Choice Golden Award for the DeCloakBrain AipA Robotic System. The AipA platform, with patented tech, provides personal data de-identification, autonomous situational awareness, and real-time AI anomaly detection, advancing robotics in sectors like security and healthcare.(Source: https://etron.com)

Segments Covered in the Report

By Robot Type

- Industrial Robots

- Articulated Robots

- SCARA Robots

- Delta Robots

- Cartesian / Gantry Robots

- Service Robots

- Delivery & Logistics Robots

- Cleaning & Maintenance Robots

- Healthcare Assistance Robots

- Collaborative Robots (Cobots)

- Single-arm

- Dual-arm

- Others

By AI Capability

- Machine Learning & Deep Learning

- Supervised Learning

- Unsupervised Learning

- Computer Vision & Imaging

- 2D Vision

- 3D Vision

- Natural Language Processing (NLP)

- Predictive Analytics & Maintenance

- Sensor Fusion & IoT Integration

- Others

By Application

- Manufacturing & Assembly

- Material Handling

- Welding & Machining

- Logistics & Warehousing

- Automated Guided Vehicles (AGVs)

- Autonomous Mobile Robots (AMRs)

- Healthcare & Medical Assistance

- Retail & Customer Interaction

- Agriculture & Farming

- Inspection & Quality Control

- Others

By End User / Industry Vertical

- Automotive

- Electronics & Electrical

- Pharmaceuticals & Healthcare

- Food & Beverage

- Consumer Goods

- Logistics & Warehousing

- Agriculture

- Others

By Deployment Mode

- On-Premises

- Edge-Cloud Integrated

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting