What is the Anomaly Detection Market Size?

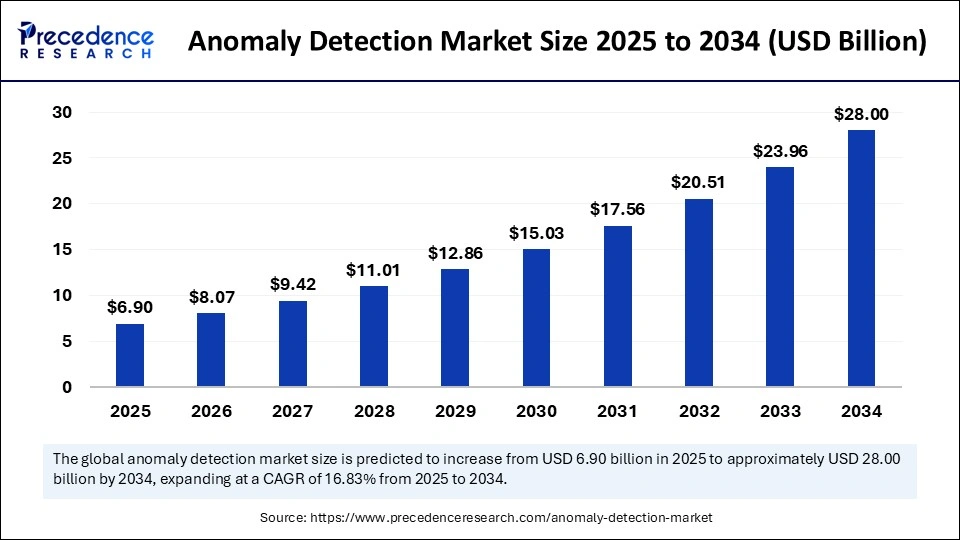

The global anomaly detection market size is calculated at USD 6.90 billion in 2025 and is predicted to increase from USD 8.07 billion in 2026 to approximately USD 28.00 billion by 2034, expanding at a CAGR of 16.83% from 2025 to 2034. The increased demand for predictive analytics solutions in various industries is driving the global anomaly detection market. Increased incidence of cyber threats and innovations and advancements in anomaly detection tools contribute to market growth.

Anomaly Detection MarketKey Takeaways

- In terms of revenue, the anomaly detection market is valued at $6.90 billion in 2025.

- It is projected to reach $28.00 billion by 2034.

- The market is expected to grow at a CAGR of 16.83% from 2025 to 2034.

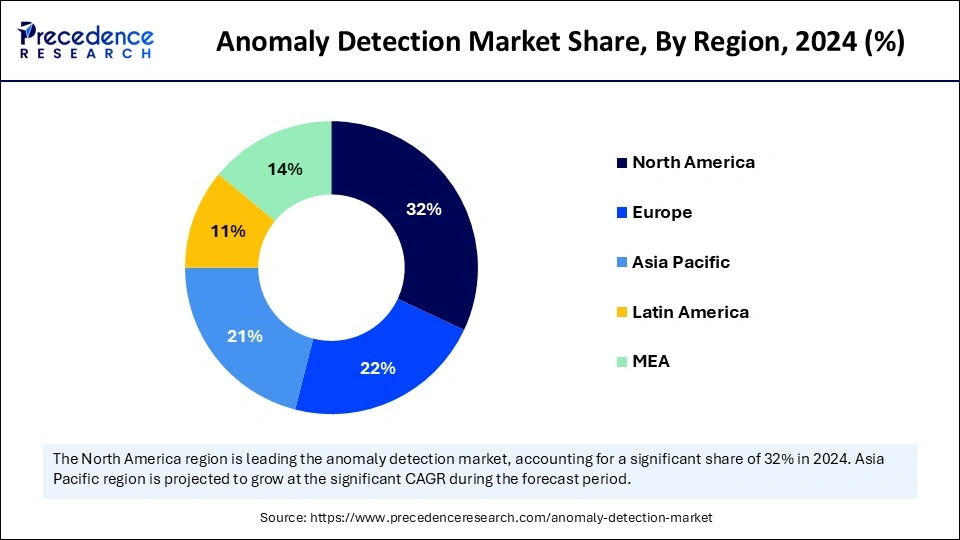

- North America generated the largest revenue share of 32% in 2024.

- Asia Pacific is expected to grow at a significant CAGR of 18% from 2025 to 2034.

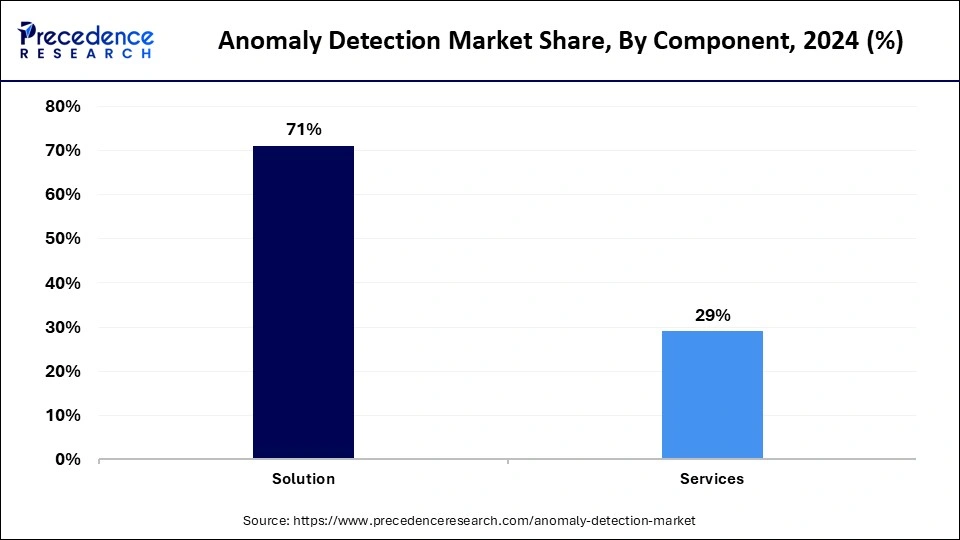

- By component, the solutions segment generated the major revenue share of 71% in 2024.

- By component, the services segment is growing at a biggest CAGR of 17.63% between 2025 and 2034.

- By technology, the big data analytics segment contributed the highest revenue share of 43% in 2024.

- By technology, the machine learning & artificial intelligence segment is expected to expand at the highest CAGR of 18.92% during from 2025 to 2034.

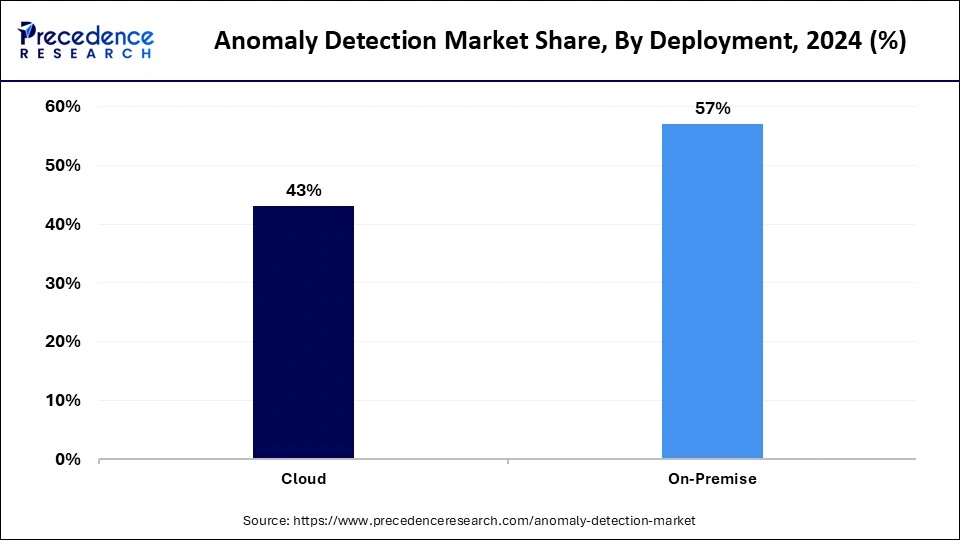

- By deployment, the on-premise segment held the major revenue share of 57% in 2024.

- By deployment, the cloud segment is growing at a significant CAGR of 17.91% from 2025 to 2034.

- By end-user, the BFSI segment dominated the market by holding more than 29% of revenue share in 2024.

- By end-user, the IT & telecom segment is expected to grow at a significant CAGR of 18.81% from 2025 to 2034.

Market Overview

The increased demand for advanced security systems in various industries is driving the worldwide anomaly detection market. Expanding organizations and their large amount of data-driven insights create the need for advanced anomaly detection solutions to prevent organizations from cyber threats and data breaches. The increasing fraud activities, especially in the finance industry, are creating the need for fraud detection mechanisms with cutting-edge technologies like artificial intelligence AI and machine learning ML. Anomaly detection solutions help to detect fraud and provide network security and quality control, making solutions ideal for industries like finance, healthcare, networking, cybersecurity, and manufacturing. Statistical anomaly detection, machine learning integrated solutions, and proximity-based and rule-based anomaly detection solutions are the most popular solutions in the market.

Anomaly Detection MarketGrowth Factors

- Rising Cybersecurity Threats: Multiple sectors are witnessing a rise in cybersecurity threats and data breaches, driving demand for advanced anomaly detection solutions.

- Need for Predictive Analytics Solutions: The need for predictive analytics solutions has increased in various industries to detect and prevent the risk of fraud or cyber threats, driving demand for anomaly detection solutions.

- Demand for Real-time Monitoring: The rising need for real-time monitoring and mitigation of risk regarding anomalies driving the adoption of anomaly detection solutions.

- Digital Transformation: The rapid digital transformation in various sectors and government initiatives in promoting the adoption of digital technologies are fostering market growth.

- Increasing Financial Fraud Detection: The rising incidence of cyber threats and data breaches in the financial sector has increased the need for fraud detection, driving the adoption of advanced anomaly detection solutions.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 28.00 Billion |

| Market Size in 2025 | USD 6.90 Billion |

| Market Size in 2026 | USD 8.07 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 16.83% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Deployment, Technology,End-use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Drivers

Increasing Volume of Data

The volume of data generation is increasing constantly from various sources, such as social media, IoT devices, and business transactions, making the adoption of anomaly detection essential. The high risk of complexity and avatars of data sources in organizations requires advanced anomaly detection solutions to identify patterns and provide decision-making abilities. Anomaly detection solutions are scalable and help to provide real-time analytics of a large database. Industries like cybersecurity, finance, healthcare, and manufacturing are driving the adoption of anomaly detection solutions to analyze data, identify patterns, and provide real-time help.

Restraint

High Implementation Cost

The implementation of anomaly detection solutions is a complex procedure and requires significant investments and skilled personnel, making it expensive. These solutions need high investments in infrastructure, technology, and expertise. Additionally, customized anomaly detection solutions are expensive, making it challenging to meet specific business needs. The high implementation cost of anomaly detection solutions hinders their adoption among small & medium-sized organizations, as these businesses hesitate to invest in expensive solutions due to their budget constraints.

Opportunity

Interdisciplinary Applications

The use of anomaly detection solutions has increased in various industries like finance, healthcare, cybersecurity & networking, and manufacturing, driven by their valuable insights. The anomaly detection market continues to evolve due to interdisciplinary applications, enabling the creation of more effective and versatile solutions. Anomaly detection applications can leverage multiple files, making them versatile, which helps to improve anomaly detection capabilities and provide accurate analysis. Interdisciplinary applications can help create more sophisticated solutions that leverage expertise from multiple domains. The rising adoption of solutions in multiple industries is driving the adoption of interdisciplinary technology.

Component Insights

Why Did Solutions Segment Dominated the Anomaly Detection Market in 2024?

The solutions segment generated the largest revenue share of 71% in 2024. This is mainly due to the increased need for anomaly detection solutions in various organizations to analyze and handle a large amount of data and identify hidden patterns. The segment growth is also attributed to the increasing need for proactive threat detection in the industries. There is a significant rise in data volume and cyber threats, driving the demand for efficient and scalable anomaly detection solutions. Additionally, ongoing technological advancements like the integration of AI and ML in anomaly detection solutions bolster segmental growth.

The services segment is expected to grow at the highest CAGR of 17.63% during the forecast period due to the rising demand for customized anomaly detection services. Organizations are seeking experts and support services to facilitate seamless implementation and maintenance of anomaly detection solutions. There is a rising demand for managed services to ensure optimal performance of solutions. As businesses are rapidly adopting anomaly detection solutions, the demand for consulting, implementation, training & education, and support & maintenance services is rising.

Technology Insights

How Big Data Analytics Segment Dominated the Market in 2024?

The big data analytics segment dominated the market by holding more than 43% of market share in 2024. Organizations have recognized the importance and benefits of big data analytics-based anomaly detection solutions, driving their adoption. These solutions identify unusual patterns and behaviors. Big data analytics provides real-time analysis of large databases, detects hidden and unusual patterns in data, and provides scalability by handling a vast amount of data. The increased need for specialized anomaly detection solutions further bolstered the segment.

The machine learning & artificial intelligence segment is expected to expand at a notable CAGR of 18.92% during the forecast period. The adoption of machine learning & artificial intelligence-based anomaly detection solutions is increasing among various industries like finance, healthcare, manufacturing, and cybersecurity. Machine learning & artificial intelligence-based anomaly detection solutions offer real-time analysis of the data, pattern identification, and scalability. The ability of machine learning & artificial intelligence to handle the vast amount of data makes them significant for large-scale solutions. Additionally, the ongoing focus of key vendors to deliver automated anomaly detection solutions support segmental growth.

- In April 2025, the Adaptive AI Anomaly Detection was launched by a leading provider of data observability and agentic data management solutions, Acceldata. The solution has around xLake Reasoning Engine capabilities, which can automatically identify hidden, multi-dimensional data anomalies before they disrupt business operations.

(Source: https://www.globenewswire.com)

Deployment Insights

What Made On-premise the Dominant Segment in 2024?

The on-premise segment accounted for the highest revenue share of 57% in 2024. This is mainly due to the increased organizations' need for data protection and security protocols. Organizations require compliance with regulatory standards, making on-premises solutions ideal for them. The need for flexible, customized, and integrated solutions is driving demand for anomaly detection solutions. On-premises anomaly detection solutions improve security, provide better control over the system, and ensure reliability. Regulatory requirements, rising data sensitivity, and customized needs are driving the adoption of on-premises solutions in the industries.

The cloud segment is poised to grow at a significant CAGR of 17.91% during the forecast period. The segment growth is attributed to the rapid shift toward cloud-based solutions. Various industries prefer cloud-based anomaly detection solutions due to their enhanced scalability and cost-effectiveness. These solutions are easy to integrate with existing systems, making them ideal for small & medium-sized organizations. These solutions offer flexibility in management, access, and deployment, making them ideal solutions for responding quickly to emerging threats or fraud.

End-user Insights

Which End-user Segment held the Largest Revenue Share in 2024?

The BFSI segment generated the largest revenue share of 29% in 2024. BFSI (banking, financial services, and insurance) is the major end-user of anomaly detection solutions, driven by a high risk of fraud, cyberattacks, and regulatory compliance. BFSI organizations must comply with stringent regulatory requirements, making anomaly detection solutions ideal to meet requirements. These organizations generate huge transaction-related data, driving the need for advanced anomaly detection solutions. Additionally, the rising digitalization in the sector is fueling demand for anomaly detection solutions.

The IT and telecom segment is projected to grow at a significant CAGR of 18.81% over the projected period, driven by increasing data generation, the need for enhanced cybersecurity measures, and the complex network infrastructure of the IT & telecom industry. IT & Telecom companies need to identify and mitigate network security threats and ensure security continuity, which drives demand for advanced anomaly detection solutions. Gen AI is gaining significant popularity for transforming anomaly detection solutions in the telecom industry.

Regional Insights

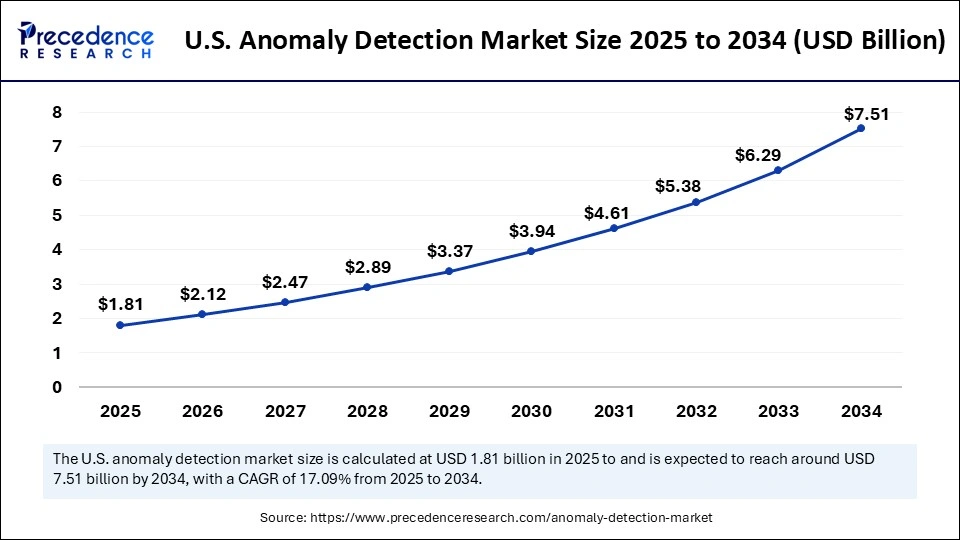

U.S. Anomaly Detection Market Size and Growth 2025 to 2034

The U.S. anomaly detection market size is exhibited at USD 1.81 billion in 2025 and is projected to be worth around USD 7.51 billion by 2034, growing at a CAGR of 17.09% from 2025 to 2034.

What Factors Drive North America's Lead in the Anomaly Detection Market?

North America dominated the market by holding more than 32% of revenue share in 2024. This is mainly due to its advanced IT infrastructure and early adoption of cutting-edge technologies, including anomaly detection. The region boasts a large number of market players, driving innovations and accelerating the growth of the market. The robust IT infrastructure of North America creates the need for anomaly detection solutions for the protection of sensitive data, identification of hidden data patterns, and reducing the risk of cyber threats.

The U.S. is a major player in the North American anomaly detection market. The country is an early adopter of anomaly detection solutions due to stringent regulations regarding data security. The rising incidence of cyber threats and data breaches in various industries have increased regulatory compliance, making the adoption of advanced anomaly detection solutions essential to manage regulatory standards.

What are the Key Trends in the Anomaly Detection Market in Asia Pacific?

Asia Pacific is expected to grow at the fastest CAGR of 18% in the coming years due to the rapid digital transformation. The adoption of digital technologies is rising in various industries, creating the need for advanced anomaly detection solutions. Growing concerns about the risks of cyber threats in industries like healthcare, finance, and telecommunication are boosting the demand for anomaly detection solutions. Additionally, the rapid expansion of the IT industry and the adoption of AI technologies are contributing to regional market growth.

China, India, and Japan are leading the regional market due to rising digital transformation, increased network traffic, cyber security concerns, and technological advancements. Government investments and support for industrial development and advancements create fertile ground for cutting-edge solutions, including anomaly detection solutions. Additionally, rising concerns about cyberattacks and data breaches in the government sector are fostering the development and adoption of advanced anomaly detection technologies.

What Opportunities Exist in the European Anomaly Detection Market?

Europe is a significantly growing area in the realm of anomaly detection. The increased cybersecurity threats, adoption of advanced technologies, and stringent regulations regarding data security bolster the growth of the market in the region. European governments mandate organizations to comply with regulatory compliance. Rising industries and complexity in data and a strong focus on enhancing customer experiences are fostering the adoption of advanced anomaly detection solutions in Europe.

France is expected to lead the anomaly detection market within Europe, driven by increasing data volumes, data complexity, and cybersecurity measures. Industries around the country are seeking ways to enhance operational efficiency, creating the need for anomaly detection solutions. There is high adoption of cutting-edge technologies, including cloud computing and internet of things (IoT) devices, driving the necessity for advanced anomaly detection solutions.

Anomaly Detection MarketCompanies

- Amazon Web Services, Inc.

- Cisco Systems, Inc.

- Anodot Ltd.

- Dell Technologies, Inc.

- Broadcom, Inc.

- Hewlett-Packard Enterprise Company

- International Business Machines Corp.

- Dynatrace, LLC

- GURUCUL

- Happiest Minds

- LogRhythm, Inc.

Recent Developments

- In May 2025, AWS Cost Anomaly Detection and AWS User Notifications have been integrated, enabling customers to design improved alerting capabilities in the AWS User Notifications console. The AWS User Notifications help customers receive immediate alerts through various channels, like email, AWS Chatbot, and the AWS Console Mobile Application, while maintaining a centralized history of alert notifications. (Source: https://aws.amazon.com)

- In May 2025, Cavallo and its partner Microsoft launched the Profit Max Platform, featuring new anomaly detection and predictive capabilities. The platform is integrated with Microsoft Dynamics 365, Business Central, Finance and Operations, and GP.

(Source: https://www.technologyrecord.com) - In April 2025, Middle East-based HITEK AI launched its latest innovative solution, the Predictive Maintenance and Anomaly Detection System. This system is now available within its CAFMTEK platform. This AI-driven tool is designed to enhance operational efficiency and reliability of MEP assets, including HVAC, Main Distribution Board (MDB) assets as well as many others. (Source: https://intlbm.com)

Segment Covered in the Report

By Component

- Solution

- Network Behavior Anomaly Detection

- User Behavior Anomaly Detection

- Services

- Professional Services

- Managed Services

By Deployment

- Cloud

- On-Premise

By Technology

- Machine Learning & Artificial Intelligence

- Big Data Analytics

- Business Intelligence & Data Mining

By End-use

- BFSI

- Retail

- IT & Telecom

- Healthcare

- Manufacturing

- Government & Defense

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting