What is the Artificial Intelligence (AI) in Banking Market Size?

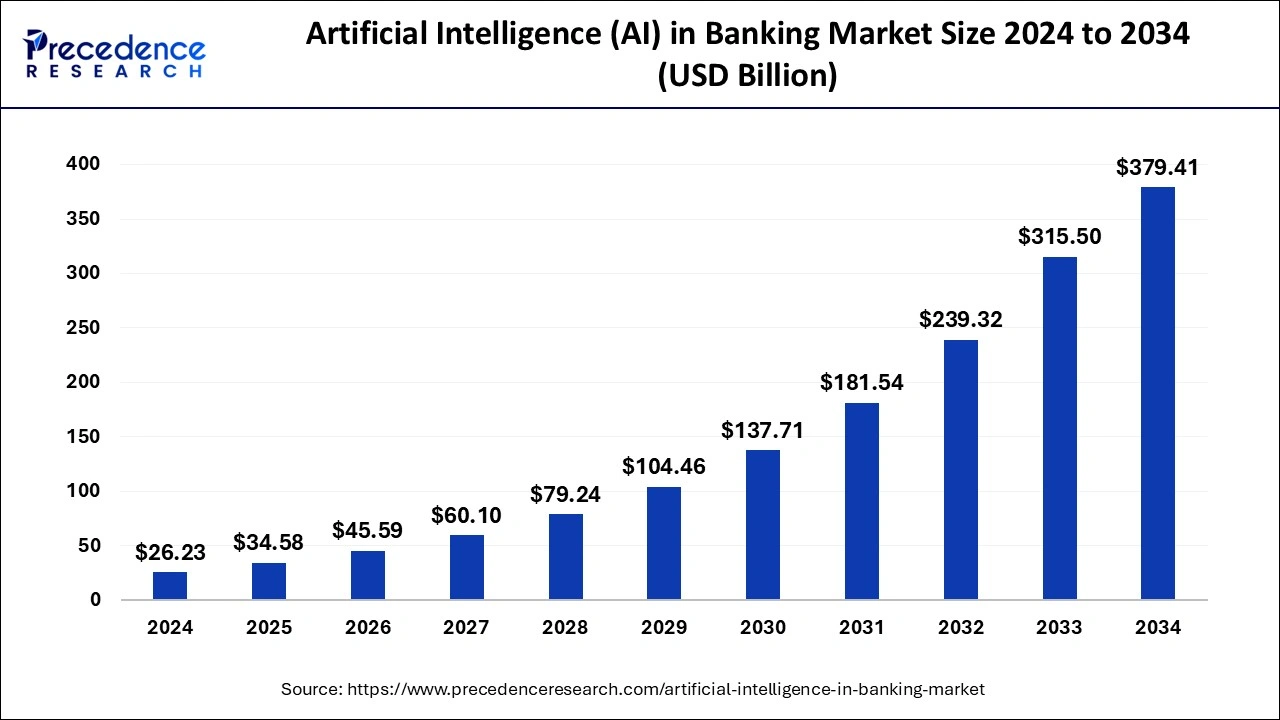

The global artificial intelligence (AI) in banking market size is calculated at USD 34.58 billion in 2025 and is predicted to increase from USD 45.59 billion in 2026 to approximately USD 451.50 billion by 2035 expanding at a CAGR of 29.30% from 2026 to 2035. The digitization and modernization of banking and financial institutes are driving the growth of the market.

Artificial Intelligence (AI) in Banking Key Takeaways

- In terms of revenue, the global artificial intelligence (AI) in banking market was valued at USD 34.58 billion in 2025.

- It is projected to reach USD 451.50 billion by 2035.

- The market is expected to grow at a CAGR of 29.30% from 2026 to 2035.

- North America led the artificial intelligence (AI) in banking market in 2025.

- Asia Pacific is expected to witness the fastest growth in the market during the forecast period.

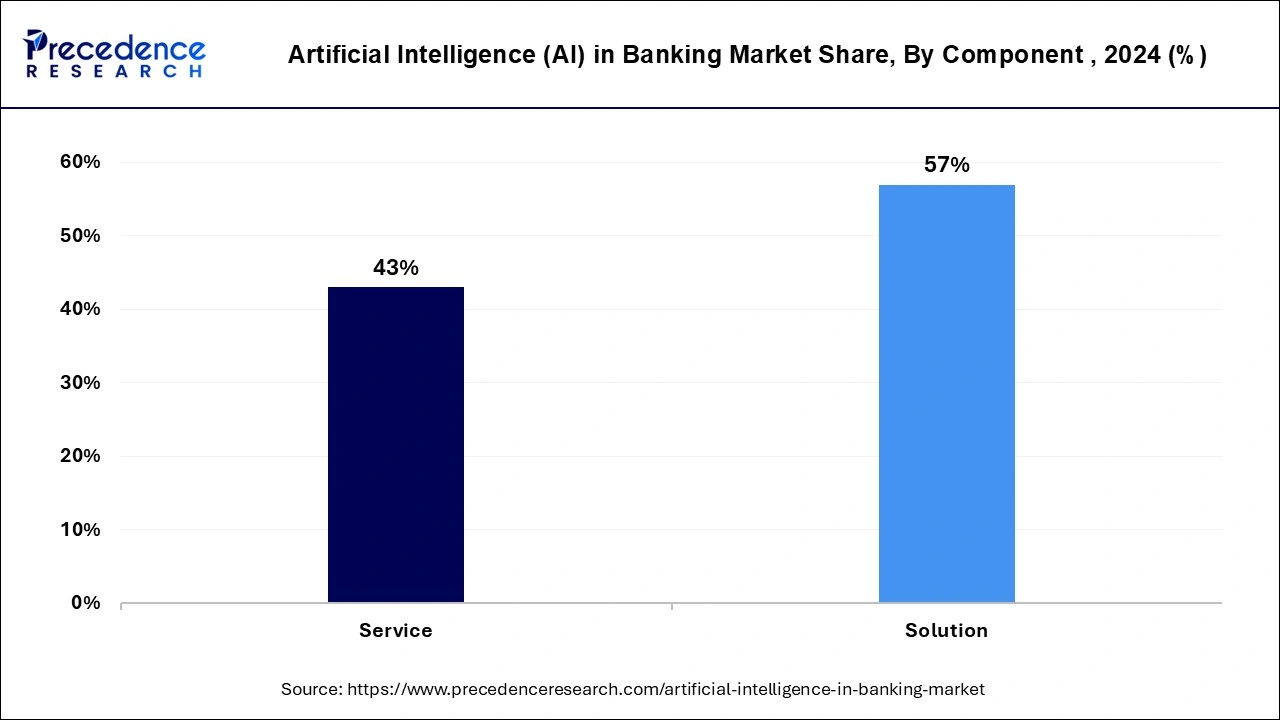

- By component, the solution segment dominated the market in 2025.

- By component, the service segment is expected to gain a significant share of the market during the forecast period.

- By application, the risk management segment held the largest share of the market in 2025.

- By application, the customer service segment is expected to increase its CAGR over the forecast period.

- By technology, the natural language processing (NPL) segment accounted for the largest of the market in 2025.

- By technology, the computer vision segment will grow rapidly in the market during the forecast period.

- By enterprise size, the large enterprise segment accounted for the largest share of the market in 2025.

- By enterprise size, the small & medium enterprises (SMEs) segment is expected to register significant growth in the market during the forecast period.

What is Artificial Intelligence (AI) in Banking?

AI or artificial intelligence is used to enhance the working process in banking and financial institutions. The integration of AI into banking refers to the combining of advanced technologies like machine learning and data analytics into banking operations. Artificial intelligence is used in banking for data-driven insights, automation, risk management, enhanced customer experiences, and reduction in cost.

AI reduces manpower and efficiently performs tasks like decision-making, data analysis, and customer service. AI also helps assess customer creditworthiness, predict market fluctuations, and minimize and detect fraudulent transactions. The increasing demand for personalized banking operations by the consumer and the adoption of banking mobile applications for digital banking is further driving the growth of the artificial intelligence (AI) in banking market.

Artificial Intelligence (AI) in Banking Market Growth Factors

- The rise in technological integration over several end-use industries like automotive, banking and finance, manufacturing, healthcare, and others is driving the growth of the artificial intelligence (AI) in banking market.

- The integration of rising technological advancements like artificial intelligence and machine learning into the banking sector to increase working efficiency, technological relevance, and consumer-centric approach are driving the adoption of the artificial intelligence (AI) in banking market.

- The adoption of AI in banking helps increase efficiency, simplify operations, enhance productivity, and minimize the cost of operations. Thus, AI helps to enhance the overall operational process.

- The increasing cases of cybercrime and fraud in the banking sector and the rising awareness about fraud prevention and detention, data-driven decision-making, and risk management are driving the demand for the artificial intelligence (AI) in banking market.

- The rising demand for personalization banking services and the implementation of data collection technology in several financial institutes and banks are driving the growth of the artificial intelligence (AI) in banking market.

Market Outlook

- Industry Growth Overview: The use of AI banking is being propelled by operational effectiveness and personalisation across the world.

- Sustainability Trends: Banks use AI on ESG risk analysis and paperless processes.

- Global Expansion: The major adoption and innovation areas are still in North America and the Asia-Pacific.

- Major investors: IBM, Microsoft, Google, JPMorgan Chase, Bank of America, SoftBank, and Andreessen Horowitz are the major investors.

- Startup Ecosystem: Fintech startups that aim at AI grow their operations with existing banks.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 34.58 Billion |

| Market Size in 2026 | USD 45.59 Billion |

| Market Size by 2035 | USD 451.50 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 29.30% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Component, Application, Technology, Enterprise Size, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

AI helps enhance overall banking operations

The advancement in banking and financial institutions is driving the demand for the artificial intelligence (AI) in banking market. It assesses the overall working operations in banking, such as how it is used to enhance the customer experience with AI-powered solutions like virtual assistance and chatbots to help consumers with quick and effective responses and answers to their queries. AI integration also helps in operating tasks like data entry, automation, customer onboarding, and document processing.

AI is also used to increase risk management by analyzing a large amount of data and predicting the potential risk associated with the data. It helps in making informed data-driven decisions. It automates the operational tasks and reduces the manual interventions that cause cost reduction, streamline processes, and improve operational efficiency. The rise in customers, the modernization of banking, and the adoption of digital banking are also contributing to the growth of the artificial intelligence (AI) in banking market.

Restraint

Rising cases of cybercrimes

The integration of AI tools into banking and finance also creates potential risks like cyberattacks, difficulty in maintaining outcome accuracy, model biases, and others. Additionally, the higher cost of installation of AI tools and software is limiting the expansion of the artificial intelligence (AI) in banking market.

Opportunity

Digital transformation in banking

Digitization is transforming the banking and financial sector, increasing customer demand for the automated experience with self-service capabilities and personalized services that drive the growth opportunity for the artificial intelligence (AI) in banking market. The rising investment in artificial intelligence by the banking sector to stay ahead of the competition and provide technologically advanced tools for managing their financial requirements.

The rising digitization results in the increased adoption of mobile banking by customers, and they prefer choosing banks with well-developed technological infrastructure to serve the customer demand. AI offers the latest operating models, smart automation, and relevant digitization and enhances profitability in the future of retail and commercial banking. Thus, all these factors are contributing to the growth opportunity of the artificial intelligence (AI) in banking market.

Segment Insights

Component Insights

The solution segment dominated the market with share of 57% in 2024. The rising adoption of AI tools in banking operations like customer service, fraud detection, and personalized financial recommendations. The rising integration of technological advancements in the banking sector and rising demand for digital banking are driving the growth of the artificial intelligence (AI) in banking market. The rising investment in artificial intelligence by the banking sector to enhance operational efficiency, decision-making, and customer services is driving the demand for AI banking solutions.

The service segment is expected to gain a significant share of the artificial intelligence (AI) in banking market during the forecast period. The growth of the segment is attributed to the rising demand for AI services to navigate difficulties and optimize AI systems for banking requirements. AI services help the banking and financial sectors to support and guide the installation of AI tools into the existing banking structure. Insufficient expertise in AI technologies in banking further boosts the growth of the AI banking services segment.

Application Insights

The risk management segment held the largest share of the artificial intelligence (AI) in banking market in 2024. The rising demand for risk management by the banking and financial sector to improve the detection of fraudulent activities is contributing to the growth of artificial intelligence in the banking sector. The increasing prevalence of cyber security and financial fraud is driving the demand for prevention applications that drive the demand for the risk management segment. AI-powered risk management helps enhance efficiency and productivity while minimizing costs. AI risk management helps evaluate, identify, and manage tasks associated with the use of AI in the banking sector. There are several risks managed by AI risk management, such as technical risks like data privacy risks, bias in AI models, overfitting, and inaccurate results. Non-technical risks include ethical and social risks, regulatory risks, and others.

- In May 2024, Swift collaborated with its member banks to introduce two AI-based experiments to explore how technology could help fight cross-border payment fraud and save billions of dollars in industry fraud-related issues.

The customer service segment is expected to increase its CAGR over the forecast period. Consumers' increasing demand for the personalized banking experience is also driving the growth of the AI customer services segment. AI helps to serve the customer rapidly, which saves hours of operations. The development of AI customer services like AI chatbots for improving customer services. AI chatbots can automatically generate relevant answers to customer queries and summarize and provide service replies. Thus, the rising investment in the development of personalized banking solutions and enhanced customer services is further boosting the demand for the artificial intelligence (AI) in banking market.

- In May 2024, Newgen Software Technologies launched the LumYn, a revolutionary Gen AI-powered hyper-personalization platform specially developed for the banking sector. The launch is established to enhance profitability and customer experience for banks worldwide.

Technology Insights

The natural language processing (NPL) segment accounted for the largest of the artificial intelligence (AI) in banking market in 2024. The increasing adoption of natural language processing in the banking sector to understand and extract valuable insights from unstructured data, customer queries, and social media interaction helps cater to the demands and requirements of customers. Natural language processing helps in performing different tasks in banking operations, such as analyzing sentiments, streamlining repetitive tasks, reducing errors, and predicting future performance. Natural language processing also helps in risk assessment, intelligent search documents, investment analysis, and fraud detection. NLP is also used in predictive analysis by analyzing historical data and, according to that, predicting the future performance of investment funds. It is also used in customer services, retention, and analysis.

The computer vision segment will grow rapidly in the artificial intelligence (AI) in banking market during the forecast period. The rising incidence of fraud cases in banking and financial institutions is driving the demand for computer vision for security purposes, using video analytics and facial recognition for monitoring and security purposes of branches, ATMs, and online transactions. Computer vision helps automate manual tasks, improve operational efficiency, and enhance accuracy.

Enterprise Size Insights

The large enterprise segment accounted for the largest share of the market in 2024. The rise in banking and financial institutions in economically developed nations is driving the demand for AI to improve the working operations that drive the growth of the market. Large enterprises have the capability to invest in AI technologies at a larger scale. Large enterprises have a wide range of operations like documentation, fraud detection, risk management, customer services, and others that drive highly sophisticated AI-driven tools. AI could improve the customer experience, decision-making, data analysis, automation, and personalized services in banking, which drives the growth of the artificial intelligence (AI) in banking market.

The small & medium enterprises (SMEs) segment is expected to register significant growth in the artificial intelligence (AI) in banking market during the forecast period. The increasing availability of cost-effective AI solutions for small and medium enterprises to improve operational efficiency and customer engagement through the various latest strategies and technologies associated with AI drives the demand for AI in banking in small and medium-sized enterprises.

Regional Insights

North America led the artificial intelligence (AI) in banking market in 2024. The growth of the market in the region is increased due to increased economic stability and the higher number of people with the increased and stable income sources that drive the growth of the banking sector in the region. The early adoption of technologies in every end-use industry and the banking industry, as well as the increasing digitization and technological evaluation in the banking sector in the region, is driving the growth of the market. The rising investment in AI by the large-scale banking sector for working efficiency and the continuous research and development activities in the expansion of technologies and mergers and acquisitions are further driving the growth of the artificial intelligence (AI) in banking market in the region.

- In May 2024, Intellect Design Arena launched Canada eMACH.ai Cloud for Credit Unions and Banks. An innovative product spans Liquidity, Digital Engagement, Core Banking, and Viral Accounts, with the embedded AI enabling financial institutions to customize digital experiences and meet growing customer demand.

U.S. Artificial Intelligence (AI) in Banking Market Trends

The U.S. has a robust infrastructure and a high level of individual investment in AI banking. Megabanks such as Google, Microsoft, IBM, and Amazon Web Services provide AI solutions in the banking sphere. Banks such as JPMorgan Chase and Bank of America are employing AI in the sphere of personalization, loan processing and risk assessment, fraud detection, and cybersecurity analysis.

Asia Pacific is expected to experience the fastest market growth during the forecast period. This is due to the region's growing population and improved access to banking services. The development of the fintech industry and digital transformation in banking are also contributing to market growth. The increasing demand for personalized customer experiences and the region's rising economic growth is further driving the expansion of artificial intelligence (AI) in banking market in the Asia Pacific.

China Artificial Intelligence (AI) in Banking Market Trends

China prioritizes nationalism in its adoption of artificial intelligence. Large datasets and powerful state support are used by banks implementing AI on a large scale. Onboarding, fraud, and decisions become automated through AI. Generative AI assists in banking operations, including processing documents, conversational banking, and knowledge management within the company.

Artificial Intelligence (AI) in Banking Market Companies

- Amazon Web Services, Inc.: Provides cloud technology and AI solutions that allow banks to deploy machine learning models, automate services, and create custom financial solutions securely.

- Capital One: Relies on AI to apply to its Chat Concierge, fraud detection, and analytics-based transformation, enhancing the efficiency of customer service and reinforcing internal banking operations.

- Cisco Systems, Inc.: Provides agentic AI-based networking and security services, such as Hypershield, in service of agentic AI workload and secure banking data center environments.

Other Major Key Players

- FAIR ISAAC CORPORATION (FICO)

- Goldman Sachs

- International Business Machines Corporation

- JPMorgan Chase & Co.

- NVIDIA Corporation

- RapidMiner

- SAP SE

Recent Developments

- In November 2025, the Global Alliance for Banking on Values (GABV) launched a new initiative involving 72 member banks from 45 countries, focusing on AI's role in the banking industry. This coincides with Banking on Values Day on 10 November, highlighting AI's increasing significance.

(Source: https://sustainabilityonline.net ) - In August 2025, Malaysia launched Ryt Bank, its first AI-powered bank, developed by YTL Group in collaboration with Sea Limited, just before Merdeka. Dato' Seri Yeoh Seok Hong emphasized its innovation, reflecting Malaysia's values and culture, providing a banking experience unique to Malaysians, and setting new standards in the industry. (Source: https://www.artificialintelligence-news.com )

- In May 2024, The Ministry of Industry and Advanced Technology (MoIAT) announced the collaboration with the Emirates Development Bank (EDB), a major financial engine of industrial advancements and economic development in the UAE, for providing AED 370 million in financing solutions for the development of new AI Innovation Program.

- In May 2024, Sterling Bank collaborated with AI in Nigeria to introduce the ‘Nigeria AI Landscape and Startup Report', providing a diversified view of Nigeria's ecosystem and startup scene.

Segments Covered in the Report

By Component

- Service

- Solution

By Application

- Risk Management

- Customer Service

- Virtual Assistant

- Financial Advisory

- Others

By Technology

- Natural Language Processing (NLP)

- Machine Learning & Deep Learning

- Computer Vision

- Other

By Enterprise Size

- Large Enterprise

- SMEs

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting