What is the At-Home Peptic Ulcer Testing Market Size?

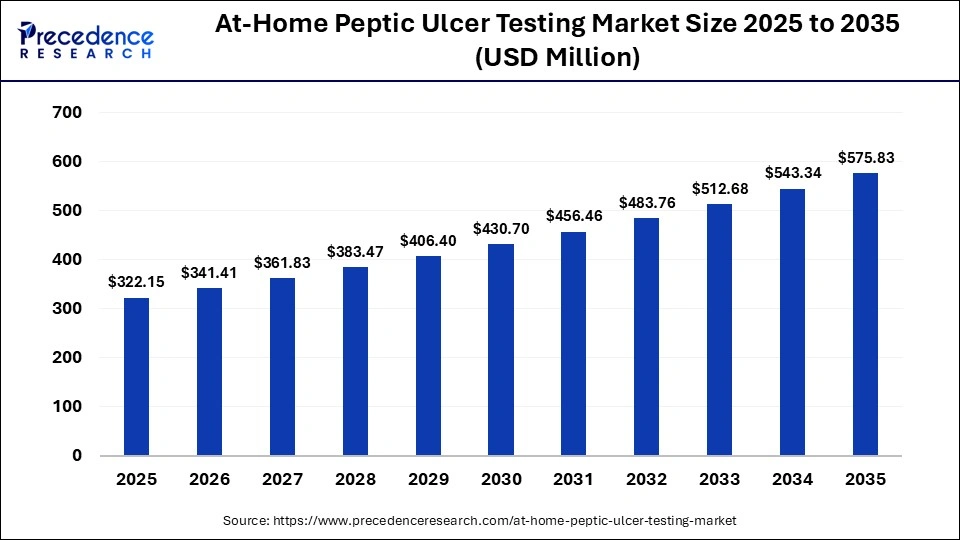

The global at-home peptic ulcer testing market size accounted for USD 322.15 million in 2025 and is predicted to increase from USD 341.41 million in 2026 to approximately USD 575.83 million by 2035, expanding at a CAGR of 5.98% from 2026 to 2035. The market is expanding as consumer demand rises for convenient, non-invasive detection modules, increased health awareness, and advancements in rapid diagnostic kits.

Market Highlights

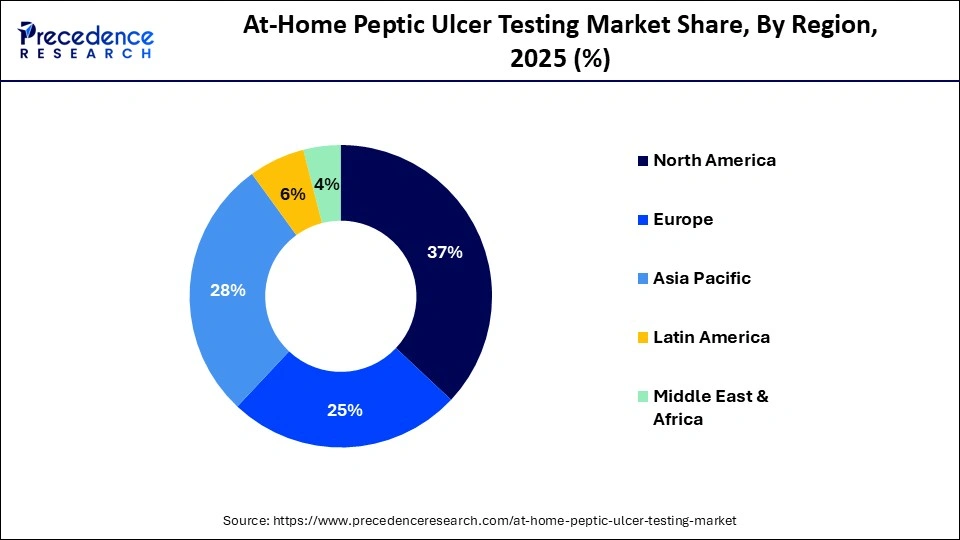

- North America led the at-home peptic ulcer testing market with the largest share of 37% in 2025.

- Asia Pacific is expected to expand at the fastest CAGR of 6.0% between 2026 and 2035.

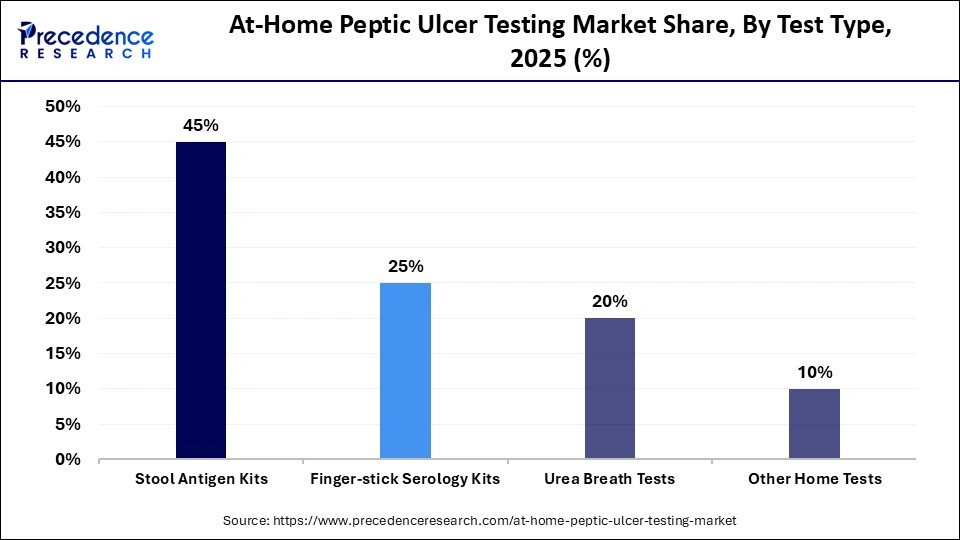

- By test type, the stool antigen kits segment dominated the market with approximately 45% share in 2025.

- By test type, the finger-stick serology segment is expected to grow at a strong CAGR of 5.8% from 2026 to 2035.

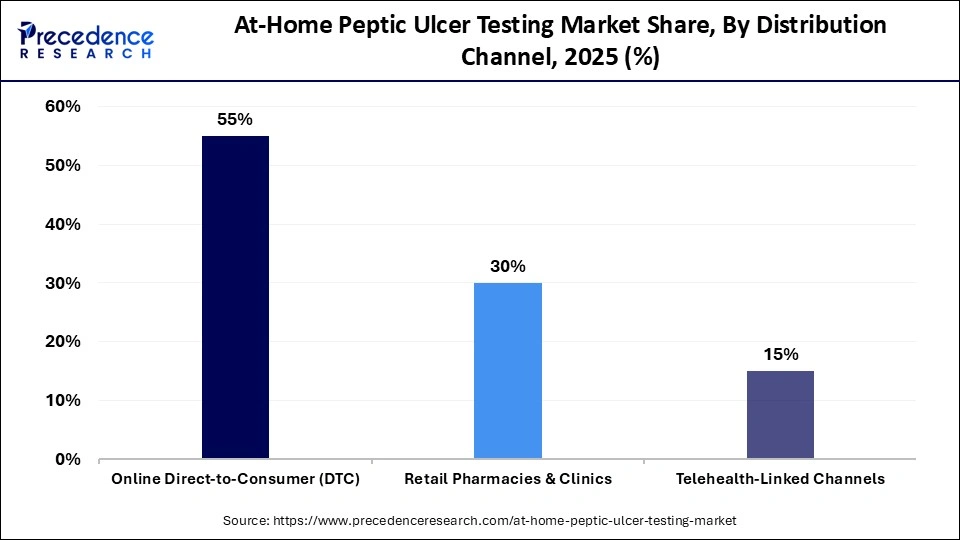

- By distribution channel, the online direct-to-consumer (DTC) segment held around 55% market share in 2025.

- By distribution channel, the retail pharmacies & clinics segment is expected to grow at a solid CAGR of 5.6% between 2026 and 2035.

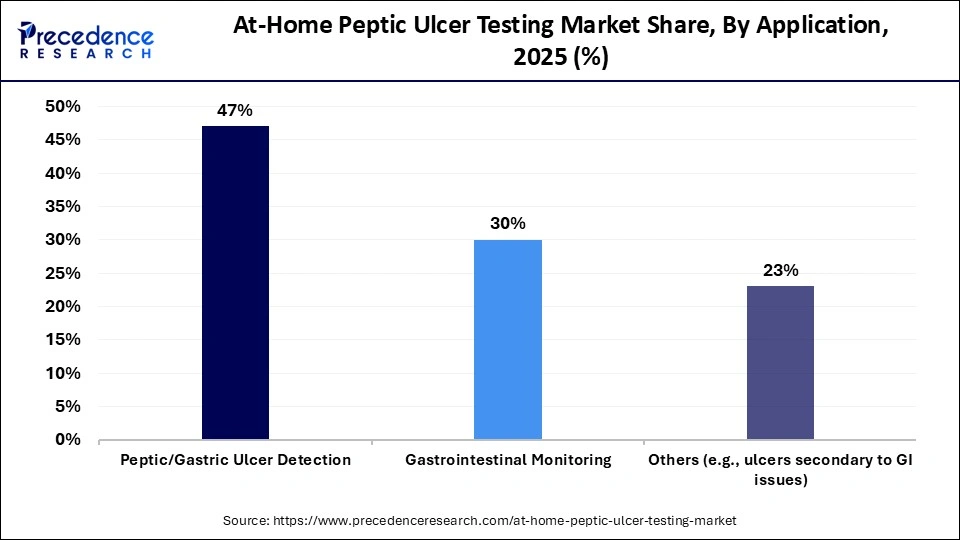

- By application, the peptic/gastric ulcer detection segment led the market while capturing approximately 47% share in 2025.

- By application, the gastrointestinal monitoring segment is expected to expand at a significant CAGR of 5.0% from 2026 to 2035.

How is At-Home Testing Changing How Peptic Ulcers are Diagnosed and Treated?

Self-testing for peptic ulcer disease is available to individuals who would like to know if they have an H. pylori infection. There are diagnostic kits available that use blood, stool, and breath samples to identify whether or not an individual has an infection. By quickly diagnosing H. pylori infection, these tests help individuals identify their risk for ulcers before they develop into something more serious.

There is an increase in the demand for home testing for H. pylori infection due to the increase in gastrointestinal disorders, increased use of NSAIDs, and the preference for non-invasive and confidential diagnosis. The introduction of rapid immunoassays to accurately measure the presence of H. pylori in the body and allow for faster analysis of results has made consumers more comfortable using home testing. Additionally, the continued growth of health e-commerce platforms and the increasing awareness of health among both older and urban populations are creating opportunities for market growth. The market is also driven by the need for regulatory approval, physician endorsement, and collaboration with telemedicine companies.

How is AI Transforming the At-Home Peptic Ulcer Testing Market?

Artificial intelligence (AI) is transforming the market for at-home peptic ulcer testing by increasing the accuracy of these tests, reducing the need for specialist physician interpretation, and automating the analysis of test data. By incorporating AI algorithms into digital diagnostic tools, the chances of correctly identifying Helicobacter pylori and other clinical indicators are increased, which improves consumer confidence in these home testing kits and supports the use of predictive risk stratification.

As artificial intelligence (AI) is increasingly integrated into diagnostic businesses, it is enhancing the value of software-based tools by improving the speed and accuracy of screening processes. Recent advancements in at-home ulcer testing are providing consumers with more comprehensive and convenient options, aligning with the growing trend toward early detection and self-care.

What are the Major Trends Influencing the At-Home Peptic Ulcer Testing Market?

- Non-Invasive Home Testing: The growing trend of non-invasive at-home testing, such as stool and breath tests, reduces the need for specialist visits while enabling consumers to monitor their health more comfortably, privately, and proactively during the early stages of an illness.

- Increasing Awareness About H. Pylori: The increase in awareness surrounding H. pylori has increased the demand for early detection and timely decisions regarding treatment through the availability of simple home tests.

- Digital Health Integration: Mobile apps and telehealth platforms make it easier for consumers to track symptoms, interpret results, and connect with healthcare professionals, building trust in home testing kits.

- Expansion of Pharmacy Channel: Growth in retail and online pharmacies has increased the availability and visibility of self-diagnostic tests, improving access for consumers.

- Focus on Preventive Care: Emphasis on preventive gastrointestinal health encourages at-home testing, helping to prevent disease progression and reduce long-term treatment costs.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 322.15 Million |

| Market Size in 2026 | USD 341.41 Million |

| Market Size by 2035 | USD 575.83 Million |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.98% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Test Type, Distribution Channel, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Test Type Insights

Why Did the Stool Antigen Kits Segment Lead the At-Home Peptic Ulcer Testing Market?

The stool antigen kits segment led the market with a 45% share in 2025 because they have a consistent and high level of accuracy when diagnosing people with an active H. pylori infection. Clinicians have also widely endorsed stool antigen tests and consider them to be a great tool for monitoring the success of H. pylori treatment. They allow for the collection of stool samples without performing a procedure on the patient. They are the preferred choice by both consumers and telehealth providers because of their high acceptance from the medical community, cost-effectiveness, and ability to be retested frequently.

The finger-stick serology segment is expected to grow at a 5.8% CAGR during the forecast period due to the increasing preference for solutions that are minimally invasive and provide results in a matter of minutes. These tests require only a small blood sample, can be performed at home with minimal guidance, and do not rely on laboratory support. The popularity of finger-stick serology tests to diagnose H. pylori has increased significantly due to increased levels of accurate antibody detection, increased consumer demand for quick preliminary screening tests for H. pylori, and the expanding availability of this test type in areas where stool and breath tests are not available.

Distribution Channel Insights

What Made Online Direct-To-Consumer the Dominant Segment in the At-Home Peptic Ulcer Testing Market?

The online direct-to-consumer segment dominated the market while holding a 55% share in 2025 due to its convenience, accessibility, and privacy, allowing consumers to order tests directly without visiting a clinic or pharmacy. These distribution methods allow consumers to purchase products without being restricted by geography. As a result, many consumers prefer to order products discreetly, receive them via subscription, or have them sent directly to their homes. Online digital platforms provide access to educational materials, such as online educational courses, symptom-checking tools, and bundles of tests that all help improve consumer confidence and speed up the process of buying at-home diagnostic tests.

The retail pharmacies & clinics segment is expected to expand at a healthy CAGR of 5.6% in the upcoming period due to increased accessibility and consumer trust associated with established healthcare outlets. Many retail pharmacies and clinics now offer a growing range of over-the-counter (OTC) diagnostic tests that are readily available for purchase. This availability has been strengthened by increased investments in expanding OTC testing sections and enhanced collaborations between pharmacy chains and diagnostic companies, including off-site partnerships, making these products more accessible to consumers.

Application Insights

Why Did the Peptic/Gastric Ulcer Detection Segment Dominate the Market in 2025?

The peptic/gastric ulcer detection segment dominated the at-home peptic ulcer testing market with a 47% share in 2025 due to the high prevalence of H. pylori infections and related gastrointestinal disorders, which drives strong demand for early and convenient detection. The availability of accurate, non-invasive tests, including stool, breath, and finger-stick serology kits, has made home-based testing increasingly reliable and accessible. Additionally, growing consumer awareness of gastrointestinal health, emphasis on preventive care, and preference for self-administered diagnostic solutions reinforced this segment's leadership in the market.

The gastrointestinal monitoring segment is expected to grow at a robust CAGR of 5.0% in the coming years. This is mainly due to the increase in the number of people suffering from chronic GI issues and the availability of at-home tests for use in monitoring following treatment. There are increased awareness of gut health and a higher demand for follow-up work via telehealth. In addition, more consumers are taking a proactive approach in tracking their GI condition over time and beyond the initial diagnosis of ulcers.

Regional Insights

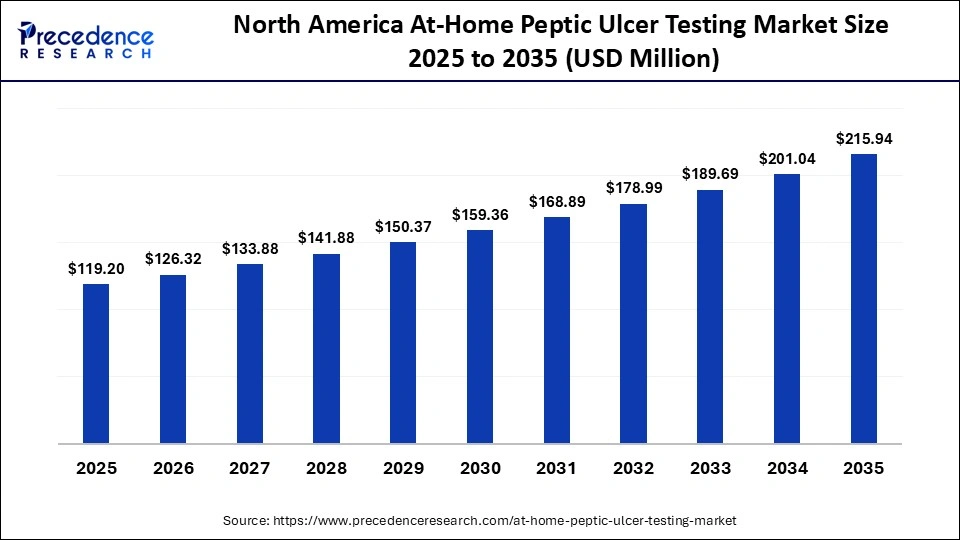

How Big is the North America At-Home Peptic Ulcer Testing Market Size?

The North America at-home peptic ulcer testing market size is estimated at USD 119.20 million in 2025 and is projected to reach approximately USD 215.94 million by 2035, with a 6.12% CAGR from 2026 to 2035.

What Made North America the Dominant Region in the At-Home Peptic Ulcer Testing Market?

North America dominated the at-home peptic ulcer testing market by capturing the largest share of 37% in 2025. This is due to a high level of public awareness regarding health, a strong focus on preventive care, and a broad acceptance of home testing products. North America has established distribution channels for home testing kits, and the general public is comfortable with using digital technologies for healthcare services.

Additionally, the insurance policies offered by North American health plans, as well as the public health initiatives aimed at detecting gastric disorders early, support demand for at-home peptic ulcer tests. There is a strong emphasis on patient-centric care and the integration of digital health into patient care. This makes it easy for patients to obtain timely information about their digestive health without requiring a clinical visit to a healthcare provider.

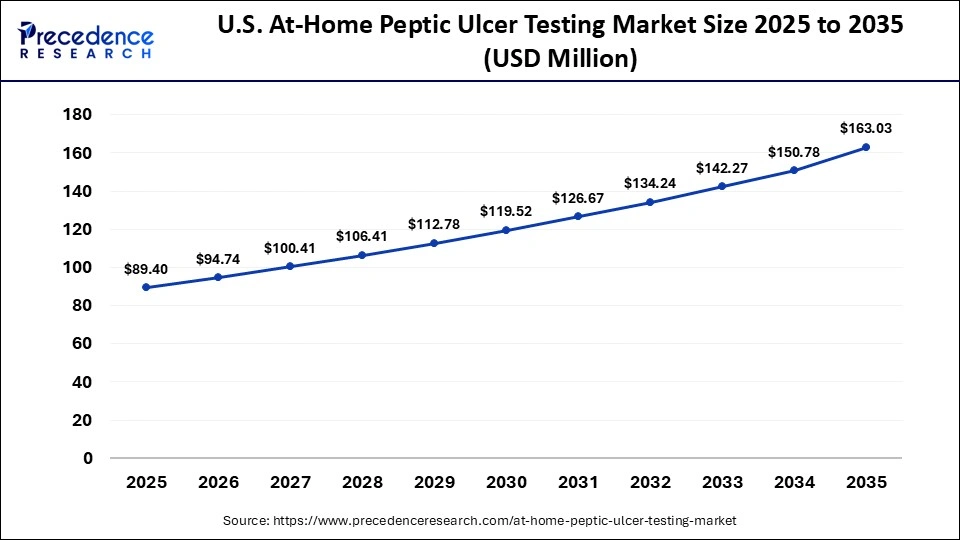

What is the Size of the U.S. At-Home Peptic Ulcer Testing Market?

The U.S. at-home peptic ulcer testing market size is calculated at USD 89.40 million in 2025 and is expected to reach nearly USD 163.03 million in 2035, accelerating at a strong CAGR of 6.19% between 2026 and 2035.

U.S. At-Home Peptic Ulcer Testing Market Trends

The market in the U.S. is expanding due to its robust healthcare system, along with a large emphasis on consumer health. Rising awareness of H. pylori infections and gastrointestinal health, coupled with the availability of accurate home testing kits such as stool, breath, and finger-stick serology tests, has driven adoption. Additionally, the integration of digital health tools, expansion of pharmacy and online distribution channels, and a focus on preventive care are enabling consumers to monitor their health early, boosting market growth.

Why is Asia Pacific Considered the Fastest-Growing Region in the At-Home Peptic Ulcer Testing Market?

Asia Pacific is expected to grow at the fastest CAGR of 6.0% in the market during the forecast period, primarily due to the growing health consciousness among consumers, expanding access to healthcare, the increase in prescribing and diagnostic testing for digestive disorders, and a shift to proactive health & wellness. In addition, the growing trend of digital access is enabling more people to purchase and use self-tests through online platforms and e-commerce channels. Furthermore, government initiatives to strengthen primary healthcare and raise awareness of screening programs have played a crucial role in expanding testing, particularly among younger, digitally connected consumers seeking convenient ways to monitor and manage their health.

India At-Home Peptic Ulcer Testing Market Trends

In India, the market is growing due to increased awareness regarding gastric disorders, which is leading to the highest increase in the demand for home testing of peptic ulcers. The rapid growth of a middle class in India and enhanced e-commerce infrastructure continue to provide the greatest access for consumers to obtain and use self-test kits. In addition, consumer education about digestive disorders and health and wellness via mobile technology continues to increase, contributing to the market.

How is the Opportunistic Rise of Europe in the At-Home Peptic Ulcer Testing Market?

Europe is witnessing an opportunistic rise in the market due to a combination of increasing consumer health awareness, well-established healthcare infrastructure, and supportive regulatory frameworks. Growing adoption of non-invasive home diagnostic solutions, coupled with the expansion of retail pharmacies, e-commerce channels, and telehealth platforms, has made these tests more accessible to consumers across the region. Additionally, government initiatives promoting preventive healthcare and the rising prevalence of gastrointestinal disorders are driving demand, positioning Europe as a key emerging market for at-home peptic ulcer testing.

Who are the Major Players in the Global At-Home Peptic Ulcer Testing Market?

The major players in the at-home peptic ulcer testing market include Abbott Laboratories, QuidelOrtho Corp, SD Biosensor, Inc., Bio-Rad Laboratories, Siemens Healthineers, Randox Laboratories Ltd, Sekisui Diagnostics, Becton, Dickinson and Co, Thermo Fisher Scientific, Roche Diagnostics, LabCorp, Biomerica, Inc., Meridian Bioscience, OraSure Technologies, Inc., and Hemosure Inc.

Recent Developments

- In August 2025, Biomerica received the United Arab Emirates (UAE) Ministry of Health and Prevention approval for its Fortel Ulcer Test for at-home use. The test delivers results in 10 minutes and identifies the bacterium responsible for peptic ulcers, dyspepsia, and gastric cancer.(Source: https://www.medicaldevice-network.com)

Segments Covered in the Report

By Test Type

- Stool Antigen Kits

- Finger-stick Serology Kits

- Urea Breath Tests

- Other Home Tests

By Distribution Channel

- Online Direct-to-Consumer (DTC)

- Retail Pharmacies & Clinics

- Telehealth-Linked Channels

By Application

- Peptic/Gastric Ulcer Detection

- Gastrointestinal Monitoring

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content