What is the Automotive Active Safety Systems Market Size?

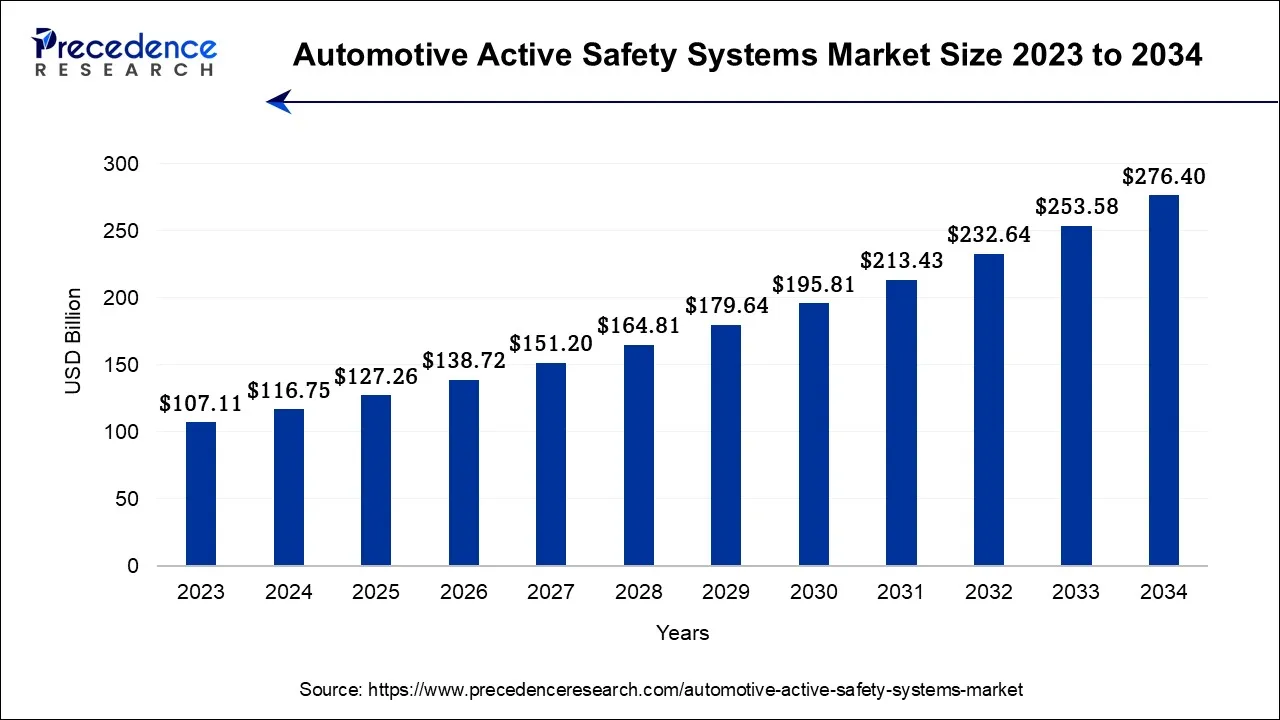

The global automotive active safety systems market size is calculated at USD 127.26 billion in 2025 and is predicted to increase from USD 138.72 billion in 2026 to approximately USD 297.97 billion by 2035, expanding at a CAGR of 8.88% from 2026 to 2035.

Automotive Active Safety Systems Market Key Takeaways

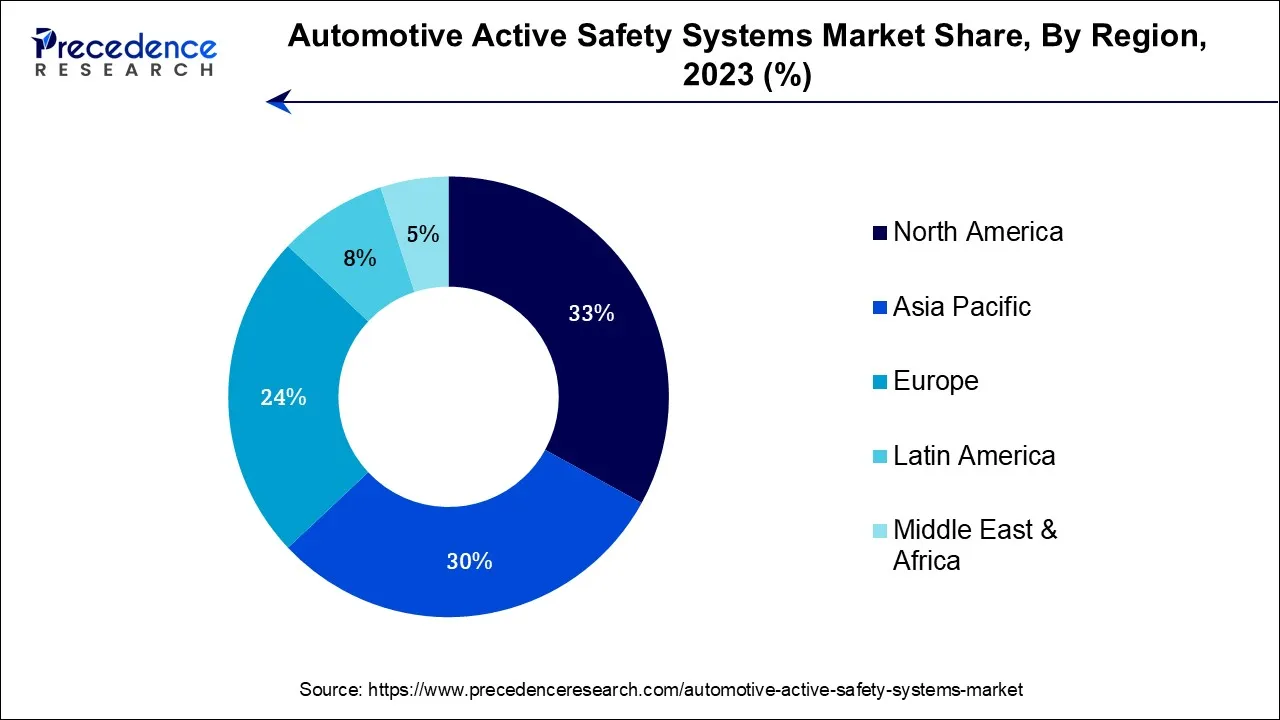

- North America led the global market with the largest market share of 33% in 2025.

- Europe region is considered to be the quickest-growing region.

- By Product Type, the adaptive cruise control segment dominated the market in 2025.

- By Product Type, the antilock braking segment is anticipated to grow significantly.

- By Sensor Type, the radar sensor segment led the market in 2025.

- By Sensor Type, the camera sensor segment is anticipated to increase significantly.

Market Overview

Automobiles' active safety systems make it simpler to avert or lessen casualties in collisions. The active safety system helps keep the occupant in place during collisions and reduces the chance of injuries, including seatbelts and headrests. The device delivers alerts and other aids to reduce accidents. Additionally, it helps keep the vehicle in the appropriate lane and alerts other road users to blind zones, preventing accidents. Among the more well-known active safety systems are lane departure warning systems (LDWS), tire pressure monitoring systems (TPMS), and electronic stability control (ESC).

Vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communication are emerging trends. These technologies enable vehicles to communicate with each other and infrastructure, enhancing safety and traffic management. Governments worldwide are implementing regulations to promote the adoption of active safety systems. These regulations encourage automakers to incorporate safety features into their vehicles.

How is AI Influencing the Automotive Active Safety Systems Industry?

AI is revolutionizing automotive active safety by changing systems from reactive to proactive, utilizing real-time data from sensors to forecast and prevent accidents. AI utilizes emotion recognition and cameras to determine driver fatigue, distraction, or distress, and thus triggers alerts to prevent accidents. AI anticipates component failures and adjusts safety systems based on driving patterns, like tightening stability control on slippery roads.

Automotive Active Safety Systems Market Growth Factors

Automotive active safety systems are intended to improve a vehicle's safety and prevent accidents. The creation and uptake of these systems are motivated by various factors. Governments worldwide have increased the requirements for automobile safety. Automakers are compelled to install active safety measures to comply with these standards. Customers are increasingly searching for cars with cutting-edge safety features. Many automobile purchasers now prioritize features like adaptive cruise control, lane-keeping assistance, and automatic emergency braking.

Active safety measures can now be implemented more affordably because of developments in sensor technology, including radar, lidar, and cameras. Automobile manufacturers are driven to lower accidents and raise safety standards since doing so can boost their brand's reputation and prevent expensive lawsuits. Consumer preference for passenger cars has skyrocketed recently, propelling the market's expansion. As an illustration, the graph below depicts the ten-year global sales of passenger cars.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 9% |

| Market Size in 2025 | USD 127.26 Billion |

| Market Size in 2026 | USD 138.72 Billion |

| Market Size by 2035 | USD 297.97 Billion |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Product Type and By Sensor Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increase in demand for high-speed vehicles

Consumer preferences are undergoing a substantial transition, with a rise in the desire for fast cars, which impacts the automobile sector. Numerous technological developments, shifting lifestyles, and the quest for better performance all contribute to this trend. Because of this rising desire for fast cars, the automotive active safety systems market is expanding in tandem with it.

The rising demand for high-speed vehicles has several major causes, including changing consumer lifestyles. Urbanization and the necessity for efficient mobility have resulted in a preference for speedier automobiles, particularly in congested urban areas. People want shorter commutes and to experience the excitement of highway driving at high speeds. This shift towards high-speed vehicles necessitates advanced safety systems to ensure that these vehicles can be driven safely, even at high speeds.

Technological advancements have played a crucial role in the development of high-speed vehicles. Automakers continually incorporate cutting-edge technology to improve engine performance, aerodynamics, and overall vehicle design. These advancements enable vehicles to reach higher speeds and offer superior acceleration. However, the faster a vehicle can go, the more critical safety becomes. This is where automotive active safety systems come into play.

Autonomous emergency braking, lane-keeping assistance, adaptive cruise control, and collision avoidance systems are just a few of the active safety features intended to improve the safety of drivers and passengers, particularly when traveling at high speeds. These systems monitor the area around the car and react instantly to any threats using sensors, cameras, and radar technologies. They have the ability to act to avert collisions, maintain proper lane positions, and automatically modify speed.

The demand for high-speed vehicles goes hand in hand with the demand for more advanced active safety systems. As people seek faster cars, they also demand a higher level of safety to mitigate the risks associated with high-speed driving. This has led to a growing market for automotive active safety systems as automakers strive to meet these safety requirements.

Restraint

High cost

The high expense of implementing modern active safety systems in automobiles is a key issue that consumers and manufacturers must deal with. These cutting-edge safety systems integrate several technologies and features to reduce the risk of accidents, safeguard passengers, and improve traffic safety. Developing cutting-edge safety technologies necessitates significant research and development expenditures. This entails creating and testing sophisticated sensors, creating complex real-time decision-making algorithms, and doing meticulous safety evaluations. Time and resources must be committed heavily to these initiatives.

Making sensors, cameras, lidar, radar, and processing units, which are physical parts of active safety systems, is frequently expensive. High reliability and precision requirements for these components may increase production costs. Adding these systems to automobiles is a difficult task. Automakers must either incorporate active safety systems into new designs or retrofit them onto current ones. This integration procedure might be expensive and time-consuming. Thorough testing and validation are necessary to guarantee that these systems operate dependably under everyday driving conditions. Manufacturers require extensive safety testing and simulations, adding to their costs.

Opportunity

Advancements in technology

The market for automobile active safety systems has grown and evolved due to technological advancements. These systems have advanced significantly since their first incarnations, and a number of technological elements are influencing their further development and uptake. The development of sensor technology has been particularly impressive. Radar, lidar, cameras, and ultrasonic sensors are much more capable and reasonably priced. Active safety systems rely on these sensors as their eyes and ears because they help them recognize and evaluate the environment around the vehicle in real-time.

For instance, radar sensors have improved accuracy, enabling better object detection and tracking capabilities. The accuracy and range of lidar, which uses lasers to detect distances, have also increased, making it a useful tool for 3D. Additionally, machine learning and artificial intelligence (AI) have been crucial in boosting the efficiency of active safety systems. With the aid of these technologies, vehicles can evaluate a tremendous amount of sensor data and make quick judgments to steer clear of accidents or hazardous circumstances. The system can learn from various circumstances and adapt due to machine learning algorithms, which makes it more predictive and able to handle challenging real-world driving situations.

The availability of high-end computing power has increased, enabling real-time data processing aboard. Because of the decreased reliance on external servers or cloud computing, active safety systems are now quicker and more dependable.

Segment Insights

Product Type Insights

The adaptive cruise control segment accounted for the largest share in 2025and is expected to maintain its dominance during the forecast period. System developments, safety concerns, and consumer demand have all contributed to the widespread use of Adaptive Cruise Control (ACC), a sophisticated vehicle system. This system improves convenience and safety for drivers by enabling a vehicle to automatically alter its speed to maintain a safe following distance from the vehicle in front.

Safety is paramount in the automotive sector, and adaptive cruise control has been instrumental in tackling this problem. Adaptive cruise control systems use radar and cameras to scan the road ahead and the positions of other vehicles. This real-time data allows for quick response to changes in traffic conditions, reducing the risk of collisions and making driving safer. Sensor technology and computing power advances have made adaptive cruise control more accurate and reliable. High-resolution sensors can detect and track vehicles and objects more precisely, while powerful processors enable faster data analysis and decision-making.

These improvements have enhanced adaptive cruise control systems' overall performance and responsiveness. Many key companies operating in the market are launching adaptive cruise control and other products to maintain a strong foothold. For instance, Mitsubishi Motors Corporation (hereafter, Mitsubishi Motors) declared in 2022 that its European subsidiary, Mitsubishi Motors Europe B.V., has presented the new generation ASX for the European market at an online event. In order to enhance safe driving, the vehicle incorporates cutting-edge driver assistance systems like MI-PILOT single-lane driver assistance technology for highways, which blends Adaptive Cruise Control (ACC) and Lane Centering Assist (LCA).

The antilock braking systems sector is growing quickly in the worldwide market. The automotive sector is primarily responsible for numerous important factors that influence the need for antilock braking systems (ABS). Safety precautions are of the utmost importance. By minimizing wheel lock-up during abrupt braking, ABS considerably improves vehicle safety by lowering the chance of skidding and enhancing driver control. The requirement for ABS in various areas has increased demand as safety standards worldwide become more stringent.

Consumer preferences are also changing, with an increased focus on safety features when buying cars. Automobile manufacturers now use ABS and other ADAS as marketing points because more and more buyers demand these features from their vehicles. An increased awareness of road safety and a desire for less congestion have increased this need. Environmental concerns also contribute to ABS demand. ABS can enhance fuel efficiency by preventing wheel slippage, reducing tire wear, and improving overall vehicle performance. As governments and consumers prioritize fuel efficiency and emissions reduction, automakers are encouraged to incorporate ABS into their vehicles.

Sensor Type Insights

In2025, the radar sensor segment had the dominating share, which is anticipated to continue its dominance over the projection period. A convergence of forces spanning numerous sectors and applications has recently been propelling the expansion of radar sensor technology on an increasing trend.

Due to their adaptability and efficiency, radar sensors have experienced a spike in demand and acceptance. Radar sensors, which provide real-time information on the environment around the vehicle, are an essential part of autonomous vehicles. Radar sensors are becoming more and more in demand as self-driving technology develops. They provide dependable performance in bad weather, which makes them crucial for secure autonomous navigation.

Traditional vehicles also benefit from radar sensors as part of Advanced Driver Assistance Systems (ADAS). These systems, which include features like adaptive cruise control and collision avoidance, rely on radar sensors for accurate object detection and tracking, enhancing road safety.

The demand for camera sensors is growing quickly. The demand for camera sensors is influenced by several key factors, reflecting the dynamic nature of the photography and imaging industry.

Technological advancements play a pivotal role. As camera sensors continue to improve in terms of resolution, low-light performance, and dynamic range, consumers and professionals seek upgraded equipment to capture higher-quality images and videos. This pursuit of enhanced image quality is further driven by the rising popularity of visual-centric social media platforms and the need for content creators to stand out. Another major factor is the increasing integration of cameras in various devices. Smartphones, tablets, drones, security cameras, and even automotive systems now feature camera sensors, driving demand. The growth of these industries further contributes to the need for camera sensors. Additionally, expanding applications like augmented reality (AR) and virtual reality (VR) rely heavily on advanced camera sensors for accurate tracking and immersive experiences.

Regional Insights

What is the U.S. Automotive Active Safety Systems Market Size?

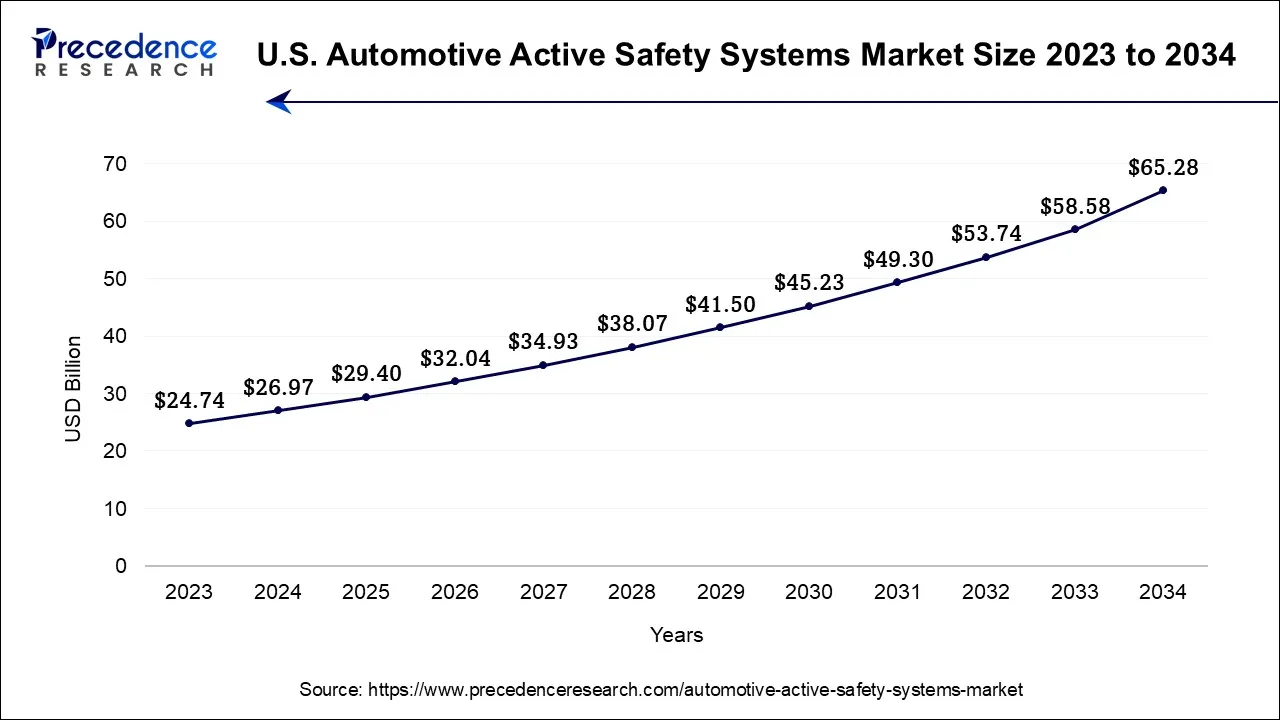

The U.S. automotive active safety systems market size is exhibited at USD 29.40 billion in 2025 and is projected to be worth around USD 70.74 billion by 2035, growing at a CAGR of 9.18% from 2026 to 2035.

North America

North America is a mature and technology-driven market, supported by high consumer awareness, strict vehicle safety regulations, and early adoption of advanced driver assistance systems. The presence of major automotive OEMs and technology providers, along with strong demand for premium and semi-autonomous vehicles, sustains steady growth across passenger and commercial vehicle segments.

US

The US leads the North American market owing to federal safety standards, widespread ADAS penetration, and strong investments in autonomous driving technologies. High demand for SUVs and luxury vehicles equipped with advanced safety features, combined with collaboration between automakers and AI sensor developers, significantly boosts market growth.

Europe

Europe is characterized by stringent safety regulations, strong NCAP standards, and a high focus on reducing road fatalities. The region shows widespread adoption of active safety technologies across both mass-market and premium vehicles. Continuous innovation in radar, camera, and LiDAR systems supports long-term market development.

Germany

Germany plays a pivotal role in the European automotive active safety systems market, supported by its strong premium automotive manufacturing ecosystem. German OEMs lead in integrating advanced safety features such as predictive braking and collision avoidance systems. Heavy R&D investments and alignment with EU safety directives further strengthen market growth.

Asia Pacific

Asia Pacific represents the fastest-growing region for automotive active safety systems, driven by rising vehicle production, increasing road safety awareness, and tightening government safety mandates. Rapid urbanization, expanding middle-class vehicle ownership, and the adoption of ADAS technologies by OEMs are accelerating demand. Cost-effective sensor integration and growing EV penetration further support market expansion.

China

China dominates the Asia Pacific automotive active safety systems market due to its massive automotive manufacturing base and strong government push for intelligent and connected vehicles. Local and global OEMs are increasingly integrating features such as adaptive cruise control, lane departure warning, and automatic emergency braking. Regulatory emphasis on vehicle safety ratings continues to drive adoption.

Impact of Safety Regulation on the Automotive Active Safety Systems in Latin America

Latin America's market shows notable growth during the forecast period. It is driven by increasing user safety awareness, escalating vehicle safety regulations, and rapid technological advancements. Adoption of advanced driver assistance systems (ADAS) and AI enhanced technologies like radar, camera, and sensor fusion is increasing, supported by falling component costs and integration of semi autonomous capabilities

Brazil Automotive Active Safety Systems Market Trends

Brazil's market is a rapidly increasing, high-potential sector, driven by stricter safety regulations, growing vehicle production, and increased consumer need for advanced technologies. The manufacturing sector is accepting Industry 4.0 principles, aiming on localized production, decreased lead times, and even sustainable, eco-friendly materials.

Road Safety Standards Accelerating the Automotive Active Safety Systems Market in MEA

MEA's market shows fast growth during the forecast period. It is primarily because governments are incorporating strict regulations to combat high rates of traffic fatalities and injuries, changing from passive safety, such as seatbelts, to active safety, accident avoidance.

UAE Automotive Active Safety Systems Market Trends

The UAE automotive active safety systems market is rapidly rising, driven by strict government regulations targeting for 3% traffic fatalities per 100,000 residents. The market provides advanced technologies such as AEB, lane departure warnings, adaptive cruise control, along with blind-spot detection, funded by IoT advancements, smart city initiatives, and rising user demand for safer vehicles.

Value Chain Analysis for the Automotive Active Safety Systems Market

- Raw Material Sourcing:It includes a multi-tiered supply chain where Tier-2 and Tier-3 suppliers offer components such as semiconductor chips, rare earth magnets, along with specialty plastics to Tier-1 suppliers, who then assemble and supply finished systems to Original Equipment Manufacturers (OEMs).

Key Players: Robert Bosch GmbH, Continental AG, ZF Friedrichshafen AG - Component Manufacturing:It includes producing advanced hardware such as sensors, cameras, radar, LiDAR, and electronic control units, and software algorithms programmed to prevent accidents before they occur.

Key Players: Continental AG, ZF Friedrichshafen AG, Denso Corporation - Vehicle Assembly and Integration:This procedure has shifted from simple component installation to a complex, high-precision operation, usually necessitating specialized, in-plant calibration, automated assembly lines, and rigorous testing.

Key Players: Bosch, Continental, ZF Friedrichshafen, Magna International, Denso, and Autoliv

Automotive Active Safety Systems Market Companies

- Bosch: Bosch provides a comprehensive portfolio of automotive active safety systems designed to prevent accidents and improve driving stability, aiming on sensor technology, software, and also integrated vehicle control.

- Continental: Continental provides a comprehensive portfolio for the Automotive Active Safety Systems market, targeting "Vision Zero," such as zero traffic fatalities via Advanced Driver Assistance Systems (ADAS), along with integrated, intelligent safety technologies. Their offerings span from sensor hardware to full-stack software solutions for commercial vehicles, passenger cars, and two-wheelers.

Other Major Key Players

- Delphi

- ZF Friedrichshafen

- Autoliv

- Takata

- PSA Peugeot Citroen

- Denso Corporation

- Hella

- Hyundai Mobis

Recent Developments

- In November 2025, the Tata Nexon with ADAS was launched in India for the top-spec petrol-automatic variant. The new ADAS features bring Level 2 active safety capabilities to the compact SUV segment.

- (Source:https://www.autocarindia.com )

- In March 2025, Honda Cars India surpassed 50,000 ADAS-enabled vehicles on Indian roads. This milestone supports Honda's global vision for zero traffic collision fatalities involving its vehicles by 2050

(Source: https://www.hondacarindia.com ) - In July 2025, Mack Trucks began taking orders for the redesigned Mack Anthem, which includes the proprietary Mack Protect™ active safety system. This system, introduced earlier in 2025 with the Mack Pioneer™, signifies a shift towards a fully integrated, proprietary safety suite for the brand.

(Source: https://www.volvogroup.com ) - In September 2025, ZF Friedrichshafen AG is aiming for zero accidents and emissions with the global introduction of its integrated active safety and software-defined chassis technologies planned for 2026.

https://www.zf.com/products/en/cv/ind/campaigns/active_safety_technologies.html - In September 2023, Great Wall Motor ("GWM"), a prominent vehicle manufacturer based in China, and Autoliv China, a division of Autoliv, Inc. (NYSE: ALV and SSE: ALIVsdb), the world leader in automotive safety systems, intend to work together to address opportunities and challenges in the quickly changing global automotive landscape.

- In June 2023, a new ultrasonic sensor technology was unveiled by Murata Manufacturing Co., Ltd. (TOKYO: 6981) (ISIN: JP3914400001) for use in automobile applications. The MA48CF15-7N is protected against liquid infiltration by being enclosed in a hermetically sealed container with excellent sensitivity and quick response times.

- In February 2023,the 2023 Tata Harrier featured an advanced driver assistance system (ADAS), according to Tata Motors. The upgraded SUV has a starting price of Rs 15 lakh and a maximum price of Rs 24.07 lakh.

Segments covered in the report

By Product Type

- Tire-pressure Monitoring System

- Lane Departure Warning

- Adaptive Cruise Control

- Night Vision System

- Driver Monitoring

- Antilock Braking System

- Blind Spot Detection

By Sensor Type

- Camera Sensor

- Radar Sensor

- Lidar Sensor

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content