What is the Automotive Actuators Market Size?

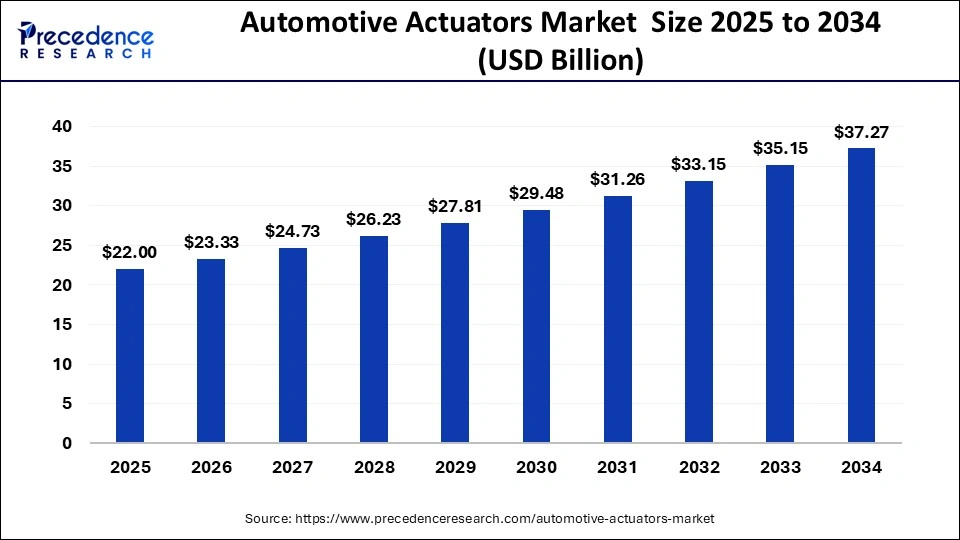

The global automotive actuators market size is estimated at USD 22.00 billion in 2025 and is predicted to reach around USD 39.39 billion by 2035, accelerating at a CAGR of 6.03% from 2026 to 2035. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year. The increasing demand for energy conversion equipment has boosted the growth of the automotive actuators industry.

Market Highlights

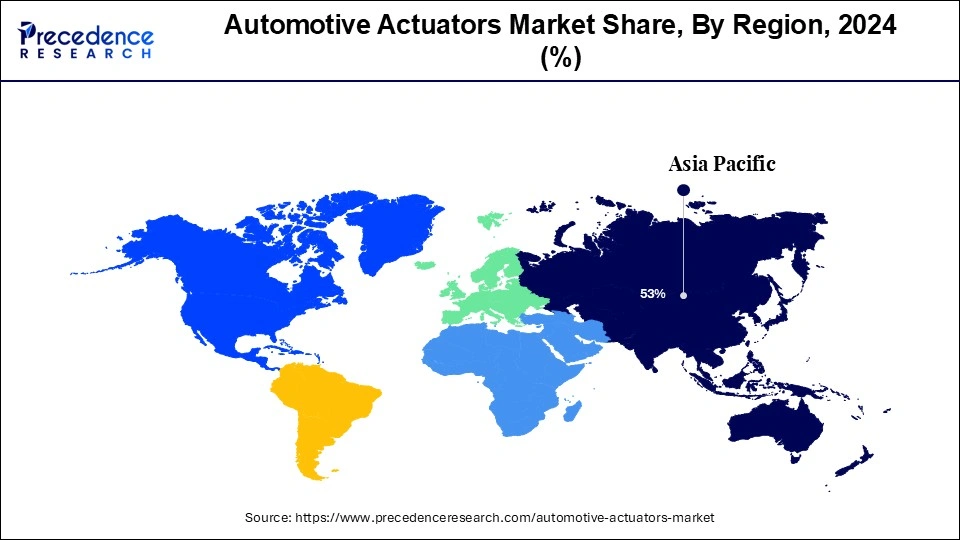

- Asia Pacific led the automotive actuators market with the highest share of 53% in 2025.

- Europe is expected to attain significant growth during the forecast period.

- By type, the pneumatic actuators segment held the largest share of the market in 2025.

- By type, the electric actuators segment is expected to grow with the highest CAGR during the forecast period.

- By application, the engines segment dominated the market in 2025.

- By application, the HVAC systems segment is expected to grow at the fastest rate during the forecast period.

- By vehicle type, the SUVs has held a major market share of 62% in 2025.

- By vehicle type, the hatchback/sedan segment is estimated to exhibit a considerable growth rate during the forecast period.

- By propulsion, the ICE segment held a significant share of the market in 2025.

- By propulsion, the electric segment is expected to grow with the highest CAGR during the forecast period.

What is the role of AI in the Automotive Actuators Industry?

The automotive industry is developing gradually with the advancement of technologies that enhance the manufacturing process. The ongoing advancements in AI technology are adopted by automotive OEM manufacturers and aftermarket manufacturers. Nowadays, automotive actuator companies are integrating AI in the manufacturing of actuators to optimize production, ensure quality standards, and increase the efficiency of workers employed in this industry. Moreover, the integration of AI in actuators will allow us to perform various tasks accurately based on real-time feedback in automotive. Thus, AI plays an important role in the automotive actuators industry.

- In February 2024, Volkswagen announced the opening of a new AI Lab. This lab was inaugurated to use AI technologies to manufacture cars and the components associated with them.

Market Overview

The global automotive industry is growing rapidly with the advancements in science and technologies. The automotive actuators market is a sub-domain of the automotive industry that deals in the manufacturing and distribution of automotive actuators for vehicles. The main function of automotive actuators is the conversion of electrical energy into mechanical energy for moving the vehicle.

The automotive actuators industry mainly deals in manufacturing several types of actuators, such as electric actuators, pneumatic actuators, hydraulic actuators, and mechanical actuators. These actuators are used for various applications, including HVAC systems, gearboxes, engines, and interior & exterior. This industry is mainly driven by the surging demand for commercial vehicles and the increasing application of actuators for braking purposes.

- According to the IPC, the automotive electronic components will account for more than 50% of the overall cost of the car by 2030.

Automotive Actuators Market Growth Factors

- The trend of luxury vehicles among the people in developed nations.

- The increasing use of advanced automation systems in automotive.

- The demand for fuel-efficient cars due to rising oil prices in various countries.

- The developments associated with autonomous vehicles play an important role in the growth of this industry.

- Government policies for the adoption of electric vehicles (EVs) around the world.

- The actuators are used for various applications such as battery management, powertrain control, electronic stability control, and others.

- Several partnerships and acquisitions among companies associated with automotive actuators.

- The upsurge in demand for hybrid vehicles increases the application of automotive actuators.

- The use of electromagnetic actuators in power steering system.

- The advancements in automotive gear systems have increased the demand for transmission actuators.

What are the Key Trends in the Market?

- The automotive actuators market is witnessing a notable shift towards electric vehicles, which necessitates the need for advanced actuator systems for optimal performance. This shift is prompting manufacturers to innovate and develop actuators that cater to unique requirements.

- There is a growing trend towards the integration of smart technologies. This includes the incorporation of sensors and connectivity features that can enhance the functionality and efficiency of actuators.

- There is an increasing emphasis on safety and comfort in modern vehicles, which is driving demand for sophisticated actuator systems. Automakers are increasingly incorporating actuators that can support advanced safety features and enhance passenger comfort.

- The Automotive Actuators Market is being increasingly transformed due to the integration of advanced manufacturing technologies. Innovations such as 3D printing, automation, and smart manufacturing are also gaining traction.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 22.00 Billion |

| Market Size in 2026 | USD 23.33 Billion |

| Market Size by 2035 | USD 39.39 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 6.03% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Application, Vehicle Type, Propulsion, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

ADAS-enabled vehicles increase the demand for actuators

The demand for advanced driver assistance systems (adas) features in vehicles has increased in recent times. The integration of ADAS system in cars enhances safety of passengers, enhance fuel efficiency and improve the driving experience. It also provides better visibility during night ride along with allowing assistance for parking automatically. The increasing application of ADAS systems has increased the use of actuators for converting electric signals to maintain safe distance among vehicles. Thus, rising demand foradvanced driver assistance systems (ADAS) enabled vehicles is likely to boost the growth of the automotive actuators market.

- In January 2024, Morris Garages launched MG Astor. This car bundles superior ADAS features along with panoramic sunroof, personal AI assistant and powerful petrol engine of 1498CC.

Restraint

High component cost and adjustment issues

There are several problems in the automotive actuators industry. The cost of some actuator components is very high, which increases the overall cost of the product, which in turn restrains the market growth. Also, few actuators may fail to adhere to the HVAC system, which acts as a restraining factor in this industry.

Opportunity

Advancement in sensor-actuator hybrid systems

The sales and production of cars are increasing rapidly around the world. The ongoing developments in sensor actuator hybrid systems can drastically change the landscape of the automotive industry. These sensor-actuator systems can increase efficiency, safety, and performance in vehicles. Thus, advancements in sensor-actuator systems are expected to create ample growth opportunities for market players in the future.

Segment Insights

Type Insights

The pneumatic actuators segment dominated the market in 2025. The rising sales of premium cars have increased the demand for pneumatic actuators to enhance engine control, braking systems, transmission control, and some others. Also, these actuators provide high force and increased speed of movement for linear motion control, along with enhanced heat-resistant capacity that is suitable for numerous automotive applications. Moreover, the growing use of pneumatic actuators in EVs, due to their reliability and cost-effectiveness, coupled with their application in controlling the suspension system of vehicles, has gained popularity among car manufacturers. The above-mentioned factors contribute significantly to the growth of the automotive actuators market.

- In April 2022, Festo launched a pneumatic actuator. This actuator finds application in performing automotive operations.

The electric actuators segment is estimated to exhibit the fastest growth rate during the forecast period. The growing demand for electric actuators due to high precision control and less maintenance has boosted the market growth. Also, the rising application of electric actuators in economy vehicles due to energy efficiency and versatility drives the market growth. Moreover, the increasing use of electric actuators to convert electricity into kinetic energy is expected to drive the growth of the automotive actuators market.

- In June 2022, Emerson launched Aventics. Aventics is a series of servo profile advanced (SPRA) electric actuators that find several automotive applications.

Application Insights

The engines segment held a dominant share of the market in 2025. The rising demand for advanced actuators to enhance engine performance drives market growth. Also, the rising application of pneumatic actuators for converting energy into physical action and controlling the throttle response boosts the market growth. Moreover, the increased use of linear actuators in automotive engines to provide superior control and enhance fuel efficiency and reliability has propelled the growth of the automotive actuators market.

The HVAC systems segment is expected to grow with the highest CAGR during the forecast period. The growing demand for actuators to automate control functions, including the operations of dampers and valves, boosts market growth. Also, the rising application of actuators for converting electrical signals into mechanical motion in automotive fosters market growth to some extent. Moreover, the increasing demand for high-quality air conditioning systems in automobiles has increased the demand for actuators, thereby driving the growth of the automotive actuators market.

Vehicle Type Insights

The SUVs segment dominated the market in 2025. The rising demand for off-roading vehicles and all-wheel drive vehicles (AWD) among youths drives the market growth. Also, the growing demand for compact SUVs in developing nations boosts industrial growth. Moreover, the increasing trend of performance SUVs among the elite class, along with the rising production of electric SUVs, is expected to drive the growth of the automotive actuators market.

- In April 2024, Kia Motors launched Carens. Carens is a SUV that comes with 6 airbags, all wheel disk brakes, downhill brake control and others.

- In January 2024, Mahindra launched the all-new XUV700. XUV700 is a premium SUV that comes with various features such as vehicle status, remote functions, captain seats, location-based services, safety, third-party apps, and all-wheel drive (AWD) capabilities.

The hatchback/sedan segment is estimated to exhibit a considerable growth rate during the forecast period. The growing demand for luxurious sedans among rich people has increased the demand for actuators, thereby driving the market growth. Also, the increasing trend of fuel-efficient sedans, along with the growing demand for hatchbacks, has boosted the market growth. Moreover, the better handling capacity of hatchbacks and sedans as compared to SUVs is expected to drive the growth of the automotive actuators market.

- In May 2024, Mercedes Benz launched Mercedes AMG S63 E and Maybach GLS 600 facelift in the Indian Subcontinent. These cars are equipped with modern features including automatic climate control, ADAS, 9-speed gear assembly.

- In May 2024, Maruti Suzuki launched the all-new Swift 2024 model in India. This car has improved features such as a 9.0-inch touchscreen infotainment system, six airbags, and a claimed mileage of around 25 km.

Propulsion Insights

The ICE segment held a dominant share of the market in 2025. The rising demand for passenger vehicles around the world has increased the demand for actuators, thereby driving market growth. The growing demand for diesel vehicles due to higher fuel efficiency and durability has boosted the market growth. The increasing sales of petrol vehicles due to less maintenance and enhanced performance are expected to drive the growth of the automotive actuators market.

- In February 2024, Hyundai launched the Creta N line. This car comes with a 1.5-litre turbo-petrol engine that produces a peak power of 158bhp and features a new front grille, a pronounced roof spoiler, sporty front and rear bumpers, 18-inch wheels, and a leather dashboard.

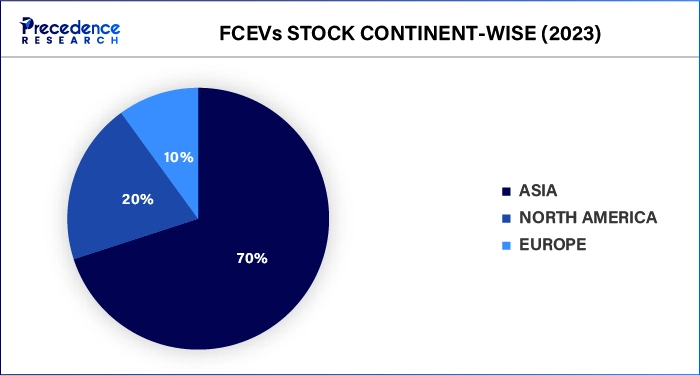

The electric segment is expected to grow with the highest CAGR during the forecast period. The trend of EVs has increased rapidly in various parts of the world. The growing adoption of electric vehicles is mainly due to several benefits, such as low emission, high efficiency, low maintenance, tax and financial benefits, and some others. With the rising production of electric vehicles, the demand for automotive actuators increases for several applications, including thermal and powertrain management, precise control, energy efficiency, and others. Thus, the growing trend of EVs is expected to drive the growth of the automotive actuators market during the forecast period.

- In March 2024, BMW launched the electric vehicle‘ iX xDrive50' in India. This car provides superior features to ensure a smooth driving experience and comes with standard adaptive 2-axle air suspension for a comfortable ride along with a driving range of up to 635 km.

- In December 2023, Burger Group launched a new series of automotive actuators. This actuator is used for thermal management in electric vehicles.

Regional Insights

Asia Pacific Automotive Actuators Market Size and Growth 2026 to 2035

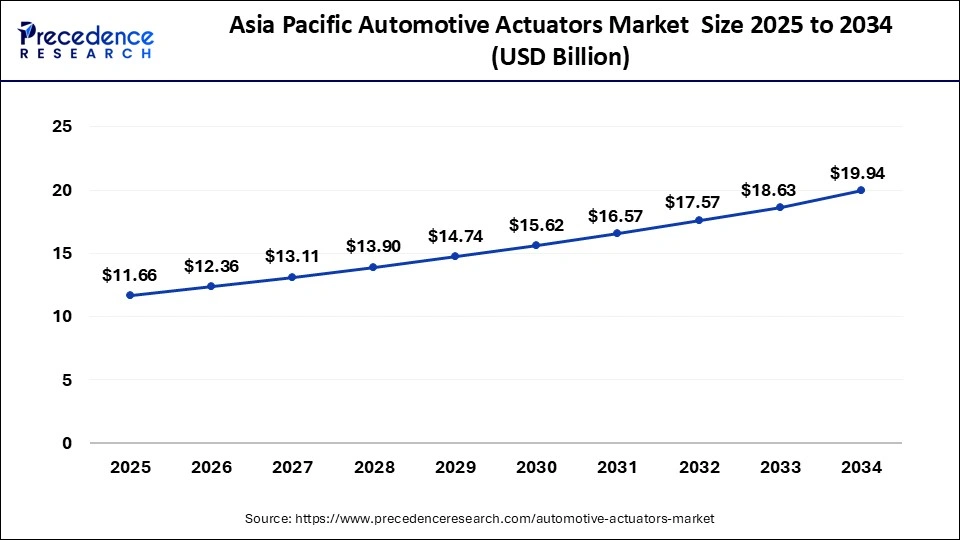

The Asia Pacific automotive actuators market size is exhibited at USD 11.66 billion in 2025 and is projected to be worth around USD 21.08 billion by 2035, poised to grow at a CAGR of 6.12% from 2026 to 2035.

Asia Pacific held the largest share of the automotive actuators market in 2025. The sales of plug-in-hybrid vehicles in China and India, along with the rising application of commercial trucks in Japan for the transportation of goods, is an ongoing trend. The automotive companies of the Asia-Pacific region, such as Toyota, Tata, Suzuki, Hyundai, Honda, and Mazda, are engaged in partnerships with OEM companies to develop automotive electronics to perform several functions in vehicles. The application of LCVs has also gained traction in South Korea for delivering parcels and providing various services to the people. The above-mentioned factors are expected to drive the growth of the automotive actuators market during the forecast period.

- In June 2024, Hyundai announced a partnership with LG. This partnership is done to develop various electronic components that are used in automobiles.

- In February 2024, Mitsubishi launched the Canter truck in Japan. Canter truck is a commercial truck that comes with enhanced safety for superior comfort and safe driving.

- In February 2024, Tata Daewoo launched Dexen Vision Truck in South Korea. This truck is powered with an 8-speed ZF automatic transmission for enhancing driving along with air brakes for excellent braking performance.

There are several local market players in automotive actuators, such as Denso Corporation, Mitsubishi Electric Corporation, Johnson Electric, Nidec Corporation, and some others that are constantly engaged in manufacturing high-quality actuators for automotive and adopting several strategies such as partnerships, acquisitions, collaborations, launches, and business expansions, which in turn drives the growth of the automotive actuator market in this region.

- In May 2024, Nidec Corporation announced to inaugurate a manufacturing facility in India. This production facility has been opened to manufacture electrical components for various vehicles, including ICE and EVs.

China's Robust Manufacturing Capabilities: A Dominant Trend

China is the major leader of the Asian automotive actuators market. China has strong manufacturing capabilities for automotives. Government support in the manufacturing industry, promoting the use of electric vehicles, and initiatives like “Make in China 2025” are contributing to this growth. China's market has witnessed spectacular demand for luxury and electric vehicles. China's manufacturing industries are highlighting areas, including Intelligent Vehicles & Connected Car Technology, New Energy Vehicles (NEVs) & Battery Solutions, Core Components & Electronic Systems, Automotive Electronic Components, Software-Defined Vehicles (SDVs), Advanced Automotive Materials, Automotive Engineering & Assembly Technologies.

By 2025, China's NEV sales are projected to cross 16.5 million units, with an average annual growth rate of nearly 30% and a penetration rate exceeding 50%.

China's connected industry, the Shenzhen International Intelligent Connected Vehicle Industry Exhibition, Automotive World China (AWC 2025), will be held from October 28-30 at the Shenzhen World Exhibition & Convention Center (Bao'an). The event will feature a comprehensive 30,000? business platform, which will bring together over 300 top-tier global supply chain resources.

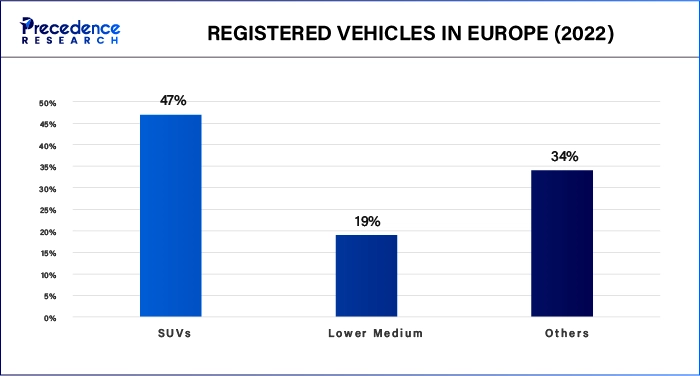

Europe is expected to grow significantly during the forecast period. The developments in the automotive industry, along with government investments in the electric vehicle sector, have helped the automotive actuators industry in a positive way. The trend of fuel-efficient vehicles, along with the integration of ADAS in vehicles, has increased the demand for automotive actuators in this region. The applications of pneumatic actuators have increased due to the rising sales of SUVs and commercial trucks in Germany, Italy, France, the UK, and some others. The use of throttle actuators has increased due to the rise in sales of diesel vehicles in the European region. The above-mentioned factors positively impact the growth of the automotive actuators market in Europe.

- In January 2024, Daimler Trucks partnered with Bosch and Here Technologies. This partnership is done to develop an advanced driver assistance system (ADAS) for commercial vehicles in the European region.

- In September 2023, the government of Germany announced to invest around 9.5 Billion Euros for providing subsidies to EV consumers in the country.

- For instance, in June 2023, Volkswagen launched Tiguan. Tiguan is a mid-range SUV that comes with features such as a Car2X warning system, modern cockpit design, assist (emergency braking system), and other unique features. This car comes with various engine types, including petrol, diesel, and hybrid.

Strong Automotive Industry: German Active Market

Germany is leading the market in the region, growth driven by the country's strong automotive industry and high R&D capabilities. Germany is a leader in providing high-performance vehicle capabilities. German automakers have strong control over investing heavily in research & development, enabling production of automatic transmissions to meet changing consumer demands for high-performance electric vehicles.

The presence of various local companies of automotive actuators, such as Robert Bosch, Continental AG, Hella, ZF Friedrichshafen, and some others, are constantly developing various types of automotive actuators and related components to cater to the demand in Europe, in turn, is expected to drive the growth of the automotive actuators market in this region.

- In July 2024, ZF Friedrichshafen launched the cubiX vehicle motion control platform. This platform has been launched to integrate it with virtual driver systems along with vehicle actuators to ensure enhanced safety, precision, and performance of commercial vehicles.

Why North America's Increase in Demand on the Way?

The automotive actuators market in North America is experiencing steady growth as automakers increase their commitment to advanced driver-assistance systems, electrified powertrains, and lightweight component integration. Strong manufacturing capabilities, prompt adoption of automated processes, and increase in EV production capacity are also fueling demand for precision motion-control components. The presence of established automotive OEMs and continued investments in smart manufacturing polymers support growth in the market.

U.S. Automotive Actuators Market Trend

The United States occupies the No. 1 position in North America owing to a strong base of automotive production, extensive research and development (R&D) on autonomous and electric mobility platforms, and enhanced levels of adoption of mechatronic components. Continued enhancements in electronics packed into vehicles, along with OEMs focus on adding premium features, support the need for actuators.

How Middle East & Africa has Emerging Growth Potential?

The Middle East & Africa is moving up as an attractive market for automotive actuators driven by growth in vehicle parc, user acceptance of technology enabled passenger vehicles and government-led diversification of the industrial base. Growth in urban mobility, improving road infrastructure to support mobility, along with increasing popularity of comfort-related cabin experience, driven in part by urban mobility, are contributing to actuator increases in the region. Growing shifts to hybrid vehicles as well as full electric vehicles assist in demand.

United Arab Emirates Automotive Actuators Market Trend

The UAE is leading the way in this region with high consumer expectance for luxury vehicles and automotive importing, quickly adopting advanced safety and comfort related technologies, along with increasingly supportive regulations and growing interest in electric vehicles boosting actuator growth potential in modern vehicle platforms.

What are the Advancements in the Automotive Actuators Industry in Latin America?

Latin America is poised for substantial growth over the forecast period. This growth is driven by factors such as increasing vehicle safety regulations, rising consumer safety awareness, and expanding automotive production across key economies. The region has strong regulatory frameworks that emphasize safety compliance and environmental standards, thus fostering innovation and modernization. All these factors lead to market expansion and development.

Brazil Automotive Actuators Market Trends: The country's market landscape is growing due to factors like increasing vehicle electrification, stringent emissions regulations, and an increased demand for advanced driver assistance systems. Moreover, expanding EV adoption and tech developments propel the market further. Overall, the market is expected to maintain solid growth through the late 2020s, supported by electrification trends, safety regulations, and ongoing investments in automotive manufacturing.

Value Chain Analysis for Automotive Actuators Market

- R&D & system design

Engineers identify actuator specifications, control algorithms, control units and safety (ASIL) targets, alongside vehicle-level interface and software validation prior to prototyping.

Key Players: Bosch, DENSO, Valeo, ZF, Continental. - Component manufacturing (motors, gears, sensors, electronics)

Specialized vendors develop motors, precision gears, encoders, sensors and PCB/ECU modules to automotive durability, EMC and thermal requirements.

Key Players: Nidec, FAULHABER, Sensata, TE Connectivity, Bosch. - Module assembling & calibration

Key Players: Magna, Aisin, Aptiv, Valeo, ZF. - Tier-1 supply & OEM integration

Tier-1 suppliers adapt actuator modules to vehicle architectures, ensure certifications, scale manufacturing and co-develop features with OEMs.

Key Players: Bosch, DENSO, ZF, Aptiv, Magna. - Aftermarket, remanufacture & EOL services

Aftermarket distributors provide replacement part option, remanufacturing, fault-diagnosis, warranty processing, and recycling option with spare parts logistics and field service.

Key Players: Bosch Aftermarket, DENSO Aftermarket, Continental Aftermarket, ACDelco, SKF.

Automotive Actuators Markets Top 10 Companies

- Robert Bosch GmbH

- Denso Corporation

- Assured Automation

- Nidec Corporation

- Johnson Electric

- Isotech, Inc.

- Mitsubishi Electric Corporation

- Hella

- BorgWarner

- Magna International

Recent Developments

- In March 2025, Continental, a global leader in automotive technology, announced the launch of the "Ac2ated Sound" Display, which integrates actuators into vehicle displays to create high-quality sound output and reduce the need for traditional speakers.

- In June 2024, Johnson Electric launched a new series of EV locking actuators. These actuators feature precision control, high durability, improved reliability, and others for preventing accidental hazards.

- In June 2024, Vitesco Technologies launched a rotor lock actuator. This actuator functions rotor position sensing, park locking, and the optional brush system for electric vehicles.

- On April 16, 2024, Nexteer Automotive unveiled its Electro-Mechanical Brake (EMB) system, an advanced Brake-by-Wire (BbW) solution designed to improve safety, comfort, and serviceability and support software-defined chassis integration.

- In December 2023, HELLA announced the inauguration of a new factory in GroBpetersdorf, Austria. This facility is opened to manufacture locking actuators for electric vehicles.

- In November 2023, ADVICS launched electric parking brake (EPB) actuator kits. These kits are designed for the vehicle's caliper to enhance the performance of the parking brake.

- In October 2023, Continental launched brake actuators. These new electronic brake actuators will support Audi, Land Rover, Mercedes-Benz, BMW, Jaguar, Volkswagen, and Volvo.

- In September 2023, Marelli launched a multipurpose smart actuator. This range of smart actuators is designed for simplifying complex functions in electric cars.

- In March 2023, Ewellix launched electric actuators. This automotive actuator is equipped with safety features such as a speed limiter and electromechanical motor braking.

- In June 2022, Curtiss Wright launched the Exlar GTW actuator. This actuator comes with high force repeatability and precision for performing several automotive applications.

- In February 2022, Vishay launched AEC-Q200. AEC-Q200 is a feedback actuator that finds application in touchscreens, LCD displays, and touch switches in automotive.

- Hyundai Mobis announced that it has started to supply key components for Boston Dynamics' next-generation Atlas humanoid robot, marking its first commercial customer in the robotics components business as the auto parts maker accelerates its push beyond traditional automotive parts. Hyundai Mobis said it plans to build a mass-production system for actuators and gradually expand its robotics portfolio to include hand grippers, sensors, controllers, and battery packs.

(https://www.koreaherald.com)

Segments Covered in the Report

By Type

- Electric Actuators

- Pneumatic Actuators

- Hydraulic Actuators

- Mechanical Actuators

By Application

- HVAC System

- Gearbox

- Engine

- Interior & Exterior

By Vehicle Type

- Hatchback/Sedan

- LCV

- SUV

- HCV

By Propulsion

- ICE

- Electric

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting